Alkermes's Earnings: A Preview

Alkermes ALKS is gearing up to announce its quarterly earnings on Thursday, 2024-10-24. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Alkermes will report an earnings per share (EPS) of $0.74.

Anticipation surrounds Alkermes’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

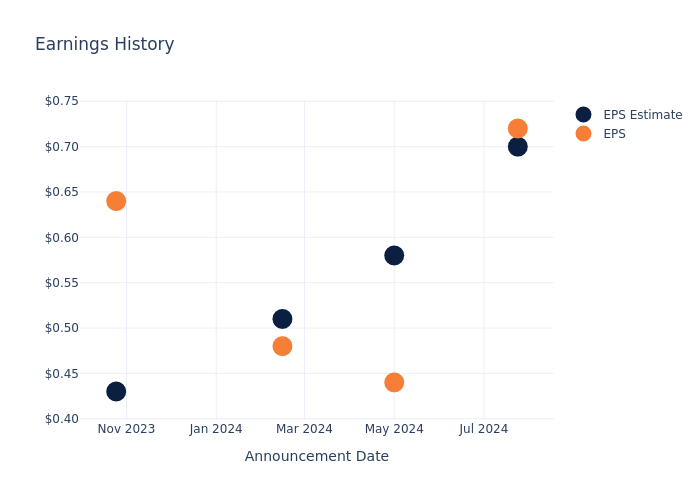

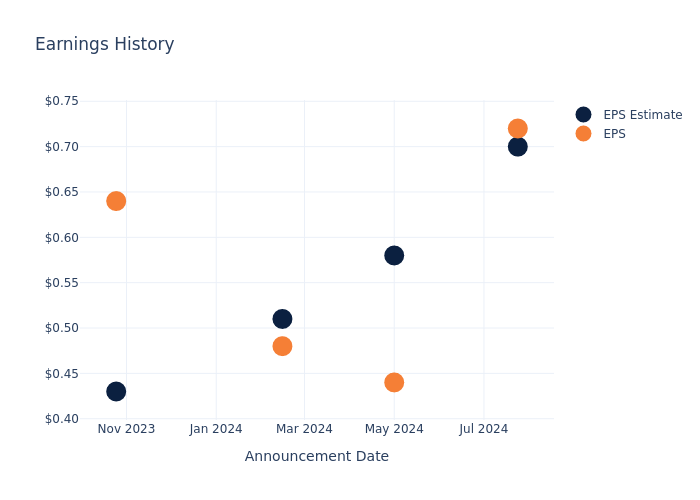

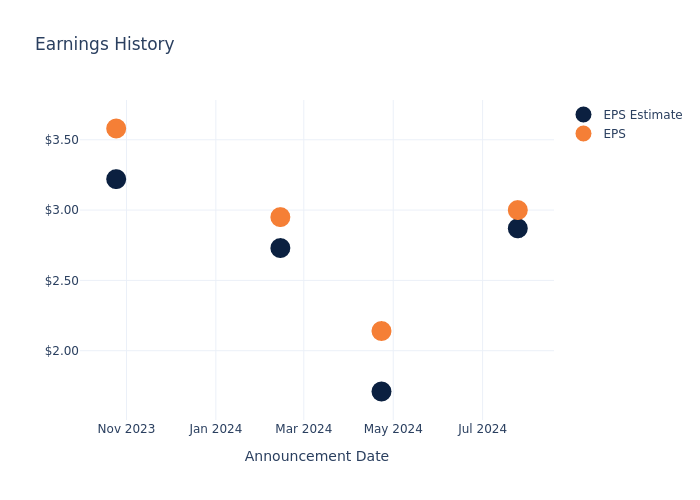

Overview of Past Earnings

The company’s EPS beat by $0.02 in the last quarter, leading to a 5.77% increase in the share price on the following day.

Here’s a look at Alkermes’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.70 | 0.58 | 0.51 | 0.43 |

| EPS Actual | 0.72 | 0.44 | 0.48 | 0.64 |

| Price Change % | 6.0% | -1.0% | -1.0% | 5.0% |

Performance of Alkermes Shares

Shares of Alkermes were trading at $28.1 as of October 22. Over the last 52-week period, shares are up 22.14%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Alkermes

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Alkermes.

Analysts have provided Alkermes with 7 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $41.14, suggesting a potential 46.41% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Ultragenyx Pharmaceutical, TG Therapeutics and Blueprint Medicines, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for Ultragenyx Pharmaceutical, with an average 1-year price target of $91.64, indicating a potential 226.12% upside.

- The prevailing sentiment among analysts is an Buy trajectory for TG Therapeutics, with an average 1-year price target of $38.0, implying a potential 35.23% upside.

- Analysts currently favor an Buy trajectory for Blueprint Medicines, with an average 1-year price target of $126.6, suggesting a potential 350.53% upside.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for Ultragenyx Pharmaceutical, TG Therapeutics and Blueprint Medicines are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Alkermes | Outperform | -35.35% | $337.66M | 7.20% |

| Ultragenyx Pharmaceutical | Outperform | 35.75% | $125.75M | -45.96% |

| TG Therapeutics | Buy | 357.05% | $65.16M | 4.07% |

| Blueprint Medicines | Buy | 139.98% | $130.56M | -15.85% |

Key Takeaway:

Alkermes ranks at the bottom for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity.

About Alkermes

Alkermes PLC is a fully integrated biotechnology company that applies its proprietary technologies to research, develop, and commercialize pharmaceutical products designed for unmet medical needs in therapeutic areas. The company utilizes several to develop and commercialize products and, in so doing, access technological, financial, marketing, manufacturing, and other resources. Alkermes either purchases active drug products from third parties or receives them from its third-party licensees to formulate products using its technologies. It operates in U.S., which derives maximum revenue, Ireland and Rest of the world.

Breaking Down Alkermes’s Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Alkermes’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -35.35% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Alkermes’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 22.89% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.2%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Alkermes’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.22%, the company showcases efficient use of assets and strong financial health.

Debt Management: Alkermes’s debt-to-equity ratio is below the industry average at 0.29, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Alkermes visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dean Graziosi and Mastermind.com Introduce the Upgraded Mastermind Business System: a Complete Solution for Business Owners to Scale with Information Products

Scottsdale, AZ October 23, 2024 –(PR.com)– Dean Graziosi, renowned entrepreneur and Co-Founder of Mastermind.com, has launched the newly upgraded Mastermind Business System, an all-in-one platform designed to help business owners transform their knowledge into profitable digital products. This innovative system combines expert education, personalized support, and easy-to-use tools, making it a comprehensive solution for scaling digital ventures.

Dean Graziosi, a multiple New York Times best-selling author, created the Mastermind Business System to offer a streamlined approach for business owners of all backgrounds—whether they are seasoned entrepreneurs or new to digital products. With this enhanced version, business owners can access proven tools, strategies, and real-time support that pave the way for sustainable success.

For more details about the Mastermind Business System, visit joinmbs.com.

“With the rapid changes in today’s business landscape, the potential to turn knowledge into income has never been greater,” Graziosi said. “The revamped Mastermind Business System delivers everything business owners need to create, launch, and scale digital products, moving from their first sale to consistent growth.”

The Mastermind Business System provides a clear, step-by-step roadmap, helping users achieve results faster and more efficiently. It’s a holistic approach designed to drive real outcomes, ensuring business owners can easily adapt and excel in the evolving digital economy.

Key features of the Mastermind Business System include:

Personalized Roadmap: Users start with a pre-course assessment that identifies strengths, learning preferences, and goals, resulting in a tailored learning path.

Mastermind Business System Course: Comprehensive training modules that guide users from initial sales to consistent growth.

Hotseat With GG, Your 24/7 AI Business Guide: On-demand coaching that provides actionable insights, offering the feel of having Dean as a personal mentor.

All-In-One Business Hub: A fully integrated suite of tools that streamlines the entire sales and marketing process, eliminating the need for multiple software platforms.

Pre-Loaded Industry Templates: Ready-made templates designed for specific industries to help users get started quickly.

Live Mentoring with Dean Graziosi: Monthly sessions focused on driving momentum, marketing strategies, and business breakthroughs.

24/7 Live Support: Real-time assistance to ensure users never feel stuck.

Bonus VIP Ticket to the Business Breakthrough Workshop: A 3-day, immersive event on December 12-14, 2024, dedicated to scaling businesses through hands-on learning.

Unlike traditional programs that overwhelm users with scattered content, the Mastermind Business System offers a streamlined, results-oriented approach. It combines hands-on learning, continuous support, and practical tools, making it easier for business owners to achieve consistent growth and long-term success.

“Whether you’re taking your first step into the knowledge economy or looking to scale your existing digital product, the Mastermind Business System is designed to empower you at every stage,” Graziosi added.

Thousands of business owners have already experienced success with the Mastermind Business System, creating new revenue streams, maximizing impact, and gaining more freedom in their businesses. It’s more than just a system—it’s a pathway to redefining what’s possible in today’s digital landscape.

For more information or to explore the Mastermind Business System, visit joinmbs.com.

About Dean Graziosi

Dean Graziosi is a multiple New York Times best-selling author, seasoned business coach, and serial entrepreneur. With over 30 years of experience in transforming businesses and lives, Dean has helped thousands of entrepreneurs achieve breakthrough results. As Co-Founder of Mastermind.com, he continues to revolutionize the knowledge industry by delivering innovative tools and strategies for business growth.

Contact Information:

Mastermind.com

Tanner Sheldon

757-645-5957

Contact via Email

Read the full story here: https://www.pr.com/press-release/923730

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why AT&T Stock Is Jumping Today

AT&T (NYSE: T) stock is climbing in Wednesday’s trading session following the telecom giant’s third-quarter report. The share price was up by about 4% as of 1:45 p.m. ET.

AT&T reported its Q3 results before the market opened Wednesday morning, posting non-GAAP (adjusted) earnings of $0.60 per share, which beat the average estimate of Wall Street analysts for $0.57 per share. But its sales of $30.2 billion fell short of expectations for sales of $30.45 billion. However, margins were strong, and the company gave encouraging guidance along some key lines.

In the quarter, the company added 403,000 postpaid phone subscriptions, and mobility services sales climbed 4% compared to the prior-year period. Meanwhile, it added 226,000 new AT&T Fiber subscriptions, making Q3 the 19th straight quarter with net additions above 200,000. Total consumer broadband sales were up 6.4% year over year.

Despite strong performances from its wireless and broadband segments, continued declines in the business wireline segment continued to weigh on the top line. Total sales in the period were down 0.5% from the $30.4 billion posted in the prior-year period, and adjusted earnings per share declined roughly 6%.

Even with annual declines in sales and earnings in Q3, AT&T’s core growth drivers served up encouraging results — and profitability came in better than anticipated. Strategy execution appears to be on track.

Management also reiterated its full-year guidance. The company continues to expect annual wireless services and broadband revenue to grow by roughly 3% and more than 7%, respectively. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are projected to increase by 3%. Management also said that the company is on track to reach its goal of hitting a net-debt-to-adjusted-EBITDA ratio of 2.5 in the first half of next year.

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $879,935!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Philip Morris' Q3 Driven By Smoke-Free Products Amid Rising Market Share In Key Regions: Analyst Forecasts Growth Across IQOS And ZYN Brands

Stifel analyst Matthew E. Smith reiterated a Buy rating on Philip Morris International Inc PM, raising the price forecast to $145 from $138.

Yesterday, the Marlboro maker reported third-quarter revenue of $9.91 billion, up 8.4% year over year, beating the consensus of $9.69 billion.

Smith writes that growth in smoke-free products is driving both organic revenue growth and margin expansion.

Net revenues increased by 11.6% on an organic basis, mainly reflecting a favorable pricing variance, primarily due to higher combustible tobacco pricing, and a favorable volume/mix, mainly driven by higher smoke-free product volume.

Per Smith, there is a strong argument for owning the stock, thanks to the impressive and accelerating growth of IQOS and ZYN brands, which supports robust long-term business expansion.

The analyst highlighted that market share is growing steadily in important regions like Japan and Europe, with Europe’s share hitting 9.5% this quarter.

Most of the flavor bans in Europe are now in place, and Smith adds that the rebound in in-market sales (IMS) and market share shows promising growth potential for IQOS in the region.

Philip Morris has raised the low end of its U.S. ZYN volume outlook for 2024, now expecting 570 to 580 million cans, which is an increase of 10 million at the low end. The analyst estimates a total of 579 million cans, reflecting over 50% growth.

For 2025, the analyst estimates 9.5% EPS growth, driven by 8% organic revenue growth and margin expansion from smoke-free products.

This includes a 10% increase in organic operating profit, supported by volume growth and over 7 percentage points from price/mix contributions.

Price Action: PM shares are trading lower by 0.36% to $130.94 at last check Wednesday.

Photo by nawamin on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Nasdaq leads stocks lower as Wall Street braces for Tesla earnings

Sales of existing homes fell in September as house hunters remained on the fence about buying a home despite mortgage rates easing during the month.

Existing home sales slipped 1.0% from August’s tally to a seasonally adjusted annual rate of 3.84 million, the National Association of Realtors said Wednesday. That marked the lowest rate since October 2010. Economists polled by Bloomberg expected a pace of 3.88 million in September.

On a yearly basis, sales of previously owned homes were 3.5% lower in September. The median home price rose 3.0% from last September to $404,500, marking the 15th consecutive month of annual price increases.

“Home sales have been essentially stuck at around a 4 million-unit pace for the past 12 months,” NAR chief economist Lawrence Yun said in a press release.

There have been significant challenges that have weighed on sales activity, including a lack of inventory, escalating prices, and elevated mortgage rates. Last month, however, those factors turned around.

The Federal Reserve cut its benchmark rate by half a percentage point in September. While the central bank doesn’t set mortgage rates, its actions influence their direction of movement.

Mortgage rates hit the lowest level since February 2023 ahead of the Fed decision to ease, while listing inventory picked up.

But overall, that hasn’t been enough to entice buyers.

“Some consumers are hesitating about moving forward with a major expenditure like purchasing a home before the upcoming election,” Yun said.

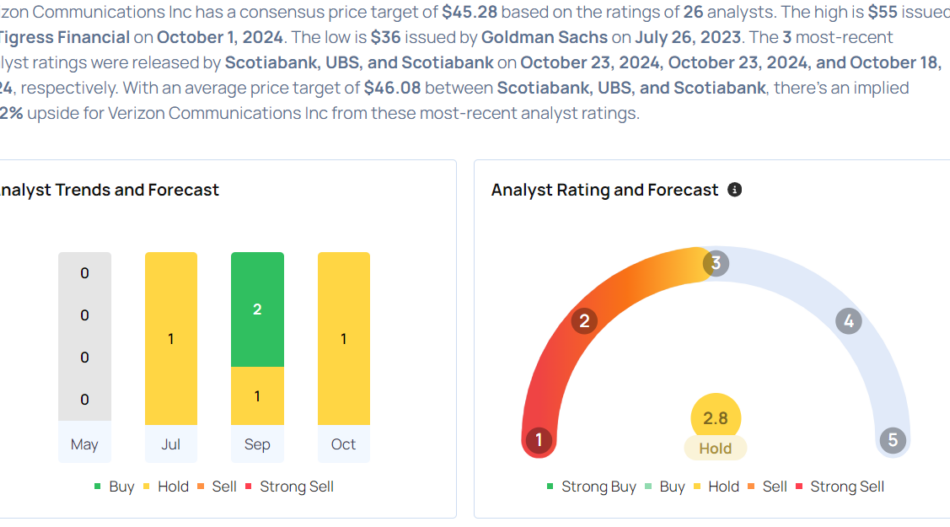

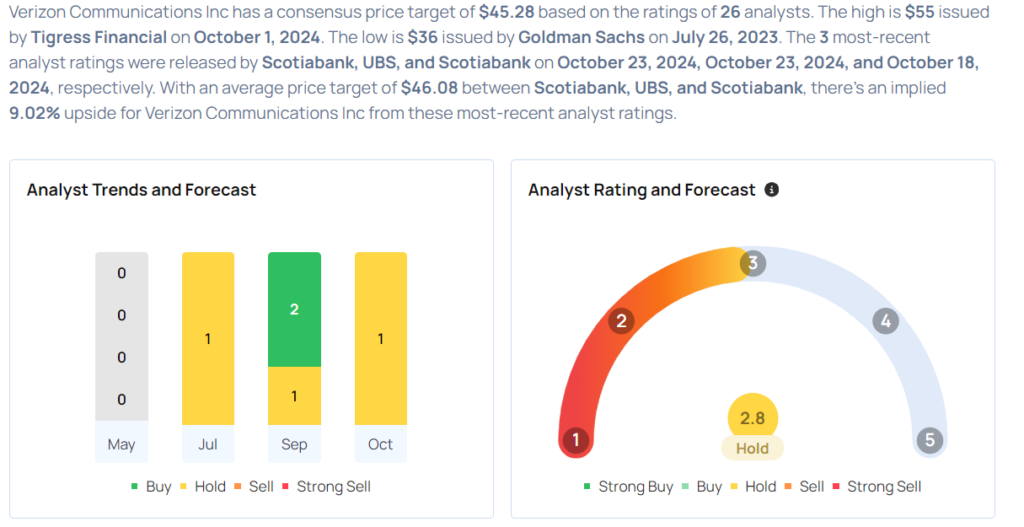

These Analysts Revise Their Forecasts On Verizon After Q3 Results

Verizon Communications Inc VZ reported mixed fiscal third-quarter results on Tuesday.

Its sales growth was flat year over year, reaching $33.33 billion, marginally missing the analyst consensus estimate of $33.43 billion. Service and other revenue growth was offset by declines in wireless equipment revenue. Adjusted EPS of $1.19 beat the analyst consensus estimate of $1.18.

Postpaid phone net additions were 239,000. Verizon’s retail postpaid net additions were 349,000. The quarter saw 389,000 total broadband net additions. The company ended the quarter with 11.9 million broadband subscribers, up 16.0% year over year.

For FY24, Verizon reiterated a 2.0%–3.5% wireless service revenue growth. It maintained an adjusted EPS of $4.50 – $4.70 versus consensus of $4.57.

Verizon shares gained 1.9% to trade at $42.31 on Wednesday.

These analysts made changes to their price targets on Verizon following earnings announcement.

- UBS analyst John Hodulik maintained Verizon with a Neutral and raised the price target from $43 to $44.

- Scotiabank analyst Maher Yaghi maintained Verizon Communications with a Sector Perform and lowered the price target from $47.25 to $47.

Considering buying VZ stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BSI Financial Launches Portfolio Guardian, an AI-driven Prepayment Predictor Model to Identify Borrowers Likely to Refinance

BSI to make the tool available to its subservicing clients

IRVING, Texas, Oct. 23, 2024 /PRNewswire/ — BSI Financial Services, a leading mortgage fintech platform, has launched Portfolio GuardianSM, an AI-driven predictor model that calculates the likelihood a borrower will refinance their mortgage within the next 90 days. Portfolio Guardian generates a precise prepayment score for each borrower in BSI’s portfolio, allowing BSI and its clients to strategically target refinancing opportunities and enhance customer retention.

Portfolio Guardian leverages a sophisticated combination of data sources to generate its predictive scores, including zero-party data directly provided by borrowers, real-time industry data like current mortgage rates, and demographic information such as education completed and length of homeownership.

BSI has also implemented model monitoring and state-of-the-art training pipelines for Portfolio Guardian to ensure its ongoing accuracy and adaptability. These systems continuously evaluate model performance against real-world outcomes and allow the model to adapt to changing market conditions, evolving borrower behaviors, and new data patterns.

With 30-year fixed mortgage rates projected to dip below 6% by the end of 2025 according to the Mortgage Bankers Association, tools like Portfolio Guardian will become crucial for lenders and servicers. BSI’s predictive technology enables its subservicing clients to proactively manage and capitalize on borrower behaviors during periods of fluctuating rates and enhance their competitive edge in a dynamic market. It also allows BSI and its clients to focus marketing efforts on borrowers who are more likely to pay off their loans and work to build long-term relationships with them.

“Portfolio Guardian is a valuable tool for boosting customer satisfaction and reducing portfolio churn,” said BSI Founder and CEO Gagan Sharma. “From a retention and recapture perspective, anticipating what our customers are likely to do in the future is a real game-changer.”

Having developed and refined Portfolio Guardian on its own portfolio, BSI is now offering this model to its subservicing clients.

About BSI Financial Services

BSI Financial Services is leading the evolution of mortgage servicing for originators, investors, and homeowners using a mortgage fintech platform. The company brings together a talented team with long mortgage industry expertise, scalable digital capabilities, and deep regulatory understanding. BSI Financial is one of the fastest-growing mortgage servicers across the industry and currently services nearly $50 billion in mortgages. The company is approved as a servicer by Fannie Mae, Freddie Mac, FHA, VA, and USDA, approved as an issuer by Ginnie Mae, and rated by S&P, Fitch and DBRS as a servicer. For more information, visit www.bsifinancial.com

Media Contact:

Mike Murray

Strategic Vantage Marketing & Public Relations

240.498.0863

MikeMurray@StrategicVantage.com

![]() View original content:https://www.prnewswire.com/news-releases/bsi-financial-launches-portfolio-guardian-an-ai-driven-prepayment-predictor-model-to-identify-borrowers-likely-to-refinance-302283940.html

View original content:https://www.prnewswire.com/news-releases/bsi-financial-launches-portfolio-guardian-an-ai-driven-prepayment-predictor-model-to-identify-borrowers-likely-to-refinance-302283940.html

SOURCE BSI Financial Services

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Exercise: Eric Venker At Roivant Sciences Realizes $782K

A large exercise of company stock options by Eric Venker, President & COO at Roivant Sciences ROIV was disclosed in a new SEC filing on October 23, as part of an insider exercise.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Venker, President & COO at Roivant Sciences, a company in the Health Care sector, just exercised stock options worth 100,000 shares of ROIV stock with an exercise price of $3.85.

The Wednesday morning market activity shows Roivant Sciences shares down by 0.51%, trading at $11.67. This implies a total value of $782,000 for Venker’s 100,000 shares.

Discovering Roivant Sciences: A Closer Look

Roivant Sciences Ltd is a commercial-stage biopharmaceutical company dedicated to improving the delivery of healthcare to patients. It also incubates discovery-stage companies and health technology startups complementary to its biopharmaceutical business. Its drug candidate VTAMA (tapinarof) is a treatment of plaque psoriasis in adult patients and is in its commercial stage. The other drug candidates in their different stages of development are; Batoclimab, IMVT-1402, Brepocitinib, Namilumab, and others.

Understanding the Numbers: Roivant Sciences’s Finances

Revenue Growth: Roivant Sciences displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 154.96%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 92.78%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Roivant Sciences exhibits below-average bottom-line performance with a current EPS of 0.13.

Debt Management: Roivant Sciences’s debt-to-equity ratio is below the industry average. With a ratio of 0.07, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 2.05, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 61.99 is above industry norms, reflecting an elevated valuation for Roivant Sciences’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 0.72 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

The Insider’s Guide to Important Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Roivant Sciences’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

At Roivant Sciences, Eric Venker Chooses To Exercise Options, Resulting In $782K

A substantial insider activity was disclosed on October 23, as Venker, President & COO at Roivant Sciences ROIV, reported the exercise of a large sell of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Venker, President & COO at Roivant Sciences, a company in the Health Care sector, just exercised stock options worth 100,000 shares of ROIV stock with an exercise price of $3.85.

Roivant Sciences shares are trading, exhibiting down of 0.51% and priced at $11.67 during Wednesday’s morning. This values Venker’s 100,000 shares at $782,000.

Discovering Roivant Sciences: A Closer Look

Roivant Sciences Ltd is a commercial-stage biopharmaceutical company dedicated to improving the delivery of healthcare to patients. It also incubates discovery-stage companies and health technology startups complementary to its biopharmaceutical business. Its drug candidate VTAMA (tapinarof) is a treatment of plaque psoriasis in adult patients and is in its commercial stage. The other drug candidates in their different stages of development are; Batoclimab, IMVT-1402, Brepocitinib, Namilumab, and others.

A Deep Dive into Roivant Sciences’s Financials

Revenue Growth: Roivant Sciences displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 154.96%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 92.78%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Roivant Sciences’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.13.

Debt Management: With a below-average debt-to-equity ratio of 0.07, Roivant Sciences adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Roivant Sciences’s P/E ratio of 2.05 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 61.99 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 0.72, Roivant Sciences presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Deep Dive into Insider Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Roivant Sciences’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ryder System's Earnings Outlook

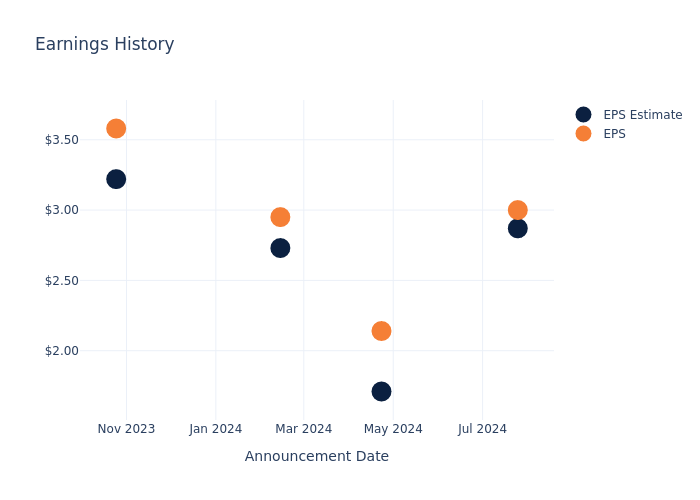

Ryder System R is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ryder System to report an earnings per share (EPS) of $3.42.

Ryder System bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.13, leading to a 0.13% increase in the share price on the subsequent day.

Here’s a look at Ryder System’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.87 | 1.71 | 2.73 | 3.22 |

| EPS Actual | 3 | 2.14 | 2.95 | 3.58 |

| Price Change % | 0.0% | 0.0% | -2.0% | -1.0% |

Market Performance of Ryder System’s Stock

Shares of Ryder System were trading at $145.73 as of October 22. Over the last 52-week period, shares are up 55.78%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Ryder System

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ryder System.

A total of 1 analyst ratings have been received for Ryder System, with the consensus rating being Outperform. The average one-year price target stands at $155.0, suggesting a potential 6.36% upside.

Comparing Ratings with Competitors

In this comparison, we explore the analyst ratings and average 1-year price targets of Landstar System, Schneider National and RXO, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Landstar System received a Neutral consensus from analysts, with an average 1-year price target of $172.43, implying a potential 18.32% upside.

- Schneider National is maintaining an Neutral status according to analysts, with an average 1-year price target of $27.78, indicating a potential 80.94% downside.

- RXO is maintaining an Neutral status according to analysts, with an average 1-year price target of $27.3, indicating a potential 81.27% downside.

Analysis Summary for Peers

The peer analysis summary provides a snapshot of key metrics for Landstar System, Schneider National and RXO, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ryder System | Outperform | 8.91% | $648M | 4.13% |

| Landstar System | Neutral | -10.83% | $160.64M | 5.21% |

| Schneider National | Neutral | -2.21% | $110.70M | 1.20% |

| RXO | Neutral | -3.43% | $163M | -1.21% |

Key Takeaway:

Ryder System ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity compared to its peers.

Unveiling the Story Behind Ryder System

Ryder System Inc operates in three business segments: (1) Fleet Management Solutions which provides full-service leasing and leasing with flexible maintenance options, commercial rental and maintenance services of trucks, tractors and trailers to customers; (2) Supply Chain Solutions (SCS), which provides integrated logistics solutions, including distribution management, dedicated transportation, transportation management, brokerage, e-commerce, last mile, and professional services; and (3) Dedicated Transportation Solutions (DTS), which provides turnkey transportation solutions in the U.S., including dedicated vehicles, professional drivers, management, and administrative support.

Ryder System: A Financial Overview

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Ryder System’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 8.91%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Ryder System’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.97%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ryder System’s ROE stands out, surpassing industry averages. With an impressive ROE of 4.13%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Ryder System’s ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.77%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Ryder System’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.83, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Ryder System visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.