Peter Schiff Criticizes Trump's Tariff Strategy, Oil Prices Drop Following Netanyahu's Statement, Kamala Harris Pledges To Remove Unnecessary Degree Requirements And More: Top Political Updates This Week

The past week was a hotbed of activity, with political debates and economic strategies taking center stage. From tariff discussions to election battles, the week saw a flurry of statements and counterarguments from prominent figures. Here’s a quick recap of the top stories that made headlines over the weekend.

Peter Schiff Criticizes Trump’s Tariff Strategy

Noted economist and financial commentator Peter Schiff voiced his opinion on former President Donald Trump’s tariff strategy. Schiff, in a recent social media post, argued that Trump’s tariffs were not imposed on China but on Americans purchasing Chinese products. Read the full article here.

Barry Diller Criticizes Billionaire Trump Supporters

Barry Diller, the chair of IAC Inc and a supporter of Vice President Kamala Harris, expressed his disapproval of wealthy business figures backing Donald Trump in the 2024 election. Diller, a longtime Democratic Party supporter, shared his views in recent interviews. Read the full article here.

Kamala Harris Pledges To Remove Unnecessary Degree Requirements

Vice President and Democratic presidential nominee Kamala Harris reiterated her commitment to eliminating degree prerequisites for certain federal jobs. She also urged the private sector to follow suit, stating that a college degree isn’t the only measure of a qualified worker. Read the full article here.

Oil Prices Drop Following Netanyahu’s Statement

Crude oil prices saw a significant drop after Israeli Prime Minister Benjamin Netanyahu stated his willingness to strike military targets in Iran instead of oil or nuclear facilities. This statement was made during a call with President Joe Biden last Wednesday. Read the full article here.

Mark Cuban And Kevin O’Leary Clash Over China Tariffs

“Shark Tank” co-stars Mark Cuban and Kevin O’Leary engaged in a public disagreement over tariffs on China. O’Leary called for a massive 400% increase in tariffs, citing unfair business practices by China. However, Cuban expressed his concerns over this approach. Read the full article here.

Image via Wikimedia Commons

This story was generated using Benzinga Neuro and edited by Anan Ashraf.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Backyard Treehouse Gets So Much Attention On Airbnb, Owner Doesn't Have To Work Anymore: 'I'm Booked For Months'

A DIYer once dreamt of constructing a treehouse on his land before his own house was even built. Now, with multiple accommodations on the property, the treehouse has become a reality, and a legitimate source of income.

Getting Off The Ground: Will Sutherland built a treehouse in his backyard in six months’ time. It’s super popular on Airbnb Inc ABNB, bringing in an average of $30,000 per year on the platform, according to a Business Insider report.

He saved money on the build by doing all the work himself and sourcing a lot of the material from a friend who was in the process of building a house at the same time.

There’s a queen bed with a loft area above it, so it can accommodate a family. It doesn’t have running water, but there’s a five-gallon tank, so guests can brush their teeth or wash their hands. The treehouse also has a window unit air conditioner and an electric heater.

See Also: This DIYer Built A $17K Tiny Home That Generates $50K A Year — Now He Works Just 2 Hours A Week

Despite the lack of amenities, the house in the trees doesn’t have any trouble attracting guests, and let’s be real, if you are interested in staying the night in a treehouse, you probably aren’t expecting a whole lot.

Depending on the time of year, Sutherland lists it on Airbnb for anywhere from $160 to $250 a night.

“The treehouse gets thousands of views per month on Airbnb, and I’m booked for months out,” he said.

The treehouse alone brings in $30,000 a year in income, but Sutherland also has a renovated school bus on his property that he rents out to guests and a bathhouse for anyone staying on the land.

Combined, the two unique Airbnb listings generate enough annual income that he was able to quit his job and spend his time working on other projects.

“We basically live in a little miniature community here, flanked by our bus guests and treehouse guests all the time,” Sutherland said.

The Airbnb income is rewarding in more ways than one. Sutherland now works from home, which has freed up more time that he can spend with friends and family. He also feels fulfilled seeing his guests create memories in a treehouse he built himself.

Read Next:

This story is part of a new series of features on the subject of success, Benzinga Inspire. Some elements of this story were previously reported by Benzinga and it has been updated.

This illustration was generated using artificial intelligence via MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Reason to Buy Eli Lilly Stock Hand Over Fist Right Now

Pharmaceutical powerhouse Eli Lilly (NYSE: LLY) is having a terrific 2024. Shares have gained 58% so far this year, handily outperforming both the S&P 500 and Nasdaq Composite indexes.

Much of the share price appreciation can be attributed to Lilly’s success in the diabetes and obesity care markets thanks to its blockbuster glucagon-like peptide-1 (GLP-1) agonists, Mounjaro and Zepbound. Moreover, Lilly made headlines back in July as the company’s Alzheimer’s drug, donanemab, received approval from the Food and Drug Administration (FDA).

About a month ago, Lilly secured another big win that I think is being overshadowed by the company’s success in other areas of the healthcare realm. Below, I’m going to break down Lilly’s latest milestone and explain why I see now as a great opportunity to scoop up shares.

Lilly’s latest win

Back in September, Lilly received FDA approval for its atopic dermatitis medication Ebglyss. Atopic dermatitis is more commonly referred to as eczema.

Eczema is generally treated with topical medications such as creams, ointments, or gels. For some patients, topical solutions are suboptimal as symptoms such as dry skin and itchiness continue lingering.

Ebglyss differs from topical ointments because it is an injectable. The medication is specifically marketed for patients with moderate-to-severe eczema who are not able to fully treat their symptoms with topical prescriptions.

A $31 billion opportunity

According to Lilly’s announcement regarding Ebglyss, there are 16.5 million adults with eczema just in the U.S. Moreover, roughly 40% of this cohort experiences “moderate-to-severe symptoms like itchiness, dry and scaly skin, discoloration and rashes, which can lead to more scratching that may cause skin to crack and bleed”.

To put some numbers on the eczema treatment opportunity, Precedence Research estimates that the global total addressable market (TAM) will reach $31.4 billion by 2034 — up from $14.7 billion today. Additionally, Precedence’s report suggests that North America is the largest market for eczema and could reach $8.1 billion by the middle of next decade.

Is Eli Lilly a good stock to buy right now?

The chart below illustrates the price-to-earnings (P/E) ratio for Eli Lilly over the last six months.

Right off the bat, I’ll admit that a P/E multiple of 113 is not cheap.

However, there are some trends from the chart above that I think are worth calling out and studying a bit further. Notice that Lilly’s P/E ratio began to fall between July and August.

At a company-specific level, some of the sell-off can be traced to rising fears that Lilly’s dominance in weight loss will begin to decelerate should new products from competitors come to market. Additionally, some in the political arena have also taken issue with Lilly’s pricing protocols for Mounjaro and Zepbound.

From a wider standpoint, the markets in general experienced some brutal selling activity over the summer, and Lilly’s price action was impacted by these moves as well.

And yet over the last month or so, Lilly’s P/E has rebounded back to where it was about six months ago. I find this dynamic peculiar because Lilly is a much different enterprise today than just several months back.

The company now has opportunities across Alzheimer’s disease, eczema, and even artificial intelligence (AI). So, while Lilly stock isn’t trading at a steal by any means, I think the stock is potentially underpriced considering the massive opportunities outside of weight management that the company has.

Lilly’s eczema approval looks like yet another stepping stone as it continues to build one of the most prolific pharmaceutical operations on the market. I see the stock as a compelling buy for long-term investors and believe that Lilly’s growth is just getting started.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Adam Spatacco has positions in Eli Lilly. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Reason to Buy Eli Lilly Stock Hand Over Fist Right Now was originally published by The Motley Fool

2 Surefire Chip Stocks to Buy and Hold for the Next Decade

The chip industry has been growing for decades, and the investment in artificial intelligence (AI) technology could keep the industry growing for years to come.

While the semiconductor industry can experience cyclical demand, the increasing quantity of chips used in consumer devices, cars, and data centers bodes well for the industry’s long-term prospects. Statista projects the industry will grow 10% per year through 2029 to reach $980 billion.

To profit off this opportunity, here are two outstanding chip companies to hold for the next 10 years.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM) is close to joining the $1 trillion club. The share price has doubled since 2022, bringing its market cap to about $971 billion. TSMC is in a lucrative position as the leading semiconductor foundry, which refers to its business of making chips for other companies, including Nvidia, Broadcom, Advanced Micro Devices, and Intel, among others.

The company has delivered market-beating returns for years, and it continues to show strong growth. Analysts expect revenue to be up 26% this year before increasing 24% in 2025, according to YCharts.

Investing in Taiwan Semiconductor is making a bet on the long-term advances in chip technology and increasing chip quantities in smartphones, data centers, and cars. Because its chips are used in a variety of end markets, TSMC is a relatively safe way to invest in the growth of the chip industry.

TSMC is in a great position to benefit from growing demand for chips used for AI workloads. The company’s revenue from high-performance chips makes up half of the business, and TSMC controls 61% of the global foundry market. Its long-standing customer relationships, advanced manufacturing processes, and large capacity to meet demand are advantages that position the company to deliver profitable growth for shareholders.

The stock offers excellent return prospects in the near term, too, as it trades at a very attractive price-to-earnings ratio relative to forward earnings estimates. Analysts expect the company’s earnings to grow at an annualized rate of 26%. Assuming TSMC meets those estimates, the stock could double within three years if it’s still trading at the same price-to-earnings multiple.

2. Arm Holdings

Arm Holdings (NASDAQ: ARM) potentially has even greater long-term upside than TSMC. It currently has a market cap of about $159 billion, but could join the $1 trillion club one day. It is gaining share in several markets where its chips are used, including cloud computing, networking equipment, consumer electronics, automotive, and the Internet of Things.

Arm’s revenue grew 39% year over year in the most recent quarter, but it’s important to know that Arm doesn’t make money by manufacturing chips. Instead, Arm focuses on chip design, and then it licenses those designs to other semiconductor companies and manufacturers. It earns a royalty on nearly all processors shipped using its products, which allows Arm to earn very high margins.

Arm-based processors are in high demand because they deliver exceptional performance with lower energy consumption. The latter is becoming increasingly important, since more powerful chips run hotter and drive up energy costs. For large data centers, this can be a problem, but Arm is offering solutions that address this challenge. For example, U.K.-based Avantek has developed an Arm-based server that consumes up to 90% less electricity.

Arm-based products play such an important role in the industry that Nvidia tried to acquire it four years ago, which ultimately failed to gain the approval of regulators. But Nvidia’s Grace processor included in its upcoming Blackwell platform for AI workloads is based on Arm. This positions the chip designer to benefit from the growing demand for AI chips in data centers.

Arm stock has been volatile, but patient investors should do well. Analysts expect the company’s earnings to grow at an annualized rate of 27% over the next several years. The company should continue to grow faster than the chip industry and deliver excellent returns to investors over the next decade.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Ballard has positions in Advanced Micro Devices and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

2 Surefire Chip Stocks to Buy and Hold for the Next Decade was originally published by The Motley Fool

A $295 Billion Opportunity Is Hiding In Plain Sight. 2 Stocks That Should Help You Plug Into It.

Last month, utility company Constellation Energy unveiled plans to restart one of the two now-mothballed nuclear reactors at Pennsylvania’s Three Mile Island power facility.

On the surface it doesn’t mean much. The world needs more electricity right now. Nuclear is a quickly accessible low-cost option.

There was a curious detail within Constellation’s press release, however. That is, although it will connect to the national power grid, the electricity it will generate is largely meant to power AI data centers managed by software giant Microsoft. The news underscores the fact that data centers are power-hungry, and increasingly so the bigger the business gets. Goldman Sachs believes data centers’ power consumption will grow 160% between now and 2030, yet will still just be getting started then.

