US Stocks Set To Open On A Mixed Note As Investors Await Earnings From Tesla, Boeing, GM And Others: Strategist Predicts Significant Gains In This Bull Market

U.S. stocks could get off to a mixed start on Monday after the averages posted weekly gains for a sixth straight week.

Earning news flow will pick up momentum in the coming days, potentially cushioning any downside, with Tesla Inc. TSLA, Boeing Co. BA, General Motors Co. GM and several others set to post their results through Friday.

Nearly a fifth of S&P 500 companies are set to report their earnings this week. Cumulative earnings of S&P 500 companies are set to rise for a fifth straight quarter, FactSet said. According to the analytics firm, 79% of the 14% of S&P 500 companies that have reported so far have exceeded Street expectations.

On Monday, traders could focus on earnings from over 100 S&P 500 companies, and some focus could also be on the housing market.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.23% |

| S&P 500 | -0.08% |

| Dow Jones | 0.03% |

| R2K | 0.17% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY fell 0.21% to $583.38 and the Invesco QQQ ETF QQQ declined 0.38% to $492.60, according to Benzinga Pro data.

Cues From Last Week:

Despite simmering tensions in the Middle East, Energy was the worst-performing sector in the market due to multiple factors. Slower economic growth in China and a surge in U.S. oil production resulted in a fall of over 8% in WTI crude prices.

The Dow Jones Industrial Average and the S&P 500 Index jumped to fresh highs in intraday trading on Friday.

| Index | Week’s Performance (+/-) | Value |

| Nasdaq Composite | -0.07% | 18,489.55 |

| S&P 500 | 0.08% | 5,864.67 |

| Dow Jones | 0.49% | 43,275.91 |

| Russell 2000 | 1.87% | 2,276.09 |

Insights From Analysts:

Ryan Detrick, Chief Market Strategist at Carson Group, recently highlighted positive trends for the S&P 500, noting that the index has risen in 10 of the last 11 months.

Detrick emphasized the significance of sustained bull markets, remarking, “Once a bull market gets past its second birthday, they tend to last for many more years.” This insight suggests a robust outlook for investors as the current bull market matures.

Detrick underscored that the S&P 500 has registered a six-week streak of gains for the first time this year. Referencing data from 51 similar instances in the past, Detrick concluded that stocks surged 86.3% of the time when this happened, registering an average increase of 11.1%.

“Both are better than any-time returns,” he noted, reinforcing his bullish sentiment.

Nathan Peterson, Director of Derivatives Analysis at the Schwab Center for Financial Research, noted that the focus will be on earnings next week.

“At this point in time, I don’t see enough to suggest that we may be setting up for a mean reversion pullback, so the path of least resistance still seems to be higher in my view.”

He underscored that his view on equities this week is “slightly bullish.”

However, in case earnings momentum reverses, investors could book profits, Peterson added.

See Also: How To Trade Futures

Upcoming Economic Data

This week’s economic calendar is light, but housing market data could influence investor sentiment – September’s existing home sales data is scheduled to be released on Wednesday, while new home sales data will be out on Thursday.

- On Monday, Dallas Fed President Lorie Logan will speak at 8:55 a.m. ET.

- On Tuesday, Philadelphia Fed President Patrick Harker has a speech scheduled at 10 a.m. ET.

- On Wednesday, Fed Governor Michelle Bowman is scheduled to speak at 9 a.m. ET.

- Initial jobless claims are scheduled to be released on Thursday at 8:30 a.m. ET.

Stocks In Focus:

- Boeing Co. BA surged 3.8% in premarket trading after the company landed a big win with Emirates SkyCargo ordering five more Boeing 777 freighters.

- Tesla, Inc. TSLA edged lower, down by 0.8% after Friday’s marginal decline of 0.1%.

- Nvidia Corp. NVDA rose 0.33%, building on gains of 0.8% on Friday.

- Bank of America Corp. BAC shares fell 0.3% in premarket trading after the company announced the extension of guaranteed exchange rates by up to a year.

Commodities, Bonds And Global Equity Markets:

Crude oil futures edged up in the early New York session, rising nearly 1.65% as China lowered its key lending rates to support the economy.

The 10-year Treasury note yield rose marginally to 4.126%.

Most major Asian markets ended lower on Monday, with Chinese markets edging lower amid economic growth concerns.

European stocks showed tentativeness and were mostly lower in early trading.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SHAREHOLDER INVESTIGATION: Halper Sadeh LLC Investigates USAP, CPTN, NBR, INSI on Behalf of Shareholders October 21, 2024

NEW YORK, Oct. 21, 2024 (GLOBE NEWSWIRE) — Halper Sadeh LLC, an investor rights law firm, is investigating the following companies for potential violations of the federal securities laws and/or breaches of fiduciary duties to shareholders relating to:

Universal Stainless & Alloy Products, Inc. USAP‘s sale to Aperam for $45.00 per share in cash. If you are a Universal shareholder, click here to learn more about your legal rights and options.

Cepton, Inc. CPTN‘s sale to KOITO MANUFACTURING CO., LTD. for $3.17 per share in cash. If you are a Cepton shareholder, click here to learn more about your legal rights and options.

Nabors Industries Ltd. NBR‘s merger with Parker Wellbore. Per the terms of the proposed transaction, Nabors would acquire all of Parker’s issued and outstanding common shares in exchange for 4.8 million shares of Nabors common stock, subject to a share price collar. If you are a Nabors shareholder, click here to learn more about your rights and options.

Insight Select Income Fund INSI‘s sale to KKR Income Opportunities Fund. Under the terms of the agreement, INSI shareholders will receive shares of KKR Income and may elect to receive up to 5% of the consideration in cash. If you are an INSI shareholder, click here to learn more about your rights and options.

Halper Sadeh LLC may seek increased consideration for shareholders, additional disclosures and information concerning the proposed transaction, or other relief and benefits on behalf of shareholders. We would handle the action on a contingent fee basis, whereby you would not be responsible for out-of-pocket payment of our legal fees or expenses.

Shareholders are encouraged to contact the firm free of charge to discuss their legal rights and options. Please call Daniel Sadeh or Zachary Halper at (212) 763-0060 or email sadeh@halpersadeh.com or zhalper@halpersadeh.com.

Halper Sadeh LLC represents investors all over the world who have fallen victim to securities fraud and corporate misconduct. Our attorneys have been instrumental in implementing corporate reforms and recovering millions of dollars on behalf of defrauded investors.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Halper Sadeh LLC

Daniel Sadeh, Esq.

Zachary Halper, Esq.

One World Trade Center

85th Floor

New York, NY 10007

(212) 763-0060

sadeh@halpersadeh.com

zhalper@halpersadeh.com

https://www.halpersadeh.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: Vanguard's Best-Performing ETF in 2024 Will Also Outperform the S&P 500 in 2025

Buying an S&P 500 index fund is an excellent way to achieve diversification and bet on the growth of the U.S. economy. However, some investors may prefer to mix in individual stocks and exchange-traded funds (ETFs) to invest in companies they believe can help them achieve their investment objectives — whether that is fueling their passive income stream, betting on a certain theme or sector, or trying to outperform the S&P 500.

Vanguard offers over 85 low-cost ETFs for stocks, fixed income, and blends. The best-performing of those ETFs year to date has been the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) — which is up 29.2% so far in 2024 vs. a 21.9% gain in the S&P 500. Here’s why the ETF could beat the market again in 2025, and why it is worth buying and holding over the long term.

Betting on the biggest and best growth stocks

Growth investing prioritizes the potential for future earnings and cash flows, whereas value investing focuses on what a company is producing today.

With 231 holdings, the Vanguard S&P 500 Growth ETF essentially splits the S&P 500 in half and targets those companies with the highest growth rates, regardless of valuation. The strategy works well if companies deliver on earnings growth, but can backfire if actual results don’t live up to expectations.

The Vanguard S&P 500 Growth ETF has a whopping 59.7% weighting in its top 10 names — Apple, Microsoft, Nvidia, Alphabet, Meta Platforms, Amazon, Eli Lilly, Broadcom, Tesla, and Netflix. Meanwhile, the Vanguard S&P 500 ETF has just a 34.3% weighting in those same 10 stocks. Given that many of these companies have been market-beating stocks in 2024, it makes sense that the Vanguard S&P 500 Growth ETF is outperforming the S&P 500.

To continue beating the market, these companies must prove that they can grow their earnings faster than the market average, justifying higher valuations.

Understanding growth stock valuations

The following chart shows the forward earnings multiplies for these 10 companies, which are based on analysts’ estimates for the next 12 months. With the exception of Alphabet, none of these stocks look particularly cheap. But context is key.

Take Meta Platforms, for example. Meta is spending a ton of money on research and development, from buying artificial intelligence (AI)-powered Nvidia chips to experimenting with virtual reality, the metaverse, and more. Meta could easily not make these investments and boost its short-term earnings, which would make the stock look dirt cheap.

The same could be said for Nvidia, which could have toned down its pace of innovation to inflate its profitability. Instead, it chose to invest in a new chip that could deliver unparalleled efficiency and cost savings for its customers.

Amazon is known for focusing more on sales growth than on earnings growth. It could easily be a high-margin, inexpensive company if it didn’t reinvest so much of its cash flow into the business.

One reason these companies sport expensive valuations is that investors have been bidding up their stock prices. But another, more important factor is that these companies are not focused on generating as much earnings as possible right now, but rather on charting a path toward future growth that often comes at the expense of near-term results.

For this strategy to work well over time, companies must allocate capital to projects that generate a return on investment. If a company begins spending money on bad ideas, it will fall apart quickly.

A reasonably balanced growth ETF

What separates the Vanguard S&P 500 Growth ETF from other growth funds is that it includes many traditional “value” stocks, like Procter & Gamble, Merck, Coca-Cola, PepsiCo, and McDonald’s, as well as faster-growing companies in non-tech focused sectors, like UnitedHealth and Costco Wholesale. These companies don’t have nearly the growth potential of an innovative tech stock like Nvidia, but they do have track records for steady earnings growth over time. Investors are willing to pay a higher multiple for a stock like P&G relative to its peers because P&G is a high-margin, well-run business that does a masterful job developing its top brands.

While roughly 60% of the Vanguard S&P 500 Growth ETF is in its top 10 holdings, the other 40% of the fund is fairly balanced across companies from various sectors. All told, the Vanguard S&P 500 Growth ETF has a price-to-earnings (P/E) ratio of 32.9 compared to 29.1 for the Vanguard S&P 500 ETF. So it’s not like it is that much more expensive, especially compared to ultra-growth-focused ETFs like the Vanguard Mega Cap Growth ETF, which has fewer holdings and higher weightings in a handful of companies.

Think long-term with the Vanguard S&P 500 Growth ETF

With an expense ratio of just 0.1%, the Vanguard S&P 500 Growth ETF offers investors a low-cost way to target hundreds of top growth stocks without racking up high fees.

Concentrating on high-quality businesses that grow their earnings is a recipe for outperforming other funds or indexes with fewer quality names. However, it’s important to understand that the stock market can do just about anything in the short term.

If near-term results disappoint or investor sentiment turns negative, companies whose valuations are based on future growth will likely sell off more than companies that are valued fairly based on what they are earning today.

Therefore, it’s important to approach the Vanguard S&P 500 Growth ETF with a long-term mindset and the understanding that even the best companies suffer brutal sell-offs.

Should you invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Merck, Meta Platforms, Microsoft, Netflix, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: Vanguard’s Best-Performing ETF in 2024 Will Also Outperform the S&P 500 in 2025 was originally published by The Motley Fool

PET MRI Market Set to Reach $494.7 Million by 2034 with 9.1% CAGR Growth | Fact.MR Report

Rockville, MD, Oct. 21, 2024 (GLOBE NEWSWIRE) — According to new research report published by Fact.MR, valuation of the global PET MRI market is expected to reach US$ 206.3 million in 2024 and climb to US$ 494.7 million by the end of 2034.

Primary factor driving demand for PET MRI systems is their increasing utilization in various healthcare fields such as neurology, cardiology, oncology, and musculoskeletal imaging. These systems enable medical professionals to analyze diseases in depth, aiding in early detection, precise staging, and treatment planning.

By allowing the simultaneous viewing of anatomical, functional, and molecular data, the combination of PET (positron emission tomography) and MRI (magnetic resonance imaging) is an excellent technological advancement that provides high-end insights into disease processes and treatment responses.

Through the concurrent assessment of metabolic activity, tissue perfusion, and structural morphology, PET MRI enhances diagnostic precision and expedites the early detection, staging, and monitoring of several disorders, including cancer, neurological conditions, and cardiovascular ailments. These techniques make it simple for medical providers to give patients individualized treatment programs based on their needs or issues, which improves clinical outcomes and fuels market expansion.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10141

Key Takeaways from Market Study

- The global PET MRI market is projected to expand at 1% CAGR from 2024 to 2034.

- North America is expected to hold 8% of the global market share in 2024.

- The East Asia market is forecasted to reach a valuation of US$ 91 million by the end of 2034, up from US$ 31 million in 2024.

- In 2024, the United States is set to hold 9% market share in the North American region.

- Under application, demand for clinical PET MRI systems is projected to reach a market value of US$ 426.6 million by the end of 2034.

- The market in South Korea is forecasted to expand at 2% CAGR through 2034.

- Based on product type, the integrated PET MRI segment is projected to generate revenue of US$ 340.3 million by 2034.

- Demand for simultaneous PET MRI scanners is forecasted to rise at 9% CAGR through 2034.

“Technologies that enable simultaneous data collection and precise spatial co-registration of PET and MRI images are enabling the seamless integration of these two medical imaging modalities to improve diagnostic accuracy and patient outcomes,” says a Fact.MR analyst.

Leading Players Driving Innovation in the PET MRI Market:

Key industry participants like Siemens AG; Hallmarq Veterinary Imaging; Koninklijke Philips N.V.; GE Healthcare; Time Medical Holdings; MR Solutions; United Imaging; Mediso Ltd.; Aspect Imaging; IMV Imaging., etc. are driving the PET MRI industry.

High Demand for Simultaneous PET MRI Scanners

Simultaneous PET MRI scanners are seen to be an important development in medical imaging technology since they speed up diagnostic processes and enhance patient experience. With simultaneous scanners, which need patient movement and separate scans, PET/MRI systems capture PET and MRI data concurrently. This integration improves workflow efficiency and diagnostic accuracy by cutting down on total scan time, reducing patient pain, and eliminating registration mistakes. These scanners are considered key systems in today’s healthcare settings, maximizing clinical efficiency and enhancing patient experience since they seamlessly integrate PET and MRI modalities.

PET MRI Industry News:

- In April 2024, the PGI Department of Nuclear Medicine announced plans to acquire a PET-MRI system, marking the first of its kind among government facilities in northern India, including AIIMS, New Delhi. This advanced diagnostic device is used for detecting soft tissue malignancies, such as brain tumors and pelvic cancers.

- In January 2023, Esaote North America launched the Magnifico Vet MRI, offering fast and easy diagnostics for veterinary use. Similarly, in November 2022, Hallmarq Veterinary Imaging introduced its Zero-Helium Small Animal 1.5T MRI system, which uses a conduction-based cooling system instead of helium.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10141

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the PET MRI market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (integrated, separate, insert, hybrid), imaging technology (conventional, time of flight), image acquisition (sequential PET MRI scanners, simultaneous PET MRI scanners), application (pre-clinical PET MRI systems, clinical PET MRI systems), and end user (hospitals, diagnostic laboratories, research institutes, pharmaceutical & biopharmaceutical companies), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR Research:

Respiratory syncytial virus (RSV) diagnostics market is projected to reach US$ 1.3 billion by 2031, growing at a 9% CAGR. High demand for RSV diagnostic kits and assays is expected, with their market value reaching US$ 720 million by the end of 2031.

Oncology molecular diagnostics market was valued at around US$ 1.7 Billion in 2020 and is anticipated to reach a valuation of US$ 4 Billion by 2031.

Kidney cancer diagnostics market is estimated to be valued at US$ 800 Million in 2022 and increasing at a CAGR of 7% reach US$ 1.4 Billion by 2032.

Antibody drug conjugate contract market demand is anticipated to be valued at US$ 9.2 Billion in 2022, forecast a CAGR of 15.5% to be valued at US$ 38.8 Billion from 2022 to 2032.

Muscle stimulators market is expected to reach US$ 1.85 Billion by 2032, growing at a CAGR of 5.4%.

Endoscopy cameras market is valued at US$ 1.3 billion and is projected to reach a value of US$ 2.15 billion by the end of 2027.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Upcoming Presidential Election Could Impact Macroeconomic Lens, And How You Could Benefit – Crossroads Summit Aims To Offer Insight

Former President Barack Obama is quoted as saying that elections have consequences. Perhaps this is why voters can often be consumed with confusion and anxiety leading up to them. Today’s political climate appears more divisive than most can remember, and the two candidates couldn’t be more different, both from a personality and policy perspective. Each one’s stated policies come with potential risks and rewards.

Comparing The Candidates’ Corporate Tax Policies

The Republican candidate Donald Trump vows to reduce the rate big companies pay in income taxes. He says he will lower the corporate tax rate from its current 21% to 15%. His Democratic opponent Kamala Harris pledges to raise it to 28%.

The potential increase in corporate profits created by a lower tax bill might well benefit shareholders of public companies. But are they likely to increase the federal budget deficit?

On the flip side, would an increase in those same tax rates so badly decrease corporate earnings that the stock market swoons? Or will GDP rise and will we witness a reduction in the deficit?

The reality is that nobody can truly know with absolute certainty. According to the Penn Wharton Budget Model (PWBM), both candidates’ policy proposals will increase the federal budget deficit. More problematic is that the PWBM “analyses only include proposals that are detailed enough to score.” In other words, they really don’t have enough to go on to arrive at a solid conclusion.

How Geopolitics And Economics Collide – Where Does Each Candidate Stand?

Russia’s war on Ukraine “could upend fiscal and monetary policy in advanced economies,” according to the International Monetary Fund. The two candidates for president have very different views on how to deal with the conflict.

Donald Trump says that the United States should “get out” of the mix and leave any resolution up to the two combatants. Vice President Harris has vowed “unwavering support” for the embattled country.

Many investors find it problematic to determine whether the next President of the United States will usher in a new world order or maintain the status quo. The Council on Foreign Relations offers a stark contrast between the two.

For example, Trump says that the United States should reassess its role in the North Atlantic Treaty Organization (NATO). The Vice President is a strong supporter of multilateral cooperation like NATO.

Conflicts in places like Gaza and Congo and instability in places like Venezuela – where the U.S. has sanctioned judicial and election officials – add further chaos to the mix. All of this begs the question: How could these regional skirmishes change the climate for investment?

Will The United States Lead, Follow Or Stay Out Of The Way?

Potentially more troubling for American investors is the broader role the United States takes in global affairs beyond possible conflict resolution. Will an America First philosophy bolster the country’s standing as a leader among other nations and help it promote mutually beneficial synergies? Or will it stifle cooperation?

The two candidates do not have the same approach to reinvigorating American engagement in the world. The consequences of trade and foreign policy are far-reaching, hugely complicated and as the World Trade Organization notes, “have always been intertwined.”

Where Can Investors Turn For Insights?

A recent article in Forbes magazine predicted that “over one hundred thousand humanoid robots will be deployed in the real world” by 2030 and that the job losses related to that and AI will lead to “civil unrest and protests.”

Investors looking to make sense of the chaos of a rapidly changing world might consider attending the Crossroads Summit 2024.

The event offers traders an opportunity to network with geopolitical experts and thought leaders across different disciplines to help leaders refine investing strategies focused on the future. The Summit will feature several keynote speakers including bestselling authors Peter Zeihan and Neil Howe, City of Miami Mayor Francis Suarez, Vice President of Mastercard MA Eduardo R. Abreu and more.

The Crossroads Summit seeks to connect leaders and investors with some of the most respected visionaries in their fields. These analysts have a deep and multi-disciplinary understanding of the complex issues facing the world today.

They are focused on identifying opportunities in potential innovations that may emerge from global chaos. The conference provides attendees with an opportunity to discuss their concerns about the future with experts whose business it is to profit from it. The Crossroads Summit believes that the sharpest traders and investors are always looking beyond the headlines and soundbites.

Featured photo by Phil Hearing on Unsplash.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Textile Chemicals Market Expected to Grow at a CAGR of 4.7% by 2031 | SkyQuest Technology

Westford, US, Oct. 21, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Global Textile Chemicals Market will attain a value of USD 37.81 billion by 2031, with a CAGR of 4.7% over the forecast period (2024-2031). Rapid surge in demand for textiles around the world on the back of the growing world population and rising disposable income is slated to drive the demand for textile chemicals going forward. Rapidly evolving consumer preferences and growing awareness regarding aesthetic appearance are also expected to indirectly bolster market growth in the future.

Download Sample for detailed overview: https://www.skyquestt.com/sample-request/textile-chemicals-market

Browse in-depth TOC on “Textile Chemicals Market” Pages – 197, Tables – 95, Figures – 76

Textile Chemicals Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $26.19 billion |

| Estimated Value by 2031 | $37.81 billion |

| Growth Rate | Poised to grow at a CAGR of 4.7% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Updated financial information/product portfolio of players |

| Key Market Opportunities | Use of textile chemicals to develop smart textile products |

| Key Market Drivers | Rising disposable income and growing world population |

Coating and Sizing Textile Chemicals to Bring in the Most Revenue for Market Players

Use of coating and sizing chemicals in the textile industry is projected to surpass any other type of chemical going forward. Use of coatings and sizing chemicals to provide textiles with specific characteristics such as stain resistance, wrinkle-free properties, and enhanced comfort. Improvement of the physical properties of textiles through the use of these chemicals is what allows them to hold a dominant stance.

Demand for Textile Chemicals is Slated to Rise at a Rapid Pace for Technical Textile Applications in the Future

Growing emphasis on safety and advancements in the development of novel technical textile materials are projected to make the technical textile segment a highly opportune one. Extensive use of advanced textile chemicals to enhance the properties of technical textiles such as durability, water and fire resistance, antimicrobial characteristics, etc. is slated to present new opportunities for textile chemicals companies over the coming years.

Presence of Key Textile Manufacturers Allows Asia Pacific Region to Hold Sway Over Global Textile Chemical Demand

The Asia Pacific region is forecasted to spearhead sales of textile chemicals on a global level owing to the massive population base, evolving consumer preferences, and the presence of major textile manufacturing industries and companies. Growing disposable income of people in this region will also help bolster the demand for textile chemicals in the future. China and India are estimated to emerge as the most opportune markets for textile chemicals companies operating in this region.

Request Free Customization of this report: https://www.skyquestt.com/speak-with-analyst/textile-chemicals-market

Textile Chemicals Market Insights:

Drivers

- Rapidly increasing global population

- Evolving consumer preferences and rising disposable income

- Increasing aesthetic awareness among people

Restraints

- Ban on use of toxic chemicals

- Lack of sustainable chemical alternatives

Prominent Players in Textile Chemicals Market

- Archroma

- BASF SE

- Huntsman Corporation

- Lubrizol Corporation

- DyStar Group

- Kemin Industries

- Solvay SA

- The Dow Chemical Company

- Evonik Industries AG

- Clariant International AG

Key Questions Answered in Textile Chemicals Market Report

- What drives the global Textile Chemicals market growth?

- Who are the leading Textile Chemicals providers in the world?

- Which region leads the demand for Textile Chemicals in the world?

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/textile-chemicals-market

This report provides the following insights:

Analysis of key drivers (growing global population, evolving consumer preferences, rising disposable income), restraints (bans on use of toxic textile chemicals, lack of sustainable chemical alternatives), and opportunities (development of sustainable Textile Chemicals, use of textile chemicals for the development of smart textiles) influencing the growth of Textile Chemicals market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Textile Chemicals market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

Specialty Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Construction Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Aroma Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Crop Protection Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Water Treatment Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization has expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Super Micro Computer a Millionaire-Maker Stock?

Super Micro Computer (NASDAQ: SMCI) has been through an interesting 2024. It started the year as one of the hottest stocks to own, tripling its share price in less than three months. Then, it slowly declined after investors took profits, and Supermicro (as the company is often called) reported a bad earnings report. To make matters worse, Hindenburg Research, a famed short-selling firm, reported that Supermicro was involved in accounting fraud, triggering a Department of Justice (DOJ) probe into the claims.

That’s quite the roller-coaster ride for Supermicro investors, and it has left the stock significantly down from its all-time high. So, could this be a million-dollar investing idea? After all, Supermicro’s business is booming.

Demand for Supermicro’s products has been off the charts

Super Micro Computer’s rise is tied to the incredible demand for artificial intelligence (AI) computing power. Supermicro makes components for servers and also sells complete server systems. The company’s products are set apart from the competition by their superior cooling technology: Its most efficient servers are liquid-cooled, which eliminates the need to place these servers in large rooms to be cooled by expensive air conditioning.

According to Supermicro, this provides up to 40% energy savings and 80% space savings, as the racks can be placed closer together because airflow isn’t as critical. This combo allows its customers to pack more servers in a room, and that’s a key selling point.

The massive demand for its products has rapidly accelerated Supermicro’s business. In Q4 FY 2024 (ending June 30), Supermicro’s revenue rose 143% year over year to $5.3 billion. The company also gave strong guidance for FY 2025, with management expecting between $26 billion and $30 billion in revenue — about 74% to 101% growth.

But management has a larger vision than that. It believes it can grow its business to $50 billion in annual revenue. While this may seem like a lofty goal, this projection was $20 billion during last year’s Q4 results, and Supermicro’s 2025 guidance has already exceeded that level.

If that were the only piece of information investors had, Supermicro would probably still be one of the most popular stocks on the market, but there’s far more to this story.

Supermicro isn’t without its problems

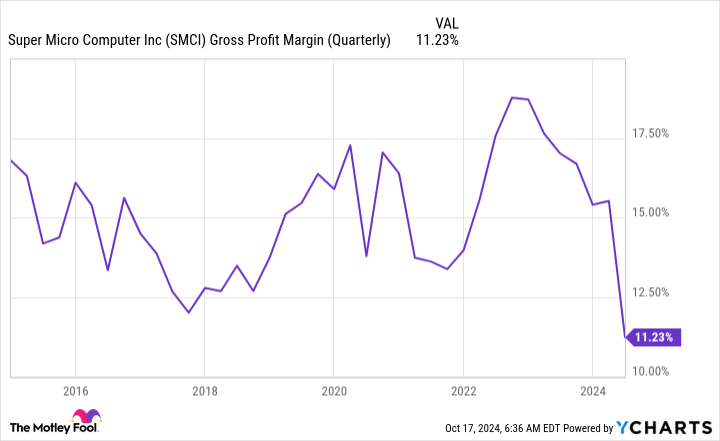

One huge red flag in Supermicro’s results is its declining gross margin. This value has leached to a decade-long low despite rising revenues. That’s never a good sign.

Management claims that its gross margin should tick up throughout FY 2025 due to a more profitable product mix, manufacturing efficiencies in its liquid-cooled product line (its factories in Malaysia and Taiwan are still scaling up production), and new products. This will be a key point for investors to watch, as Supermicro’s profits could boom if its gross margin improves throughout the year.

However, with accounting malpractice claims in the air, some investors are worried that they cannot trust anything management says. Noted short-selling firm Hindenburg Research called out Supermicro’s past mistakes, as the company paid a $17.5 million fine for accounting errors it made in 2018. To make matters worse, Supermicro also delayed its end-of-year form 10-K filing this year because it was assessing the “design and operating effectiveness of its internal controls over financial reporting.”

That’s another potential weakness, and with the DOJ looking into it, the potential scandal may cause investors to stay far away from Supermicro. I wouldn’t blame anyone, as there’s a lot of risk in the stock. But there’s also a lot of reward if management’s projections come true and the DOJ probe finds nothing wrong.

Supermicro may be one of the cheapest stocks associated with the AI investment trend, trading for a mere 15 times forward earnings estimates.

If it gets through these choppy waters unscathed, it’s not unrealistic to think that it could fetch a premium equal to that of the S&P 500 (SNPINDEX: ^GSPC), which trades at 23.8 times forward earnings on average.

Supermicro stock involves a lot of risk, but the possible upside is also there. So, will this stock make you a millionaire? Likely not. I’m talking about the stock doubling or tripling in the next few years, so unless you have a massive pile of cash to put into it, it won’t do it.

However, if you’re interested in taking a small position that’s adjusted for risk (Supermicro makes up about 1% of my portfolio), it has the potential to boost your long-term returns. This way, the stock could accelerate your path to becoming a millionaire.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Super Micro Computer a Millionaire-Maker Stock? was originally published by The Motley Fool

Oil rises as Israel plans next Iran move after weekend attack

(Bloomberg) — Oil gained — after losing almost 8% last week — as traders tracked the risk to supplies from tensions in the Middle East and China again moved to bolster its the economy.

Most Read from Bloomberg

Global benchmark Brent rose above $74 a barrel, while West Texas Intermediate topped $70. On Saturday, a Hezbollah drone exploded next to Prime Minister Benjamin Netanyahu’s private home. The following day, Israel opened a fresh military assault on the group’s strongholds in Lebanon. Israel has already vowed to retaliate against Iran for a missile attack at the start of October.

Meanwhile, China — the world’s largest oil importer — cut its benchmark lending rates on Monday, after the central bank lowered interest rates at the end of September as part a series of measures to revive growth. Speaking in Singapore, Saudi Aramco Chief Executive Officer Amin H. Nasser said he is bullish about the nation’s consumption.

Crude has had a volatile month, with traders balancing risks to flows from the Middle East against signs of soft demand in China. At the same time, the International Energy Agency has said rising global supplies could lead to a surplus next year, with OPEC+ set to restore some shuttered capacity in stages from December.

“If we don’t see a major escalation of the situation in the Middle East, I still expect that oil prices will be further under pressure because we are entering a period, including next year, of more comfortable markets,” Fatih Birol, head of the IEA, told Bloomberg Television on Monday. He cited factors including the rapid growth of output in the Americas.

Still, traders remain on edge. Bullish call options continue to trade at a premium to bearish puts, while weekly call option volumes on the global Brent benchmark were the second-largest on record last week.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Gas Pressure Regulator Market is Projected to Reach a Valuation of US$ 4.09 Billion at a CAGR of 3.7% by 2034 | Fact.MR Report

Rockville, MD , Oct. 21, 2024 (GLOBE NEWSWIRE) — According to a newly published study by Fact.MR, a market research and competitive intelligence provider, the global Gas Pressure Regulator Market is analyzed to reach a size of US$ 2.84 billion in 2024 and further increase at a CAGR of 3.7% from 2024 to 2034.

The oil and gas industry’s ongoing production and exploration efforts are driving the expansion of the gas pressure regulator market growth. Reliable pressure management systems are becoming pivotal as companies in this sector spend more on advanced extraction technology and infrastructure. Gas pressure regulators are crucial to the efficiency of operations because they ensure that gas flow and pressure levels are kept within safe and useful ranges.

This is vital for maintaining stringent safety standards, which decreases the possibility of accidents and assures regulatory compliance, in addition to optimizing production. Consequently, the demand for effective gas pressure regulating systems is rising.

East Asia’s growing manufacturing sector and the increasing reliance on natural gas for electricity and heating are contributing to the market expansion in the region. The market in North America is expanding due to increased consumption of natural gas in industrial, commercial, and residential settings. Effective gas distribution systems are becoming more necessary as shale gas output rises.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10422

Key Takeaways from Market Study:

- The global market for gas pressure regulators is approximated to reach a valuation of US$ 4.09 billion by the end of 2034.

- The East Asia region is analyzed to lead with a 26.9% worldwide market share in 2024.

- The North American market is projected to touch a value of US$ 960.7 million by 2034-end.

- Demand for single-stage gas pressure regulators in Japan is forecasted to increase at 3.9% CAGR between 2024 to 2034.

- China is estimated to hold 47.9% portion of the East Asia market in 2024.

- By gas type, the fuel gases segment is evaluated to expand at a CAGR of 3.8% through 2034.

“Leading gas pressure regulator manufacturing companies are focusing on R&D projects to offer end users high-value solutions that increase their safety and productivity,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Gas Pressure Regulator Market:

Emerson Electric Co.; Rotarex SA; Matheson Tri-Gas, Inc.; Essex Industries, Inc.; Linda plc.; Watts Water Technologies, Inc.; Honeywell International; Itron Inc.; Xylem; Tewelding Engineers; Shenzen Wofly Technology Co., Ltd.; GMR Gas S.R.O.

Single-stage Gas Pressure Regulators Becoming Ideal Choice in Several Settings:

The popularity of single-stage gas pressure regulators is increasing due to their low cost, simplicity of operation, and efficiency. Because these regulators are designed to drop high inlet pressure to lower exit pressure in a single step, they are ideal for applications requiring only slight pressure reductions. Its simple design has fewer components than multi-stage regulators, which lowers manufacturing costs and makes installation and maintenance easier.

For people and businesses searching for dependable and efficient solutions to manage gas pressure in a variety of applications, from industrial operations to residential heating, single-stage gas pressure regulators are a budget-friendly choice. The increasing need for trustworthy, low-maintenance, and effective solutions from customers is driving an expansion in the requirement for single-stage gas pressure regulators across several industries.

Gas Pressure Regulator Industry News:

- GCE Healthcare introduced a new design for their most recent high-pressure gas regulator in June 2021. MediTec is a high-pressure regulator with a distinctive and cutting-edge design that combines extensive manufacturing expertise with professional medical knowledge.

- In March 2021, Colfax Corporation unveiled a new gas regulator solution that was more capable than its previous offers. Once the company makes its debut, its global market share should rise.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10422

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the gas pressure regulator market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (single-stage, double-stage), gas capacity (toxic gases, corrosive gases, inert gases, fuel gases, others), and application (oil & gas, medical, automotive, manufacturing, residential & commercial, mining, water treatment), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Segmentation of Gas Pressure Regulator Market Research:

- By Product Type :

- By Gas Capacity :

- Toxic Gases

- Corrosive Gases

- Inert Gases

- Fuel Gases

- Others

- By Application :

- Oil & Gas

- Medical

- Automotive

- Manufacturing

- Residential & Commercial

- Mining

- Water Treatment

Checkout More Related Studies Published by Fact.MR Research:

Fire Protection System Market: is estimated to achieve a size of US$ 70.48 billion in 2024, according to a revised research report published by Fact.MR. Demand is projected to expand at a notable CAGR of 9.1% to touch a valuation of US$ 168.4 billion by 2034-end.

Flexographic Printing Technology Market: is projected at US$ 2.86 billion in 2024. The market has been evaluated to advance at a CAGR of 6.5% and reach a valuation of US$ 5.38 billion by the end of 2034.

Blow Moulding Machine Market: was valued at US$ 2,443.4 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 3.7% to end up at US$ 3,604.0 Million by 2034.

Land Survey Equipment System Market: is expected to reach a valuation of US$ 8,523.2 million in 2024 and is projected to climb to US$ 13,363.4 million by 2034, expanding at a CAGR of 4.6% during the forecast period of 2024 to 2034.

Portable Inverter Generator Market: was valued at US$ 3,404.1 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 9.4% to end up at US$ 8,959.8 Million by 2034. The portable inverter generator market accounts for around 19% in overall generator market.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.