Dividend Investor Making $5,300 a Month Shares His Portfolio: Top 6 High-Yield REIT Stocks You Shouldn't Miss

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend investing often takes a back seat when the market is focused on tech growth stocks, especially today when AI drives much of the market hype. But hype does not last long and long-term investors should prefer solid income-generating stocks for good times and dry spells. The performance of dividend stocks is best understood over long-term horizons. According to a report from Richard C. Young Investment Advisors, dividends and reinvested dividends have accounted for about 60% of the S&P 500’s total return over the past 40 years through 2022.

Don’t Miss:

A few months ago, a dividend investor shared his detailed income report on the r/Dividends community on Reddit, saying he earns about $5,300 a month in dividend income. According to the portfolio screenshots shared by the investor, his total portfolio was worth roughly $880,368. He said it took about one year to go from $4,000 to $5,300 in monthly dividend income.

Someone asked the investor how he chose dividend stocks for investing. Here is what he said:

“Mainly the following:

-

Is the yield over 3%?

-

Is the dividend Growth at least over 3-4% to keep up with inflation?

-

What is the stock price over the past five years? Going up, down or plateau?

-

Is the brand power strong?

-

Is this what the majority of people need? (Such as EPD or ENB where everyone pretty much needs energy.)”

The investor was also asked to share his advice for beginner investors.

“If you are not sure where to start, then I always recommend starting with VOO and QQQM. You cant go wrong with these two combination. Give yourself some time to watch the market and start investing in individual stocks.”

Trending: Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. Sign up today to earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

Arbor Realty Trust

Arbor Realty Trust Inc. (NYSE:ABR) was among the investor’s biggest holdings, earning $5,300 per month in dividends. The portfolio screenshots showed he owned 2,020 shares of the company, raking in $3,650 annually. Arbor Realty is a mortgage REIT with a dividend yield of over 11%.

Earnings Preview: Getty Realty

Getty Realty GTY is gearing up to announce its quarterly earnings on Wednesday, 2024-10-23. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Getty Realty will report an earnings per share (EPS) of $0.58.

The announcement from Getty Realty is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Performance in Previous Earnings

Last quarter the company beat EPS by $0.01, which was followed by a 3.38% increase in the share price the next day.

Here’s a look at Getty Realty’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.57 | 0.57 | ||

| EPS Actual | 0.58 | 0.57 | 0.57 | 0.57 |

| Price Change % | 3.0% | -0.0% | 2.0% | 2.0% |

Analyst Opinions on Getty Realty

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Getty Realty.

With 3 analyst ratings, Getty Realty has a consensus rating of Buy. The average one-year price target is $33.33, indicating a potential 3.67% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Retail Opportunity, Netstreit and InvenTrust Properties, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- As per analysts’ assessments, Retail Opportunity is favoring an Neutral trajectory, with an average 1-year price target of $16.0, suggesting a potential 50.23% downside.

- Netstreit received a Buy consensus from analysts, with an average 1-year price target of $17.75, implying a potential 44.79% downside.

- As per analysts’ assessments, InvenTrust Properties is favoring an Buy trajectory, with an average 1-year price target of $31.33, suggesting a potential 2.55% downside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Retail Opportunity, Netstreit and InvenTrust Properties are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Getty Realty | Buy | 11.72% | $45.95M | 1.69% |

| Retail Opportunity | Neutral | 1.56% | $60.36M | 0.57% |

| Netstreit | Buy | 24.71% | $32.88M | -0.18% |

| InvenTrust Properties | Buy | 4.23% | $48.13M | 0.10% |

Key Takeaway:

Getty Realty ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Consensus rating and Return on Equity.

Get to Know Getty Realty Better

Getty Realty Corp is the real estate investment trust in the U.S. specializing in the acquisition, financing, and development of convenience, automotive, and other single tenant retail real estate. The company’s portfolio includes convenience stores, car washes, automotive service centers (gasoline and repair, oil and maintenance, tire and battery, collision), automotive parts retailers, and certain other freestanding retail properties, including drive-thru quick service restaurants. It generates majority of the revenue in the form of rental income.

Financial Milestones: Getty Realty’s Journey

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, Getty Realty showcased positive performance, achieving a revenue growth rate of 11.72% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Getty Realty’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 32.13%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Getty Realty’s ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.69%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.86%, the company showcases effective utilization of assets.

Debt Management: Getty Realty’s debt-to-equity ratio is below the industry average at 0.9, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Getty Realty visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Noteworthy Insider Activity: Laura G Scheland Invests $239K In Oil-Dri Corp of America Stock

On October 21, Laura G Scheland, VP and Chief Legal Officer at Oil-Dri Corp of America ODC executed a significant insider buy, as disclosed in the latest SEC filing.

What Happened: Scheland demonstrated confidence in Oil-Dri Corp of America by purchasing 3,500 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the transaction is $239,505.

Oil-Dri Corp of America‘s shares are actively trading at $69.5, experiencing a up of 1.56% during Tuesday’s morning session.

Get to Know Oil-Dri Corp of America Better

Oil-Dri Corp of America develops, manufactures, and markets sorbent products made predominantly from clay. Its absorbent offerings, which draw liquid up, include cat litter, floor products, toxin control substances for livestock, and agricultural chemical carriers. The company has two segments based on the different characteristics of two primary customer groups namely Retail and Wholesale Products Group and Business to Business Products Group. The company’s products are sold under various brands such as Cat’s Pride, Jonny Cat, Amlan, Agsorb, Verge, Pure-Flo, and Ultra-Clear.

Financial Insights: Oil-Dri Corp of America

Revenue Growth: Oil-Dri Corp of America displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 5.88%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Insights into Profitability:

-

Gross Margin: The company shows a low gross margin of 29.04%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Oil-Dri Corp of America’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.26.

Debt Management: Oil-Dri Corp of America’s debt-to-equity ratio is below the industry average at 0.34, reflecting a lower dependency on debt financing and a more conservative financial approach.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 12.6 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.38, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 7.72 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Oil-Dri Corp of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GE Aerospace's Q3 Results Solid, But Segments Tell Different Stories: Analyst

Goldman Sachs analyst Noah Poponak expresses their view on GE Aerospace‘s GE third-quarter 2024 results.

The company reported adjusted revenue growth of 6% Y/Y to $8.943 billion and GAAP revenue of $9.84 billion. The analyst consensus was $9.022 billion.

GE still expects adjusted revenue growth in the high single digits. It now sees adjusted EPS of $4.20 – $4.35 (prior $3.95 – $4.20) vs. the $4.25 consensus.

The company now expects adjusted operating profit of $6.7 billion – $6.9 billion (prior $6.5 billion – $6.8 billion) and adjusted free cash flow of $5.6 billion – $5.8 billion (prior $5.3 billion – $5.6 billion).

The analyst writes that GE’s results are solid overall but mixed by segment. Market expectations were high, and segment EBIT fell short of consensus.

While commercial engines remain a key growth driver, the analyst says the defense segment underperformed due to lower revenue and margins.

Goldman Sachs rated the company ‘Buy’, with a price target of $201. The analyst expects EPS of $4.12 for FY24, $5.16 for FY25, and $6.30 for FY26.

Investors can gain exposure to the stock via IShares U.S. Aerospace & Defense ETF ITA and TCW Transform Systems ETF NETZ.

Price Action: GE shares are down 8.69% at $177.36 at the last check Tuesday.

Photo by Ground Picture on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: 1 Unstoppable Stock Will Join Nvidia, Apple, Microsoft, Amazon, Alphabet, and Meta in the $1 Trillion Club In 2025

U.S. stock exchanges are home to eight companies with a valuation of at least $1 trillion:

-

Apple: $3.59 trillion.

-

Nvidia: $3.52 trillion.

-

Microsoft: $3.11 trillion.

-

Alphabet: $2.02 trillion.

-

Amazon: $1.98 trillion.

-

Meta Platforms: $1.45 trillion.

-

Taiwan Semiconductor Manufacturing: $1.04 trillion.

-

Berkshire Hathaway: $1 trillion.

Apple was the founding member of the exclusive $1 trillion club in 2018. Warren Buffett‘s Berkshire Hathaway and Taiwan Semi are the newest members, having joined in the last few months. And despite only joining in 2023, Nvidia has leapfrogged tech giants like Microsoft to become the second-most valuable company in the world, thanks to soaring demand for its artificial intelligence (AI) data center chips.

I predict one more company is about to join them. Broadcom (NASDAQ: AVGO) has a market capitalization of $840 billion as of this writing, following an incredible 527% gain in its stock over the last five years. Like Nvidia, Broadcom is experiencing incredible demand for its AI data center hardware, and that could be the company’s ticket to the $1 trillion club in 2025.

Broadcom stock only needs to gain another 19% to get there, and with two full months remaining in 2024, I’m not discounting the possibility that it could cross the $1 trillion milestone before the new year. But here’s why I think 2025 is a more realistic target.

Broadcom has a history of innovation that spans decades. It pioneered everything from optical mouse sensors for computers to fiber optic transmitters for data communications. However, starting in 2016, it evolved into far more than a semiconductor and electronics company.

That was the year Broadcom merged with chip giant Avago Technologies. Since then, it has spent nearly $100 billion acquiring other companies, including semiconductor equipment supplier CA Technologies, cybersecurity giant Symantec, and cloud software provider VMware. Each of them contributes to Broadcom’s growing portfolio of AI products and services.

On the hardware side, Broadcom is having incredible success supplying custom AI accelerators (a type of chip used for processing AI workloads) to hyperscale customers — which typically includes Microsoft, Amazon, and Alphabet. During the recent fiscal 2024 third quarter (ended Aug. 4), Broadcom said sales of its AI accelerators surged by three and a half times compared to the year-ago period.

The company also supplies Ethernet switches for data centers, which regulate how quickly information travels between chips and devices. Many AI data centers cluster tens of thousands of graphics processing units (GPUs) or accelerators together. High-quality networking equipment ensures developers can build AI models at the fastest speed possible, which also keeps costs down.

GM beats on Q3 earnings, raises profit forecast for 3rd time this year

General Motors (GM) gave investors something to cheer early Tuesday morning after the automaker raised its guidance for a third time this year, in addition to easily beating third quarter revenue and profit expectations.

For the quarter, GM reported revenue of $48.78 billion, easily topping estimates of $44.69 billion per Bloomberg consensus and higher than the prior quarter’s nearly $48 billion. GM’s Q3 revenue was also 10.5% higher than a year ago.

The company booked adjusted earnings per share of $2.96, far outstripping expectations of $2.44. It reported EBIT-adjusted profit of $4.115 billion, up 15.5% from a year ago, with EBIT-adjusted margin climbing to 8.4% from 8.1% year over year.

GM stock jumped nearly 8% in early trading.

In terms of guidance, GM made the following upward revisions to its full-year 2024 forecast:

-

Adjusted EBIT (earnings before interest and taxes): $14 billion to $15 billion ($13 billion-$15 billion previously)

-

Automotive operating cash flow: $22 billion to $24 billion ($19.2 billion-$22.2 billion previously)

-

Adjusted automotive free cash flow: $12.5 billion to $13.5 billion ($9.5 billion-$11.5 billion previously)

-

Diluted-adjusted EPS: $10 to $10.50 ($9.50-$10.50 previously)

“I’m proud that GM is delivering our best vehicles ever with strong financial results. But I want to be clear that we are not mistaking progress for winning,” GM CEO Mary Barra wrote in her letter to shareholders. “Competition is fierce, and the regulatory environment will keep getting tougher. That’s why we are focused on optimizing our ICE [internal combustion engine vehicle] margins and working to make our EVs profitable on an EBIT basis as quickly as possible.”

GM CFO Paul Jacobson added in a media call with reporters that while the reduction of GM’s share count by 19% via buybacks provided a “tailwind” to the EPS beat, the profit beat was due more to the earnings power of the company’s fundamental business.

Jacobson told Yahoo Finance the company would stay aggressive on buybacks in 2025.

In Q3, GM delivered 659,601 vehicles, down 2% compared with a year ago; however, retail sales were up 3%. GM said it delivered more vehicles than any other automaker in the US in the quarter.

Not surprisingly, GM’s sales of pickups and full-size SUVs led the way, but electric vehicle sales were also a highlight. Amid a drop in sales for the Bolt EV, GM’s other EV models picked up the slack with sales of 32,195 EVs in total, up 60% compared to a year ago.

Jacobson said at GM’s investor day in early October that the company is still targeting EV profitability on a positive variable profit margin basis, despite the fact that it revised its EV production volume forecast to 200,000 units, at the low end of its previous range of 200,000 to 250,000 units. The company is expecting to trim EV costs by $2 billion to $4 billion in 2025.

In Swing States Bipartisan Majorities Favor Federal Government Actions To Make Housing More Affordable

COLLEGE PARK, Md., Oct. 22, 2024 /PRNewswire/ — As housing affordability has become a major issue for many Americans, a new survey by the Program for Public Consultation (PPC) in six swing states and nationally finds majority support – bipartisan in most cases – for the Federal government taking a variety of actions to make housing more affordable, especially for low and middle-income households. These include:

- providing billions in grants and tax incentives for building and repairing affordable homes

- providing down payment assistance to first-time buyers

- reducing large corporate ownership of houses

- incentivizing local governments to reduce single-family zoning restrictions

- increasing the number of public Housing Vouchers

Steven Kull, Director of PPC noted, “In the swing states, bipartisan majorities want the Federal government to pursue an active and multi-pronged approach to deal with the high cost of housing.”

This survey is the tenth, and last, in a series – the Swing Six Issue Surveys – being conducted in the run-up to the November election in the swing states of Arizona, Georgia, Michigan, Nevada, Pennsylvania and Wisconsin, as well as nationally, on major policy issues. Unlike traditional polls, respondents in a public consultation survey go through an online “policymaking simulation” in which they are provided briefings and arguments for and against each policy proposal. All Americans are invited to go through the same policymaking simulation as the survey sample. [More Detailed Report]

New Federal Spending and Tax Incentives for Affordable Housing

Respondents were informed that the Federal government currently provides some funding and tax incentives for building more affordable homes, mostly for low-income households. They were told that housing is considered affordable when it costs the household no more than 30% of their income to live there.

They then evaluated a series of proposals for the Federal government to do more to increase the supply of affordable homes. Each one is favored by bipartisan majorities in every swing state and nationally.

- $40 billion to build or repair housing affordable to very low and low-income households, through 1) grants to cities and states, and 2) support for more low-interest loans to home builders, is favored by majorities in every swing state (69-73%). This includes majorities of Republicans (57-63%) and Democrats (79-89%). Nationally, a bipartisan majority is in favor (74%, Republicans 63%, Democrats 86%). [BAR GRAPH]

- $25 billion to build or repair housing affordable to low and middle-income households, through grants to cities and states, is favored by 66-73% in the swing states, including majorities of Republicans (54-60%) and Democrats (80-86%). Nationally, a bipartisan majority is in favor (71%, Republicans 57%, Democrats 88%). [BAR GRAPH]

- A tax credit for building or repairing housing to be rented, on the condition that 60% of them are affordable to middle-income households, is favored by 69-73% in the swing states, including majorities of Republicans (56-64%) and Democrats (79-86%). Nationally, a bipartisan majority is in favor (73%, Republicans 63%, Democrats 85%). [BAR GRAPH]

- A tax incentive for building or repairing housing that is affordable for low and middle-income people to purchase–specifically in low-income, non-urban areas–is favored by 64-68% in the swing states, including majorities of Republicans (54-61%) and Democrats (73-79%). Nationally, a bipartisan majority is in favor (67%, Republicans 59%, Democrats 77%). [BAR GRAPH]

$25,000 Down Payment Assistance for First-Time Homebuyers

Providing assistance–up to $25,000–to help first-time homebuyers cover the down payment on a home, with more assistance for people whose parents never owned a home, is favored by majorities in every swing state (63-68%), including majorities of Democrats (81-87%). Among Republicans, a majority is in favor in Georgia (54%), views are closely divided in Arizona, Nevada, and Pennsylvania, and less than half are in favor in Michigan and Wisconsin (43-44%). Nationally, 67% are in favor, including 84% of Democrats, and a bare majority (52%) of Republicans. [BAR GRAPH]

Reducing Large Corporate Ownership of Houses

Respondents were informed that some experts believe the increase in large corporations purchasing houses accounts for some of the rise in home sale prices, while other experts do not. Two proposals for reducing large corporate ownership are favored by bipartisan majorities in the swing states and nationally:

- Requiring corporations with more than $50 million in assets to sell all their single-family houses, townhouses and duplexes within the next ten years, and prohibit them from buying any more, with substantial financial penalties for non-compliance, is favored by 66-71% in the swing states. This includes majorities of Democrats in each state (75-81%), as well as majorities of Republicans (57-63%) in every state except Wisconsin which is statistically divided. Nationally, a bipartisan majority of 67% is in favor (Republicans 55%, Democrats 81%). [BAR GRAPH]

- Denying corporations that own more than 50 single-family houses, townhouses or duplexes any Federal tax deductions related to their ownership of those houses (e.g. for mortgage interest or depreciation), is favored by 67-71% in the swing states. This includes majorities of Republicans (55-66%) and Democrats (78-81%). Nationally, a bipartisan majority of 71% is in favor (Republicans 61%, Democrats 82%). [BAR GRAPH]

Federal Incentives for Cities to Reduce Single-Family Zoning, and Allow More Dense Housing

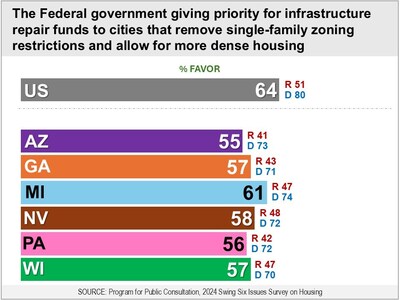

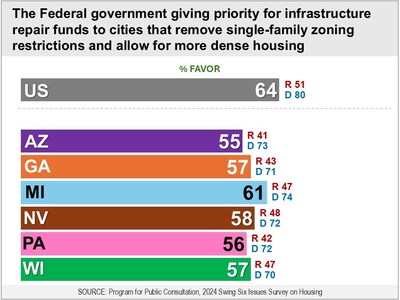

Respondents were informed that, according to experts, one reason that housing has become less affordable is that local governments restrict building dense and mixed-use housing. They were told that the Federal government – when distributing funding for infrastructure repair – has started giving priority to local governments that allow more dense and mixed-use housing.

Asked whether they favor the Federal government continuing that policy, a majority in every swing state is in favor (55-61%), including majorities of Democrats (71-74%). Among Republicans, less than half are in support in Arizona, Georgia, and Pennsylvania (41-43%), while views are statistically divided in Michigan, Nevada and Wisconsin. Nationally, 64% are in favor, including 80% of Democrats, while Republicans are statistically divided (51% favor, 49% oppose).

Asked whether they would favor their own local government allowing for the construction of more dense and mixed-use housing, 61-70% are in favor in the swing states, including majorities of Democrats (79-83%). Among Republicans, majorities are in favor in Georgia, Nevada, Pennsylvania and Wisconsin (53-56%), while views are statistically divided in Arizona and Michigan. Nationally, a bipartisan majority of 68% are in favor (Republicans 54%, Democrats 84%). [BAR GRAPH]

Additional $24 Billion In Public Housing Vouchers

Respondents were informed that the government provides people who qualify for public housing – very low-income, disabled or elderly people – with Housing Vouchers that help cover rent in the private housing market. Majorities of 69-72% favor increasing the number of people who can receive Housing Vouchers by spending an additional $24 billion for that purpose, including majorities of Democrats (78-88%). Among Republicans, majorities are in favor in Arizona, Georgia, Nevada and Pennsylvania (58-64%), while they are statistically divided in Michigan and Wisconsin. Nationally, a bipartisan majority of 74% is in favor (Republicans 63%, Democrats 87%). [BAR GRAPH]

About the Survey

The surveys were fielded October 4-14, 2024 to a representative non-probability sample of 4,638 adults by the Program for Public Consultation at the University of Maryland’s School of Public Policy, including approximately 600 adults in each state of Arizona, Georgia, Michigan, Nevada, Pennsylvania and Wisconsin, and 1,190 nationally. Samples were obtained from multiple online non-probability panels, including Cint, Dynata and Prodege. Sample collection and quality control was managed by QuantifyAI under the direction of the Program for Public Consultation. Samples were pre-stratified and weighted by age, race, ethnicity, gender, education, income, and metro/non-metro status to match the general adult population. The national sample was also weighted by marital status and home ownership. The national and most state samples were further weighted by partisan affiliation. The survey was offered in both English and Spanish. The confidence interval for the national sample is +/-3.2%, and for the state samples it ranges from +/-4.5% to 4.6%.

About UMD’s Program for Public Consultation

The Program for Public Consultation (PPC) at the University of Maryland’s School of Public Policy, develops and conducts public consultation surveys, seeking to improve democratic governance by consulting representative samples of citizens on key public policy issues. It shares its findings with officials in government, the media, other academics, and the general public.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/in-swing-states-bipartisan-majorities-favor-federal-government-actions-to-make-housing-more-affordable-302282096.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/in-swing-states-bipartisan-majorities-favor-federal-government-actions-to-make-housing-more-affordable-302282096.html

SOURCE Program for Public Consultation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Silver’s scarcity factor is helping it catch up to gold’s record run

While gold prices have repeatedly set fresh record highs this year, silver has been rallying as well — with one analyst predicting that prices for the precious and industrial metal will reach $40 an ounce or more before the end of the year, as supplies continue to come up short of demand.

Fundamentally, silver “has all the right ingredients” for a “melt-up move,” said Peter Spina, president and founder of GoldSeek.com, a website that has provided investors with gold prices, research and information for nearly 30 years.

“As gold tears higher to new records, the buying pressures on silver grows, as does the fourth year of supply deficits,” he told MarketWatch. The Silver Institute forecasts 2024 total global silver supply at nearly 1.004 billion ounces, compared with total demand of 1.219 billion ounces, following supply deficits in 2021, 2022 and 2023.

On Monday, the December contract for silver futures SI00 SIZ24 climbed 66.1 cents, or 2%, to $33.895 an ounce on Comex. Based on the most active contract, prices are poised for their highest settlement since Nov. 29, 2012, according to Dow Jones Market Data. They are trading around 41% higher this year to date.

“Silver is making a major move now and it is going to get noticed by more investors and speculators,” said Spina. “This means to me that the next move higher in silver prices will be aggressive with $40-plus an ounce on the horizon, likely before year’s end.”

That would lift silver futures closer to their all-time settlement high of $48.70 from Jan. 17, 1980. Prices set an intraday record high at $50.36 on Jan. 18, 1980.

The climb in gold prices has taken center stage, climbing on Monday to a fresh all-time intraday high of $2,755.40 an ounce, and the yellow metal’s rise is making “silver look cheap,” Spina said.

December gold GC00 GCZ24 was at $2,736.40 an ounce in Monday dealings.

Read: Gold’s record-breaking run comes as stocks hit fresh highs. Is it too late for investors?

Capitalizing In Growth Prospects, Daniel Szot Acquires In Simulations Plus Stock Options

A notable acquisition unfolded on October 21, as Szot, Chief Revenue Officer at Simulations Plus SLP, reported the acquisition of stock options for 7,500 shares in an SEC filing.

What Happened: In a Form 4 filing with the U.S. Securities and Exchange Commission on Monday, Szot, Chief Revenue Officer at Simulations Plus, acquired stock options for 7,500 shares of SLP. These options provide Szot with the right to purchase the company’s stock at $33.29 per share.

Currently, Simulations Plus shares are trading down 0.82%, priced at $34.0 during Tuesday’s morning. This values Szot’s 7,500 shares at $5,325.

Unveiling the Story Behind Simulations Plus

Simulations Plus Inc is engaged in the software industry. It develops and produces software for use in pharmaceutical research and education, and provides consulting and contract research services to the pharmaceutical industry. The company’s operating segments include Software and services. It generates maximum revenue from the software segment.

Simulations Plus’s Economic Impact: An Analysis

Revenue Growth: Simulations Plus displayed positive results in 3 months. As of 31 May, 2024, the company achieved a solid revenue growth rate of approximately 14.23%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 71.49%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Simulations Plus’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.16.

Debt Management: Simulations Plus’s debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Simulations Plus’s current Price to Earnings (P/E) ratio of 71.42 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 10.4 is above industry norms, reflecting an elevated valuation for Simulations Plus’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 39.26, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Simulations Plus’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TSMC says it has alerted US of potential China AI chip curbs violation

(Reuters) -Taiwan Semiconductor Manufacturing Company (TSMC) said on Tuesday it has informed the United States of a potential attempt by Huawei to circumvent U.S. export controls prohibiting the chipmaker from producing AI chips for the Chinese company.

The U.S. government restricted the export of high-end AI chips to China two years ago, citing the need to limit the Chinese military’s capabilities.

“We are not aware of TSMC being the subject of any investigation at this time,” the company said in a statement, adding that it has not supplied to Huawei since mid-September 2020. TSMC’s U.S.-listed shares were down 1.5%.

A crucial element of export controls is a rule prohibiting global chip manufacturers from utilizing U.S. technology or equipment to produce chips intended for Huawei or its products.

In recent years, the United States has escalated its use of export controls, aiming to thwart Chinese companies from obtaining, designing, or manufacturing advanced semiconductors.

Huawei, a primary target of these efforts, epitomizes the growing technology rivalry between Beijing and Washington.

TSMC informed the U.S. Commerce Department after a customer placed orders for a chip similar to Huawei’s Ascend 910B, a processor designed for large language model training, a Financial Times report said earlier in the day, citing people familiar with the matter. The Commerce Department and Huawei did not immediately respond to Reuters requests for comments.

(Reporting by Karen Freifeld in New York and Akash Sriram in Bengaluru; Editing by Shinjini Ganguli)