This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here's Why I Couldn't Be More Optimistic

Autozone and O’Reilly are the two giants in the car-parts retail space. These two companies have market capitalizations of $53 billion and $71 billion, respectively. By comparison, Advance Auto Parts (NYSE: AAP) is tiny with its market cap of just $2.4 billion. But this value disparity is somewhat surprising.

Advance has almost 4,800 locations, while Autozone has nearly 7,400 and O’Reilly has around 6,200. So the latter two are bigger, but not by the margin that the market valuations would suggest.

For its part, Advance has problems that can’t be sugarcoated. But it’s working to fix them. And it’s about to get a $1.2 billion payday to help fund its turnaround, which is an unbelievable amount for a company with such a low valuation.

How is Advance getting a big payday?

On top of its namesake retail chain, Advance also owns other businesses, namely Carquest and Worldpac. Last year, the company hired CEO Shane O’Kelly, who’s trying to restructure the business. This restructuring includes selling the Worldpac business.

In August, Advance reached a deal to sell Worldpac for $1.5 billion. Taking transaction expenses into account, the company will net about $1.2 billion — half of its current market cap. The deal is expected to close in the fourth quarter.

Advance says that Worldpac has generated $2.1 billion in trailing-12-month revenue and has earned $100 million in earnings before interest, taxes, depreciation, and amortization (EBITDA). This means that Advance sold it for 0.7 times its sales and 15 times its EBITDA.

That’s more than a fair sales price. For perspective, Advance stock trades at 0.2 times sales and at about 7 times EBITDA. So the sales price for Worldpac represents a significant premium to where Advance stock itself trades today.

How Advance’s windfall can help

O’Kelly says that selling Worldpac gives Advance more “financial flexibility” as it navigates the changes it needs to make. And to be sure, the changes are going to be substantial.

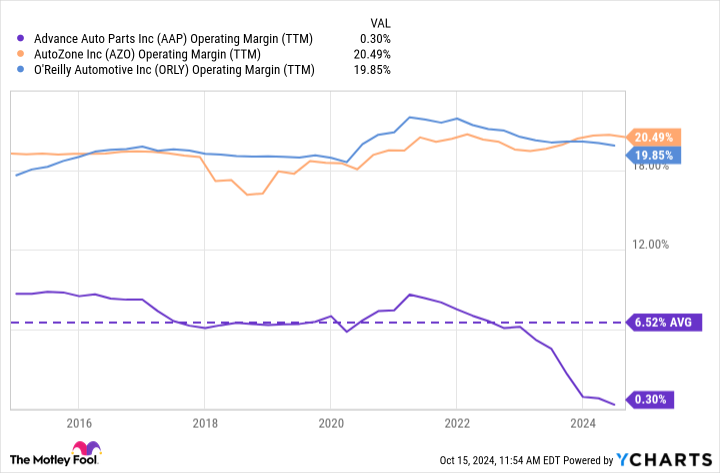

They need to be, considering how poorly Advance has performed relative to its peers. Take one metric: the operating-profit margin. For the past decade, both Autozone and O’Reilly have had operating margins mostly between 18% and 20%. By comparison, Advance has averaged an operating margin of about 6%, and it’s fallen even lower than that lately.

Advance hired O’Kelly to fix this profitability problem. The new CEO is a supply chain expert and quickly realized that Advance is struggling with profitability because of its inefficient supply chain infrastructure.

A multiyear supply chain transformation is already underway for Advance, and I’m optimistic that this will completely transform returns for shareholders.

Consider that if Advance can squeeze a 10% margin from its business — still half of what its peers have — it can generate close to $1 billion in annual profits. After all, even after selling Worldpac, Advance still generates over $9 billion in annual sales. And if the stock is valued at 10 times its operating profit, then shares could quadruple in value in this scenario.

Therefore, restructuring the supply chain is crucial for Advance and its shareholders. But it’s costly, and the company’s balance sheet isn’t the greatest. It has almost $1.8 billion in long-term debt and less than $500 million in cash and equivalents. To be clear, it’s not in danger of running out of liquidity anytime soon. But this is an unattractive net-debt position nonetheless.

Selling Worldpac will even out Advance’s balance sheet and give it just a little more breathing room. And this breathing room will allow management to make the business decisions that will set it up best for long-term success.

This is why I couldn’t be more optimistic about Advance stock now that it’s selling Worldpac. And if the turnaround is successful, the stock is trading at quite the bargain valuation today.

Should you invest $1,000 in Advance Auto Parts right now?

Before you buy stock in Advance Auto Parts, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advance Auto Parts wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jon Quast has positions in Advance Auto Parts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here’s Why I Couldn’t Be More Optimistic was originally published by The Motley Fool

Elon Musk Spent His Teen Years Working Odd Jobs In Canada. For $18 An Hour, He'd Clean The Boiler Room With 'No Escape' In A Lumber Mill

Before Elon Musk became the billionaire CEO of Tesla and SpaceX, he was just a teenager trying to make ends meet in Canada. His ascent to the top wasn’t easy, nor was it particularly glamorous, as evident in Ashlee Vance’s book, Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future.

Don’t Miss:

At 17, Musk left his home in South Africa and headed to Canada, hoping to eventually make it to the United States. He obtained citizenship with the help of his mother, who was born in Canada, but in the interim, he had to accept whatever job he could find to make ends meet.

One of Musk’s first jobs was at his cousin’s farm in Saskatchewan, a small village with fewer than 300 people. He worked as a vegetable gardener and grain bin shoveler, not exactly the life of a tech startup founder you might expect from one of the most well-known businesspeople in the world. After that, Musk learned to cut logs with a chain saw in Vancouver, British Columbia.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

But Musk’s hardest job during his time in Canada was working in a lumber mill’s boiler room. After asking at the unemployment office which job paid the most, Musk took on a grueling gig that paid $18 an hour – good money for 1989, but at a steep cost.

The work was exhausting and dangerous, involving crawling through small tunnels wearing a hazmat suit to “shovel [sand and goop] through the same hole you came through.” The conditions were so tough that most workers didn’t last long. According to Musk, out of 30 people who started the job with him, only five were left by the third day. By the end of the week, just Musk and two others were still shoveling.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

“There is no escape,” Musk said in the biography. The job required him to crawl into a small space, shovel the hot residue through the same hole and hope the person on the other side managed to clear it out. It was physically demanding and the heat made it dangerous if anyone stayed too long inside.

After a few stints working odd jobs across Canada, Musk eventually enrolled at Queen’s University in Ontario and then transferred to the University of Pennsylvania in the United States. He earned degrees in physics and economics, but not without keeping his entrepreneurial spirit alive. To help pay for tuition, Musk hosted large, ticketed house parties, turning his college house into a nightclub on the weekends.

See Also: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Musk’s early years were full of tough work and key decisions to keep him on track. He even turned down a spot in Stanford’s graduate program to jump into the booming internet scene instead. He cofounded Zip2, which later sold for $300 million and used the money to start X.com, which eventually became PayPal.

That sale to eBay for $1.5 billion gave Musk the financial boost he needed to launch SpaceX and Tesla – ventures that would make him one of the richest people in the world.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Elon Musk Spent His Teen Years Working Odd Jobs In Canada. For $18 An Hour, He’d Clean The Boiler Room With ‘No Escape’ In A Lumber Mill originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'He Taught Me A Word I Never Heard,' Says Shaquille O'Neal About The Time He Received The Greatest Investment Advice From A Rich 80-Year-Old

Shaquille O’Neal has developed a successful business, entertainment and investing career in addition to his illustrious athletic career. He also hosts a program called “The Break” on his YouTube channel, in which he talks to a group of guests in a lighthearted and informal discussion about important topics like money management.

But just like anyone else, he wasn’t born knowing all the ins and outs of managing money. In an episode called “Investing,” Shaq shared a story that perfectly sums up his journey from being rich to truly wealthy.

Don’t Miss:

“I used to see this rich guy, really rich, older – like 80 – driving a Rolls-Royce,” Shaq recalled. Curious, as many of us would be, Shaq asked the man how he got so wealthy. It wasn’t flashy stock picks or risky real estate deals that the man shared. Instead, he gave Shaq a word he’d never heard before: annuity.

Shaq went home to check it out because he didn’t want to miss anything important. He discovered that an annuity is an investment that lets you put money down now and get payouts regularly later on – think of it as a guaranteed retirement income.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

“I was making so much money from commercials and all, I didn’t know what to do with it,” Shaq said. But the advice clicked with him. The older man told Shaq that all the money he was making now could work for him in the future – he just needed to invest it wisely.

Shaq’s approach to handling his finances took a significant turn after that conversation. He said it was the best advice he ever got because it taught him to think about the future. “All this money you’re making, if you save it, you can invest it and start collecting at 50, 60 and 70,” the older man told him. Thus, instead of spending all his money or taking big risks, Shaq learned the importance of steady growth and safety.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

But before Shaq shared his story, Juan Toscano-Anderson, who won the NBA championship with the Golden State Warriors in 2022 and was one of the guests on the show, admitted that, like many people, he was often tempted by the idea of quick money.

He hired financial advisors but sometimes found their advice boring. He was more interested in seeing his $100,000 turn into $350,000 overnight. But after losing money in a friend’s business venture, he learned a crucial lesson: the basics might not be flashy, but they’re reliable. “It doesn’t [sic] have to be sexy. They’re the basics for a reason,” he said.

These examples teach a straightforward but important lesson – sometimes, the greatest investment advice isn’t to chase the latest hot stock or aim to double your money in a year. It all comes down to patience and realizing that wealth is accumulated gradually.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article ‘He Taught Me A Word I Never Heard,’ Says Shaquille O’Neal About The Time He Received The Greatest Investment Advice From A Rich 80-Year-Old originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Don't Normalize' Trump's Behavior, Warns Mark Cuban, Says It's An Insult To American Workers To Claim Their Job Could Be Done By A Child

In a recent social media clash, Mark Cuban called out Donald Trump for insulting American autoworkers. Cuban, the entrepreneur and part-owner of the Dallas Mavericks, took to Twitter to criticize Trump’s remarks during his interview at the Economic Club of Chicago.

Trump claimed that autoworkers in America were essentially just assembling car parts “out of a box” and even went as far as to say, “We could have our child do it.”

Don’t Miss:

Cuban was not having any of it. In a tweet, he said, “He still thinks it’s 1965. It’s obvious he has no idea what it takes to manufacture any advanced product, car or otherwise.” Cuban made it clear that Trump’s comments were completely out of touch with the reality of modern manufacturing and a direct insult to hardworking Americans who keep the industry going.

When Stephen Miller, a former advisor to Trump, rushed in to defend the former president, Cuban responded quickly. Miller suggested that Cuban had been “hoaxed” by a “deceptively edited clip” and argued that Trump’s comments were directed at European car manufacturers, not American workers.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Cuban responded, “Stephen, the Mercedes plant is in the USA,” before continuing, “The workers are American. He said a child could do the job of an American worker. That’s an insult.”

Cuban wasn’t just upset about the specific comments on autoworkers. He also aimed at Trump’s behavior during the interview, calling it “awful.” According to Cuban, whenever Trump couldn’t answer a question, he insulted the interviewer instead, adding, “Now THAT is something a child can do.”

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

There was more back-and-forth. Cuban even provided extensive information via Grok chatbot to support his assertions, citing Mercedes-Benz U.S. International (MBUSI), the company that operates Mercedes-Benz activities in Alabama.

The company made a significant investment in this factory, which is close to Vance, Alabama. It manufactures models like the GLE and GLS, as well as electric EQS and EQE SUVs. Mercedes-Benz employs its ‘One Man–One Engine’ philosophy at this plant for its AMG models, where a single technician hand-builds an engine from start to finish. This philosophy emphasizes that American workers at this plant deserve respect for their skills and contributions.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Cuban’s message was very clear: don’t accept Trump’s actions as usual, especially if doing so means disparaging hardworking Americans. He called on people like Stephen Miller not to excuse or justify the insults. “I know your guy insults hardworking Americans often, but don’t normalize this, Stephen,” Cuban tweeted.

Trump has a track record of opposing global trade deals and enacting tariffs to encourage homegrown manufacturing. But rather than bringing about the rebirth he frequently claims, it has been demonstrated that his policies – such as tariffs on steel and aluminum – damage the American auto sector, driving up costs and even resulting in plant closures.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article ‘Don’t Normalize’ Trump’s Behavior, Warns Mark Cuban, Says It’s An Insult To American Workers To Claim Their Job Could Be Done By A Child originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘I retired earlier than planned’: I’m 69 and will have $6,000 a month in retirement income. The bulk of my $3.6 million is equities. Is that OK?

Dear Quentin,

I appreciate and enjoy your column and advice.

I am 69, single, female and in good health. I worked extremely hard. I saved money and lived frugally. I retired earlier than planned, in April 2022, because our elderly mom required more care. She lived to 91, but in her final years had dementia and poor mobility, eventually needing 24/7 care. Luckily, she had lived modestly and invested wisely, which paid for in-home care, supplemented by my sisters’ and my labor.

Most Read from MarketWatch

My house is fully paid for, as is my modest five-year-old car, which I bought certified used using a lump payout from saved-up vacation hours. I have a great federal pension of $3,000 a month after taxes and health insurance, great federal health insurance, and $3 million invested after my self-managed stock portfolio exploded over the past three years. I don’t trade that much, just to invest extra money or move a bit here and there when it makes sense for taxes.

My inheritance raises that to about $3.6 million. My current investments are in Roth IRAs worth $600,000, which includes an $85,000 inherited Roth, so that has 10 years to grow tax-free. The rest is in stocks, exchange-traded funds and tax-deferred Thrift Savings Plan funds. It’s allocated about 60/40 tax-deferred/taxable accounts, except for about $100,000 in CDs and cash. My non-TSP accounts are tech-heavy, with the nontech stocks well diversified.

The common wisdom is to keep less in equities as we age. However, my pension, Social Security benefits — which I’ll draw at 70 and which will amount to about $3,000 per month after taxes — and health insurance are all federally backed, so those are all more like a Treasury bond. Even if Social Security payments decrease after 2035, I should be fine. I’ll keep the final inheritance money — about $90,000 — in cash and CDs in order to make significant repairs to my small house.

Do I have too much money in equities?

Single Retired Investor

Dear Investor,

I love that you bought your car using money saved from vacation time.

I found myself cheering you on as I read your letter because of your open, evenhanded approach to the story of your financial life. You weren’t grandstanding, nor did you express any lingering resentments or lamentations about the years you spent taking care of your elderly mother. In other words, you did all of this while climbing some pretty steep virtual mountains, and you did it by not having anyone to rely on but your good self.

Asset allocation should be based on a person’s income and expenses, not their age alone, says Jesica Ray, lead adviser at Brighton Jones, a Seattle-based registered investment adviser. “Portfolio immunization is an asset-allocation strategy that focuses on ensuring that a person is only taking the amount of risk they can afford,” she says. “The goal primarily is to safeguard the funding of liabilities. Then the rest can be put into the growth engine of the portfolio.”

You’re going against conventional wisdom by holding the bulk of your assets in equities, but you have made smart decisions, including going heavy on tech stocks, even if the group of tech stocks known as the Magnificent Seven may not show as much growth in the years ahead as they have recently. At age 70, most advisers would say to invest 30% in stocks and the rest in bonds and safer havens. But you have an appetite for risk and success. You also have a pension and Social Security to spread out that risk.

During the third quarter of 2024, the Magnificent Seven — Nvidia NVDA, Apple AAPL, Microsoft MSFT, Alphabet GOOGL, Tesla TSLA, Meta META and Amazon AMZN — underperformed the broader index for the first time since the final quarter of 2022. But as Michael Arone, chief investment strategist for State Street Global Advisors, said in an interview with MarketWatch in early October, “A few myths have been busted.” Chief among them: The stock market can rise without them.

You have $190,000 in cash and CDs, which is a smart move and gives you a de facto emergency fund, and I fully support your intention to do a bit of splurging here and there. You’ve worked extremely hard and given your mother your time and love, and now is the time for you to see a bit of the world, have an adventure and enjoy life. This is what good planning gives you: peace of mind, freedom and the opportunity to take trips to keep the cobwebs from the door.

Nate Ahlberg, a senior wealth adviser at wealth-management company Prosperity in Minneapolis, Minn., suggests moving on to the next phase of your wealth-management plan. “Your reference to your self-managed portfolio exploding’ over the past three years and that your non-TSP accounts are ‘tech-heavy’ leads me to suspect that you have some concentrated holdings,” he says. “That has likely helped you create significant wealth.”

Diversification can now help preserve your wealth, in whatever form that takes. “Diversification doesn’t necessarily mean making significant adjustments to your equity allocation,” Ahlberg says. “If your risk tolerance remains aggressive, you could consider diversifying within your equity allocation — growth versus value, large cap versus mid cap versus small cap, domestic versus international.”

And if there is a stock-market bust? It would probably take you less than a decade to get back to black. But you have, for the most part, enough cash to see you through. After the 1929 crash, when the stock market lost roughly 90% of its value, the Dow Jones Industrial Average DJIA took more than 25 years — until Nov. 23, 1954 — before it closed above the level at which it closed on that fateful day. But analysts say it actually took five to 10 years, accounting for deflation.

You lived through the recession of 2007-09, so you don’t need me to tell you that it took more than five years for the market to recover from that financial crisis, which was caused in part by predatory and subprime lending in the mortgage market and a lack of financial regulation. Keep in mind that diversification is also key to weathering such unexpected storms: Many companies survived the 1929 and 2008 financial crashes, but some did not.

If you can live comfortably on your existing income, I think you should stay the course.

More columns from Quentin Fottrell:

Most Read from MarketWatch

Want Safe Dividend Income in 2024 and Beyond? Invest in the Following 3 Ultra-High-Yield Stocks.

Finding stocks with healthy dividend yields isn’t too tough of a task. Finding above-average yields based on dividends that will be sustained into the foreseeable future, however, is a different story. Sometimes yields are only high because investors are dumping a stock, sensing bad news is on the horizon.

With that in mind, here’s a closer look at three ultra-high-yield stocks paying dividends that are indeed well protected, and should remain so for a long while.

1. British American Tobacco

You likely recognize that the worldwide smoking-cessation movement is still gaining traction, posing a threat to British American Tobacco (NYSE: BTI). Although the parent to cigarette brands Pall Mall, Camel, and Lucky Strike is also developing vaping and heated-tobacco businesses, smoking remains its breadwinner, accounting for more than 80% of its top line.

Except, smoking isn’t anywhere as close to its end as you might think.

Although smoking prevalence is down from 33% of the global population in 2000, the World Health Organization reports there are still roughly 1.3 billion regular smokers on the planet today. Population growth has offset much of the effort to encourage quitting. This progress is slowing down, too. The WHO predicts that by 2030, 18% of the world’s population will still be smoking on a regular basis.

That’s not a suggestion to simply ignore the eventual end looming here. British American Tobacco itself says it’s “committed to building a smokeless world” by developing alternatives to smoking tobacco. It’s just that this inevitable end is years down the road, and even though the company’s top line is now shrinking, there’s still plenty of profit left to not only prolong the business’s fruitful life, but continue funding its dividend as well.

That’s a dividend, by the way, that’s steadily grown for years now, loosely in step with modest profit growth that’s apt to persist. Today’s newcomers will be buying it while the stock’s forward-looking yield stands at a hefty 8.4%.

2. Verizon

If you know Verizon Communications (NYSE: VZ) at all (and you most likely do), then you likely recognize how modest its growth prospects are. Its number of landline phones is shrinking, and Pew Research reports that 97% of adults living in the United States also already own a mobile phone. At best, Verizon can only hope to poach a few competitors’ mobile subscribers without losing any of its own paying customers in the meantime.

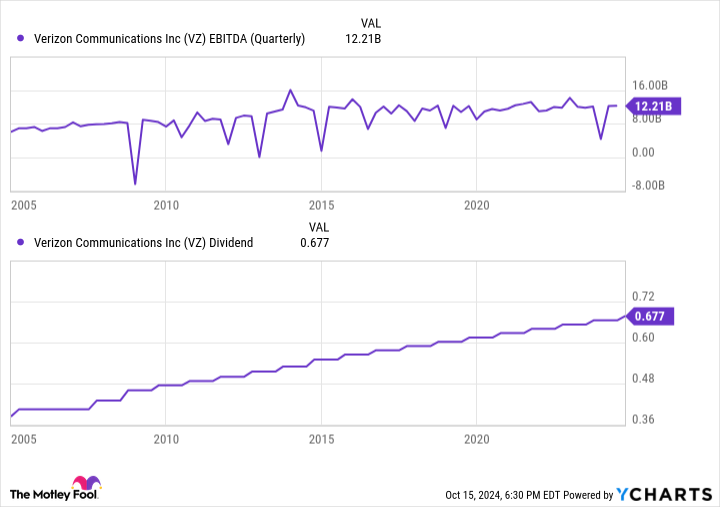

What this telecom company lacks in growth potential, however, it more than makes up for in a consistent profitability that supports its equally reliable dividend.

Fact: People are fiercely addicted to their cellphones. Owners are staring at them on the order of four hours per day, checking them several dozen times even without a chime or vibration, according to a survey by Reviews.org. Indeed, most mobile phone owners report feeling anxious without their phone, while some indicate feeling a sense of panic when their device’s battery is nearly depleted.

Looking past the mental health concerns raised by the data, it’s clear that consumers aren’t willing — or even able — to let go of their phones now. They’ll pay to remain connected. Verizon just needs to offer them a competitive price. Given its market-leading scale, that’s typically not a problem for Verizon. The company has reported positive earnings before interest, taxes, depreciation, and amortization (EBITDA) every quarter for well over a decade.

More relevant to income-minded investors, Verizon has not only paid a quarterly dividend like clockwork since the company was formed as consumers know it back in 2000, but has also raised its annual dividend payment every year since 2005. You can plug into this reliable growth while the stock’s forward-looking dividend yield is a solid 6.3%.

3. Ambev

Last but certainly not least, add Ambev S.A. (NYSE: ABEV) to your list of ultra-high-yield dividend stocks to buy while its forward-looking yield stands at just under 6.5%.

Ambev is the combination of a handful of beer companies, with the most noteworthy of these combinations being 2004’s merger with Belgium’s Interbrew, followed by 2008’s acquisition of Anheuser-Busch. You’re of course familiar with Anheuser-Busch’s Budweiser, Michelob, and Busch brands. Ambev owns a far greater number of less familiar craft brands, however, some of which you can only find overseas. In fact, the bulk of the company’s revenue actually comes from Latin America.

That hasn’t exactly mattered a whole lot of late. Although beer consumption is holding up better outside of the United States than it is within it, it’s not exactly seeing robust growth anywhere. Inflation is taking its toll on consumers, crimping demand. In this vein, Ambev’s total volume of beer sold through the first half of this year is barely better than even with last year’s comps.

