On-demand Transportation Market Surges to USD 287.6 Billion by 2031, Registering at a 7.2% | States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 18, 2024 (GLOBE NEWSWIRE) — The on-demand transportation market (주문형 운송 시장) was valued at US$ 153.2 billion in 2022. A CAGR of 7.2% is expected between 2023 and 2031, increasing the market to US$ 287.6 billion.

Connectivity and digitalization have significantly impacted on-demand transportation. In addition to making it easier to book rides, the Internet and mobile apps have also enabled service operators to offer flexible options for transportation.

In the future of transportation and mobility, on-demand services are expected to become increasingly popular. The investment in on-demand transit has tripled over the past few years, making it the fastest-growing on-demand industry. These services bridge single occupancy vehicles and fixed-route mass transit via shared, autonomous, technology-enabled transportation.

As autonomous technology develops, on-demand transportation will be further revolutionized. On-demand transportation systems will become safer, more efficient, and more accessible with the use of self-driving vehicles in the future.

On-demand transportation services have also grown in popularity due to the increased cost of owning and operating a vehicle. In urban areas with high parking costs and vehicle maintenance expenses, on-demand services can be a more cost-efficient alternative to owning a vehicle

Request for sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=55536

Key Findings of the Market Report

- The ride-sharing segment is expected to grow the market for on-demand transportation services.

- On-demand transportation is poised to gain much traction in the coming years as passenger cars become more popular.

- The manual segment is predicted to hold the largest share of the market for on-demand transportation in the near future.

- The tourism industry largely drives the on-demand transportation market.

- Asia Pacific holds the largest market share and is expected to lead in the coming years.

Global On-demand Transportation Market: Growth Drivers

- Increasing smartphone usage and the accessibility of app-based transportation services like Uber, Lyft, and Grab are facilitating the growth of the on-demand transportation market.

- As traffic congestion and rapid urbanization increase in the world’s largest cities, commuters are looking for alternatives to traditional transportation methods. Transportation solutions on demand are becoming more important as public and private cars become less prevalent.

- With the changing preferences of consumers in terms of shared mobility, flexibility, and convenience, transportation on-demand services are becoming increasingly popular, especially among millennials and urban dwellers.

- Enacting ridesharing rules and regulatory frameworks that facilitate the operation of ride-hailing businesses while guaranteeing passenger safety and high-quality service can help governments and municipalities expand the on-demand transportation sector.

- A growing awareness of environmental issues and concerns about air pollution and greenhouse gas emissions have led to the demand for environmentally friendly transportation options. A green, electric, and hybrid fleet has emerged to provide on-demand transportation services.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=55536

Global On-demand Transportation Market: Regional Landscape

- Asia Pacific is expected to drive demand for the on-demand transportation market. As urbanization and traffic increase, on-demand transport services will become increasingly important. Increasing tech-savvy citizens and the growing use of smartphones have contributed to the rise of app-based ride-hailing in countries such as South Korea and China.

- Regulatory assistance and advantageous regulations promote expanding on-demand transportation services in economies such as Japan. The growing demand for shared mobility solutions is driving the popularity of ride-sharing and bike-sharing services. In addition to e-scooters and bike rentals, micro-mobility options provide more on-demand transport alternatives.

- Integrating on-demand transportation with public transportation networks can be improved by working with local transportation authorities and providers. Digital wallets and novel payment mechanisms are becoming increasingly common in regions like China and India, allowing smooth transactions and improving customer satisfaction.

Global On-demand Transportation Market: Competitive Landscape

Sustainable and inclusive practices are increasingly incorporated by players operating in the on-demand transportation market. Cooperative transportation and shared mobility are being invested in by key players in the on-demand transportation market to improve consumer convenience and demand.

Key Players

- Uber Technologies Inc.

- ANI Technologies Pvt. Ltd. (OLA)

- Lyft Inc.

- Grab

- Careem

- Taxify OÜ

- Gett

- Beijing Xiaoju Technology Co Ltd. (Didi Chuxing)

- BlaBlaCar

- Wingz Inc.

- Curb Mobility

- Easy Taxi Serviços LTDA

- Cabify

- Turo

- Yandex

- Car2go NA, LLC

- DriveNow GmbH & Co. KG

- Cabio CarSharing

- Maven

- Mobility Cooperative

- SOCAR Mobility Malaysia

- Europcar

- Sixt SE

- The Hertz Corporation

- Avis Budget Group, Inc.

- Enterprise Holdings Inc.

Key Developments

- In June 2023, Uber, an app that offers ridesharing services, introduced its first electric vehicle product, Uber Green, at the Chhatrapati Shivaji Maharaj International Airport (CSMIA). As part of its electrification journey, the company offers zero-emission electric rides on-demand in Mumbai, a convenient and emission-free option.

Global On-demand Transportation Market: Segmentation

By Type

- Ride-sharing

- Vehicle Rental/Leasing

- Ride Sourcing

By Business Model

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

- Micro-mobility

By Autonomy Level

- Manual

- Semi-autonomous

- Autonomous

By Power Source

By Application

- Passenger Transportation

- Goods Transportation

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=55536<ype=S

More Trending Reports by Transparency Market Research –

Smart Transportation Market (スマート交通市場) – The global smart transportation market is projected to flourish at a CAGR of 21.30% from 2021 to 2031. As per the report published by TMR, a valuation of US$ 400.77 billion is anticipated for the market in 2031. As of 2023, the demand for smart transportation is expected to close at US$ 85.5 billion.

Electric Bus Market (سوق الحافلات الكهربائية) – The global electric bus market was estimated at 74.157 thousand units in 2020. It is anticipated to register a 17.89% CAGR from 2021 to 2031 and by 2031; the market is likely to head to 448.920 thousand units.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These 4 Vanguard ETFs Are All You Need for a Well-Rounded Stock Portfolio

There are many misconceptions about investing, and a common one is that it’s difficult. Are there many moving parts that are confusing, even for those who study this for a living? Absolutely. Does it have to be complicated or require “advanced knowledge”? Not at all.

One way to simplify investing is to use exchange-traded funds (ETFs). Seasoned investors preach the importance of a well-rounded and diversified portfolio, and using ETFs is arguably the easiest way to accomplish this goal. There’s no need to invest in dozens (or hundreds) of individual stocks if you don’t want to do so. A few ETFs can do the trick.

Following are four Vanguard ETFs that can give you a well-rounded portfolio you can lean on for the long haul.

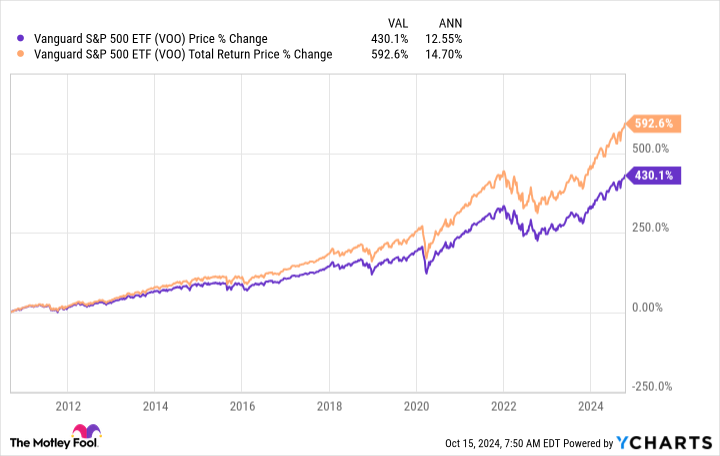

1. Vanguard S&P 500 ETF

If you ask me, no single investment serves as a better one-stop shop than an S&P 500 ETF. The Vanguard S&P 500 ETF (NYSEMKT: VOO) is my largest holding and likely will be for the remainder of my investing journey.

The S&P 500 index tracks 500 of the largest U.S. companies on the market, so investing in this ETF exposes you to some of the world’s most accomplished and promising companies. It contains businesses from all the major sectors, many of which are industry leaders. Here’s how the ETF is broken down by sector (as of Sept. 30):

-

Communication services: 8.9%

-

Consumer discretionary: 10.1%

-

Consumer staples: 5.9%

-

Energy: 3.3%

-

Financials: 12.9%

-

Health care: 11.6%

-

Industrials: 8.5%

-

Information technology: 31.7%

-

Materials: 2.2%

-

Other: 0.1%

-

Real estate: 2.3%

-

Utilities: 2.5%

There’s volatility with any stock or ETF on the market. However, this ETF generally has more long-term stability because it contains all large-cap companies better built to weather whatever storms come their way. Since it was created, it has averaged impressive annual returns.

If you’re looking for a single ETF that can be the bulk of your portfolio, this is it.

2. Vanguard Mid-Cap ETF

The Vanguard Mid-Cap ETF (NYSEMKT: VO) contains just over 310 mid-sized companies. Typically, mid-cap companies have a market capitalization between $2 billion and $10 billion. Because of the size of the companies in this ETF, it can be the sweet spot between stability and growth.

On the one hand, mid-cap companies are small enough to be agile and take on new growth opportunities. On the other hand, companies that managed to hit this market size typically have sustainable business models.

This ETF also contains companies from all major sectors, but it’s more diversified than the S&P 500. The top five represented sectors are industrials (21.1%), consumer discretionary (12.3%), financials (12.6%), technology (13.8%), and healthcare (9.2%).

I would feel comfortable with up to 10% of my stock portfolio being in mid-cap companies.

3. Vanguard Small-Cap ETF

Small-cap stocks are generally those with a market cap between $300 million and $2 billion. The Vanguard Small-Cap ETF (NYSEMKT: VB) contains over 1,300 of these companies, with a median market cap of $7.8 billion. This ETF doesn’t follow the Russell 2000 index like many other small-cap ETFs, but is still broad and diversified.

Small-cap stocks come with more risk than larger companies because they’re generally more volatile and still finding their lane in their respective industries, but they can also have more upside because of their growth potential.

To be clear, not all small-cap companies are young or early-stage companies; many are established businesses operating in niche markets.

Similar to mid-cap stocks, having around 10% of your stock portfolio is a good goal. That’s just enough to benefit from growth without relying too much on it.

4. Vanguard Total International Stock ETF

Part of having a well-rounded portfolio is investing in companies abroad. The Vanguard Total International Stock ETF (NASDAQ: VXUS) is a great way to do this because it contains companies from both developed and emerging markets.

Developed markets have more stable economies, a higher level of infrastructure, and mature financial markets (think the U.S., U.K., Japan, and Australia). Emerging markets have younger economies, increasing industrialization, and developing infrastructure (think: Brazil, China, Mexico, and Thailand).

Investing in companies from both markets is beneficial because they come with different risks and benefits. Developed markets are less risky because they have more economic (and often political) stability. However, they may not have room for rapid growth. Emerging markets carry more risk because of increased volatility and potential political instability, but they offer the possibility of higher growth.

I don’t recommend having a large portion of your portfolio in international stocks (mostly because U.S. companies have historically shown more long-term growth potential), but anything up to 20% of your portfolio is acceptable.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Stefon Walters has positions in Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard S&P 500 ETF, and Vanguard Total International Stock ETF. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard S&P 500 ETF, and Vanguard Total International Stock ETF. The Motley Fool has a disclosure policy.

These 4 Vanguard ETFs Are All You Need for a Well-Rounded Stock Portfolio was originally published by The Motley Fool

Billionaire Investor Ray Dalio Urges Xi Jinping's China To Implement This To Prevent Debt Crisis: 'They Have The Willingness To Do That'

Ray Dalio, the founder of Bridgewater Associates, has called on Xi Jinping‘s China to adopt a “beautiful deleveraging” strategy. This comes in the wake of China’s recent stimulus measures, which Dalio believes should be complemented with this strategy to avert a potential debt crisis.

What Happened: Dalio, while speaking at the FutureChina Global Forum in Singapore on Friday, underscored the importance of a balanced approach to deficits, which he terms “beautiful deleveraging,” CNBC reported.

This strategy encompasses debt restructuring, money printing, and debt monetization.

Dalio elaborated that debt restructuring is deflationary, while money creation is inflationary, thus making it an effective method to alleviate the debt burden. He expressed faith in China’s ability and readiness to execute this strategy, as demonstrated by their recent policies.

“That’s the real interesting question of China, in terms of how it’s approaching its debt issue,” Dalio said.

“They have the capacity to do that, and I believe they have the willingness to do that. That’s being demonstrated by [recent] policies,” he added.

Since the end of September, Beijing has rolled out several rounds of stimulus and reform measures to strengthen its economy. However, Dalio emphasized the need for debt restructuring amid these changes. He also drew attention to the speculation surrounding Beijing’s potential fiscal stimulus package, which some economists estimate could be as high as 10 trillion yuan ($1.4 trillion).

Despite the simplicity of creating money and credit, Dalio cautioned that this could aggravate other problems if not properly executed as part of a restructuring. He also highlighted other challenges, such as China’s local-level debt and aging population.

Why It Matters: Dalio’s recent remarks align with his previous observations about China’s economic landscape. In an earlier LinkedIn post, he highlighted three key factors that have set Chinese markets “on fire”: A “reflationary barrage” of fiscal and monetary policies, strong statements supporting free markets, and the current low valuation of Chinese assets.

However, Dalio also raised concerns about the complexities of investing in China amid the country’s shifting economic policies. He questioned China’s favorability towards capitalism and highlighted the challenges posed by significant structural changes in the Chinese economy.

Earlier in the year, Dalio had also warned of escalating U.S.-China tensions and stressed the importance of diversification in the face of growing global risks.

Meanwhile, several major Chinese companies saw significant gains in Friday pre-market. As per Benzinga Pro, Alibaba Group Holding Ltd – ADR BABA rose by 3.23%, while its rival PDD Holdings Inc. PDD increased by 5.38%. Baidu Inc BIDU climbed 4.23%, and JD.Com Inc JD was up 5.05%.

In the electric vehicle sector, Nio Inc – ADR NIO and Li Auto Inc LI saw increases of 5.44% and 6.48%, respectively. The jump came after China’s GDP grew by 4.6% year-over-year in the third quarter, surpassing expectations from a Reuters poll, though slightly below the 4.7% growth in the previous quarter.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of HealthStream's Earnings

HealthStream HSTM is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

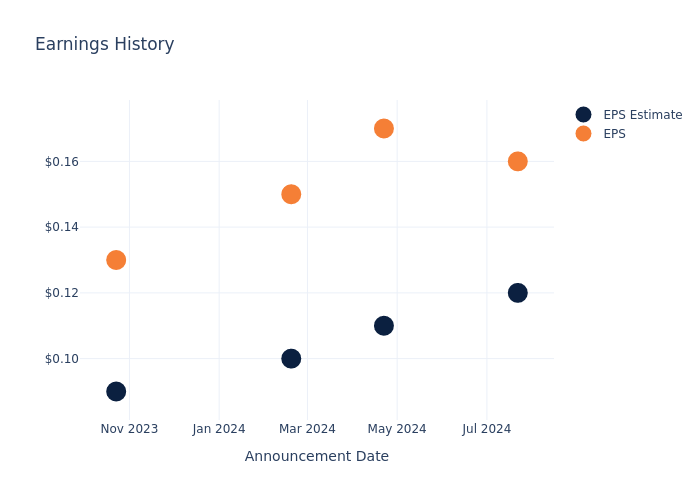

Analysts expect HealthStream to report an earnings per share (EPS) of $0.12.

The market awaits HealthStream’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Past Earnings Performance

Last quarter the company beat EPS by $0.04, which was followed by a 4.04% drop in the share price the next day.

Here’s a look at HealthStream’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.12 | 0.11 | 0.10 | 0.09 |

| EPS Actual | 0.16 | 0.17 | 0.15 | 0.13 |

| Price Change % | -4.0% | 10.0% | -2.0% | 15.0% |

HealthStream Share Price Analysis

Shares of HealthStream were trading at $28.93 as of October 17. Over the last 52-week period, shares are up 30.86%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on HealthStream

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on HealthStream.

HealthStream has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $28.0, the consensus suggests a potential 3.21% downside.

Peer Ratings Overview

The analysis below examines the analyst ratings and average 1-year price targets of Simulations Plus, Phreesia and Definitive Healthcare, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Simulations Plus received a Outperform consensus from analysts, with an average 1-year price target of $47.0, implying a potential 62.46% upside.

- The prevailing sentiment among analysts is an Buy trajectory for Phreesia, with an average 1-year price target of $29.4, implying a potential 1.62% upside.

- Analysts currently favor an Neutral trajectory for Definitive Healthcare, with an average 1-year price target of $5.61, suggesting a potential 80.61% downside.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for Simulations Plus, Phreesia and Definitive Healthcare are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| HealthStream | Neutral | 3.41% | $47.82M | 1.20% |

| Simulations Plus | Outperform | 14.23% | $13.26M | 1.75% |

| Phreesia | Buy | 18.97% | $69.30M | -7.15% |

| Definitive Healthcare | Neutral | 4.56% | $50.45M | -28.39% |

Key Takeaway:

HealthStream ranks in the middle for consensus rating among its peers. It is at the bottom for revenue growth. In terms of gross profit, HealthStream is at the top among its peers. However, its return on equity is at the bottom compared to the others.

All You Need to Know About HealthStream

HealthStream Inc provides workforce and provider solutions for healthcare organizations. Its reportable segments include Workforce Solutions and Provider Solutions. Workforce development solutions consist of SaaS, subscription-based products that are used by healthcare organizations. Its Provider Solutions products offer healthcare organizations software applications for administering and tracking provider credentialing, privileging, call center and enrollment activities. The company generates a majority of its revenue from Subscription Services.

HealthStream: Delving into Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining HealthStream’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.41% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: HealthStream’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 5.82% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): HealthStream’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.2%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): HealthStream’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.82% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.05.

To track all earnings releases for HealthStream visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

With $900k in a Roth and $2,200 Monthly Social Security, Is Retiring at 66 Feasible?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Imagine that you have $900,000 in a Roth IRA and collect another $2,200 per month in Social Security. Can you afford to retire at age 66?

A good way to answer this question is to start with your budget. What do you expect to spend on essentials, like housing and fixed monthly expenses, and what will it cost to maintain your lifestyle? Then take a look at your retirement income and see how all those figures compare. (And if you need additional help planning for retirement or building an income plan, consider speaking with a fiduciary financial advisor.)

Income and Expense Planning

For the sake of argument, let’s say that you earn the median household income of $75,000. Conventional wisdom suggests that you’ll need about 80% of your pre-retirement income to maintain your current lifestyle in retirement. That would mean that your Roth IRA withdrawals and Social Security benefits would need to generate about $60,000 before taxes and about $54,600 in after-tax income.

Can that work?

To start, you have $26,400 per year in Social Security benefits. Since full retirement age is 67 for most, your benefits would be around 7% by claiming at age 66. (Based on these numbers you would receive $28,295 per year in benefits if you retired at 67.)

You also have your Roth IRA, which will eliminate your potential tax liability on both your portfolio withdrawals and your Social Security. Since your Roth withdrawals aren’t taxable income, your Social Security benefits wouldn’t generate any federal income taxes either. Also, Roth accounts aren’t subject to required minimum distributions (RMDs) when you reach 73, giving you more flexibility compared to a pre-tax account.

The issue is that your Roth portfolio is relatively light to support a full retirement. You may be able to make the numbers work, but there wouldn’t be a lot of wiggle room in your budget.

For example, take the classic 4% rule for withdrawals, which calls for you to withdraw 4% from a balanced portfolio in your first year of retirement and then adjust subsequent withdrawals for inflation. The 4% rule is designed to stretch a portfolio at least 25 years.

Withdrawing 4% from a $900,000 Roth IRA would give you $36,000 in your first year of retirement. With Social Security, you’d have a combined retirement income of approximately $62,400. Again, this is a tax-free income. But it doesn’t surpass your spending needs by much, limiting your flexibility. More importantly, if your lifestyle or your area in which you live is even modestly more expensive than average, this might not work at all.

You could also consider investing an annuity. With $900,000, a representative lifetime annuity could pay you around $70,440 per year ($5,870 per month), according to Schwab’s Income Annuity Estimator. That would give a combined annual income of about $96,840 (with Social Security).

This may be enough to provide some households with a comfortable standard of living, this income won’t be inflation-protected. As a result, a large portion of your retirement income would lose purchasing power over time. (Whether you need help protecting your money from inflation or evaluating annuity options, consider working with a financial advisor.)

There’s Value in Waiting

Alternatively, you could consider delaying your retirement by just a few years. This may be especially attractive if you want to build more flexibility into your budget so you can afford some luxuries, leisure and travel.

If you delay retirement by three years and claimed Social Security at age 69, your benefit would increase to $32,823 per year ($2,735 per month). Second, at the S&P 500’s 10% average annual rate of return, your Roth IRA could potentially grow to about $1.22 million.

Even if you use a 4% withdrawal rate, your Roth portfolio could generate about $48,880 in your first year of retirement. Combined with Social Security, you’d have $81,712 in year 1. Or, you could invest the whole $1.2 million into an annuity that might pay you approximately $95,000 per year. As a result, you’d have a combined income of more than $127,000 in your first year of retirement.

In both of these cases, delaying retirement would give you much more financial flexibility for a comfortable, sustainable lifestyle. (A financial advisor can help you assess when you can afford to retire.)

Bottom Line

With $900,000 in a Roth IRA and $2,200 per month in Social Security, you may be able to afford to retire at age 66. However, it could mean some tight budgeting and thin margins. Instead, it might be wise to wait just an extra couple of years to let your portfolio and benefits grow a little bit more.

Retirement Budgeting Tips

-

Social Security plays a major role in most Americans’ retirement budgets. Figuring out when to claim your benefits is an important step in the retirement planning process. SmartAsset’s Social Security calculator can help you estimate how much your benefits will be at different claiming ages.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Charday Penn, ©iStock.com/Vadym Pastukh, ©iStock.com/Wasana Kunpol

The post I Have $900k in a Roth IRA and Would Receive $2,200 Monthly From Social Security. Can I Retire at 66? appeared first on SmartReads by SmartAsset.

Analyst Report: Crown Castle Inc.

Summary

Crown Castle is a domestic communications infrastructure REIT that owns and leases 40,000 towers, 105,000 small cells, and 90,000 route miles of fiber. The average number of tenants per tower in 2024 is 2.4. The company has both single-tenant and colocation towers, and operations in 49 states. While organic growth continues to be driven by tower revenue, the company added about 8,000 new small cell nodes in 2023.

Small cells are comprised of a series of smaller, lower-power antennas, and may be built either indoors or outdoors. They are able to boost wireless coverage in congested regions and extend coverage to hard-to-reach areas.

In 2023, the Tower segment generated about 68% of revenue, with Fiber accounting for about one-third. Within each segment, annual site rental revenues account for about 95% of revenues and service fees for the remainder. About three-quarters of CCI’s tower tenants are large cell phone carriers, with T-Mobile accounting for 36% of site revenues, and AT&T and Verizon 19% each. The company focuses on long-term lease agreements. The weighted-average remaining lease term is about six years, and the average number of tenants per tower is 2.5. About 40% of t

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

American Express CEO Sees "No Landing," Watch Nvidia For A Breakout

To gain an edge, this is what you need to know today.

No Landing

Please click here for an enlarged chart of American Express Company AXP.

Please click here for an enlarged chart of NVIDIA Corp NVDA.

Note the following:

- This article is about the big picture, not an individual stock. The charts of AXP and NVDA stocks are being used to illustrate the point.

- American Express CEO Stephen Squeri said that he sees “no landing” for the U.S. economy. In plain English, no landing means the economy continues to grow without a major slowdown. American Express has about 55M cardholders in the U.S. Spending on these cards provides a good data point.

- American Express CEO’s statement is another data point showing that the Fed spiked the punch with the 50 bps interest rate cut.

- The AXP chart shows a strong trendline.

- The AXP chart shows an RSI divergence. In plain English this means that as the price has moved higher, RSI is showing lower peaks. This indicates a lack of internal momentum. RSI divergence often leads to a pullback.

- AXP reported earnings better than the consensus but less than whisper numbers.

- The AXP chart shows that after spiking higher, AXP stock is pulling back.

- In the big picture, the data points from American Express earnings are important because they reflect 55M affluent consumers.

- The NVDA chart shows that NVDA stock moved higher in the resistance zone after blowout earnings from Taiwan Semiconductor Mfg. Co. Ltd. TSM. TSM manufactures Nvidia’s AI chips. TSM indicated the demand for AI chips is strong.

- The NVDA chart shows the resistance proved to be too strong for NVDA stock to breakout yesterday.

- Prudent investors should carefully watch to see if NVDA stock breaks out above the resistance zone. If NVDA breaks out above the resistance zone, it would be positive for the entire stock market, especially AI stocks. On the other hand, if this NVDA rally fails, it will be a negative for the entire stock market.

Housing Starts

Housing starts came roughly in line but building permits dropped. Building permits are a leading indicator. Investors should focus on leading indicators. Here are the details:

- Housing starts came at 1.354M vs. 1.350M consensus.

- Building permits came at 1.428M vs. 1.455M consensus.

China

China Q3 GDP came at 0.9% quarter-over-quarter vs. 1.0% consensus.

In The Arora Report analysis, even though China’s GDP is slightly weaker than expected, it is not of concern because GDP is a lagging indicator. New stimulus measures that we have been writing about are designed to lift GDP going forward.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Meta Platforms Inc META, Apple Inc AAPL, and NVDA.

In the early trade, money flows are neutral in Microsoft Corp MSFT.

In the early trade, money flows are negative in Tesla Inc TSLA.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is range bound.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DPZ INVESTOR ALERT: Kirby McInerney LLP Notifies Domino's Pizza, Inc. Investors of Class Action Lawsuit Deadline

NEW YORK, Oct. 18, 2024 (GLOBE NEWSWIRE) — The law firm of Kirby McInerney LLP reminds investors that a class action lawsuit has been filed in the U.S. District Court for the Eastern District of Michigan on behalf of those who acquired Domino’s Pizza, Inc. (“Domino’s” or the “Company”) DPZ securities during the period of December 7, 2023 to July 17, 2024, inclusive (“the Class Period”). Investors have until November 19, 2024, to apply to the Court to be appointed as lead plaintiff in the lawsuit.

[Click here to learn more about the class action]

On July 18, 2024, Domino’s issued a press release announcing its second quarter 2024 financial results. The Company disclosed challenges experienced by its master franchisees, Domino’s Pizza Enterprises (“DPE”), relating to both openings and closures. As a result, the Company stated that it expected to “fall 175 to 275 stores below its 2024 goal of 925+ net stores in international,” and “is temporarily suspending its guidance metric of 1,100+ global net stores until the full effect of DPE’s store opens and closures on international net store growth are known.” On an earnings call held that same day, the Company’s Chief Financial Officer Sandeep Reddy further revealed that the long-term guidance announced at the prior year’s 2023 Investor Day did not accurately reflect the extent of DPE’s challenges with respect to new store openings and closures of existing stores. On this news, the price of Domino’s shares declined by $64.23 per share, or approximately 13.6%, from $473.27 on July 17, 2024, to close at $409.04 per share on July 18, 2024.

The lawsuit alleges that Domino’s made false and/or misleading statements and/or failed to disclose that: (i) DPE, the Company’s largest master franchisee, was experiencing significant challenges with respect to both new store openings and closures of existing stores and(ii) as a result, Domino’s was unlikely to meet its own previously issued long-term guidance for annual global net store growth.

If you purchased or otherwise acquired Domino’s securities, have information, or would like to learn more about this investigation, please contact Thomas W. Elrod of Kirby McInerney LLP by email at investigations@kmllp.com, or by filling out this CONTACT FORM, to discuss your rights or interests with respect to these matters without any cost to you.

Kirby McInerney LLP is a New York-based plaintiffs’ law firm concentrating in securities, antitrust, whistleblower, and consumer litigation. The firm’s efforts on behalf of shareholders in securities litigation have resulted in recoveries totaling billions of dollars. Additional information about the firm can be found at Kirby McInerney LLP’s website.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Kirby McInerney LLP

Thomas W. Elrod, Esq.

212-699-1180

https://www.kmllp.com

investigations@kmllp.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New supportive housing for Indigenous 2SLGBTQI+ community in Edmonton

EDMONTON, AB, Oct. 18, 2024 /CNW/ – Today the federal government and Edmonton 2 Spirit (E2S) announced $6.84 million in funding for 24 supportive living homes for Indigenous 2SLGBTQI+ community members removing themselves from gender-based violence in greater Edmonton and surrounding Northern Alberta communities.

The project, owned and operated by E2S, will be developed into two, energy efficient buildings with 24 supportive living spaces, including transitional homes and shelter spaces, for all societies of Two Spirit peoples. These homes will cater to their unique needs including vulnerability to violence, trauma and further marginalization affecting their physical and mental health. Support programs and services will be available on-site through trained support staff, ensuring residents have the resources needed to heal and rebuild.

The federal government is dedicated to enabling Indigenous communities reach their housing goals through various programs and initiatives, including the Indigenous Shelter and Transitional Housing Initiative (ISTHI). A subsidy for ongoing operations and support will also be provided by Indigenous Services Canada (ISC). Construction will begin this fall and the first building is expected to be completed in 2025.

Total funding for this project is as follows:

- $6.84 million from the federal government through the Indigenous Shelter and Transitional Housing Initiative, delivered by Canada Mortgage and Housing Corporation (CMHC)

- Subsidy from ISC for ongoing operations and support

“Indigenous 2SLGBTQI+ community members face steep housing and social obstacles across Canada – but especially in Alberta. They deserve a safe space to call home. So we’re delivering just that. Today, we’re investing $6.84 million in 24 supportive living homes right here in Edmonton. This means more homes for our Indigenous Queer neighbours, more affordability and one fewer obstacle for them to overcome.” – The Honourable Randy Boissonnault, Minister of Employment, Workforce Development and Official Languages

“Everyone deserves to live in safety and dignity. Our support for the Peyakôskân Centre is vital in addressing critical service gaps by establishing a dedicated space for Indigenous 2SLGBTQI+ and gender diverse individuals facing gender-based violence. This center will offer culturally appropriate programs, services, and resources to help them rebuild their lives and reclaim their identities. Today’s groundbreaking marks a significant step toward creating a more equitable Canada for all.” – The Honourable Patty Hajdu, Minister of Indigenous Services and Minister responsible of FedNor

“Our way as Indigenous People is to ensure that we have every opportunity walk in a healthy way, Physically, Mentally, Emotionally and Spiritually, and to support each other in that journey. With affordable and safe housing, 2 Spirit and gender diverse people have opportunity to find our balance, and live a healthy way after experiencing violence. We can then grow to support others as they walk their own journeys, our ways, Indigenous ways, 2 Spirit ways, because we are all related.” – Quinn Wade, Housing Manager of Edmonton 2 Spirit Society

Quick facts:

- Canada’s National Housing Strategy (NHS) is a 10-year, $115+ billion plan that will give more Canadians a place to call home.

- NHS is built on strong partnerships between the federal, provincial, and territorial governments, and continuous engagement with municipalities, Indigenous governments and organizations, and the social and private housing sectors. It was created after consultations with Canadians from all walks of life, including those who have experienced housing need. All NHS investments delivered by the federal, provincial and territorial governments will respect the key principles of NHS that support partnerships, people and communities.

- The $724.1 million Indigenous Shelter and Transitional Housing Initiative was launched in November 2021 to support the construction of additional shelters and transitional homes for Indigenous women, children, and 2SLGBTQQIA+ individuals fleeing gender-based violence, including in urban areas and in the North.

- The funding is part of the $724.1 million budget for a comprehensive Violence Prevention Strategy, as announced in the 2020 Fall Economic Statement, of which:

-

- Canada Mortgage and Housing Corporation (CMHC) is allocating $420 million over 5 years to support the construction of new shelters and transitional housing.

- Indigenous Services Canada (ISC) is investing $304.1 million over five years, and $96.6 million annually to support the operational costs of new shelters and transition homes and expand funding for culturally relevant violence prevention activities.

- CMHC and ISC sought input from Indigenous organizations and subject matter experts to form committees and develop the evaluation process

- Eligible applications are evaluated by Indigenous-led committees comprised of representatives from CMHC, ISC, Indigenous organizations, subject matter experts in shelters and housing delivery, as well as people with lived experience. This ensures selected projects are culturally appropriate and meet the needs of clients. The committees provide overall direction and prioritization, as well as review and score proposals.

- The Federal Pathway is Canada’s contribution to the broader 2021 Missing and Murdered Indigenous Women, Girls, and 2SLGBTQIA+ People National Action Plan developed in partnership with provincial and territorial governments, Indigenous Peoples, survivors, families, and Indigenous women’s organizations in response to the National Inquiry into Missing and Murdered Indigenous Women and Girls.

- Call for Justice 4.7, 16.19 and 18.25 of the Final Report of the National Inquiry into Missing and Murdered Indigenous Women and Girls call for all governments to support the establishment and funding of shelters, safe spaces, transition homes, second-stage housing, and services for Indigenous women, girls, and 2SLGBTQQIA+ people.

- The Missing and Murdered Indigenous Women and Girls Crisis Line is available to provide emotional support and crisis referral services to individuals impacted by the issue of Missing and Murdered Indigenous Women, Girls and 2SLGBTQI+ people. Call the toll-free Crisis Line at 1-844-413-6649. This service is available 24 hours a day, 7 days a week.

Associated Links:

- Visit Canada.ca/housing for the most requested Government of Canada housing information.

- As Canada’s authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford and that meets their needs. For more information, please visit cmhc.ca or follow us on X, Instagram, YouTube, LinkedIn and Facebook.

- To find out more about the National Housing Strategy, visit: www.placetocallhome.ca.

- More information about the Indigenous Shelter and Transitional Housing Initiative can be found here: ISTHI

- Visit Housing for Indigenous Peoples for more information on Programs and subsidies that support the building and management of housing for Indigenous Peoples

- Check out the National Housing Strategy Housing Funding Initiatives Map to see affordable housing projects that have been developed across Canada. Information on the Family Violence Prevention Program is available at: Family Violence Prevention Program (sac-isc.gc.ca)

- More information about the Government of Canada’s work with partners to end violence against Indigenous women, girls and 2SLGBTQI+ people can be found here:

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c9822.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c9822.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.