Packaging Corp of America's Earnings: A Preview

Packaging Corp of America PKG is preparing to release its quarterly earnings on Tuesday, 2024-10-22. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Packaging Corp of America to report an earnings per share (EPS) of $2.49.

Anticipation surrounds Packaging Corp of America’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

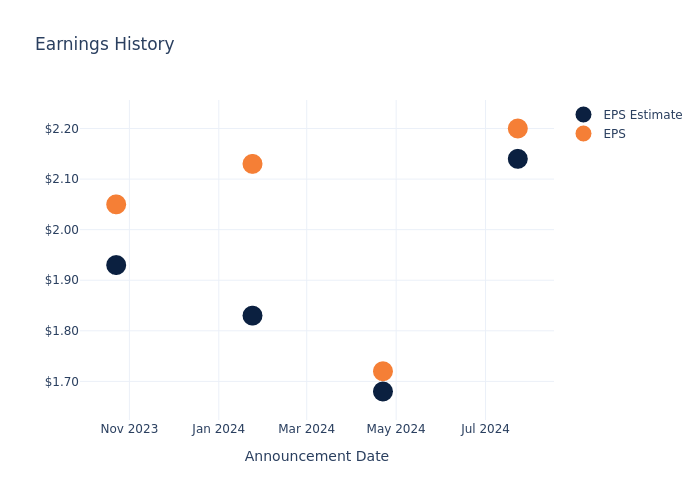

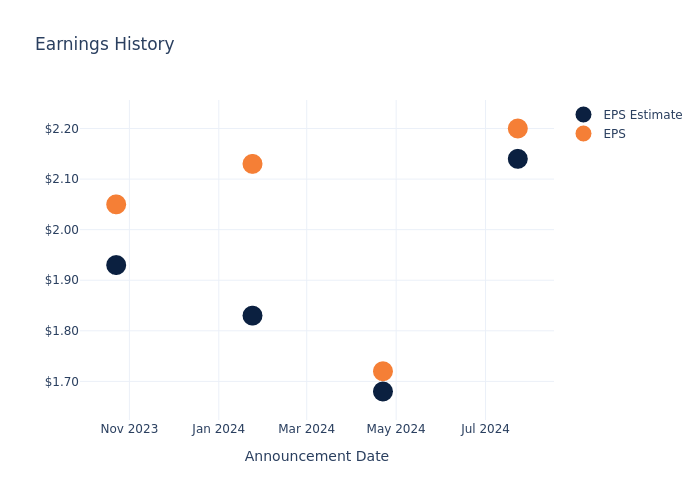

Past Earnings Performance

Last quarter the company beat EPS by $0.06, which was followed by a 0.24% increase in the share price the next day.

Here’s a look at Packaging Corp of America’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.14 | 1.68 | 1.83 | 1.93 |

| EPS Actual | 2.20 | 1.72 | 2.13 | 2.05 |

| Price Change % | 0.0% | -5.0% | 4.0% | 3.0% |

Market Performance of Packaging Corp of America’s Stock

Shares of Packaging Corp of America were trading at $220.12 as of October 18. Over the last 52-week period, shares are up 47.24%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Packaging Corp of America

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Packaging Corp of America.

The consensus rating for Packaging Corp of America is Buy, based on 5 analyst ratings. With an average one-year price target of $226.4, there’s a potential 2.85% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Avery Dennison, International Paper and Graphic Packaging Holding, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- As per analysts’ assessments, Avery Dennison is favoring an Outperform trajectory, with an average 1-year price target of $248.43, suggesting a potential 12.86% upside.

- As per analysts’ assessments, International Paper is favoring an Buy trajectory, with an average 1-year price target of $52.5, suggesting a potential 76.15% downside.

- The consensus outlook from analysts is an Outperform trajectory for Graphic Packaging Holding, with an average 1-year price target of $33.0, indicating a potential 85.01% downside.

Analysis Summary for Peers

The peer analysis summary provides a snapshot of key metrics for Avery Dennison, International Paper and Graphic Packaging Holding, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Packaging Corp of America | Buy | 6.31% | $437.70M | 4.84% |

| Avery Dennison | Outperform | 6.93% | $662.70M | 7.87% |

| International Paper | Buy | 1.11% | $1.37B | 5.91% |

| Graphic Packaging Holding | Outperform | -6.48% | $481M | 6.70% |

Key Takeaway:

Packaging Corp of America ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind Packaging Corp of America

Packaging Corp of America is the third-largest containerboard and corrugated packaging manufacturer in the United States. It produces over 4.5 million tons of containerboard annually. The company’s share of the domestic containerboard market is roughly 10%. The firm differentiates itself from larger competitors by focusing on smaller customers and operating with a high degree of flexibility.

Packaging Corp of America’s Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Packaging Corp of America’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 6.31%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company’s net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 9.52%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 4.84%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 2.21%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.77, Packaging Corp of America adopts a prudent financial strategy, indicating a balanced approach to debt management.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply