Billionaires Are Buying These 3 Top Artificial Intelligence (AI) Stocks Hand Over Fist

Artificial intelligence (AI) is one of the hottest investing themes on the planet right now, thanks to this technology’s potential to revolutionize how business is done — and your daily life. Investors big and small have been buying AI stocks like hotcakes over the past year, and top AI tech players have helped the S&P 500 soar to records over and over ever since.

If you haven’t yet gotten in on AI stocks or are looking to add to your current AI positions, you may be wondering which companies to choose at this point. It’s often a good idea to look to billionaire investors for some inspiration, as they have a solid track record of success when it comes to choosing quality long-term investments.

This doesn’t mean you should follow their every move — your comfort with risk or your investing horizon may differ from theirs, for example. And billionaire investors don’t agree with each other on every buy and sell.

But in recent times, certain billionaires have seen eye-to-eye on three top AI players and loaded up on them in the second quarter. Bridgewater Associates’ Ray Dalio, Citadel’s Ken Griffin, and Tudor Investment’s Paul Tudor Jones all bought these three stocks hand over first. Are they good buys for you? Let’s find out.

1. Nvidia

Nvidia (NASDAQ: NVDA) has become almost synonymous with AI in recent times. The company is the world’s No. 1 AI chipmaker, and this dominance and its broad offerings of AI products and services has grown earnings in the triple digits quarter after quarter. And this has helped the stock price to climb more than 200% over the past year.

Billionaires clearly believe Nvidia’s gains are far from over. Bridgewater’s Dalio increased his position by 831% to 6,556,193 shares in the second quarter; Citadel’s Griffin lifted his position by 107% to 2,421,072 shares; and Tudor Investment’s Tudor Jones increased his holdings by 853% to 273,294 shares.

Considering Nvidia’s current market position, as well as the company’s focus on innovation — it’s pledged to update its chips annually — and the general forecast for an AI market of $1 trillion by 2030, the company could have plenty of new waves of growth ahead. And more growth could be just around the corner, as Nvidia is about to launch its new Blackwell architecture by the end of the year.

All of this makes this top AI company a great buy for these billionaires — and it could make a solid long-term addition to your portfolio, too.

2. Amazon

You may think of e-commerce first when you think of Amazon (NASDAQ: AMZN), but the company actually is a leader in the AI market, too. Amazon uses AI to help gain in efficiency across its e-commerce business, and it also is a seller of AI through its Amazon Web Services (AWS) unit.

AWS has gone all-in on AI, offering its customers products and services to suit every AI need, which has helped AWS reach an annualized revenue run rate of more than $105 billion. The cloud computing business is Amazon’s profit driver, so this performance is excellent news for the company.

Certain billionaires are optimistic about Amazon’s future, as we can see from their second-quarter investments. Dalio lifted his Amazon holdings by 153% to 2,645,567 shares; Griffin raised his Amazon stake by 17% to 7,692,857 shares; and Tudor Jones boosted his holdings by 28% to 336,407 shares.

Amazon is the ideal investment for investors who want to get in on the AI theme, but want to minimize their risk. This is because Amazon doesn’t rely on AI for growth — the company’s e-commerce and cloud computing businesses generated billion-dollar sales prior to the AI boom, establishing a solid track record of strength. And the company’s focus on AI these days offers an additional opportunity for growth.

3. Super Micro Computer

Super Micro Computer (NASDAQ: SMCI) is a behind-the-scenes winner in the AI world. The company makes servers, workstations, and other products that power AI data centers. Supermicro works closely with top chip designers like Nvidia so it can immediately integrate their innovations in its equipment — and this speed to market appeals to AI customers.

The company has generated triple-digit revenue growth in recent quarters, and moving forward, it could see a new wave of growth thanks to its specialization in direct liquid-cooling technology — something that should solve the big problem of heat buildup in AI data centers.

Dalio opened a new position in Supermicro, buying 15,777 shares in the second quarter; Tudor Jones did the same, buying 26,165 shares; and Griffin lifted his holdings by 96% to 201,733 shares.

Is Supermicro right for you too? This depends on your comfort with risk. Supermicro encountered headwinds recently: A short report back in August alleged troubles at the company, and a few weeks later, The Wall Street Journal reported a possible Justice Department probe into Supermicro. Investors may be seeking further clarification, and this could weigh on the stock in the near term — so you should only consider this AI stock today if you’re an aggressive investor.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

Billionaires Are Buying These 3 Top Artificial Intelligence (AI) Stocks Hand Over Fist was originally published by The Motley Fool

Bitcoin, Ethereum, Dogecoin Plunge After Hitting Multi-Month Highs: Don't Be Scared To Buy BTC Dips Between $62K-$63K, Says Analyst

Leading cryptocurrencies made a sharp U-turn Monday, mirroring the pullback in stocks, as the ‘Uptober’ rally takes a halt.

| Cryptocurrency | Gains +/- | Price (Recorded at 8:45 p.m. EDT) |

| Bitcoin BTC/USD | -3.28% | $66,950.69 |

| Ethereum ETH/USD |

-4.26% | $2,631.99 |

| Dogecoin DOGE/USD | -2.13% | $0.1421 |

What Happened: Bitcoin went downhill throughout the day, dipping to an intraday low of $66,580. The retracement occurred just one day after the leading cryptocurrency surpassed $69,000 for the first time since early June.

Ethereum saw a steeper decline, falling back into the $2,600 zone. On Sunday, the second-largest cryptocurrency hit its highest level since the first week of August.

Total cryptocurrency liquidations surged to $204 million in the last 24 hours, with over $174 million longs being wiped out.

Bitcoin’s Open Interest dropped by 2% in the last 24 hours, while Ethereum’s speculative market contracted by 3.75%.

The pullback triggered bearish sentiment as the number of traders shorting Bitcoin rose compared to those bullishly leveraged on the asset, as per the Long/Shorts Ratio.

That said, market sentiment remained in the “Greed” zone as of this writing, according to the Cryptocurrency Fear & Greed Index.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 8:45 p.m. EDT) |

| Apecoin (APE) | +8.46% | $1.55 |

| Cosmos (ATOM) | +2.81% | $4.83 |

| Cat in a dogs world (MEW) | +1.93% | $0.009029 |

The global cryptocurrency stood at $2.33 trillion, contracting 2.14% in the last 24 hours.

Stocks pulled back Monday, giving up gains from last week. The Dow Jones Industrial Average slipped 344.31 points, or 0.80%, to end at 42,931.60. The S&P 500 fell 0.18% to 5,853.98. The tech-heavy Nasdaq Composite defied the slump, gaining 0.27% to end at 18,540.01.

The retrace followed record closes for both the Dow and the S&P 500 on Friday, marking the sixth consecutive week of gains for Wall Street.

Investors expected the upcoming third-quarter earnings of premium tech companies like Tesla Inc. TSLA and Amazon.com Inc. AMZN to drive the markets.

See More: Best Cryptocurrency Scanners

Analyst Notes: A widely followed cryptocurrency analyst, operating under the pseudonym Emperor, advised his followers not to hesitate to buy Bitcoin dips between $62,000 and $63,000.

He added that the area between $66,000 and $66,500 could be a good area of support and short-sellers could take profit at these levels.

“My target of $69,000 has now been hit and I’m looking to relong dips,” the analyst remarked.

Another well-known cryptocurrency market observer, Michaël van de Poppe, noted that whale activity was high despite Bitcoin approaching its all-time highs.

“In essence: that’s a great sign for Bitcoin, but a terrible sign for the global economy,” Van De Poppe remarked.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FAU BEPI Poll: Hispanics Wary of Economic Outlook Ahead of Election

BOCA RATON, Fla., Oct. 22, 2024 (GLOBE NEWSWIRE) — Hispanic consumers are hesitant about the long-term outlook for the United States economy as the presidential election approaches, according to a new poll from the Business and Economic Polling Initiative at Florida Atlantic University (FAU BEPI).

Only 39% of Hispanics were optimistic about the long-run economic outlook of the economy, substantially down from 58% in the first quarter and just a notch up from the 38% in the second quarter of the year, the Hispanic Consumer Sentiment Index (HCSI) shows.

“With the upcoming election approaching, many Hispanic consumers appear to be reserving judgment on the longer-term outlook for the economy,” said Monica Escaleras, Ph.D., director of FAU BEPI.

The HCSI dropped slightly to 69.8 in the third quarter from 85.3 in the first quarter of the year but slightly higher than 68.3 in the second quarter.

The poll showed that 38% of Hispanics felt better off financially than a year ago, up from 31% in the second quarter but still a substantial drop from 59% in the first quarter. Hispanics were also less optimistic about their future financial situations and the short-term outlook for the economy. Only 61% were more confident about their finances in the future, a decrease from 80% in the second quarter. Regarding the short-run economic outlook of the country, 45% of Hispanics said they expect the country to experience good business conditions in the upcoming year, a drop when compared to 51% in the second quarter.

However, in terms of big-ticket purchases, 46% percent of Hispanics believe it is an excellent time to buy big-ticket items, up from 41% in the first quarter and 24% percent in the second quarter.

“Hispanic consumers are showing slightly more optimism about their current financial situation compared to a year ago, likely due to easing inflation,” Escaleras said. “Additionally, they are expressing increased confidence in purchasing big-ticket items for their homes, which recent interest rate declines may influence.”

The poll is based on a sampling of 453 Hispanic adults from July 1 to Sept. 30. The margin of error is +/- 4.60 percentage points. The survey was administered using landlines via IVR data collection and online data collection using Dynata. Responses for the entire sample were weighted to reflect the national distribution of the Hispanic population by region, gender, age and income, according to the latest American Community Survey data. The polling results and full cross-tabulations can be viewed here.

Amber Bonefont Florida Atlantic University College of Business 5617579188 abonefont@fau.edu

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

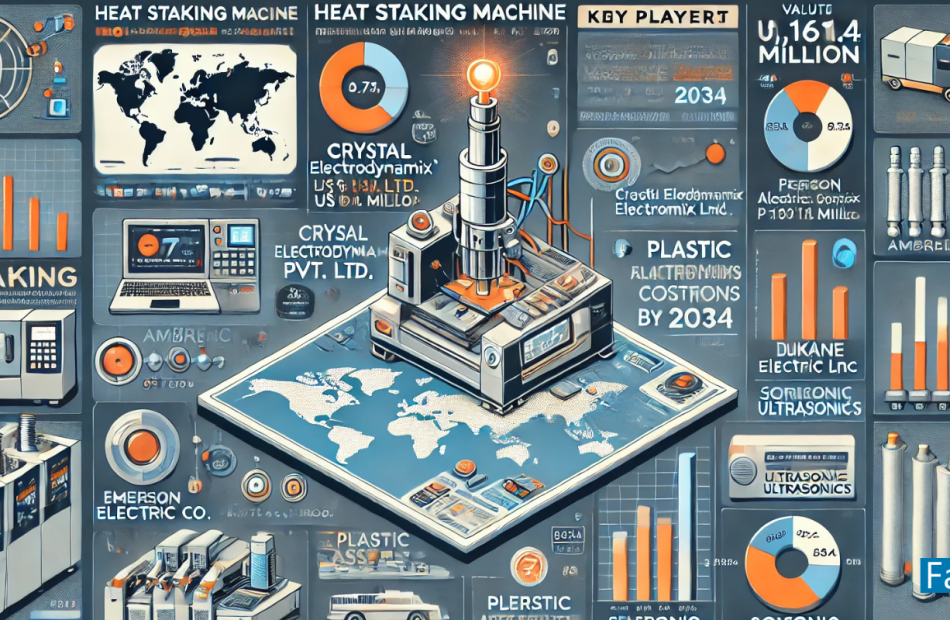

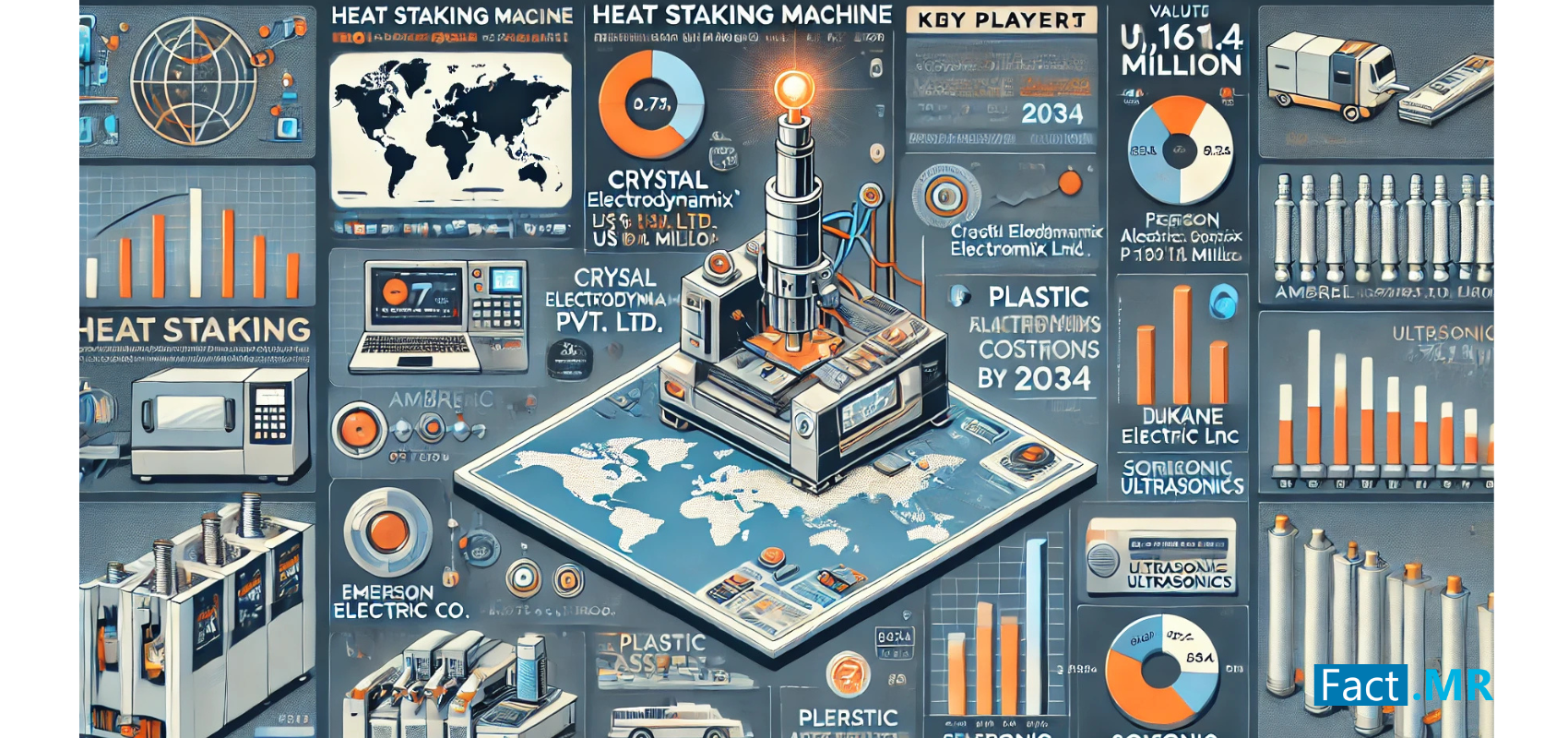

Heat Staking Machine Market Size is Projected to Reach US$ 1,161.4 Million by 2034 at a CAGR of 9.7% | Fact.MR Report

Rockville, MD , Oct. 22, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global Heat Staking Machine Market is estimated at US$ 419.5 million in 2023 and is expected to expand at an impressive CAGR of 9.7% during the forecast years of 2024-2034.

Heat staking is a heat-joining technique for bonding two or more pieces when at least one component is plastic. This process takes in deforming the plastic material through a controlled application of force and heat during certain predetermined periods.

The result of such deformation forms a bond, securely joining these pieces with minimal mechanical stresses. It is especially effective in sensitive and hard-to-process thermoplastics from industries like medical, automotive, telecom, and consumer goods. These industries generally operate best within small windows of temperature, requiring very accurate and precise control.

Heat staking has numerous applications in the medical field, such as attaching adhesive patches onto portable meters and medical dispensers. Due to these factors, the heats taking machine market expected to grow roughly 2.5X during the forecast period, owing to increased adoption due to advancements within the packaging industry and other key sectors.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7575

Factors Contributing to Market Growth:

The demand for electric vehicle manufacturing and higher automotive componentry requires super-accurate heat stake processes in today’s time. This segment reinforced with huge investment in manufacturing technology and infrastructure.

Heat staking plays an important role in putting together plastic parts within the electronics industry, especially regarding smartphones, tablets, and wearables. The continuous advancement and proliferation of consumer electronics are creating strong demand for efficient and reliable heat staking solutions.

With the innovation in heat staking technology, increased automation, precision, and efficiency are furthering the applications that use these machines across many industries. In particular, improved machine design and control systems continue to make the heat staking solution more appealing and versatile.

Key Takeaways from Market Study:

- The global heat staking machine market is projected to grow at 9.7% CAGR and reach US$ 1,161.4 million by 2034

- The market created an opportunity of US$ 701.3 million growing at a CAGR of 9.7% between 2019 to 2024

- East Asia is a prominent region that is estimated to hold a market share of 32.3% in 2034

- Predominating market players include Dukane Corp, Emerson Electric Co, Sonitek Corporation, Plastic Assembly Systems & Bdtronic

- Automatic Heat Staking Machine type are estimated to grow at a CAGR of 11.2% creating an absolute $ opportunity of US$ 411.2 million between 2024 and 2034

“Investing in cutting-edge heat staking technologies, such as automation and precision control, will be key to staying competitive in the market. As industries demand more efficient and reliable solutions, adopting these innovations will boost market position and meet evolving standards,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Heat Staking Machine Market:

Some of the key players operating in the Heat Staking Machine market include Dukane Corp, Emerson Electric Co., Sonitek Corporation, Plastic Assembly Systems, Bdtronic, Ambrell, Ferriot Inc., Telesonic Ultrasonic & Thermal Press International Inc.

Market Development:

The Heat Staking Machine market is witnessing a concerted effort towards developing efficient, versatile, and application-specific designs to cater to the evolving needs of construction industries.

The key players in the market are seen to actively invest in research and development activities, collaborate with industry partners, and also venture into new market opportunities.

- In 2024, Vertex introduced its new model, the Vertex Basic Series heat staking presses. These compact systems provide precision and versatility for small bench-top applications.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=7575

Heat Staking Machine Industry News:

- The Vertex Basic Series heat staking presses were Vertex’s new model, which debuted in 2024. These tiny-sized devices offer adaptability and accuracy for modest bench-top applications.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global Heat Staking Machine Market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of the Type, (Benchtop & Standalone, By Technology (Automatic Semi –Automatic & Manual) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Heat Staking Machine Market Research:

- By Type :

- By Technology :

- Automatic

- Semi-Automatic

- Manual

- By Force Range :

- Up to 100 Kg

- 100-300 Kg

- 300-500 Kg

- Above 500 Kg

- By Stroke Length :

- Below 5″

- 5″ – 10″

- Above 10″

- By End Use Industry :

- Automotive

- Aerospace & Defence

- Electronics & Electrical

- Healthcare & Medical Devices

- Packaging

- Food & Beverages

- Consumer Products

- Textile

- Others

Check out More Related Studies Published by Fact.MR:

Industrial Protective Clothing Fabrics Market: Size is expected to reach a valuation of US$ 11,357.3 million in 2024. It is projected to climb to US$ 24,747.6 million by 2034, expanding at a CAGR of 8.1% during the forecast period of 2024 to 2034.

Industrial Air Preheater Market: Size is expected to reach a valuation of US$ 9,069.8 million in 2024 and is projected to climb to US$ 16,396.5 million by 2034, expanding at a CAGR of 6.1% during the forecast period of 2024 to 2034.

Fuel Cell for Data Center Market: Size is estimated at US$ 178.3 million in 2024 and is forecasted to increase at a CAGR of 15.6% to achieve a value of US$ 759.85 million by the end of 2034.

Gas Pressure Regulator Market: Size is approximated to achieve a valuation of US$ 2.84 billion in 2024. The market has been forecasted to rise at 3.7% CAGR to reach US$ 4.09 billion by 2034-end.

Flexographic Printing Technology Market: Size is projected at US$ 2.86 billion in 2024. The market has been evaluated to advance at a CAGR of 6.5% and reach a valuation of US$ 5.38 billion by the end of 2034.

Fire Protection System Market: Demand is projected to expand at a notable CAGR of 9.1% to touch a valuation of US$ 168.4 billion by 2034-end.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow, S&P 500 poised for more losses as Fed rate-cut doubts build

US stocks retreated on Tuesday as investors digested a recent bond-market selloff and braced for the next wave of earnings reports.

The S&P 500 (^GSPC) dropped more than 0.5%. The Dow Jones Industrial Average (^DJI) dropped more than 120 points, or around 0.3%, while the tech-heavy Nasdaq Composite (^IXIC) slid roughly 0.6%.

Stocks are coming under pressure amid growing doubts that the Federal Reserve will continue to cut rates aggressively — or even hold steady in November. Strength in the economy, cautious Fedspeak, and concerns about the fiscal impact of an election win by Republican nominee Donald Trump are factors in play.

Amid the uncertainty, the 10-year Treasury yield (^TNX) steadied around 4.2% after Monday’s sharp gains helped push it above that level for first time since July. The bond selling has weighed on rate-sensitive stocks such as real estate, with rising yields typically a catalyst for stock drawdowns.

On the earnings front, General Motors (GM) raised its guidance for the third time this year as upbeat EV sales helped deliver a quarterly profit and revenue beat. GM shares were up more than 5%. Elsewhere in earnings, GE Aerospace (GE) fell over 7% and Verizon shares fell around 5% on mixed third quarter reports.

At the same time, anticipation is building for earnings from Tesla (TSLA) on Wednesday, as Wall Street debates whether the “Magnificent Seven” tech megacaps will lead stocks’ next leg higher.

Despite higher yields, gold (GC=F) prices rose, on track to reclaim Monday’s record high. The gains came as investors sought safety with the US presidential election looming and Middle East tensions still on the rise.

Live5 updates

-

Markets are debating a higher for longer interest rate stance from the Fed

Treasury yields spiked over the last month amid a slew of stronger-than-expected economic data and signs that inflation’s path down toward the Fed’s 2% goal may take longer than initially hoped.

The data have pushed the 10-year Treasury yield (^TNX) up nearly 50 basis points in the past month to hover near 4.2%, its highest level since July. As our graph below shows, the debate among investors appears to be more about how quickly the Fed will reduce interest rates over the next year, not about whether the central bank will once again cut in November.

As of Tuesday, morning markets are still pricing in a roughly 88% chance the Fed cuts rates at its November meeting, per the CME FedWatch Tool. But by the end of next year, markets now see the Fed likely making one less cut than was priced in on October 4 and two less cuts than markets were projecting on Sep. 18, the day the Fed slashed rates by half a percentage point.

-

-

-

-

Genco Shipping & Trading Limited Announces Third Quarter 2024 Conference Call and Webcast

NEW YORK, Oct. 21, 2024 (GLOBE NEWSWIRE) — Genco Shipping & Trading Limited GNK announced today that it will hold a conference call to discuss the Company’s results for the third quarter of 2024 on Thursday, November 7, 2024 at 8:30 a.m. Eastern Time. The conference call will also be broadcast live over the Internet and include a slide presentation. The Company will issue financial results for the third quarter ended September 30, 2024 on Wednesday, November 6, 2024 after the close of market trading.

| What: | Third Quarter 2024 Conference Call | |

| When: | Thursday, November 7, 2024 at 8:30 a.m. Eastern Time | |

| Where: | There are two ways to access the call: | |

| Dial-in: 646-307-1963 or 800-715-9871 | ||

| Please dial in at least 10 minutes prior to 8:30 a.m. Eastern Time to ensure a prompt start to the call. | ||

| For live webcast and slide presentation: http://www.gencoshipping.com. | ||

If you are unable to participate at this time, a replay of the call will be available for two weeks at 609-800-9909 or 800-770-2030. Enter the code 6365548 to access the audio replay. The webcast will also be archived on the Company’s website: http://www.gencoshipping.com.

About Genco Shipping & Trading Limited

Genco Shipping & Trading Limited is a U.S. based drybulk ship owning company focused on the seaborne transportation of commodities globally. We provide a full-service logistics solution to our customers utilizing our in-house commercial operating platform, as we transport key cargoes such as iron ore, grain, steel products, bauxite, cement, and nickel ore among other commodities along worldwide shipping routes. Our wholly owned high quality, modern fleet of dry cargo vessels consists of the larger Capesize (major bulk) and the medium-sized Ultramax and Supramax vessels (minor bulk), enabling us to carry a wide range of cargoes. We may make capital expenditures from time to time in connection with vessel acquisitions. Genco’s fleet is expected to consist of 42 vessels, including 16 Capesize, 15 Ultramax and 11 Supramax vessels with an aggregate capacity of approximately 4,446,000 dwt and an average age of 11.9 years, after the delivery of the Genco Intrepid.

CONTACT:

Peter Allen

Chief Financial Officer

Genco Shipping & Trading Limited

(646) 443-8550

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SoftBank-Backed Jellysmack Restructures, Lays Off Employees, And Scales Back Creator Program On Meta Platforms

In a bid to restructure its operations, Jellysmack, a SoftBank Group SFTBF SFTBY-backed creator-economy startup, is laying off employees and reducing its creator program.

What Happened: Jellysmack is undergoing a reorganization and will be downsizing its workforce, reported Business Insider. The company has confirmed that 22 U.S.-based employees will be affected, with French employees also facing potential layoffs in the coming months.

The company is shifting its focus to its content business, which includes YouTube channels like Gamology, House of Bounce, Beauty Studio, and Oh My Goal. It is scaling back a program that helped creators earn money by posting content on Meta Platforms Inc META-owned apps like Facebook.

“Jellysmack is making organizational adjustments to better align resources with key areas of growth,” a company representative said according to the report. “Jellysmack’s goal is to prioritize and invest in our business units that hold IP, given their continued success on YouTube.”

This move comes after Jellysmack faced challenges in its business, including a decrease in monetization across platforms. The company, which initially focused on creating its own YouTube content, shifted to working with other creators to edit and recirculate their content across platforms like Facebook and Snap Inc‘s SNAP Snapchat to capture additional ad revenue.

Why It Matters: Jellysmack’s decision to restructure its operations and focus on its content business comes at a time when the creator economy is undergoing significant changes. Meta Platforms Inc. has also been restructuring its operations and laying off employees across Instagram, WhatsApp, and Reality Labs. This is part of a broader trend of tech companies reevaluating their strategies and operations, which has been ongoing for some time.

This was part of a strategic reshuffle aimed at boosting efficiency. The company has also been undergoing a prolonged process of evaluating individual employee performance for 2023, with the reviews now concluding. This has left many employees anxious about their job security.

Read Next:

Image Via Unsplash

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Jeff Yass Sold 73% of Susquehanna's Stake in Nvidia and Is Piling Into This Beloved Artificial Intelligence (AI) Stock Instead

Earnings season is officially kicking into high gear. Over the span of roughly six weeks, a majority of America’s most-important publicly traded companies will spill the beans to Wall Street and investors regarding their operating performance over the prior quarter.

While corporate profit growth is vital to the success of a historically pricey stock market, earnings season isn’t the only important data release investors would be wise to monitor.

August 14 marked the filing deadline for institutional investors with at least $100 million in assets under management (AUM) to file Form 13F with the Securities and Exchange Commission. This filing provides investors with a snapshot of what Wall Street’s brightest and most-successful asset managers bought and sold in the latest quarter (in this instance, the second quarter).

Admittedly, 13Fs have a drawback — they’re filed up to 45 calendar days following the end to a quarter, which means they’re likely providing stale information for active hedge funds. Yet in spite of this flaw, they can still offer invaluable clues as to which stocks, industries, sectors, and trends Wall Street’s leading money managers are intrigued by.

Aside from Berkshire Hathaway‘s extraordinary CEO Warren Buffett, one of the most closely followed billionaire money managers is Susquehanna International Group’s co-founder and managing director, Jeff Yass.

Susquehanna ended June with $537 billion in AUM and thousands of holdings, including various put and call options. However, the actions that stand out most in the June-ended quarter, based on Susquehanna’s 13F, is what Yass and his team did within the artificial intelligence (AI) arena.

Yass’s Susquehanna dumped more than 52 million shares of Nvidia

Arguably no public company has been more responsible for lifting Wall Street’s major stock indexes to new highs, or fueling the AI revolution, than Nvidia (NASDAQ: NVDA). Since the end of 2022, Nvidia’s market cap has catapulted from $360 billion to $3.39 trillion, as of the closing bell on Oct. 18.

Despite Nvidia’s graphics processing units (GPUs) being the undisputed top choice by businesses overseeing generative AI solutions and training large language models, not all billionaire money managers are optimistic about its future.

During the second quarter, Yass’s fund jettisoned 52,497,275 shares of Nvidia’s stock, which reduced its stake by 73% from the March-ended quarter. Keep in mind that Nvidia completed a historic 10-for-1 forward stock split following the close of trading on June 7, and the above share count has been adjusted for this split.

While profit-taking may be a viable and relatively benign explanation behind this selling activity, there are also a few glaring headwinds that could have coerced Susquehanna’s aggressive selling of Nvidia’s shares in the June-ended quarter.

Topping the list of possible sell-side catalysts is history. Since the advent of the internet in the mid-1990s, we’ve witnessed a multitude of game-changing technologies and innovations come along. While many of these next-big-thing trends have offered eye-popping addressable markets, their only certainty has been an early stage bubble-bursting event.

For three decades, investors have repeatedly overestimated how quickly a new technology, innovation, or trend would be adopted and utilized in a mainstream capacity by consumers and/or businesses. When these lofty expectations are, inevitably, not met, the music stops and the bubble bursts. With most businesses lacking a clear plan to monetize their AI investments and generate a positive return, it would appear as if investors have overestimated the early stage utility of artificial intelligence. If the AI bubble bursts, Nvidia would presumably be clobbered.

Regulators aren’t doing Nvidia any favors, either. The U.S. has restricted exports of the company’s high-powered AI-GPUs to China, which is one of Nvidia’s top-dollar markets.

Yass and his team might also be worried about competitive pressures weighing on Nvidia’s pricing power and margins. In addition to external competitors bringing chips to market, Nvidia’s four most-important customers by net sales are all developing AI-GPUs for use in their data centers. With Nvidia’s AI-GPUs backlogged and substantially pricier than these in-house chips, Wall Street’s AI darling could lose out on future orders.

But while Susquehanna’s brightest minds, including Yass, were busy dumping shares of Nvidia, they were absolutely piling into another key company in the AI arena.

Yass is piling into the networking company fueling AI-accelerated data centers

Despite Yass’s fund adding to more than 4,600 positions during the second quarter, the one that really stands out is Susquehanna’s sizable addition to its existing stake in AI networking colossus Broadcom (NASDAQ: AVGO).

During the June-ended quarter, Yass oversaw the purchase of 2,347,500 shares of Broadcom, which increased Susquehanna’s stake by 73% to 5,582,590 shares. Broadcom also completed a 10-for-1 stock split, but did so in mid-July.

There’s no question that artificial intelligence is a big reason Broadcom is expected to deliver 44% sales growth this year. The company’s networking solutions are being relied on by businesses to connect tens of thousands of GPUs to maximize their computing capabilities and reduce tail latency. Broadcom’s solutions are critical to the split-second decision-making that powers AI-driven software and systems.

Although Broadcom’s stock and operating performance would be susceptible to downside if the AI bubble bursts, the big difference between Nvidia and Broadcom is their revenue channels. Whereas an overwhelming majority of Nvidia’s sales and recent growth are tied to its AI hardware, AI still represents a minority of Broadcom’s net revenue.

Broadcom’s bread-and-butter profit driver has long been its ties to the global smartphone industry. It provides an assortment of wireless chips and accessories used in next-generation smartphones. With wireless carriers expanding the reach of 5G, Broadcom has benefited from a steady device replacement cycle.

On top of being a notable player in smartphones, Broadcom develops optical sensors used in industrial equipment and robotics, connectivity and LED solutions for next-generation automobiles, and cybersecurity solutions, to name just a few of its other revenue channels.

Building on this point, the company’s management team hasn’t been afraid to lean on the occasional acquisition to expand its footprint and bolster cross-selling opportunities. Broadcom’s 2019 purchase of Symantec’s enterprise security business opened the door to high-margin cybersecurity services, while its $69 billion buyout of cloud-based virtualization software provider VMware in November 2023 should bolster the company’s private and hybrid cloud strategy.

A considerably more diverse product and service portfolio for Broadcom appears to be the lure that hooked Susquehanna International’s billionaire co-founder Jeff Yass.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 21, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Billionaire Jeff Yass Sold 73% of Susquehanna’s Stake in Nvidia and Is Piling Into This Beloved Artificial Intelligence (AI) Stock Instead was originally published by The Motley Fool

The case for a 'Magnificent 7' resurgence: Morning Brief

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

The broadening of the stock market rally has become a crucial theme during the second half of 2024.

Amid the start of rate cuts — and economic data that’s showed the US economy remains in better shape than initially feared — the recent push to new record highs has largely been about companies not named Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), Tesla (TSLA), or Nvidia (NVDA).

But the debate over whether the market’s next leg higher will be led by just a few large tech companies — as was the case in 2023 and the early part of 2024 — continues to roll on among investors.

In a note on Friday, data from FactSet showed that earnings for the 493 companies in the S&P 500 outside the “Magnificent Seven” are expected to grow by an average of more than 13% over the next five quarters. Conversely, the Magnificent Seven are expected to see earnings grow by an average of nearly 19% over the same time period.

Notably, this represents a pickup in growth for the 493 from 2024 and a notch lower for the Magnificent Seven. This more positive trend in the 493 is one of the reasons strategists have called for a continued broadening out of the rally. But as our chart below shows, the difference in trend growth is a narrowing race.

And some believe Big Tech could still be the winner.

“The Mag 7 are still expected to post superior (and presumably more reliable) earnings growth than the rest of the index,” DataTrek co-founder Nicholas Colas said.

Colas noted that this data suggests tech “should begin to play catchup into the end of the year,” as the tech-heavy Nasdaq 100 (^NDX) has underperformed the S&P 500 over the past month and throughout 2024.

“Going forward, the path to outperformance will be assessing whether Big Tech or the rest of the S&P 500 will exhibit better earnings momentum,” Colas wrote. “If one believes that US GDP growth can be +3% in 2025, then the S&P 493 is likely the better bet. Our own view is that growth will be more modest, giving the edge to Big Tech.”

Part of the tech revival may already be playing out. Nvidia has soared to a fresh record high over the past month, its first since June. Apple stock closed at a record high of $235 per share on Friday and added to those gains on Monday. Netflix (NFLX), the first of the large tech giants to report earnings, saw a massive rally in its stock to a fresh record high after another impressive round of earnings.

That move in the streaming giant is perhaps the most illuminating when considering the case for Big Tech to lead the market. Even Netflix, which had already seen its stock rise more than 50% on the year before earnings, managed to surprise Wall Street to the upside.

Perhaps this serves as an early reminder that while growth in tech is “expected” to slow from its rapid pace over the past year, that doesn’t mean there can’t be upside surprises — or that it still can’t outperform. You don’t need to look beyond the past 18 months of many tech earnings reports coming in better than expected for the empirical evidence.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Meta's Smart Glasses Dominate Ray-Ban Stores, AI Features Still Missing

Ray-Ban and Meta Platforms Inc META glasses have become the top-selling product in 60% of Ray-Ban stores across Europe, the Middle East, and Africa (EMEA). Companies commonly use this region to define their global market divisions.

EssilorLuxottica CFO Stefano Grassi shared the update during the company’s third-quarter 2024 earnings call, Upload VR reports.

Also Read: Meta Cuts Jobs in WhatsApp, Instagram, and Reality Labs In Latest Reorganization

EssilorLuxottica, Ray-Ban’s parent company, has a stronghold in the global eyewear market and owns other popular brands like Oakley.

Grassi expressed satisfaction with the performance of Ray-Ban Meta glasses, noting their popularity in the US and across the EMEA region. The higher price point of $300 for the Meta glasses, compared to the average $150-$200 range for regular Ray-Ban products, indicates that consumers are willing to pay more for smart glasses that combine style and functionality.

While Ray-Ban Meta glasses offer basic smart features, Meta has consistently added new capabilities like WhatsApp voice messages and QR code scanning. Future updates are expected to include live translation and Spotify controls.

Despite the absence of advanced AI features in Europe due to regulatory delays, these glasses have still outperformed traditional Ray-Ban models in these regions, driving significant sales for the company.

While Meta’s smart glasses offer speakers and cameras that have attracted early adopters, the AI capabilities—including live translation and Spotify controls—are not yet available in Europe.

TechCrunch reports that Meta attributes this delay to ongoing uncertainty from European regulators.

Despite the lack of AI integration, Ray-Ban Meta glasses have exceeded sales expectations, signaling consumers are already drawn to the current smart functionality.

The success of the Ray-Ban Meta glasses has likely contributed to Meta’s decision to extend its partnership with EssilorLuxottica into the 2030s.

JMP Securities’ Andrew Boone flagged growing confidence in Meta’s hardware and XR (extended reality) roadmap at Meta Connect. He noted Meta’s strides in augmented reality (AR) hardware over the past five years and suggested that Orion could become the next major consumer computing platform.

Boone emphasized that Meta’s platform could become twice as profitable if it controlled its infrastructure, similar to Microsoft Corp MSFT and Apple Inc AAPL.

He also highlighted the potential of Meta’s Llama models to capture a portion of search queries. The analyst expects Meta’s continued focus on lowering hardware prices will boost consumer adoption.

Meta Platforms stock has increased over 83% in the last 12 months. Investors can gain exposure to the stock through the iShares S&P 500 Growth ETF IVW and The Communication Services Select Sector SPDR Fund XLC.

Price Action: META stock is up 0.50% at $578.03 at last check Tuesday.

Also Read:

Photo courtesy: Ray-Ban

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.