These Analysts Boost Their Forecasts On Marsh & McLennan Following Upbeat Earnings

Marsh & McLennan MMC reported better-than-expected third-quarter earnings on Thursday.

Marsh & McLennan reported quarterly earnings of $1.63 per share which beat the analyst consensus estimate of $1.57 per share. The company reported quarterly sales of $5.70 billion which met the analyst consensus estimate.

John Doyle, President and CEO, said: “This was a milestone quarter for Marsh McLennan as we delivered strong results and announced the acquisition of McGriff Insurance Services. Our performance demonstrated continued momentum, with 5% underlying revenue growth, 110 basis points of margin expansion and adjusted EPS growth of 4%, or 11% excluding a one-time tax benefit a year ago. We remain on track for another great year in 2024.”

M&T Bank shares fell 0.4% to trade at $198.04 on Friday.

These analysts made changes to their price targets on M&T Bank following earnings announcement.

- RBC Capital analyst Scott Heleniak maintained Marsh & McLennan with a Sector Perform and raised the price target from $232 to $242.

- Roth MKM analyst Harry Fong maintained Marsh & McLennan with a Neutral and raised the price target from $220 to $230.

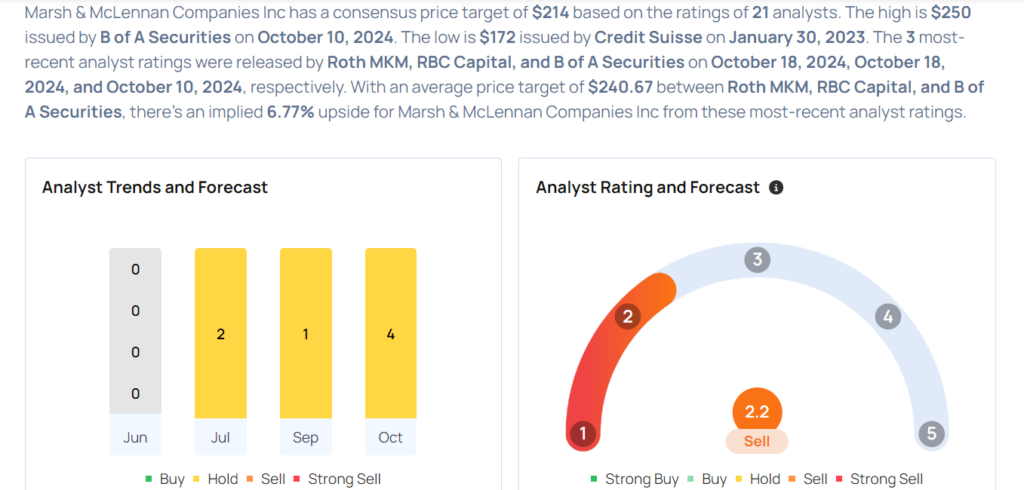

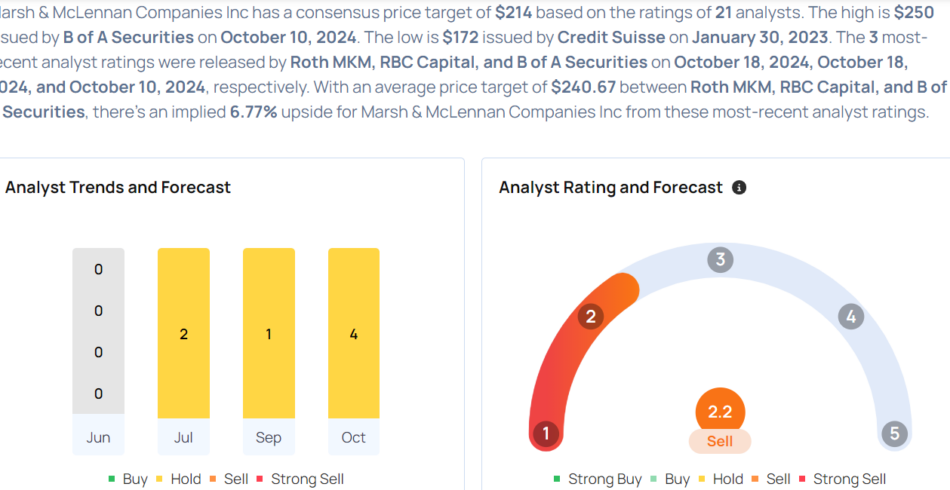

Considering buying MMC stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply