Examining the Future: KKR & Co's Earnings Outlook

KKR & Co KKR is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect KKR & Co to report an earnings per share (EPS) of $1.22.

The announcement from KKR & Co is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

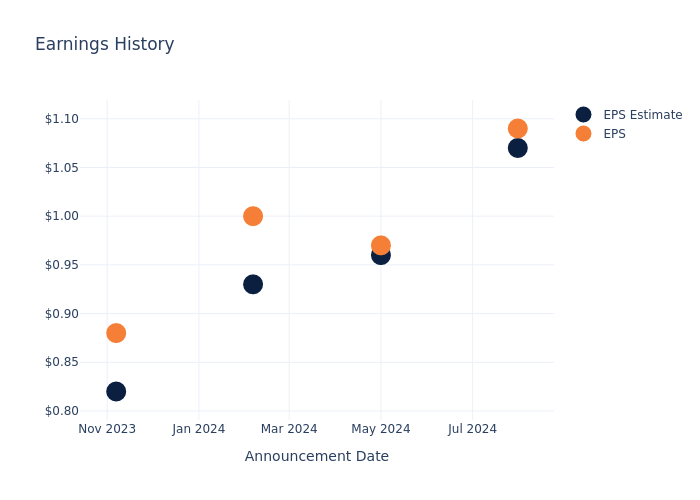

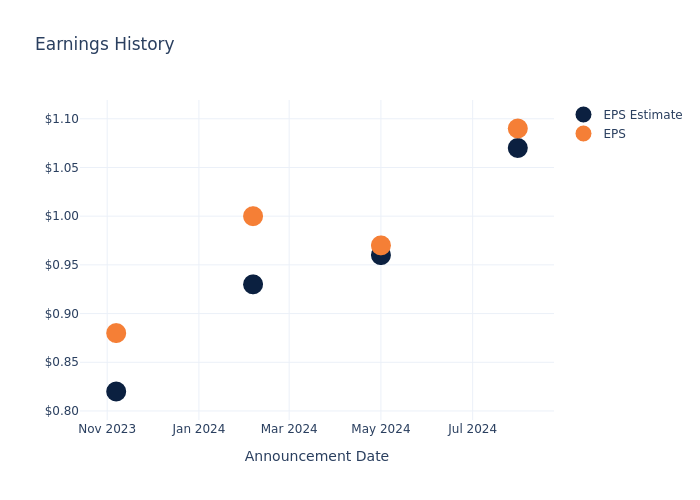

Past Earnings Performance

In the previous earnings release, the company beat EPS by $0.02, leading to a 3.0% drop in the share price the following trading session.

Here’s a look at KKR & Co’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.07 | 0.96 | 0.93 | 0.82 |

| EPS Actual | 1.09 | 0.97 | 1 | 0.88 |

| Price Change % | -3.0% | 2.0% | 1.0% | 0.0% |

KKR & Co Share Price Analysis

Shares of KKR & Co were trading at $140.17 as of October 22. Over the last 52-week period, shares are up 155.55%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on KKR & Co

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on KKR & Co.

KKR & Co has received a total of 18 ratings from analysts, with the consensus rating as Outperform. With an average one-year price target of $143.61, the consensus suggests a potential 2.45% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of BlackRock, Brookfield and Ares Management, three key industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for BlackRock, with an average 1-year price target of $1023.88, indicating a potential 630.46% upside.

- For Brookfield, analysts project an Outperform trajectory, with an average 1-year price target of $50.96, indicating a potential 63.64% downside.

- For Ares Management, analysts project an Neutral trajectory, with an average 1-year price target of $161.31, indicating a potential 15.08% upside.

Peer Metrics Summary

The peer analysis summary provides a snapshot of key metrics for BlackRock, Brookfield and Ares Management, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| KKR | Outperform | 14.54% | $980.89M | 3.10% |

| BlackRock | Outperform | 7.66% | $2.31B | 3.75% |

| Brookfield | Outperform | -2.61% | $3.90B | 0.00% |

| Ares Management | Neutral | -20.67% | $718.06M | 5.04% |

Key Takeaway:

KKR & Co ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity. Overall, KKR & Co is positioned in the top tier compared to its peers in this analysis.

Get to Know KKR & Co Better

KKR is one of the world’s largest alternative asset managers, with $601.3 billion in total managed assets, including $487.3 billion in fee-earning AUM, at the end of June 2024. The company has two core segments: asset management (which includes private markets-private equity, credit, infrastructure, energy, and real estate-and public markets-primarily credit and hedge/investment fund platforms) and insurance (following the firm’s initial investment in, and then ultimate purchase of, Global Atlantic Financial Group, which is engaged in retirement/annuity and life insurance lines as well as reinsurance).

KKR & Co: Delving into Financials

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: KKR & Co’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 14.54%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: The company’s net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 16.26%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): KKR & Co’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 3.1%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.19%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: KKR & Co’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.32, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for KKR & Co visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply