A Closer Look at DoorDash's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on DoorDash DASH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DASH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 27 uncommon options trades for DoorDash.

This isn’t normal.

The overall sentiment of these big-money traders is split between 62% bullish and 22%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $69,725, and 25 are calls, for a total amount of $1,832,170.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $125.0 to $210.0 for DoorDash over the last 3 months.

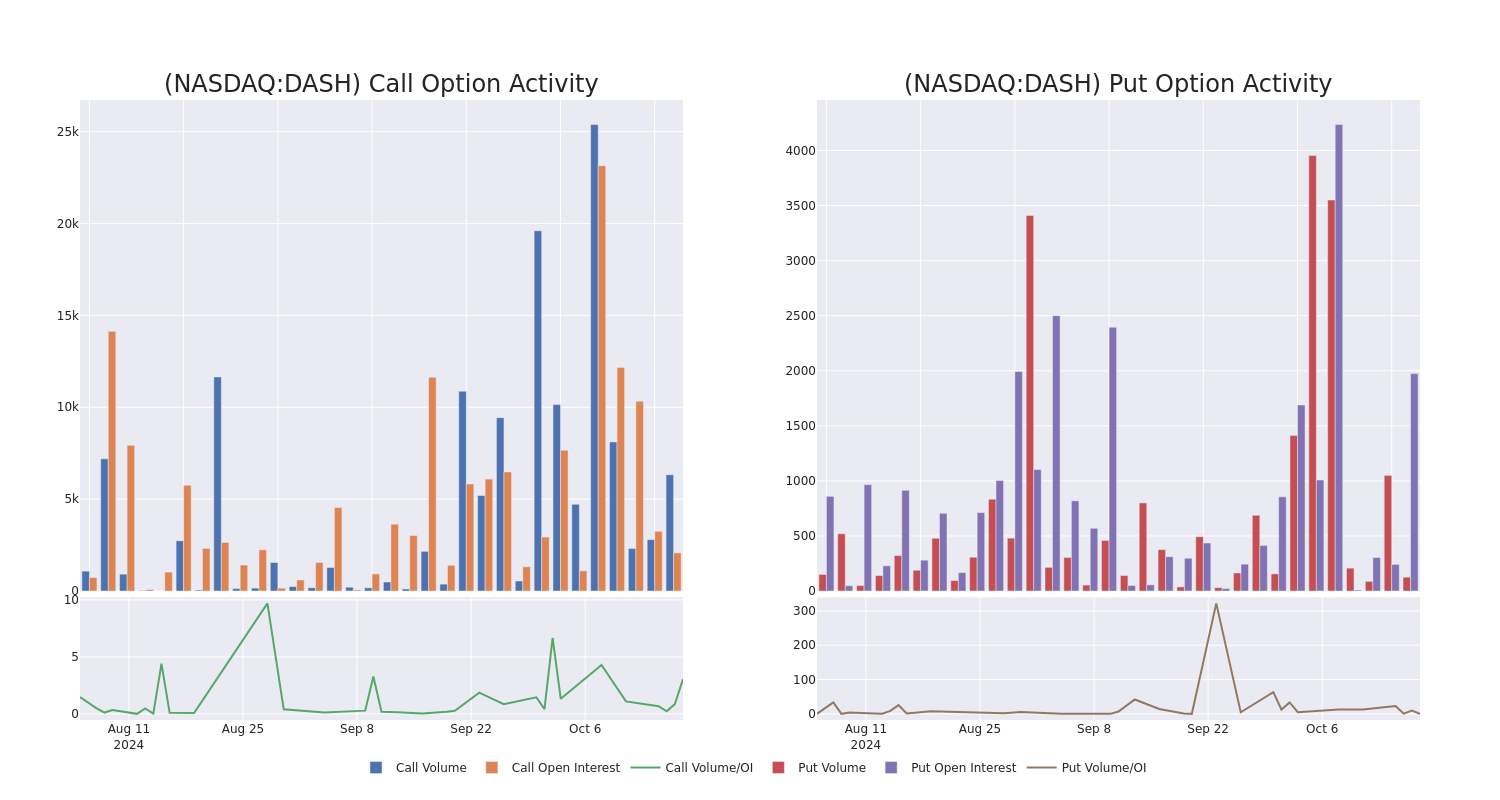

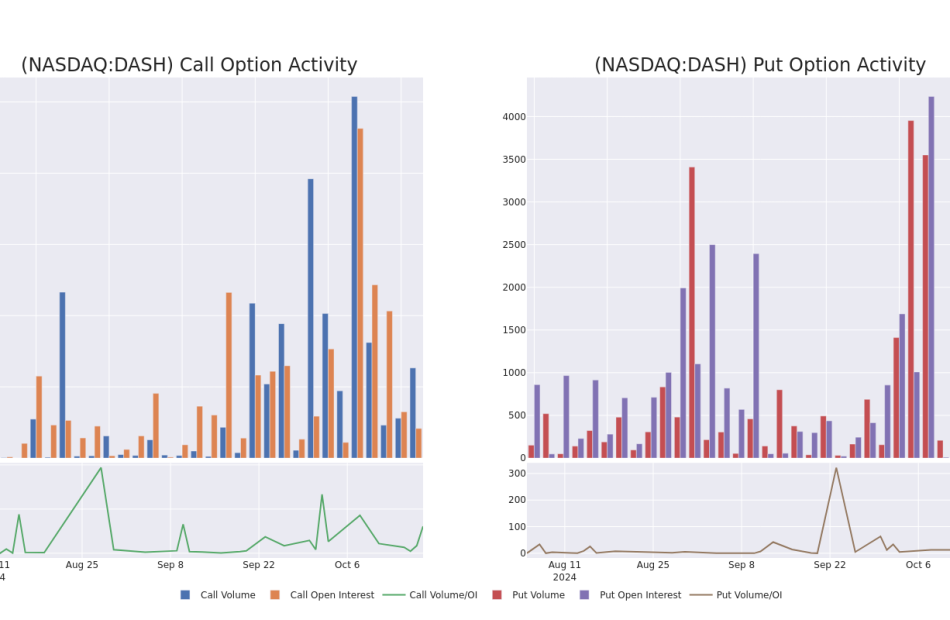

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for DoorDash’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DoorDash’s whale trades within a strike price range from $125.0 to $210.0 in the last 30 days.

DoorDash Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.9 | $23.9 | $23.9 | $130.00 | $423.0K | 1.6K | 177 |

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.5 | $23.5 | $23.5 | $130.00 | $279.6K | 1.6K | 470 |

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.8 | $23.8 | $23.8 | $130.00 | $211.8K | 1.6K | 224 |

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.9 | $23.4 | $23.4 | $130.00 | $65.5K | 1.6K | 500 |

| DASH | CALL | TRADE | BULLISH | 01/17/25 | $30.25 | $30.15 | $30.25 | $125.00 | $60.5K | 1.3K | 182 |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online food order demand aggregator. Consumers can use its app to order food on-demand for pickup or delivery from merchants mainly in the US. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe. DoorDash provides a marketplace for the merchants to create a presence online, market their offerings, and meet demand by making the offerings available for pickup or delivery. The firm provides similar service to businesses in addition to restaurants, such as grocery, retail, pet supplies, and flowers.

Following our analysis of the options activities associated with DoorDash, we pivot to a closer look at the company’s own performance.

Present Market Standing of DoorDash

- Trading volume stands at 991,640, with DASH’s price up by 0.25%, positioned at $152.36.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 9 days.

What Analysts Are Saying About DoorDash

5 market experts have recently issued ratings for this stock, with a consensus target price of $155.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160.

* In a cautious move, an analyst from Raymond James downgraded its rating to Outperform, setting a price target of $155.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on DoorDash with a target price of $160.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $160.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on DoorDash with a target price of $142.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DoorDash options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply