Insider Unloading: Robert G Brown Sells $396K Worth Of SPAR Group Shares

It was reported on October 21, that Robert G Brown, 10% Owner at SPAR Group SGRP executed a significant insider sell, according to an SEC filing.

What Happened: Brown opted to sell 165,153 shares of SPAR Group, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The transaction’s total worth stands at $396,421.

Monitoring the market, SPAR Group‘s shares down by 0.01% at $2.41 during Tuesday’s morning.

Unveiling the Story Behind SPAR Group

SPAR Group Inc is a supplier of merchandising and other marketing services. It also provides range of services to retailers, consumer goods manufacturers and distributors around the globe. The company divides its operations into three reportable regional segments: Americas, which is comprised of United States, Canada, Brazil and Mexico; Asia-Pacific (APAC), which is comprised of Japan, China, and India; and Europe, Middle East and Africa (EMEA), which is comprised of South Africa. It generates maximum revenue from Americas.

A Deep Dive into SPAR Group’s Financials

Revenue Challenges: SPAR Group’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -13.11%. This indicates a decrease in top-line earnings. When compared to others in the Communication Services sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 19.19%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.15, SPAR Group showcases strong earnings per share.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.73, caution is advised due to increased financial risk.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: SPAR Group’s P/E ratio of 4.55 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.23 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 2.51, SPAR Group’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Important Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of SPAR Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

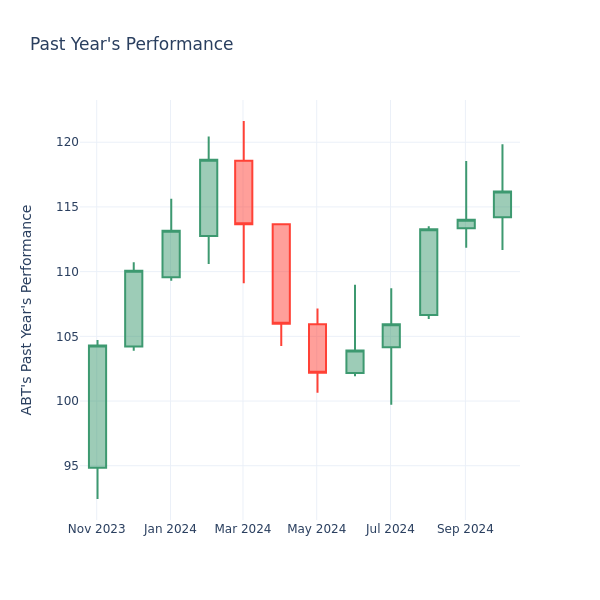

P/E Ratio Insights for Abbott Laboratories

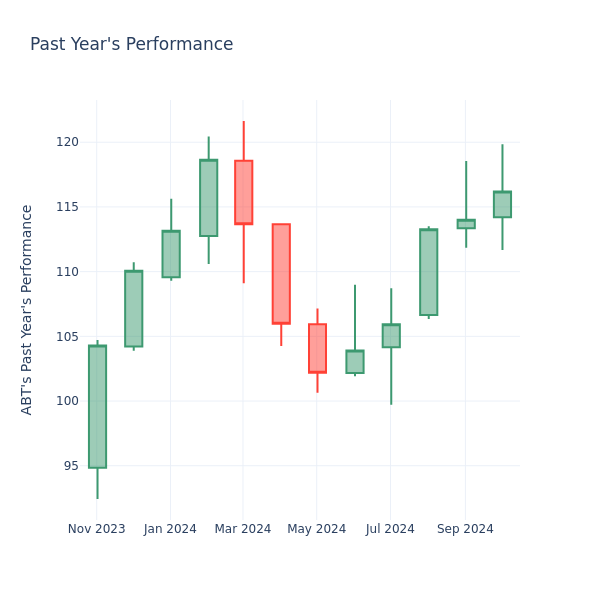

In the current market session, Abbott Laboratories Inc. ABT stock price is at $116.19, after a 0.68% decrease. However, over the past month, the company’s stock increased by 2.51%, and in the past year, by 24.17%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

Abbott Laboratories P/E Ratio Analysis in Relation to Industry Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Abbott Laboratories has a lower P/E than the aggregate P/E of 265.82 of the Health Care Equipment & Supplies industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

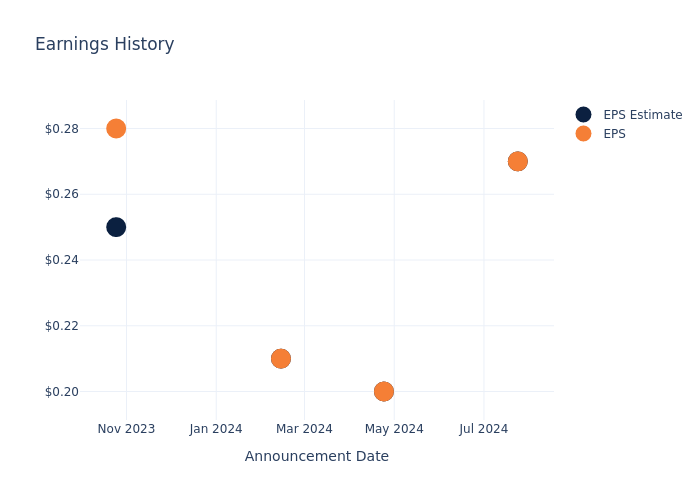

A Look at Rollins's Upcoming Earnings Report

Rollins ROL is gearing up to announce its quarterly earnings on Wednesday, 2024-10-23. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Rollins will report an earnings per share (EPS) of $0.30.

Investors in Rollins are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Overview of Past Earnings

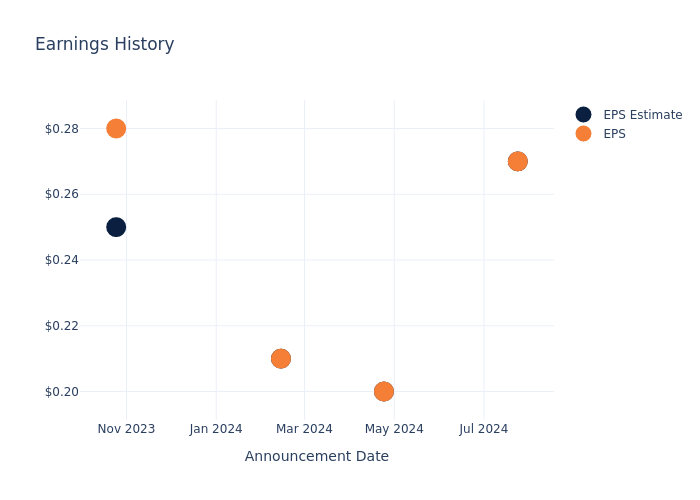

Last quarter the company missed EPS by $0.00, which was followed by a 6.45% drop in the share price the next day.

Here’s a look at Rollins’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.27 | 0.2 | 0.21 | 0.25 |

| EPS Actual | 0.27 | 0.2 | 0.21 | 0.28 |

| Price Change % | -6.0% | 3.0% | -6.0% | 4.0% |

Performance of Rollins Shares

Shares of Rollins were trading at $49.84 as of October 21. Over the last 52-week period, shares are up 44.54%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Take on Rollins

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Rollins.

Analysts have provided Rollins with 3 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $54.0, suggesting a potential 8.35% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of Veralto, Clean Harbors and Tetra Tech, three key industry players, offering insights into their relative performance expectations and market positioning.

- Veralto is maintaining an Neutral status according to analysts, with an average 1-year price target of $113.11, indicating a potential 126.95% upside.

- Clean Harbors is maintaining an Outperform status according to analysts, with an average 1-year price target of $265.57, indicating a potential 432.85% upside.

- Tetra Tech received a Outperform consensus from analysts, with an average 1-year price target of $198.0, implying a potential 297.27% upside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Veralto, Clean Harbors and Tetra Tech are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Rollins | Outperform | 8.67% | $481.63M | 10.77% |

| Veralto | Neutral | 2.79% | $774M | 12.90% |

| Clean Harbors | Outperform | 11.08% | $517.18M | 5.61% |

| Tetra Tech | Outperform | 11.20% | $223.17M | 5.28% |

Key Takeaway:

Rollins ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

All You Need to Know About Rollins

Rollins is a global leader in route-based pest-control services, with operations spanning North, Central and South America, Europe, the Middle East and Africa and Australia. Its portfolio of pest-control brands includes the prominent Orkin brand, market leader in the US, where it boasts near national coverage, and in Canada. Residential pest and termite prevention dominates the services provided by Rollins, owing to the group’s ongoing focus on US and Canadian markets.

Rollins: A Financial Overview

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Rollins’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 8.67%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Rollins’s net margin is impressive, surpassing industry averages. With a net margin of 14.51%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Rollins’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 10.77% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.77%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.71, Rollins adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Rollins visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Teledyne Technologies's Earnings: A Preview

Teledyne Technologies TDY is preparing to release its quarterly earnings on Wednesday, 2024-10-23. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Teledyne Technologies to report an earnings per share (EPS) of $4.97.

Investors in Teledyne Technologies are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Past Earnings Performance

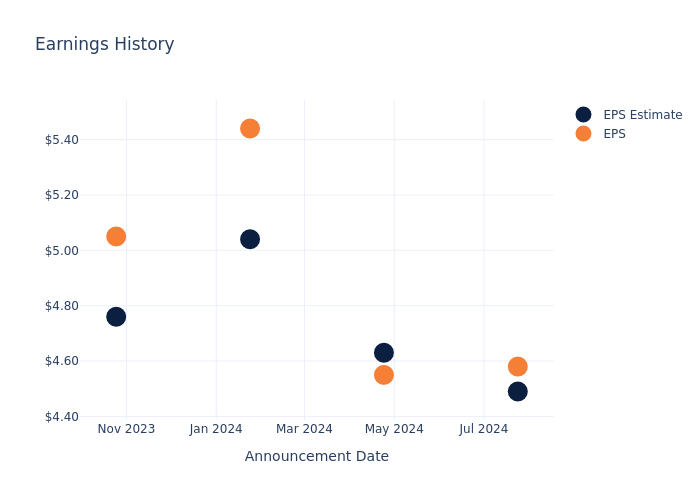

The company’s EPS beat by $0.09 in the last quarter, leading to a 0.31% drop in the share price on the following day.

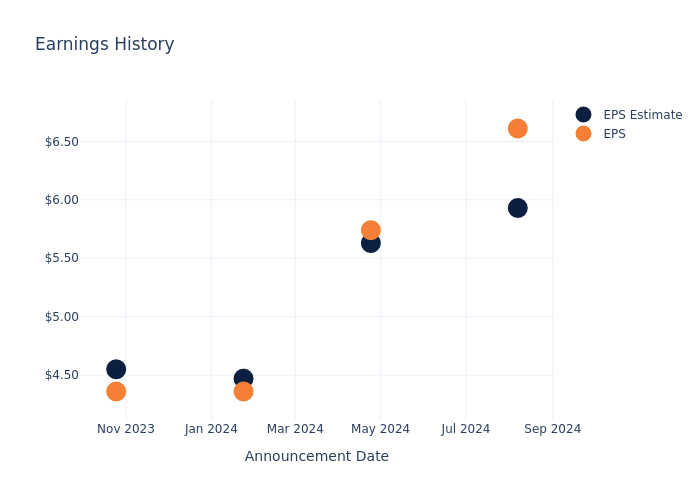

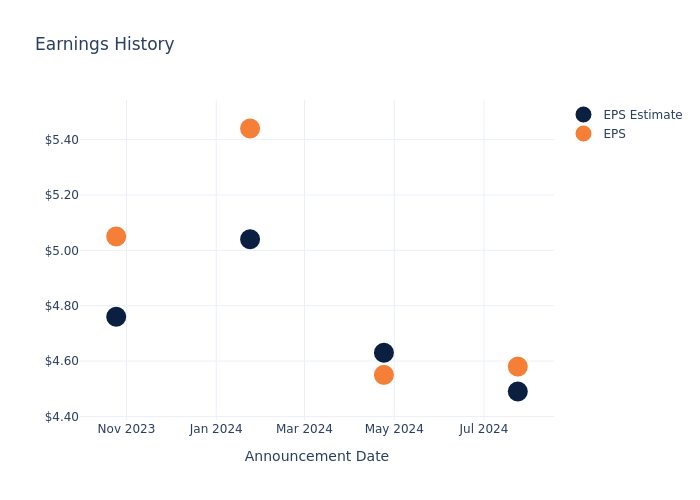

Here’s a look at Teledyne Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 4.49 | 4.63 | 5.04 | 4.76 |

| EPS Actual | 4.58 | 4.55 | 5.44 | 5.05 |

| Price Change % | -0.0% | 4.0% | 2.0% | -0.0% |

Teledyne Technologies Share Price Analysis

Shares of Teledyne Technologies were trading at $446.93 as of October 21. Over the last 52-week period, shares are up 19.21%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Teledyne Technologies

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Teledyne Technologies.

Teledyne Technologies has received a total of 1 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $482.0, the consensus suggests a potential 7.85% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Zebra Technologies, Keysight Techs and Cognex, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Zebra Technologies, with an average 1-year price target of $375.71, suggesting a potential 15.94% downside.

- As per analysts’ assessments, Keysight Techs is favoring an Outperform trajectory, with an average 1-year price target of $164.12, suggesting a potential 63.28% downside.

- The prevailing sentiment among analysts is an Buy trajectory for Cognex, with an average 1-year price target of $45.43, implying a potential 89.84% downside.

Snapshot: Peer Analysis

In the peer analysis summary, key metrics for Zebra Technologies, Keysight Techs and Cognex are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Teledyne Technologies | Buy | -3.55% | $592.60M | 1.93% |

| Zebra Technologies | Neutral | 0.25% | $589M | 3.50% |

| Keysight Techs | Outperform | -11.94% | $755M | 7.68% |

| Cognex | Buy | -1.33% | $166.60M | 2.42% |

Key Takeaway:

Teledyne Technologies ranks at the top for Gross Profit and Return on Equity among its peers. However, it ranks at the bottom for Revenue Growth.

All You Need to Know About Teledyne Technologies

Teledyne Technologies Inc sells technologies for industrial markets. Roughly a fourth of Teledyne’s revenue comes from contracts with the United States government. The firm operates in four segments: instrumentation, digital imaging, aerospace and defense electronics, and engineered systems. The instrumentation segment provides monitoring instruments primarily for marine and environmental applications. The digital imaging segment contributes the largest proportion of revenue and includes image sensors and cameras for industrial, government, and medical customers. The aerospace and defense electronics segment provides electronic components and communication products for aircraft. The engineered systems segment provides solutions for defense, space, environmental, and energy applications.

Teledyne Technologies’s Economic Impact: An Analysis

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Teledyne Technologies’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -3.55%. This indicates a decrease in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Teledyne Technologies’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 13.11%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Teledyne Technologies’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.93%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Teledyne Technologies’s ROA excels beyond industry benchmarks, reaching 1.25%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.3, Teledyne Technologies adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Teledyne Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Flora Growth Enters $220M Cannabis Beverage Market With New Facility, Using Peak's Technology

Flora Growth Corp. FLGC announced the build-out of its specialized beverage facility, marking its official entry into the $220 million U.S. THC-infused beverage market.

This facility, developed on time and within budget, allows Flora to capitalize on the rapidly expanding demand for cannabis-infused beverages, a sector showing strong potential for growth.

Leveraging Proven Technology For Competitive Advantage

The new facility employs technology developed by Peak, a Canadian company responsible for producing nearly 40% of all cannabis beverages in Canada.

By incorporating Peak’s proven methods, Flora Growth is positioned to deliver high-quality THC-infused products. This will help the company maintain a competitive edge in the U.S. market.

With the facility boasting over 100 formulations, Flora aims to power major cannabis brands and replicate Peak’s success in the Canadian beverage market.

“Our new specialized beverage facility is a game-changer for Flora and the U.S. beverage market as a whole,” said Clifford Starke, CEO of Flora Growth. “By incorporating Peak’s proven technology, we are not only ensuring the highest quality of our products but also creating a competitive advantage.”

Read Also: Summer Sizzles With THC-Infused Beverages: Market Report Reveals Top-Selling Weed Drinks In U.S.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

THC-Infused Beverages: A Growing Sector

The U.S. THC-infused beverage market, currently accounting for around 1% to 3% of cannabis sales, is poised for significant growth. As consumers increasingly seek alternatives to alcohol, the cannabis beverage sector has gained traction, particularly among premium retailers such as Total Wine and ABC, which have begun dedicating sections to THC-infused products.

Data Bridge Market Research projects the U.S. cannabis beverage market to reach half a billion dollars by 2030, with a CAGR of 14.7%.

Flora’s new facility positions the company to meet that increasing demand.

Cover: IA generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I'm Earning $275k This Year. Can I Use a Backdoor Roth Strategy to Reduce Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

If you’re making $275,000 a year, you can’t contribute to a Roth IRA due to income limits. However, a backdoor conversion can allow a high earner to sock away unlimited sums in a Roth account, enabling tax-free requirement withdrawals and a way past pesky required minimum distribution rules (RMDs) that many pretax retirement account require. But this will likely require sufficient after-tax funds – such as from a non-retirement bank account or brokerage account – to pay the upfront tax bill that a backdoor conversion strategy generates.

Conversions are most advisable for savers who will be in a higher tax bracket after retirement. Assuming these conditions are met, a backdoor conversion can be a useful method of avoiding Required Minimum Distributions (RMDs) and enjoying tax-free withdrawals in retirement. Consider discussing a Roth backdoor conversion with a financial advisor to make sure you understand the ins and outs of this strategy.

Roth retirement accounts allow savers to use after-tax money to fund accounts where investments accumulate earnings tax-free and, in most circumstances, withdrawals are also tax-free. Another appealing feature of Roth accounts is that they are exempt from RMD rules requiring savers to begin withdrawing from pre-tax savings accounts such as IRAs and 401(k)s after age 73, which can expose retirees to unwelcome tax bills.

Roth IRAs also have income limits that make them inaccessible to some high earners. For 2024, individuals earning $161,000, married couples filing jointly earning $240,000 and married couples filing separately earning $10,000 are all prohibited from contributing to Roth retirement accounts at all.

However, since 2010 it’s been possible for a saver to convert unlimited funds from a pre-tax retirement account to a Roth account. This backdoor conversion, as it’s known, has become a popular way for people who earn and lot and have saved a lot to get the advantages of Roth accounts.

To perform a backdoor conversion, a saver can transfer funds from a pre-tax retirement account such as a 401(k). 401(k)s and other qualified accounts may not limit an investor based on his or her income, and its annual contribution limits are also much higher than Roth IRA contribution caps. Next, they transfer funds from their other retirement account to a new Roth IRA account. Because the funds from the 401(k) are pre-tax, the saver will have to pay income taxes on the converted amounts in that tax year, as if they were withdrawals treated as ordinary income. A large transfer can generate a large tax bill if the entire amount is converted at once. Sometimes conversions of large IRAs are done gradually over several years to manage the tax bill and keep the person in lower tax brackets.

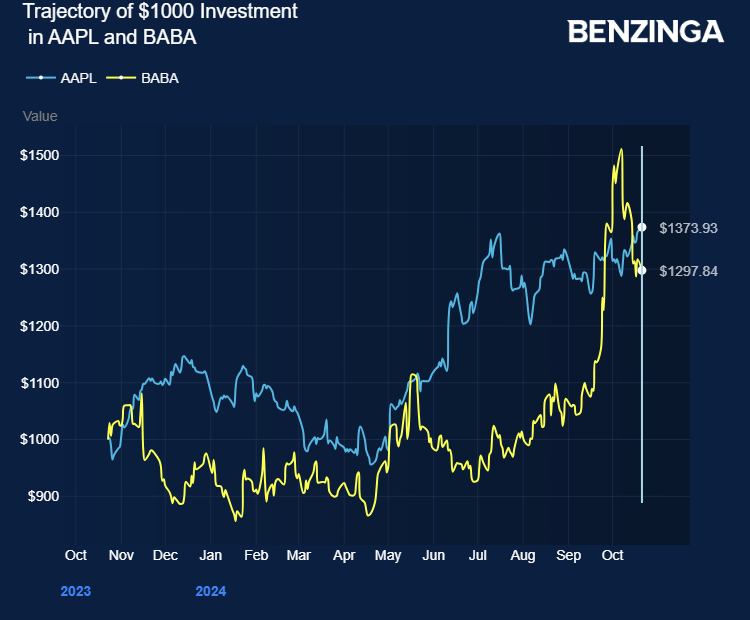

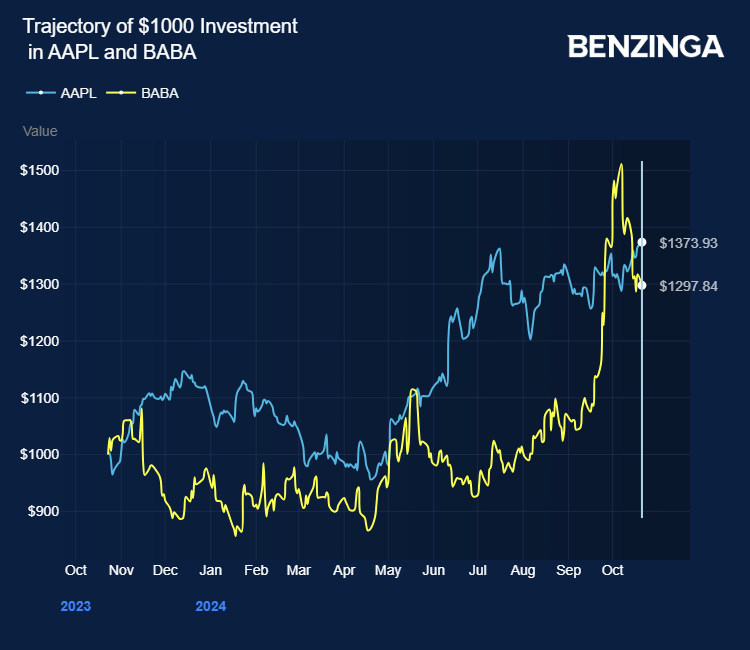

Apple iPhone 16 Discounts Roll Out on Alibaba's Tmall, AI Delays and Domestic Competitors Fuel Aggressive Pricing

Apple Inc AAPL has reduced iPhone 16 prices by up to 1,600 yuan ($225) on its Alibaba Group Holding’s BABA Tmall store to boost sales during Singles’ Day, the world’s largest shopping festival.

Beginning Monday evening, Apple offered a 500-yuan voucher for all iPhone 16 models, with the base iPhone 16 and iPhone 16 Pro Max starting at 5,499 yuan and 9,499 yuan, respectively, SCMP reports.

These price cuts come as Apple aims to counter the lukewarm initial response to the iPhone 16 on Chinese social media.

The discounting is partly due to Apple Intelligence’s on-device AI system not supporting Chinese until next year.

Tmall has also introduced a trade-in subsidy of up to 1,100 yuan, allowing customers to save as much as 1,600 yuan on iPhone 16 purchases. JD.com Inc JD announced a similar discount, offering a free AppleCare+ subscription for the iPhone 16’s base and Plus models. PDD Holdings Inc PDD Pinduoduo further slashed prices, with the 256GB iPhone 16 Pro Max now priced at 9,199 yuan.

Riding the success of its 5G comeback, Huawei Technologies Co outpaced Apple in mainland smartphone sales in August for the first time in 46 months, SCMP cites CINNO Research.

Prior reports indicated that Pinduoduo and Taobao were slashing the prices of the iPhone 16 series before its official release due to its lack of AI features.

Pinduoduo started selling the iPhone 16 Plus with 512 gigabytes of storage at a 10% discount and the 128GB iPhone 16 at an 11% discount. Both Pinduoduo and Taobao marketplace have slapped a 4% discount on the 256GB version of the high-end iPhone 16 Pro Max.

Needham analyst Laura Martin expects the iPhone to constitute 89%- 96% of Apple’s fiscal 2025 revenue.

Apple stock gained 37% in the last 12 months. Investors can gain exposure to the stock through Vanguard Information Tech ETF VGT and iShares Russell 1000 Growth ETF IWF.

Price Action: AAPL stock is down 0.99% at $234.13 at the last check on Tuesday.

Also Read:

Photo courtesy: Apple

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CACI International's Earnings Outlook

CACI International CACI is preparing to release its quarterly earnings on Wednesday, 2024-10-23. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect CACI International to report an earnings per share (EPS) of $5.06.

The announcement from CACI International is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

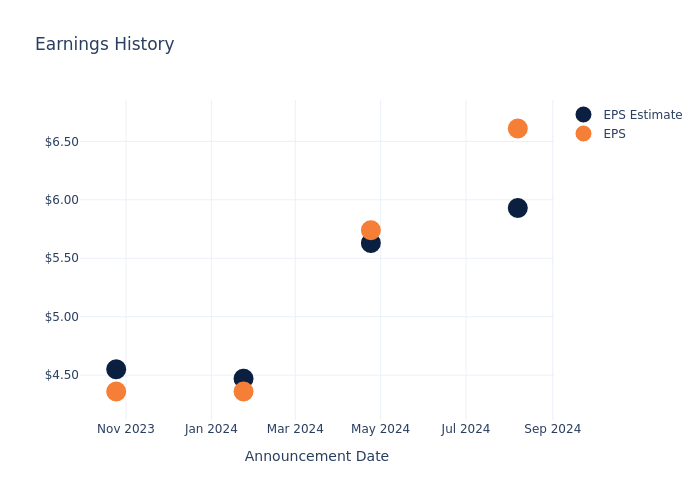

Overview of Past Earnings

The company’s EPS beat by $0.68 in the last quarter, leading to a 3.05% increase in the share price on the following day.

Here’s a look at CACI International’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 5.93 | 5.63 | 4.47 | 4.55 |

| EPS Actual | 6.61 | 5.74 | 4.36 | 4.36 |

| Price Change % | 3.0% | 6.0% | -2.0% | 2.0% |

Stock Performance

Shares of CACI International were trading at $532.16 as of October 21. Over the last 52-week period, shares are up 64.36%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on CACI International

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on CACI International.

A total of 6 analyst ratings have been received for CACI International, with the consensus rating being Buy. The average one-year price target stands at $540.33, suggesting a potential 1.54% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Parsons, UL Solutions and KBR, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- As per analysts’ assessments, Parsons is favoring an Outperform trajectory, with an average 1-year price target of $105.0, suggesting a potential 80.27% downside.

- UL Solutions received a Neutral consensus from analysts, with an average 1-year price target of $53.5, implying a potential 89.95% downside.

- Analysts currently favor an Buy trajectory for KBR, with an average 1-year price target of $76.33, suggesting a potential 85.66% downside.

Comprehensive Peer Analysis Summary

In the peer analysis summary, key metrics for Parsons, UL Solutions and KBR are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| CACI International | Buy | 19.68% | $197.75M | 3.91% |

| Parsons | Outperform | 23.15% | $351.54M | 3.17% |

| UL Solutions | Neutral | 5.95% | $366M | 14.03% |

| KBR | Buy | 5.82% | $271M | 7.54% |

Key Takeaway:

CACI International ranks highest in Gross Profit among its peers. It is in the middle for Revenue Growth and Return on Equity.

Delving into CACI International’s Background

CACI International Inc is an information solutions and services provider, offering information solutions and services to its customers. The company’s primary customers are agencies and departments of the U.S. government, which account for the vast majority of the firm’s revenue. It provides information solutions and services supporting national security missions and government modernization for intelligence, defense, and federal civilian customers. Some of the services provided by the company are functional software development, data, and business analysis, IT operations support, naval architecture, and life cycle support intelligence among others. The company’s operating segments are; Domestic operations and International operations. It derives key revenue from the Domestic segment.

CACI International: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining CACI International’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 19.68% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.61%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): CACI International’s ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.91%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): CACI International’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 1.98% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: CACI International’s debt-to-equity ratio is below the industry average at 0.55, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for CACI International visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitmedia Introduces Groundbreaking Wallet Targeting Technology For Web3 Advertising

Bitmedia.IO proudly announces the launch of its innovative Wallet Targeting Technology. This new feature marks an important point in Web3 advertising, offering advertisers the ability to tap into targeted blockchain audiences with unprecedented accuracy. With this wallet-targeting technology and advanced conversion tracking, Bitmedia.IO provides a platform for unmatched ROI, transforming the way brands connect with their Web3 customers.

How Bitmedia.io’s Wallet Targeting Works:

The process begins with anonymous data collection, as users connect their wallets through Bitmedia’s data providers or publishers. An anonymous ID is assigned to their device, ensuring privacy while facilitating targeted advertising based on blockchain activity.

Audience segmentation follows, with blockchain indexing to categorize individuals by their wallet’s holdings and activities. This allows for an understanding of the unique preferences and behaviors within the crypto community, leading to the display of highly relevant, personalized Web3 ads.

Furthermore, Bitmedia’s innovative Web3 cookie library supports end-to-end user engagement tracking, from ad exposure to conversion. This capability clearly shows advertisers their campaign’s effectiveness and ROI.

The company aims to expand the range of Web3 audiences further, particularly focusing on enhancing categories such as users with NFTs, coin holders across various crypto like BNB, ETH, and USDT, as well as those engaged in specific sectors like DEX/DeFi, betting, and gambling. Currently, the company identifies the following segments of Web3 audiences:

- Crypto Traders – Active market participants buying and selling crypto.

- NFT Holders – Collectors or investors owning Non-Fungible Tokens.

- Crypto Degens – High-risk crypto enthusiasts often engage in speculative investments.

- Hodlers – Individuals holding onto their cryptocurrencies long-term, regardless of market volatility.

- Holders – Individuals with diverse crypto portfolios (e.g., BNB, ETH, Matic, USDT).

- Niche Coin Enthusiasts – Users invested in specific coin categories like NFT, DEX, DeFi, and Exchange.

- Gaming/Gambling Token Gamers – Participants in betting/gambling platforms utilizing specific crypto.

Additionally, Bitmedia is committed to improving its wallet-targeting feature to better serve these diverse groups

“Wallet-based targeting opens a lot of opportunities for advertisers in terms of finding their audience and understanding it better. It is a great tool that will optimize conversion costs for our clients by making it easier to find the right customer. We will offer our users targeting options based on the assets held, and interests like NFT, games, trading etc. Bitmedia will be expanding and customizing our audience-targeting features on the go so go ahead, try it out, and share your feedback with us!“

Tanya Petrusenko, CEO at Bitmedia.IO

Step into the Future of Web3 Advertising with Bitmedia.IO

Using traditional Web 2.0 marketing strategies with the innovative capabilities of Web 3.0, Bitmedia opens up new opportunities for Web3 audience engagement and transforms the targeting of Web3 wallet owners into a key competitive advantage for crypto brands.

For more information and to launch your Web3 campaign, visit Bitmedia.IO.

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice. Benzinga does not make any recommendation to buy or sell any security or any representation about the financial condition of any company.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

