Behind the Scenes of Synopsys's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Synopsys.

Looking at options history for Synopsys SNPS we detected 21 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $423,980 and 16, calls, for a total amount of $811,190.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $420.0 and $610.0 for Synopsys, spanning the last three months.

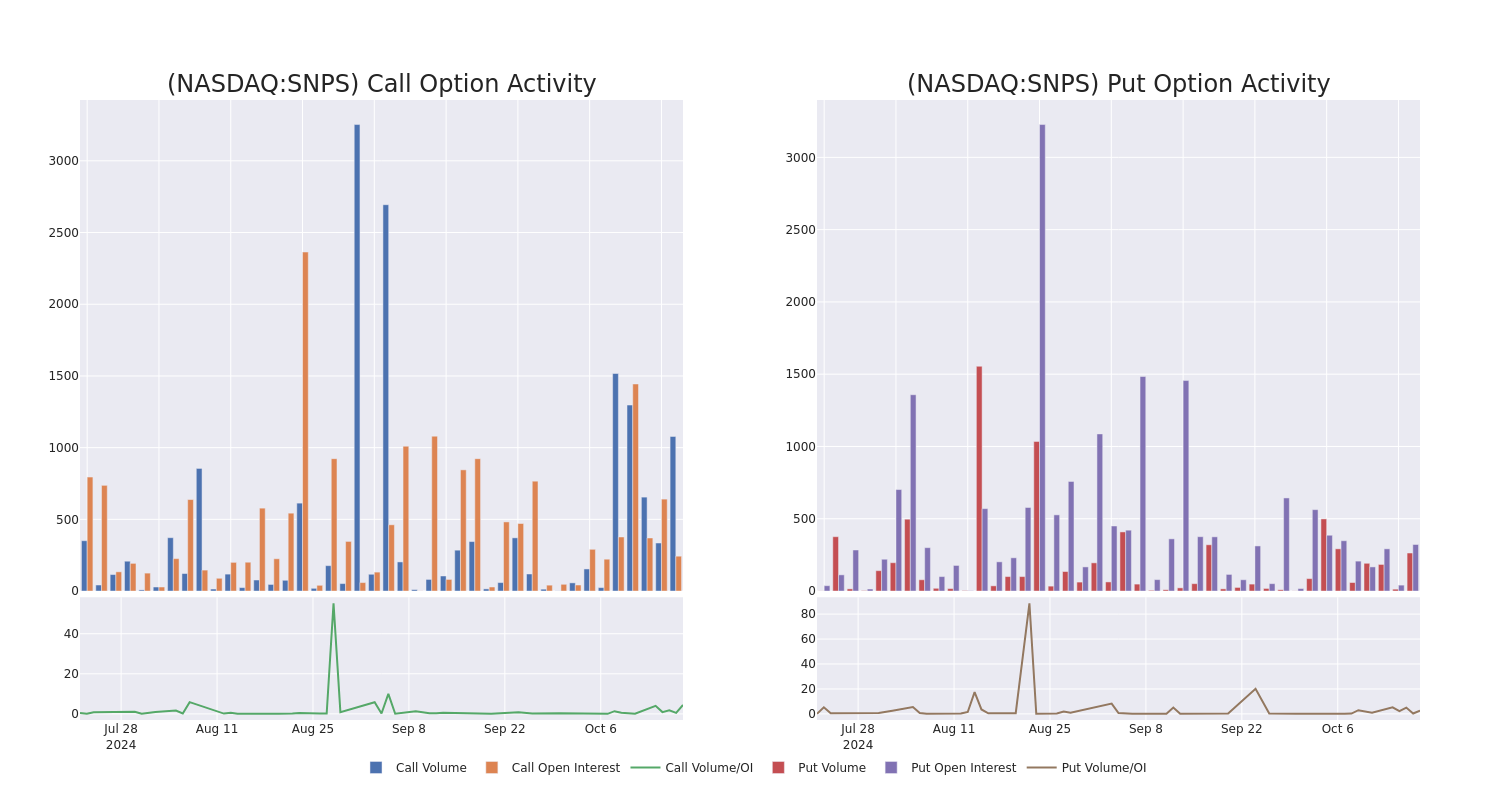

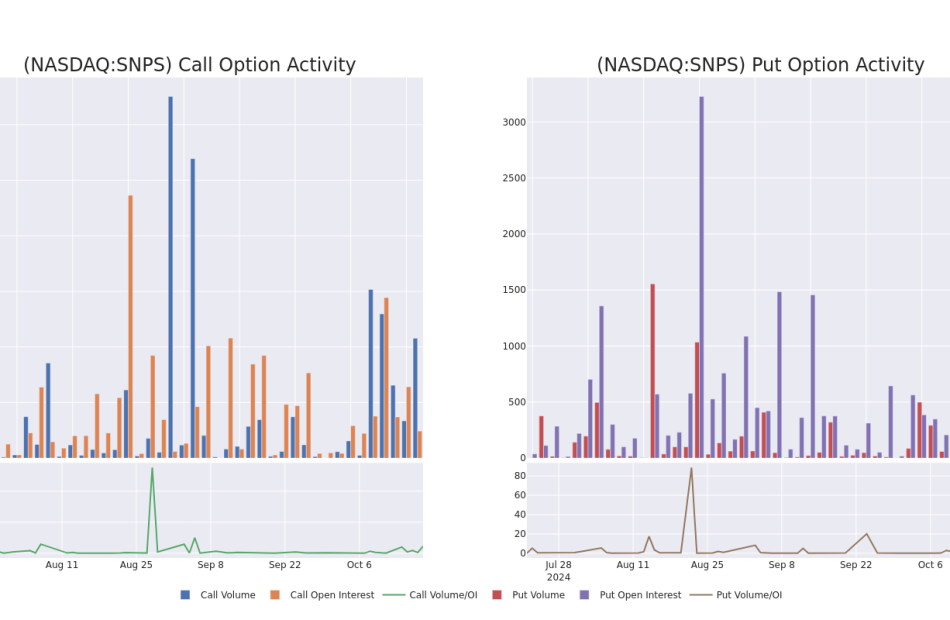

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Synopsys’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Synopsys’s significant trades, within a strike price range of $420.0 to $610.0, over the past month.

Synopsys Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNPS | PUT | SWEEP | BULLISH | 01/15/27 | $55.0 | $50.8 | $50.8 | $420.00 | $213.3K | 80 | 42 |

| SNPS | CALL | SWEEP | BEARISH | 01/16/26 | $63.3 | $61.0 | $61.0 | $600.00 | $91.5K | 150 | 64 |

| SNPS | PUT | TRADE | BULLISH | 12/20/24 | $31.9 | $31.4 | $31.6 | $510.00 | $69.5K | 103 | 50 |

| SNPS | PUT | TRADE | BULLISH | 12/20/24 | $31.9 | $31.5 | $31.5 | $510.00 | $63.0K | 103 | 72 |

| SNPS | CALL | SWEEP | BEARISH | 01/16/26 | $61.0 | $60.0 | $60.0 | $600.00 | $60.0K | 150 | 116 |

About Synopsys

Synopsys is a provider of electronic design automation software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. The firm’s growing SI business allows customers to continuously manage and test the code base for security and quality. Synopsys’ comprehensive portfolio is benefiting from a mutual convergence of semiconductor companies moving up-stack toward systems-like companies, and systems companies moving down-stack toward in-house chip design. The resulting expansion in EDA customers alongside secular digitalization of various end markets benefits EDA vendors like Synopsys.

Following our analysis of the options activities associated with Synopsys, we pivot to a closer look at the company’s own performance.

Where Is Synopsys Standing Right Now?

- Trading volume stands at 854,725, with SNPS’s price up by 0.46%, positioned at $507.03.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 40 days.

What Analysts Are Saying About Synopsys

In the last month, 1 experts released ratings on this stock with an average target price of $660.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Berenberg downgraded its rating to Buy, setting a price target of $660.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Synopsys, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply