These Analysts Revise Their Forecasts On Autoliv After Q3 Results

Autoliv, Inc. ALV reported better-than-expected third-quarter sales results on Friday.

The company reported third-quarter adjusted earnings per share of $1.84, missing the analyst consensus of $1.95. Quarterly revenues of $2.56 billion topped the street view of $2.53 billion.

“Light vehicle production was weak in the third quarter, declining by close to 5% globally. This was driven by a combination of inventory reductions, especially in the Americas and a high comparison base, especially in China,” said Mikael Bratt, President & CEO.

Autoliv now expects full-year 2024 organic sales growth to be 1%, down from the previously anticipated 2%, due to unfavorable market mix developments.

Autoliv shares fell 1.2% to trade at $98.36 on Monday.

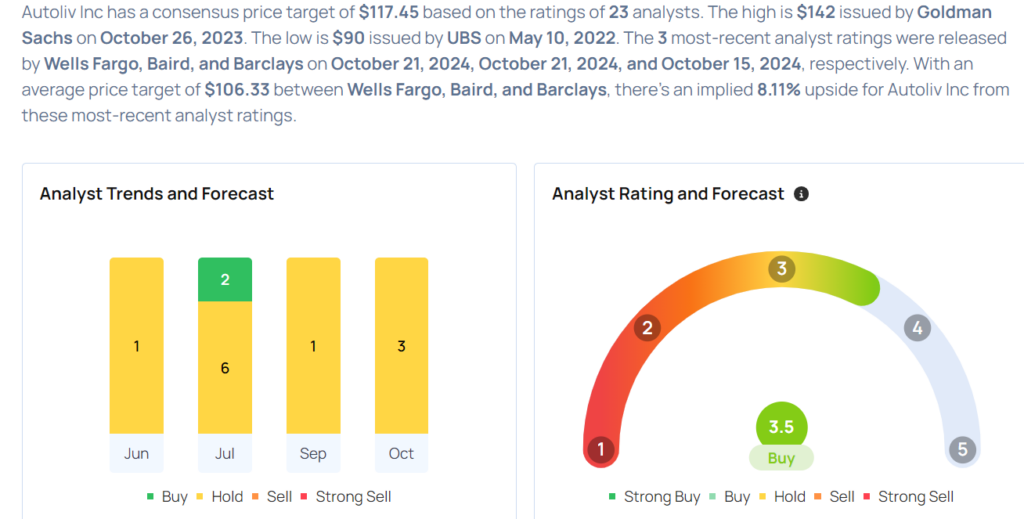

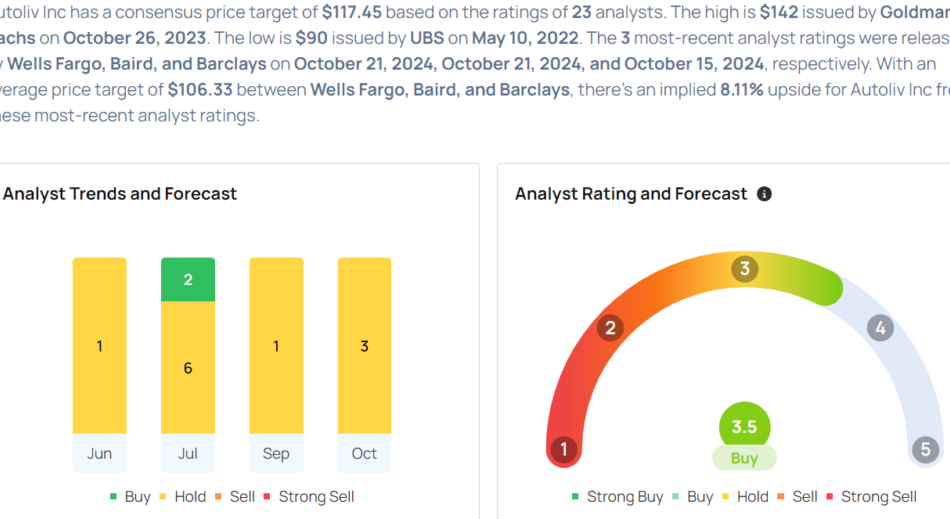

These analysts made changes to their price targets on Autoliv following earnings announcement.

- Baird analyst Luke Junk maintained Autoliv with a Neutral and raised the price target from $103 to $108.

- Wells Fargo analyst Colin Langan maintained Autoliv with an Equal-Weight and cut the price target from $102 to $101.

Considering buying ALV stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply