RLF, A LEADING LAW FIRM, Encourages STMicroelectronics N.V. Investors to Secure Counsel Before Important October 22 Deadline in Securities Class Action – STM

NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of STMicroelectronics N.V. STM between January 25, 2024 and July 24, 2024, both dates inclusive (the “Class Period”), of the important October 22, 2024 lead plaintiff deadline.

SO WHAT: If you purchased STMicroelectronics securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the STMicroelectronics class action, go to https://rosenlegal.com/submit-form/?case_id=28219 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 22, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) contrary to prior representations, demand in ST’s automotive and industrial sectors continued to decline in the first half of 2024; (2) as a result, ST’s revenues and gross margins also continued to decline during this period; and (3) as a result, ST’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the STMicroelectronics class action, go to https://rosenlegal.com/submit-form/?case_id=28219 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Newsom Sides With Musk In Dispute Over California SpaceX Launches

Gov. Gavin Newsom (D-Calif.) has expressed his support for Elon Musk in the billionaire’s dispute with a California agency that rejected an expansion of SpaceX’s rocket launches along the Pacific coast.

In a recent interview, Newsom voiced his disapproval of the agency’s decision, aligning himself with Musk’s position after returning from a campaign event for Vice President Kamala Harris in North Carolina, reported Politico.

Musk filed a lawsuit against the California Coastal Commission in federal court in Los Angeles on Tuesday, alleging that the commission engaged in blatant political discrimination by citing his support for former President Donald Trump when it rejected a Department of Defense proposal to increase SpaceX launches at Vandenberg Space Force Base.

Newsom acknowledged that his comments might not aid Musk’s legal case, suggesting that such explicit political issues should not be raised.

The Coastal Commission’s 6-4 vote against the increased launches raised concerns about the classification of SpaceX activities and shifted discussions to Musk’s political conduct and labor practices.

Previously, Newsom and Musk have had tensions over various issues, including Musk’s relocation of businesses and Newsom’s criticisms of Trump.

Newsom pointed out that while Musk’s recognition of political discrimination is a positive step, his substantial donations to Trump raise questions about his character.

He emphasized that his administration had previously collaborated with the Defense Department to address concerns related to the launch proposal, and indicated that efforts were made to find common ground before the commission’s decision, noting that the focus should have been on broader implications rather than Musk’s political persona.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key Battlegrounds Heat Up As Trump Gains Ground In Critical States

As voters across the United States prepare to head to the polls on November 5, the presidential race is heating up.

As election day approaches, attention turns to the polling averages compiled by the polling analysis website 538, a part of ABC News. This platform gathers data from various national and battleground state polls, applying strict quality control measures to ensure reliability.

National Polls: Harris Holds a Narrow Lead On Average

Since entering the race in late July, Kamala Harris has maintained a slight lead over Donald Trump in national polling averages, reported BBC. Initially experiencing a surge in popularity, she built a lead of nearly four percentage points by the end of August.

Swing States: A Tight Contest

Currently, the race in seven battleground states is exceptionally close, with neither candidate holding a decisive advantage. Trump has recently claimed a slight lead in Arizona, Georgia, and North Carolina.

Conversely, in Nevada, Harris has edged ahead. Meanwhile, in Michigan, Pennsylvania, and Wisconsin, traditionally Democratic strongholds, Harris has maintained a narrow lead, though the numbers have tightened recently.

Notably, on the day Biden exited the race, he was trailing Trump by nearly five percentage points in these crucial swing states. Pennsylvania, in particular, is vital due to its significant electoral votes, and it had shown Biden behind by nearly 4.5 points at that time, BBC added while analyzing the polling average presented by the 538 website.

Trust in Polls: A Skeptical Landscape

Despite the current polling, uncertainty looms!

The close margins in swing states make it challenging to predict a winner, and past elections have shown that polls can underestimate Trump’s support, BBC added.

Polling companies are working to improve their methodologies, striving to better reflect the demographics of the voting population and anticipate voter turnout on November 5.

As Harris and Trump prepare for a fiercely contested election, all eyes will be on the battleground states that could determine the outcome.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

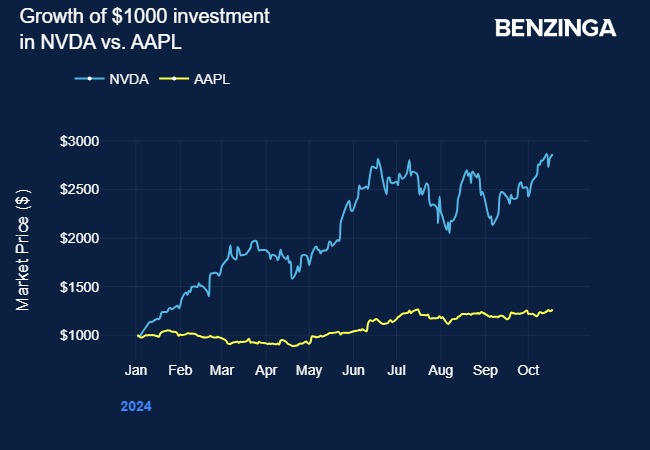

Nvidia Stock Is Up Over 233% In The Past Year And Tech Bulls Say It Could Go Even Higher From Here: '…You'll See The Stock Double Over The Next Several Years'

Nvidia Corp NVDA shares closed up 0.8% at $138 on Friday, taking its market capitalization to over $3 trillion, but the stock can go higher, according to bullish experts.

Expert Commentary: Ram Ahluwalia, CEO of Lumida Wealth Management is reportedly optimistic about the company touching a $4 trillion valuation.

“There’s no question about it. The demand for GPU chips is strong, and you’re seeing early adopters starting to get some ROI,” Ahulwali told Yahoo Finance.

T. Rowe Price portfolio manager Tony Wang also reportedly shares the confidence.

“You’ve got several more years of AI investment before you hit saturation or a more maturing AI landscape,” according to Dan Niles, founder of Niles Investment Management. “You’ll see Nvidia’s revenues double over the next several years, and I think you’ll see the stock double over the next several years,” Niles told Yahoo Finance.

“…demand for Inference compute could grow exponentially as model builders (such as OpenAI) solve for high throughput and low latency. Importantly, supported by its full-stack approach, we believe Nvidia is well-positioned to capture this growth opportunity in Inference,” according to Goldman Sachs, as reported by the Financial Times. Sachs has a price target of $150 for the stock.

Bofa Securities on Friday maintained their ‘Buy’ rating on the stock and increased its price target for the company from $165 to $190.

In fact, Nvidia has a consensus price target of $234.49 based on the ratings of 38 analysts.

Why It Matters: Nvidia stock is up by nearly 186.5% year-to-date, according to data from Benzinga Pro. The company now has a market cap of about $3.39 trillion.

As of its current valuation, Apple is the only American company with a market cap higher than Nvidia. However, even Apple’s valuation is short of $4 trillion ($3.57 trillion).

Nvidia stock has surged more than 233% over the past year, with its share price jumping from $41 to $138. Meanwhile, ETFs tracking Nvidia, such as GraniteShares 2x Long NVDA Daily ETF NVDL and Direxion Daily NVDA Bull 2X Shares NVDU, have delivered gains of at least 440% during the same period.

Read More:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lennar Expands into St. George, Utah, Bringing Innovative, All-Inclusive Homes to a Thriving Community

ST. GEORGE, Utah, Oct. 18, 2024 /PRNewswire/ — Lennar, one of the nation’s leading homebuilders, announces its expansion into the vibrant and fast-growing community of St. George, Utah. Known for its unwavering commitment to quality, value, and integrity, Lennar is set to introduce a new standard of living rooted in tradition and excellence.

Lennar’s entry into Southern Utah marks a significant milestone for the company as it continues to expand its footprint across the United States. Future homeowners can look forward to the convenience and peace of mind that comes with Lennar’s iconic Everything’s Included® homes. These homes take the guesswork out of selecting features and finishes, offering highly sought-after upgrades at no additional cost. Each home is move-in ready with top-tier enhancements, ensuring an exceptional living experience for every resident.

Lennar’s new homes in St. George will also include the popular NextGen® suites, perfect for multigenerational living offering a home within a home that provides flexibility for families. Additionally, homes with RV garages will cater to those who embrace the adventurous spirit of the Greater Zion area.

“We are beyond excited to bring Lennar’s innovative approach to homebuilding to St. George,” said Joy Broddle, Division President of Lennar. “It’s not just about building houses in a new city; it’s about creating a community where families can thrive and make lasting memories for generation to come. The inclusion of NextGen® suites and RV garages reflects our commitment to meeting the diverse needs and lifestyles of our homeowners. We believe the combination of indoor comfort and outdoor living in this stunning environment will resonate deeply with those seeking the perfect home in Southern Utah.”

Lennar’s first community in St. George, La Spazio, will offer 98 beautifully designed single and two-story homes within the master-planned community of Divario, located southwest of the Sunbrook Golf Course. Sales for La Spazio are anticipated to begin in December 2024, with prices starting in the $600,000s.

Lennar’s entry into the St. George market represents an opportunity for job seekers. To stay up to date on employment opportunities, please visit our career site at https://careers.lennar.com/.

For more information about Lennar’s new homes in St. George, please visit Lennar.com/StGeorge.

About Lennar Corporation

Lennar Corporation, founded in 1954, is one of the nation’s leading builders of quality homes for all generations. Lennar builds affordable, move-up and active adult homes primarily under the Lennar brand name. Lennar’s Financial Services segment provides mortgage financing, title and closing services primarily for buyers of Lennar’s homes and, through LMF Commercial, originates mortgage loans secured primarily by commercial real estate properties throughout the United States. Lennar’s Multifamily segment is a nationwide developer of high-quality multifamily rental properties. LENX drives Lennar’s technology, innovation and strategic investments. For more information about Lennar, please visit www.lennar.com.

Contact: Danielle Tocco

Vice President Communications

Lennar Corporation

Danielle.Tocco@Lennar.com

Direct Line: 949.789.1633

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lennar-expands-into-st-george-utah-bringing-innovative-all-inclusive-homes-to-a-thriving-community-302280629.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lennar-expands-into-st-george-utah-bringing-innovative-all-inclusive-homes-to-a-thriving-community-302280629.html

SOURCE Lennar Corporation

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Down 34%, This AI Stock Is a No-Brainer Buy Stock Right Now

As almost every investor knows by now, artificial intelligence (AI) has been driving the current bull market since its start in 2023.

The launch of OpenAI’s ChatGPT has set off a new arms race in the industry, and generative AI technology could be as transformative as the internet. While stocks with exposure to artificial intelligence, like the semiconductor sector, have generally done well, some stocks have done better than others.

Nvidia, for example, just set another all-time high on soaring demand for its new Blackwell platform, but not every AI stock has kept up with the Nasdaq Composite, which nearly set an all-time high earlier this week. In fact, ASML (NASDAQ: ASML) is now down 34% from its peak earlier this year after the industry bellwether gave a disappointing forecast in its third-quarter earnings report on Tuesday. The stock fell 16.3% on the news.

Why ASML stock just went on sale

ASML occupies a unique position in the semiconductor industry as the only maker of extreme ultraviolet (EUV) lithography machines, which are used to make the most advanced, smallest-node chips.

Investors have been looking forward to a recovery in ASML’s business after an earlier slowdown due to macrochallenges like high interest rates and inflation.

ASML is expected to benefit from the expansion of chip fabs around the world as governments and industries prepare for the AI era. The U.S., for example, is planning to invest tens of billions of dollars through the CHIPS Act to build foundries, and Taiwan Semiconductor, the world’s biggest foundry operator, is looking to diversify away from Taiwan and move closer to its customers.

While that should be a tailwind for ASML, the company just told customers that recovery would take longer than expected. Citing weakness in both the logic and memory segments, which make up two of its three business segments, CEO Christophe Fouquet said, “It now appears the recovery is more gradual than previously expected.” He also noted customer cautiousness.

ASML dialed back the 2025 revenue forecast it gave at its 2022 Investor Day from 30 billion euros to 40 billion euros ($33 billion dollars to $43 billion dollars) to 30 billion euros to 35 billion euros ($33 billion dollars to $38 billion dollars). Not surprisingly, investors were disappointed with the news.

Why it’s a buying opportunity

Companies tend to give disappointing earnings reports and forecasts for one of two reasons: Either there are challenging market conditions at the macrolevel or sector level, or the company itself isn’t executing well and is falling behind the competition.

ASML’s case looks to be safely in the first category. While there’s plenty of excitement about AI, which management nodded to, there are still some challenges in the legacy-chip business, reflected in key customers like Intel and Samsung, both of which are struggling.

Samsung is reportedly delaying mass production at a fab in Texas due to weak yields in its 3-nanometer process, and Intel just announced a massive restructuring, calling into question its foundry expansion. In recent quarters, half of ASML company’s revenue has also come from China, where the economy has been weak since the end of the pandemic.

For comparison, a good recent example of a company that struggled with similar headwinds was Alphabet as digital advertising slowed in 2022 on fears of a recession, as you can see from the chart below.

As you can see, revenue growth dropped to just 1% in 2022’s Q4, but if you had bought the stock then, you’d be up more than 80% now.

ASML retains a significant competitive advantage as the only producer of EUV lithography machines, and it should eventually benefit from the coming boom in chip production due to AI.

Even with its dialed-down guidance, the company is still calling for 16.1% growth at the midpoint and expects expanding gross margins and operating margins.

As profits recover, the stock looks like a good bet to bounce back now that the weak forecast is priced in. With its unique EUV technology, strong margins, and ramping AI demand, ASML looks like a great bet to be a winner over the long term.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Down 34%, This AI Stock Is a No-Brainer Buy Stock Right Now was originally published by The Motley Fool

Insider Decision: Mark W Peterson Exercises Options At Zurn Elkay Water For $1.08M

Disclosed in a recent SEC filing on October 17, Peterson, Chief Administrative Officer at Zurn Elkay Water ZWS, made a noteworthy transaction involving the exercise of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Peterson, Chief Administrative Officer at Zurn Elkay Water, a company in the Industrials sector, just exercised stock options worth 46,780 shares of ZWS stock with an exercise price of $14.22.

As of Friday morning, Zurn Elkay Water shares are down by 0.0%, with a current price of $37.28. This implies that Peterson’s 46,780 shares have a value of $1,078,746.

Delving into Zurn Elkay Water’s Background

Zurn Elkay Water Solutions Corp designs procure, manufactures, and markets a range of clean water solutions for drinking water, hygiene, and sustainable water management. The Zurn Elkay product portfolio includes professional-grade water control and safety, water distribution and drainage, drinking water, finish plumbing, hygienic, environmental and site works products for public and private spaces.

Understanding the Numbers: Zurn Elkay Water’s Finances

Revenue Growth: Over the 3 months period, Zurn Elkay Water showcased positive performance, achieving a revenue growth rate of 2.18% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Insights into Profitability:

-

Gross Margin: The company sets a benchmark with a high gross margin of 45.22%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Zurn Elkay Water’s EPS is below the industry average. The company faced challenges with a current EPS of 0.27. This suggests a potential decline in earnings.

Debt Management: Zurn Elkay Water’s debt-to-equity ratio is below the industry average. With a ratio of 0.34, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 51.07 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.26, Zurn Elkay Water’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Zurn Elkay Water’s EV/EBITDA ratio, surpassing industry averages at 22.8, positions it with an above-average valuation in the market.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Cracking Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Zurn Elkay Water’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia, Google And Microsoft To Present AI Tools Aimed At Reducing Healthcare Worker Burnout At Las Vegas Conference

Leading tech firms, including Nvidia Corporation NVDA, Alphabet Inc‘s Google GOOGL GOOG, and Microsoft Corporation MSFT, are preparing to showcase their artificial intelligence (AI) tools at the forthcoming HLTH healthcare technology conference in Las Vegas.

What Happened: The conference, set to kick off on Sunday, is anticipated to draw over 12,000 industry leaders, CNBC reported. The tech giants aim to demonstrate how their AI solutions can help reduce the administrative load on healthcare professionals, thereby freeing up crucial time.

Healthcare workers are currently grappling with excessive documentation, a major factor leading to industry burnout and a predicted shortfall of 100,000 healthcare workers by 2028, according to consulting firm Mercer. Tech companies are confident that their AI tools can help mitigate this problem.

See Also: Warren Buffett Says He Wouldn’t Be Successful Today If He Didn’t Take This $100 College Class

Google, on Thursday, announced the general availability of Vertex AI Search for Healthcare, a tool that enables developers to build applications to assist doctors in swiftly searching for information across various medical records. Google also published survey results showing that clinicians spend nearly 28 hours a week on administrative tasks, with 80% of providers asserting that this work takes away from patient care time.

Why It Matters: The healthcare industry has been increasingly turning to AI to address its challenges. Google, for example, has been using AI to detect illnesses through sound, such as coughs and sneezes, with its Health Acoustic Representations (HeAR) model.

Earlier this month, Microsoft unveiled its suite of tools designed to lessen clinicians’ administrative workload. These tools, most of which are still under development, include medical imaging models, a healthcare agent service, and an automated documentation solution for nurses.

AI scribe tools such as DAX Copilot, provided by Microsoft’s subsidiary Nuance Communications, have seen a surge in popularity this year. These tools employ AI to transcribe doctors’ interactions with patients into clinical notes and summaries, reducing the need for doctors to manually record these notes.

Nvidia is also gearing up to address the workload of doctors and nurses at the HLTH conference. Kimberly Powell, Nvidia’s vice president of healthcare, will give a keynote on Monday detailing how generative AI can assist healthcare professionals in devoting more time to patient care.

Photo: PeopleImages.com – Yuri A/Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

All It Takes Is $2,500 Invested in Each of These 3 High-Yield Dow Dividend Stocks to Help Generate Over $300 in Passive Income Per Year

The Dow Jones Industrial Average (DJINDICES: ^DJI) has 30 industry-leading components that act as representatives of the U.S. economy. The index’s rich history has made it a go-to destination for investors looking for quality names that can help them generate dividend income.

Over time, the composition of the Dow has changed to reflect the growing influence of technology on the economy, which has helped the Dow produce impressive gains in recent years. But even stodgy Dow names like Coca-Cola, Home Depot, and McDonald’s have been roaring higher in recent months and helped the index achieve a fresh all-time high on Oct. 11.

Despite the Dow’s track record, not every component has a high yield or has been a trustworthy dividend stock. Boeing‘s slew of challenges pressured the company to suspend its dividend. Tech stocks like Microsoft, Apple, and Salesforce have yields under 1%, and Amazon doesn’t pay dividends.

Johnson & Johnson (NYSE: JNJ), Dow (NYSE: DOW), and Chevron (NYSE: CVX) are three of the highest-yielding stocks in the index. Investing $2,500 into each stock produces an average yield of 4.2% and should generate at least $300 in passive income per year. Here’s why all three dividend stocks are worth buying now.

J&J has dealt with significant challenges over the last few years

Johnson & Johnson (J&J) is a Dividend King with 62 consecutive years of dividend increases. The company has long been known as a stodgy passive-income powerhouse. But the last few years have been challenging, as reflected in its languishing stock price.

J&J was a leader in COVID-19 vaccine developments, which was initially a boon for the company. But rapidly declining demand for the vaccine has been a drag on the company to the point where J&J now reports many of its results as “excluding the impact of the COVID-19 vaccine.”

Another challenge has been adjusting to the spinoff of J&J’s consumer health business, which occurred in August 2023. Former J&J brands, such as Band-Aid and Tylenol, are now under the new entity Kenvue. The spinoff should help J&J be a faster-growing company by focusing on just two segments — Innovative Medicine and MedTech. However, it does remove some of the safe and stodgy parts of the business that made J&J a rock-solid dividend stock, no matter the economic cycle.

