Unpacking the Latest Options Trading Trends in Intuitive Surgical

Whales with a lot of money to spend have taken a noticeably bearish stance on Intuitive Surgical.

Looking at options history for Intuitive Surgical ISRG we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $236,238 and 4, calls, for a total amount of $250,299.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $470.0 and $485.0 for Intuitive Surgical, spanning the last three months.

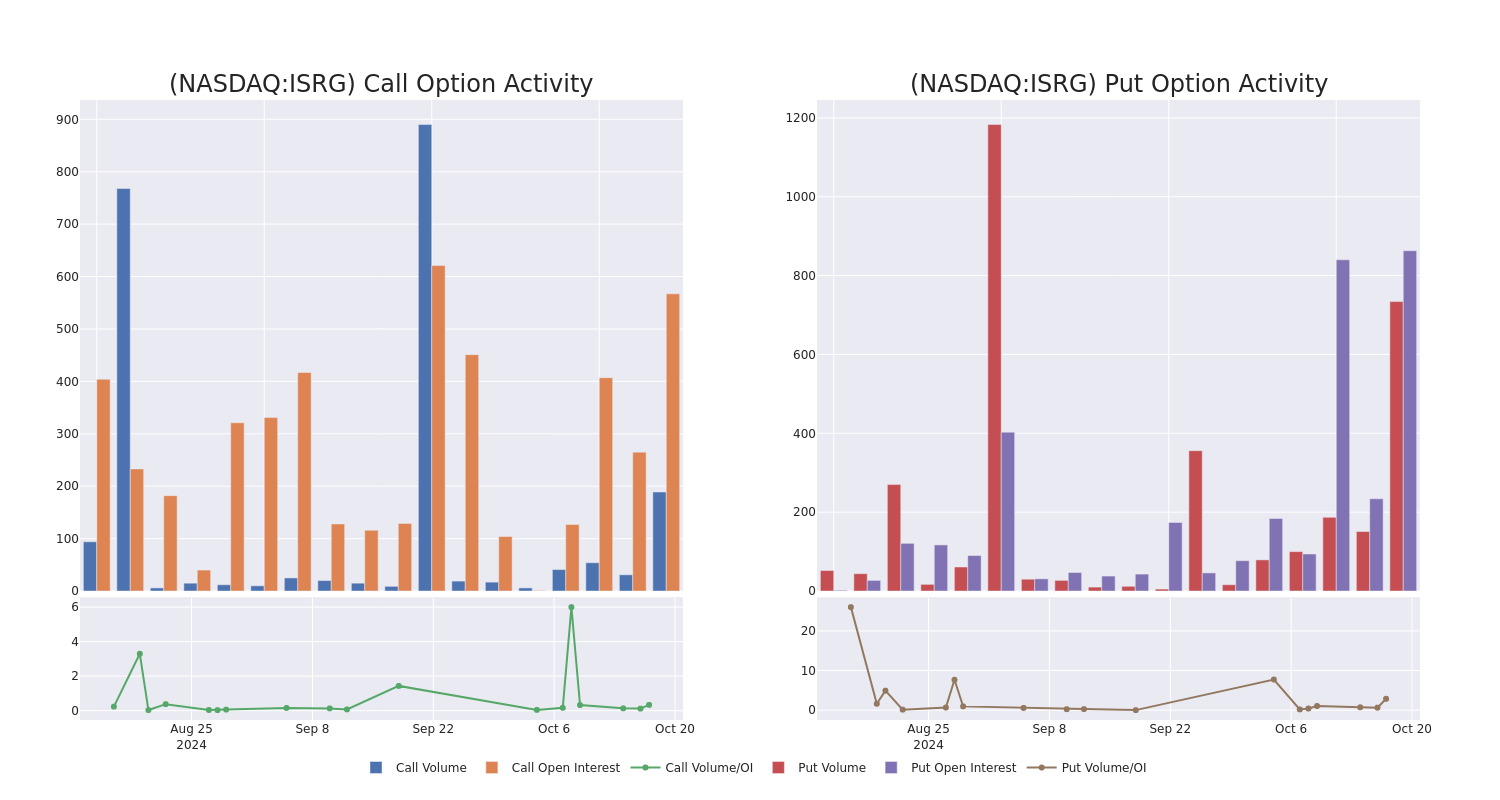

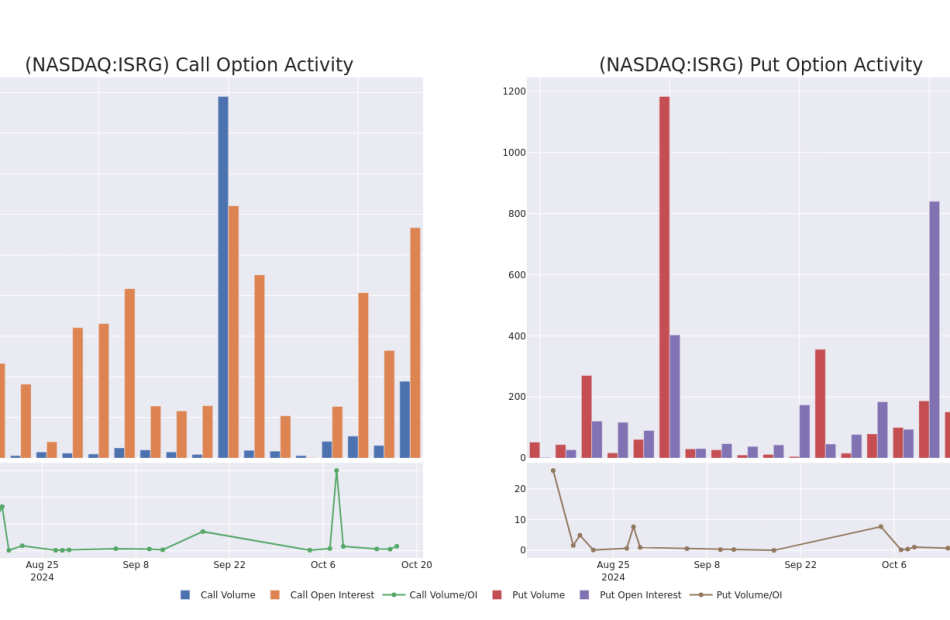

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Intuitive Surgical stands at 238.33, with a total volume reaching 923.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intuitive Surgical, situated within the strike price corridor from $470.0 to $485.0, throughout the last 30 days.

Intuitive Surgical Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | BULLISH | 01/17/25 | $28.0 | $27.9 | $28.0 | $485.00 | $145.5K | 299 | 54 |

| ISRG | PUT | TRADE | BULLISH | 01/17/25 | $27.9 | $27.4 | $27.5 | $475.00 | $110.0K | 243 | 63 |

| ISRG | PUT | SWEEP | BEARISH | 10/18/24 | $10.0 | $9.6 | $9.9 | $470.00 | $46.5K | 370 | 48 |

| ISRG | PUT | SWEEP | BEARISH | 10/18/24 | $13.4 | $12.9 | $13.3 | $475.00 | $41.2K | 250 | 340 |

| ISRG | CALL | SWEEP | NEUTRAL | 10/18/24 | $15.4 | $15.3 | $15.3 | $472.50 | $39.7K | 8 | 26 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Having examined the options trading patterns of Intuitive Surgical, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Intuitive Surgical

- Currently trading with a volume of 1,808,262, the ISRG’s price is up by 5.54%, now at $503.0.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 0 days.

Expert Opinions on Intuitive Surgical

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $537.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Intuitive Surgical with a target price of $575.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Intuitive Surgical, targeting a price of $475.

* An analyst from RBC Capital persists with their Outperform rating on Intuitive Surgical, maintaining a target price of $525.

* An analyst from Truist Securities has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $570.

* Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Intuitive Surgical with a target price of $540.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuitive Surgical with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply