Warren Buffett Dumps Nearly $10 Billion of 1 Key Stock and Buys $345 Million of His Favorite Stock. Here's What You Need to Know.

The “Oracle of Omaha” didn’t get that name for his lack of foresight. Warren Buffett‘s ability to read the tea leaves, as it were, has made him a very rich man over his 60-year career. So when the billionaire investor makes substantive changes in his company’s key holdings, people pay attention. Why, then, is Buffett scaling back one of Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) central investments?

The firm’s latest shedding of Bank of America stock brings the total sold to nearly $10 billion in just a few months — almost a quarter of its original stake. In turn, Berkshire bought $345 million of a Buffett favorite. Why?

The latest sale is particularly interesting

The Securities and Exchange Commission (SEC) requires large shareholders — investors owning more than 10% of a company’s stock — to report any trade within two business days. After the last sale of almost 10 million shares, Berkshire now owns just shy of 10% of the bank and no longer has to report transactions in a timely manner. Now, any transactions will be reported quarterly on the company’s 13-F filing.

That means any future sales will happen out of the public eye until months later. Although this could make it easier for Berkshire to further reduce its stake without spooking the market, it doesn’t necessarily mean that is what’s happening here. Still, it’s an important factor to keep in mind.

Buffett and Berkshire have done well with Bank of America

Buffett helped Bank of America recover from the 2008 financial crisis, infusing the struggling bank with $5 billion in exchange for preferred stock and warrants to buy an additional 700 million shares at just over $7 per share before 2021. He exercised the warrant in 2017 when the stock was trading above $24. Although he didn’t sell the shares, he netted an on-paper profit of $12 billion in just six years. Over the course of their relationship, Berkshire has turned a total $20 billion investment into more than $40 billion — not bad.

Given the incredible return on his money and the fact that capital gains and corporate taxes are in a favorable place — one that could change under a new administration — a plausible explanation for Buffett’s selling streak is that he’s simply happy with his investment’s performance. He may want to lock in that profit before his company might have to pay more in taxes to Uncle Sam.

Given Buffett’s comments, more could be at play

I think there is truth to this, but it’s not the whole picture. From comments he’s made in the past year or so, it seems clear that Buffett is at least somewhat uneasy with the state of things. In his 2023 shareholder letter, he talked of Wall Street loving “feverish activity” and described the current market as more “casino-like” than in the past, warning that while panics don’t happen often, “they will happen.” This was before the huge stock-market run thus far in 2024. Since Buffett made these comments, the S&P 500 is up about 23%, and by many metrics, the stock market is at one of its highest valuations ever.

I think Buffett’s concern is more specific here, however — it’s not just the market as a whole. There are some reasons to be concerned about the banking sector, and about Bank of America specifically. In the years before 2022, banks bought a large number of debt securities that are now a drain on income.

They bought them when interest rates were low, which meant they had relatively low yields. This would have been fine had things continued as usual, but as we know, rates didn’t stay low. Between 2022 and 2023, the Federal Reserve raised rates rapidly. Although this helped curb inflation, it meant the banks took a loss on these securities. Why? The yields on these securities are fixed. They don’t rise as rates rise, but the rates the banks have to pay depositors do. That means banks are stuck with a large number of securities that pay less to the bank than what the bank must pay to depositors, reducing net interest income — a key metric in the banking sector.

Additionally, the fair value of these securities — that is, what the bank could get for them in a sale — is now less than what they paid, representing an unrecognized paper loss. Of all the major commercial banks, which do you think took on the largest number of these? Yup, Bank of America.

Now, this is only a real issue if things turn south and the bank is forced to sell these securities and realize the loss. If that were to happen, it could affect its ability to remain solvent. This would be a pretty extreme situation and is not likely to happen, but it’s not impossible. Given Warren Buffett’s philosophy and temperament, it would make sense that this would concern him. After all, in the same 2023 shareholder letter, Buffett made it clear that given a black swan event, Berkshire would not be among those who “ignited the conflagration.” Rather, it would be an “asset to the country” as it was in 2008 and “help extinguish the financial fire.”

Buffett keeps buying one stock consistently

Warren Buffett’s favorite stock is his own. Berkshire has now repurchased $3 billion of its own shares this year alone after the most recent purchase. It’s the primary way the company rewards shareholders, since Berkshire offers no dividend. It’s also in line with Buffett’s attempt to keep Berkshire healthy and in a prime position to weather a potential financial storm.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Dumps Nearly $10 Billion of 1 Key Stock and Buys $345 Million of His Favorite Stock. Here’s What You Need to Know. was originally published by The Motley Fool

40+ Daytona Beach Residential Portfolio Hits Market Through Hilco Real Estate Sales

NORTHBROOK, Ill., Oct. 18, 2024 /PRNewswire/ — Hilco Real Estate Sales (HRE) announces November 19, 2024, as the start date of the auction for the portfolio of over 40 residential properties and development lots across Daytona Beach, Florida. The auction will conclude on November 21, 2024.

The portfolio consists of 44 prime sites: 23 single-family homes, nine multifamily complexes and eight land parcels, three mixed-use properties and one residential condominium. These are strategically located in highly desirable neighborhoods and towns such as Seabreeze Historic District, Surfside Historic District, Daytona Beach Shores and Port Orange. About 40% of the properties are tenant-occupied and can continue to generate rental income. With Daytona Beach being a popular tourist destination, several of these properties also present excellent opportunities for short-term rentals, appealing to vacationers and those looking for temporary stays.

The portfolio also includes two redevelopment assemblages. The first comprises of 10 properties that span an entire block, providing opportunity for a high-density multifamily development. The other assemblage features three adjacent land parcels that can accommodate single family homes or a larger fourplex structure. All the sites offer the potential to build custom beachside homes or enhance existing structures. With proximity to the Atlantic Ocean, recreational areas and Daytona’s lively entertainment scene, these residences and land parcels stand out as attractive prospects for investors and developers alike.

Long known as a tourist destination through its spring break and motorsports culture as well as hard-packed white sand beaches, Daytona Beach is rapidly transforming into a popular residential area. The city offers affordable coastal living, a year-round mild climate as well as a robust local economy driven by tourism, healthcare and education. Attracting retirees, young professionals and families, Daytona Beach has ranked fourth among the Fastest-Growing Places in the U.S. for 2024-2025 by U.S. News, with a population migration growth rate of 4.92%. This influx of new residents is driving increased demand for housing and development, making this portfolio particularly timely.

Jonathan Cuticelli, vice president at Hilco Real Estate Sales, said, “These residential sites offer a truly unique opportunity to invest in one of Florida’s most iconic and rapidly growing coastal cities. With Daytona Beach experiencing substantial growth, particularly in sought-after historic districts and waterfront neighborhoods, investors and developers alike can take advantage of these locations for either rental income, high-end residential development or someone looking for a new home.”

Individual bids are not required before the auction date for those interested in single properties. However, for those wishing to submit a bulk bid for multiple properties, these bids must be submitted to Hilco Real Estate Sales by November 13, 2024, at 5:00 p.m. (ET) ahead of the virtual auction beginning on November 19, 2024.

The sale is being conducted in cooperation with Jiovanny Restrepo PLLC, Florida Broker License #3105916. Bidders must agree to the Terms of Sale and the Florida Form Purchase Agreement, which includes an addendum for an “as-is, where-is” basis. A $5,000 deposit per property is required, with a maximum of five properties per bidder. A buyer’s seminar will be held on November 13, 2024, at 3:00 p.m. (ET) for those seeking more information about the bidding process and the online auction site.

Interested bidders should review the requirements to participate in the auction sale process available on Hilco Real Estate Sale’s website. For further information, please contact Jonthan Cuticelli at (203) 561-8737 | jcuticelli@hilcoglobal.com or Jiovanny Restrepo at (847) 386-2282 | jrestrepo@hilcoglobal.com.

For further information on the property, sale process and terms or to obtain access to due diligence documents, please visit HilcoRealEstateSales.com or call (855) 755-2300.

About Hilco Real Estate Sales

Successfully positioning the real estate holdings within a company’s portfolio is a material component of establishing and maintaining a strong financial foundation for long-term success. At Hilco Real Estate Sales (HRE), a Hilco Global company (HilcoGlobal.com), we advise and execute strategies to assist clients seeking to optimize their real estate assets, improve cash flow, maximize asset value and minimize liabilities and portfolio risk. We help clients traverse complex transactions and transitions, coordinating with internal and external networks and constituents to navigate ever-challenging market environments.

The trusted, full-service HRE team has secured billions in value for hundreds of clients over 20+ years. We are deeply experienced in complex transactions including artful lease renegotiation, multi-faceted sales structures, strategic asset management and capital optimization. We understand the legal, financial and real estate components of the process, all of which are vital to a successful outcome. HRE can help identify the most viable options and direction for a company and its real estate portfolio, delivering impressive results in every situation.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/40-daytona-beach-residential-portfolio-hits-market-through-hilco-real-estate-sales-302280528.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/40-daytona-beach-residential-portfolio-hits-market-through-hilco-real-estate-sales-302280528.html

SOURCE Hilco Real Estate

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fuji Soft Sticks With KKR Despite Higher Takeover Offer From Bain

(Bloomberg) — Fuji Soft Inc. is standing by KKR & Co.’s tender for its shares despite receiving a higher bid from Bain Capital that’s won the support of the Japanese software developer’s founder.

Most Read from Bloomberg

The Yokohama-based company held a board meeting on Friday and decided to recommend its shareholders accept the first phase of KKR’s tender offer through Monday, the firm said in a statement dated Oct. 18.

Bain last week offered ¥9,450 ($63) a share for the company, compared with KKR’s ¥8,800 proposal, and said it would start its tender bid in late October if Fuji Soft expresses support for the move. Fuji Soft will continue to consider Bain’s “sincere” proposal, and the firm will release opinions on it at the start of the tender offer, according to the statement.

“We are pleased to have Fuji Soft’s continued support for our tender offer, and their recommendation to tender into it,” a KKR spokesperson said Friday evening by email.

Fuji Soft founder Hiroshi Nozawa said he supports Bain’s offer and that its approach aligned with the company’s, according to a letter obtained by Bloomberg. Nozawa said he hoped KKR will tender its shares if it acquires them from major shareholders including 3D Investment Partners Pte and Farallon Capital Management. The two shareholders had agreed to sell their stakes to KKR in a binding pact that ensured KKR at least 32.68% of Fuji Soft.

The special committee advising Fuji Soft on the tender offer said it would be difficult for Bain to achieve its goal of taking the company private, according to the statement. The committee added that there are concerns of not reaching a consensus among major shareholders if Bain were to carry out the tender offer, the release showed.

KKR had split its takeover into two stages, after it moved up the start of its tender to Sept. 5, following a non-binding proposal from Bain.

A weaker yen and regulators’ promotion of shareholder value are fueling M&A activity in Japan. Fuji Soft had earlier said it agreed to a buyout by KKR, even though it had received a higher-priced non-binding offer from Bain, because it judged KKR’s offer was more certain to occur.

Fuji Soft contracts software from Fujitsu Ltd., a supplier of computer systems for some of Japan’s biggest banks such as Mizuho Financial Group Inc. and government agencies. The software company’s been fielding demands from Singapore-based 3D Investment Partners, its largest shareholder according to Bloomberg-compiled data, to consider steps such as taking the company private.

–With assistance from Taro Fuse.

(Updates the story throughout with a statement from Fuji Soft.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The World’s $100 Trillion Fiscal Timebomb Keeps Ticking

(Bloomberg) — Even before global finance chiefs fly into Washington over the next few days, they’ve been urged in advance by the International Monetary Fund to tighten their belts.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen

Two weeks ahead of a potentially era-defining US election, and with the world’s recent inflation crisis barely behind it, ministers and central bankers gathering in the nation’s capital face intensifying calls to get their fiscal houses in order while they still can.

The fund, whose annual meetings begin there on Monday, has already pointed to some of the themes it hopes to press home with a barrage of projections and studies on the global economy in coming days.

The IMF’s Fiscal Monitor on Wednesday will feature a warning that public debt levels are set to reach $100 trillion this year, driven by China and the US. Managing Director Kristalina Georgieva, in a speech on Thursday, stressed how that mountain of borrowing is weighing on the world.

“Our forecasts point to an unforgiving combination of low growth and high debt — a difficult future,” she said. “Governments must work to reduce debt and rebuild buffers for the next shock — which will surely come, and maybe sooner than we expect.”

Some finance ministers may get further reminders even before the week is over.

UK Chancellor of the Exchequer Rachel Reeves has already faced an IMF warning of the risk of a market backlash if debt doesn’t stabilize. Tuesday marks the last release of public finance data before her Oct. 30 budget.

The UK tax office is taking a tougher approach to clawing back debts, insolvency specialists say, a bid to squeeze £5 billion ($6.5 billion) in extra revenue.

What Bloomberg Economics Says:

“For all the talk of black holes, the overall effect of Reeves budget will be a policy that’s looser, not tighter, relative to the previous government’s plans.”

—Ana Andrade and Dan Hanson, economists. For full analysis, click here

Meanwhile, Moody’s Ratings has slated Friday for a possible report on France, which faces intense investor scrutiny at present. With its assessment one step higher than major competitors, markets will watch for any cut in the outlook.

As for the biggest borrowers of all, the glimpse of the IMF’s report already published contains a grim admonishment: your public finances are everyone’s problem.

“Elevated debt levels and uncertainty surrounding fiscal policy in systemically important countries, such as China and the United States, can generate significant spillovers in the form of higher borrowing costs and debt-related risks in other economies,” the fund said.

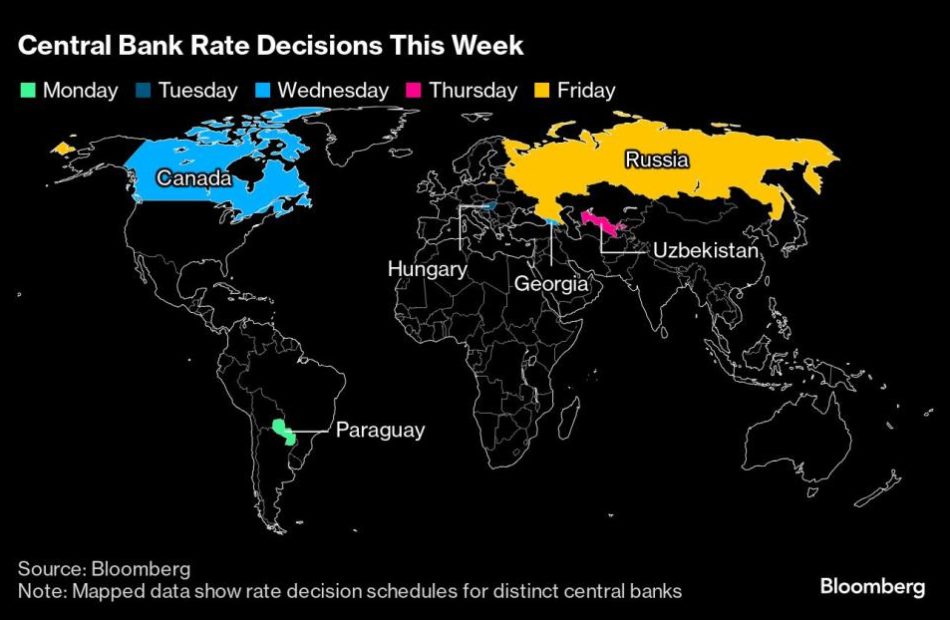

Elsewhere in the coming week, a rate cut in Canada and a hike in Russia are among the possible central bank moves anticipated by economists.

US and Canada

Economists see a pair of home sales reports showing that declining mortgage rates are merely helping to stabilize the US residential real estate market. On Wednesday, the National Association of Realtors will issue data on contract closings for previously owned homes, followed a day later by government figures on sales of new homes.

Economists project modest increases in September sales of both existing and new homes. Resales remain hamstrung by limited inventory that’s keeping asking prices elevated and hurting affordability. While purchases of previously owned properties remain near the weakest pace since 2010, builders have capitalized: New-home sales have gradually picked up over the past two years with the help of incentives.

Other US data in the coming week include September durable goods orders, plus capital goods shipments that will help economists fine-tune their estimates of third-quarter economic growth. The Federal Reserve also issues its Beige Book, an anecdotal readout of the economy.

Regional Fed officials speaking in the coming week include Jeffrey Schmid, Mary Daly and Lorie Logan.

Meanwhile, the Bank of Canada is increasingly expected to cut rates by 50 basis points after inflation cooled to 1.6% in September and some measures of the labor market remain weak.

Europe, Middle East, Africa

As with other regions, attention will largely be focused on Washington; more than a dozen appearances of European Central Bank’s Governing Council members are scheduled stateside.

That includes President Christine Lagarde, who’ll be interviewed by Bloomberg Television’s Francine Lacqua in Washington on Tuesday.

Similarly, Bank of England Governor Andrew Bailey will speak in New York on Tuesday, while Swiss National Bank President Martin Schlegel is scheduled to appear on Friday.

Among euro-area economic reports, consumer confidence on Wednesday, purchasing manager indexes the following day, and the ECB’s inflation expectations survey on Friday may be the highlights. Similarly, Germany’s Ifo Institute will release its closely watched business confidence gauge at the end of the week.

Aside from the possible rating assessment on France, S&P may also release reports on Belgium and Finland on Friday.

Turning east, two central bank decisions are likely to draw attention, starting on Tuesday with Hungary, which may keep borrowing costs unchanged.

The Bank of Russia has signaled that continued inflationary pressures could lead to another rate hike on Friday. They lifted it 100 basis points to 19% in September, and a similar move would return the rate to the 20% level imposed in an emergency increase after President Vladimir Putin began the February 2022 full-scale invasion of Ukraine.

Finally, data on Wednesday from South Africa is expected to show inflation slowed to 3.8% in September, boosting the chances of another rate cut next month. The central bank said it now forecasts consumer-price growth to stay in the bottom half of its 3% to 6% target band over the next three quarters.

Asia

Lenders in China, with a nudge from the People’s Bank of China, are expected to join the campaign to revive business activity by trimming their loan prime rates on Monday. The 1-year and 5-year rates are seen sliding by 20 basis points to 3.15% and 3.65%, respectively.

At the end of the week, data will show if the nation’s industrial profits bounced back in September after slumping more than 17% in August. The most recent numbers showed the economy expanding at the lowest pace in six quarters during that three-month period.

Elsewhere, the region gets a cluster of PMIs on Thursday, including from Japan, Australia and India.

Singapore is forecast to report Wednesday that consumer inflation slowed in September, with price growth updates for that month also due from Hong Kong and Malaysia.

On Friday, Japan will report Tokyo CPI for October, a key indicator that will capture corporate price changes at the start of the fiscal second half.

South Korea will release third-quarter growth figures on Wednesday that may show the economy’s momentum has slowed marginally.

During the week, South Korea releases early trade statistics for October, with Taiwan and New Zealand releasing trade numbers for September.

Among the region’s central banks, many leading officials will attend the IMF meetings in Washington. Reserve Bank of Australia Deputy Governor Andrew Hauser holds a fireside chat on Monday, and three days later the bank publishes its annual report.

Reserve Bank of New Zealand chief Adrian Orr speaks on policy on the sidelines of the IMF confab, and Uzbekistan’s central bank will decide Thursday whether to pause for a second meeting following its July rate cut.

Latin America

Brazil watchers will be keen to see the weekly forecasts in the central bank’s so-called Focus survey due on Monday.

Expectations for inflation, borrowing costs and debt metrics have lately taken a decidedly gloomy turn given doubts about the government’s fiscal discipline.

In Mexico, GDP proxy data should be consistent with the loss of momentum that has many economists marking down their third-quarter growth forecasts. The economy is expected to slow for a third year in 2024.

GDP proxy data for Argentina will probably show South America’s second-biggest economy sputtering and still in the grip of a recession that’s likely to extend into 2025.

Paraguay’s central bank holds its rate setting meeting; policymakers have kept borrowing costs at 6% for the past six months with inflation running slightly above the 4% target.

On the prices front, neither investors nor policymakers will be cheered by mid-month inflation reports from Brazil and Mexico given the early consensus for higher headline readings.

The data here will likely do nothing to dent the prospects of Brazil’s central bank tightening policy again on Nov. 6, while at the same time giving Banxico pause about a third straight cut at its Nov. 14 gathering.

—With assistance from Laura Dhillon Kane, Brian Fowler, Robert Jameson, Monique Vanek, Vince Golle, Brendan Scott and William Horobin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Is gold safer than U.S. Treasury bonds as federal debt keeps soaring?

Backed by the full faith and credit of the federal government, U.S. Treasuries bonds have long been viewed as the gold standard in safe investments.

In times of uncertainty, economic downturns, or full-blown crises, investors have flocked to Treasuries as a haven. But what if actual gold is the new gold standard for a safe investment?

Analysts at Bank of America asked that question in a note on Wednesday, explaining that the outlook for U.S. debt is bullish for the precious metal.

With debt as a share of GDP set to break record highs in the coming years, the Treasury Department has to sell more and more bonds to investors, who may demand higher yields. And when yields rise, the price of bonds on the secondary market falls.

That has helped weaken the historic correlation between bond yields and gold prices. While lower rates are still bullish for gold, which doesn’t pay interest or dividends, higher rates don’t necessarily put pressure on bullion anymore, BofA said, maintaining a gold price target of $3,000 per ounce.

“Indeed, with lingering concerns over US funding needs and their impact on the US Treasury market, the yellow metal may become the ultimate perceived safe haven asset,” analysts wrote.

Gold has been on a tear recently, with prices up more than 30% so far this year, topping $2,700 per ounce for the first time ever this past week.

That’s even as bond yields have rebounded since the Federal Reserve’s first rate cut last month, while fresh budget data showed that the deficit was $1.8 trillion for the fiscal year that ended on Sept. 30. Meanwhile, the interest expense alone on U.S. debt was $950 billion, more than defense spending and up 35% from the prior due mostly to higher rates.

There is no relief in sight as the deficit will expand under either Donald Trump or Kamala Harris, though less so under the Democrat, according to the Penn Wharton Budget Model and the Committee for a Responsible Federal Budget.

“Indeed, rising funding needs, debt servicing costs and concerns over the sustainability of fiscal policy may well mean that gold prices could increase, if rates move up,” BofA said.

With the supply of U.S. debt poised to continue surging, concerns have grown about demand and whether investors will keep absorbing more Treasury bonds.

That provides a strong incentive to central banks around the world keep diversifying their reserves away from U.S. debt and toward gold, BofA added.

To be sure, the U.S. isn’t the only country overflowing with red ink. But its soaring debt and deficits have been notable as they come during a strong economy and not while fighting a world war or some other calamity like a pandemic.

Meanwhile, spending will likely go up as climate change, older demographics, and military needs add more pressure on budgets.

So is gold a safer investment than Treasuries?

“Ultimately, something has to give: if markets become reluctant to absorb all the debt and volatility increases, gold may be the last perceived safe haven asset standing,” BofA said.

This story was originally featured on Fortune.com

Boeing exploring asset sales to boost finances, WSJ reports

(Reuters) -Boeing is exploring asset sales in a bid to boost its fragile finances by shedding its non-core or underperforming units, the Wall Street Journal reported on Sunday.

The planemaker last week reached an agreement to offload a small defense unit that makes surveillance equipment for the U.S. military, the paper reported, citing people familiar with the deal.

Boeing has lurched from crisis to crisis this year, ever since Jan. 5 when a door panel blew off a 737 MAX jet in mid-air. Since then, its CEO has departed, its production has been slowed as regulators investigate its safety culture, and in September, 33,000 union workers went on strike.

The Journal reported that in recent financial-performance meetings, new CEO Kelly Ortberg asked the heads of the company’s units to lay out the value of those units to the company.

Boeing’s board recently met to discuss the next steps for the company, where directors questioned division heads and combed through reports to examine the state of each unit, the report said.

Boeing declined to comment on the report.

Striking machinists at the planemaker are set to vote Wednesday on a new contract proposal that includes a 35% pay hike over four years.

The work stoppage has halted production of the planemaker’s best-selling 737 MAX and its 767 and 777 widebodies, putting added pressure on its already weak finances.

Earlier this month, Boeing announced it would cut 17,000 jobs, or 10% of its global staff, and take $5 billion in charges.

(Reporting by Shivani Tanna in Bengaluru; Editing by Hugh Lawson)

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2030.

There’s been a noteworthy shift over the past couple of decades that has seen technology companies ascend the ranks of the world’s most valuable companies. Twenty years ago, industrial and energy bellwethers General Electric and ExxonMobil reigned supreme when measured by market cap, valued at $319 billion and $283 billion, respectively. Now, just two decades later, some of the best-known names in technology are tops.

Leading the charge are three of the most familiar companies in the world today. All are leaders in the field of technology and need no introduction. Apple currently tops the list at $3.5 trillion, with its stock recently hitting new all-time highs. Nvidia also notched a new record high this week, moving ahead of Microsoft, as the two now boast market values of $3.4 trillion and $3 trillion, respectively.

With a market cap of $1.4 trillion, it might seem presumptuous to suggest that Meta Platforms (NASDAQ: META) has all the makings of a $3 trillion club member. However, the stock has been on a roll, gaining 80% over the past year and 694% over the past 10 years (as of this writing), and its winning streak appears poised to continue.

The consistent growth of the company’s social media platform, ongoing strength in digital advertising, and brilliant strategy for leveraging artificial intelligence (AI) should combine to help Meta take its place in this exclusive society.

A rebound for the ages

There’s no denying that Meta Platforms suffered during the economic slump. Yet the mark of a resilient business is the ability to bounce back, and the evidence of that rebound is undeniable. In the second quarter, Meta delivered revenue that rose 22% year over year to $39 billion, fueling diluted earnings per share (EPS) that surged 73% to $5.16.

Fueling its success is the company’s reliable user growth, as those who stopped by one of Meta’s family of social media platforms — which includes Facebook, Instagram, Threads, Messenger, and WhatsApp — increased 7% year over year to 3.27 billion.

These billions of daily users form the captive audience for its digital advertising, an industry that rebounded sharply since the economic downturn. Meta is part of a duopoly in the online marketing space. Alphabet‘s Google captured an estimated 39% of the worldwide digital advertising market, with Meta taking up the second spot with 18%, according to data compiled by business intelligence platform Statista.

Its online marketing is inextricably woven into the fabric of its social media empire, helping drive Meta’s ongoing success.

Multiple ways to win

Global advertising is expected to increase by roughly 8% and reach more than $1 trillion this year, according to ad industry researcher WARC Media. Social media is forecasted to be the fastest-growing segment in digital advertising, growing to 22% of total ad spending, according to the data. Meta figures prominently in the report, which says Meta is “on course to record oversized gains in the coming months.” As one of the biggest players in the adtech industry, Meta will benefit from the ongoing rebound.

Advertising aside, Meta has made a number of strategically important moves to profit from the accelerating adoption of artificial intelligence (AI). With billions of daily social media visitors, the company mined its vast treasure trove of data to create a suite of top-tier language models, which form the foundation for generative AI.

The fruit of those labors is LLaMA (Large Language Model Meta AI), the AI system that fuels its Meta AI chatbot. The latest version — LLaMA 3 — is “one of the world’s leading AI assistants,” according to the company. By making LLaMA open source, Meta is hoping to boost adoption, which will lead to even more data to leverage. While Meta AI is free to individual users, the company charges enterprises and cloud infrastructure providers, which peddle it on their cloud platforms.

While AI makes all the headlines, there are other potential ways for Meta to win. The company has invested heavily in Meta’s Reality Labs, which housed its Oculus virtual reality (VR) business, Quest VR headsets, and its ambitions for the metaverse. While these are little more than sidelines at this point, CEO Mark Zuckerberg believes these will be key to Meta’s future growth and, eventually, its bottom line.

With the trifecta of a recovery in digital advertising, the opportunity represented by generative AI, and its other initiatives, it isn’t hard to envision a path for Meta Platforms to make its way into the $3 trillion club.

The path to $3 trillion

Meta has a market cap of roughly $1.46 trillion (as of market close on Oct. 17), so it will take stock price gains of roughly 105% to increase its value to $3 trillion. According to Wall Street, Meta is expected to generate revenue of $161.9 billion in 2024, giving the stock a forward price-to-sales (P/S) ratio of 9. Assuming its P/S remains constant, Meta would need revenue of roughly $332 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting growth of nearly 14% annually over the coming five years for Meta. If the company achieves that target, it could achieve a $3 trillion market cap as soon as 2030. It’s worth noting that Meta has grown its annual revenue by more than 900% over the past decade, so those estimates could well be conservative.

Furthermore, at 29 times earnings, Meta is selling for a discount compared to a multiple of 30 for the S&P 500 — yet boasts stock price gains of 694% over the past 10 years, far exceeding the 214% increase for the S&P 500. That helps illustrate why Meta Platforms is worth every penny, particularly as it pursues multiple paths to success.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2030. was originally published by The Motley Fool

Tesla Stock vs. Alphabet Stock: Wall Street Says Buy One and Sell the Other

Despite soaring interest in artificial intelligence (AI), “Magnificent Seven” stocks Tesla (NASDAQ: TSLA) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) underperformed the S&P 500 by a wide margin during the past year. Specifically, Tesla shares fell 9%, and Alphabet shares advanced 18%, while the S&P 500 soared 36%.

Looking ahead, Wall Street expects Tesla to slide lower over the next year, but analysts think Alphabet will produce sizable gains. Here are the specifics from The Wall Street Journal:

-

Among the 58 analysts who follow Tesla, the average 12-month price target is $216 per share. That forecast implies 2% downside from its current share price of $221.

-

Among the 68 analysts who follow Alphabet, the average 12-month price target is $203 per share. That forecast implies 24% upside from its current share price of $163.

Investors should never rely on price targets, but they are a good place to begin researching a company. Here are the important details on Tesla and Alphabet.

Tesla: 2% implied downside

Tesla has stumbled due to macroeconomic challenges. High interest rates have exacerbated inflationary pressure on consumer wallets, suppressing demand for electric cars. Tesla has cut prices several times to boost demand, but its leading market share fell 3.1 percentage points year to date through August, and the price cuts have weighed heavily on its financial results.

Tesla narrowly topped the consensus sales estimate in the second quarter, but its earnings fell short for the fourth consecutive time. Specifically, while revenue increased 2% to $25.5 billion, operating expenses soared 39%, and non-GAAP (generally accepted accounting principles) net income declined 43% to $0.52 per diluted share. However, there were a few silver linings, including increased production of its 4680 battery cell, something management called a “major cost reduction milestone.”

Tesla recently hosted a robotaxi event where it unveiled the Cybercab. The self-driving vehicle lacking a steering wheel and pedals will enter production in 2027 and cost less than $30,000. CEO Elon Musk also said Tesla would launch an unsupervised version of its full self-driving (FSD) software in California and Texas next year. But investors are justifiably skeptical, given that the company has overpromised in the past.

Looking ahead, Wall Street expects Tesla’s earnings to increase by 12% annually over the next three years. That estimate makes the current valuation of 62 times earnings look very expensive. However, Tesla could beat the consensus forecast if its FSD software can truly function without supervision by 2025. That could boost FSD subscription sales and allow a quick launch of robotaxi services.

Personally, I think eager investors can buy a small position in the stock here, provided they know its long-term performance depends greatly on Tesla’s ability to transition toward high-margin artificial intelligence revenue (i.e., FSD software and robotaxi services) and away from capital-intensive automobile manufacturing. Having said that, it may be more prudent to wait for additional details concerning unsupervised FSD and the Cybercab.

Alphabet: 24% implied upside

Alphabet is the global leader in digital advertising, with an estimated market share of 27.4% in 2024, according to eMarketer. That dominance stems from its ability to source data and engage consumers with popular internet platforms like Google Search and YouTube. Alphabet has long used AI to inform its search engine and ad tech software, but it has recently added generative AI capabilities to further improve the user experience.

Alphabet also operates the third-largest public cloud in Google Cloud Platform. While its market share trails that of Amazon Web Services and Microsoft Azure by a wide margin, strength in AI infrastructure and large language models helped the company gain a percentage point of market share over the past year. “Google’s Gemini combines a world-class model with enterprise cloud services,” according to analysts at Forrester Research.

Alphabet reported solid financial results in the second quarter, beating estimates on the top and bottom lines. Revenue rose 14% to $84.7 billion due to strong momentum in the cloud computing unit and more modest growth in the advertising segment. Meanwhile, GAAP net income increased 31% to $1.89 per diluted share due to continued cost control efforts.

Beyond advertising and cloud computing, Alphabet also has a long-term opportunity with its autonomous driving subsidiary, Waymo. The company provides more than 100,000 rides weekly across Phoenix, San Francisco, and Los Angeles. It has partnered with Uber to bring autonomous ride-hailing services to Atlanta and Austin in 2025.

Analysts at Bank of America estimate Waymo’s revenue could reach $75 million this year, an inconsequential sum compared to Alphabet’s total revenue, but the autonomous driving unit should become increasingly significant in the future. The robotaxi market is projected to increase at 67% annually to reach $108 billion by 2031, according to Straits Research.

Looking ahead, Wall Street expects Alphabet’s earnings to increase by 17% annually over the next three years. That consensus estimate makes the current valuation of 23.4 times earnings look reasonable. Those figures give a price/earnings-to-growth ratio (PEG ratio) of 1.4, which matches the three-year average. Long-term investors should feel comfortable buying a small position in this stock today.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Bank of America, Microsoft, Tesla, and Uber Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Tesla Stock vs. Alphabet Stock: Wall Street Says Buy One and Sell the Other was originally published by The Motley Fool

Are the Dow, S&P 500, and Nasdaq Composite Set to Plunge? 1 Virtually Flawless Forecasting Tool Thinks So.

Over the last century, no asset class has performed better than stocks. While Treasury bonds, housing, and various commodities, including gold, silver, and oil, have delivered positive returns, nothing has come close to matching the annualized return stocks have brought to the table.

Thanks to the artificial intelligence (AI) revolution, stock-split euphoria, and stronger-than-expected corporate earnings, Wall Street’s bull market rally recently celebrated its two-year anniversary. The mature stock-driven Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) have all reached multiple record-closing highs in 2024.

But history also tells us that stocks don’t move higher in a straight line. Though no metric or indicator can concretely predict short-term directional moves in the major stock indexes with 100% accuracy, it doesn’t stop investors from seeking out events and forecasting tools that have strongly correlated with advances or declines in the Dow Jones, S&P 500, and/or Nasdaq Composite.

At the moment, one nearly flawless forecasting tool offers an ominous warning for Wall Street that investors would be wise not to ignore.

It’s been almost six decades since this probability tool was incorrect

For more than a year, I’ve examined a number of correlative events and predictive indicators that have, until now at least, incorrectly forecast downside to come in the Dow, S&P 500, and Nasdaq Composite. This includes the first notable decline in U.S. M2 money supply since the Great Depression, a big decline in the Conference Board Leading Economic Index (LEI), and one of the highest S&P 500 Shiller price-to-earnings ratios during a continuous bull market, when back-tested 153 years.

However, the one virtually flawless forecasting tool that portends trouble for the U.S. economy, and subsequently Wall Street’s three major stock indexes, is the Federal Reserve Bank of New York’s recession probability indicator.

The NY Fed’s recession tool examines the spread (difference in yield) between the 10-year Treasury bond and three-month Treasury bill to calculate how likely it is that a U.S. recession will take shape within the next 12 months.

Usually, the Treasury yield curve slopes up and to the right. This is to say that bonds maturing 10 or 30 years from now are going to offer higher yields than Treasury bills set to mature in a year or less. The longer your money is tied up, the higher the yield should be.

But every so often, the yield curve inverts, which is where short-term bills sport higher yields than long-term bonds. Inversions are typically a sign of skepticism from investors about the health of the U.S. economy.

The spread between the 10-year and three-month Treasury yields has been upside-down for quite some time. According to the NY Fed’s recession forecasting tool, there’s a 57.05% chance of the U.S. dipping into a recession by September 2025.

Keep in mind that this predictive tool has been wrong before. In October 1966, the probability of a U.S. recession taking shape within 12 months exceeded 40% but never materialized. While not every yield-curve inversion is followed by a recession, every U.S. recession following World War II has been preceded by a yield-curve inversion. Think of a yield-curve inversion as a necessary ingredient to an economic downturn.

Although the NY Fed’s recession probability indicator isn’t perfect, it has been 100% accurate over the last 58 years.

You might be wondering what a predictive tool for the U.S. economy has to do with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite. A study released in 2023 from Bank of America Global Research found that approximately two-thirds of the S&P 500’s peak-to-trough downturns since 1929 have occurred after, not prior to, a U.S. recession being declared.

Even though the stock market doesn’t mirror the U.S. economy, a recession would be expected to drag down corporate earnings. Eventually, this would be bad news for Wall Street and its major stock indexes.

Perspective has a tendency to change things on Wall Street

Based purely on what the NY Fed’s recession probability tool is saying, the Dow, S&P 500, and Nasdaq Composite could be in for a bumpy ride in the quarters to come. However, this only tells part of the story.

As noted earlier, stocks have been superior to all other asset classes over the last century. For investors willing to take a step back, widen their lens, and look to the horizon, none of these downside indicators — including the NY Fed’s recessional probability tool — are particularly worrisome.

The non-linearity of the economic cycle serves as the perfect example of how perspective can be a game changer. While recessions are both normal and inevitable, they’re historically short-lived. Only three of the 12 recessions since the end of World War II endured at least one year, with none surpassing 18 months.

On the other end of the spectrum, a majority of economic expansions stuck around for multiple years. Wagering on the U.S. economy (and subsequently corporate earnings) to expand has been a winning strategy.

Being able to take a step back and look to the horizon has been undeniably beneficial on Wall Street, too.

In June 2023, with the S&P 500 bull market officially confirmed, the researchers at Bespoke Investment Group released the extensive data set you see above, which was posted on social media platform X. Bespoke calculated the calendar day length of every bear and bull market for the S&P 500 dating back to the start of the Great Depression in September 1929.

As you’ll note from the table, the average S&P 500 bear market has lasted only 286 calendar days, or roughly 9.5 months. Comparatively, the typical bull market over 94 years has endured 3.5 times as long (1,011 calendar days). Further, 13 out of 27 S&P 500 bull markets have lasted longer than the lengthiest bear market. The value of being a long-term optimist simply couldn’t be clearer.

Ultimately, we’re never going to be able to predict short-term directional moves in the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite with concrete accuracy. But this shouldn’t stop long-term-minded investors from maintaining perspective and allowing time to work its magic.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

Are the Dow, S&P 500, and Nasdaq Composite Set to Plunge? 1 Virtually Flawless Forecasting Tool Thinks So. was originally published by The Motley Fool

Why I Keep Buying More Shares of This Amazing 5%-Yielding Dividend Stock

My long-term goal is to become financially independent. I plan to get there by growing my passive income to the point where it covers my regular expenses. That way, I won’t have the stress of needing to make an income to cover my living expenses.

I still have quite a way to go. However, I make steady progress toward my target by pouring more money into income-generating investments each month. I love to invest in high-quality dividend stocks with higher-yielding payouts that steadily increase because they should help me reach my goal faster. Realty Income (NYSE: O) certainly fits the bill, which is why I keep buying more shares every chance I get.

An amazing dividend stock

Realty Income embodies everything I seek in a dividend stock. The real estate investment trust (REIT) is the model of consistency. It has paid 652 consecutive monthly dividends throughout its history. It has increased its payment 127 times since going public, including in each of the last 30 consecutive years and the past 108 quarters in a row.

The REIT’s dividend currently yields around 5%. That’s well above average (the S&P 500 index’s dividend yield is currently less than 1.5%).

That high-yielding payout is on a very sustainable foundation. Realty Income generates more than enough cash flow to cover its payment. During the first half of this year, the REIT produced nearly $1.8 billion of adjusted funds from operations (FFO), which covered its $1.3 billion dividend outlay with almost $500 million to spare. The REIT used that excess cash to invest in additional income-producing commercial real estate.

Realty Income also has a very strong balance sheet. It’s one of only eight REITs in the S&P 500 with two A3/A- credit ratings or better, thanks to its lower leverage ratios and the quality of its portfolio.

The REIT’s conservative financial profile gives it the flexibility to continue expanding its real estate portfolio so that it can keep increasing its high-yielding dividend.

Multiple dividend growth drivers

Realty Income has grown its dividend at a 4.3% compound annual rate since going public, driven by a combination of rent growth and accretive acquisitions. Those catalysts will continue to drive its growth in the future.

The REIT signs long-term net leases with high-quality tenants. Those leases require that tenants cover all operating expenses, including routine maintenance, building insurance, and real estate taxes. Because of that, it generates very predictable rental income each year. Meanwhile, those leases feature escalation clauses that increase rents by an average of 1.5% each year.

Acquisitions are the company’s other growth driver. Thanks to its abundant post-dividend free cash flow, the REIT can internally fund a meaningful amount of acquisitions each year. It estimates that internally funded investments will add 2% to 3% annually to its adjusted funds from operations. After subtracting bad debt expense (about 0.4% annually) and the impact of refinancing debt in today’s higher interest rate environment (a 1% to 2% annual headwind), Realty Income can internally grow its adjusted FFO per share by about 2% each year.

Thanks to the company’s strong financial profile, it has abundant access to external funding to make additional accretive acquisitions. At its current cost of capital, the REIT estimates that it can deliver 0.5% of adjusted FFO-per-share growth for every $1 billion of externally funded investments it makes. It conservatively estimates it can add 2% to 3% to its FFO-per-share growth rate each year by making externally funded acquisitions ($4 billion to $6 billion annually).

That investment volume is well within reach. Realty Income made an average of more than $9 billion in acquisitions in each of the past four years, which includes single-property investments and mergers with VEREIT and Spirit Realty. Meanwhile, it has a massive investment opportunity set (a $5.9 trillion total addressable market in the U.S. and $8.5 trillion in Europe). The REIT routinely reviews over $50 billion of acquisition opportunities annually, selectively closing only the highest-quality accretive investments.

Add its internal growth rate with its external growth potential, and Realty Income should increase its adjusted FFO per share at a 4% to 5% annual rate. That could support a similar growth rate in its high-yielding dividend.

An exceptional income investment

Realty Income is the type of dividend stock I want to help anchor my passive income. It pays a very sustainable, high-yielding dividend that should continue to rise. That’s why I continue to add to my position, which I expect to keep doing in the coming years. It’s a core income position for me and one that I want to become an even more meaningful contributor in the future.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Matt DiLallo has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

Why I Keep Buying More Shares of This Amazing 5%-Yielding Dividend Stock was originally published by The Motley Fool