Why I Just Bought This Ultra-High-Yield Dividend Stock

I viewed utilities as boring investments for much of my life. The closer I get to retirement, though, the more I realize the truth of the statement, “Boring is beautiful.”

My portfolio now includes several utility stocks. And I recently added another: UGI Corporation (NYSE: UGI). Why did I buy shares of UGI? Three key reasons rank at the top of the list.

1. A resilient business

The last thing I want to invest in these days is a company that could go under because of a bad move or two. UGI isn’t that kind of company because its business is highly resilient.

UGI owns AmeriGas, the largest retail propane distributor in the U.S. It operates natural gas utilities serving customers in Pennsylvania, Maryland, and West Virginia.

The company’s electric utility serves customers in Pennsylvania, and its Energy Services subsidiary operates natural gas pipelines and natural gas storage facilities. UGI also owns a liquified petroleum gas (LPG) distribution unit that serves several European countries.

The company has been in business for 142 years. It expects to deliver average long-term earnings-per-share growth of between 4% and 6%.

Sure, AmeriGas’ earnings have been highly volatile. Last year, Fitch lowered its outlook on the business to negative from stable.

However, UGI is committed to stabilizing AmeriGas by controlling costs and strengthening its balance sheet. Those efforts seem to be bearing fruit, based on the company’s solid fiscal 2024 third-quarter results.

2. An impressive dividend

I’d be lying if I said UGI’s dividend wasn’t an important part of my decision to buy the stock. Its forward dividend yield is an ultra-high 5.95%. Its payout ratio also stands at a reasonable level of 47.8%.

UGI has paid a dividend for 140 consecutive years, and that’s not a typo. The utility company first paid a dividend way back in 1884 and hasn’t missed a beat since. Few dividend stocks have such a reliable track record.

Over the last 10 years, UGI has increased its dividend by a compound annual growth rate of 6%. Granted, the company won’t give shareholders a dividend hike this year and doesn’t expect to do so in fiscal 2025 or 2026, either, as it focuses on strengthening its balance sheet. However, UGI plans to return to increasing its dividend payout by roughly 4% per year in fiscal 2027 and beyond.

3. An attractive valuation

UGI’s share price has trended mainly downward over the last three years. Its AmeriGas challenges served as a primary culprit behind this disappointing performance. However, there’s a positive side effect of the stock’s decline — an attractive valuation.

Zacks Equity Research gives UGI a grade of “A” on valuation, and the stock trades at only 8x forward earnings. That’s less than half the average forward price-to-earnings ratio of 18.8 for the S&P 500 utilities sector.

I might view UGI as a value trap if I didn’t think its future looked brighter than its recent past, but that’s not the case as the company’s financials are improving. It expects to deliver reliable earnings growth going forward.

Plus one bonus

Some investors like to “bet on the jockey and not the horse.” My take is that if the horse is fast enough, it doesn’t matter much who the jockey is. That said, I want solid, capable management in charge of the companies in which I invest.

It was a nice bonus, therefore, when UGI named Bob Flexon as its new CEO, effective Nov. 1, 2024. Flexon served as UGI’s CFO for roughly six months in 2011 and was CEO of power company Dynegy from July 2011 to April 2018. He’s also been CEO of engineering and construction contractor Foster Wheeler and CFO and COO of NRG Energy.

I didn’t load up on UGI stock because Flexon is taking the helm of the company, but he exemplifies the kind of leadership I like to see. With Flexon as CEO, I expect UGI will deliver the steadiness that investors want.

Should you invest $1,000 in UGI right now?

Before you buy stock in UGI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UGI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Keith Speights has positions in UGI. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why I Just Bought This Ultra-High-Yield Dividend Stock was originally published by The Motley Fool

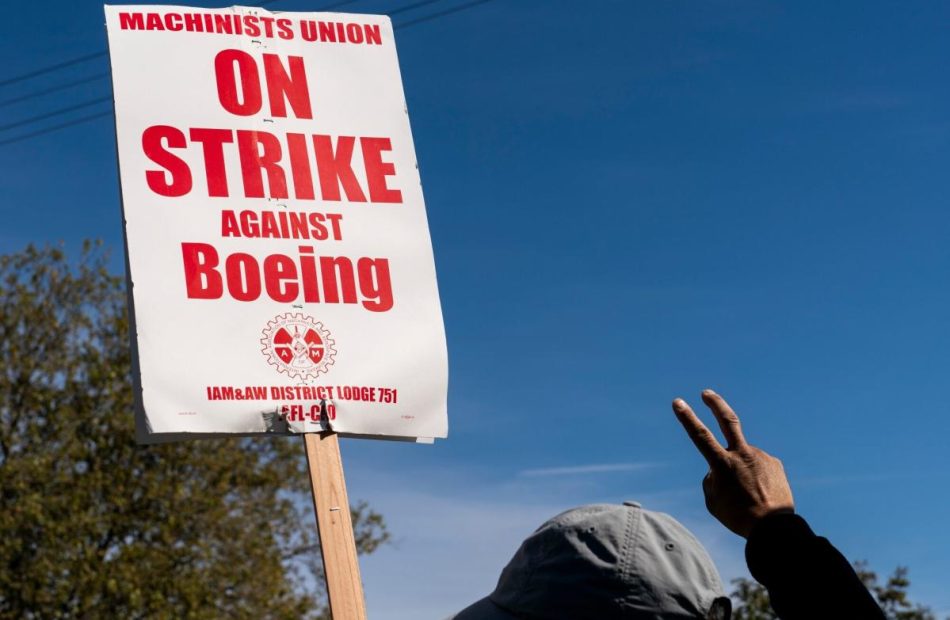

Boeing Proposes 35% Wage Hike in New Bid to End Lengthy Strike

(Bloomberg) — Boeing Co. and the union representing 33,000 striking workers reached a tentative agreement on a new contract with help from the White House, underscoring the high stakes to end a work stoppage that has crippled one of the largest US exporters.

Most Read from Bloomberg

The proposal hammered out overnight in Seattle includes a wage increase of 35% spread over four years, a guaranteed annual bonus of at least 4% and an additional $7,000 bonus if workers approve the contract, IAM District 751 said in a statement on its website Saturday. A ratification vote is set for Oct. 23.

The potential breakthrough ends a lengthy impasse marked by miscues and finger-pointing on both sides. The White House sent Acting Secretary of Labor Julie Su to Seattle to support the collective bargaining process, and she met multiple times with both the union and new Boeing Chief Executive Officer Kelly Ortberg to overcome the stalemate.

“President Biden believes the collective bargaining process is the best way to achieve good outcomes for workers, and the ultimate decision on a contract will be for the union workers to decide,” the White House said in a statement after the two sides confirmed that they’d reached a deal.

Resolving the strike would provide a boost to Ortberg, who joined Boeing in August with a mandate to revamp operations. He is slated to address analysts and investors for the first time Oct. 23, when Boeing reports its third-quarter results.

A tentative deal between Boeing and the union doesn’t guarantee that workers will also fall in line. When the first proposal, which was backed by both sides, was put to a vote last month, employees overwhelmingly turned it down.

Boeing has since come back twice with sweetened bids, first with a 30% increase that it took directly to workers, and now with the latest plan that is on the table and is 10 percentage points above the initial offer.

“We look forward to our employees voting on the negotiated proposal,” Boeing said in a statement.

Pressure Mounting

Pressure is mounting for Boeing, its suppliers and striking workers as the strike enters a sixth week. The work stoppage that began Sept. 13 stretches along the West Coast and has forced Boeing to shut down assembly lines for its cash-cow 737 Max, 767 and 777 aircraft.

The planemaker is moving forward with plans to cut 10% of its workforce, the first step toward a broader realignment of its businesses under Ortberg. The pain has also started to ripple through Boeing’s supply chain, with Spirit AeroSystems Holdings Inc. warning it would have to lay off 700 workers building components for the 767 and 777 programs.

Boeing has taken the initial steps to raise capital it will need to shore up its operations and maintain its investment-grade credit rating. The company has lined up a $10 billion credit facility with banks, and filed a shelf registration to raise as much as $25 billion over the next three years.

The strike by IAM District 751 marks the first major labor strife at Boeing in 16 years. As hourly workers are pushing for 40% pay increases and better retirement benefits, they’re driven by resentment over receiving paltry wage increases over the past decade while senior executives were richly rewarded.

The latest agreement addresses many of the frustrations that workers expressed with the company’s earlier proposals. But it doesn’t reinstate Boeing’s defined-benefit pension plan, a potential sticking point for some members.

Instead, Boeing would raise its contributions to workers’ retirement savings plans. The company would make a one-time contribution of $5,000 into the 401(k) plans of all eligible workers, and fully match their contributions of as much as 8% of salaries.

–With assistance from Allyson Versprille and Danny Lee.

(Updates with White House comment in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Here's where investors worried about a stock market bubble should put their money, according to a top economist

-

Investors worried about a market correction should adjust their portfolios, David Rosenberg says.

-

The top economist has warned stocks are in a bubble and at risk of a major decline.

-

He advised investors to pay attention to key sectors and add “insurance” to their portfolios.

A number of Wall Street forecasters have been warning of a stock bubble as the market climbs to a series of fresh highs in 2024 — and investors worried about such a scenario should be putting their money in a handful of assets to protect themselves from the eventual bursting.

That’s according to David Rosenberg, a top economist and the founder of Rosenberg Research, who’s been warning of a potential craash in stocks for months. In the past, he’s warned of a 39% correction to stocks, among the more extreme predictions on Wall Street, where most investors are feeling optimistic about a soft landing amid a robust economy and easing interest rates.

“Watching the market these days is like watching a clown blowing up a balloon (or Chuck Prince dancing the ballroom), knowing the inevitable,” Rosenberg said in a note to clients on Friday. “When this mega-bubble pops, it will be spectacular.”

Investors need to exercise caution and avoid following the “herd mentality,” Rosenberg said, pointing to the fervor for mega-cap tech stocks. Instead, he said, investors should focus on stocks with strong business models, strong growth, and good prices, and add some “insurance” to their portfolios.

Below are his top investment ideas for to prepare for the potential bursting of a market bubble.

Healthcare and consumer staples

Investors should gear their investments towards what people will always need in the future. In particular, Rosenberg recommended that investors pay attention to options in the healtcare and consumer staples sectors.

“Focus on where people are going to focus on what they need, not what they want,” Rosenberg wrote. “Anything related to e- commerce, cloud services, and wiring up your home to become your new office has been in a budding secular growth phase.”

Utilities

Utility stocks also look promising. Other forecasters have predicted huge upside for utility firms, due to the growing need for power and data centers stemming from the AI boom.

“Utilities, as we have been saying for a long time, are as close to a ‘no brainer’ as there is, given their yield attributes and their being re-rated for ‘defensive growth’ owing to enhanced earnings visibility through the strong and secular outlook for US power needs,” Rosenberg said.

Aerospace, Defense

Aerospace and defense stocks could also be a buy, he added, given rising geopolitical tensions around the world.

“Aerospace/defense has been a long-standing bull call for us for several years, and the best hedge against an increasingly troubled world where military budgets are expanding everywhere — and not at all sensitive to who comes to power on November 5th.”

Big tech

While some areas of tech are exhibiting bubble characteristics, investors could still seize on opportunities in some large-cap tech names, given the prevalence of work-from-home, cloud services, and remote work, Rosenberg said. Still, investors should wait to scoop up tech names at better prices, he said.

“I’d prefer to pick these plays up at better prices than we have today because this last melt-up has eaten enough into future expected returns to keep us cautious for now. But we would be an avid buyer on any significant pullback.”

Safe bets

Investors should look to put a “dose of insurance” in their portfolios. That means gold — the “truest store of value,” Rosenberg says, — as well as government bonds.

“The beautiful thing about gold is that it is not a liability that a central bank can simply have forgiven or a currency that can simply be printed by government fiat,” he said of the precious metal. “I also favor the Treasury market because it commands just about the highest yield of any major industrial country – and with the great liquidity attributes.”

Real estate investment trusts could also be good ways to hedge risk, Rosenberg said. That particularly applies to REITs tied to the industrial and healthcare sectors.

“In any event, we all have to become increasingly thematic and thoughtful in our decision-making and more selective than normal because the stock market, and financial assets in general, have become nothing more than a momentum casino,” he added.

Most forecasters on Wall Street still expect a strong performance from equities into year-end and 2025. Goldman Sachs, UBS, BMO, and Deutsche Bank have raised their year-end price targets for the S&P 500 in recent weeks, with new forecasts ranging from 5,750 to 6,400.

Read the original article on Business Insider

3 Bargain Stocks to Buy in a Market That's Priced for Perfection

How richly valued are stocks right now? Legendary investor Warren Buffett has built Berkshire Hathaway‘s cash stockpile up to roughly $277 billion. When Buffett is sitting on that much cash because he can’t find appealing investments to buy, you know stocks are expensive.

There are exceptions, though. In a market that’s broadly speaking priced for perfection, three Motley Fool contributors have identified what they think are bargain stocks to buy: Axsome Therapeutics (NASDAQ: AXSM), CRISPR Therapeutics (NASDAQ: CRSP), and Pfizer (NYSE: PFE).

A biotech with multiple catalysts on the horizon

Prosper Junior Bakiny (Axsome Therapeutics): Few things can jolt biotechs, especially relatively small ones, like solid clinical and regulatory wins. Axsome Therapeutics, a drugmaker with a market cap of about $4.3 billion, could experience quite a few of those in the next two years. It has already made tremendous progress since the start of the decade, going from a clinical-stage biotech to one with two approved products on the market. But it isn’t done yet.

Within the next 12 months, AXS-07, a potential therapy for migraines, and AXS-14, an investigational treatment for fibromyalgia, could both earn regulatory approval. The company will also release results from multiple clinical trials in the coming months. Positive results could lift Axsome Therapeutics’ share price.

Is the biotech a bargain stock? In my view, the answer is yes. While Axsome Therapeutics generates little revenue and is still unprofitable — which isn’t unusual for biotechs of this size — its late-stage pipeline is incredibly promising. Before long, it should have a lineup with four to six products that will generate growing sales for years.

Axsome Therapeutics’ valuation continues to lag the potential of its pipeline. Sure, it could experience clinical and regulatory setbacks — indeed, it has already faced some. However, there is a good chance that it will generate strong returns in the next five years, partly because its likely successes aren’t baked into its valuation. That’s why I’d advise investors to buy the stock today.

A biotech with tons of upside

David Jagielski (CRISPR Therapeutics): Although it may seem like just about every growth stock is trading at a significant premium these days, there are some bargain-basement options available. One is gene-editing company CRISPR Therapeutics. It is down 24% this year, but optimism should be higher than ever for the business as it is on the cusp of some exciting growth opportunities.

Within the past year, the Food and Drug Administration approved CRISPR’s treatment Casgevy for two indications — sickle cell disease and transfusion-dependent beta-thalassemia. It could be a life-changing treatment for patients with these conditions as it provides them with a functional cure. That’s part of the reason why its list price is as high as it is — $2.2 million. CRISPR will split the profits on Casgevy 40/60 with its development partner, Vertex Pharmaceuticals.

Prior to this, CRISPR didn’t have any approved products; now, it may have a path to profitability. But despite this, the biotech stock is trading around the levels it was at back in 2019. Casgevy has the potential to generate more than $1 billion in annual revenue at its peak and is likely to play a pivotal role in CRISPR’s growth.

For investors looking for a real bargain, you don’t need to look much further than CRISPR Therapeutics. The business is still in the early stages of rolling out Casgevy, and over time investors should expect to see stronger financial results from the company. As that happens, it could trigger a big rally.

Post-pandemic problems but a brighter future

Keith Speights (Pfizer): I won’t sugarcoat matters: Pfizer faces some problems. Sales of COVID-19 vaccine Comirnaty have plunged as worries about the pandemic have subsided. Several of the company’s top blockbuster drugs will lose patent exclusivity over the next few years. And Pfizer recently voluntarily withdrew its sickle cell disease drug, Oxbryta, from the market because of safety concerns.

Because of these problems, Pfizer’s share price has fallen by more than 50% since late 2021. However, there have been two positive effects of this steep decline for investors. First, Pfizer’s forward dividend yield has risen to 5.7%. Second, the stock’s valuation has become much more attractive. Pfizer’s shares now trade at 10.6 times forward earnings. That’s well below the forward earnings multiple of 18.6 for the S&P 500 healthcare sector.

This low metric raises a question, though: Is Pfizer stock a value trap? I think the answer is a resounding “no.” The company’s future is brighter than you might think.

Pfizer recently returned to year-over-year revenue growth for the first time since late 2022, when its COVID-19 vaccine and antiviral sales were at their peak. Acquisitions have been key to this turnaround. Migraine drug Nurtec ODT, which Pfizer picked up with its 2022 acquisition of Biohaven, contributed $356 million in sales in the second quarter of 2024. Adcetris and Padcev, cancer drugs added to Pfizer’s lineup with its 2023 buyout of Seagen, together generated $673 million in sales in Q2.

I expect new products — both those developed in-house and those gained through acquisitions — will more than offset the declines in revenue from drugs that lose their exclusivity over the next several years. Pfizer’s pipeline, which features 33 late-stage programs, could produce other big winners.

Should you invest $1,000 in Axsome Therapeutics right now?

