‘God works in mysterious ways’: I became a Nvidia millionaire playing ‘World of Warcraft.’ Am I smart — or just lucky?

Dear Quentin,

In 2010, I was working for a company that was going under, but I didn’t know that. My evil manager was a jerk and manipulated me into quitting by severely and publicly bullying and humiliating me every day. I was too naive at the time to understand this type of manipulation. I decided to quit my job like a boss, but after finding out how I got played, I was devastated. I had no job and no unemployment benefits.

I spent the next year unemployed, at home playing “World of Warcraft.” That’s when I discovered how great Nvidia graphics cards were. One day I got a surprise pension check from the company for over $4,000. I sat on the money for a while, not sure what to do with it. Eventually, I decided to put it all in Nvidia stock. Why not? I thought. It’s just a few thousand dollars, and I like their cards.

Most Read from MarketWatch

It was literally the first stock I ever bought. Those Nvidia stocks are now worth $2 million. Yes, I became a multimillionaire by quitting my job and playing videogames all day. I’m not really religious, but even I have to think, ‘God works in mysterious ways.’ And that’s my funny story about how Nvidia made me a multimillionaire. What do you think? Did I deserve this windfall? Should I feel guilty or smart or did I just get lucky?

Mr. Lucky or Mr. Smart?

Dear Mr. Smart,

In 2010 you were in a funk, and by investing in this stock you were investing in something far more ephemeral — hope.

You saw something others didn’t. There’s a fine line between a stroke of genius and a stroke of luck. And you, my friend, walked it. In 2018, Nvidia made a ride-or-die push to upgrade those graphics cards by revamping the graphics processing units that helped fuel its artificial-intelligence ambitions. Speaking at a conference in Los Angeles last year, Nvidia NVDA CEO Jensen Huang said that he had a “bet-the-company moment.” As TechCrunch reported, Huang said: “It required that we reinvent the hardware, the software, the algorithms and, while we were reinventing CG with AI, we were reinventing the GPU for AI.”

The awesome truth: Your good fortune is due to both your gut instinct and an educated guess as a gamer that this company displayed foresight — and pursued excellence. In 2018, Ryan Shrout, the founder and lead analyst at Shrout Research, wrote on MarketWatch about Nvidia’s next-generation graphics architecture. Despite competition from bigger rivals, Shrout wrote, “Nvidia continues to ship products with leadership performance and penetration. Even Google GOOG GOOGL is using Nvidia graphics chips for its cloud-based AI inference systems, proving that Nvidia is doing while most others are simply trying to.”

Honest retail investors who made successful once-in-a-lifetime bets in the other six members of the “Magnificent Seven” group of stocks — Apple, Microsoft MSFT, Alphabet, Amazon AMZN, Meta META and Tesla TSLA — will tell you what you told me: They bought the stock on a hunch or because they noticed something special about the company’s products or philosophy. Of course, you’re more likely to get lucky with a long-term investment: 14 hours or days may be a long time in politics, but 14 years is a short time for many investors in the stock market.

The upshot: Instinct is a powerful tool — especially when you’re proved right. You’re not the first person to buy a company’s stock because you like one of their products. Have you ever used a BlackBerry BB? I did not find them to be an easy or intuitive device to use, and I never understood their appeal. Mine stayed in the box. It was subsequently upstaged by a new device called the iPhone AAPL. So yes, not liking a company’s products may be one reason to avoid the stock — or vice versa. As obvious as it may seem, it can also be useful to look at a company’s financials and price-earnings ratio before committing your hard-earned cash.

You took a bet on one stock and, while you went against all the rules of diversification, you had perhaps once-in-lifetime luck with the explosion of artificial intelligence. But you also had an inkling that this company was doing something special, even if you did not foresee the exact nature of the stock’s meteoric rise — or that, in the words of DataTrek cofounder Nick Colas, Nvidia would “become, quite literally, the single most important company in the world to global equity investors.”

Financial advisers, for better or for worse, have all sorts of methods for choosing stocks — such as fundamental analysis or technical analysis — but there are no guarantees, even for the most forensic stock picker. And history is littered with bad calls. “Fundamental analysis attempts to identify stocks offering strong growth potential at a good price,” says Charles Schwab SCHW. “Investors have traditionally used fundamental analysis for longer-term trades, relying on metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, P/E growth, and dividend yield.”

Schwab continues: “Technical analysis, on the other hand, bypasses the underlying company’s fundamentals and instead looks for statistical patterns on stock charts that might foretell future price moves. The idea here is that stock prices already reflect all the publicly available information about a particular company, so there’s nothing to be gained from poring over a balance sheet, income statement, or other financial information. Given the focus on price and volume moves, traders have traditionally used technical analysis for shorter-term trades.”

What were your objectives in buying this stock? Long-term growth? Capitalizing on a hot trend? Making a quick buck? Or did you merely want a foothold in the stock market with a $4,000 investment in your future and a shot at something less tangible — something that was in short supply after the traumatic experience with your former manager — a chance at a better future? Buying low is only the beginning: Riding the stock’s volatility, and resisting cashing out as the price slowly climbed before finally exploding. That takes chutzpah, nerves of steel and self-restraint, so give yourself credit for that.

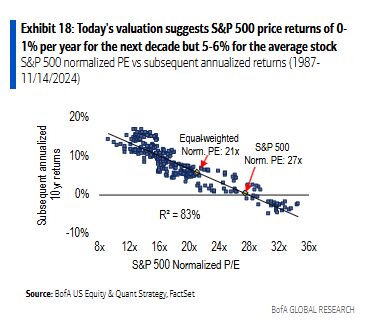

You put your life savings in one stock, a risky move, but it paid off. God works in mysterious ways and, sometimes, so does the S&P 500 SPX.

Related: ‘I’m convinced the U.S. will be drawn into World War III’: How do I prepare my finances?

Leave a Reply