US Stock Futures Slide With Rate-Cut Path at Risk: Markets Wrap

(Bloomberg) — Stocks wavered as traders mulled prospects for a slower pace of Federal Reserve rate cuts. Treasury 10-year yields hovered near 4.2%.

Most Read from Bloomberg

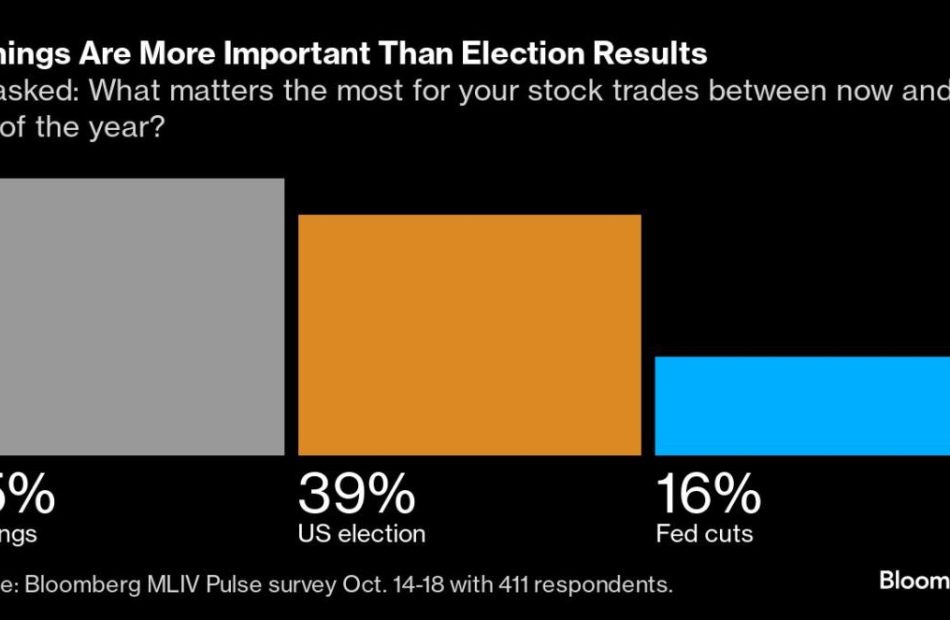

Wall Street is paring back bets on aggressive policy easing as the US economy remains robust while Fed officials sound a cautious tone over the pace of future rate decreases. Rising oil prices and the prospect of bigger fiscal deficits after the upcoming presidential election are only compounding the market’s concerns. Since the end of last week, traders have trimmed the extent of expected Fed cuts through September 2025 by more than 10 basis points.

“Of course, higher yields do not have to be negative for stocks. Let’s face it, the stock market has been advancing as these bond yields have been rising for a full month now,” said Matt Maley at Miller Tabak + Co. “However, given how expensive the market is today, these higher yields could cause some problems for the equity market before too long.”

Exposure to the S&P 500 has reached levels that were followed by a 10% slump in the past, according to Citigroup Inc. strategists. Long positions on futures linked to the benchmark index are at the highest since mid-2023 and are looking “particularly extended,” the team led by Chris Montagu wrote.

The S&P 500 was little changed. The Nasdaq 100 rose 0.1%. The Dow Jones Industrial Average was little changed. In late hours, Texas Instruments Inc. gave a lackluster revenue forecast for the fourth quarter. Starbucks Corp.’s guidance will be suspended for 2025.

Treasury 10-year yields were little changed at 4.20%. The euro hit the lowest since early August amid bets the European Central Bank will keep lowering rates. Options traders are increasing bets that Bitcoin will reach $80,000 by the end of November no matter who wins the US election.

Oil advanced as traders tracked tensions between Israel and Iran. Gold climbed to a fresh record.

The stock market has rallied this year thanks to a resilient economy, strong corporate profits and speculation about artificial-intelligence breakthroughs — sending the S&P 500 up over 20%. Yet risks keep surfacing: from a tight US election to war in the Middle East and uncertainty around the trajectory of Fed easing.

Leave a Reply