Boeing Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

The Boeing Company BA will release earnings results for its third quarter, before the opening bell on Wednesday, Oct. 23.

Analysts expect the Arlington, Virginia-based company to report a quarterly loss at $10.52 per share, versus a year-ago loss of $10.48 per share. Boeing projects to report revenue of $6.06 billion for the quarter, compared to $17.82 billion, compared to $16.51 billion a year earlier, according to data from Benzinga Pro.

According to Reuters, Boeing plans to issue around $10 billion in new shares and $5 billion in mandatory convertible bonds, a hybrid bond that converts into equity at a predetermined date. The plane maker also filed regulatory documents indicating it could raise up to $25 billion in stock and debt.

Boeing shares rose slightly to close at $159.88 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

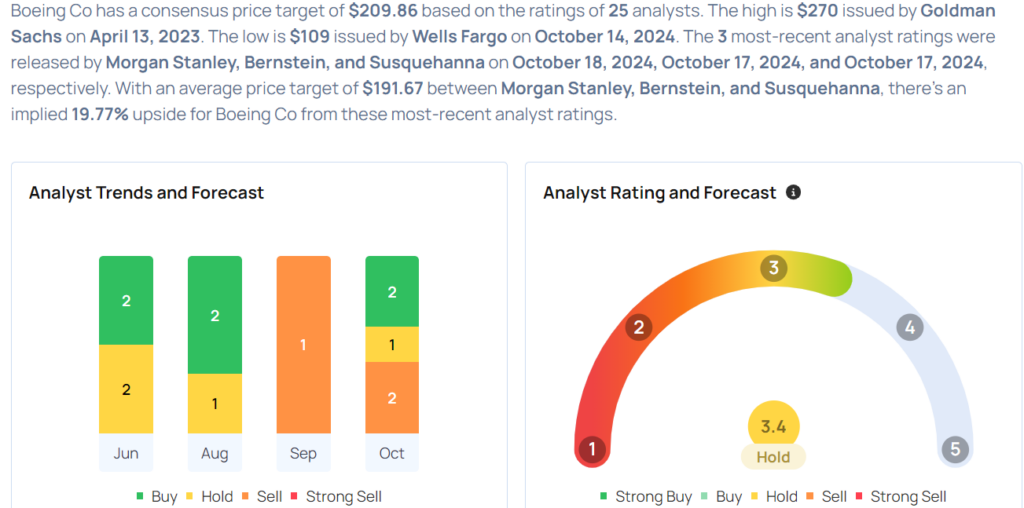

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Kristine Liwag maintained an Equal-Weight rating and cut the price target from $195 to $170 on Oct. 18. This analyst has an accuracy rate of 71%.

- Citigroup analyst Jason Gursky maintained a Buy rating and slashed the price target from $224 to $209 on Oct. 15. This analyst has an accuracy rate of 83%.

- TD Cowen analyst Cai Rumohr maintained a Buy rating and cut the price target from $200 to $190 on Oct. 14. This analyst has an accuracy rate of 77%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and lowered the price target from $235 to $195 on Oct. 14. This analyst has an accuracy rate of 85%.

- Wells Fargo analyst Matthew Akers maintained an Underweight rating and cut the price target from $110 to $109 on Oct. 14. This analyst has an accuracy rate of 78%.

Considering buying BA stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply