A Look Ahead: Western Digital's Earnings Forecast

Western Digital WDC is gearing up to announce its quarterly earnings on Thursday, 2024-10-24. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Western Digital will report an earnings per share (EPS) of $1.72.

The market awaits Western Digital’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

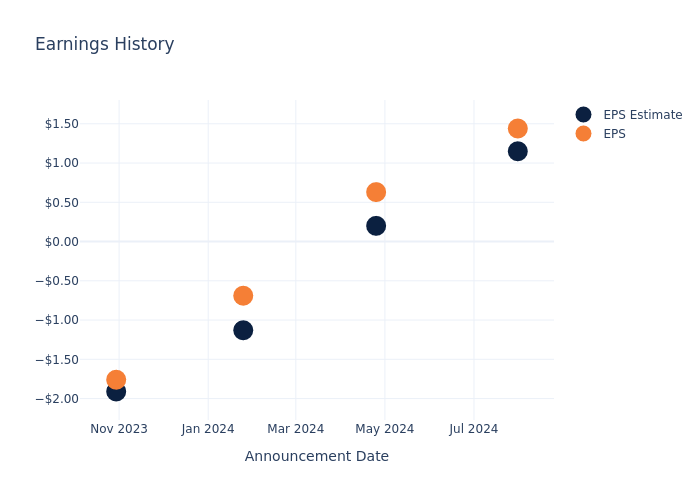

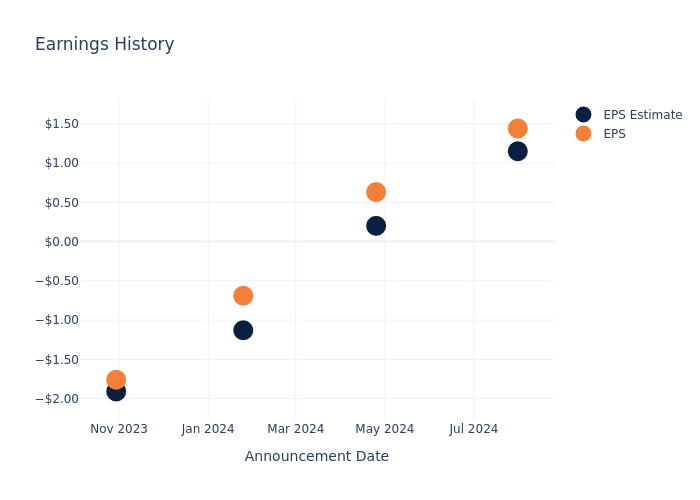

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.29, leading to a 9.72% drop in the share price on the subsequent day.

Here’s a look at Western Digital’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.15 | 0.20 | -1.13 | -1.91 |

| EPS Actual | 1.44 | 0.63 | -0.69 | -1.76 |

| Price Change % | -10.0% | 3.0% | -3.0% | -4.0% |

Tracking Western Digital’s Stock Performance

Shares of Western Digital were trading at $67.76 as of October 22. Over the last 52-week period, shares are up 74.96%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Western Digital

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Western Digital.

A total of 9 analyst ratings have been received for Western Digital, with the consensus rating being Buy. The average one-year price target stands at $89.33, suggesting a potential 31.83% upside.

Comparing Ratings Among Industry Peers

The analysis below examines the analyst ratings and average 1-year price targets of NetApp, Hewlett Packard and Super Micro Computer, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- NetApp received a Neutral consensus from analysts, with an average 1-year price target of $133.5, implying a potential 97.02% upside.

- Analysts currently favor an Neutral trajectory for Hewlett Packard, with an average 1-year price target of $20.89, suggesting a potential 69.17% downside.

- For Super Micro Computer, analysts project an Neutral trajectory, with an average 1-year price target of $641.8, indicating a potential 847.17% upside.

Snapshot: Peer Analysis

In the peer analysis summary, key metrics for NetApp, Hewlett Packard and Super Micro Computer are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Western Digital | Buy | 40.87% | $1.35B | 0.28% |

| NetApp | Neutral | 7.61% | $1.10B | 23.90% |

| Hewlett Packard | Neutral | 10.11% | $2.44B | 2.34% |

| Super Micro Computer | Neutral | 37.87% | $597.37M | 6.68% |

Key Takeaway:

Western Digital ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is at the top for Return on Equity.

All You Need to Know About Western Digital

Western Digital is a leading vertically integrated supplier of data storage solutions, spanning both hard disk drives and solid-state drives. In the HDD market it forms a practical duopoly with Seagate, and it is the largest global producer of NAND flash chips for SSDs in a joint venture with competitor Kioxia.

Unraveling the Financial Story of Western Digital

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Western Digital showcased positive performance, achieving a revenue growth rate of 40.87% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Western Digital’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 0.77%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Western Digital’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 0.28%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Western Digital’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.12% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Western Digital’s debt-to-equity ratio is below the industry average. With a ratio of 0.69, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Western Digital visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply