2 Surefire Chip Stocks to Buy and Hold for the Next Decade

The chip industry has been growing for decades, and the investment in artificial intelligence (AI) technology could keep the industry growing for years to come.

While the semiconductor industry can experience cyclical demand, the increasing quantity of chips used in consumer devices, cars, and data centers bodes well for the industry’s long-term prospects. Statista projects the industry will grow 10% per year through 2029 to reach $980 billion.

To profit off this opportunity, here are two outstanding chip companies to hold for the next 10 years.

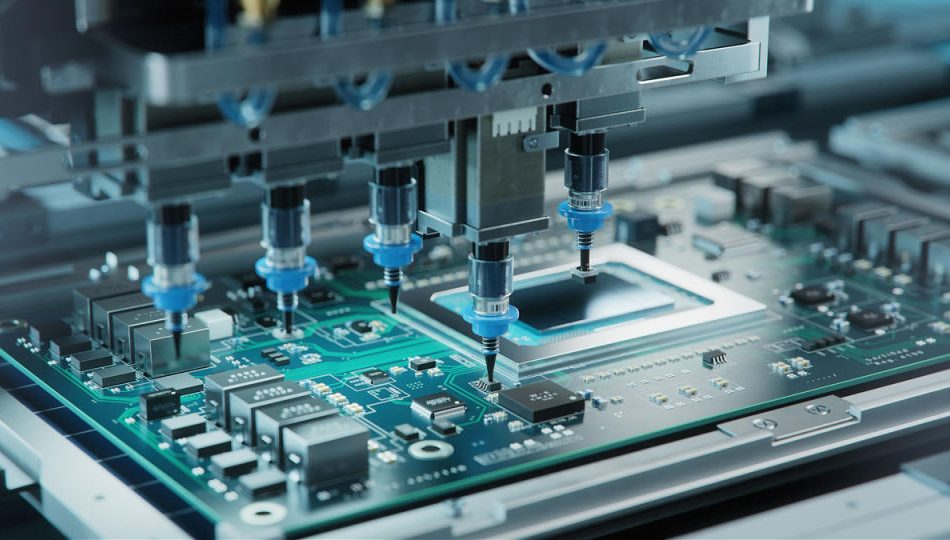

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM) is close to joining the $1 trillion club. The share price has doubled since 2022, bringing its market cap to about $971 billion. TSMC is in a lucrative position as the leading semiconductor foundry, which refers to its business of making chips for other companies, including Nvidia, Broadcom, Advanced Micro Devices, and Intel, among others.

The company has delivered market-beating returns for years, and it continues to show strong growth. Analysts expect revenue to be up 26% this year before increasing 24% in 2025, according to YCharts.

Investing in Taiwan Semiconductor is making a bet on the long-term advances in chip technology and increasing chip quantities in smartphones, data centers, and cars. Because its chips are used in a variety of end markets, TSMC is a relatively safe way to invest in the growth of the chip industry.

TSMC is in a great position to benefit from growing demand for chips used for AI workloads. The company’s revenue from high-performance chips makes up half of the business, and TSMC controls 61% of the global foundry market. Its long-standing customer relationships, advanced manufacturing processes, and large capacity to meet demand are advantages that position the company to deliver profitable growth for shareholders.

The stock offers excellent return prospects in the near term, too, as it trades at a very attractive price-to-earnings ratio relative to forward earnings estimates. Analysts expect the company’s earnings to grow at an annualized rate of 26%. Assuming TSMC meets those estimates, the stock could double within three years if it’s still trading at the same price-to-earnings multiple.

2. Arm Holdings

Arm Holdings (NASDAQ: ARM) potentially has even greater long-term upside than TSMC. It currently has a market cap of about $159 billion, but could join the $1 trillion club one day. It is gaining share in several markets where its chips are used, including cloud computing, networking equipment, consumer electronics, automotive, and the Internet of Things.

Arm’s revenue grew 39% year over year in the most recent quarter, but it’s important to know that Arm doesn’t make money by manufacturing chips. Instead, Arm focuses on chip design, and then it licenses those designs to other semiconductor companies and manufacturers. It earns a royalty on nearly all processors shipped using its products, which allows Arm to earn very high margins.

Arm-based processors are in high demand because they deliver exceptional performance with lower energy consumption. The latter is becoming increasingly important, since more powerful chips run hotter and drive up energy costs. For large data centers, this can be a problem, but Arm is offering solutions that address this challenge. For example, U.K.-based Avantek has developed an Arm-based server that consumes up to 90% less electricity.

Arm-based products play such an important role in the industry that Nvidia tried to acquire it four years ago, which ultimately failed to gain the approval of regulators. But Nvidia’s Grace processor included in its upcoming Blackwell platform for AI workloads is based on Arm. This positions the chip designer to benefit from the growing demand for AI chips in data centers.

Arm stock has been volatile, but patient investors should do well. Analysts expect the company’s earnings to grow at an annualized rate of 27% over the next several years. The company should continue to grow faster than the chip industry and deliver excellent returns to investors over the next decade.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Ballard has positions in Advanced Micro Devices and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

2 Surefire Chip Stocks to Buy and Hold for the Next Decade was originally published by The Motley Fool

Leave a Reply