Smart Money Is Betting Big In Citigroup Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Citigroup.

Looking at options history for Citigroup C we detected 41 trades.

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 51% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $1,005,393 and 36, calls, for a total amount of $2,928,597.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $42.5 to $75.0 for Citigroup during the past quarter.

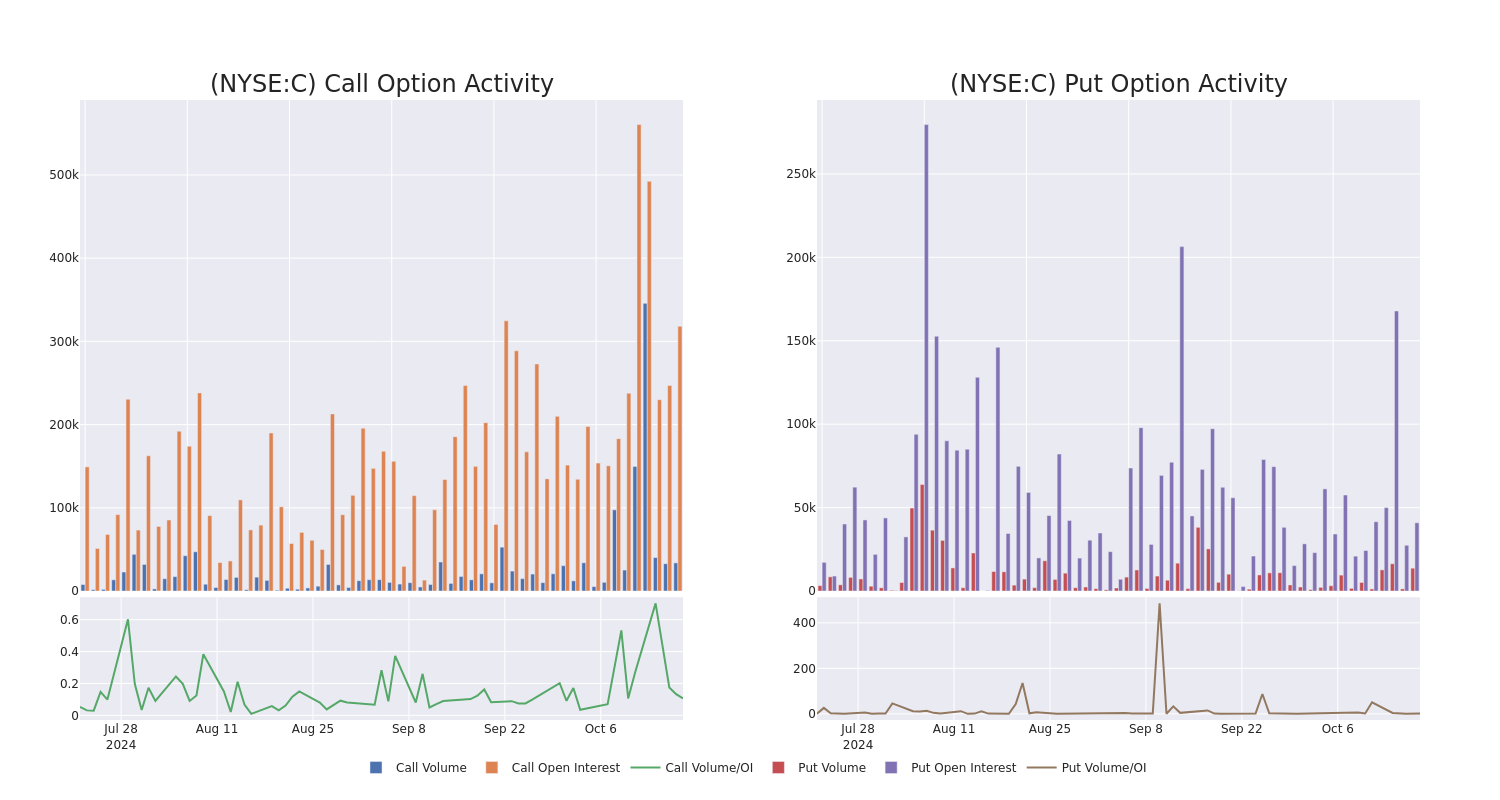

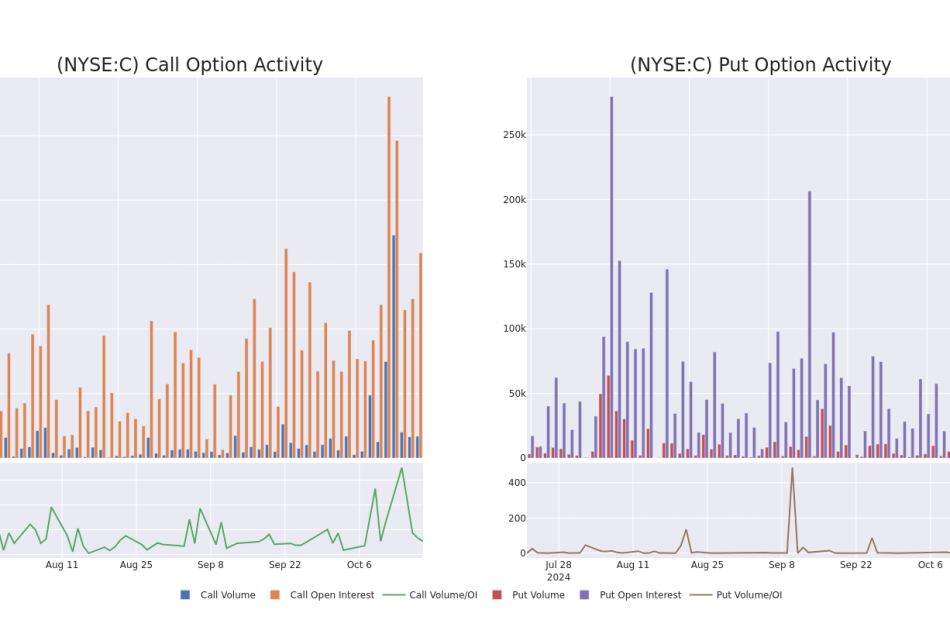

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Citigroup options trades today is 14959.83 with a total volume of 47,452.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Citigroup’s big money trades within a strike price range of $42.5 to $75.0 over the last 30 days.

Citigroup Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | PUT | TRADE | NEUTRAL | 06/20/25 | $5.0 | $4.9 | $4.95 | $62.50 | $814.7K | 14.6K | 3.2K |

| C | CALL | SWEEP | BEARISH | 01/17/25 | $13.55 | $13.5 | $13.5 | $50.00 | $472.5K | 39.1K | 352 |

| C | CALL | SWEEP | BULLISH | 01/17/25 | $13.3 | $13.25 | $13.25 | $50.00 | $198.7K | 39.1K | 761 |

| C | CALL | SWEEP | BULLISH | 01/17/25 | $13.3 | $13.25 | $13.25 | $50.00 | $198.7K | 39.1K | 611 |

| C | CALL | SWEEP | BULLISH | 01/17/25 | $15.8 | $15.7 | $15.8 | $47.50 | $145.3K | 23.9K | 2.1K |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup’s operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank’s primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

In light of the recent options history for Citigroup, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Citigroup Standing Right Now?

- Trading volume stands at 13,599,539, with C’s price down by -1.75%, positioned at $62.85.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 89 days.

What Analysts Are Saying About Citigroup

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $82.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Citigroup, targeting a price of $64.

* An analyst from B of A Securities persists with their Buy rating on Citigroup, maintaining a target price of $78.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Citigroup with a target price of $86.

* An analyst from Oppenheimer persists with their Outperform rating on Citigroup, maintaining a target price of $92.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Citigroup with a target price of $91.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Citigroup, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply