2 High-Yield REITs to Buy Hand Over Fist and 1 to Avoid

If you are looking at high-yielding stocks while the S&P 500 Index (SNPINDEX: ^GSPC) is trading near all-time highs, as it is today, you’ll likely be considering stocks with higher levels of risk. Simply put, the high yield is the compensation for the extra risk.

As an income investor, you need to make sure you are shouldering risks that are worth taking. AGNC Investment (NASDAQ: AGNC) and its nearly 14% yield have a very real chance of eventually letting you down. EPR Properties (NYSE: EPR) and W.P. Carey (NYSE: WPC) have let investors down, too, but they both look like they’re on an upward trajectory. Here’s what you need to know.

AGNC Investment is one to avoid

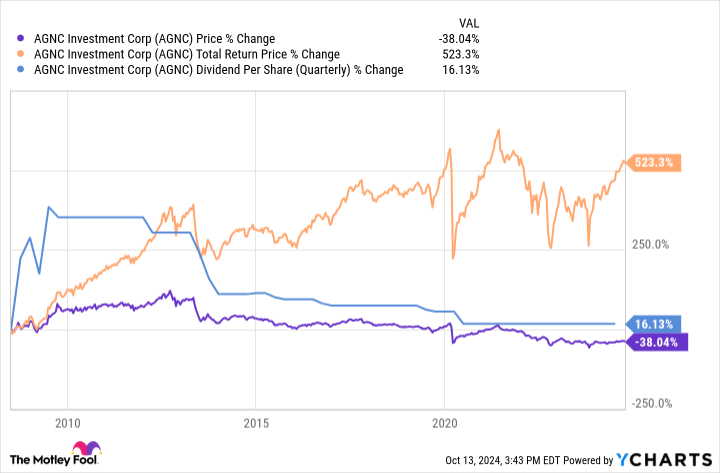

To be fair, AGNC Investment isn’t a bad company. It has produced a fairly strong total return since going public. But the total return includes reinvesting dividends.

If you are a dividend investor trying to live off your dividends, you won’t be buying more shares with that income, you will be spending it on things like food and housing. This is where the big problem comes in for this mortgage real estate investment trust (REIT).

As the chart above highlights, while the total return line (orange) is positive, the price (purple) and dividend (blue) have been trending steadily lower for years. And before that decline started, the dividend was volatile.

Even if the dividend is increased from its current level, there will always be a substantial risk that it will be cut again because of the nature of the mortgage REIT niche. Indeed, mortgage REITs are fairly complicated investments that only more aggressive and active investors should probably be looking at.

But dividend investors don’t really need a deep dive into the mortgage REIT sector to see that AGNC Investment’s payout history isn’t going to be appealing.

All dividend cuts aren’t the same

That said, just because a REIT cuts its dividend doesn’t mean you should permanently throw it off your high-yield wish list. Two dividend-cutting REITs that you might want to consider today are landlords EPR Properties and W.P. Carey.

EPR Properties cut its dividend during the pandemic because the experiential properties it owns (like casino resorts and movie theaters) were effectively shut down by social distancing.

W.P. Carey cut its dividend at the start of 2024 when it decided to exit the office sector in one quick move after the pandemic’s work-from-home trend led to ongoing difficulties for that property type.

What’s notable, however, is that both are growing their dividends again. W.P. Carey’s move was the more compelling, because it started back up with its cadence of quarterly increases in the quarter after the cut. It was a clear sign that it was nothing more than a reset driven by the large portfolio change it made (office space was 16% of assets prior to the exit from that property type).

And the REIT’s departure from the office sector has left it with a record level of liquidity. Management plans to put that cash to work buying more properties, which will add to the company’s portfolio and its ability to keep raising the dividend.

In other words, W.P. Carey’s 5.8% yield not only looks like it is on solid ground, but it also appears that the dividend is highly likely to keep growing. It’s the kind of dividend stock you’ll be glad to get your hands on before investors realize the opportunity they are missing.

EPR Properties’ story is a little less attractive, but hardly bad. Owning assets that bring people together is a solid model in the internet age, even though it was a terrible focus during the pandemic.

And while the portfolio is still overweight in movie theaters (37% of rents), overall rent coverage is now at 2.2 times, above the 1.9 times before the pandemic. Rental coverage for movie theaters, which were hit particularly hard, is back to where it was in 2019. Simply put, the risk profile here has vastly improved.

EPR’s payout ratio of its adjusted funds from operations in the second quarter of 2024 was roughly 72% — a very reasonable number. The dividend has now been increased three times since it was cut, with the last increase coming in March 2024.

EPR Properties did what it needed to do to get through a massive exogenous event. At this point, it looks like it is getting back on the growth track, which suggests that grabbing a fistful of its 7.1% yielding shares could be well worth it.

Investing involves risk, but only some risks are worth taking

Every investment you make requires you to shoulder some risk, even if you own cash (which could lead you to miss out on other investment opportunities). The goal is to balance risk and reward in a way that allows you to sleep at night.

For income investors, the dividend risk at AGNC Investment just isn’t likely to be worth it. But the dividend risk at W.P. Carey and EPR Properties seems pretty low even though both have cut their dividends in the recent past.

Wall Street’s perception of heightened dividend risk, however, could be offering long-term dividend investors an opportunity to lock in high yields from these two REITs that have already started growing their dividends again.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Reuben Gregg Brewer has positions in W.P. Carey. The Motley Fool recommends EPR Properties. The Motley Fool has a disclosure policy.

2 High-Yield REITs to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool

Leave a Reply