The restart of Three Mile Island’s 800-megawatt reactor, however, is only a stopgap measure. The future of nuclear power is likely to be defined by so-called small modular reactors, which are precisely what they sound like … nuclear power plants that are easy to build and cost-effective to manage. Perhaps most notably, they can be put into action much close to where the electricity they generate is used, rather than delivering their electricity through the power grid.

Two particular companies stand ready to capitalize on this quickly gelling opportunity.

Small modular reactors are the real deal

This isn’t merely theoretical thinking either. Just within the past week Alphabet as well as Amazon announced intentions to purchase electricity generated by small modular reactors (or SMRs) to power their AI data centers. Industry research outfit Wood Mackenzie estimates the SMRs already under construction will eventually be able to produce over 22 gigawatts of electricity. That’s enough to power over 16 million homes or, presumably, at least a whole bunch of data centers.

Even before the first of these power plants becomes operational, though, more are apt to be lined up in anticipation of their success. IDTechEx reports the annual SMR market will be worth over $72 billion per year by 2033, en route to $295 billion in 2043. That’s an annualized growth rate of 30%.

It almost sounds too fantastical. If nothing else the complicated logistics of the SMR movement is a limiting factor.

There are many factors working in the small modular reactors’ favor, however, that are so much more powerful.

Chief among these factors are carbon-neutral power goals that are evolving into outright mandates. While nuclear power may have a dented reputation due to its fair share of catastrophic (or near-catastrophic) accidents, it does work and can be safe using more modern reactor designs and better-grounded standards.

Another driving force is the way and reasons energy is created and then utilized. Modular reactors are feasible for on-site energy creation at facilities like mines, refineries, and desalination plants, or even for generating the heat needed by smelters, many of which still burn coal.

SMRs are also particularly promising as a means of producing pure hydrogen, used in fuel cells to create clean electricity. The stumbling block is just the amount of raw energy needed to split water into its two atomic elements (hydrogen and oxygen) in the first place. With nuclear power, there’s plenty of clean energy to spare when splitting water molecules.

Two ways to play

So it’s a work in progress. The core opportunities are starting to gel, though. Two stand out among the rest.

First, with the creation and consumption of nuclear power set to grow for the foreseeable future, the world needs more nuclear fuel — predominantly uranium-238. BMO Capital Markets expects global consumption of uranium to grow by nearly 3% per year through 2035.

That’s not massive growth, but given that the supply-and-demand dynamic favors continued price increases, look for uranium prices to continue growing.

There’s a handful of publicly traded uranium miners like Uranium Energy (NYSEMKT: UEC) and Australia’s diversified mineral miner BHP Group Limited. But perhaps your best bet is a company called Cameco (NYSE: CCJ). It’s one of the world’s biggest suppliers of high-grade uranium, selling $2.6 billion worth of nuclear fuel last year, turning $339 million of it into net income thanks to its low-cost operation. It’s also sitting on nearly 500 million pounds worth of the material just waiting to be dug up.

Small modular reactors are of course the other major opportunity. Nano Nuclear Energy (NASDAQ: NNE) and Oklo (NYSE: OKLO) are a couple of SMR manufacturers perhaps worth putting on your radar. A company called NuScale Power (NYSE: SMR), however, is arguably further along than any other outfit on the monetization front.

This optimism wasn’t felt a year ago when Utah Associated Municipal Power Systems canceled its plans made with NuScale to establish what would have been the nation’s first SMR. It wasn’t quite the indictment of the idea it was being made out to be at the time though. NuScale is still working on nearly a dozen other small modular reactor projects — here and abroad — with undeterred partners.

The reward aligns with the risk

There’s risk here, to be sure.

Again, although nuclear power itself is well-proven, small modular reactors aren’t; would-be partners may be taking a “wait and see” approach, prolonging the adoption process. Moreover, while NuScale is the only company with an SMR design thet’s been approved by U.S. Nuclear Regulatory Commission for use in this country, this particular 50-megawatt reactor design isn’t the 77-megawatt version NuScale Power ultimately hopes to offer. Even if the new model is approved, that approval won’t come through until mid-2025, clouding the bullish argument.

Waiting for absolute certainty before stepping in, however, also leaves money on the table. The time to take your shot on less-than-fully gelled premises is before they become obvious opportunities. Once they’re obvious, much of any prospective gain is in the rearview mirror.

Of course, given the fluidity of the movement, we can’t rule out the possibility of a new name surfacing as an important nuclear power player either. Keep your eyes open to that possibility too.

Should you invest $1,000 in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, and Goldman Sachs Group. The Motley Fool recommends Cameco and NuScale Power. The Motley Fool has a disclosure policy.

A $295 Billion Opportunity Is Hiding In Plain Sight. 2 Stocks That Should Help You Plug Into It. was originally published by The Motley Fool

Apple's Week In Review: From Termining Self-Driving Car Permit To Setting iPhone Sales Records

The past week has been a rollercoaster for Apple Inc. AAPL. The tech giant made headlines with its decision to abandon its self-driving car project, the revelation of a secret partnership with Chinese EV manufacturer BYD, and record-breaking iPhone sales. Let’s dive into the details of these stories.

Apple Abandons Autonomous Vehicle Project

Apple has officially terminated its self-driving vehicle testing permit in California, following its earlier decision to abandon its electric vehicle project. The California Department of Motor Vehicles confirmed that Apple requested the cancellation on Sept. 25, with the permit officially ending on Sept. 27. This move aligns with previous reports indicating Apple’s retreat from the electric vehicle market after a decade-long effort.

Apple’s Secret Partnership with BYD

In a surprising revelation, it was reported that Apple had a secret partnership with Chinese electric vehicle manufacturer BYD to create long-range electric vehicle batteries. The partnership, which started in 2017, aimed to develop a battery system using lithium iron phosphate cells. While Apple does not own any technology used in BYD’s current Blade batteries, this development proves Cupertino’s efforts to produce a car.

Record-Breaking iPhone Sales

Apple set a new sales record for its iPhone during the third quarter of 2024, coinciding with a broader recovery in the global smartphone market. According to Canalys, Apple’s iPhone sales were narrowly edged out by Samsung Electronics Co. Ltd., with both tech giants capturing an 18% market share.

Apple’s Low-Cost Vision Pro

Apple is reportedly ramping up its efforts to compete with Meta Platforms Inc. The iPhone maker’s discounted version of the first-generation mixed-reality headset, Vision Pro, could be ready by next year. Over the weekend, it was reported that Apple’s Vision Pro team is working on at least four new devices that address current criticisms.

Apple’s Inventory Shortage

Apple is reportedly experiencing a shortage in inventory for several of its products, leading to speculation about the imminent launch of new models. Retail inventory for several Apple products, including iMacs, MacBook Pros, Mac minis, iPad minis, and their accessories, is running low. Such inventory shortages are often indicative of a company preparing to introduce updated versions of its products.

Read Next:

Photo courtesy: Unsplash

This story was generated using Benzinga Neuro and edited by Rounak Jain

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Plaza Retail REIT Announces Date of Third Quarter 2024 Financial Results Conference Call

FREDERICTON, NB, Oct. 18, 2024 /CNW/ – Plaza Retail REIT (“Plaza”) PLZ invites you to participate in a live conference call with senior management discussing Plaza’s third quarter 2024 financial results on Friday, November 8, 2024 at 10:00 am EST (11:00 am AST).

Plaza’s financial statements and management’s discussion and analysis for the quarter ended September 30, 2024 will be released prior to the call and will be made available on Plaza’s website at www.plaza.ca in the Investor Relations section, and on SEDAR+ at www.sedarplus.ca.

To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/4dPSsJ1 to receive an instant automated call back.

You can also dial direct to be entered to the call by an operator. In this case, please dial in five to ten minutes prior to the scheduled start of the call to ensure your participation. The dial-in numbers are:

Local Toronto: 437-900-0527

North American Toll Free: 1-888-510-2154

If you cannot participate in the live mode, a replay will be available until November 15, 2024. To access the replay, please dial 289-819-1450 (local Toronto) or 1-888-660-6345 (North American toll free) and enter passcode 52498 #. The audio replay will also be available for download on Plaza’s website for 90 days following the conference call.

ABOUT PLAZA

Plaza is an open-ended real estate investment trust and is a leading retail property owner and developer, focused on Ontario, Quebec and Atlantic Canada. Plaza’s portfolio at June 30, 2024 includes interests in 225 properties totaling approximately 8.9 million square feet across Canada and additional lands held for development. Plaza’s portfolio largely consists of open-air centres and stand-alone small box retail outlets and is predominantly occupied by national tenants with a focus on the essential needs, value and convenience market segments. For more information, please visit www.plaza.ca.

SOURCE Plaza Retail REIT

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/18/c1835.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/18/c1835.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Does Stanley Druckenmiller Know Something Wall Street Doesn't? The Billionaire Investor Is Making a Big Bet Against the Federal Reserve.

Billionaire investor Stanley Druckenmiller might be the best to ever do it, at least from a pure returns perspective. His firm, Duquesne Capital Management, which closed in 2010, generated average annual returns of 30% for three decades. That’s better than Warren Buffett and Berkshire Hathaway.

Although Duquesne Capital is no more, Druckenmiller still invests through the Duquesne Family Office, and is not afraid to go against the grain. The George Soros protege is now making a bet that goes against the broader view of the market and the Federal Reserve, according to reported remarks of people who heard him speak at a conference in early October. Does he know something Wall Street doesn’t?

Betting on a bond bust

The majority of the market and the Federal Reserve believe inflation will continue to slow and the Fed will keep lowering interest rates through 2025. The CME Group‘s FedWatch tool, which tracks the likelihood of interest rate changes by looking at one-month futures prices, indicates that the majority of traders (as of Oct. 15) expect the Fed to lower interest rates by an additional 50 basis points this year and get its benchmark rate down to a target range of 3.25% to 3.50% by the end of 2025. Keep in mind that these future projections of interest rates are constantly changing.

The Fed’s “dot plot” also currently charts a similar path. The dot plot shows how each member of the Federal Open Market Committee (FOMC) thinks interest rates will trend and then compiles a consensus. The dot plot is updated every three months. The Fed believes that with inflation trending lower, it now needs to worry about the labor market, which has seen unemployment trending higher until the last two months. The Fed is trying to engineer a “soft landing” for the economy where inflation falls and gets back to the Fed’s preferred 2% target without previous interest rate hikes tipping the economy into recession.

Druckenmiller is taking the other side of this bet, reportedly recently unveiling at a conference that he is shorting U.S. Treasury bonds. Bets against U.S. government bonds now account for 15% to 20% of Druckenmiller’s portfolio, according to reports of what people at the conference said.

A bet against Treasury bills or bonds is effectively a bet against the current view that interest rates will fall. Bonds have an inverse relationship to bond yields, so if bonds fall, yields rise. The federal funds rate influences bond yields, although most yields do not move solely based on the federal funds rate. Druckenmiller also reportedly said inflation could surge to levels seen in the 1970s. If inflation surges, the Fed will not be able to drop interest rates as much as the market thinks or even at all because the economy will be too hot to stimulate with further cuts.

We don’t know the exact bet

We don’t know the exact bet Druckenmiller is making. For instance, we don’t know the duration of bonds that Druckenmiller is shorting. Being short of the two-year Treasury bill is different from being short of the 30-year. Druckenmiller also reportedly said he is unsure how long the trade will take to unfold. It could take six months or six years, he said. Additionally, Druckenmiller is worried about “bipartisan fiscal recklessness.”

For all we know, Druckenmiller’s bet could have more to do with government spending and the national debt than anything else. If debt levels get too high and the market starts to worry about the government’s ability to pay its debt or interest payments, investors would demand higher interest rates for the added risk, which would tank bond prices.

Still, given his comments on inflation, Druckenmiller does seem to be playing contrarian to the Fed and the general market. While retail investors should listen to Druckenmiller and try to get into his mindset, it’s not a good idea to completely shift your strategy when the exact trade is not known. The motive of institutional investors is not always entirely clear. But thinking about and being open to opposing views — and then doing your own due diligence — is what makes a good investor.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 820% — a market-crushing outperformance compared to 172% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of October 14, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

Does Stanley Druckenmiller Know Something Wall Street Doesn’t? The Billionaire Investor Is Making a Big Bet Against the Federal Reserve. was originally published by The Motley Fool

2 High-Yield Dividend Stocks to Buy Now and Help You Generate Passive Income

Companies with high dividend yields have a much better chance of providing investors with predictable income regardless of what the broader stock market is doing. The key, of course, is to stick with companies that can afford their payouts. After all, a dividend expense is only as good as the company paying it.

And companies that don’t have a runway for future earnings growth won’t be able to raise their dividend without jeopardizing their balance sheet. With that in mind, here’s why United Parcel Service (NYSE: UPS) and Kinder Morgan (NYSE: KMI) stand out as two top dividend stocks to buy now.

UPS has more work to do to regain investor excitement

UPS will report third-quarter 2024 earnings on Oct. 24. With the stock trading less than 9% from its four-year low, it will be a “show me” quarter for the delivery giant.

In its last quarterly report, UPS guided for full-year consolidated revenue of $93 billion, a consolidated operating margin of 9.4%, and capital expenditures of $4 billion. UPS has pulled back on spending to cut costs and restore its margins, which went from a 10-year high to a 10-year low in less than two years.

In March, UPS held an investor presentation and announced new three-year financial targets of $108 billion to $114 billion in consolidated revenue by 2026, an adjusted operating margin above 13%, and $17 billion to $18 billion in free cash flow. The plan had two phases, with 2024 focusing on volume and adjusted operating profit dollar growth, and 2025 and 2026 focused on volume and adjusted operating profit margin growth.

Last quarter, UPS returned to domestic volume growth for the first time in nine quarters — which was a step in the right direction toward achieving its 2024 goal. But as for now, the three-year targets look out of reach and could be delayed until 2027.

UPS must implement more concrete measures to get back on track and accelerate sales growth momentum into next year. In the meantime, UPS yields a hefty 4.9%, and management has indicated that maintaining its current payout is a top priority.

Oil and gas infrastructure is proving its value

Between 2016 and the end of 2023, Kinder Morgan stock’s price increased less than 20% compared to a 133% rise in the S&P 500 index. Factoring in dividends, Kinder Morgan returned a much better 77%, but it was still a drastic underperformance from the S&P 500’s 170% total return during that period.

So, heading into 2024, Kinder Morgan investors had grown used to mediocrity. The main draw of buying and holding the stock was the dividend. But Kinder Morgan’s stock price has surged over 40% year to date. Even after that rise, Kinder Morgan still yields 4.6% — illustrating just how high its yield was when the stock was more beaten down.

Pipeline and infrastructure companies like Kinder Morgan have been on a tear this year due to expectations for increased natural gas domestic demand, and the opportunity for higher exports to Mexico and overseas by cooling and condensing gas into liquid form. Higher demand is vital for justifying new project investment. When Kinder Morgan is at its best, it builds new projects that can return steady cash flow over time, funneling a portion of that cash into even more projects and paying a growing dividend to shareholders.

Part of the reason Kinder Morgan has been such a poor-performing stock over the last decade or so is due to concerns that its infrastructure assets could lose value over time as natural gas demand weakened and the energy mix shifted more toward renewables. Less natural gas production could also lead to less justification for new projects, jeopardizing Kinder Morgan’s business model.

Those concerns certainly haven’t gone away, but there are signs that natural gas could remain a part of the energy mix well into the medium term. In addition to the demand drivers mentioned, natural gas could also power data centers and support the energy needs of artificial intelligence.

Kinder Morgan generates plenty of cash to reinvest in the business and fuel its growing payout, making it a reliable high-yield dividend stock to consider now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

2 High-Yield Dividend Stocks to Buy Now and Help You Generate Passive Income was originally published by The Motley Fool

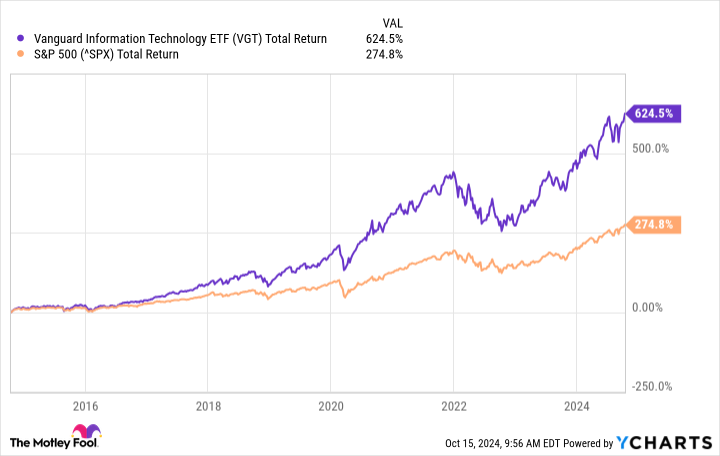

This Vanguard ETF Has Generated 620% Returns in 10 Years. Is It Still a Buy?

If you’re not sure where to invest in the stock market, you should consider holding an exchange-traded fund (ETF) in your portfolio. Doing so can drastically simplify your decision-making process. ETFs hold dozens, hundreds, and sometimes even thousands of stocks. They can give you some excellent exposure through just a single investment. Vanguard funds, in particular, are popular choices due to their low fees and solid stock selection.

In some cases, you can also achieve considerable returns from investing in ETFs. One exceptional example is the Vanguard Information Technology Index Fund ETF (NYSEMKT: VGT), which has generated some significant returns for investors in the past decade. Can it still be a good investment today?

The Vanguard Information Technology ETF is up 620% in 10 years

A big reason the Vanguard Information Technology fund has been a phenomenal investment to own over the past decade is because it focuses on top tech stocks, including big names such as Apple, Microsoft, and Nvidia — three companies that are benefiting from the excitement over artificial intelligence (AI) in recent years. Together, those three stocks account for 44% of the fund’s total weight. Overall, there are 316 stocks in the ETF.

When including the ETF’s dividend (it yields a modest 0.6%), its total returns over the past 10 years come in at around 620%. That means a $25,000 investment in the fund then would be worth approximately $180,000 right now. In comparison, if you made the same size investment mirroring the S&P 500, it would be worth considerably less today, totaling around $94,000.

Why the fund can still rally higher

As well as the ETF has performed over the past decade, there’s still a bullish case to be made for investors who are contemplating the fund, which is due to the potential in AI.

Research company Gartner projects that AI chip sales will total at least $119 billion by 2027, which is more than double the $53 billion it totaled just last year. That’s good news for Nvidia and other chipmakers, as it suggests demand will remain strong. The overall AI market is also looking promising. Analysts from Fortune Business Insights estimate that globally, it will grow at a compound annual growth rate of 20.4% until 2032.

While the Vanguard fund isn’t exclusively an AI fund, tech stocks as a whole will benefit from businesses building AI models and related products and services. Companies will invest in new AI technologies, and they will need to upgrade their existing IT infrastructure to help ensure they have the capabilities to handle the added workloads. Many tech companies are at least indirectly involved with AI in some way, even if they aren’t creating AI-specific products and services.

Should you invest in the Vanguard Information Technology ETF?

The Vanguard Information Technology ETF has a modest expense ratio of 0.10%, and it offers investors a great way to gain exposure to the best tech stocks in the world.

Given the soaring valuations in tech, investors may feel uneasy about investing in this type of fund. But while there may be a correction in the cards for some highly priced tech stocks in the near future, the long-term trajectory still looks promising. Tech has, for the most part, been a great option for long-term investors, and it has allowed investors to generate some incredible returns along the way.

As long as you plan to stay invested for years, this Vanguard fund can be a great investment to hold in your portfolio.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Vanguard ETF Has Generated 620% Returns in 10 Years. Is It Still a Buy? was originally published by The Motley Fool