Before you buy stock in Axsome Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Axsome Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. Keith Speights has positions in Berkshire Hathaway, Pfizer, and Vertex Pharmaceuticals. Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Axsome Therapeutics, Berkshire Hathaway, CRISPR Therapeutics, Pfizer, and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.

3 Bargain Stocks to Buy in a Market That’s Priced for Perfection was originally published by The Motley Fool

SoFi Technologies price target raised to $12.50 from $11 at Citi

Citi analyst Andrew Schmidt raised the firm’s price target on SoFi Technologies (SOFI) to $12.50 from $11 and keeps a Buy rating on the shares. The firm says conditions for continuation of positive sector performance remain in place for the FinTech group heading into the Q3 reports. Citi believes a relatively benign macro environment thus far, steady-to-lower rates, more even fund flows, improving sentiment regarding larger-cap multiple ceilings and transitions, and further profitability ramps can better support stock valuations. The analyst’s stock preferences “shift further along the risk spectrum, which correspond to the new sector phase.”

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

See today’s best-performing stocks on TipRanks >>

Read More on SOFI:

SCHD: Split or Not, This Is a Strong Dividend ETF

The Schwab U.S. Dividend Equity ETF (SCHD) is one of the most popular dividend ETFs in the market today with a massive $63.7 billion in assets under management (AUM).

The fund recently made some waves by executing a 3-for-1 split which went into effect on October 10th. We’ll discuss the rationale and details regarding the share split in this article. But more importantly, we’ll evaluate the merits of holding SCHD in an investment portfolio.

I’m bullish on this well-known dividend ETF based on the strength of its attractive yield, its diversified portfolio of highly-rated dividend stocks, and an ultra-low expense ratio.

What Is the SCHD ETF’s Strategy?

According to fund sponsor Charles Schwab, SCHD’s strategy is simply to invest in an index called the Dow Jones U.S. Dividend 100 Index. The index is “focused on the quality and sustainability of dividends.” The fund also “invests in stocks selected for fundamental strength relative to their peers, based on financial ratios.”

Examining the Split

As one of the most popular dividend ETFs in the market, SCHD recently made some waves when it conducted a 3-for-1 stock split that went effective on October 10, 2024. It’s much more common for company stocks to split than ETFs, and here is a rare case where an exchange-traded fund has split. The split doesn’t have any fundamental impact on SCHD’s investment prospects. What’s occurred is that investors now own three shares of SCHD for every one share previously held, while the market price of the ETF is 1/3 the value it would be without the split.

A share split has some minor benefits, such as the lower price per share making it easier for smaller investors to establish an investment. A stock split can also enhance liquidity. It may also trigger increased options activity on the ticker (an options contract consists of 100 shares). But with all that said, the outlook for SCHD stock should be no different now than if no split had taken place.

Many popular stocks that have engaged in stock splits over the past year, like Nvidia (NVDA) and Broadcom (AVGO), had share prices of well over $1,000 a share, making a split more meaningful. Those splits made it significantly more affordable for investors to buy a share, or one lot (100) of shares. SCHD, on the other hand, was trading at just under $85 per share before the split, so the need for a split seemed less apparent here. The ability to buy fractional shares on brokerages like Robinhood (HOOD) and others also mitigates the need for stock splits to some degree.

Regardless, at the end of the day, this is the same solid dividend ETF with the same holdings it had prior to the share split.

Portfolio of Blue-Chip Dividend Stocks

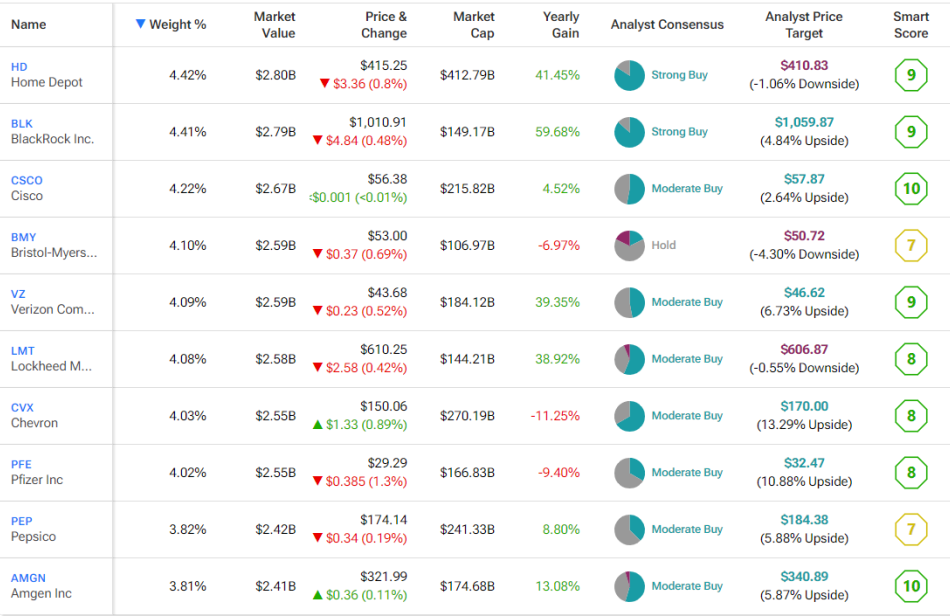

The SCHD ETF offers sound diversification to investors. It owns 100 stocks, and its top 10 holdings account for 41.0% of its assets. Below, you’ll find an overview of SCHD’s top 10 holdings from TipRanks’ holdings tool.

As you can see, the fund owns a plethora of well-known dividend stocks, ranging from top holding Home Depot (HD), to BlackRock (BLK), to Lockheed Martin (LMT).

In addition to being blue-chip dividend stocks, another thing that these top holdings have in common is that they offer strong Smart Scores. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. The score is data-driven and does not involve any human interpretation. Impressively, eight stocks from SCHD’s top 10 holdings have Smart Scores of eight or better.

The Smart Score system also rates SCHD itself favorably, giving it an Outperform-equivalent ETF Smart Score of 8.

Advantageous Valuation

Beyond being top dividend stocks, another nice thing about SCHD’s holdings is that overall, they are fairly inexpensive. The ETF’s holdings currently have a price-to-earnings ratio of 17.6x. This is another reason I’m bullish on the ETF.

While a 17.6x P/E ratio isn’t dirt cheap, it’s considerably more affordable than the broader market at a time when the S&P 500 has a price-to-earnings ratio of 24.7x.

This means that SCHD and its holdings probably offer a bit more downside protection than the broader market, and potentially have a bit more room for upside from multiple expansion. The fund also carries a beta of 0.74. This means that SCHD’s share price is only about three-quarters as volatile as the broader market. This adds credence to SCHD’s defensive qualities (as discussed above in the valuation section) which can be attractive for investors seeking to avoid volatility.

Assessing SCHD’s Performance

SCHD has generated solid returns for its shareholders over the years. As of September 30th, the ETF has produced a three-year annualized return of 8.2%, a five-year annualized return of 13.0%, and a 10-year annualized return of 11.7%.

It’s worth noting that SCHD has lagged behind broad market funds like the Vanguard S&P 500 ETF (VOO) over each of these time frames (for reference, VOO has posted an annualized five-year return of 15.9%). That is likely attributable to the growth opportunities many non-dividend paying companies have available.

SCHD’s underperformance against the S&P 500 index (SPX), and its tracking ETFs, comes at a time when many large-cap tech stocks with small (or no) dividends have powered the index. If we return to an environment where more value-oriented dividend stocks are favored again, SCHD could outperform the broad market. For example, SCHD has slightly outperformed VOO over the past three months in what has been a volatile time for tech stocks.

Regardless of comparisons, double-digit returns over a 10-year time horizon, like SCHD has delivered, are nothing to scoff at. Furthermore, for investors who own a large number of high-flying tech stocks, SCHD could provide worthwhile diversification benefits.

SCHD Offers an Attractive Yield

The SCHD ETF currently yields 3.4%. This is an attractive yield and more than double the current yield of the S&P 500. That’s pretty attractive.

Furthermore, the fund has a track record of dividend consistency. SCHD has paid a dividend for 12 straight years, and increased its payout annually. The dividend payout has been growing at a solid 12% clip over the past five years, so investors can likely expect continued increases in payouts over time. Unless, of course, hard times hit Corporate America, forcing some companies to cut their dividend.

Low Expense Ratio for SCHD

SCHD charges a bargain-bin expense ratio of just 0.06%. This means that an investor with $10,000 in the fund will pay just $6 in fees over the course of a year. It’s hard to argue with this expense ratio; it’s less than the price of a fast-food lunch these days.

The savings from a low-fee investment fund like SCHD can really add up over time. Assuming that the current expense ratio remains the same, and the fund returns 5% per year on an annualized basis going forward, an investor putting $10,000 into SCHD would pay just $77 in fees over the course of a decade.

Is SCHD Stock a Buy, According to Analysts?

Turning to Wall Street, SCHD earns a Moderate Buy consensus rating based on 54 Buys, 37 Holds, and 10 Sell ratings assigned in the past three months. The average SCHD stock price target of $30.16 implies about 5% upside potential from current levels.

In Conclusion

I’m bullish on SCHD based on its attractive 3.4% dividend yield, its diversified portfolio of highly-rated blue-chip dividend stocks, the relatively inexpensive valuation of these holdings, and the fund’s investor-friendly expense ratio.

The recent 3-for-1 split was an interesting development but ultimately doesn’t change much for the ETF or its holders.

The one downside of SCHD is that it has lagged the broader market over the years, despite posting respectable double-digit annualized returns. As noted above, some of SCHD’s underperformance versus the S&P 500 is due to the dominant performance of large-cap tech stocks, companies that don’t generally pay attractive dividends.

SCHD stock could be serve a valuable purpose in an investor’s portfolio, by delivering strong dividend income and lower volatility. SCHD could also outperform should investors rotate away from growth and back toward value-oriented dividend stocks.

The S&P 500 Just Did This for the First Time in 13 Years. Here's What History Says Happens Next.

The S&P 500 (SNPINDEX: ^GSPC) is the most widely followed stock market index in the U.S. and includes the 500 largest companies in the country. Because it contains a broad swath of American businesses, it’s also considered by many to be the best overall benchmark and the most reliable gauge of overall stock market performance.

The storied index has been squarely in rally mode since it bottomed in October 2022, driven higher by waning inflation, the advance of artificial intelligence (AI), and the Federal Reserve Bank’s long-awaited decision to begin its campaign of interest rate cuts. These factors have combined to create an environment that’s ripe for the stock market rally to continue.

The S&P 500 just delivered its best January-through-September performance since 1997 and has now entered the third year of its current bull market run, something that hasn’t happened since 2011. If history is any indicator, the current rally still has much further to go.

A bull can run a long way

Fresh off the worst bear market since 2009, investors are relishing the good times — and well they should. History shows that bull markets have more stamina and tend to last much longer than their bearish counterparts.

Since World War II, the average bull market has lasted roughly four and a half years, according to data compiled by Bespoke Investment Group. For context, that’s far longer than the average bear market, which lasts roughly one year.

That said, not all bull markets are created equal. For example, the bull market that started in 1987 ran for more than 12 years, while the bull market that began in 2009 ran for 11 years. On the other end of the spectrum, the bull market that began in 2001 lasted just three months.

The current rally just completed its second full year, so — if history holds true — this bull market still has further to run. Of the 13 bull markets that have occurred over the past 77 years, seven have lasted three years or more, so history is on the side of the bulls.

Then there’s the matter of returns. Bull markets have generated returns of 152%, on average, which bodes well for current investors. However, the market gains varied greatly, depending on the length of the rally. For example, the bull market that began in 1987 generated returns of 582%, while the one that began in 2009 returned 400%. However, the short-lived rally of 2001 — which lasted just three months — returned just 21%.

Generally speaking, the longer the bull market, the greater the potential returns. That holds true for the ongoing run as well. Looking back to October 2022 — the beginning of the current market rally — the S&P 500 has generated returns of 63%. If history holds true, the current bull market has much more to give.

Where do we go from here?

There are plenty of opinions about the market and where we go from here. Goldman Sachs Chief U.S. Equity Strategist, David Kostin, just boosted his 2024 year-end target for the S&P 500 to 6,000 while lifting his 2025 target to 6,300. This suggests that after notching 22% gains already this year, the index is poised to tack on an additional 3%. It also suggests that the S&P 500 will climb 5% in 2025.

While market prognosticators will provide their best guesses about what happens from here, the truth is no one knows for sure. If the economy keeps ticking along, and business and consumer spending hold up, the current bull market has a shot at joining some of the longer bull market runs in history.

However, things don’t always go as planned. Investors should be aware of the potential for a “black swan” event, a random and seemingly unpredictable happening that can have an enormous impact on the financial landscape. Think the 2008 financial crisis or the recent global pandemic. Many a bull market run has been derailed by a black swan.

Does that mean investors should hunker down and fear the worst? Far from it. Market legend Peter Lynch — one of the most successful investors of all time — said, “Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.” This knowledge should help investors be mentally prepared for events that couldn’t possibly be foreseen.

The biggest takeaway from this exercise is that time is the biggest advantage that investors have. As illustrated by the above chart, the stock market has generated robust returns over time despite market downturns. Buying quality stocks and holding them for the long term is the best strategy for thriving in a bull market. Furthermore, continuing to add to your portfolio at regular intervals — a process known as dollar-cost averaging — and keeping it up during both bull and bear markets helps develop the discipline needed to thrive no matter what the conditions.

The stock market has returned 10% annually, on average, over the past 50 years, which helps illustrate the benefits of investing for the long term.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Danny Vena has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool has a disclosure policy.

The S&P 500 Just Did This for the First Time in 13 Years. Here’s What History Says Happens Next. was originally published by The Motley Fool

Warren Buffett Recently Sold $800 Million Worth of This Artificial Intelligence (AI) Stock, While Buying Another $345 Million Worth of His Favorite Stock

Warren Buffett has served as the CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) since 1965. He and his team manage a portfolio of publicly traded stocks and securities worth $318 billion, in addition to $277 billion in cash and numerous private wholly owned subsidiaries.

Berkshire stock has delivered a compound annual return of 19.8% under Buffett’s leadership, which could have turned an investment of $1,000 into more than $42 million over his 59-year tenure. That’s why Wall Street closely watches his every move.

During the second quarter of 2024, Berkshire went on a selling spree, cutting its $160 billion stake in Apple in half and trimming a number of other positions, including Chevron, T-Mobile, and Capital One Financial, to name just a few.

Berkshire also sold its entire $800 million position in data specialist Snowflake (NYSE: SNOW), which it had held since 2020. But there is one stock Buffett clearly still loves.

Snowflake wasn’t a great fit for Berkshire’s portfolio

Berkshire’s sales of Apple, Chevron, and T-Mobile might reflect Buffett‘s cautious view on the broader stock market overall. The S&P 500 index currently trades at a price-to-earnings (P/E) ratio of 27.8, which is a 53% premium to its long-term average P/E of 18.1 going back to the 1950s. Prudent portfolio management can involve taking money off the table when the market looks expensive.

However, I think Berkshire might have sold Snowflake stock for a different reason. Despite its growing portfolio of AI products and services, the cloud computing company is experiencing a deceleration in its revenue growth and blowout losses at the bottom line. Buffett often invests in companies for their robust profitability, because it allows them to maintain shareholder-friendly programs like stock buybacks and dividend schemes for the long term, which help compound his gains. Snowflake simply doesn’t fit the bill.

Berkshire bought Snowflake stock ahead of its IPO in 2020, so we don’t know exactly what price it paid. However, it floated at $120 per share, which is roughly where it’s trading today, so Snowflake basically hasn’t delivered any gains in its four-year period as a public company, despite the S&P 500 setting multiple record highs over that stretch.

Snowflake’s Data Cloud helps large organizations aggregate their valuable information in one place so they can analyze it to extract valuable insights. The company could do well in the AI race, because its new Cortex platform allows businesses to combine their data with ready-made large language models (LLMs) to build powerful AI software.

Cortex also comes with several pre-built AI tools to further enhance the Data Cloud. Document AI, for example, allows businesses to extract information from unstructured sources like contracts and invoices. In the past, human workers would have to read through those documents and manually transfer the data into a usable format, so Document AI could save the user an incredible amount of time.

I don’t think Snowflake stock is destined for an upside surge in the near term (and apparently neither does Buffett), but it’s a stock to watch as the AI industry expands.

Buffett continues to plow money into his favorite stock

You won’t find Buffett’s favorite stock in Berkshire’s quarterly 13F filings, because that stock is…Berkshire Hathaway! Despite his cautious approach to the broader market, Buffett continued to authorize stock buybacks during the second quarter of 2024, deploying $345 million into Berkshire shares.

Why do I call it his favorite stock? Besides the fact he has been at the helm of Berkshire Hathaway for 59 years, Buffett has authorized the repurchase of $77.8 billion worth of its shares since 2018, which is twice the amount he spent buying Apple! In other words, you could argue he often sees more value in his own company than any other across the entire market.

Buybacks are Buffett’s preferred way to return money to shareholders. Berkshire can continue repurchasing stock at management’s discretion as long as its cash, equivalents, and holdings in U.S. Treasury bills remain above $30 billion. Since the conglomerate is sitting on a whopping $277 billion in liquidity right now, the buybacks probably won’t stop anytime soon.

There is one caveat. Berkshire stock currently trades at a price-to-sales ratio of 2.5, which is 26% higher than its 10-year average of 1.98. That means it isn’t cheap, which probably explains why Buffett only authorized $345 million worth of buybacks in the second quarter — the smallest amount Berkshire spent acquiring its own shares in any quarter since it resumed buybacks in 2018.

What should investors do from here?

Snowflake is one of many AI stocks, and its issues aren’t necessarily typical of the others. Nvidia, for example, is experiencing triple-digit growth in its revenue and earnings, and its stock is trading near a record high. Simply put, Berkshire’s sale of Snowflake isn’t a sign investors should avoid the rest of the sector.

But the S&P 500 is undeniably expensive right now. That doesn’t mean it has to fall — Buffett himself will tell you he has no idea what the market will do tomorrow, or even a year from now. He’s a long-term investor who buys quality companies and lets time do the hard work.

He does have a duty to Berkshire’s shareholders, though, which means he is obligated to make decisions that he thinks will deliver the most value. That occasionally involves selling large volumes of stock, as Berkshire has done this year.

Buffett often recommends that regular investors buy exchange-traded funds (ETFs), which directly track the performance of indexes like the S&P 500. Even though the market looks expensive today, its current price will probably look cheap when we reflect on this moment 10 years from now. Therefore, consistently adding to an ETF each month can yield powerful results over time.

Berkshire holds positions in the Vanguard S&P 500 ETF and the SPDR S&P 500 ETF Trust, both of which are great options for investors.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Chevron, Nvidia, Snowflake, and Vanguard S&P 500 ETF. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Warren Buffett Recently Sold $800 Million Worth of This Artificial Intelligence (AI) Stock, While Buying Another $345 Million Worth of His Favorite Stock was originally published by The Motley Fool

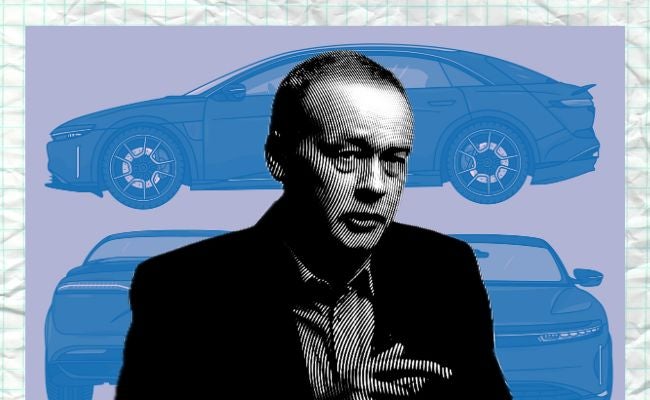

Lucid CEO Peter Rawlinson Talks Saudi Investment, Elon Musk's Political Views And Taking Business From Tesla

In an interview with Semafor published on Thursday, Peter Rawlinson, CEO of Lucid Group, Inc. LCID discussed the company’s relationship with the Public Investment Fund (PIF) of Saudi Arabia, Lucid’s rivalry with Tesla, Inc. TSLA and Elon Musk‘s political views.

Saudi Money: Saudi Arabia’s PIF has invested approximately $8 billion in Lucid, and the sovereign wealth fund holds about a 60% stake in the EV maker, making it the company’s largest shareholder. Lucid is also building a factory in Saudi Arabia with an annual production capacity of 150,000 vehicles. The PIF has said that it views Lucid as an important part of its strategy to diversify Saudi Arabia’s economy and invest in future technologies.

“They are looking for multipliers that can help their transition,” Rawlinson said regarding the Saudi partnership. “I didn’t go out and try to seek Saudi money specifically. But I needed billions of dollars.”

Lucid announced a public offering of its stock on Wednesday and Saudi PIF-affiliate Ayar Third Investment Company had agreed to purchase an additional 374,717,927 shares of Lucid’s stock in a private placement in connection with the offering. The company expects to receive another $970.2 million in gross proceeds from the PIF’s latest investment.

Rawlinson on Elon Musk’s Politics: Rawlinson revealed that he knows Elon Musk “very well” after working for him for three years, but that the Tesla CEO has become “distracted with politics.”

“His mind is not where it was, and you see the result now,” Rawlinson said in the interview. “We’re the new leader, and many of my team from Tesla have come and joined me.”

Rawlinson went so far as to claim that he was not only taking staff from Tesla due to Musk’s political involvement, but said former Tesla customers are fleeing to Lucid as well. He illustrated his point with an anecdote about an email from a customer who switched from Tesla to Lucid.

“We just couldn’t drive around in a Tesla anymore. We bought a Lucid out of disdain for Elon, but now we’ve got it, we can’t believe what we’ve got,” Rawlinson said the customer wrote.

EV Demand: Lucid recently scaled back its production targets, though Rawlinson claims Lucid is outperforming luxury EV competitors in certain markets.

“In some markets now, Lucid Air is outselling Tesla Model S,” Rawlinson stated.

The Lucid CEO said vehicle manufacturing is not a problem and pointed to the company’s production levels of 100 EVs per day in 2022. He sees Lucid’s problem as low EV market demand.

“The market is tough. The actual sales numbers of EVs are increasing. It’s just that the rate of increase was not what we anticipated.”

LCID Price Action: According to Benzinga Pro, Lucid shares ended Friday’s session at $2.63, down more than 22% over the past five days.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Veterans United Launches Homebuyer Readiness Index

Proprietary Index Shows More Buyers Feel Ready to Enter the Market as Optimism About the U.S. Economy Reaches Highest Level in Six Quarters

COLUMBIA, Mo., Oct. 18, 2024 /PRNewswire/ — Today marks the official launch of the Veterans United Homebuyer Readiness Index, a proprietary measure of financial aptitude and optimism among prospective Veteran and civilian homebuyers created by Veterans United Home Loans, the nation’s largest VA lender. Buoyed by growing optimism about the U.S. economy, the latest quarterly index reading shows that prospective buyers are more optimistic about a new home purchase than anytime over the past 18 months.

The index reading for all would-be buyers rose to 67 in the third quarter, the highest yet for the score, which Veterans United began tracking in early 2023. Veterans and service members continue to feel more prepared for homebuying than their civilian counterparts. But the three distinct scores overall were the highest readings yet.

Veterans United Homebuyer Readiness Index

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

53 |

52 |

55 |

59 |

62 |

67 |

|

Veterans |

57 |

55 |

60 |

64 |

64 |

70 |

|

Civilians |

50 |

50 |

50 |

55* |

59 |

64 |

*Civilian sample not included in Q1 2024. This is an average of Q4 2023 and Q2 2024.

The index tracks homebuying sentiment and preparedness using the company’s quarterly national survey of Veterans, service members and civilians with near-term homebuying plans, creating unique scores related to four key areas: home purchase time frame, personal financial outlook, outlook on the U.S. economy and purchase motivators. Those unique scores roll up into an overall readiness score.

Optimism about the U.S. economy was the primary driver of homebuyer readiness in the latest quarter. More than half of homebuyers said the economy will be better off in the coming year, marking the first time a majority of respondents have offered a positive economic outlook.

Nearly three-quarters (74%) of Veterans and service members plan to buy in the next year, compared to 69% of civilians. This compares to 67% and 75% during the same period a year ago, respectively.

“This growing confidence in the economy is translating directly into the housing market in communities across the country,” said Chris Birk, vice president of mortgage insight at Veterans United. “With inflation showing signs of easing and more consumers believing mortgage rates will stabilize or even decrease, we’re seeing a significant boost in homebuying readiness. Although high interest rates and home prices remain a concern among prospective homebuyers, there is growing optimism, especially among Veterans and service members, which could drive increasing demand in the months ahead.”

Homebuyer Timeline

Veterans and service members are adjusting their buying timelines, while civilians are showing less intent to buy compared to last quarter.

The percentage of Veterans and service members intending to buy a home in the next three years dipped slightly in the third quarter. But the percentage of those who plan to buy in the next 12 months jumped to 74% in the third quarter from 67% in the third quarter of last year.

Fewer civilian respondents plan to buy homes in the next three years (40% in Q3). The percentage of civilians who plan to buy in the next year fell to 69% in the third quarter from 75% a year prior.

Homebuyer Timeframe Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

59 |

58 |

58 |

61 |

63 |

62 |

|

Veterans |

64 |

61 |

66 |

68 |

69 |

69 |

|

Civilians |

54 |

54 |

51 |

54* |

58 |

55 |

*Score is calculated by taking the average of the two time frames. No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

Personal Finances Outlook

Financial confidence continues to improve, with the Personal Financial Outlook Score reaching 40 for Veterans and service members and 38 for civilians, both the highest readings yet. Nearly half (48%) of Veterans, service members and civilians (47%) reported feeling at ease with their finances.

The third quarter also shows a continued boost in optimism about would-be buyers’ own personal finances. About 70% of civilians and 65% of Veterans expect their personal finances to improve over the coming year, up from 58% and 56% a year ago, respectively.

Personal Financial Outlook Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

25 |

25 |

27 |

31 |

33 |

39 |

|

Veterans |

35 |

31 |

37 |

39 |

37 |

40 |

|

Civilians |

16 |

20 |

17 |

23* |

30 |

38 |

*No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

U.S. Economic Outlook

Over the last year, there’s been a significant increase in feeling the economy is heading in the right direction. The overall U.S. Economic Outlook Score climbed to 102 in the third quarter, reflecting confidence in the economy and that inflation is easing.

There’s also growing optimism about mortgage rates. The percentage of Veterans and service members who think rates will be lower over the next year jumped 10 percentage points quarter-over-quarter (35%), while the percentage who think rates will be higher in the coming year fell to its lowest level in the history of the survey (38%).

Civilian prospective buyers remain more pessimistic about rates than Veterans. Only about a quarter of civilians expect mortgage rates to be lower in the coming year, while nearly half (47%) think they’ll be higher.

Economic Outlook Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

72 |

69 |

76 |

85 |

90 |

102 |

|

Veterans |

70 |

70 |

76 |

90 |

94 |

107 |

|

Civilians |

73 |

68 |

76 |

81* |

85 |

97 |

*No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

Purchase Motivators

High home prices and interest rates remain the top two barriers to homebuying for all groups. But recent Federal Reserve rate cuts have both Veterans and civilians feeling significantly better about where mortgage rates are heading.

Just 46% of Veteran prospective buyers cited high interest rates as a barrier to homebuying in the third quarter, down from 52% the previous year. The civilian figure fell seven percentage points, from 46% in the third quarter of 2023 to 39% in the third quarter this year.

Purchase Motivators Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

58 |

58 |

59 |

60 |

61 |

64 |

|

Veterans |

58 |

57 |

60 |

58 |

58 |

62 |

|

Civilians |

57 |

59 |

58 |

61* |

64 |

66 |

*No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

To view the full Veterans United Homebuyer Readiness Index and methodology, visit https://www.veteransunited.com/education/homebuyer-readiness-index/

About Veterans United Home Loans

Based in Columbia, Missouri, the full-service national direct lender financed more than $17 billion in loans in Fiscal Year 2023 and is the country’s largest VA lender, according to the Department of Veterans Affairs Lender Statistics. The company’s mission is to help Veterans and service members take advantage of the home loan benefits earned by their service.

VeteransUnited.com | 1-800-884-5560 | 550 Veterans United Drive, Columbia, MO 65201 | Veterans United Home Loans NMLS # 1907 (www.nmlsconsumeraccess.org). A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Licensed in all 50 states. For State Licensing information, please visit https://www.veteransunited.com/licenses/. Equal Opportunity Lender.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/veterans-united-launches-homebuyer-readiness-index-302279415.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/veterans-united-launches-homebuyer-readiness-index-302279415.html

SOURCE Veterans United Home Loans

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.