An Overview of Deckers Outdoor's Earnings

Deckers Outdoor DECK is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Deckers Outdoor to report an earnings per share (EPS) of $1.21.

Deckers Outdoor bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

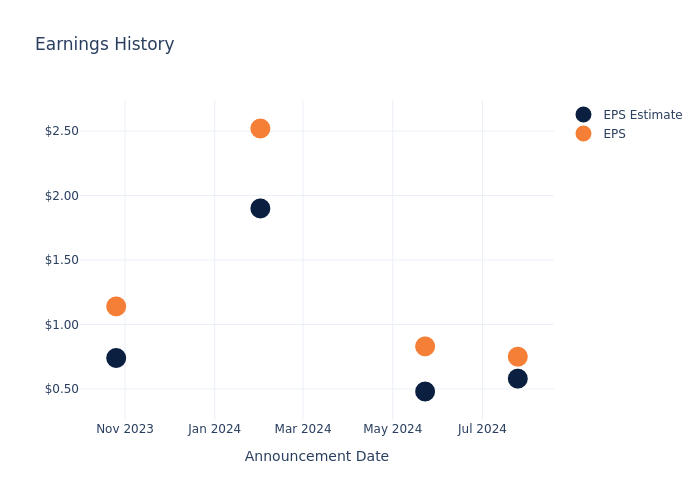

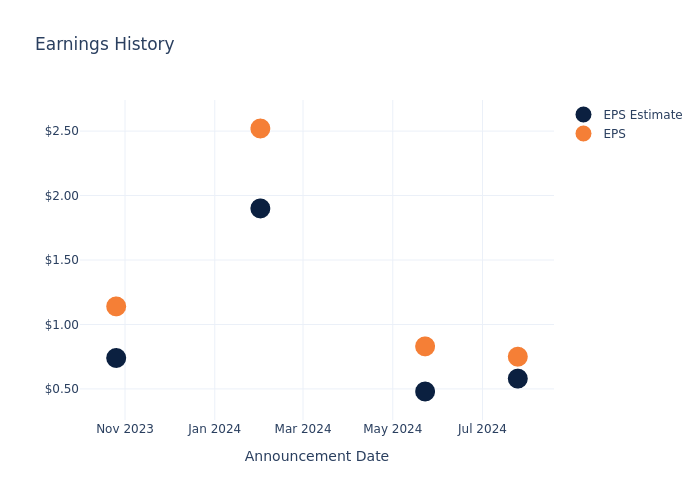

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.17, leading to a 6.32% increase in the share price on the subsequent day.

Here’s a look at Deckers Outdoor’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.58 | 0.48 | 1.90 | 0.74 |

| EPS Actual | 0.75 | 0.83 | 2.52 | 1.14 |

| Price Change % | 6.0% | 14.000000000000002% | 14.000000000000002% | 19.0% |

Stock Performance

Shares of Deckers Outdoor were trading at $154.05 as of October 22. Over the last 52-week period, shares are up 88.09%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Deckers Outdoor

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Deckers Outdoor.

The consensus rating for Deckers Outdoor is Outperform, based on 16 analyst ratings. With an average one-year price target of $692.3, there’s a potential 349.4% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of Skechers USA, Birkenstock Holding and Crocs, three key industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Buy trajectory for Skechers USA, with an average 1-year price target of $78.0, indicating a potential 49.37% downside.

- Analysts currently favor an Outperform trajectory for Birkenstock Holding, with an average 1-year price target of $68.0, suggesting a potential 55.86% downside.

- The consensus among analysts is an Outperform trajectory for Crocs, with an average 1-year price target of $166.86, indicating a potential 8.32% upside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Skechers USA, Birkenstock Holding and Crocs are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Deckers Outdoor | Outperform | 22.13% | $470M | 5.53% |

| Skechers USA | Buy | 7.21% | $1.18B | 3.35% |

| Birkenstock Holding | Outperform | 19.35% | $335.93M | 2.87% |

| Crocs | Outperform | 3.65% | $681.92M | 14.09% |

Key Takeaway:

Deckers Outdoor ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

All You Need to Know About Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Majority of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Majority of its sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. It has structured their reporting around six segments which inlcudes the wholesale operations of specific brands like UGG, HOKA, Teva, Sanuk, and Other brands, alongside a segment focused on direct-to-consumer (DTC) operations.

Deckers Outdoor’s Financial Performance

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Deckers Outdoor displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 22.13%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 14.01%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Deckers Outdoor’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.53%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Deckers Outdoor’s ROA stands out, surpassing industry averages. With an impressive ROA of 3.59%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.13, Deckers Outdoor adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Deckers Outdoor visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply