A Look at Rollins's Upcoming Earnings Report

Rollins ROL is gearing up to announce its quarterly earnings on Wednesday, 2024-10-23. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Rollins will report an earnings per share (EPS) of $0.30.

Investors in Rollins are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

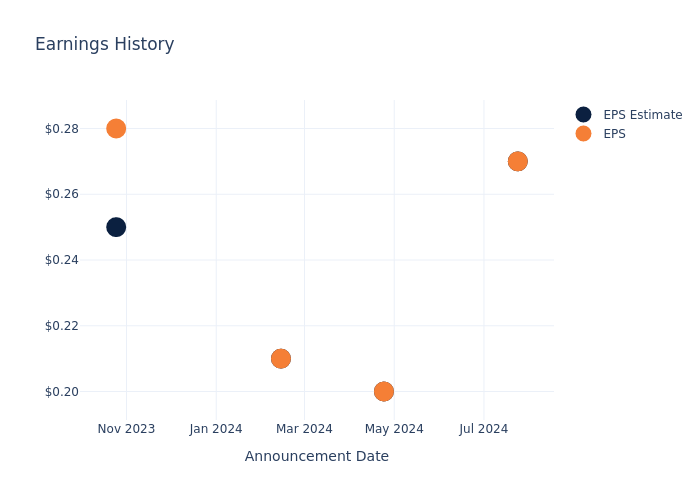

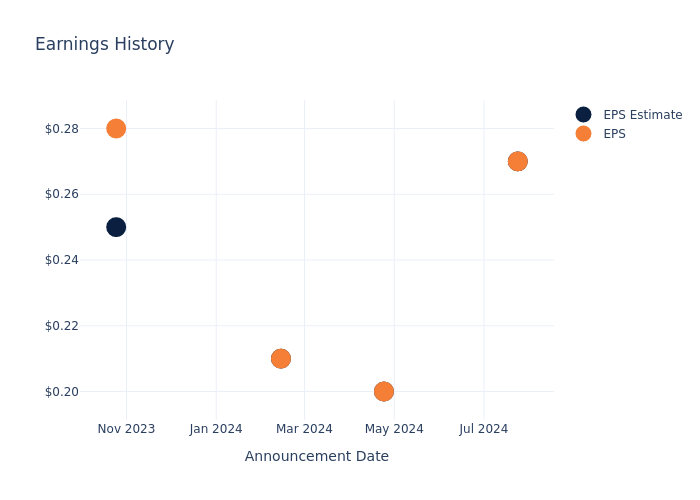

Overview of Past Earnings

Last quarter the company missed EPS by $0.00, which was followed by a 6.45% drop in the share price the next day.

Here’s a look at Rollins’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.27 | 0.2 | 0.21 | 0.25 |

| EPS Actual | 0.27 | 0.2 | 0.21 | 0.28 |

| Price Change % | -6.0% | 3.0% | -6.0% | 4.0% |

Performance of Rollins Shares

Shares of Rollins were trading at $49.84 as of October 21. Over the last 52-week period, shares are up 44.54%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Take on Rollins

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Rollins.

Analysts have provided Rollins with 3 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $54.0, suggesting a potential 8.35% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of Veralto, Clean Harbors and Tetra Tech, three key industry players, offering insights into their relative performance expectations and market positioning.

- Veralto is maintaining an Neutral status according to analysts, with an average 1-year price target of $113.11, indicating a potential 126.95% upside.

- Clean Harbors is maintaining an Outperform status according to analysts, with an average 1-year price target of $265.57, indicating a potential 432.85% upside.

- Tetra Tech received a Outperform consensus from analysts, with an average 1-year price target of $198.0, implying a potential 297.27% upside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Veralto, Clean Harbors and Tetra Tech are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Rollins | Outperform | 8.67% | $481.63M | 10.77% |

| Veralto | Neutral | 2.79% | $774M | 12.90% |

| Clean Harbors | Outperform | 11.08% | $517.18M | 5.61% |

| Tetra Tech | Outperform | 11.20% | $223.17M | 5.28% |

Key Takeaway:

Rollins ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

All You Need to Know About Rollins

Rollins is a global leader in route-based pest-control services, with operations spanning North, Central and South America, Europe, the Middle East and Africa and Australia. Its portfolio of pest-control brands includes the prominent Orkin brand, market leader in the US, where it boasts near national coverage, and in Canada. Residential pest and termite prevention dominates the services provided by Rollins, owing to the group’s ongoing focus on US and Canadian markets.

Rollins: A Financial Overview

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Rollins’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 8.67%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Rollins’s net margin is impressive, surpassing industry averages. With a net margin of 14.51%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Rollins’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 10.77% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.77%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.71, Rollins adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Rollins visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply