This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here's Why I Couldn't Be More Optimistic

Autozone and O’Reilly are the two giants in the car-parts retail space. These two companies have market capitalizations of $53 billion and $71 billion, respectively. By comparison, Advance Auto Parts (NYSE: AAP) is tiny with its market cap of just $2.4 billion. But this value disparity is somewhat surprising.

Advance has almost 4,800 locations, while Autozone has nearly 7,400 and O’Reilly has around 6,200. So the latter two are bigger, but not by the margin that the market valuations would suggest.

For its part, Advance has problems that can’t be sugarcoated. But it’s working to fix them. And it’s about to get a $1.2 billion payday to help fund its turnaround, which is an unbelievable amount for a company with such a low valuation.

How is Advance getting a big payday?

On top of its namesake retail chain, Advance also owns other businesses, namely Carquest and Worldpac. Last year, the company hired CEO Shane O’Kelly, who’s trying to restructure the business. This restructuring includes selling the Worldpac business.

In August, Advance reached a deal to sell Worldpac for $1.5 billion. Taking transaction expenses into account, the company will net about $1.2 billion — half of its current market cap. The deal is expected to close in the fourth quarter.

Advance says that Worldpac has generated $2.1 billion in trailing-12-month revenue and has earned $100 million in earnings before interest, taxes, depreciation, and amortization (EBITDA). This means that Advance sold it for 0.7 times its sales and 15 times its EBITDA.

That’s more than a fair sales price. For perspective, Advance stock trades at 0.2 times sales and at about 7 times EBITDA. So the sales price for Worldpac represents a significant premium to where Advance stock itself trades today.

How Advance’s windfall can help

O’Kelly says that selling Worldpac gives Advance more “financial flexibility” as it navigates the changes it needs to make. And to be sure, the changes are going to be substantial.

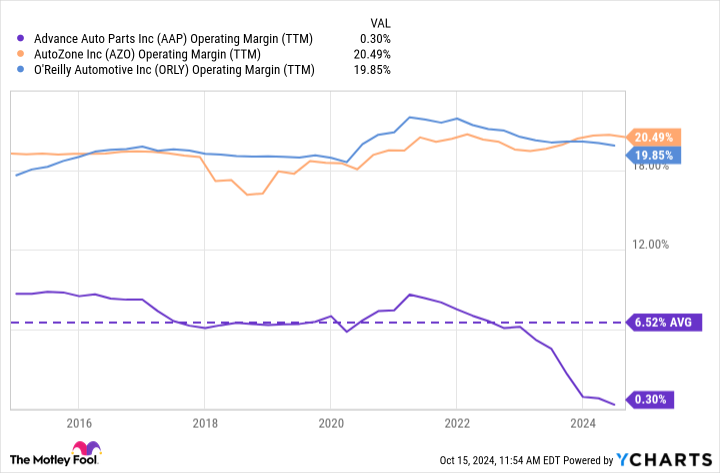

They need to be, considering how poorly Advance has performed relative to its peers. Take one metric: the operating-profit margin. For the past decade, both Autozone and O’Reilly have had operating margins mostly between 18% and 20%. By comparison, Advance has averaged an operating margin of about 6%, and it’s fallen even lower than that lately.

Advance hired O’Kelly to fix this profitability problem. The new CEO is a supply chain expert and quickly realized that Advance is struggling with profitability because of its inefficient supply chain infrastructure.

A multiyear supply chain transformation is already underway for Advance, and I’m optimistic that this will completely transform returns for shareholders.

Consider that if Advance can squeeze a 10% margin from its business — still half of what its peers have — it can generate close to $1 billion in annual profits. After all, even after selling Worldpac, Advance still generates over $9 billion in annual sales. And if the stock is valued at 10 times its operating profit, then shares could quadruple in value in this scenario.

Therefore, restructuring the supply chain is crucial for Advance and its shareholders. But it’s costly, and the company’s balance sheet isn’t the greatest. It has almost $1.8 billion in long-term debt and less than $500 million in cash and equivalents. To be clear, it’s not in danger of running out of liquidity anytime soon. But this is an unattractive net-debt position nonetheless.

Selling Worldpac will even out Advance’s balance sheet and give it just a little more breathing room. And this breathing room will allow management to make the business decisions that will set it up best for long-term success.

This is why I couldn’t be more optimistic about Advance stock now that it’s selling Worldpac. And if the turnaround is successful, the stock is trading at quite the bargain valuation today.

Should you invest $1,000 in Advance Auto Parts right now?

Before you buy stock in Advance Auto Parts, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advance Auto Parts wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jon Quast has positions in Advance Auto Parts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here’s Why I Couldn’t Be More Optimistic was originally published by The Motley Fool

Leave a Reply