Finally, J&J has been dealing with lawsuits that allege its talc-based products led to cancer development. J&J restructured and made a subsidiary called Red River Talc LLC, which filed for Chapter 11 bankruptcy on Sept. 20 to handle current and future claims.

After a messy few years, J&J is finally ready to turn the corner. The business has been putting up solid results and growing at a rate that should support good, if not excellent, dividend raises going forward. J&J generates a ton of free cash flow that easily covers its dividend expense. And with a yield of 3.1%, J&J stands out compared to the S&P 500 dividend yield of just 1.2%.

Dow is a coiled spring for economic growth

Not to be confused with the “Dow” in the Dow Jones Industrial Average, Dow makes chemicals used in plastics, seals, foams, gels, adhesives, resins, coatings, and more. The commodity chemical company has three key segments — Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings.

Dow’s business model is capital intensive and vulnerable to ebbs and flows in global demand and supply. Dow has been hit hard by volume declines and lower margins. In the following chart, you can see that revenue and margins surged in 2021 and early 2022 but have fallen considerably since then. Similarly, the stock price has gone practically nowhere since the spinoff.

Dow has blamed macroeconomic factors as a key reason for its weak results. However, low interest rates could greatly benefit many of the company’s end markets. For example, lower mortgage interest rates could boost housing demand, which would help Dow’s polyurethanes and construction chemicals business. Lower interest rates could also boost demand for durable goods.

Overall, Dow is well positioned to see a sizable uptick in earnings next year. Analyst consensus estimates call for just $2.26 in earnings per share (EPS) in 2024 but $3.55 in 2025 EPS. Although Dow looks expensive based on trailing earnings, it would have a far more reasonable valuation if it delivers on expectations.

Despite the volatility of Dow’s performance, it has proven to be a reliable income stock spinning off from DowDuPont in 2019. Dow yields 5.2%, making it the second-highest yielding stock in the Dow Jones, behind only Verizon Communications. Dow hasn’t raised its payout since the spinoff, but it has incorporated stock repurchases as part of its capital return program. The company’s goal is to return 65% of earnings to shareholders through buybacks and dividends so it has enough dry powder to fund long-term investments in new production plans, low-carbon efforts, and more.

Overall, Dow is a good value stock for income investors to consider now.

A quality energy stock with a high yield

Like Dow, Chevron can be a highly cyclical business whose results are heavily impacted by commodity prices. But Chevron has a strong balance sheet, a diversified upstream business that doesn’t depend on one production region, a massive refining business, and a track record for raising its dividend no matter what oil prices are doing.

In fact, Chevron has paid and raised its dividend for 37 consecutive years. Chevron yields 4.3%, which is the third-highest yield in the Dow Jones. The company’s track record for dividend raises, paired with its high yield, makes it arguably the single best passive income play out of the 30 Dow components.

Investors worried about declining oil prices can take solace in knowing that Chevron has a large margin for error in supporting its dividend. Chevron’s capital expenditures and buybacks are near five-year highs. If oil prices tank, Chevron can simply pause buybacks and pull back on capital expenditures. Chevron didn’t cut its dividend when oil prices crashed in 2020, so it stands to reason that it would take a prolonged downturn for the company even to consider reducing its payout.

Chevron stands out as a balanced buy for investors looking for a safer way to invest in oil and gas and power their passive income stream.

Should you invest $1,000 in Johnson & Johnson right now?

Before you buy stock in Johnson & Johnson, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson & Johnson wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Chevron, Home Depot, Kenvue, Microsoft, and Salesforce. The Motley Fool recommends Johnson & Johnson and Verizon Communications and recommends the following options: long January 2026 $13 calls on Kenvue, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

All It Takes Is $2,500 Invested in Each of These 3 High-Yield Dow Dividend Stocks to Help Generate Over $300 in Passive Income Per Year was originally published by The Motley Fool

The governments of Canada and Quebec, the City of Montréal and their partners announce new social and affordable housing for nearly 900 households

MONTRÉAL, Oct. 18, 2024 /CNW/ – The Government of Canada, the Government of Quebec, the City of Montréal, Bâtir son quartier and their partners are proud to announce that nine social and affordable housing projects are being built or have officially opened in Montréal. With these projects, nearly 900 households can find new homes.

Coordinated by the community real estate developer Bâtir son quartier, these projects, either underway or already completed, total 893 units. This represents an investment of nearly $340 million by the 3 levels of government. Rent for the units will be kept affordable in the long term, increasing more slowly and in smaller increments than private-market rents.

Details of financial contributions

- Government of Canada: $57.7 million

- Government of Quebec: $228.7 million

- City of Montréal: $52.8 million

Note that more than half of the 893 households in the units announced today could be eligible for the Société d’habitation du Québec’s (SHQ’s) Rent Supplement Program, ensuring that they spend no more than 25% of their income on housing. This additional assistance is covered by the SHQ (90%) and the City of Montréal (10%).

About the projects

- Habitation Héritage de Pointe-Saint-Charles

- Coopérative d’habitation de la Pointe Amicale

- Résidence LoReli

- Habitations Libr’Elles

- Logifem

- Maison des RebElles

- Coopérative d’habitation le Trapèze

- Espace la Traversée-SSA

- Coopérative d’habitation Laurentienne

- Loge-Accès OSHA phase 7

- Maison Glaneuses

View the map of projects announced today

QUOTES

“I’ve often said that we need to innovate to build more and better housing, especially given the current housing crisis. This collaboration with Bâtir son quartier and its partners is further proof that our government is taking concrete action, alongside municipalities and community stakeholders, to better house Quebecers with low or moderate incomes. We continue to innovate and propose new solutions to build more, faster and better.”

– France-Élaine Duranceau, Quebec Minister Responsible for Housing

“Our government is proud to support the construction of these nine new affordable housing projects. These are excellent initiatives to help address Southwest Montréal’s needs and those of the entire Island of Montréal. I would like to thank the partners involved in these important projects for our community. They’ve made a big difference in the day-to-day lives of the people who live there. Together, we’re building a generation of new housing we can all be proud of.”

– The Honourable Mélanie Joly, Minister of Foreign Affairs and Member of Parliament for Ahuntsic-Cartierville

“What a wonderful announcement we’re making today for people in Montréal and throughout the Greater Montréal area! I’m proud to see that our government is doing whatever it takes to make sure everyone has a safe and affordable place to live.”

– Christine Fréchette, Quebec Minister Responsible for the Metropolis and the Montréal region

“The City of Montréal, together with the other levels of government, developers and community housing organizations, is committed to doing everything in its power to create new off-market housing units. The new Loger + strategy proves it. With measures like priority land transfer for off-market housing, the adoption of a 120-day administrative standard for issuing permits for as-of-right projects, and the three-year, $3 million fund I set up to cover project startup costs, Montréal is taking action to make things happen.”

– Valérie Plante, Mayor of Montréal

“The diversity of the projects presented today clearly demonstrates the community housing sector’s ability to meet the needs of Montréal households. Housing co-operatives, new resources for people experiencing homelessness, housing for low-income families, seniors and women — it all gives people a chance to find long-term, supportive and inclusive places they can afford to live in. With financial support from the Government of Canada, the Government of Quebec and the City of Montréal, our team is working closely with co-operatives, non-profits and all our partners to complete these life-changing real estate projects.”

– Edith Cyr, Executive Director, Bâtir son quartier

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

About Bâtir son quartier

Bâtir son Quartier is a social economy enterprise that coordinates the delivery of housing and community real estate projects. Since 1976, Bâtir son quartier has coordinated the delivery of 470 co-operative and non-profit projects with a total of nearly 16,000 housing units in the Greater Montréal area, as well as about 40 non-residential projects including early childhood centres, community centres and facilities for social economy enterprises.www.batirsonquartier.com

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c8349.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c8349.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.