Trump's Rally Hits a Sour Note: Audio Woes And Frustrations In Detroit

During a rally in Detroit, Donald Trump greeted a packed audience after a 17-minute audio malfunction prevented him from speaking.

This incident marked the second time a week that a Trump rally faced disruption, a notable concern as the campaign against Vice President Kamala Harris enters its final days, reported NBC News.

Recent polling suggests the race is tightly contested, making these missteps particularly impactful.

During the audio outage, Trump roamed the stage, interacting with technical staff and attendees, but refrained from mingling with the crowd. When the sound was restored, he did not hold back his frustration.

“I won’t pay the bill for this stupid company,” he declared, blaming the unnamed audio provider for the disruption, NBC News added.

He further threatened, “If it goes out again, I’ll sue the a– off that company.”

Also Read: Harris Clings To Narrow National Lead As Trump Gains Ground

Despite the setback, the rally continued for another hour. However, Trump struggled to shake off the initial audio problems, lamenting that he had to “scream” to make himself heard, even after the system was back up and running.

In a lighter moment, Trump jokingly expressed his desire for Michigan Republican Senate nominee Mike Rogers to join him on stage, but quipped that he didn’t want Rogers to speak from the “crappy” microphone. Ultimately, Rogers did not make an appearance alongside Trump.

As the campaign enters its final weeks, these audio failures serve as a reminder of the challenges faced on the trail, especially in such a crucial political landscape.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EF Hutton Announces Withdrawal of Lawsuits by Joseph Rallo and David Boral

NEW YORK, Oct. 20, 2024 (GLOBE NEWSWIRE) — EF Hutton LLC (“EF Hutton”) a relationship-driven investment bank focused on growth issuers and their investors, announces that Principals Joseph Rallo and David Boral have withdrawn their lawsuits.

Mr. Rallo and Mr. Boral have mutually decided to take their businesses in different directions, with Mr. Boral retaining the broker-dealer and its holding company and Mr. Rallo retaining the EF Hutton brand, name, and trademark. Any public statements they made about each other as they worked through the separation of their business should not be viewed as a reflection on Mr. Rallo or Mr. Boral. Both Mr. Rallo and Mr. Boral are pleased to put their dispute behind them and move forward with confidence that their new, separate business ventures will be successful.

About EF Hutton

EF Hutton LLC is an investment bank headquartered in New York, NY, which provides strategic advisory and financing solutions to middle market and emerging growth companies. EF Hutton has a proven track record of offering superior strategic advice to clients across the globe in any sector, with access to capital from the USA, Asia, Europe, UAE, and Latin America.

EF Hutton is a leader on Wall Street, having raised over $16 billion in capital across more than 275 transactions through various product types. Since 2022, by deal count, the firm has been #1 in US IPO issuance and #1 in SPAC issuance, per Bloomberg and SPAC Insider. EF Hutton is one of the most active investment banks in the middle of the market space. For more information, please visit efhutton.com.

EF Hutton Contact:

David W. Boral

Chief Executive Officer

590 Madison Avenue, 39th Floor

New York, NY 10022

info@efhutton.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Exactly How I Plan to Spend My Social Security Checks in Retirement

There’s no denying the United States’ Social Security program is on the defensive. Without any changes to how — or how well — it’s funded, experts anticipate a roughly 20% reduction to benefits sometime in the mid-2030s.

I’m still hopeful, however, and even if a cut to payouts is possible, I’m still planning on receiving most of my expected benefits in the future. In fact, I’m even budgeting for them.

This optimism raises an important question. What will my spending look like in retirement? Will my Social Security be enough to cover all my expenditures?

Here’s exactly how I plan to spend my Social Security checks in retirement. I’m willing to bet your budget will look rather similar.

Breaking down the average retiree’s spending

First things first: My Social Security benefits won’t be my only retirement income. I doubt it will even make up the majority of my income, presuming there are no major setbacks for the long-term growth of my retirement savings. My intended budget reflects both sources of future income the best I can predict them. It’s all going into the same pot, so to speak.

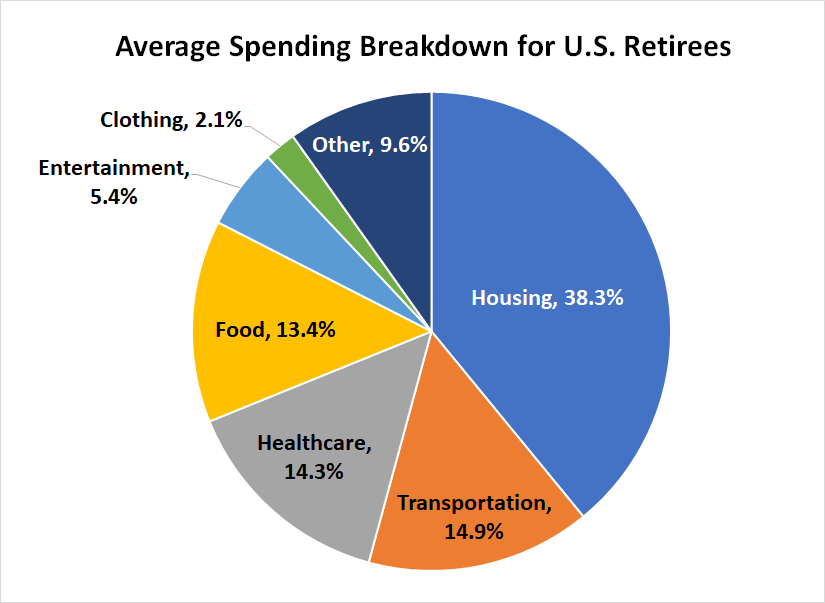

Regardless, whatever the future holds, I expect my budget’s percentage-based breakdown to be about average. This average is laid out in the graphic below.

For additional perspective, the U.S. Census Bureau reports the average U.S. retiree’s annual income stands right around $75,000, while the median is just under $48,000. This, of course, includes a combination of Social Security and income from Americans’ personal retirement savings. The Social Security Administration says its average payments are only putting a tad less than $23,000 in retirees’ pockets this year. Also, bear in mind these numbers are per-person figures. The average household income is at least slightly higher, reflecting the lifetime earnings and savings of two or more individuals.

These are just averages, though. Your actual spending may differ a little, or even a lot. For instance, although spending on clothing might be about the same regardless of how much retirement income you have access to, housing costs can vary widely. If you’ve been a lifelong renter rather than a home owner, you’ll likely continue paying rent in retirement with more of your income going to housing. If instead you purchased a home, it’s likely paid for by the time you enter your golden years. Although you’ll still owe taxes and pay for utilities, at least the mortgage is paid off.

Perhaps the most disappointing data nugget in the budgetary breakdown above, however, is how little the average retiree is spending on entertainment. People have worked hard to reach this stage in life where they have leisure time, but they’re putting little money towards it.

Help yourself

The thing is, you don’t have to be quite so budget-minded or stressed out about whether or not Social Security benefits will see cuts. The best thing you can do is take matters into your own hands by saving for retirement on your own, even if your efforts seem modest. With enough time, even a little bit of savings now can grow into a surprisingly sizable nest egg later.

Don’t believe it? A little number-crunching might change your mind.

Let’s say an investor can come up with an extra $300 per month to tuck away for retirement. Assuming it’s invested in the stock market and earning an average of 10% per year, their investments would be worth somewhere in the ballpark of $62,000. If you can up the monthly contribution to $500, that nest egg grows to more than $100,000. And if you can commit $500 per month for 20 years, the account swells to an incredible $380,000. Putting $500 into the market each month for 30 years will likely leave you with over $1.1 million. Earning a 4% yield on this amount of money would generate annual income of more than $40,000, nicely supplementing any other income you’re due in retirement.

There are tax considerations, of course, and you may not want to be wholly invested in the stock market as your retirement date approaches. Many people dial back their risk as they near retirement by transitioning to assets with more stability.

The key point here is that time is money, and a modest but consistent savings habit can go a long way when given enough time.

Just start somewhere, even if it’s small

Whatever you decide to do or change about your spending and savings plan, know this: While I’m counting on at least some Social Security income — and at the same time have every reason to believe my retirement spending budget will be quite typical — I also know that Social Security alone isn’t going to cut it. I have to keep saving on my own, and you should as well.

Of course, if you’re going to bother saving at all, you’ll also want to optimize your returns. For most, that means investing in the stock market.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Here’s Exactly How I Plan to Spend My Social Security Checks in Retirement was originally published by The Motley Fool

Prediction: These 3 Phenomenal Stocks Are Set to Soar

Peter Lynch, one of the greatest investors of all time, has said: “I can’t say enough about the fact that earnings are the key to success in investing in stocks. No matter what happens to the market, the earnings will determine the results.”

I believe this. Therefore, as a long-term investor, I try to watch earnings growth and predict where it will be in five years or so. The idea is that if earnings go up, the stock price eventually will as well. The ups and downs along the way are just noise.

However, I was recently reminded of just how patient investors have to be sometimes. Take Sprouts Farmers Market as an example. Its earnings per share (EPS) has consistently increased since it went public 11 years ago. But after going nowhere for 10 years, Sprouts’ stock has skyrocketed 200% in the past year, finally reflecting its long-term EPS growth.

Investors must stay patient because sometimes it can take time for earnings to lift a stock price higher. But sooner or later, they will be rewarded. Therefore, patience is needed for investors in Airbnb (NASDAQ: ABNB), PayPal Holdings (NASDAQ: PYPL), and PubMatic (NASDAQ: PUBM). But here’s why I believe earnings are headed higher for this trio of phenomenal stocks.

1. Airbnb

With over 125 million nights and experiences booked in the second quarter of 2024 alone, Airbnb is a well-known and well-adopted travel booking platform. Hosts list their spaces for rent as well as posting tailored travel experiences.

Travelers go to the platform to book, and Airbnb sits in the middle, quietly taking its high-margin cut of the deal.

Indeed, Airbnb’s business model is extremely lucrative. With its second-quarter profit margin of 20%, few companies can surpass its profitability. And from the perspective of free cash flow, things are even better with a 41% margin.

If there’s a knock against Airbnb, it’s that the platform is already large, and growth is consequently slowing: Second-quarter revenue was up only 11% year over year. That’s why management is turning its attention elsewhere.

The truth is, Airbnb’s core platform is rock solid — millions of people use it without prompting from advertising. This is allowing management to enter a “new phase.” It aims to launch multiple new businesses every year. Many will fail. But it hopes that a small percentage will succeed and contribute to the growth of the company.

Airbnb’s earnings are strong and should stay strong. And if this phenomenal stock can find new sources of growth, earnings could head higher in the coming years, lifting the stock price.

2. PayPal

Over the last 12 months, fintech pioneer PayPal has earned just over $4 per share. Four years ago, its earnings were about the same, meaning growth has been lacking. And investors can point fingers at its lack of earnings growth when explaining the lackluster stock price.

However, PayPal is already on a better path for earnings growth now. The company reworked its management about a year ago, and this new team is forging important new partnerships, margins are improving, and it’s looking to develop new ways to grow the business.

Regarding specifics, PayPal has long known it has valuable consumer data. And it seems like management is finally figuring out ways to package this to improve its services for merchants. More details would be nice. But one important detail is that the company hired Mark Grether earlier this year to head up its advertising business — the same Grether who quickly built a $1 billion ad business for Uber.

With margins improving under new management and with new potential revenue streams coming online, PayPal’s earnings should finally return to growth, which should in turn lift the stock in coming years.

3. PubMatic

Whereas Airbnb and PayPal are household names, PubMatic is far smaller and obscure. But I still feel comfortable calling it phenomenal. As I’ll explain, this little company dares to be different.

PubMatic’s market capitalization is only $750 million as of this writing. But this small company is determined to keep a clean balance sheet, with no debt and $166 million in cash, cash equivalents, and short-term investments as of the second quarter of 2024. That’s unusual for a company this small.

Moreover, PubMatic chooses to own and operate all of its hardware infrastructure as well, rather than rely on public cloud providers, where it can’t control pricing. That’s not necessarily an easy road to walk, but it does give it a greater degree of control over its business.

PubMatic is an advertising technology company that works with publishers to monetize content. It hasn’t been a great environment for these kinds of companies lately. But PubMatic is still modestly growing and running a profitable business. And it’s in great shape for earnings growth when its market eventually heats back up.

In coming years, it will be important for investors to not focus so much on the stock prices for Airbnb, PayPal, and PubMatic. As I pointed out with Sprouts stock, the price can stagnate for a really long time. But if earnings are growing and the business has the opportunity for more growth in the future, then these will be stocks to continue holding, while expecting prices to eventually catch up.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jon Quast has positions in Airbnb and PubMatic. The Motley Fool has positions in and recommends Airbnb, PayPal, PubMatic, and Uber Technologies. The Motley Fool recommends Sprouts Farmers Market and recommends the following options: short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Prediction: These 3 Phenomenal Stocks Are Set to Soar was originally published by The Motley Fool

Why I Just Swapped These 2 Well-Known Dividend Stocks

I enjoy investing in dividend stocks. I like to see the income flow into my portfolio. It gives me more money to reinvest into income-generating investments. That grows my passive income stream toward my ultimate goal of eventually reaching the level where it can offset my regular expenses.

I’ve hit a few speed bumps in achieving that goal over the years because companies I owned cut their dividends. One of those disappointing investments is 3M (NYSE: MMM). The industrial giant ended a streak of more than 60 straight years of dividend growth when it slashed its payment earlier this year. That cut led me to sell my stake. I used some of that cash to start a new position, adding Whirlpool (NYSE: WHR) to my income portfolio. Here’s why I made that switch.

Abdicating its throne

3M had been one of the most reliable dividend stocks around. Its more than a half-century history of dividend increases had it in the elite group of Dividend Kings. However, a series of issues forced the industrial giant to make some difficult decisions, including cutting its dividend.

A couple of the company’s products caused some very expensive legal issues. Ultimately, it agreed to pay about $18.5 billion to settle those claims. That’s a lot of money, even for a company as financially strong as 3M. As a result, the company has taken several steps to preserve its financial flexibility so that it can cover those payments and its other capital needs.

One of its moves was spinning off its healthcare unit to create Solventum. 3M loaded that entity with debt, which gave it more financial flexibility. However, the downside of the spinoff was that it removed a big chunk of 3M’s cash flow. As a result, the company reset its dividend following the spin, cutting it by about 50%.

3M’s dividend was a big reason why I initially invested in the company years ago. I was seeking a high-quality and steadily rising payout. While 3M delivered that steady growth for many years, its legal issues proved to be too much to maintain the payout any longer. With its dividend now a shell of its former self, I decided it was time to sell 3M. I also sold my shares in Solventum since that company has no plans to start paying a dividend anytime soon because it needs to pay down some of the debt 3M saddled it with before the spin.

This dividend stock hits close to home

I used some of the proceeds from my 3M/Solventum sale to buy shares of Whirlpool. The iconic appliance maker is a company that has been on my radar for a while, not just because it pays dividends. My wife and I recently bought a new home, and with that came the need to purchase some new appliances. Whirlpool makes many of the appliances that we’re looking to buy.

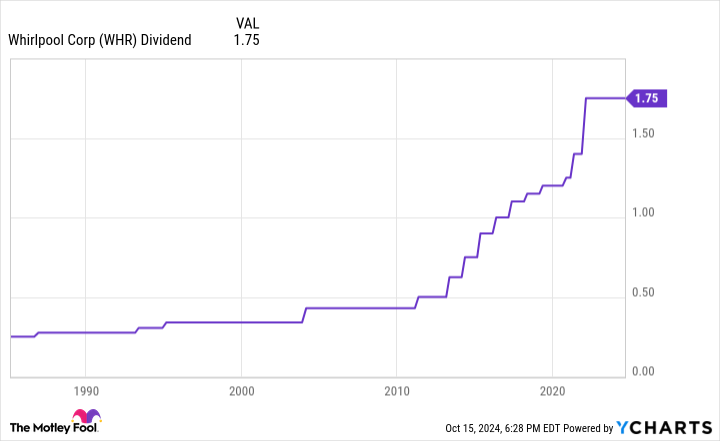

In researching appliances, I also started looking closer at the stock. I first noticed that it pays a pretty enticing dividend (it currently yields nearly 7%). The company has paid dividends for about 70 years. While it hasn’t increased its payment every year (it last raised its dividend in 2022), it has never cut its payout:

Now, as I learned from 3M (and others), a strong dividend history is no guarantee that the company will be able to achieve similar success in the future. However, Whirlpool is in a good position to maintain its dividend despite some current headwinds. Its dividend will cost it about $400 million this year, which it can easily cover with free cash flow (estimated to be about $500 million after capital expenses and other items). Whirlpool is looking to boost its free cash flow by selling off some of its international businesses, which, along with other initiatives, should reduce its global cost structure by $300 million-$400 million. It’s also working to reduce debt, which should cut interest expenses.

Meanwhile, the company expects the housing market to eventually recover as interest rates fall. That should drive higher sales as home sellers replace their appliances to appeal to more buyers or new homeowners buy new ones after moving in. I can vouch for this; my wife and I disliked the refrigerator at our new home (not a Whirlpool) so much that we’re buying a new one. That replacement cycle should boost Whirlpool’s sales and bottom line, putting its dividend on an even firmer foundation.

Spinning out lots of income

3M’s dividend cut was a huge disappointment, given its long history of steady growth. That’s why I recently sold my shares to make way for Whirlpool. The company pays a much higher-yielding dividend that it should be able to sustain through the current downcycle in the housing market. While it’s still facing some headwinds that will prevent it from increasing its payout in the near term, I think it will be a solid income stock over the long haul as it spins out cash into my account.

Should you invest $1,000 in 3M right now?

Before you buy stock in 3M, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and 3M wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Matt DiLallo has positions in Whirlpool. The Motley Fool recommends 3M, Solventum, and Whirlpool. The Motley Fool has a disclosure policy.

Why I Just Swapped These 2 Well-Known Dividend Stocks was originally published by The Motley Fool

Could Buying Rivian Automotive Stock Today Set You Up for Life?

Rivian Automotive (NASDAQ: RIVN) attracted a stampede of bulls with its IPO on Nov. 9, 2021. The electric vehicle (EV) maker went public at $78 per share, and its stock opened at $106.75 before touching a record high of $172.01 just a week later.

At that peak, Rivian’s market cap hit $153 billion, which was 92 times higher than the revenue it would generate in 2022. It briefly made the tiny EV maker more valuable than Ford or General Motors.

Rivian’s stock initially soared for three reasons: It was backed by Amazon and Ford, it was already producing thousands of EVs, and it went public at the apex of the meme stock craze. But today, Rivian shares trade for about $10, giving it a far humbler market cap of $10 billion. That’s less than 2 times the revenue it’s expected to generate next year.

The bulls fled as Rivian’s growth slowed, it racked up steep losses, and rising interest rates popped its bubbly valuations. Ford also ditched its plans to co-develop an electric pickup with Rivian in 2021 and liquidated most of its stake in the company in 2022. But could buying Rivian now while the market is shunning it set you up for massive gains in the future?

Why did Rivian disappoint its investors?

Rivian currently produces three models of vehicle: the R1T pickup, the R1S SUV, and a custom delivery van it sells to Amazon. Before its public debut, Rivian claimed it would produce 50,000 vehicles in 2022. Instead, it produced 24,337 vehicles, and only delivered 20,332. It blamed those disappointing numbers on supply chain constraints, the cooling growth of the EV market, and other macro headwinds across the industry.

In 2023, Rivian overcame those challenges to produce 57,232 EVs and deliver 50,122. Its growth accelerated as it resolved its supply chain problems and ramped up production of its in-house Enduro drive unit to cut costs.

But for 2024, Rivian only expects to produce between 47,000 and 49,000 vehicles. Once again, it blamed supply chain problems — but its problems were exacerbated by the temporary shutdown of its main plant in Illinois for upgrades in April, intense competition in the EV space, and higher interest rates. It expects its full-year deliveries to land between 50,500 and 52,000 EVs.

Can Rivian finally scale up its business?

Rivian’s revenue soared by 167% to $4.43 billion in 2023, but it only slightly narrowed its net loss from $6.75 billion to $5.43 billion. For 2024, analysts expect its revenue to rise by just 6% to $4.71 billion, but expect it to narrow its net loss to $4.88 billion. Those losses are steep, but Rivian still had $9.18 billion in total liquidity (including $7.87 billion in cash, cash equivalents, and short-term investments) on its books at the end of June.

Volkswagen also launched a new joint venture with Rivian in June to co-develop new EV architecture and software. As part of the deal, the German automaker plans to invest up to $5 billion in Rivian and the joint venture over the next two years. That fresh cash should provide Rivian the breathing room to bring its cheaper new R2 SUV to market in 2026, launch its higher-end R3 and R3X SUVs in 2026 and 2027, and continue to fulfill Amazon’s massive order for 100,000 electric delivery vans through 2030. It also plans to start selling some of those delivery vans to other customers over the next few years.

To support its expansion plans, Rivian recently applied for a federal loan, seeking funds to resume construction on a new $5 billion plant in Georgia that could eventually triple its annual production capacity. That roadmap sounds promising, but Rivian still needs to resolve its latest supply chain bottlenecks and prove that it can scale up its business.

Unfortunately, Rivian insiders have sold nearly 86 times as many shares as they bought over the past three months, so it might take a long time for it to stabilize its shaky business and convince the market that it deserves a higher valuation. On the bright side, Amazon is still holding its stake in Rivian and remains its top investor.

Could Rivian’s stock set you up for life?

Rivian’s low price-to-sales ratio could make it a tempting turnaround play for value-seeking investors. If it can scale up its business in the same way Tesla did over the past decade, it could be a millionaire-maker stock from here. However, Tesla established an early-mover advantage in the EV space, was aided by more generous government subsidies, and didn’t face as much direct competition during its expansion phase. It’s far too early to assume Rivian could replicate Tesla’s growth trajectory.

But with Rivian shares trading at these prices, the downside risk for new investors could be limited — and it could be a worthwhile investment for aggressive speculative investors looking for long-term gains. Rivian certainly has the potential to turn a modest investment into a major asset, but its stock could also easily be cut in half again (or worse) if the company can’t meaningfully ramp up EV production.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Leo Sun has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Tesla, and Volkswagen. The Motley Fool recommends General Motors and Volkswagen Ag and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Could Buying Rivian Automotive Stock Today Set You Up for Life? was originally published by The Motley Fool

Cuban Vs Ackman, Dalio's Advice To China, Krugman's Warning, And More: This Week In Economics

This week was a whirlwind of financial news, with billionaires clashing over political policies, renowned investors offering advice to world leaders, and economists warning against potential economic pitfalls. Let’s dive into the top stories that made headlines.

Mark Cuban And Bill Ackman Lock Horns Over Harris’ Tax Proposal

Mark Cuban and Bill Ackman found themselves at odds over Democratic presidential candidate Kamala Harris‘ tax proposal for startups. Ackman, a staunch supporter of Donald Trump, labeled Harris’ proposal as “extremely misleading,” sparking a heated exchange with Cuban.

Ray Dalio’s Strategy For China’s Debt Crisis

Billionaire investor Ray Dalio has urged China to adopt a “beautiful deleveraging” strategy to prevent a looming debt crisis. Dalio believes that China’s recent stimulus measures should be balanced with debt restructuring, money printing, and debt monetization.

Paul Krugman’s Warning On Trump’s Tariff Plan

Nobel laureate Paul Krugman has warned that former President Donald Trump’s proposed tariff plan could set back economic progress by 90 years and potentially ignite global conflict. Trump’s suggestion of tariffs as high as 20%, including a 60% tariff on imports from China, has been met with widespread opposition from economists.

Former FDIC Chief’s Warning To Federal Reserve

Former FDIC Chief Sheila Bair has expressed concern over the Federal Reserve’s potential rate cuts amidst a thriving economy. Despite positive economic indicators, the Federal Reserve, led by Chair Jerome Powell, is considering further rate cuts to stimulate a perceived cooling labor market.

Trump’s Potential Federal Reserve Pick Defends Rate Cuts

Kevin Hassett, Donald Trump’s potential nominee for the Federal Reserve, has defended the central bank’s recent interest rate reduction, despite Trump’s criticism. Hassett justified the rate cut, citing a weakening jobs market.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Ananya Gairola

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla, Boeing, UPS highlight earnings rush: What to know this week

Stocks secured their sixth straight week of wins on Friday as strong earnings from Netflix (NFLX) boosted the overall tech sector. The attention now turns to other Magnificent Seven names, with EV maker Tesla (TSLA) set to report quarterly results on Wednesday.

The Dow Jones Industrial Average (^DJI) led markets higher, up about 1% over the past week. The benchmark S&P 500 (^GSPC) and tech-heavy Nasdaq Composite (^IXIC) followed, each securing weekly gains of around 0.9% and 0.8% respectively.

Both the Dow Jones and S&P 500 reached all-time highs throughout the course of the week as well.

Meanwhile, the rotation out of megacap tech and into other areas of the market was on display this week as Utilities (XLU) ripped higher to end the five-day period up 3.4%, followed by Real Estate (XLRE) and Financials (XLF) with gains of 3% and 2.4%, respectively. Small caps also outpaced the major indexes, with the Russell 2000 (^RUT) finishing the week up around 2%.

The market moves come as investors have enjoyed a particularly strong start to earnings season, with Big Tech giants like Apple (AAPL) and Amazon (AMZN) still yet to report.

So far, 79% of S&P 500 companies have delivered a positive earnings surprise for Q3, which is above the overall five-year average of 77%, according to FactSet senior earnings analyst John Butters.

The earnings season party will continue this week, with reports from Tesla, Boeing (BA), General Motors (GM), American Airlines (AAL), and UPS (UPS) among names set to highlight a busy calendar.

Outside of earnings, investors will also be monitoring a slew of economic data, including the final reading of consumer sentiment from the University of Michigan due Friday. The Fed Beige Book, slated for Wednesday, will provide another pulse check on current economic conditions across the 12 Federal Reserve districts.

The housing market will also be top of mind after mortgage rates increased for the third consecutive week, with the 30-year fixed rate inching closer to 6.5%.

A weekly update on jobless claims is also on the schedule, as well as activity checks from the services and manufacturing sectors.

Can Tesla drive strong earnings growth?

Tesla is set to deliver quarterly earnings on Wednesday following the much-anticipated “We, Robot” event that took place on Oct. 10.

Wall Street analysts polled by Bloomberg expect the EV giant to deliver adjusted earnings per share of $0.60 on revenue of $25.42 billion. Global deliveries, which improved sequentially for the first time this year, along with a potential tick-up in automative gross margins, should help boost profits in the quarter.

However, investors remain on edge when it comes to the company’s future investments after last week’s robotaxi unveiling fell short of expectations.

In a note to clients following the event, Jefferies analysts called the $30,000 driverless robotaxi, dubbed the Cybercab, a “toothless taxi,” adding that Tesla has “ambitious targets” with “little evidence of feasibility.”

The new Cybercab, designed to be fully autonomous, has no steering wheel or pedals. Production is slated to begin “before 2027,” according to CEO Elon Musk, and will likely be a big talking point on the earnings call.

“Investors may seek details on the rollout of Tesla’s sub-$30,000 vehicle,” Bloomberg Intelligence analyst Steve Man wrote on Friday. “For high-volume sales, the automaker might need to include traditional features like a steering wheel and pedals in its Cybercabs.”

Tesla shares, which have seen volatile swings over the past few months, are down about 10% since the start of the year.

Consumer, labor checks

Retail sales for the month of September came in marginally above consensus expectations earlier last week, signaling that the US economy remains strong. But investors will have more data points to chew on, with the final reading of the University of Michigan’s consumer sentiment index due Friday.

For the final reading of October, sentiment is expected to tick up to 69.5 after the index’s preliminary reading unexpectedly fell for the first time in three months to 68.9 in September.

According to the University of Michigan, consumers have continued to express frustration over high prices despite moderating inflation data. This had offset more optimistic views of the jobs market, which remains a critical focus point for the Federal Reserve after it slashed interest rates by 50 basis points at its last meeting.

Markets are currently pricing in another 25 basis point cut in November, but Fed officials seem split on the path forward.

Earlier this week, San Francisco Federal Reserve president Mary Daly said one or two more rate cuts this year would still be a “reasonable thing to do” if inflation pressures continue to cool and the job market remains on solid footing.

“The work to achieve a soft landing is not fully done,” Daly said in her speech on Tuesday. “We are resolute to finish that job.”

But just one day prior, Federal Reserve governor Chris Waller said the central bank needs to be more cautious when it comes to rates, saying in a speech at Stanford University, “Data is signaling that the economy may not be slowing as much as desired.”

Another round of jobless claims, due Thursday, will be closely scrutinized after the number of people filing for unemployment benefits fell back to earth in the week ending Oct. 12.

US jobless claims fell by 19,000 to 241,000, but economists have warned the labor market could be skewed in the near term following the aftermath of both Hurricane Helene and Hurricane Milton in the Southeast regions, along with the labor strike at Boeing.

“Hurricanes Helene and Milton and the Boeing strike are starting to distort the economic data, but given the timing of those storms — with Helene making landfall September 26 and Milton on October 10 — the most significant impact on the data is still ahead of us,” Oxford Economics wrote in a note on Friday.

Weekly calendar

Monday:

Economic data: Leading Economic Index, September (-0.3% expected, -0.2% prior)

Earnings: SAP SE (SAP), Nucor Corporation (NUE), HBT Financial (HBT), Zions Bancorporation (ZION), Nucor Corporation

Tuesday:

Economic data: Philadelphia Fed Non-Manufacturing Index, October (-6.1 prior); Richmond Fed Manufacturing Index, October (-21 prior); Richmond Fed Business Conditions (-3 prior)

Earnings: General Motors (GM), 3M Company (MMM), RTX Corporation (RTX), Verizon Communications (VZ), GE Aerospace (GE), Lockheed Martin (LMT), Quest Diagnostics (DGX), Philip Morris (PM), Denny’s Corporation (DENN), Sherwin-Williams (SHW), Interpublic Group of Companies (IPG), Norfolk Southern Corporation (NSC), RTX Corporation (RTX), Texas Instruments (TXN), PulteGroup (PHM), Enphase Energy (ENPH)

Wednesday

Economic data: MBA Mortgage Applications, week ending Oct. 18 (-17.0% prior); Existing Home Sales, Sept. (3.88 million expected, 3.86 million prior); Federal Reserve Beige Book

Earnings: Tesla (TSLA), Boeing (BA), AT&T (T), IBM (IBM), Coca-Cola (KO), GE Verona (GEV), T-Mobile (TMUS), Las Vegas Sands (LVS), Hilton Worldwide Holdings (HLT), Whirlpool Corporation (WHR), Mattel (MAT), CME Group (CME), General Dynamics (GD), ServiceNow (NOW), Viking Therapeutics (VKTX)

Thursday

Economic data: Initial Jobless Claims, week ending Oct. 19 (240,000 expected, 241,000 prior); Continuing Claims, week ending Oct. 12 (1.87 million prior); S&P Global US Manufacturing PMI, October preliminary (47.5 expected, 47.3 prior); S&P Global US Services PMI, October preliminary (55.2 expected, 55.2 prior); New Home Sales, September (720,000 expected, 716,000 prior); Kansas City Fed Manufacturing Activity, October (-8 prior); Chicago Fed National Activity Index, September (0.12 prior)

Earnings: UPS (UPS), American Airlines (AAL), Southwest (LUV), Dexcom (DXCM), Deckers Outdoor Corporation (DECK), Sketchers (SKX), Coursera (COUR), Dow Inc. (DOW), Honeywell International (HON), Union Pacific Corporation (UNP), Hasbro (HAS), Northrop Grumman Corporation (NOC), Capital One (COF), Beyond, Inc. (BYON)

Friday

Economic data: Durable Goods Orders, September preliminary (-1.0% expected, 0.0% prior); Durables Ex-Transportation, September preliminary (-0.1% expected, 0.5% prior); University of Michigan Consumer Sentiment, October final (69.5 expected, 68.9 prior); Kansas City Fed Services Activity, October (-2 prior)

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.

What went wrong at CVS? Departing CEO Karen Lynch’s reign started brilliantly, then unraveled fast

Karen Lynch, a superstar CEO championing the biggest of big ideas, is out.

As chief of corner drug store and health insurance colossus CVS, Lynch headed the largest Fortune 500 enterprise, measured by sales, of any female CEO, and for years reigned as the most powerful woman in American business. In her first two years after being chosen for the top job in late 2020, Lynch seemed on the road to glory. By late 2022, she’d lifted CVS’s share price from $70 to roughly $110. Investors were buying her daring new strategy: Making CVS a one-stop shop for and basic care, right in their own neighborhoods, augmented by hands-on, data-driven management from their in-house insurer that reminded folks to refill prescriptions and get their annual physical.

Lynch pledged to “revolutionize healthcare as we know it” by repurposing thousands of CVS’s more than 9,000 stores into either fully-dedicated providers of such services as diabetic retinopathy and cholesterol screening, and mental health counseling, or hybrid retail and PC centers called HealthHUBs. CVS would then store tons of data on the patients’ condition at its Aetna insurance arm, whose costs would fall because seniors were getting preventive care that curbed heart disease and other chronic conditions that account for the bulk of our health care spending. Rival insurers would also reward CVS with part of the savings they achieved from the spread of primary care from far-away doctors’ offices requiring long waits, to the CVS just around the block, where you could also pick up your pills and buy shampoo and candy bars.

It was an intriguing vision that targeted our hugely expensive, largely consumer-unfriendly healthcare system. But Lynch couldn’t fully deliver on the paradigm that’s already starting to upend the current regime, and where CVS will continue playing a pivotal role going forward––one that will likely determine whether it rebounds from its current tailspin.

At press time, CVS hadn’t responded to a Fortune email requesting comment.

CVS underperforms already low expectations

On October 18, CVS disclosed that its heretofore weak financial performance was even worse the low expectations that already pushed big investors, including activist Glenview Capital, to demand changes in the C-suite. The board pre-announced that earnings for Q3 would prove far lower than both the company’s forecast, and Wall Street’s predictions. CVS posited EPS at $1.05 to $1.10, well below the FactSet consensus of $1.69. Accounting for most of the shortfall: Extremely tight margins in the health benefits business at Aetna, and especially in its giant Medicare Advantage franchise. CVS disclosed that its medal cost ratio of premiums to expenses had soared from an estimated 91% to over 95%. “That represents some combination of providing benefits that are too rich and underpricing premiums,” says Michael Ha of Robert W. Baird.

The same press release stated that Lynch “stepped down from her position in agreement with the company’s board of directors,” and will be replaced by David Joyner, a CVS veteran who’s been heading Caremark, the pharmacy benefits business.

Where Lynch’s transformation went awry

A trifecta of problems, some that started before she took the top job, ended a reign that appeared to start brilliantly, then unraveled fast. The first was CVS’s errors in vastly overpaying for acquisitions, a practice that piled on amounts of capital so huge that only magical performance could provide shareholders with decent returns going forward. In the years following its successful acquisition of Caremark in 2007, CVS was thriving. By late 2017, its shares had jumped around three-fold to $75. Then, it unveiled its acquisition of Aetna, where Lynch had risen to the position of heir apparent based on her skill in building the Medicare Advantage side.

CVS paid a gigantic $68 billion, or a 73% premium for Aetna. The day of the announcement, the two companies boasted a combined market cap of $128 billion. Proof that CVS hasn’t come close to generating the extra profits needed to cover that Brobdingnagian price: Its valuation now stands at just $76 billion, only slightly higher than what it paid for Aetna. The Aetna lesson didn’t deter Lynch and the board. In 2023, CVS made another hugely expensive deal, purchasing Oak Street Health, owner of over 200 centers in 25 states providing care for the elderly, this time laying out $10.5 billion, 30% or $2 billion more than the target’s cap prior to clinching the purchase. CVS made still another big bet by acquiring Signify, a health care analytics provider, for $8 billion. The Oak Street and Signify buys signaled that CVS was making desperate moves, adding big pieces to bolster the complex construct that Lynch conceived, but that wasn’t performing.

CVS became a revolving door at the top, and the vision proved overly complex

Lynch also kept changing her group of lieutenants at an alarming rate. It isn’t clear if she kept choosing the wrong people for the wrong roles, or was unable to get the talent she recruited to do their best work. From the spring of 2023 through this month, no fewer than seven C-suite stalwarts, all of whom she’d hired after officially taking charge in February of 2021, departed. The exodus encompassed the head of Aetna, who left after less than a year, the CFO (whose statement cited health reasons), the chiefs of HR, communications, healthcare delivery, and the retail stores. Two other longstanding CVS execs exited as well, the general counsel and chief marketing officer.

The third and final rub: The lofty, intricate blueprint proved beyond Lynch’s capacity to implement. It was her predecessor, Larry Merlo, who launched the initial phase via the purchase of Aetna, the first time ever that a huge insurer combined with a pharmacy chain. Lynch extended the framework through her plan for bringing primary care to America’s doorstep. Though the idea was a big one, CVS was getting a late start on the retail component, since Walgreens, Concentra and sundry others, including Oak Street, were invading what promised to become a gigantic market. Besides, the culture formed from running drugstores clashed with the mindset required to manage a major insurer, making it difficult to mate Aetna’s data troves with the folks CVS attempted to lure to its stores for primary care. The sudden drop in profitability for Aetna’s Medicare Advantage arm further undermined the ambition plan to meld the two businesses.

In the last couple of years, CVS has made scant mention of the original HeathHUBs concept. The focus now appears to be building out the well established Oak Street network. And according to Ha of Baird, it’s an excellent strategy. “That initiative will drive their growth for the next decade,” he says. “Oak Street-style, value-based care is still the future for CVS.”

The Pharmacy Division, the Health Services Division she set up, and the retail are doing well. Aetna’s margins collapsed as the Federal Government reduced their payments to Medicare Advantage. United and Cigna are both suffering too. That was unforeseen but it happened just as Aetna increased its Medicare rolls by 300,000 seniors. That was either unlucky or an unforced error. This extremely personable, charismatic leader deserves great credit for developing and superbly articulating a vision. It may even turn out that Lynch just needed more time. But that was a luxury that was, at least for CVS, out of stock.

This story was originally featured on Fortune.com

Prediction: Nvidia Could Be Headed to $175 in 2025

Bloomberg recently reported the U.S. could impose caps on exports of advanced artificial intelligence (AI) chips to some Middle Eastern countries. Semiconductor fabrication equipment maker ASML lowered its 2025 guidance. Both were widely viewed as bad news for Nvidia (NASDAQ: NVDA).

Is Nvidia’s huge multiyear run nearly over? I don’t think so. Instead, I predict that Nvidia’s share price could be headed to $175 in 2025.

Why a 30% gain is achievable

Nvidia’s stock would have to jump 30% to reach $175 next year. I believe this gain is achievable for three key reasons.

First, the shift to accelerated computing appears to be unstoppable. This trend should easily offset any negative impact on Nvidia from restrictions on shipping advanced AI chips to some Middle Eastern countries. During the first half of 2024, only 6.5% of the company’s total revenue came from countries other than the U.S., Singapore, Taiwan, and China. Middle Eastern revenue is only a portion of that percentage.

But what about ASML’s weaker outlook? I suspect it’s more related to overcapacity at factories that manufacture chips than anything else. Just because the demand for chipmaking equipment declines doesn’t necessarily mean that the demand for chips will fall, too.

Second, Blackwell is coming. Nvidia CEO Jensen Huang told CNBC the demand for its new GPU platform is “insane.” Morgan Stanley learned in a meeting with Nvidia’s management that Blackwell GPUs are already sold out for the next 12 months.

Huang has said in the past that Blackwell could be the most successful product in Nvidia’s history. I think he could be right. As Nvidia begins to report sales numbers for Blackwell in the next few quarters, I expect the stock to rise.

Third, look for Nvidia to announce its next generation of AI chips sometime next year. Even if the company doesn’t begin shipping these chips until the end of 2025 (or even early 2026), investors’ excitement about the next big GPU advance could provide a catalyst for the stock.

Many on Wall Street don’t agree (yet)

Granted, many Wall Street analysts aren’t nearly as bullish. The average 12-month price target reflects an upside potential for Nvidia of around 10%.

Of the 38 analysts surveyed by financial data provider LSEG in October, 15 rated Nvidia as a “hold.” Another recommended selling the stock. That’s a marked change from September, when 55 of 60 analysts rated Nvidia as a “buy” or a “strong buy.”

However, I’ve noticed a pattern with Wall Street recommendations and price targets for Nvidia. The consensus tends to be modestly optimistic until the company reports its next quarterly results. Then, analysts frantically scramble to revise their estimates upward.

I fully expect that history will repeat itself as we move into 2025. As Nvidia reveals its sales figures for Blackwell, my hunch is that the average price target for the stock will increase significantly — and perhaps to my predicted level of $175.

What could go wrong?

Of course, my prediction could fall flat on its face. What could go wrong? Several things.

The U.S. economy could run into trouble. An escalation of tensions around the world could negatively impact Nvidia’s business. Major cloud service providers could choose to scale back their investments in GPUs. They could also shift some of their spending to buy chips from Nvidia’s rivals or rely more heavily on their own AI chips.

While I acknowledge these risks, I stand by my prediction. Nvidia’s share price could reach $175 next year. How long it stays at or above that level, though, is another question.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Nvidia. The Motley Fool has a disclosure policy.

Prediction: Nvidia Could Be Headed to $175 in 2025 was originally published by The Motley Fool