A Closer Look at RH's Options Market Dynamics

Financial giants have made a conspicuous bearish move on RH. Our analysis of options history for RH RH revealed 14 unusual trades.

Delving into the details, we found 35% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $213,413, and 8 were calls, valued at $836,480.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $280.0 to $400.0 for RH over the recent three months.

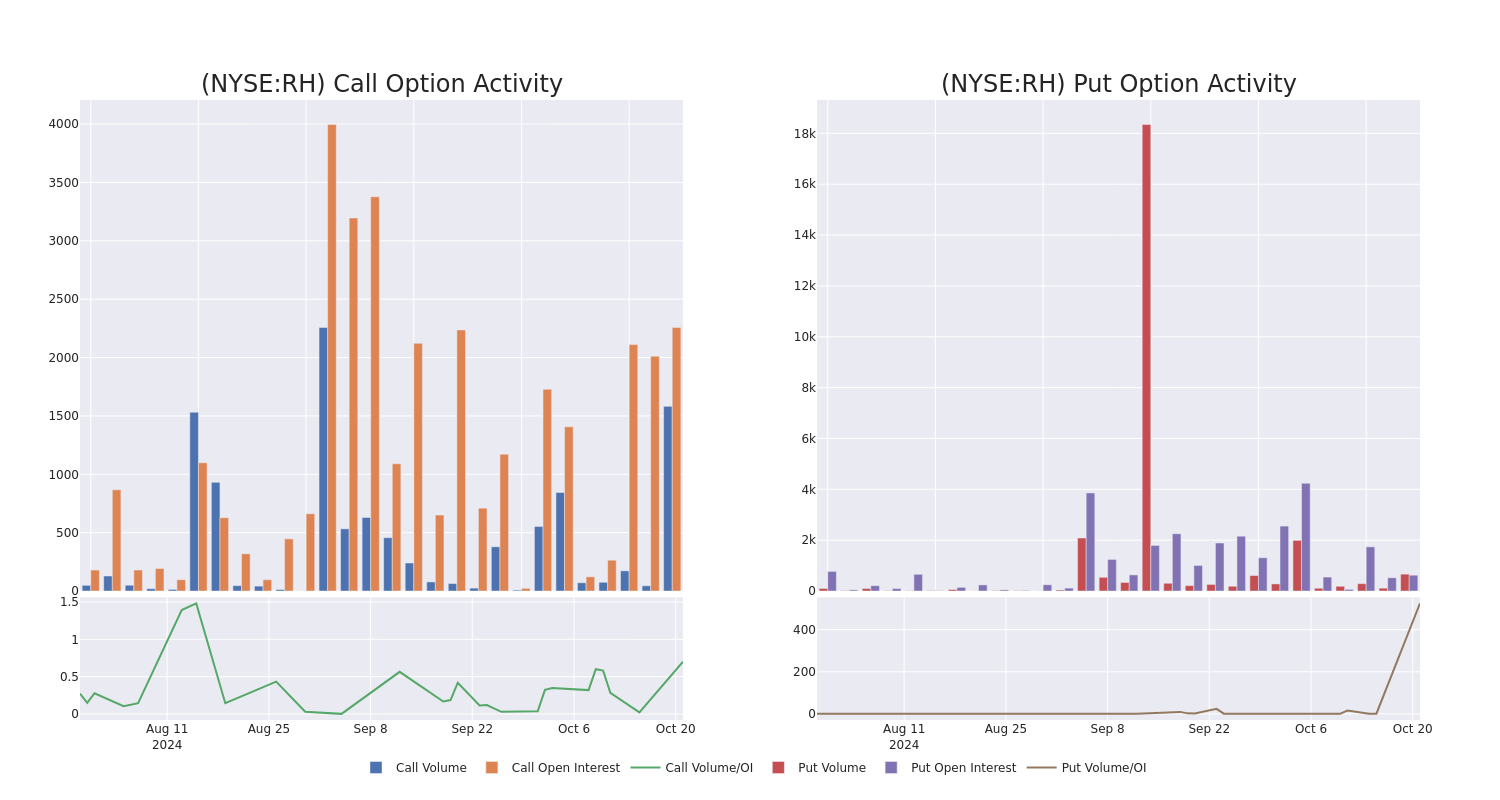

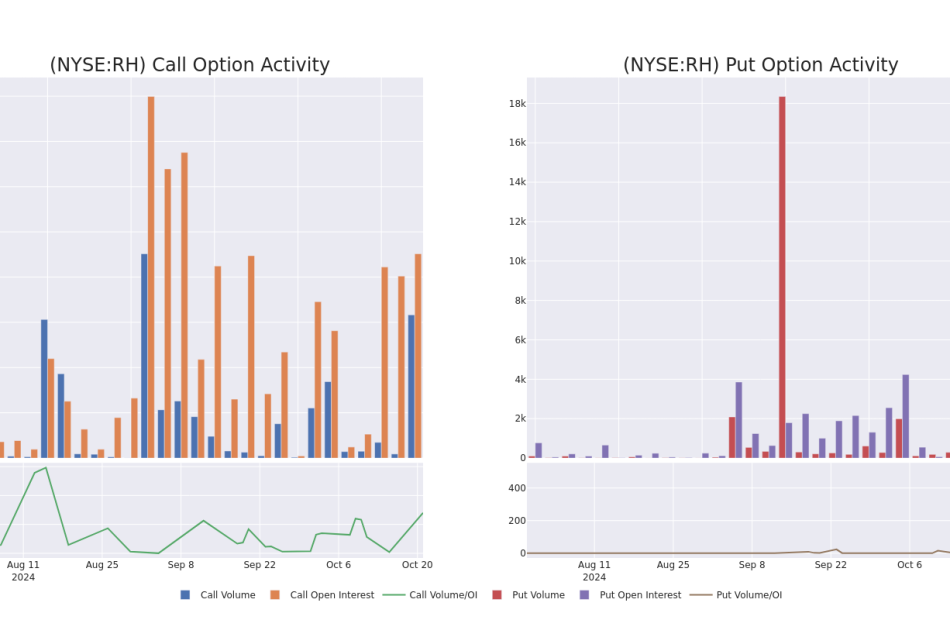

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in RH’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to RH’s substantial trades, within a strike price spectrum from $280.0 to $400.0 over the preceding 30 days.

RH 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $51.7 | $50.5 | $50.5 | $330.00 | $429.2K | 630 | 201 |

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $46.6 | $46.1 | $46.6 | $330.00 | $129.3K | 630 | 403 |

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $47.7 | $44.0 | $44.0 | $350.00 | $110.0K | 1.3K | 347 |

| RH | PUT | TRADE | BULLISH | 11/08/24 | $9.2 | $8.5 | $8.7 | $335.00 | $64.3K | 1 | 268 |

| RH | CALL | TRADE | BULLISH | 11/15/24 | $12.1 | $11.5 | $11.9 | $365.00 | $41.6K | 0 | 109 |

About RH

RH is a luxury furniture and lifestyle retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, and children and is growing the presence of its hospitality business with 18 restaurant locations. RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels and is positioned to broaden its addressable market over the next decade by expanding abroad, with its World of RH digital platform (highlighting offerings outside of home furnishings), and with offerings in color, bespoke furniture, architecture, media, and more.

In light of the recent options history for RH, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is RH Standing Right Now?

- Currently trading with a volume of 641,527, the RH’s price is down by -1.77%, now at $348.25.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 45 days.

Professional Analyst Ratings for RH

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $430.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wedbush has elevated its stance to Outperform, setting a new price target at $430.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for RH, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply