Why I Just Swapped These 2 Well-Known Dividend Stocks

I enjoy investing in dividend stocks. I like to see the income flow into my portfolio. It gives me more money to reinvest into income-generating investments. That grows my passive income stream toward my ultimate goal of eventually reaching the level where it can offset my regular expenses.

I’ve hit a few speed bumps in achieving that goal over the years because companies I owned cut their dividends. One of those disappointing investments is 3M (NYSE: MMM). The industrial giant ended a streak of more than 60 straight years of dividend growth when it slashed its payment earlier this year. That cut led me to sell my stake. I used some of that cash to start a new position, adding Whirlpool (NYSE: WHR) to my income portfolio. Here’s why I made that switch.

Abdicating its throne

3M had been one of the most reliable dividend stocks around. Its more than a half-century history of dividend increases had it in the elite group of Dividend Kings. However, a series of issues forced the industrial giant to make some difficult decisions, including cutting its dividend.

A couple of the company’s products caused some very expensive legal issues. Ultimately, it agreed to pay about $18.5 billion to settle those claims. That’s a lot of money, even for a company as financially strong as 3M. As a result, the company has taken several steps to preserve its financial flexibility so that it can cover those payments and its other capital needs.

One of its moves was spinning off its healthcare unit to create Solventum. 3M loaded that entity with debt, which gave it more financial flexibility. However, the downside of the spinoff was that it removed a big chunk of 3M’s cash flow. As a result, the company reset its dividend following the spin, cutting it by about 50%.

3M’s dividend was a big reason why I initially invested in the company years ago. I was seeking a high-quality and steadily rising payout. While 3M delivered that steady growth for many years, its legal issues proved to be too much to maintain the payout any longer. With its dividend now a shell of its former self, I decided it was time to sell 3M. I also sold my shares in Solventum since that company has no plans to start paying a dividend anytime soon because it needs to pay down some of the debt 3M saddled it with before the spin.

This dividend stock hits close to home

I used some of the proceeds from my 3M/Solventum sale to buy shares of Whirlpool. The iconic appliance maker is a company that has been on my radar for a while, not just because it pays dividends. My wife and I recently bought a new home, and with that came the need to purchase some new appliances. Whirlpool makes many of the appliances that we’re looking to buy.

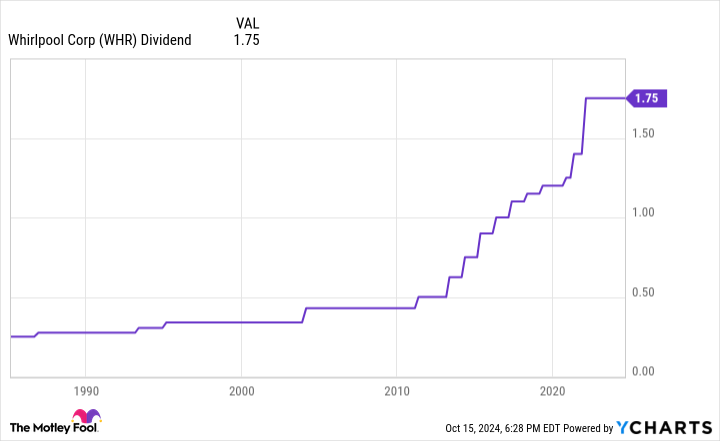

In researching appliances, I also started looking closer at the stock. I first noticed that it pays a pretty enticing dividend (it currently yields nearly 7%). The company has paid dividends for about 70 years. While it hasn’t increased its payment every year (it last raised its dividend in 2022), it has never cut its payout:

Now, as I learned from 3M (and others), a strong dividend history is no guarantee that the company will be able to achieve similar success in the future. However, Whirlpool is in a good position to maintain its dividend despite some current headwinds. Its dividend will cost it about $400 million this year, which it can easily cover with free cash flow (estimated to be about $500 million after capital expenses and other items). Whirlpool is looking to boost its free cash flow by selling off some of its international businesses, which, along with other initiatives, should reduce its global cost structure by $300 million-$400 million. It’s also working to reduce debt, which should cut interest expenses.

Meanwhile, the company expects the housing market to eventually recover as interest rates fall. That should drive higher sales as home sellers replace their appliances to appeal to more buyers or new homeowners buy new ones after moving in. I can vouch for this; my wife and I disliked the refrigerator at our new home (not a Whirlpool) so much that we’re buying a new one. That replacement cycle should boost Whirlpool’s sales and bottom line, putting its dividend on an even firmer foundation.

Spinning out lots of income

3M’s dividend cut was a huge disappointment, given its long history of steady growth. That’s why I recently sold my shares to make way for Whirlpool. The company pays a much higher-yielding dividend that it should be able to sustain through the current downcycle in the housing market. While it’s still facing some headwinds that will prevent it from increasing its payout in the near term, I think it will be a solid income stock over the long haul as it spins out cash into my account.

Should you invest $1,000 in 3M right now?

Before you buy stock in 3M, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and 3M wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Matt DiLallo has positions in Whirlpool. The Motley Fool recommends 3M, Solventum, and Whirlpool. The Motley Fool has a disclosure policy.

Why I Just Swapped These 2 Well-Known Dividend Stocks was originally published by The Motley Fool

Leave a Reply