Behind the Scenes of Nike's Latest Options Trends

Financial giants have made a conspicuous bullish move on Nike. Our analysis of options history for Nike NKE revealed 26 unusual trades.

Delving into the details, we found 57% of traders were bullish, while 34% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $1,019,899, and 11 were calls, valued at $727,876.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $130.0 for Nike over the last 3 months.

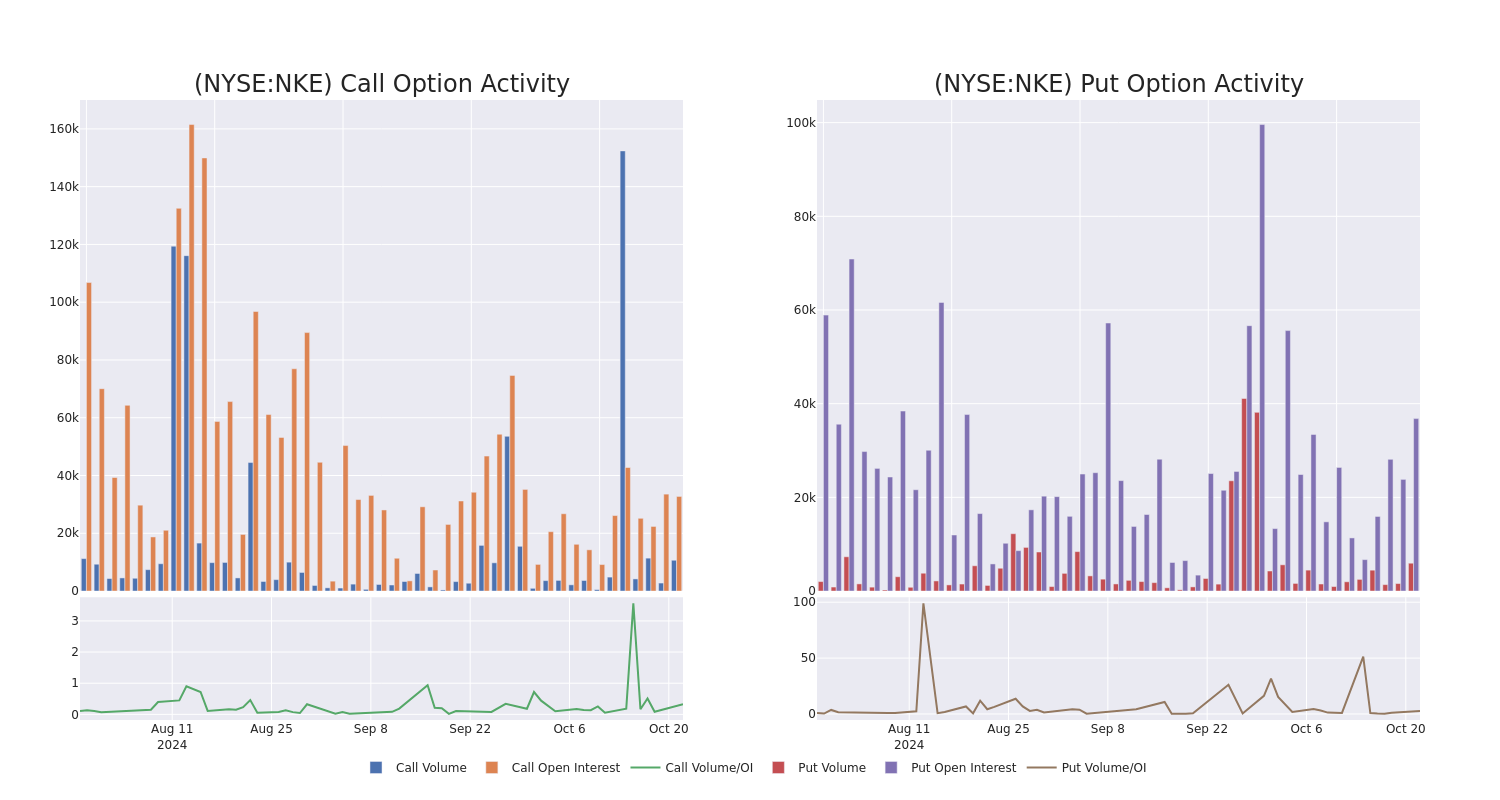

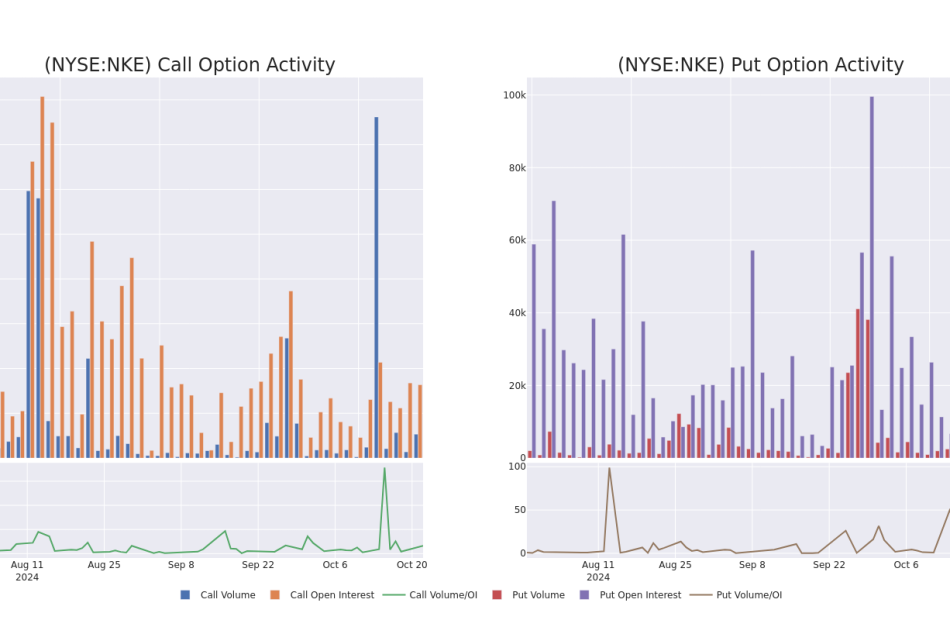

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nike’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nike’s whale trades within a strike price range from $75.0 to $130.0 in the last 30 days.

Nike 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | PUT | SWEEP | BULLISH | 12/20/24 | $1.43 | $1.37 | $1.37 | $75.00 | $205.7K | 13.7K | 1.6K |

| NKE | CALL | SWEEP | BEARISH | 01/17/25 | $9.0 | $8.9 | $9.0 | $75.00 | $162.0K | 7.0K | 495 |

| NKE | PUT | TRADE | BEARISH | 01/17/25 | $3.7 | $3.6 | $3.7 | $80.00 | $128.3K | 10.5K | 455 |

| NKE | CALL | SWEEP | BEARISH | 01/17/25 | $1.05 | $0.96 | $0.96 | $95.00 | $99.9K | 5.3K | 3.5K |

| NKE | PUT | SWEEP | BULLISH | 12/20/24 | $3.05 | $2.93 | $2.93 | $80.00 | $97.2K | 6.7K | 454 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Having examined the options trading patterns of Nike, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Nike

- With a volume of 3,285,197, the price of NKE is down -0.28% at $81.25.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 58 days.

Professional Analyst Ratings for Nike

In the last month, 5 experts released ratings on this stock with an average target price of $87.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Truist Securities has decided to maintain their Hold rating on Nike, which currently sits at a price target of $83.

* An analyst from B of A Securities downgraded its action to Buy with a price target of $104.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Nike with a target price of $82.

* Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on Nike with a target price of $85.

* Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Nike, targeting a price of $82.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply