2 Game-Changing Artificial Intelligence (AI) Stocks to Buy Right Now (Hint: Not Nvidia)

Artificial intelligence (AI) has been around for decades. From industrial automation and unbeatable chess engines to self-driving cars and automatic vacuum cleaners, AI-assisted technologies are becoming a normal part of our everyday lives.

But the adoption and general awareness of AI accelerated dramatically in November 2022, when OpenAI released the ChatGPT AI platform. This ultramodern large language model (LLM) could do things previously seen as uniquely human. ChatGPT and its rivals can write halfway decent text, generate nearly photorealistic images and videos, and even create new music from a primordial soup of earlier examples. Large sets of human creations have become fodder for computer-powered, semi-creative productions.

A handful of companies are driving this generative AI boom, led by AI accelerator designer Nvidia (NASDAQ: NVDA). That stock has soared more than 1,000% higher in two years, powered by a 237% uptick in revenues and a ninefold boost to Nvidia’s free cash flows. The LLMs you see today wouldn’t be possible without Nvidia’s high-performance AI accelerator chips, and the company is often seen as the best AI stock on the market today.

But even stellar business performers can become overvalued. Nvidia’s stock trades at extremely lofty valuation ratios nowadays, and many die-hard bulls are ignoring the rise of alternative AI hardware solutions.

So I have a few Nvidia shares in my portfolio, but am not eager to buy more today. There are safer AI investments out there, and I’m here to show you a couple of great AI stocks not named Nvidia.

|

Stock |

Two-Year Return |

Price-to-Sales Ratio (P/S) |

Price-to-Free Cash Flow Ratio (P/FCF) |

|---|---|---|---|

|

Nvidia |

1,050% |

58.4 |

72.4 |

|

IBM |

92% |

3.4 |

16.9 |

|

UiPath |

5% |

5.1 |

21.6 |

Data collected from Finviz.com and YCharts on 10/18/2024.

IBM’s strategic focus on enterprise-class AI

Yeah, you heard me: International Business Machines (NYSE: IBM) is one of the best AI stocks to buy right now.

Big Blue has been an AI innovator since the 1970s, introducing game-changing technologies such as the first speech recognition system and the first programming language for self-learning manufacturing robots. And IBM’s AI interest never faded. The company remains a leading AI researcher today, even though you don’t often see its name in generative AI headlines.

You see, IBM lets other companies mess around with consumer-friendly chatbots and image generation systems. Meanwhile, the company focuses its AI products on deep-pocketed enterprise clients. The IBM Watsonx generative AI platform delivers business-oriented features such as deep integration with other business-grade information systems, audit-ready paths from input data to generated content, and robust digital security.

So IBM took some extra time to prepare these AI tools for release, insisting on quality results instead of rushing a half-baked solution to the market. Now it’s time to reap the rewards of that strategic delay.

Watsonx has been around for a year and a half now, and has already generated more than $2 billion of generative AI orders. Next week’s third-quarter report will show how quickly corporate clients are embracing IBM’s AI solutions in a healthier economy. And as seen in the table, the stock looks downright cheap next to Nvidia’s high-flying shares.

UiPath’s AI-powered automation solutions

Process automation expert UiPath (NYSE: PATH) is another low-priced bet on a solid AI business. The company’s robotic process automation (RPA) may sound like an industrial hardware controller, but is actually software that helps businesses automate repetitive tasks.

Automated software has many benefits over their human counterparts in this area. Computers don’t get bored or tired. Their actions can’t result in “human error,” and UiPath’s sophisticated software robots don’t suffer from machine learning equivalents such as sloppy programming. With the recent addition of LLM functions, UiPath’s robots can even manage advanced but repetitive tasks like filling out forms and interpreting the meaning of text entered by end users.

“RPA is not AI; AI is not RPA,” according to UiPath. But the combination of robust RPA systems and powerful AI backends bring out the best of both worlds in a single job-automation process. UiPath’s tools are already game changers for clients with lots of rote information management activities. They will only grow more powerful over time.

UiPath’s shares have barely moved in two years, falling far behind other AI specialists and the S&P 500 (SNPINDEX: ^GSPC) market index. At the same time, trailing sales rose by 32% over the last two years, while free cash flows swung from a $134 million loss to $327 million of cash profits.

The stock is swooning while financial results are soaring, and UiPath’s AI-plus-RPA solutions are only getting more powerful. That’s why this game changer looks like a no-brainer buy today.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Anders Bylund has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends Nvidia and UiPath. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

2 Game-Changing Artificial Intelligence (AI) Stocks to Buy Right Now (Hint: Not Nvidia) was originally published by The Motley Fool

Trump Turns Up To Serve Fries At McDonald's: 'I Could Do This All Day, I Wouldn't Mind This Job"

Former President Donald Trump was seen serving customers at a McDonald’s Corp. MCD drive-thru in Pennsylvania on Sunday, while continuing to ridicule Vice President Kamala Harris’s past work experience at the fast-food chain.

What Happened: Trump swapped his suit jacket for an apron at a McDonald’s outlet in Bucks County, operating the fry cooker and serving an order to a drive-thru customer. He said he was running against somebody who said she worked at McDonald’s.

Former White House press assistant Margo Martin shared some videos of the ex-presidents at the McDonald’s location via X.

“I’m having a lot of fun here everybody,” said Trump while serving to one set of customers. “I could do this all day,” said Trump. “I wouldn’t mind this job.”

A customer told Trump, “Mr. President, please don’t let the United States become Brazil, my native Brazil.” He responded by saying, “We’ll keep it good. We gonna make it better than ever, okay?”

Why It Matters: The Democrats have previously used Harris and her husband Doug Emhoff’s past work experience at McDonald’s to connect with working-class voters. Trump’s recent stint at McDonald’s could be seen as an attempt to win over these voters, especially considering Pennsylvania’s importance as a swing state in the upcoming elections.

Recent polls have shown a shift in favor of Trump, with the former president surpassing Harris in the latest election poll for the current cycle.

Image via Shutterstock

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MEI DEADLINE ALERT: RLF, LEADING INVESTOR COUNSEL, Encourages Methode Electronics, Inc. Investors With Losses in Excess of $100K to Secure Counsel Before Important Deadline in Securities Class Action – MEI

NEW YORK, Oct. 20, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of common stock of Methode Electronics, Inc. MEI between June 23, 2022 and March 6, 2024, both dates inclusive (the “Class Period”), of the important October 25, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Methode common stock during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Methode class action, go to https://rosenlegal.com/submit-form/?case_id=21318 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 25, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) Methode had lost highly skilled and experienced employees during the COVID-19 pandemic necessary to successfully complete Methode’s transition from its historic low mix, high volume production model to a high mix, low production model at its Monterrey, Mexico facility; (2) Methode’s attempts to replace its General Motors (“GM”) center console production with more diversified, specialized products for a wider array of vehicle manufacturers and Original Equipment Manufacturers (“OEMs”), in particular in the electric vehicle (“EV”) space, had been plagued by production planning deficiencies, inventory shortages, vendor and supplier problems, and, ultimately, botched execution of Methode’s strategic plans; (3) Methode’s manufacturing systems at its critical Monterrey facility suffered from a variety of logistical defects, such as improper system coding, shipping errors, erroneous delivery times, deficient quality control systems, and failures to timely and efficiently procure necessary raw materials; (4) Methode had fallen substantially behind on the launch of new EV programs out of its Monterrey facility, preventing Methode from timely receiving revenue from new EV program awards; and (5) as a result of the foregoing, Methode was not on track to achieve the 2023 diluted earnings per share (“EPS”) guidance or the 3-year 6% organic sales compound annual growth rate (“CAGR”) represented to investors and such estimates lacked a reasonable factual basis. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Methode class action, go to https://rosenlegal.com/submit-form/?case_id=21318 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Stanley Druckenmiller Sold Out of Nvidia. He's Buying This AI Stock Instead.

Stanley Druckenmiller is one of the greatest investors of all time. As the manager of Duquesne Capital Management from 1981 to 2010, Druckenmiller generated an average annual return of 30% and never had a losing year during that time. These days, Druckenmiller is no longer an active fund manager but still manages a portfolio of his own stocks through the Duquesne Family Office. And investors pay close attention to his moves.

That’s why investors took notice when Druckenmiller, who was early to buy shares of Nvidia (NASDAQ: NVDA) in Q4 2022 after ChatGPT launched, dumped most of his stake in the AI chip leader in the first half of this year. At the time, he said that the market now sees in Nvidia what he recognized earlier. In an interview last week with Bloomberg, the Duquesne chief revealed that he had sold his entire stake in Nvidia.

Druckmiller admitted that it was a mistake to sell the chip stock, as Nvidia’s stock price has continued to run up since then. He also said he remained bullish on artificial intelligence (AI), adding, “We’re big long-term believers in AI, and there are still many ways we’re playing AI, particularly the infrastructure that’s been built to support the power needed.”

The AI stock Druckenmiller has been buying

While Druckenmiller has sold all 9.5 million shares of Nvidia he once owned, he’s been accumulating shares of another under-the-radar AI stock. That’s Vistra (NYSE: VST), and it was Duquesne’s third-biggest holding by market value as of the end of the second quarter at $225.7 million.

Druckenmiller first bought the stock in the third quarter of 2023, the same quarter he started to unload his Nvidia stake. Since the end of that quarter, the stock is up 309%, and it’s now the best-performing stock on the S&P 500 this year, having recently passed Nvidia for the title after a recent surge. Year to date, Vistra is up 252%.

Should you follow Druckenmiller into Vistra? Let’s take a look at what this unique AI play has to offer.

What is Vistra?

As Druckenmiller alluded to in the quote above about AI infrastructure, energy is going to play a major role in AI as it takes incredible amounts of power to run AI data centers. That’s where Vistra comes in. The Texas-based company is now the largest competitive (meaning deregulated) power generator in the country, with 41,000 megawatts (MW) of installed generation capacity.

It’s also one of the biggest producers of nuclear energy in the country at 6,400 MW capacity. Following its acquisition of Energy Harbor earlier this year, it now has the second-largest energy storage capacity in the country at 1,020 MW.

The reason why investors increasingly see Vistra as a play on the AI boom is because power demand from data centers is expected to roughly triple from 2023 to 2030, adding 35 gigawatts of power demand in that time. Vistra also sees a number of other growth drivers, including the reshoring of industrial activity, construction of new semiconductor foundries due to the CHIPS Act, and increased electrification needs, including in the Permian Basin where it expects demand to jump by 20 gigawatts by 2030.

That growth explains why investors believe utility stocks like Vistra offer an appealing way to get exposure to the growth of AI.

Is Vistra a buy?

Vistra is a utility company, so it’s still subject to most of the constraints of a utility. However, it has one advantage over other utilities: It operates in unregulated power markets, supplying power at market price, rather than at a price determined by regulators. That’s the way most utilities operate because they’re regulated monopolies.

That gives the business significant upside potential if a supply crunch ensues from the growth of AI and data centers.

Despite that growth opportunity, at this point, Vistra is actually more expensive than Nvidia, trading at a price-to-earnings ratio of 100, though analysts expect profits to ramp up through 2025. Energy prices are notoriously difficult to predict, however.

Announcements this week from Alphabet and Amazon have helped drive nuclear stocks higher. They show that big tech companies are working to secure adequate sources of clean power for their data center needs.

Vistra could fit in an AI portfolio. However, after the recent run-up, I think it makes more sense to wait for a better price to buy the stock.

Druckenmiller seems to agree with that statement. After buying the stock three quarters in a row, he took a break in the second quarter, perhaps thinking that the price had already run up substantially.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool has a disclosure policy.

Billionaire Stanley Druckenmiller Sold Out of Nvidia. He’s Buying This AI Stock Instead. was originally published by The Motley Fool

Energy Transfer Takes a Preliminary Step Toward Adding a Lot More Fuel to Its Growth Engine

Energy Transfer (NYSE: ET) has stomped on the growth accelerator this year. The midstream giant’s distributable cash flow surged 32% in the second quarter. Acquisitions were the main fuel source, as it closed a couple of needle-moving deals in the past year. It also completed several more expansion projects

The master limited partnership (MLP) is getting closer to locking down another major growth driver. It recently signed a preliminary deal to build its proposed Lake Charles liquified natural gas (LNG) plant. The company could get a big boost from building that facility.

Another step closer to finally coming to fruition

Energy Transfer signed a preliminary contract with a consortium to build its proposed Lake Charles LNG project. The agreement is subject to the MLP making a final investment decision (FID) on the project. It’s currently working to secure regulatory approval and additional partners for the project.

The midstream giant has been working on the project on and off for nearly a decade. It has experienced several setbacks along the way, including challenging market conditions and the loss of its joint venture partner, Shell. The most recent speed bump was a denial by the Department of Energy of its request for a second extension to export LNG to countries that don’t have a free trade agreement with the U.S.

Energy Transfer has been steadily working to overcome its obstacles. It has signed several commercial agreements with LNG buyers, including Shell, for most of the project’s proposed 16.5 million tons of annual export capacity. It’s also working to bring in new joint venture partners to help fund the facility’s construction and has reapplied for an export permit.

A potential needle-moving project

Energy Transfer still has a lot of work to do before it can make an FID on Lake Charles LNG. However, it would significantly enhance its future growth profile if it can finally push that project over the finish line.

The project would provide two notable benefits for the MLP. First, it would earn stable cash flow from its retained interest in the export facility. The company has been looking for financial and strategic partners willing to fund up to 80% of the equity in the project, which would leave the company with a 20% interest. Given the size of the facility, that minority stake would still produce a meaningful amount of stable annual cash flow.

In addition, the project will have a major impact on its natural gas pipeline operations. The facility will use a significant amount of feed gas, which Energy Transfer will transport to the liquefaction plant via its extensive pipeline system. Energy Transfer noted in a regulatory filing that, “Upon completion of the LNG project, we expect to realize significant incremental cash flows from transportation of natural gas on our Trunkline pipeline system, and other Energy Transfer pipelines upstream from Lake Charles.”

While it will be many years before the company sees a return on its investment, given the long construction timeline, it will provide the MLP with more visibility into its future cash flows by enhancing and extending its growth outlook. Energy Transfer currently has projects on track to enter service through 2026. In addition, it has several other large projects under development, which could significantly enhance and extend its growth outlook. Securing Lake Charles LNG and other expansion projects would give the MLP more fuel to increase its distribution in the future.

Getting closer to finally making an FID

Energy Transfer has been working to move forward with a project to convert its Lake Charles facility from imports to exports for nearly 10 years. It’s taking another notable step toward finally breaking ground on that project by signing a preliminary agreement with a consortium of construction contractors. While it has a few more things to do before it can push the project over the finish line, it’s getting really close. Finally moving forward with the project will remove a lot of overhang while significantly enhancing the company’s long-term growth outlook. Because of that, it remains an important project for investors to monitor.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Matt DiLallo has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Energy Transfer Takes a Preliminary Step Toward Adding a Lot More Fuel to Its Growth Engine was originally published by The Motley Fool

Here's the 1 Stock We Know for Certain Warren Buffett and Berkshire Hathaway Are Buying

Warren Buffett hasn’t seen a lot to like in the stock market lately.

The Oracle of Omaha has sold more stocks than he bought in each of the last seven quarters reported by Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B). That includes a massive sale of around $75 billion worth of Apple stock in the second quarter and over $10 billion in Bank of America shares over the last three months. That pattern makes it likely the third quarter was the eighth straight quarter of net sales for Buffett and his team of portfolio managers.

But Buffett (or one of his fellow managers) is buying at least one stock for Berkshire Hathaway shareholders based on required filings with the SEC.

Buffett’s typical buying behavior has changed

Over the last few years, Buffett had some predictable stock purchases, but even those might not be so reliable in today’s market.

Despite reducing or selling out his exposure to equities in Berkshire’s portfolio, Buffett could be counted on to repurchase shares of Berkshire Hathaway over the last six years. But share buybacks may be less appealing at Berkshire’s current price, which has climbed 30% year to date.

Buffett didn’t buy back a single share in June, and the stock has consistently traded higher in the third quarter. That could lead to the first quarter where Buffett didn’t buy back a single share since the board of directors changed the repurchase authorization in mid-2018. Investors will have to wait until Berkshire’s Q3 earnings report in early November to know for certain.

Buffett has also given the cold shoulder to another stock he’s consistently bought over the last few years. Any time Occidental Petroleum saw its share price dip below $60 per share, investors could reasonably expect a filing showing Berkshire Hathaway had purchased more of its common stock. Despite plunging oil prices in Q3 leading to a two-year low stock price for Occidental, those SEC filings never materialized.

It could be that Buffett is content with a 27.3% stake in the company at this point. He mentioned that he has no interest in taking a controlling stake of Occidental, and he praised CEO Vicki Hollub on multiple occasions, indicating he believes his investment is in good hands.

Just one SEC filing since the end of June showed that Berkshire added to an existing position. In October, Berkshire Hathaway bought $87 million worth of Sirius XM (NASDAQ: SIRI) shares.

Berkshire now owns a huge portion of this company

Berkshire Hathaway had previously owned shares of Sirius XM, but it started acquiring its stake in the company in earnest late last year. The vast majority of the stake was acquired through a position in the Liberty SiriusXM tracking stock, which aimed to track Liberty Media’s stake in the satellite radio operator. The two stocks merged earlier this year, leaving Berkshire Hathaway with over 30% of the total outstanding shares.

Sirius XM is the only satellite radio operator in the United States. Unlike terrestrial radio, Sirius XM makes the bulk of its revenue from subscriptions instead of advertising. Its method for attracting new subscribers primarily relies on free trials with new car purchases. Over the years, it’s managed to attract about 33 million paid subscribers, and it counted 7.4 million free-trial listeners as of the end of the second quarter.

Its free-trial strategy and focus on exclusive content takes care of much of the marketing Sirius XM needs, which helps it keep operating expenses low. On top of that, Sirius XM benefits from lower music royalty rates than on-demand streaming services, paying just 15.5% of gross revenue for music licenses. On-demand streaming pays about twice as much.

As a result, Sirius XM produces steadily rising operating profits as its subscriber base grows. While its subscriber base has stagnated recently, the company remains nicely profitable.

There’s no indication that Sirius XM is facing a mass exodus of subscribers, but the stock appears to be trading as such. Shares are currently priced at just over 8 times analysts’ estimates for 2025 earnings. Its enterprise value is just 6.8 times management’s forecast for 2024 EBITDA.

With shares trading at such a low valuation and Sirius XM’s simple-to-understand business model, it’s a prototypical Warren Buffett investment.

A warning from Buffett

As of this writing, Sirius XM is the only stock we know for certain that Buffett and his team bought in recent months. That speaks to a broader warning from Buffett about the current stock market.

Sirius XM is a relatively small company with a market cap just over $9 billion. That won’t really move the needle for Berkshire Hathaway (and its nearly $1 trillion market cap), even if it acquires the entire company.

But Buffett hasn’t found much else to put Berkshire’s cash toward. The bigger companies that could move the needle likely aren’t attractive right now (in Buffett’s eyes) from a valuation standpoint, which explains why he’s been a net seller of stocks.

But for everyday investors, i.e. 99.99% of the world, there are a ton of opportunities. Sirius XM may be just one of many small- and mid-cap stocks investors should look to add to their portfolios in the current market.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Here’s the 1 Stock We Know for Certain Warren Buffett and Berkshire Hathaway Are Buying was originally published by The Motley Fool

Bank of America Predicts up to ~390% Surge for These 2 ‘Strong Buy’ Stocks

We’re well into Q4, and investors are positioning their portfolios for the coming year. As always, the key is identifying stocks poised to deliver solid returns, and Bank of America has highlighted strong choices for those seeking high-growth opportunities.

BofA’s analysts aren’t limiting their focus to just one part of the market; they are looking across sectors at a diverse group of stocks – and they are looking ‘under the hood’ to find shares that are ready to jump.

With that in mind, we turned to the TipRanks database to review two of Bank of America’s latest stock picks, both of which present strong upside — including one with a potential gain of nearly 390%.

In fact, the banking giant isn’t the only one backing these names; both stocks are rated as ‘Strong Buys’ by the broader analyst consensus. Let’s take a closer look and find out what the optimism is all about.

Werewolf Therapeutics (HOWL)

We’ll begin in the world of biotherapeutics, where Werewolf Therapeutics is developing new immunotherapy drugs specifically designed to reduce the common and severe side effects often associated with cancer treatment. The company has created a proprietary development platform, known as PREDATOR, to engineer conditionally activated molecules that stimulate both the adaptive and innate functions of the immune system. With this approach, Werewolf has successfully advanced two drug candidates into clinical trials.

Both products are INDUKINE molecules, a proprietary development, and are designed to selectively activate in tumor tissues while remaining inactive in peripheral tissues, a feature intended to reduce the occurrence of unwanted off-target effects while maximizing the anti-tumor immune response. Werewolf’s goal is to create anti-cancer drugs with higher tolerability levels than existing treatments.

Werewolf’s lead drug candidate, WTX-124, is being developed to treat solid tumors and is under investigation as both a monotherapy and in combination with Keytruda. The company is enrolling patients in a Phase 1 open-label, multicenter study – a first-in-human trial of the drug. At the ASCO Annual Meeting in June 2024, the company shared new interim results from the monotherapy dose-escalation arm, along with early data from the combination arm. The latest data highlighted WTX-124’s clinical activity and its overall tolerability in patients. Dose escalation in the combination study section is ongoing, with updated data expected by year-end.

The company’s second candidate, WTX-330, is focused on treating advanced or metastatic solid tumors as a monotherapy. Early data from its Phase 1 trial, also presented at ASCO, showed promising outcomes in patients with advanced solid tumors or Non-Hodgkin Lymphoma. Werewolf plans to release further updates later in this quarter.

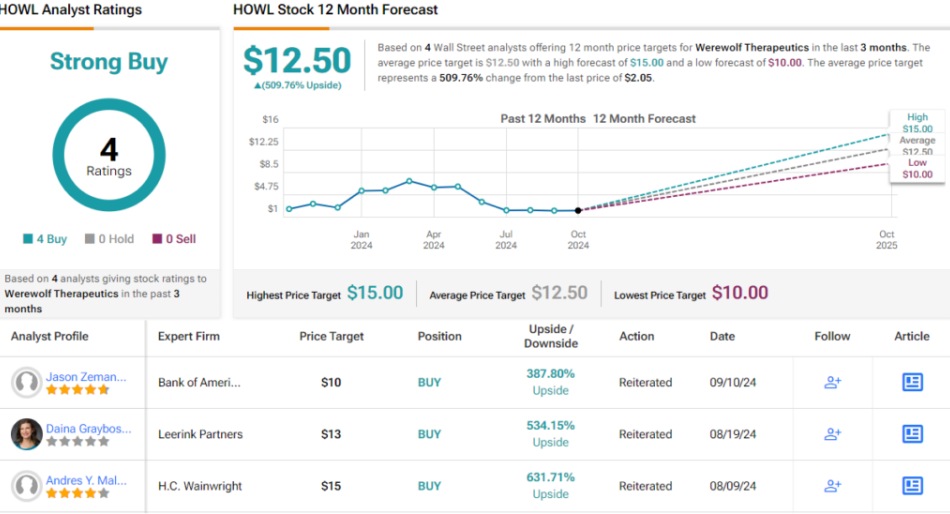

Despite a 47% drop in the stock price this year, could this present a prime buying opportunity? Bank of America’s 5-star analyst, Jason Zemansky, certainly thinks so.

“Despite an arguably positive conference, Werewolf Therapeutics shares have been pressured since ASCO. In our view, this has had less to do with concerns about the WTX-124 data, which arguably added support to an encouraging, albeit early, clinical profile. Rather, we believe the pullback has been driven more by competitive fears related to ‘124’s magnitude and duration of responses. We recognize the concerns but feel they are overdone; beyond the caveats of comparing (especially) early-stage efficacy data, we think investors are overlooking the more critical safety updates that not only set Werewolf’s IL-2 asset apart but which also further validate its platform – the main value driver of the story, in our view,” the analyst opined.

Looking ahead, Zemansky sees strong potential for investors, stating, “Ahead of a catalyst rich 12mos – several capable of driving a re-rating – we see compelling near-term upside potential and opportunity on weakness.”

Taken together, these comments back up Zemansky’s Buy rating on HOWL, while his $10 price target points toward an impressive ~390% upside potential for the next 12 months. (To watch Zemansky’s track record, click here)

Overall, there are 4 recent analyst reviews on record for Werewolf, all of which are positive, resulting in a unanimous Strong Buy consensus rating. The shares are priced at $2.05, with an average price target of $12.50, even higher than Bank of America’s call, suggesting a potential ~510% gain over the next 12 months. (See HOWL stock forecast)

Ibotta, Inc. (IBTA)

From biotech we’ll move over to consumer tech with a look at Ibotta, a shopping rewards company. Based in Denver, Colorado, Ibotta provides and manages a direct-to-consumer app that allows shoppers to claim cash-back rewards on a wide variety of online and in-person purchases. The app makes it easy for users to claim rewards virtually anywhere. A long list of retailers, primarily grocers, participate, including major names such as Publix, Dollar General, Costco, Jewel-Osco, Kroger, Meijer, Walmart, and Whole Foods. Beyond the grocery sector, chains like Home Depot, Lowes, and Kohl’s also participate, as does Amazon.

Ibotta was founded in 2011, and earlier this year, after 13 years in business, the company entered the public markets through an IPO. The public offering saw 6.56 million shares go on the market by both the company and several private shareholders, with an initial price of $88 per share. This price was well above the estimated IPO range of $76 to $84. In total, the event raised $577 million. Ibotta directly sold 2.5 million shares, realizing proceeds of $220 million.

Since going public, Ibotta’s stock has dipped by nearly 32%. In response, the company initiated a $100 million share repurchase program in August to help support the share price.

On the financial side, Ibotta has released two sets of earnings results since the IPO. The most recent, released in August and covering 2Q24, showed a top line of $87.9 million, up ~14% year-over-year and beating the forecast by $2.15 million. At the bottom line, the company’s non-GAAP EPS of 68 cents per share was 5 cents per share below expectations.

In his coverage of this stock for Bank of America, analyst Curtis Nagle sees this stock as a potential growth opportunity for investors. He discusses the company’s wide-ranging footprint in its niche, noting: “As CPG brands focus on ways to efficiently deliver value to consumers and increase vols, we see Ibotta as a prime beneficiary. Ibotta works with ~2,400 brands and is the only digital promotions co. that offers full bottom of the funnel attribution (ties purchase to person, place, time, etc.) and is paid only when a promotion leads to a purchase. We see Ibotta as a highly attractive alternative to other forms of marketing and promotions where ROAS is much more difficult to measure.”

Nagle goes on to rate IBTA as a Buy, and complements that with a $110 price target suggesting a ~64% share appreciation on the one-year horizon. (To watch Nagle’s track record, click here)

All in all, this newly public stock has earned its Strong Buy analyst consensus rating by picking up 6 positive reviews from the Street. The stock is priced at $67.19 and its $101.17 average target price implies a one-year upside potential of ~51%. (See IBTA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Cigna revives merger talks with Humana, Bloomberg reports

Cigna (CI) has refreshed efforts to combine with Humana (HUM) after merger discussions fell apart late last year, Bloomberg’s Michelle Davis and John Tozzi report, citing people familiar with the matter. The companies have held informal talks lately about a possible deal, though such discussions are in early stages, the authors note. Shares of Humana are up about 4% in after-hours trading, while Cigna shares are 1.2% lower.

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

See Insiders’ Hot Stocks on TipRanks >>

Read More on CI:

We heard from 1,000 older Americans: Here are some of their biggest regrets

-

More than 1,000 older Americans shared their biggest regrets in life with Business Insider.

-

These included not saving enough for retirement and taking Social Security benefits too early.

-

Most older Americans are unable to absorb a financial shock, while millions can’t afford daily needs.

Over 1,000 Americans between the ages of 48 and 90 told Business Insider their biggest regrets in life. Those insights show how perplexing retirement and planning for it can be.

Responses to an opt-in Business Insider reader survey, along with interviews with 20 respondents, show that preparing for retirement while juggling life’s many obstacles is often a trial-and-error process. Many said they couldn’t crack the code on balancing how much to save, where to invest, when to retire, and how to be fiscally responsible when raising a family. Others said they took Social Security too early or didn’t pursue career opportunities that may have led to higher pay.

Janis Carroll, 79, said she was in the middle class for much of her life and made decent wages, but she is now struggling to live comfortably on about $25,000 in Social Security each year and $35,000 in savings.

Though she retired over a decade ago with enough to get by, she said not being more savvy with investing, moving too frequently, and draining an IRA account to buy a home she lost $50,000 on have contributed to her fears about the future. She’s considered returning to work, but she’s worried it would be too physically and mentally taxing.

“I don’t have the money to go to the movies or go anywhere,” said Carroll, who lives in Eugene, Oregon. “I have no idea what’s going to happen to me if I’m going to have an emergency.”

The median 55-year-old has less than $50,000 in retirement savings, according to a Prudential survey — which was conducted by Brunswick Group between April and May and interviewed 905 Americans ages 55, 65, and 75. According to the National Council on Aging and the LeadingAge LTSS Center, which analyzed the data of 11,874 households from the Health and Retirement Study, nearly 50% of Americans 60 or older say they have household incomes below what’s necessary for meeting their basic needs.

To be sure, three in four retired Americans say they have enough money to live comfortably compared to less than half of non-retirees, according to a Gallup poll conducted in April which surveyed 1,001 people and was published in August.

Many respondents’ regrets are partially out of their control, from a cancer diagnosis disrupting financial stability to an unexpected divorce or layoff.

BI analyzed over 1,000 responses to a callout in previous stories asking about older Americans’ life regrets, in addition to dozens of emails reporters received, to determine four of the main regrets they have about their lives.

We want to hear from you. Are you an older American with any life regrets that you would be comfortable sharing with a reporter? Please fill out this quick form.

1. Not saving enough for retirement

After navigating various job losses and undergoing cancer treatments, Jan Hoggatt, 69, is unsure she can ever retire and works part-time.

“I wish I hadn’t assumed I’d be able to work into my 70s,” said Hoggatt, who lives in the St. Louis suburbs and receives about $1,800 monthly in Social Security.

She regrets not better preparing financially for an emergency, adding that she never knew exactly how to go about saving for retirement or what resources were available.

Dozens, like Hoggatt, remarked that their parents, employers, or professors never taught them investing basics, adding that there weren’t many accessible resources for financial planning in their early careers. Some described saving for retirement as a trial-and-error process, noting that they wished they had worked with a financial advisor or taken courses on growing their wealth.

Meanwhile, nearly every respondent wished they had saved more for retirement. Many said they lived too much in the moment and didn’t consider putting money into retirement accounts or investments throughout their lives.

Respondents also commonly thought they would be able to survive on Social Security once they retired and wouldn’t need hefty savings. Well over a quarter said they have little savings and receive between $1,000 and $2,000 monthly in Social Security, forcing some to work part-time jobs or move into low-income housing.

“The benefits that we’re providing for people as they age are not keeping up with the cost of living,” Jessica Johnston, senior director for the Center of Economic Wellbeing at the National Council on Aging, told BI. She added that the asset limit people can have to receive Supplemental Security Income, which is $2,000 for individuals and $3,000 for couples, hasn’t changed since 1989.

To be sure, dozens said they rarely had enough money to set aside each week for retirement savings. A few dozen said they were single parents working two or three jobs to put food on the table. Others went on disability earlier in life and had only enough income to pay rent.

2. Making mistakes during the retirement process

Hundreds wrote that they were lost on how much to save, what to invest in, when to retire, and what to do financially during retirement. A few dozen wished they had more guidance on what pitfalls to avoid, how to live comfortably after working for decades, and what to do when a spouse dies.

Steve Watkins and his wife both worked for 50 years at their respective employers and retired with enough to live comfortably. Then his wife died in January.

Watkins, 74, receives about $3,100 a month in Social Security and has more than $1 million in savings. However, Social Security rules dictate that he cannot collect his wife’s $1,300 monthly benefits because her amount is lower than his. That lack of income worries him, as he doesn’t know how long his savings will finance his remaining years.

“You either have to go get another job to make up for it or suffer by losing that amount of money,” said Watkins, who lives outside Los Angeles.

Over two dozen respondents said they claimed Social Security too early and received less money each month than if they had waited until their full retirement age to collect more. Some had to collect Social Security early because they needed the money, though others didn’t realize how much more they could get if they waited.

Americans can collect Social Security as early as age 62, though benefits are reduced until reaching the full retirement age of either 66 or 67, depending on your birth year. People can delay taking their benefits until 70, which increases the amount.

Similarly, dozens regretted retiring too early without an insufficient nest egg. Then, they needed part-time work to supplement their Social Security payments. A handful noted that even though they waited until 65 to retire, they wished they had delayed retirement until 70 to pad their accounts and feel more financially secure.

3. Not making the right career choices

Along with not saving enough, hundreds of respondents said they should have been more aggressive during their careers to secure higher-paying roles.

Dozens said they stayed too long in dead-end jobs and avoided developing marketable skills. More than 100 respondents said they wished they had gone into higher-paying sectors or applied for more prestigious positions where they could have made more money.

Those in corporate positions wished they had tried harder to get promoted instead of settling. Over two dozen wished they had networked more outside their companies in case of job loss; many said they’re now facing unemployment in their 50s and 60s.

At least a dozen said they should have stayed more up-to-date on the skills necessary for securing new positions, such as new coding languages or online tools.

Alternatively, some wished they had been less ambitious. A few dozen regretted leaving stable careers to start businesses, some of which failed and put their founders in the red. Michael R., 70, told BI he lost over $650,000 in savings and had to declare bankruptcy after his New York-based business crashed during the 2008 recession. He asked to use partial anonymity due to privacy concerns.

4. Not prioritizing education enough

Hundreds of respondents wrote they should have pursued education more. Though a few dozen said they lacked the money to attend higher education institutions — or were not told about the benefits of college — those with the means wished they had gotten an associate’s or bachelor’s degree to better prepare for the workforce.

However, respondents were divided over student loans. Over two dozen said they regretted not attending college and taking out loans to pursue higher education, as it may have opened more doors for them. Another dozen wished they took out fewer loans or worked throughout college to fund their tuition. These people are still paying off loans from 50 years ago.

To be sure, at least a dozen said they regretted attending college and not going into the workforce immediately. They said college didn’t prepare them well for more advanced careers.

A few said they went to college later in life, which opened more doors for them professionally, though they said it was difficult attending classes while juggling a job and raising children. Still, many said this decision was fulfilling for advancing their careers.

Carol Brownfield, 48, is going back to community college to become a therapist counselor. The Washington resident said she has lots of experience, from running a casino and resort, though she wanted to “better myself and do what I want to do.”

“Going back to school is for a career that pays better and just matches with my morals,” Brownfield said. “My daughter sees that. She says, ‘I’m right behind you, Mom,’ and she wants to do it too.”

Are you an older American with any life regrets that you would be comfortable sharing with a reporter? Please fill out this quick form or email nsheidlower@businessinsider.com.

Read the original article on Business Insider

Reality bites: Is Generation X in denial about its own impending retirement?

Is Generation X in denial about its own impending retirement?

Gen X, born between 1965 and 1980, will be next to retire after the baby boom. It’s a generation largely defined by financial uncertainty: Generation X was the first to cope without ubiquitous workplace pensions, relying instead on a new savings tool called the 401(k). The Great Recession of 2008 stands as the generation’s defining economic event.

Now, with the oldest Gen Xers pushing 60, the cohort may not be ready for its next life stage.

A Wealth Watch survey from insurer New York Life is one of several recent reports that portray much of Generation X as woefully unprepared for their looming retirement.

Fewer than half of Generation X, or 46%, are “actively planning for retirement,” New York Life found, even as they approach the milestone.

Most of Generation X, or 70%, think they will retire “later than expected,” the survey found, “or not at all.” Only one-quarter of Gen-Xers believe they will retire on time. The survey, released in September, reached 2,230 adults.

‘They’re basically going to be working forever’

“There are a whole lot of Gen Xers who are finding themselves resigned to the fact that they’re basically going to be working forever,” said Matt Schulz, chief credit analyst at LendingTree, the personal finance site.

Generation X’s retirement fears are not unwarranted.

Gen Xers ages 45 to 54 had a median net worth of about $247,000 in 2022, according to the federal Survey of Consumer Finances.

That’s less money than baby boomers had at the same age. Boomers in the 45-54 age group had a median net worth of about $265,000 in 2007, after adjusting for inflation.

The contrast suggests Generation X has struggled more than other age groups to recover from the Great Recession of 2008.

“I think there’s this cumulative wear and tear of different circumstances Gen X has had throughout their lives,” said KC Boas, head of retirement thought leadership and marketing at BlackRock, the global investment firm.

First the dot-com bubble, then the Great Recession

Many in Generation X entered the workforce around the time of the dot-com bubble, the tech-stock boom that went bust in 2000, sending the stock market tumbling.

Several years later, many Gen Xers were in their prime earning years when the Great Recession hit. Every generation suffered in 2008, but economic research suggests Gen X suffered more than most.

“Older generations were hit much harder, in some ways, because they had more to lose,” said Catherine Collinson, CEO of the nonprofit Transamerica Center for Retirement Studies.

Late baby boomers, born between 1960 and 1965, were also in their top earning years when the Great Recession descended. Today, the “Beatlemania boomers” have much less retirement savings than Americans born in the 1950s or earlier. They and Gen X suffered a similar fate.

Millennials, born between 1981 and 1996, have fared better. The millennial generation is in a stronger financial position now than Gen X was at the same age, according to a new LendingTree analysis.

As of 2022, millennials had a median net worth of $84,941, LendingTree reports. Generation X had a lower net worth at the same age: $78,333, after adjusting for inflation.

Millennials are also better-off financially than boomers were at the same age. But boomers are much more likely than Gen X or millennials to have workplace pensions, a guaranteed source of retirement income.

Gen X entered the workforce as pensions were fading

Generation X entered the workforce as workplace pensions were fading, leaving most workers to build their own retirement savings with 401(k) plans and Individual Retirement Accounts.

But 401(k) plans were few and far between in the early years. Partly for that reason, many Gen Xers got a late start in retirement saving.

“This all happened without access to education and guidance,” said Jessica Ruggles, corporate vice president of financial wellness at New York Life. “It wasn’t until much later that we did things like auto-enrollment and auto-contribution,” innovations that encourage higher rates of retirement saving.

Schulz, of LendingTree, is 52: a quintessential Gen Xer. He got his first real job around 1995, in his early 20s.

“I didn’t even really think of retirement, or anything like that, at that age,” he said.

The typical Gen Xer began saving for retirement at age 30, half a decade later than millennials, according to the Transamerica Center. Today, the median Gen X household has $93,000 in retirement savings: Not nearly enough, in the eyes of many retirement planners.

As a result, Transamerica found, most Gen Xers plan to keep working in retirement.

Those figures come from the 2024 Transamerica Retirement Survey of Workers, which reached 5,730 workers.

Gen X faces a singular struggle in preparing for retirement

Other retirement surveys concur that Generation X faces a unique struggle in preparing for retirement.

Only 60% of Gen Xers feel “on track” for retirement, the lowest share of any generation, according to the 2024 BlackRock Read on Retirement report.

Three-fifths of Gen Xers worry they will outlive their retirement savings, BlackRock found. Only two-fifths of Gen Xers use a financial adviser, the lowest rate of any generation.

Generation X also seems to have a credit card problem. More than one Gen X cardholder in four, or 27%, have maxed out their credit, Bankrate reported on Thursday.

Gen-Xers are more likely than millennials or boomers to have exhausted their credit, the survey found.

The finding is worrisome, retirement experts say, because consumers should be paying down their debt as they approach retirement, not charging it up. The Bankrate survey covered 3,576 adults.

Meet the ‘Beatlemania boomers.’ They face a looming retirement crisis

Gen X remains hopeful for the future

But here’s some good news, at least from a retirement perspective: Generation X is spending less on discretionary purchases in 2024, Bank of America reports.

“Discretionary” is a category that covers non-essentials. And discretionary spending among Gen Xers is down 2% in the year ended August, according to internal Bank of America card data, the biggest drop of any generation.

At the same time, Gen X is investing a larger share of its paycheck than other generations, according to a September report from Bank of America Institute.

“Bottom line, they’re spending less and they’re investing more,” said Joe Wadford, an economist at the Bank of America Institute. “It’s certainly a sign that Gen X is hopeful for the future. They think they will retire, and they think that in the future, those investments are going to pay off.”

This article originally appeared on USA TODAY: Gen X is next up for retirement. Are they in denial?