Spirit Airlines debt refinancing deadline extended to December

By Rajesh Kumar Singh

CHICAGO (Reuters) – Spirit Airlines said on Friday it has reached an agreement with its credit card processor to extend a debt refinancing deadline by two months until Dec. 23.

The extension agreement with U.S. Bank National Association provides some breathing room to Spirit to refinance its $1.1 billion loyalty bonds due to mature next year. The previous refinancing deadline was Oct. 21.

The Florida-based discount carrier also said it has fully drawn down its $300 million revolving credit facility and expects to end this year with over $1 billion in liquidity.

Spirit has been losing money despite strong travel demand. It has failed to report a profit in the last five out of six quarters, raising doubts about its ability to manage looming debt maturities.

Those concerns have hammered its shares, which have slumped about 91% this year compared with a 31% gain in S&P 500 passenger airlines index.

In a regulatory filing, Spirit said it is still in “active and constructive discussions” with its bondholders about the upcoming maturities.

Spirit has been facing an uncertain future after the collapse of its $3.8 billion merger deal with JetBlue Airways. It has warned of a bigger third-quarter loss due to a tough race for price-sensitive leisure travelers and an oversupply of airline seats in the domestic market.

It is also among the airlines most heavily affected by issues with RTX’s Pratt & Whitney Geared Turbofan engines, which have forced it to ground multiple aircraft and have left the carrier with bloated costs. It is trying to attract premium travelers to increase its revenue and doubling down on cost cuts to save cash. It has downgraded and furloughed pilots, offered voluntary unpaid leaves to flight attendants, and deferred all aircraft deliveries from Airbus.

(Reporting by Rajesh Kumar Singh; Editing by Richard Chang)

ACHC BREAKING NEWS: BFA Law Announces that Acadia Healthcare has been Sued for Securities Fraud; Investors are Urged Contact BFA Law by December 16 (Nasdaq:ACHC)

NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Acadia Healthcare Company, Inc. ACHC and certain of the Company’s senior executives.

If you invested in Acadia Healthcare, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc.

Investors have until December 16, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in DexCom securities. The case is pending in the U.S. District Court for the Middle District of Tennessee and is captioned Kachrodia v. Acadia Healthcare Company, Inc., et al., No. 24-cv-01238.

What is the Lawsuit About?

The complaint alleges that Acadia is one of the largest for-profit chains of psychiatric hospitals in the United States. The complaint further alleges that during the relevant period, the Company misrepresented that its financial results were driven by insurance fraud and holding vulnerable people against their will in its facilities, including in cases where it was not medically necessary to do so.

On September 1, 2024, the New York Times published an article titled “How a Leading Chain of Psychiatric Hospitals Traps Patients.” The New York Times‘s “investigation found that some of that success was built on a disturbing practice: Acadia has lured patients into its facilities and held them against their will, even when detaining them was not medically necessary.” On this news, the price of Acadia stock fell $3.72 per share, or 4.5%, to close at $78.21 per share on September 3, 2024.

Then, on September 27, 2024, Acadia disclosed that it received a request for information from the U.S. Attorney’s Office for the Southern District of New York, a grand jury subpoena from the U.S. District Court for the Western District of Missouri, and that it expects similar requests from the U.S. Securities and Exchange Commission related to the Company’s patient admissions, as well as its length of stay and billing practices. This news caused a significant 16% decline in the price of Acadia stock, from $75.66 per share on September 26, 2024 to $63.28 per share on September 27, 2024.

Click here for more information: https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc.

What Can You Do?

If you invested in Acadia Healthcare you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/acadia-healthcare-company-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New affordable homes in Shelburne and Barton

HALIFAX, NS, Oct. 18, 2024 /CNW/ – The communities of Shelburne and Barton will have 13 new, energy efficient, homes after an investment of more than $5.1 million from the federal and provincial governments and Co-operative Homes Ltd. (Compass Nova Scotia).

Heritage Hall in Shelburne is a centrally located building that will be converted into five one- and two-bedroom apartments. Barton Elementary School is located on a large parcel of land near shops and services in Barton, and will be converted into eight one- and two-bedroom apartments.

The conversion to make the two buildings more energy efficient will include heat pumps, heat recovery ventilators, and envelope improvements.

Compass Nova Scotia is a not-for-profit housing co-operative that currently has 111 homes in 8 neighbourhoods across the province.

Quotes

“I am proud that we could support these two projects that will bring more affordable homes to Shelburne and Barton, here at home in Nova Scotia. We will keep working with partners across the country to build more homes and end the housing crisis.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Our investments in energy efficient housing are an important part of our efforts to give Nova Scotians clean, reliable power at affordable prices. We have a focus to meeting our ambitious climate change targets, and this investment takes us one important step closer to those goals.”

Nolan Young, MLA for Shelburne on behalf of Tory Rushton, Minister of Natural Resources and Renewables

“Compass Nova Scotia Co-operative Homes is thrilled to again be growing with the Barton School and Heritage Hall projects. These new homes will reflect the mission of Compass to build inclusive and sustainable housing communities through collaboration. This important initiative for rural Nova Scotia could not have been possible without support from various partners and all levels of government, particularly to ensure these homes are built to a high energy standard.”

Karen Brodeur, Director, Co-operative Housing Development, Co-operative Housing Federation of Canada

“I am so pleased that we will soon be able to welcome new households to Compass Nova Scotia, because of these two projects. Being part of Compass Nova Scotia means having a secure, co-operative home in an inclusive community. Many individuals and families are looking for exactly this kind of housing. I am grateful for the support of the federal, provincial and municipal governments, who together are making this possible.”

Keith MacDonald, President, Compass Nova Scotia Co-operative Homes Limited

Quick Facts

- The federal government is investing $1,539,190 through the Green Infrastructure Stream of the Investing in Canada Infrastructure Program. The Government of Nova Scotia is investing $2,498,707, and Compass Nova Scotia is contributing $1,091,552.

- This stream helps build greener communities by contributing to climate change preparedness, reducing greenhouse gas emissions, and supporting renewable technologies.

- Including today’s announcement, over 50 infrastructure projects under the Green Infrastructure Stream have been announced in Nova Scotia, with a total federal contribution of more than $330 million and a total provincial contribution of more than $434 million.

- Under the Investing in Canada Plan, the federal government is investing more than $180 billion over 12 years in public transit projects, green infrastructure, social infrastructure, trade and transportation routes, and Canada’s rural and northern communities.

- The funding announced today builds on the federal government’s work through the Atlantic Growth Strategy to create well-paying jobs and strengthen local economies.

Associated Links

Investing in Canada: Canada’s Long-Term Infrastructure Plan

https://housing-infrastructure.canada.ca/plan/icp-publication-pic-eng.htmlhttps://www.infrastructure.gc.ca/plan/icp-publication-pic-eng.html

Green Infrastructure Stream

https://housing-infrastructure.canada.ca/plan/gi-iv-eng.html

Housing and Infrastructure Project Map https://housing-infrastructure.canada.ca/gmap-gcarte/index-eng.html

Strengthened Climate Plan

https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/climate-plan-overview.html

Follow us on X, Facebook, Instagram and LinkedIn

Web: Housing, Infrastructure and Communities Canada

SOURCE Department of Housing, Infrastructure and Communities

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/18/c7497.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/18/c7497.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why the stock market will drop 7% by mid-November, according to a technical analyst

-

The stock market could face a 7% correction by mid-November, says Fundstrat’s Mark Newton.

-

Investor complacency and weak seasonals could trigger decline, according to Newton.

-

He views any potential pullback as a “buy the dip” opportunity.

The stock market looks poised for a 7% correction by mid-November, according to technical analyst Mark Newton of Fundstrat.

Newton told clients in a note on Thursday that he is expecting the S&P 500 to see weakness heading into November as investor sentiment hits complacent levels just ahead of the general election on November 5.

“While intermediate-term bullish these remains very much intact, it’s doubtful that US Equities continue to push up into and post-election without any consolidation,” Newton said.

Newton said the potential correction he expects in the stock market is likely to be a “short-term correction only” and “not the start of a larger decline,” playing into Fundstrat’s Tom Lee’s consistent message that investors should view any decline in the stock market as a “buy the dip” opportunity.

Newton is monitoring the 5,900 level on the S&P 500 as potential resistance for the index. The S&P 500 traded at around 5,850 on Friday.

“The issues with near-term complacency (as judged by low Equity put/call levels), waning breadth, poor seasonal trends and cyclical projections for November as well as SPX’s largest sector, Technology, not performing well of late, are all reasons to be alert for possible trend change in the weeks to come,” Newton explained.

One “key reason” Newton is turning bearish in the short-term is that the current rally in stocks that started in early August is 88 days long, which is exactly how long the April 19 to July 16 rally lasted before a sell-off materialized.

From a time perspective, that’s “why this rally might ‘run out of steam,” Newton said.

Other areas of technical weakness that Newton is monitoring includes negative divergences in momentum as measured by the RSI and the moving average convergence divergence (MACD) indicators, a lack of bearish investors as measured by the AAII investor sentiment data, and seasonal cycles that show a peak in the stock market in mid-to-late October followed by a sell-off through November.

“This market has seemingly ‘dodged a bullet’ thus far during one of the historically worst periods during most election years. However, investors should not take this to mean that the coast is clear for an interrupted rally higher all year,” Newton said.

Read the original article on Business Insider

Stocks are nearing a major peak and a more 'disturbed' period of weak returns is ahead for investors, CIO says

-

The bull market could be in its final days, according to Calamos Investments’ Michael Grant.

-

The CIO said the market has suffered from “invincibility syndrome.”

-

Grant said stocks could soon enter a period of weak returns, possibly for “many years.”

The bull market in stocks looks like it’s close to the top, according to an investment chief.

Michael Grant, the co-CIO of Calamos Investments, thinks large-cap stocks could be on track for one of the best years over the last century, before the market tips into a period defined by subpar returns.

That’s because stocks are flashing signs of “invincibility syndrome,” with investors falsely believing that nothing can stop further gains, he said in a note this week.

“The most significant feature of this investment year is the perception that US equities are virtually invincible. This ‘Invincibility Syndrome’ historically signals a crescendo when markets are in the process of summiting a major peak,” Grant wrote.

“In our view, the paradox of this rewarding year is its underlying warning of low future returns for 2025 and beyond,” he later added.

The precarious state of the market can be seen in a slew of data points that measure valuation, sentiment, and positioning, he noted.

A handful of valuation measures suggest stocks are at historically expensive levels, Grant said. For instance, the median price-to-earnings ratio of the S&P 500 is 28, the most expensive stocks have been relative to earnings since around the dot-com bubble.

Meanwhile, the standard Shiller cyclically adjusted price-to-earnings ratio — which smooths out outlier P/E data — has climbed past 35, the highest level on record.

Sentiment and position indicators are also flashing signs investors are overexcited about the stock market, Grant said.

Households appear to be the most bullish on stocks since the dot-com era. The percentage of consumers who expect stock gains over the next year has climbed to its highest levels recorded since 1987, according to the three-month moving average of responses to the Conference Board’s monthly survey.

Households also have a lot of cash allocated to investments. US households held a record $42.43 trillion in corporate equities and mutual fund shares over the second quarter, Federal Reserve data shows.

Meanwhile, the amount of cash held by non-bank investors as a percentage of equity mutual funds has dropped to nearly 30%, around historic lows. That suggests there’s little “cushion” in the event the stock market declines or experiences a shock, Grant said.

“What is striking today is how positioning measures corroborate the diagnosis of extended confidence and valuation for the leading categories of US equities. What remains to drive a market higher if everyone is already bullish?” Grant said.

Investors have felt pretty optimistic about stocks so far this year, thanks largely due to optimism on the US economy and expected rate cuts. But if the economy is headed for a soft landing or no landing at all, that suggests interest rates won’t move significantly lower, Grant noted.

“Put simply, the decline of long-term risk-free yields appears complete, unless the soft-landing assumption is badly wrong. The landscape taking shape represents the final stages of the bull market and a prelude to a much more disturbed period ahead, perhaps for many years,” he said.

Grant added that the push toward 6,000 for the S&P 500 suggests that 2024 will mark the strongest year for large-cap stocks of the century so far, but that doesn’t mean the future will be as bright.

“And yet, this thought pales in comparison with the growing evidence that we are witnessing a crescendo— a summit for equities that could prove durable.”

Read the original article on Business Insider

Got $3,000? 2 Artificial Intelligence (AI) Stocks to Buy and Hold for the Long Term.

Artificial intelligence (AI) is the hottest topic on Wall Street and is expanding quickly to Main Street as businesses adopt these solutions at lightning speeds. Open AI’s ChatGPT caused a search and query revolution, while Nvidia’s unprecedented growth helped power the Nasdaq Composite and S&P 500 to new highs.

AI is a vast field, and investors have oodles of options, from companies that provide tech research, like Gartner, to those providing integrated software, like Microsoft’s Copilot, to data center memory suppliers like Micron Technology. But most of us don’t have unlimited funds to invest in everything.

If you have a few thousand dollars in a retirement account or rattling around in the bank, I have a couple of ideas. I thought I would focus on two extraordinarily different companies that could provide long-term profits.

SoundHound AI

Rising costs and a lack of available workers have made drive-thru and fast-casual restaurants explore alternatives. Meanwhile, automakers are looking for next-gen conversational intelligence. Voice recognition conversational intelligence solves both problems, and SoundHound’s software offers this to many familiar brands, such as White Castle, Jersey Mikes, Stellantis, and Honda.

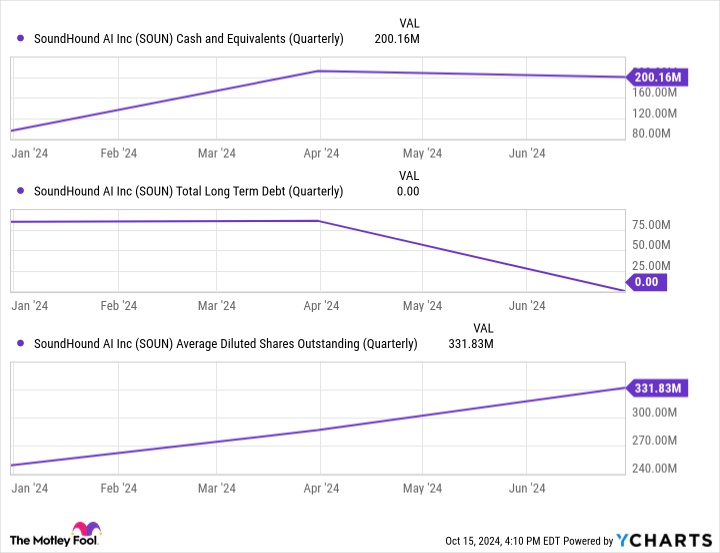

I’ve been critical of SoundHound AI (NASDAQ: SOUN) in the past. At the end of 2022, the company’s cash balance bottomed out at just $10 million against $35 million in debt. $10 million makes growth extremely difficult for an unprofitable company with negative cash flow — it’s not a recipe for success.

However, management drastically improved its position to $200 million in cash and no debt last quarter, as shown below, although the company increased its share count substantially to do it.

The increase in share count is a tough pill for the existing shareholders, but the dilution should drastically slow now that the company is on solid footing.

SoundHound trades for 26 times sales, which seems high for an unprofitable, cash-flow-negative company. However, the valuation drops drastically when accounting for the rapid growth. SoundHound hit $13.5 million in sales in Q2 on 54% year-over-year growth. It expects revenue to leap from $80 million in 2024 to $150 million next year. This brings the price-to-sales ratio to a more palatable 12.5.

SoundHound isn’t a stock for everyone; smaller companies are typically riskier, albeit with massive upside potential. Areas like voice-enabled smart TVs, home devices, carryout ordering, and retail are virtually untapped. Still, it’s best not to put all your eggs in one basket, so here’s a more mainstream idea.

Amazon

Amazon (NASDAQ: AMZN) is about 1,000 times larger than SoundHound by market capitalization. It’s also a critical cog in the AI machine. We use more data than ever, and the need for it keeps growing. Cloud service providers, like Amazon Web Services (AWS), are critical to power data-guzzling AI applications. As shown below, AWS is the largest provider, with nearly a third of the market.

AWS accounts for a growing portion of Amazon’s total revenue — 18% in Q2 2024 compared to 16% in Q2 2023. This is terrific for Amazon as AWS is highly profitable, posting a 36% operating margin last quarter compared to 10% for the company as a whole. If you still think of Amazon as a product company, think again; 58% of total sales last quarter were from services like AWS, digital advertising, Prime, and third-party seller services.

This should excite investors since services tend to be more profitable than products. The continued migration to services and the resurgence of AWS on the back of AI pushed operating profits to $30 billion for the first six months of 2024 compared to just $12 billion for the same period of 2023.

Amazon has other irons in the AI fire, like Amazon Bedrock, which provides foundational models that customers can customize to suit their needs, and forays into designing AI chips. The company has the resources to be a major player in the industry.

Now, let’s look at the stock, which trades below its recent averages based on earnings, cash flow, and sales, as depicted below.

Investors should always consider their risk tolerance (what’s yours? Try this quiz to find out) when choosing how to divide their money between investments. In this case, SoundHound is riskier than Amazon but has a more explosive potential upside because of its smaller size.

A typical long-term investor with medium risk tolerance should consider weighting their dollars heavily toward Amazon with a smaller speculative position in SoundHound. In contrast, an aggressive investor could do the opposite.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon and Micron Technology and has the following options: long January 2025 $2 calls on SoundHound AI. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Got $3,000? 2 Artificial Intelligence (AI) Stocks to Buy and Hold for the Long Term. was originally published by The Motley Fool

Chart of the Week: A hot economy is good enough for stocks — and even for rate cuts

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

The bullish euphoria that came from the possibility of a quick return to neutral rates after the Fed’s 50 basis point cut in September has faded. But it’s been swapped with a different bullish sentiment, one we all know very well: the strength of a hot economy, which has helped power the market all year — until that cut.

While inflation and economic reacceleration concerns have returned after a string of hot data (the September jobs report, the Consumer Price Index, hot retail sales, and calmer weekly jobless claims), the strength has done nothing if not buoy the market. It has done just fine (thank you very much) under the past few years of high interest rates and endless no-landing comments. A hot economy is good for stocks.

All this has kept the S&P 500 floating around its all-time high all week, now well over 5,800, as the index passes more and more year-end forecasts — and their subsequent upward revisions, like UBS’s 5,850 figure that it published Tuesday.

The mood feels different than a month ago. But as our Chart of the Week shows, not a whole lot has actually changed in terms of expectations — especially to the downside.

The latest Bank of America Global Fund Manager Survey shows the soft landing potential may have slightly decreased. But the hard landing respondents faded just as much, falling into the single digits for the first time since June, with just 8% seeing a recession in the next 12 months.

Checking in with the CME’s FedWatch tool also shows little change. The belief that the Fed will continue to cut interest rates in November is still overwhelming, with the tool showing a 91% chance of a 25 basis point cut on Friday.

Reconciling these two things — another potentially reaccelerating economy and a rate cut the market is almost certain of — sounds tough. But it’s not when you remember how high rates still are, as we wrote earlier this week in Chart of the Day. As Minneapolis Fed president Neel Kashkari said this week, rates are still “overall restrictive.”

Jason Furman, the former Council of Economic Advisers Chairman under President Barack Obama, told Yahoo Finance that he sees inflation as a bigger problem than recession right now. But the current Harvard professor mused that while “the Fed needs to have tight policy, it just doesn’t need to have policy being as tight as it was last year.”

High — but lower than they were — for longer.

Ethan Wolff-Mann is a Senior Editor at Yahoo Finance, running newsletters. Follow him on X @ewolffmann.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

2 Incredibly Cheap and Reliable Dividend Stocks With Yields Up to 5.5% to Buy Now

There are two very big trends going on in the world when it comes to energy, but they might not be what you are expecting: The first is that the global population is growing. The second is that lower-income countries are moving up the socioeconomic ladder.

These two trends are what you really need to understand when looking at the clean energy transition that’s also happening right now. And when you do, you’ll understand why Brookfield Renewable Partners (NYSE: BEP) and Chevron (NYSE: CVX) are both cheap and reliable dividend stocks you’ll find attractive today.

Oil and gas are being replaced by cleaner alternatives, but slowly

The world has gone through energy transitions before, shifting from biomass (wood) to coal, and from coal to oil. What’s interesting is that, when you examine the world’s biggest sources of energy, biomass and coal are still material producers of power, despite having been dethroned as the main source by other options.

Oil and natural gas are No. 1 today, but that seems likely to change as clean energy demand and production grow.

But just like previous energy transitions, it is highly unlikely that solar and wind suddenly replace oil and gas. In fact, energy industry watchers largely agree that oil and natural gas will remain important for decades to come even as clean energy grows in importance.

The reason? A more populous world and higher incomes will require an all-of-the-above approach because the demand for energy grows along with the population and incomes. Demand for oil and natural gas might even increase!

So investors have two energy plays to consider. The first is to buy a company like Brookfield Renewable Partners that benefits from clean energy’s growth. The second is to buy an oil and natural gas company, like Chevron, that can continue to benefit from the still-strong underlying demand for carbon fuels. The best part? Both of these high-yield stocks look cheap right now.

Chevron has been marked down by 20%

Chevron’s stock price has fallen roughly 20% from its recent peak in late 2022. That has a lot to do with the price of oil, which has also declined over that same span. That makes complete sense because Chevron is an integrated energy company, with top and bottom lines that are heavily influenced by energy prices.

But as an integrated energy company, it also has operations in the midstream (pipelines) and downstream (chemicals and refining) sectors. Having exposure to all three helps to even out financial performance over time. It is a relatively conservative way to invest in the energy space.

It also has a rock-solid balance sheet, with a debt-to-equity ratio of just 0.15. That would be low for any company, but for Chevron, it gives management the leeway to increase leverage when oil prices are weak to help support the business and dividend.

Highlighting Chevron’s consistency is its 37-year streak of annual dividend increases, which is pretty impressive given the inherent volatility of the energy sector.

Chevron’s stock is often most attractive when oil prices are plunging, but for conservative dividend investors, the roughly 20% drop in the stock makes it worth looking into today. Indeed, the yield is an attractive 4.3%, which is notably above the 1.2% from the S&P 500 Index and above the 3.4% of the average energy stock, using the Energy Select Sector SPDR ETF as an industry proxy. Those dividend comparisons make Chevron look attractively cheap right now.

Brookfield Renewable Partners has been cut nearly in half

Brookfield Renewable Partners might be even more interesting than Chevron, given that its units have declined a huge 47% since hitting a high-water mark in early 2021. That might seem odd given the long runway for growth in the clean energy sector, but you have to remember that Wall Street is a fickle place. Before 2021, renewable power was a hot story. And then investors got bored and moved on, despite the ongoing transition taking shape.

To be fair, competition has increased in the sector, which makes profitability harder to achieve. But Brookfield Renewable Partners is a financially strong business with a proven history of success.

The prime example of this is the distribution, which has increased by roughly 6% annually over the past 20 years. That will be music to the ears of most income investors.

Also, Brookfield Renewable’s parent company is Brookfield Asset Management (NYSE: BAM), one of Canada’s largest and most respected asset management companies. It has a long history of investing globally in the infrastructure sector. Brookfield Renewable is, really, a way for small investors to partner up with an established industry leader in infrastructure and collect big distributions from it.

The one caveat here is that, given the asset management approach, Brookfield Renewable Partners has a history of actively buying and selling clean energy assets. This business is not operated like a typical regulated utility, which means you’ll probably want to track it fairly closely.

But with Brookfield’s lofty 5.5% distribution yield, that extra work will be well worth the effort. Note that the average utility, using the Utilities Select Sector SPDR ETF as a proxy, is only yielding 2.7% today. That makes Brookfield Renewable Partners look incredibly cheap.

Cheap and reliable

If you are thinking about adding some out-of-favor dividend payers to your portfolio, look no further than Chevron and Brookfield Renewable Partners. Both look cheap today when you compare their yields to other alternatives. And, despite being at opposite ends of the clean energy revolution, both have long-term income appeal.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Brookfield Asset Management and Chevron. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

2 Incredibly Cheap and Reliable Dividend Stocks With Yields Up to 5.5% to Buy Now was originally published by The Motley Fool

DXCM DEADLINE ALERT: DexCom, Inc. Investors are Notified of Imminent Monday October 21 Legal Deadline; Contact BFA Law if You Lost Money (Nasdaq:DXCM)

NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against DexCom, Inc. DXCM and certain of the Company’s senior executives.

If you invested in DexCom, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/dexcom-inc.

Investors have until October 21, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in DexCom securities. The case is pending in the U.S. District Court for the Southern District of California and is captioned Alonzo v. DexCom, Inc., No. 24-cv-01485.

What is the Lawsuit About?

DexCom develops glucose monitoring systems for diabetes management. The company discussed its ability to capitalize on its growth potential to reach the projected record number of new patients and simultaneously outpace the prior fiscal year’s gross margins, while scaling customer conversion to the new G7 platform.

After the market closed on July 25, 2024, DexCom announced disappointing earnings results for its second quarter of 2024 and slashed full year revenue guidance from $4.35 billion to $4 billion-$4.05 billion. The news caused a precipitous decline in the price of DexCom stock. The price of the company’s stock closed at $107.85 per share on July 25, 2024. Prior to the market open on July 26, 2024, DexCom stock was trading in the range of $66.60 per share, a decline of $41.25 per share, or 38%.

Click here for more information: https://www.bfalaw.com/cases-investigations/dexcom-inc.

What Can You Do?

If you invested in DexCom, Inc. you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/dexcom-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/dexcom-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First in Nation Campus for Child Victims of Sex Trafficking Completed

St. Jude’s Ranch for Children to hold grand opening of residential and educational Healing Center on October 30

LAS VEGAS, Oct. 18, 2024 /PRNewswire/ — The unprecedented Healing Center at St. Jude’s Ranch for Children, a $25 million project, has completed construction. The nation’s first purpose-built residential campus for child victims of sex trafficking will provide safe therapeutic homes and specialized recovery programs.

First in US: St. Jude’s Ranch for Children’s Healing Center, $25M campus for child victims of sex trafficking.

The 10-acre campus is unique due to its local law enforcement partnerships, on-site public school, ground-up residences, holistic treatment options, survivor advocates, and trauma-sensitive design for youth who have been forced or manipulated into having sex for money.

“Building on our 58-year legacy, we’re thrilled to have fulfilled our promise,” said Dr. Christina Vela, CEO of St. Jude’s Ranch for Children. “It will be a historic moment in child advocacy as we open the doors to healing and hope that you need to see to truly experience.”

Perched above Lake Mead near Hoover Dam, the Healing Center features a neighborhood-style layout with six one-story homes, each containing four to six bedrooms, therapy offices, a multi-purpose building, yoga/meditation room, and outdoor areas with walking paths and thoughtful spaces that encourage healing through nature. Staffed 24/7 by trained specialists, the center, capable of housing up to 62 residents at full capacity, will pair victims with survivor advocates upon arrival.

Spearheading national change with community partners such as law enforcement, child protective services, and legal advocates, the Healing Center will help victims avoid being taken to jail. Juvenile detention is the standard response nationwide for underage trafficking victims, this collaboration offers a compassionate alternative to break the cycle of trauma and incarceration.

The first public school of its kind dedicated to young victims of sex trafficking will be on-site and will offer a tailored educational model including flexible learning, social and emotional integration, and accommodations for students transitioning from nocturnal life cycles.

The Ceasar’s Entertainment sponsored grand opening on October 30, 2024, will include a ribbon-cutting ceremony, time capsule contributions, and tours.

ABOUT ST. JUDE’S RANCH FOR CHILDREN

For 58 years, St. Jude’s Ranch for Children has been a community of healing and hope. The non-denominational 501(c)3 organization helps individuals, ages zero to 25, who’ve been abused, neglected, exploited and/or homeless by providing safety, stability, and healing in a caring environment. stjudesranch.org

![]() View original content:https://www.prnewswire.com/news-releases/first-in-nation-campus-for-child-victims-of-sex-trafficking-completed-302279876.html

View original content:https://www.prnewswire.com/news-releases/first-in-nation-campus-for-child-victims-of-sex-trafficking-completed-302279876.html

SOURCE St. Jude’s Ranch for Children

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.