The message being delivered by the data, however, looks past a couple of key points about the business.

The first of these is simply that true beer fans remain willing to pay a premium for the higher-end beers that Ambev S.A. offers. Industry research house GlobalData notes sales of premium beers are outpacing non-premium beer sales, and are likely to continue doing so for the foreseeable future. This theme jibes with Ambev’s recent revenue growth outpacing its volume growth.

And the second noteworthy detail to consider? Beer is somewhat cyclical anyway. It’s a bit out of favor now, ceding to growing interest in wine and spirits. But give it time. Consumers have a way of coming back around, perpetually searching for something different.

Ambev’s dividend payments are anything but consistent, for the record — the result of an overseas company doing so much foreign business of its own. So, plan accordingly. With its strong yield and track record of long-term growth though, the erratic payouts are worth it.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Verizon Communications and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Want Safe Dividend Income in 2024 and Beyond? Invest in the Following 3 Ultra-High-Yield Stocks. was originally published by The Motley Fool

Spirit Airlines Extends Debt Deadlines, JetBlue Founder Suggests Frontier Group A More Suitable Match

Spirit Airlines, Inc. SAVE announced that on October 11, it modified its card processing agreement to extend the deadline for its 2025 notes from October 21 to December 23 and the early maturity date from December 31 to March 3.

The budget airline was in the process of renegotiating an agreement with the U.S. National Bank Association concerning the processing of payments made to it through Visa or MasterCard credit cards, per an exchange filing (dated October 18).

The Wall Street Journal had earlier reported that Spirit was in discussions with bondholders regarding the conditions of a possible bankruptcy filing.

According to Benzinga Pro, SAVE stock has lost over 90% in the past year.

On October 15, Spirit indicated that it had fully utilized the $300 million available under its revolving credit facility and anticipated finishing the year with more than $1 billion in liquidity.

Since the pandemic, Spirit has not reported a profit, and its future as an independent airline became unclear after a federal judge halted its merger with JetBlue Airways Corporation JBLU, reported Skift. Additionally, problems with Pratt & Whitney engines have forced the airline to ground parts of its fleet.

According to Benzinga Pro, JBLU stock has gained over 82% in the past year. Investors can gain exposure to the stock via Themes Airlines ETF AIRL and LeaderShares Activist Leaders ETF ACTV.

Spirit has reported losses in almost every quarter since February 2020, per data from Benzinga Pro. For the 2024 fiscal year second quarter, the company reported an adjusted net loss of $157.9 million.

According to a report by Quartz, JetBlue’s founder further escalated matters following the airline’s unsuccessful merger attempt with Spirit Airlines.

David Neeleman, who left JetBlue in 2007 and now runs Breeze Airways, told the Washington Post that Spirit should have pursued a merger with Frontier Group Holdings, Inc. ULCC instead. However, JetBlue made a more attractive offer to partner with Spirit. After a judge blocked the JetBlue-Spirit merger on antitrust grounds in January, both companies ultimately abandoned the effort in March.

In a release dated August 1, the company announced that it is on track to realize $100 million in annual run-rate cost savings, with around $75 million anticipated to be achieved by the end of 2024.

Compared to the third quarter of 2023, in the third quarter of 2024, the company will have exited 42 markets while adding 77 new ones, offering more routes on specific days of the week to facilitate expansion with a lower risk profile, and aggressively managing capacity to better align with seasonal and daily demand fluctuations.

Read Next:

Image: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Florida Not-for-Profit acquires future St. Petersburg retirement community

ST. PETERSBURG, Fla., Oct. 18, 2024 /PRNewswire/ — On October 3, Convivial Life, a Florida not-for-profit organization, acquired The Manhattan–St. Petersburg, a new senior living development project along the coastal waterway of the Boca Ciega Bay in the Skyway Marina District. The planning has been underway for months by the developer, LifeStar Living, who organized the purchase of the land in 2021.

“We’re delighted to realize this opportunity,” says Joel Anderson, representative for Convivial Life and the CEO of LifeStar. “We’ve envisioned from inception that Convivial was most suitable to be the not-for-profit owner of the project.”

Convivial St. Petersburg is the third Florida-based senior living project owned and operated by Convivial. In 2022, LifeStar facilitated the acquisition of two existing communities, The Cabana at Jensen Dunes, Jensen Beach, and Jacaranda Trace, Venice, both with future expansion plans. “Our vision is to carefully grow Convivial so our brand matches the ideal value retirees are seeking for membership-style retirement living,” says Jessica Kraft, EVP, Marketing & Sales. We want to establish quality communities with well-appointed amenities and accommodations that fulfill retirees’ preferences and the lifestyle they deserve.”

During the acquisition process, Convivial completed its preliminary certificate of authority with Florida’s Office of Insurance Regulation in becoming a licensed continuing care retirement community (CCRC) that enhances the future project’s offerings by giving residents priority access to a full continuum of care including home health, assisted living, memory support, and skilled nursing care, if ever needed. “Most retirees relish over our resort-style amenities and programs that we offer with multiple dining venues, fitness and wellness, arts & leisure, and more; however, the underpinning of 5-star healthcare elevates retirees’ peace of mind when they choose to be part of one of our communities,” says Anderson, who has directed multiple CCRCs along Florida’s Gulf Coast.

Original plans were to complete the project in two phases, but Convivial is now planning to construct the entire project as a single phase that will offer 170 one- to three-bedroom apartment homes ranging from 1,065 to 2,470 square feet with all residences having private balconies overlooking the coastal waterway, historic Skyway bridge, and nearby redevelopment of the Tropicana field. Reservations are being taken by Convivial with new pre-construction pricing that includes discounts on upfront membership fees, expanded benefits for dining, care coordination, and substantial savings on future healthcare. “Convivial brings new savings and incentives for our first-generation members, especially with Convivial’s ability to access tax-exempt bond financing for the construction of the project where member’s monthly maintenance fees are lower and more predictable long-term.”, says Kraft, “Our early depositors are securing significant savings and benefits, as well as their preferred views and locations. Exclusive depositor events are also allowing these early members to create new friendships with their future neighbors and to shape the future culture of the community.”

For information on pricing and new inventory, call Convivial St. Petersburg at 727-353-6162.

About Convivial St. Petersburg

Convivial St. Petersburg is the boutique senior living community coming soon to the vibrant St. Petersburg Skyway Marina District. Offering a concierge lifestyle, it will feature sophisticated living spaces, exceptional services, and curated amenities that set a new standard in elevated senior living. With a focus on fulfilling not only members’ daily needs, but also their highest aspirations, Convivial St. Petersburg will deliver a retirement experience unlike any other. For more information, visit www.ConvivialStPete.org.

About Convivial Life

Convivial Life is a mission-driven, not-for-profit organization that operates vibrant senior living communities that promote an active lifestyle and opportunities to enjoy life to its fullest. They are inspired to create first-class communities centered in love, life, and laughter, offering distinct residences, desirable amenities, and tailored wellness and healthcare support. If you would like to learn more about Convivial Life and their family of communities, visit their website at https://conviviallife.org/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/florida-not-for-profit-acquires-future-st-petersburg-retirement-community-302280592.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/florida-not-for-profit-acquires-future-st-petersburg-retirement-community-302280592.html

SOURCE Convivial St. Petersburg

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dan Ives Expect $1 Trillion in Artificial Intelligence (AI) Infrastructure Spending in the Next 3 Years. Here's My Top Pick to Benefit

Dan Ives is an equity research analyst at Wedbush Securities. He covers the biggest names in the technology sector, and always seems to have a bead on the latest megatrend.

Right now, artificial intelligence (AI) is the biggest headline-grabber in tech. But one area of AI that could be overlooked is information technology (IT) infrastructure. What does that even mean?

Here’s how infrastructure fits into the AI narrative, and why Super Micro Computer (NASDAQ: SMCI) is my top pick to play the trend.

IT infrastructure is a huge opportunity

Developing AI requires some sophisticated protocols across hardware and software. One of the most important pieces to this puzzle are chipsets known as graphics processing units (GPUs).

Nvidia and Advanced Micro Devices are two leading GPU developers at the moment, but other big tech stalwarts including Microsoft, Amazon, and Meta Platforms are looking to get in on the action.

Investing into these types of products falls under an accounting category called capital expenditures (capex). During a recent interview on CNBC, Ives suggested that AI capex will be a $1 trillion market during the next three years.

So with that said, why do I think Supermicro is a hidden gem?

Why Supermicro could benefit

Selling GPUs and accompanying software is only part of the equation. These important AI-powered products are housed in huge data centers. Within these data centers sit enormous storage racks that hold GPUs in very specific architecture designs. This is where Supermicro comes into play.

Supermicro is an IT architecture specialist that designs how GPUs fit in storage clusters. The company works closely with both Nvidia and AMD, and I see a couple of obvious catalysts on the horizon.

Specifically, sales of Nvidia’s new Blackwell series GPUs are projected to reach the multibillion-dollar mark by the end of the year, according to management and Wall Street analysts. I surmise Supermicro will be heavily involved in the specifics pertaining to how these new products will optimally be housed in data centers, and see Blackwell as an important tailwind for the company.

Furthermore, I would not be surprised to see Supermicro broaden its reach in the IT infrastructure landscape as others in big tech start releasing their own chips. To me, rising capex is an obvious catalyst that could power Supermicro’s business for years to come.

With all of this said, there are some important things to consider before pouring into Supermicro stock.

An attractive valuation, but be careful

Although Supermicro’s price-to-earnings (P/E) multiple has been coming down throughout 2024, the graph below illustrates some notable decline during the past couple of months.

There are two big forces that have led to a sell-off in Supermicro stock. First, the company’s earnings report from early August showed how volatile Supermicro’s gross margin can be. Ideally, growth investors want accelerating revenue, expanding margins, and rising profits. Supermicro’s business is not that straightforward.

Infrastructure businesses are going to carry lower-margin profiles than software businesses or companies with pricing power. Candidly, I think investors were simply hit with a reality check and need to accept that Supermicro’s profit margin may ebb and flow from time to time.

The other factor at play here is that Supermicro found itself the subject of a report published by short-seller Hindenburg Research in late August. While short reports are often perceived as a negative, there’s one important caveat to point out: short-sellers have a vested interest in seeing a share price fall.

Although Supermicro did delay the filing of its annual report after Hindenburg’s report claimed the company manipulated its accounting, not much else has come from the short report besides speculation and a cratering stock.

I will concede that investing in Supermicro carries some risk at the moment. But thinking longer-term, I see increased investments in capex and IT infrastructure as a secular tailwind that could fuel Supermicro’s business for the long run.

For these reasons, I see Supermicro as the best positioned company to benefit from opportunities in AI IT infrastructure.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Dan Ives Expect $1 Trillion in Artificial Intelligence (AI) Infrastructure Spending in the Next 3 Years. Here’s My Top Pick to Benefit was originally published by The Motley Fool

Tentative Deal Announced To End Boeing Strike, Union Will Vote Wednesday

A preliminary agreement was reached to resolve the five-week strike at Boeing, the troubled aircraft manufacturer. The union informed its 33,000 striking members early Saturday.

The International Association of Machinists and Aerospace Workers announced that members will vote on the proposal this Wednesday.

The proposal includes several key terms:

Wages will see a total increase of 35% over four years, broken down as 12% in Year 1, 8% in Year 2, 8% in Year 3, and 7% in Year 4. The Aerospace Machinists Performance Plan (AMPP) incentive plan will be reinstated, offering a guaranteed minimum annual payout of 4%, with the first payout expected in February 2025.

For retirement benefits, the company will match 100% of the first 8% contributed to the 401(k), along with a guaranteed Special Company Retirement Contribution of 4%. Additionally, there will be a one-time contribution of $5,000 to each member’s Boeing 401(k).

Also Read: Boeing’s Q3 Earnings Face Turbulence: Strikes, Layoffs, Safety Woes Ahead

In terms of pensions, the Boeing Company Employee Retirement Plan (BCERP) multiplier benefit will increase to $105 for vested employees. There will also be a one-time ratification bonus of $7,000. Lastly, the sick time call-out policy will revert to the language in the existing contract, removing the requirement to call in before shifts.

Boeing stands as the largest exporter in the United States, contributing approximately $79 billion annually to the economy. This supports 1.6 million jobs, both directly and indirectly, across 10,000 suppliers located in all 50 states.

The strike took place just a month after Kelly Ortberg began his role as the new CEO, who has expressed a desire to “reset” the strained relationship between the company and the union, reported CNN.

According to an estimate from Standard & Poor’s, the company has been incurring losses of around $1 billion per month because of the strike, adding to its existing financial challenges.

It has also revealed intentions to reduce its global workforce by 10%, which amounts to approximately 17,000 out of its 171,000 employees, CNN added. The strike has disrupted the production of nearly all of its commercial aircraft, and the company typically receives the majority of its revenue from plane sales upon delivery.

If the members approve the contract, it will supersede an agreement reached in 2008 following a two-month strike.

Boeing later stated in securities filings that this strike led to a revenue drop of approximately $6.4 billion that year, as it delivered 104 fewer aircraft than anticipated, per a news report by The New York Times.

Boeing Q3 Preview: On October 11, Boeing said it will recognize impacts to its third-quarter financial results related to charges for programs across its Commercial Airplanes and Defense, Space & Security segments and the ongoing assembly workers strike.

The company anticipates pre-tax earnings charges of $3 billion on the 777X and 767 programs in the Commercial Airplanes segment and expects pre-tax earnings charges of $2 billion on the T-7A, KC-46A, Commercial Crew and MQ-25 programs in the Defense, Space & Security segment.

Boeing expects to report third-quarter revenue of $17.8 billion, GAAP loss per share of $9.97 and negative operating cash flow of $1.3 billion.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.