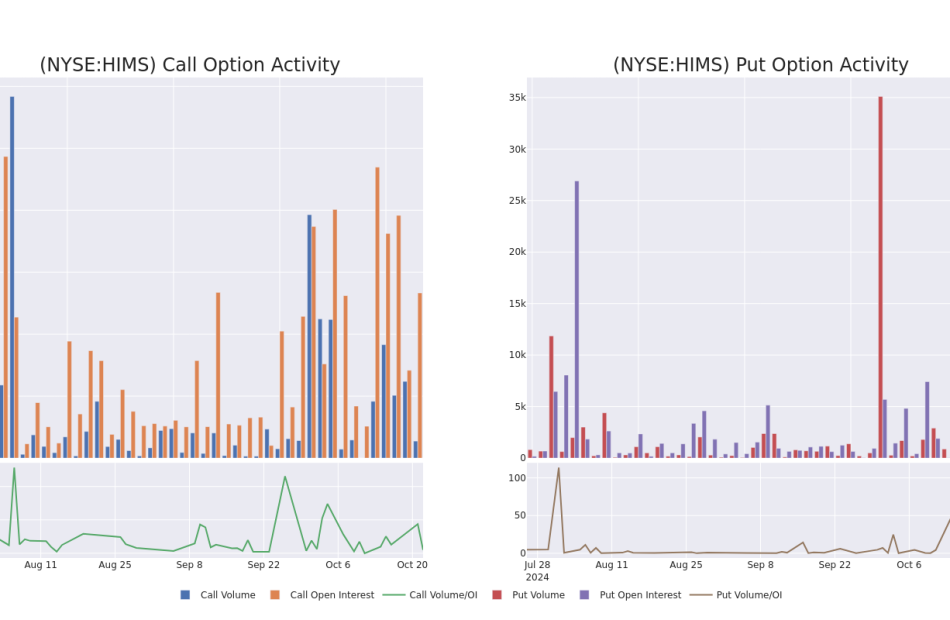

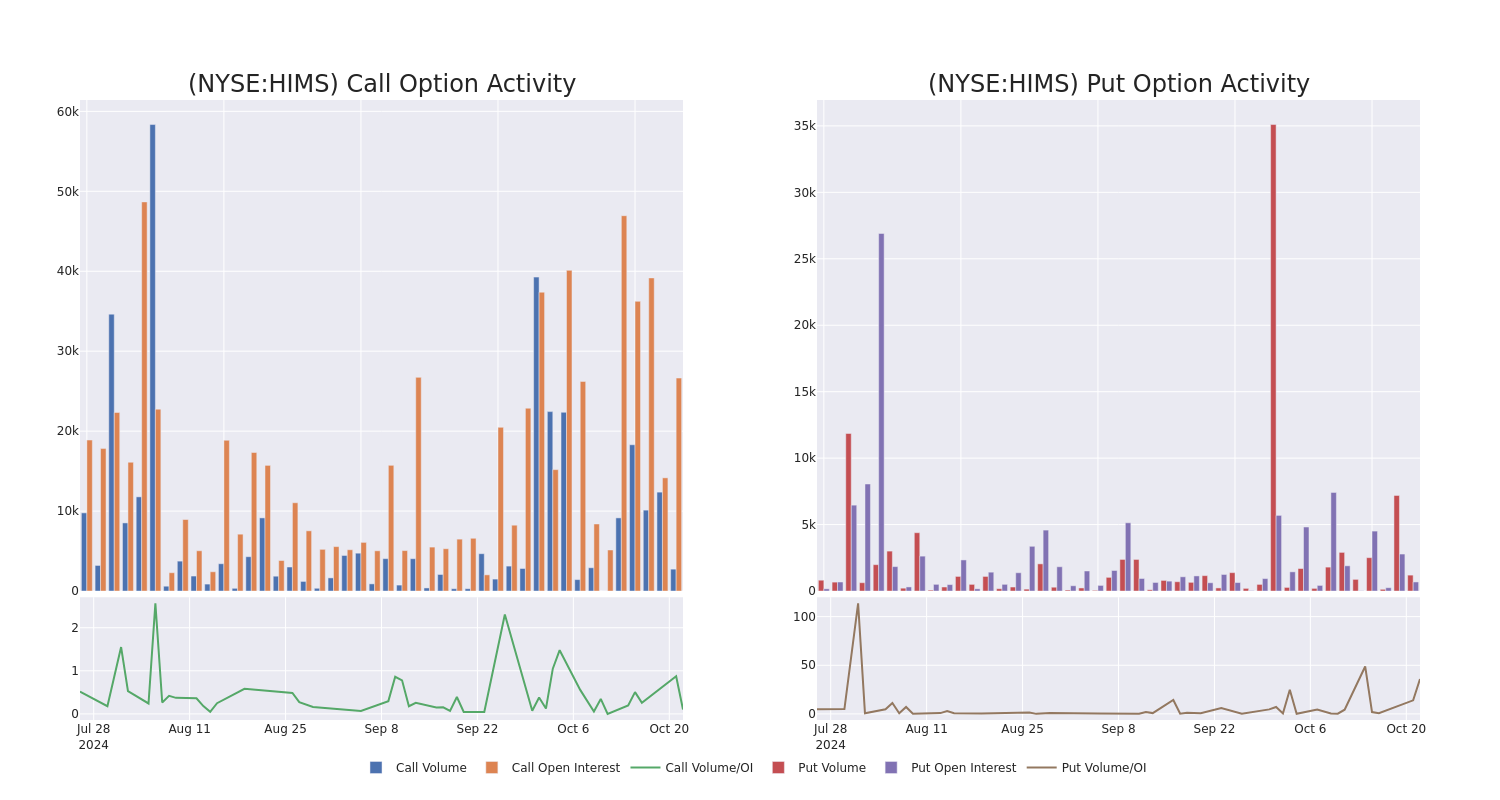

Check Out What Whales Are Doing With HIMS

Deep-pocketed investors have adopted a bearish approach towards Hims & Hers Health HIMS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HIMS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 16 extraordinary options activities for Hims & Hers Health. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 56% bearish. Among these notable options, 3 are puts, totaling $166,650, and 13 are calls, amounting to $1,382,465.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $13.0 and $35.0 for Hims & Hers Health, spanning the last three months.

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Hims & Hers Health’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Hims & Hers Health’s whale trades within a strike price range from $13.0 to $35.0 in the last 30 days.

Hims & Hers Health Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HIMS | CALL | SWEEP | BULLISH | 11/15/24 | $3.4 | $3.2 | $3.38 | $21.50 | $336.4K | 12 | 1.0K |

| HIMS | CALL | TRADE | BULLISH | 01/17/25 | $7.2 | $7.1 | $7.2 | $17.00 | $323.2K | 2.4K | 474 |

| HIMS | CALL | TRADE | BEARISH | 01/17/25 | $6.0 | $5.8 | $5.85 | $19.00 | $234.0K | 1.4K | 400 |

| HIMS | CALL | SWEEP | BEARISH | 01/17/25 | $3.1 | $3.0 | $3.02 | $25.00 | $120.6K | 5.5K | 411 |

| HIMS | PUT | TRADE | BULLISH | 01/17/25 | $7.0 | $6.9 | $6.9 | $28.00 | $69.0K | 194 | 100 |

About Hims & Hers Health

Hims & Hers Health Inc is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more.

In light of the recent options history for Hims & Hers Health, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Hims & Hers Health Standing Right Now?

- Currently trading with a volume of 4,706,782, the HIMS’s price is down by -1.08%, now at $22.8.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 13 days.

What The Experts Say On Hims & Hers Health

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $24.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Hims & Hers Health with a target price of $25.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Hims & Hers Health, targeting a price of $23.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Hims & Hers Health options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.