Comerica Analysts Boost Their Forecasts After Better-Than-Expected Earnings

Comerica CMA reported better-than-expected earnings for its third quarter on Friday.

The company posted adjusted earnings of $1.37 per share, beating market estimates of $1.16 per share. The company’s quarterly sales came in at $811.000 million versus expectations of $811.617 million.

Comerica shares fell 3.9% to trade at $62.41 on Monday.

These analysts made changes to their price targets on Comerica following earnings announcement.

- Barclays analyst Jason Goldberg maintained Comerica with an Underweight and raised the price target from $56 to $66.

- JP Morgan analyst Anthony Elian maintained the stock with a Neutral and raised the price target from $65 to $70.

- Stephens & Co. analyst Terry McEvoy maintained the stock with an Overweight and boosted the price target from $64 to $70.

- Wells Fargo analyst Mike Mayo maintained Comerica with an Underweight and raised the price target from $43 to $51.

- Truist Securities analyst Brandon King maintained the stock with a Hold and lifted the price target from $66 to $70.

- DA Davidson analyst Peter Winter maintained Comerica with a Neutral and raised the price target from $64 to $68.

- Morgan Stanley analyst Manan Gosalia maintained the stock with an Equal-Weight and increased the price target from $63 to $67.

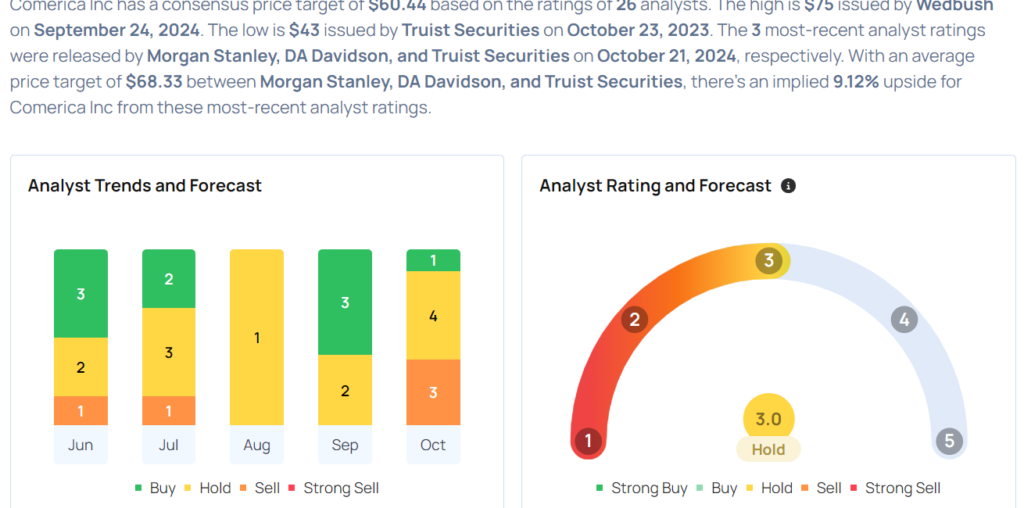

Considering buying CMA stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Stride's Earnings: A Preview

Next Post

Leave a Reply