Trump's Potential Federal Reserve Pick Defends Rate Cuts After Ex-President Slammed Jerome Powell's Move

Donald Trump‘s potential nominee for the Federal Reserve, Kevin Hassett, has defended the central bank’s recent interest rate reduction, despite Trump’s criticism.

What Happened: Hassett, a former Trump economic adviser, justified the half-point rate cut citing a weakening jobs market, Financial Times reported on Friday.

In an interview with the FT’s Unhedged newsletter, Hassett stated, “The latest move to start reducing rates is something that made a great deal of sense based on the data that they had at the time.”

This stance contrasts with Trump’s remarks at the Detroit Economic Club, where he labeled the rate cut as a political maneuver.

Trump criticized the Federal Reserve for lowering rates to benefit his Democratic opponent, Kamala Harris. Despite agreeing with Trump that the Fed has acted politically in the past, Hassett dismissed concerns about undermining the Fed’s independence if Trump returns to power. He emphasized that Trump supports central bank independence but wants his voice heard.

The Fed, which plans smaller rate cuts in the coming months, has consistently denied setting monetary policy based on political considerations. Hassett, currently at Stanford’s Hoover Institution, remains a key figure in Trump’s circle and could lead the Fed if Trump wins the upcoming election.

Why It Matters: The Federal Reserve’s decision to cut interest rates by 0.5% has sparked significant market reactions. This move marked the first rate cut since March 2020, bringing the target fed funds rate to a range between 4.75% and 5%. The rate cut has led to a surge in the S&P 500 and gold prices, while small-cap stocks have also rallied.

Price Action: On Friday’s pre-market, as per Benzinga Pro, SPDR S&P 500 ETF Trust SPY which tracks the S&P 500 was trading 0.25% higher while Invesco QQQ Trust, Series 1 QQQ was trading 0.61% higher.

Read Next:

Illustration created using artificial intelligence via MidJourney.

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXCLUSIVE: Robinhood's Steve Quirk Says New Offerings Like Crypto, Futures Bring In Customers, Bitcoin Is 'No. 1' Recurring Investment (CORRECTED)

Trading platform Robinhood Markets HOOD has grown from a strong base of young users and retail users into a platform that caters to all, a development the company’s Chief Brokerage Officer Steve Quirk told Benzinga is “kind of exciting to see” during the 2024 HOOD Summit.

Robinhood’s Growth: With a long career in the trading world at TD Ameritrade and the Cboe, Quirk has seen trends come and go in the stock market.

“At Robinhood, our customers tier toward the younger side,” Quirk said in a Friday interview, noting an average customer age in the low 30s.

Similarities exist between legacy trading firms and Robinhood, he said, but there are many differences that influence the latter’s product development.

“The technology and products we roll out cater to our customers.”

On Robinhood, around 50% of the self-directed trading occurs on mobile, which means most of the trading is done on phones, Quirk said.

With the growth of retirement accounts and more sophisticated traders joining Robinhood, Quirk said the company saw demand for web-based apps and platforms alongside mobile, which went into the company’s new trading platform.

“We are attracting a lot of large customers from other brokerages.”

Quirk emphasized the amount of effort Robinhood puts into researching customers to make better tools and products and also the effort made in education to make people feel comfortable switching their accounts over to Robinhood.

“Education is critical.”

The HOOD Summit has helped show Quirk stories of investors changing their lives through Robinhood tools and investment platforms, he said.

“Those stories make you motivated to continue to deliver for the customers.”

Platform For Everything: Robinhood recently announced a partnership with Cboe Global Markets CBOE that will bring futures trading to customers, which Quirk said is one of the platform’s most-requested features.

“It’s a natural,” Quirk said.

The tax advantages of futures and the fact they operate around the clock are some of the reasons they are in demand from Robinhood customers, he said.

With its offerings of stocks, options, futures and cryptocurrency, Quirk highlighted the uniqueness of the Robinhood platform during his interview with Benzinga’s Zunaid Suleman at the HOOD Summit in Miami.

“We’re the only place in U.S. where you can do it all.”

Robinhood offers the ability to make recurring investments in any asset, including cryptocurrency, Quirk said.

“The No. 1 traded and most reoccurred investment is Bitcoin,” he said, highlighting the leading cryptocurrency Bitcoin BTC/USD.

Bitcoin has been Robinhood’s top recurring asset for years and it shows the platform has customers who are very passionate about cryptocurrency, the chief brokerage officer said.

Read Next:

Benzinga’s Zunaid Suleman interviews Robinhood Chief Brokerage Officer Steve Quirk. Photo by Aaron Thomas.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Netting $550k from Our Home Sale – How Can We Minimize Capital Gains Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Selling your home to downsize can make your retirement more financially stable, but if you have a profit on the sale you might owe capital gains taxes. Fortunately, in many cases those selling their primary residence who are single can exclude $250,000 from capital gains taxes, while married couples filing jointly can exclude $500,000. Employing this exclusion can reduce or eliminate capital gains taxes since earnings are unlikely to go beyond those figures, if at all. Some restrictions do apply, however, so it’s best not to assume your gain will be excluded. There are other strategies that you might be able to use, but these may have significant limitations, uncertainties and risks.

Do you have questions about retirement planning? Speak with a financial advisor today.

Is the Gain on Your Home Sale Taxable?

Selling your primary residence may result in capital gains taxes, but for many people it doesn’t. To determine whether your gain will get taxed, you must first figure out how much gain qualifies to be excluded. The amount of the gain that can be shielded from taxes depends on the filing status you choose when you submit your income tax return.

Single filers can exclude $250,000 and married couples filing jointly can exclude $500,000 of profits on the sale of a primary home. However, to qualify for these exclusions, the sellers must have owned and lived in the home at least two of the five years prior to selling. Also, you can’t have used the exclusion in the previous two years.

If your gain exceeds the exclusion, the amount of the overage will be taxed as capital gains. The amount of tax depends on how long you have owned the home. If you have owned it for more than a year, you’ll likely qualify for long-term capital gains tax rates of 0%, 15% or 20%. The exact rate depends on your income and other capital gains for the year, and the gain on your home sale gets included when figuring that. In this case, a married couple who makes $550,000 in gains on their home sale would likely be subject to the 15% long-term tax bracket, which starts at $47,025 in 2024.

Downsizing in Action

Here’s how this all could play out, looking at three possible scenarios:

-

A married couple filing jointly can exclude $500,000 in gains from taxation after the sale. This would leave only $50,000 to be taxed. Because the couple has owned and lived in the home for at least two out of the last five years, long-term capital gains tax rates will apply. The tax bill for the sale alone would be $50,000 at 15%, or $7,500.

-

If you aren’t eligible for any exclusion, due to not living in the home two of the previous five years or using the exclusion more recently than two years, then the entire $550,000 will be taxed. If the whole gain of $550,000 is taxed at 15%, the bill would be $82,500.

-

For the sake of an example, let’s assume you were single and meet the criteria for the exclusion. In this scenario, you can exclude $250,000 of the $550,000 gain, which leaves $300,000 taxable. The rate will likely be 15%, as the 20% long-term tax bracket starts at $518,900 for 2024. This will result in 15% taxes owed on the $300,000, or $45,000.

While these guidelines apply to federal capital gains taxes, some states also levy capital gains taxes. States tax capital gains in a variety of ways, so you need to check local laws to get an accurate idea of your tax bill.

Other Approaches

You may be able to reduce your taxes, even if none or only part of the gain qualifies for an exclusion. This can be done by making sure you accurately figure your cost basis of the house. To do this, add up all the improvements you made to the property. Now add this figure to the property’s original cost and subtract it from the sale price.

If you have previously not fully accounted for your cost basis, this can reduce the amount of the gain and the subsequent taxes you’ll owe. For instance, if you spent $50,000 on a kitchen renovation and hadn’t included that in your cost basis, accounting for it correctly could reduce your $550,000 gain to $500,000.

Another way to potentially defer taxes is by using the gain to acquire a new residence through a like-kind exchange. This delays tax liability until you sell the replacement home. Many limitations and risks accompany these types of deals, however. For example, if you downsize to a less expensive home, the difference in the sale price of your former residence and the price of the new property could be taxable, among other complications.

Bottom Line

A home seller pocketing $550,000 can legally avoid some capital gains taxes through an exemption and other legitimate tax minimization strategies. However, limitations are abound, so consult a financial advisor to understand how these situations work and how to plan for them.

Retirement Tax Tips

-

A financial advisor can help you plan for taxes and retirement. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

SmartAsset’s income tax calculator can shine a revealing light on how much you’ll owe or receive as a refund next time you file taxes.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/svetikd, ©iStock.com/pcess609

The post We’re Selling Our House and Netting $550k to Downsize for Retirement. How Can We Avoid Capital Gains Taxes? appeared first on SmartReads by SmartAsset.

1 Top Cryptocurrency to Buy Before It Soars 700%, According to this Wall Street Executive and Billionaire

It seems that, eventually, everyone changes their tune on Bitcoin (CRYPTO: BTC). One of those people is none other than Larry Fink, billionaire chief executive officer of BlackRock, the world’s largest asset manager.

Fink was once a Bitcoin skeptic, dismissing it as worthless, but he has since done a 180 and is now leading the charge to integrate Bitcoin into traditional finance and bring the cryptocurrency to the masses. However, it is his most recent comments that truly shed light on just how far he thinks Bitcoin can go.

BlackRock and Larry Fink call their Bitcoin shot

Few companies are contributing to Bitcoin adoption quite like BlackRock. In January 2024, the firm launched its iShares Bitcoin Trust, one of 11 newly introduced spot Bitcoin exchange-traded funds (ETFs). These funds provide both institutional and retail investors with an easy way to gain exposure to Bitcoin through traditional stock markets.

While all of the spot Bitcoin ETFs have seen historic success, BlackRock’s fund stands out, leading the pack with more than $24 billion in assets under management (AUM) and solidifying its position as the frontrunner in Bitcoin investment vehicles.

More recently, BlackRock released a paper titled “Bitcoin: A Unique Diversifier,” outlining its belief in Bitcoin’s long-term value proposition. The report emphasizes how Bitcoin’s distinctive qualities (decentralization, security, and a finite supply) provide unparalleled risk diversification for investor portfolios, all of which could fuel increasing demand for the cryptocurrency as global debt levels rise and economic uncertainties persist. In many respects, BlackRock’s analysis echoes sentiments that Bitcoin advocates have asserted for years.

However, Fink hasn’t stopped there. On BlackRock’s most recent quarterly earnings call, he reinforced his bullish outlook on Bitcoin, delivering some of his most significant comments to date. Fink emphasized that Bitcoin is not just another asset, but an alternative to commodities, going so far as stating it “is an asset class in itself.” Yet the most striking comparison he made was when he likened Bitcoin’s potential to the early growth of mortgage-backed securities (MBS) in the 1980s.

Fink explained that, much like Bitcoin today, the MBS market began slowly, struggling for mainstream acceptance until data and analytics provided a clearer understanding of its value. Over time, mortgage-backed securities became a dominant force, now representing an $11 trillion market. Fink sees Bitcoin in a similar position, still in its early stages but poised for exponential growth.

If Bitcoin were to achieve a comparable market cap, it would be worth nearly $550,000 per coin — a staggering 720% increase from its current price.

Keeping things in check

These projections may sound outlandish, but it’s important to remember that Bitcoin has a long history of defying expectations. Just five years ago, Bitcoin was trading at $8,000, with many investors doubting it would ever reach $20,000, let alone surpass $60,000. Now, with Bitcoin trading around $67,000, Fink’s prediction of a $550,000 Bitcoin seems bold, but not impossible.

As BlackRock’s paper outlines, Bitcoin has the potential to become a global store of value in an economic landscape fraught with devaluation, soaring government debt, and policies that often leave the average investor behind. In such a scenario, Bitcoin’s finite supply of 21 million coins becomes even more attractive, driving increased demand and, eventually, much higher prices.

For investors, the message is clear: Bitcoin is no longer a fringe asset. With BlackRock leading the way and heavyweights like Fink throwing their weight behind it, Bitcoin presents a generational opportunity today.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

RJ Fulton has positions in Bitcoin and iShares Bitcoin Trust. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

1 Top Cryptocurrency to Buy Before It Soars 700%, According to this Wall Street Executive and Billionaire was originally published by The Motley Fool

ELAN LAWSUIT UPDATE: Elanco Animal Health Investors are Notified of Imminent December 6 Legal Deadline; Contact BFA Law if You Lost Money (NYSE:ELAN)

NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Elanco Animal Health Incorporated ELAN and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in Elanco, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated.

Investors have until December 6, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Elanco Animal Health Incorporated securities. The case is pending in the U.S. District Court of Maryland and is captioned Barpar v. Elanco Animal Health Incorporated, et al., No. 24-cv-02912.

What is the Lawsuit About?

The complaint alleges that Elanco develops products to treat diseases in animals. Two of the most important treatments in the company’s development pipeline are currently being reviewed by the U.S. Food and Drug Administration (“FDA”). The treatments are named Zenrelia, a drug for a type of dermatitis in dogs, and Credelio Quattro, which is a broad spectrum oral parasiticide covering fleas, ticks and internal parasites.

With respect to these treatments, the company stated that the FDA “has all data necessary to complete its review. All technical sections, including the label, are expected to be approved before the end of June [2024].” However, on June 27, 2024, Elanco announced that it expected the FDA would not approve either drug in June 2024 and that Zenrelia would come with a boxed warning on safety.

As a result of the news, Elanco’s stock price declined over 21%, from $17.97 per share on June 26, 2024 to $14.27 per share on June 27, 2024. BFA Law is investigating whether Elanco and certain of its executives made materially false and/or misleading statements to investors related to the FDA’s approval of its drugs.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated.

What Can You Do?

If you invested in Elanco Animal Health Incorporated ELAN you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stoneweg US Achieves 87 Points and 4 Stars for Its Varia US Portfolio, Propelling the Company to 3rd Place in the 2024 GRESB Listed Multifamily Rankings

Performance indicates Stoneweg US’ Leadership in Sustainable Asset Management

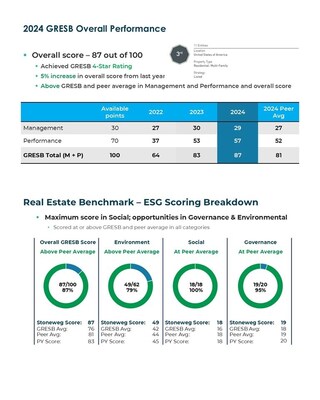

ST PETERSBURG, Fla., Oct. 18, 2024 /PRNewswire/ — Stoneweg U.S., LLC (“Stoneweg US”), a leading asset manager for multifamily real estate, is proud to report that the portfolio it manages for Varia US Properties AG’s, a Swiss publicly traded multifamily real estate company (“Varia US”), scored 87 points and 4 stars according to the last GRESB results publication. The portfolio managed by Stoneweg US ranked 3rd in the “US Listed Multifamily” category, improving from 4th in 2023 and 8th in 2022. Stoneweg US’ commitment to sustainable asset management has played a significant role in elevating Varia US’ GRESB performance, driving a substantial year-over-year improvement in several key areas of the portfolio’s overall score.

Stoneweg US’ commitment to sustainable asset management played a significant role, elevating Varia US’ GRESB performance

“Our firm’s performance for Varia US in sustainable asset management within the multifamily sector is a testament to our unwavering commitment to long-term value,” said Patrick Richard, CEO of Stoneweg US. “We are dedicated to integrating sustainability into every facet of our operations, from responsible development to optimizing asset performance. By prioritizing both environmental stewardship and financial returns, we aim to deliver exceptional value to residents and investors alike while shaping a more sustainable future for the communities we serve.”

The 2024 assessment result again shows an extraordinarily strong performance for Stoneweg US on Varia US’ account in terms of Environmental, Social and Governance dimensions:

- With the benchmark score of 87/100 and again a 4-star rating, Varia US achieved its strongest GRESB result so far (2023: 83/100, 2022: 64/100).

- For the second time in a row, Varia US outperformed the peer average (2024: 81/100, 2023: 79/100).

- Guided by Stoneweg US, Varia US has made notable year-on-year progress in key areas, including risk assessment and asset-level data for greenhouse gas emissions, water consumption and waste production and diversion. Improved like-for-like landlord-controlled energy performance by 4.5%, reduced Scope 1 & 2 GHG emissions by 4%, and achieved ENERGY STAR Performance Certification for 60% of the portfolio, significantly outperforming benchmarks and demonstrating the company’s leadership in energy efficiency and sustainability.

- The firm also saw significant scoring improvements in key areas such as risk assessment and asset-level data related to greenhouse gas emissions, water consumption, and waste reduction. In 2023, Stoneweg US, representing Varia US, produced 27 MWh of renewable energy—triple the amount from the previous year—through investments in onsite renewable energy generation. The company continues to prioritize decarbonization and increase asset value through such sustainability initiatives.

Ongoing Commitment to Achieving ESG Targets

In addition to these notable rankings, Stoneweg US has made considerable progress in specific sustainability efforts on behalf of Varia US. The company has steadily increased its portfolio of sustainable building certifications, engaging site staff, asset management, and residents to ensure these certifications deliver value to the assets.

In partnership with Stoneweg US, Varia US has set ambitious portfolio ESG improvement targets including a 20% reduction in energy consumption and water usage (intensity-based) by 2033, and a 50% reduction in greenhouse gas emissions, all using 2023 as the baseline year. Varia US has aligned with the Science Based Target Initiative, aiming for net zero emissions by 2050.

Thomas Stanchak, managing director of sustainability at Stoneweg US, commented, “We are proud to have played a pivotal role in advancing Varia US’ sustainability efforts, reflected in our significant year-over-year GRESB improvements. Our ongoing focus on renewable energy, resource efficiency, and emissions reduction is driving real progress. Stoneweg US remains committed to achieving these goals while creating value for both residents and investors and reinforcing our leadership in sustainable multifamily real estate.”

The 2024 GRESB results underscore Stoneweg US’ continued leadership in sustainable asset management and commitment to long-term responsible investing. For more information on Stoneweg US’ sustainability initiatives and asset management services, and to access the “GRESB Real Estate Benchmark Report 2024” as well as their landmark Annual ESG Report for Varia US, please visit https://www.stoneweg.us/policies-and-reports. Detailed insights about GRESB can be found on www.gresb.com.

About Stoneweg US:

Stoneweg US is a multifamily real estate investment firm located in the heart of downtown St. Petersburg, FL, with a portfolio valuation of approximately $2 billion comprised of ~11,000 units. Focusing on asset optimization through sustainability, climate resilience, and proven value-add strategies, the company invests in and develops sustainable communities to drive healthy returns and enhance the resident experience.

Contact: Tara Kassal

Ascent

917-406-2162

tkassal@brand-ascent.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/stoneweg-us-achieves-87-points-and-4-stars-for-its-varia-us-portfolio-propelling-the-company-to-3rd-place-in-the-2024-gresb-listed-multifamily-rankings-302280484.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/stoneweg-us-achieves-87-points-and-4-stars-for-its-varia-us-portfolio-propelling-the-company-to-3rd-place-in-the-2024-gresb-listed-multifamily-rankings-302280484.html

SOURCE Stoneweg US, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cigna resumes mega merger talks with rival health insurer Humana, Bloomberg News reports

(Reuters) – U.S. health insurer Cigna Group has revived efforts to merge with smaller rival Humana after abandoning the pursuit late last year, Bloomberg News reported on Friday, citing people familiar with the matter.

The companies have held informal, early discussions recently about a potential deal, the report said.

Shares of Humana, which has a market capitalization of about $32 billion, were up about 6% in after-hours trading on Friday, while those of Cigna were down about 5%. Cigna was valued at about $94 billion, according to data compiled by LSEG.

Cigna and Humana declined to comment.

Last year, Reuters reported that Cigna ended its attempt to negotiate an acquisition of Humana after the pair failed to agree on a price and announced a $10 billion worth of shares buyback.

No decision has been made and Cigna or Humana could opt to push any deal past the new year or decide against pursuing one altogether, the Bloomberg report said.

Cigna, which primarily deals with employer-sponsored healthcare plans, is in the process of selling its Medicare Advantage (MA) business that manages government-backed health insurance for people aged 65 and older.

It struck a $3.3 billion deal with insurer Health Care Service Corp earlier this year to sell its MA business.

Humana has lost nearly 40% of its value this year as it faces multiple challenges, including declining enrollments in its top-rated Medicare plans, elevated costs due to higher demand for medical care and lower-than-expected reimbursement rates from the government.

By the time the deal talks ended, sources had told Reuters that there was still a possibility of a tie-up in the future.

A fierce antitrust scrutiny was also looming at the time due to potential consolidation in the U.S. health insurance sector.

(Reporting by Mariam Sunny in Bengaluru; Editing by Alan Barona)

2 No-Brainer Oil Stocks to Buy With $200 Right Now

Oil markets have been very volatile in recent years. In 2020, the price per barrel fell below $25, only to zoom past the $100 market two years later. Today, oil prices are hovering around $70 per barrel. If you’re looking for oil stocks that can thrive in varying conditions, the two companies below are for you.

Trust in superior capital allocation

Capital allocation in the oil space can be difficult because a company’s survival is often prioritized over shareholder profits. For instance, a company might get lucky on a particular reservoir and generate hundreds of millions of dollars in free cash flow over the well’s lifespan. While the best thing to do might be to send this free cash flow back to investors, management often gets involved in empire-building. That is, they acquire all sorts of additional assets that may not have the same return profile as the original well — potentially squandering the original golden goose.

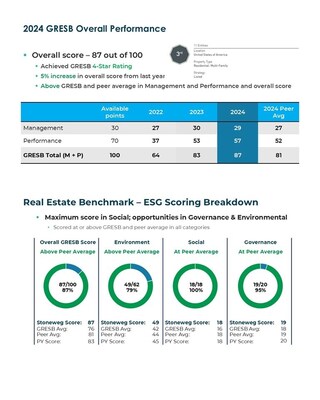

All this is to say that capital allocation is key when it comes to identifying profitable oil stocks. How can we tell how good a company has done at investing shareholder wealth? Return on equity (ROE) gives us an idea of how much a company earns for shareholders, while return on invested capital (ROIC) captures value creation for debt and equity holders. On this front, Chevron (NYSE: CVX) — one of the world’s most recognizable oil brands — comes out looking pretty good, with long-term ROE and ROIC averages in the double digits.

It hasn’t always been a smooth ride. Even Chevron has struggled to maintain its average return profile during recent volatility. But as the past year or two has proven, Chevron has the financial might and long-term vision to bounce back from operational challenges. And it’s not like the stock is overly expensive. Shares trade at just 15 times earnings — roughly half the market average — and sport a free cash flow yield above 6%.

It’s not the flashiest pick, but there’s a reason Chevron shares have attracted the eye of Warren Buffett, who owns around 6.5% of the company. Buffett likes companies that put shareholder interests first. And while it hasn’t always been perfect, Chevron has a multidecade track record of success.

Get more growth with this oil stock

Warren Buffett isn’t only a fan of Chevron’s capital allocation. He also loves Occidental Petroleum‘s (NYSE: OXY) CEO, Vicki Hollub, who he believes is “running the company the right way.” By that, he likely means she’s prioritizing profits over production — which, as mentioned, can be difficult to accomplish when it comes to capital allocation.

Comparing Occidental’s ROE and ROIC metrics against Chevron gives you an instant assessment of how each business is run. Chevron benefits hugely from allocating capital to midstream and downstream segments, including pipelines, refining, and distribution.

These segments insulate Chevron from market swings, as the profits in one division can be used to offset losses in another. For that reason, its returns have been relatively steady. Occidental, meanwhile, has experienced huge fluctuations in ROE and ROIC, given that it’s heavily reliant on its upstream operations. That is, it’s more exposed to fluctuating oil prices than an integrated producer like Chevron.

If Chevron is a reliable bet if you’re unsure of where oil markets are headed next, Occidental makes a great investment if you believe oil prices are set to rise. After leveraging its balance sheet to acquire CrownRock — a shale producer with assets in the Permian Basin — the company is set to make around $260 million in additional cash flow for every $1 increase in oil prices. If oil prices hit 2022 levels, Occidental could generate more than $10 billion in additional cash flow — 20% of its current market cap.

Was the CrownRock acquisition an attempt to chase profits? Or was it a wise strategic decision, alongside the rest of Occidental’s capital allocation plan, that incorporates dividends, share buybacks, and debt repayments? The answer will depend on where oil prices head over the next few years. If you’re bullish, few investment options are superior to Occidental, given its direct leverage to rising prices.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

2 No-Brainer Oil Stocks to Buy With $200 Right Now was originally published by The Motley Fool

An Overview of RBB Bancorp's Earnings

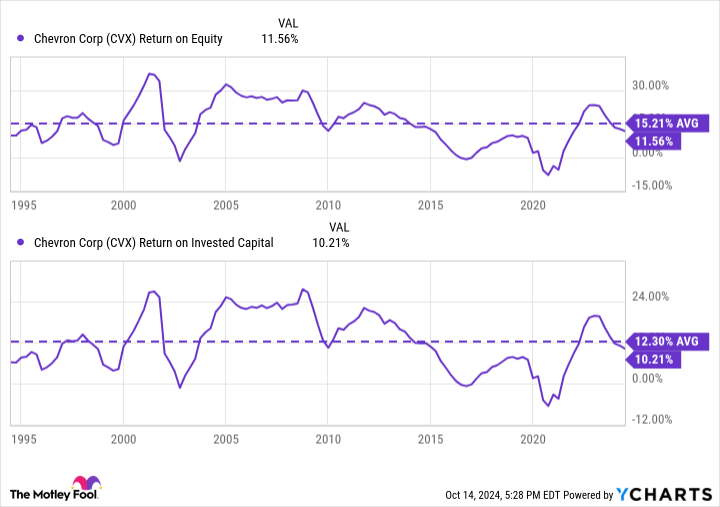

RBB Bancorp RBB is set to give its latest quarterly earnings report on Monday, 2024-10-21. Here’s what investors need to know before the announcement.

Analysts estimate that RBB Bancorp will report an earnings per share (EPS) of $0.38.

The market awaits RBB Bancorp’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

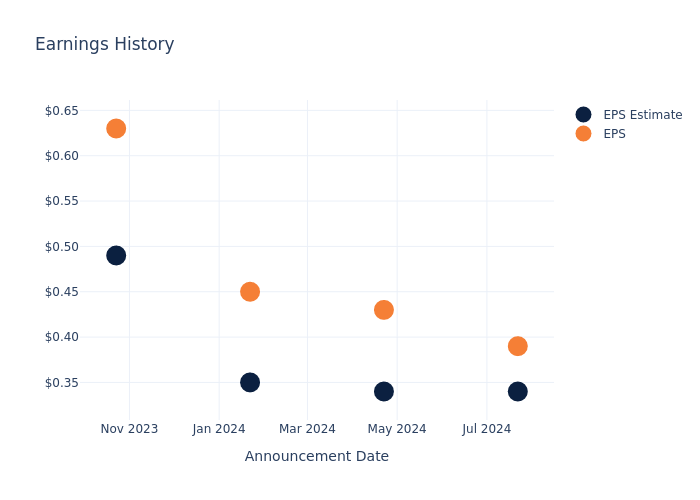

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.05, leading to a 0.04% drop in the share price the following trading session.

Here’s a look at RBB Bancorp’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.34 | 0.34 | 0.35 | 0.49 |

| EPS Actual | 0.39 | 0.43 | 0.45 | 0.63 |

| Price Change % | -0.0% | -0.0% | 2.0% | 4.0% |

To track all earnings releases for RBB Bancorp visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Ken Griffin Sold Most of Citadel's Nvidia Stock and Is Buying This Stock-Split AI Stock Instead

Billionaire Ken Griffin is the founder and CEO of Citadel Advisors, the most profitable hedge fund in history as measured by net gains, according to LCH Investments. That makes Griffin one of Wall Street’s most successful money managers, so investors should consider following his trades with quarterly Forms 13F.

In the second quarter, Griffin sold 9.2 million shares of Nvidia (NASDAQ: NVDA), reducing his exposure by 79%. Meanwhile, he bought 98,752 shares of Super Micro Computer (NASDAQ: SMCI), increasing his position by 96%. Currently, Citadel still has more capital invested in Nvidia than Supermcro, but the trades are noteworthy nevertheless because they may hint at a shift in sentiment.

Here’s what investors should know about each of these companies.

Nvidia

Nvidia is best known for its graphics processing units (GPUs), chips used to accelerate data center workloads like training large language models and running artificial intelligence (AI) applications. “Nvidia sets the pace for AI infrastructure worldwide. Without Nvidia GPUs, modern AI wouldn’t be possible,” according to analysts at Forrester Research.

Indeed, Nvidia has around 90% market share in AI chips, and analysts expect the same level of dominance for at least two or three years. That seems likely for two reasons.

First, developers prefer Nvidia GPUs because they are the fastest accelerators on the market, but also because they are backed by a more robust ecosystem of software development tools than competing products. Second, Nvidia provides adjacent data center hardware, including central processing units (CPUs) and network switches, designed for AI. The company also provides software and cloud services that support AI application development. That means Nvidia can innovate across the entire data center computing stack, which leads to better-performing systems with lower energy requirements, according to CEO Jensen Huang.

Importantly, when Ken Griffin was selling shares in the second quarter, Nvidia stock traded at an average valuation of 67 times earnings, which peaked around 79 times earnings. But Nvidia’s earnings more than doubled in the June quarter, which lowered its valuation multiple. The stock currently trades at 64 times earnings, a slight discount to where it was when Griffin was selling.

Additionally, Wall Street anticipates Nvidia’s earnings will grow at 37% annually over the next three years. That is an upward revision from the average consensus of 34% during the second quarter.

In other words, Nvidia shares are a bit cheaper, and earnings are expected to grow a bit faster versus when Ken Griffin was selling shares. Those changes make the stock more attractive, so Griffin may have added to Citadel’s position in Nvidia since the second quarter ended.

Super Micro Computer

Super Micro Computer manufacturers servers, including complete server racks equipped with storage and networking, to provide a turnkey solution for data center infrastructure. The company’s internal engineering capabilities and modular approach to product design allow it to bring new technologies to market more quickly than its competitors. That advantage has helped Supermicro secure a leadership position in AI servers.

Importantly, while the market will likely become more competitive as Dell Technologies and other equipment manufacturers lean into demand for AI infrastructure, Supermicro’s leadership in direct liquid cooling (DLC) technology may defend its position in AI servers. DLC can reduce data center power consumption by 40% versus traditional air cooling, so the percentage of liquid-cooled installations is expected to soar alongside AI server deployments.

Supermicro reported mixed financial results in the fourth quarter of fiscal 2024 (ended June 30). Revenue rose 143% to $5.3 billion. But gross margin fell nearly 6 percentage points to 11.2%, such that non-GAAP (generally accepted accounting principles) earnings increased only 78%, growing much slower than sales. That may signal waning pricing power amid increased competition, but management said gross margin will return to normal (14% to 17%) by the end of fiscal 2025.

Importantly, Ken Griffin was buying Supermicro stock in the second quarter, but his stance on the company may have changed since short-seller Hindenburg Research accused Supermicro of accounting manipulation in August. CEO Charles Liang said the accusations were “false or inaccurate statements.” But the company delayed filing its Form 10-K for fiscal 2024 and has yet to correct the problem.

For readers with déjà vu, Supermicro was fined $17.5 million in 2020 for infractions similar to those outlined by Hindenburg, including recognizing revenue prematurely and understating expenses. The incidents occurred between 2014 and 2017, and caused the company to file its 10-K for fiscal 2017 nearly two years after it was due, which resulted in the stock being temporarily delisted from the Nasdaq Stock Exchange.

In September, The Wall Street Journal reported that the Justice Department was investigating Supermicro based on allegations made by a former employee. The allegations are similar to those made by Hindenburg, but the probe is in its early stages, and details are scant. Nevertheless, investors should be aware of the risk.

Looking ahead, Statista estimates AI server sales will increase at 30% annually through 2033, and Wall Street anticipates Supermicro’s adjusted earnings will grow 54% over the next 12 months. Those estimates make the current valuation of 22 times adjusted earnings look cheap. However, given the overhanging regulatory issues, I would not be surprised if Ken Griffin has trimmed his position in Supermicro since the second quarter.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Sold Most of Citadel’s Nvidia Stock and Is Buying This Stock-Split AI Stock Instead was originally published by The Motley Fool