Unleashed Voices Publishing by Twyla Martin Announces New Book and Event: "The Power of a Transformed Woman: Turning My Trauma into Triumph"

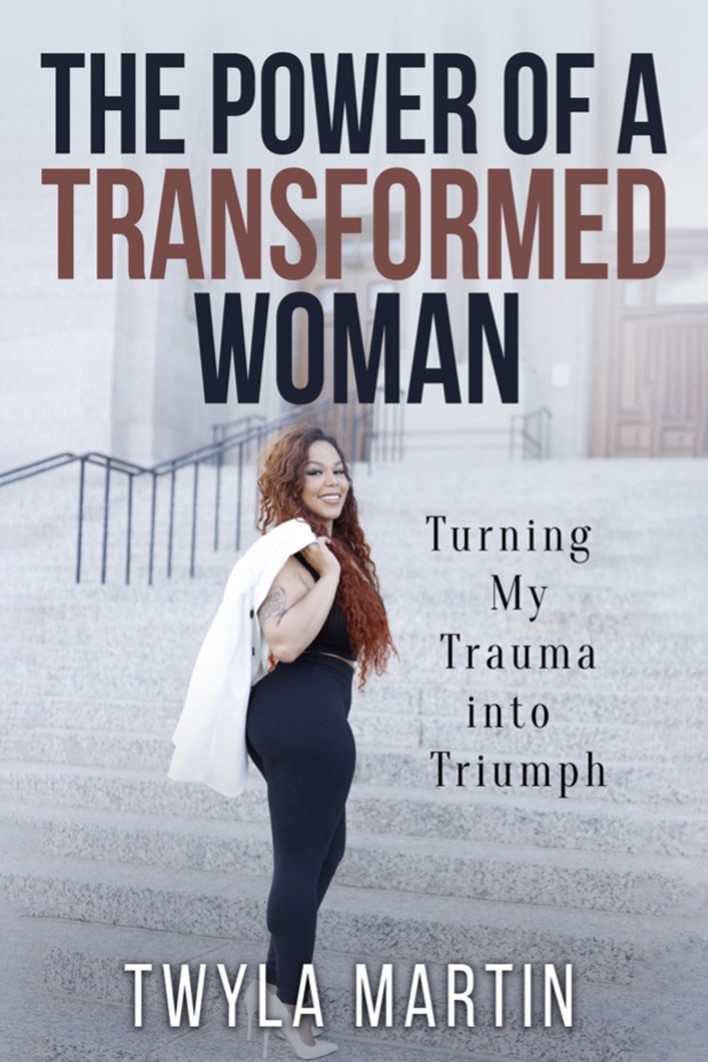

SAINT PAUL, Minn., Oct. 23, 2024 (GLOBE NEWSWIRE) — Author and motivational speaker Twyla Martin, CEO of Unleashed Voices Publishing, is proud to reveal her latest book, “The Power of a Transformed Woman: Turning My Trauma into Triumph”, set to launch on November 1, 2024. The book release will be accompanied by a significant event that includes a panel discussion focused on Black women overcoming trauma and embracing resilience.

Twyla Martin’s new book, ‘The Power of a Transformed Woman: Turning My Trauma into Triumph’

Twyla Martin’s new book shares her inspirational journey from the challenging neighborhoods of Dallas, Texas, to the Twin Cities of Minnesota, where she found her stride. Her path was one of transformative growth, rising from homelessness, addiction, and toxic relationships to becoming a successful CEO. Twyla’s story exemplifies black excellence and the unwavering power of human resilience.

“The Power of a Transformed Woman” is more than a memoir; it’s a beacon of hope for anyone struggling with adversity. Twyla offers a raw and empowering look at how faith and inner strength can drive profound personal change. “This book is about showing that no matter your beginnings, you can rise above it,” says Twyla.

The November 1st book launch event in Minneapolis will feature a panel discussion that highlights the themes of overcoming trauma and celebrating Black women’s strength. Distinguished speakers will engage the audience in a conversation about healing, empowerment, and triumph.

The panel features several reputable figures:

- Nekima Levy Armstrong: renowned for her appearance on Oprah and her activism.

- Ashley Dubose: celebrated for her stint on American Idol and her musical career.

- Lissa Jones: a dynamic thought leader and advocate for African American history and culture.

- Chantel Sings: a renowned vocalist, songwriter, and performer known for her soulful voice and captivating performances.

- Robin Hickman Winfield: an award-winning television producer, filmmaker, and CEO of SoulTouch Productions.

- Jamela Pettiford: noted for her roles as a vocalist and actress with a deep passion for the arts.

- Alana Carrington: a multifaceted creative professional with expertise spanning the arts, education, and community development.

Twyla’s narrative serves as a powerful reminder that transformation is within everyone’s reach. “If I can emerge from the darkness and thrive, anyone can. It’s time to rise up and reclaim your life, and I’m here to show you how,” Twyla declares.

The book launch and panel event are open to all who wish to engage in a meaningful dialogue about resilience, mental health, and empowerment. This is a key opportunity for the community, Black women, and mental health advocates to come together and celebrate triumph over trauma.

For more details on the book and event registration, please visit https://www.powerofatransformedwoman.com.

About Twyla Martin

Twyla Martin is an advocate, CEO, and now an author, dedicated to supporting those who face hardships similar to those she has overcome. Through her speaking engagements and her literature, she stands as a testament to the power of healing and the human spirit’s capacity to overcome.

Media Contact:

Twyla Martin

Unleashed Voices Publishing

Twyla55103@gmail.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d07d0e05-da32-4a9e-95a8-d7a122ef26c5

A video accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8211577c-a257-4691-950d-4a38a6bd4878

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chartwell Announces Issuance of $150 Million of 4.400% Series D Senior Unsecured Debentures

/NOT FOR DISSEMINATION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

MISSISSAUGA, ON, Oct. 21, 2024 /CNW/ – Chartwell Retirement Residences (“Chartwell”) CSH announced today that it has agreed to issue $150 million aggregate principal amount of Series D senior unsecured debentures (the “Debentures”). The Debentures will bear interest at a rate of 4.400% per annum and will mature on November 5, 2029. The Debentures will be unconditionally guaranteed by Chartwell Master Care LP. The Debentures are being offered on an agency basis by a syndicate of agents led by TD Securities Inc., BMO Capital Markets and CIBC Capital Markets as joint bookrunners. The offering is expected to close on October 28, 2024, subject to satisfaction of customary closing conditions. DBRS Limited has assigned a provisional rating of “BBB (low)” with a “Stable” trend to the Debentures. It is a condition to the closing of the offering that DBRS Limited assigns a final rating to the Debentures of “BBB (low)” with a “Stable” trend.

Chartwell intends to use the net proceeds from this offering to repay existing indebtedness, including indebtedness under its secured credit facility and term loan and to partially finance certain previously announced acquisitions of retirement residences expected to close in the fourth quarter of 2024, including indebtedness incurred in connection with such acquisitions.

The offering is being made by way of a private placement to “accredited investors” in each of the provinces of Canada.

The Debentures have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Debentures in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Chartwell

Chartwell is in the business of serving and caring for Canada’s seniors, committed to its vision of Making People’s Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents. Chartwell is an unincorporated, open-ended real estate trust which indirectly owns and operates a complete range of seniors housing communities, from independent living through to assisted living and long term care. Chartwell is one of the largest operators in Canada, serving approximately 25,000 residents in four provinces across the country. For more information, visit www.chartwell.com.

Forward-Looking Information

This press release contains forward-looking information that reflects the current expectations, estimates and projections of management about the future results, performance, achievements, prospects or opportunities for Chartwell and the seniors housing industry. The words “plans”, “expects”, “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “intends”, “anticipates”, “does not anticipate”, “projects”, “believes” or variations of such words and phrases or statements to the effect that certain actions, events or results “may”, “will”, “could”, “would”, “might”, “occur”, “be achieved” or “continue” and similar expressions identify forward-looking statements. Forward-looking information in this document include statements with respect to the credit rating expected to be assigned to the Debentures, the intended use of proceeds from the offering of the Debentures, the completion and expected closing date of the offering and the timing of the closing of certain previously announced acquisitions. Forward-looking statements are based upon a number of assumptions and are subject to a number of known and unknown risks and uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking statements.

While we anticipate that subsequent events and developments may cause our views to change, we do not intend to update this forward-looking information, except as required by applicable securities laws. This forward-looking information represents our views as of the date of this press release and such information should not be relied upon as representing our views as of any date subsequent to the date of this document. We have attempted to identify important factors that could cause actual results, performance or achievements to vary from those current expectations or estimates expressed or implied by the forward-looking information. However, there may be other factors that cause results, performance or achievements not to be as expected or estimated and that could cause actual results, performance or achievements to differ materially from current expectations. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those expected or estimated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. These factors are not intended to represent a complete list of the factors that could affect us. See “Risks and Uncertainties” in our management’s discussion and analysis of results of operations and financial condition for the year ended December 31, 2023 and risk factors highlighted in materials filed with the securities regulatory authorities in Canada from time to time, including but not limited to our most recent Annual Information Form.

FOR FURTHER INFORMATION PLEASE CONTACT:

Chartwell Retirement Residences

Vlad Volodarski

Chief Executive Officer

Tel: (905) 501-4709

Email: investorrelations@chartwell.com

SOURCE Chartwell Retirement Residences (IR)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/21/c2648.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/21/c2648.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Glenn Pushis Offloads $2.39M Worth Of Steel Dynamics Stock

A substantial insider sell was reported on October 21, by Glenn Pushis, Senior Vice President at Steel Dynamics STLD, based on the recent SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Monday outlined that Pushis executed a sale of 17,941 shares of Steel Dynamics with a total value of $2,387,825.

During Tuesday’s morning session, Steel Dynamics shares down by 2.62%, currently priced at $129.95.

Discovering Steel Dynamics: A Closer Look

Steel Dynamics Inc operates scrap-based steel minimills with roughly 16 million tons of annual steel production capacity. The company’s segment includes steel operations, metals recycling operations, steel fabrication operations, Aluminum Operations Segment, and others. It generates maximum revenue from the steel operations segment.

A Deep Dive into Steel Dynamics’s Financials

Revenue Growth: Steel Dynamics’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -6.28%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company faces challenges with a low gross margin of 13.94%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Steel Dynamics’s EPS is below the industry average. The company faced challenges with a current EPS of 2.06. This suggests a potential decline in earnings.

Debt Management: Steel Dynamics’s debt-to-equity ratio surpasses industry norms, standing at 0.41. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 12.0 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.18 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Steel Dynamics’s EV/EBITDA ratio stands at 8.07, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Navigating the World of Insider Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Steel Dynamics’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Fifth Third Bancorp

Summary

Fifth Third Bancorp is a diversified financial services company based in Cincinnati. The company has about 1,100 banking centers and 2,100 ATMs across 11 states. The company has four main business segments: Commercial Banking, Branch Banking, Consumer Lending, and Wealth & Asset Management. In

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level