Gold Moves Lower; AT&T Earnings Top Views

U.S. stocks traded lower midway through trading, with the Nasdaq Composite falling more than 1% on Wednesday.

The Dow traded down 0.90% to 42,540.14 while the NASDAQ fell 1.38% to 18,317.40. The S&P 500 also fell, dropping, 0.83% to 5,802.43.

Check This Out: How To Earn $500 A Month From IBM Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Real estate shares rose by 0.4% on Wednesday.

In trading on Wednesday, consumer discretionary shares fell by 0.9%.

Top Headline

AT&T Inc T reported better-than-expected earnings for the third quarter.

The company posted operating revenues of $30.21 billion, down 0.5% year over year. It marginally missed the analyst consensus estimate of $30.44 billion. Adjusted EPS of $0.60 beat the estimate of $0.57. The stock gained after the print.

Equities Trading UP

- La Rosa Holdings Corp. LRHC shares shot up 165% to $1.2950 after the company reported preliminary 9-moth revenue growth of 120% year over year.

- Shares of CNS Pharmaceuticals, Inc. CNSP got a boost, surging 91% to $0.2996. The company requested a panel hearing for November 5, 2024, and will be subject to a halt in the suspension or delisting decision until then.

- Virax Biolabs Group Limited VRAX shares were also up, gaining 60% to $2.6759 after the company announced a distribution agreement with Europa Biosite to commercialize the ImmuneSelect research-use portfolio in the United Kingdom and Ireland.

Equities Trading DOWN

- Alto Neuroscience, Inc. ANRO shares dropped 66% to $4.9550 after the company announced topline results from a Phase 2b trial evaluating ALTO-100 as a treatment for major depressed disorder did not meet its primary endpoint.

- Shares of Constellium SE CSTM were down 23% to $11.51 after the company reported third-quarter EPS and sales that missed estimates, citing macroeconomic and geopolitical uncertainties, and expressed caution heading into 2025.

- Enphase Energy, Inc. ENPH was down, falling 14% to $79.56 after the company reported worse-than-expected third-quarter financial results.

Commodities

In commodity news, oil traded down 0.6% to $71.32 while gold traded down 0.8% at $2,737.90.

Silver traded down 3.5% to $33.800 on Wednesday, while copper fell 0.7% to $4.3490.

Euro zone

European shares were mostly lower today. The eurozone’s STOXX 600 fell 0.17%, Germany’s DAX fell 0.08% and France’s CAC 40 fell 0.25%. Spain’s IBEX 35 Index rose 0.25%, while London’s FTSE 100 fell 0.47%.

Consumer confidence in the Eurozone rose by 0.4 points to a reading of -12.5 in October.

Asia Pacific Markets

Asian markets closed mixed on Wednesday, with Japan’s Nikkei 225 falling 0.80%, Hong Kong’s Hang Seng Index gaining 1.27%, China’s Shanghai Composite Index gaining 0.52% and India’s BSE Sensex falling 0.17%.

Singapore’s annual inflation rate eased to 2.0% in September versus 2.2% in the previous month.

Economics

- U.S. mortgage applications declined by 6.7% from the previous week during the third week of October, following a 17% dip in the earlier period.

- U.S. existing home sales declined 1% from the previous month to an annualized rate of 3.84 million in September.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

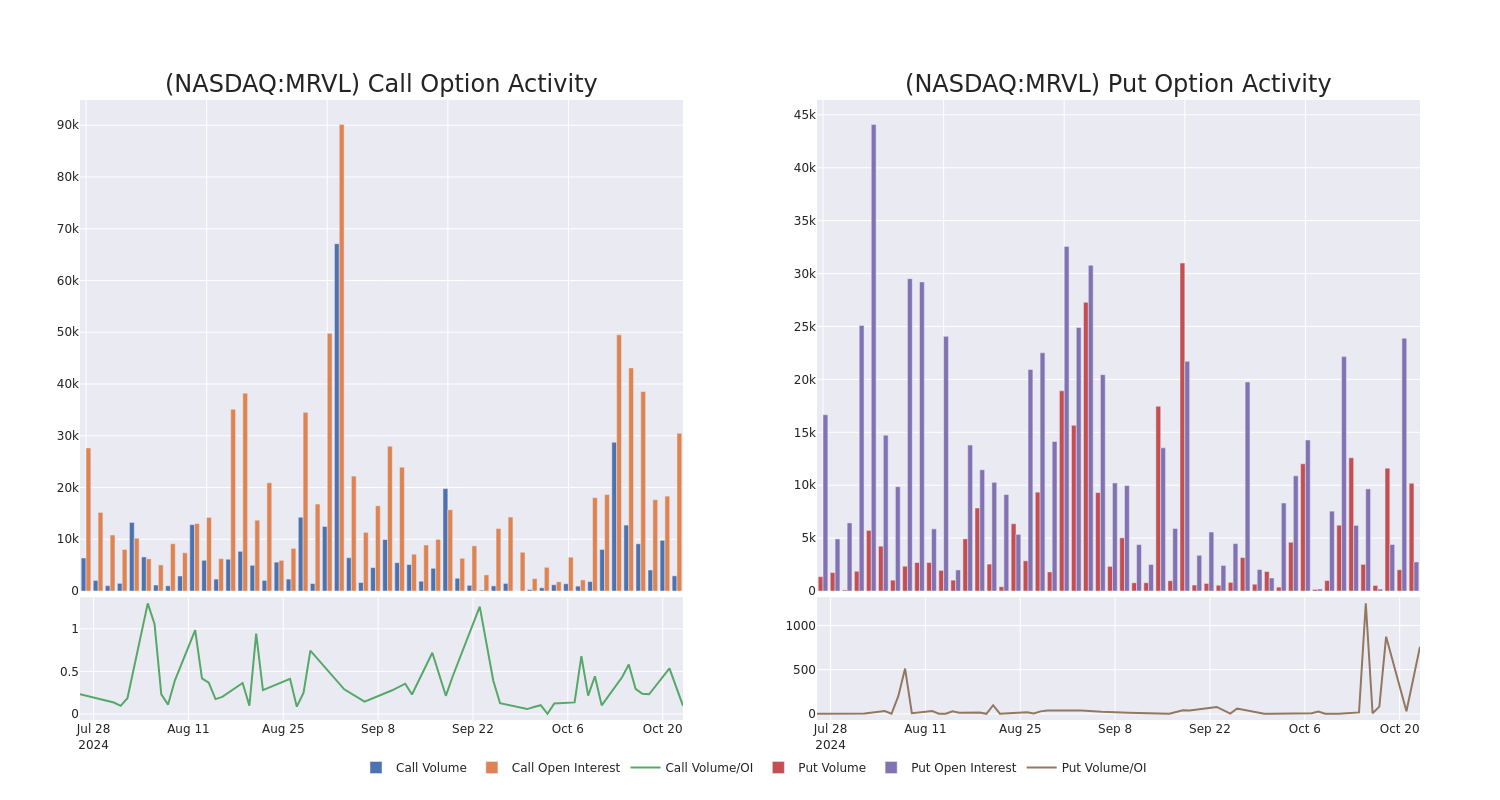

Smart Money Is Betting Big In MRVL Options

Deep-pocketed investors have adopted a bearish approach towards Marvell Tech MRVL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRVL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 23 extraordinary options activities for Marvell Tech. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 60% bearish. Among these notable options, 10 are puts, totaling $1,041,041, and 13 are calls, amounting to $792,116.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $100.0 for Marvell Tech during the past quarter.

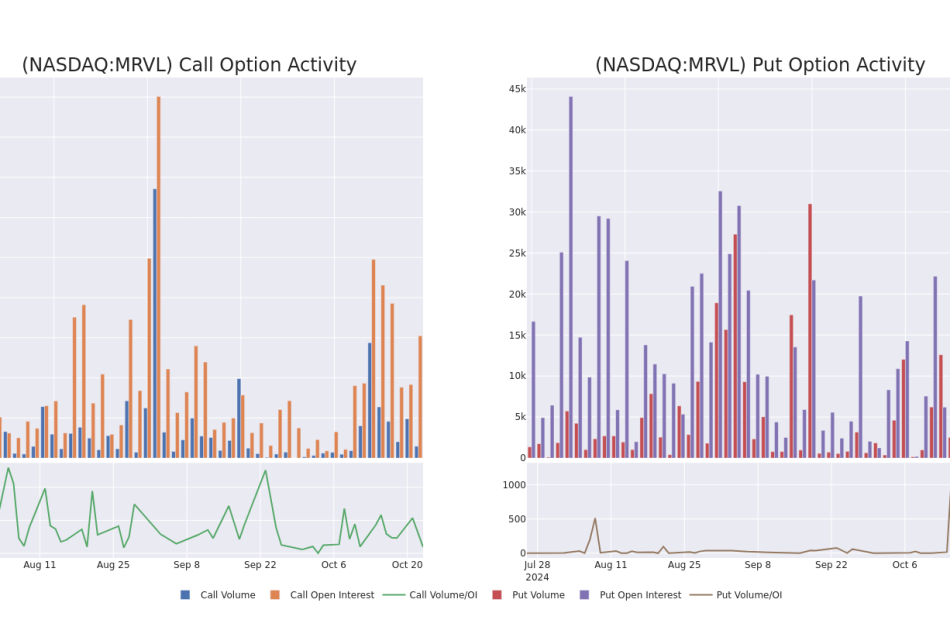

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Marvell Tech options trades today is 1661.25 with a total volume of 13,124.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Marvell Tech’s big money trades within a strike price range of $40.0 to $100.0 over the last 30 days.

Marvell Tech Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | PUT | SWEEP | BEARISH | 11/29/24 | $0.75 | $0.53 | $0.68 | $68.00 | $561.0K | 11 | 8.3K |

| MRVL | PUT | TRADE | BEARISH | 02/21/25 | $9.5 | $9.4 | $9.5 | $85.00 | $131.1K | 256 | 237 |

| MRVL | CALL | SWEEP | BULLISH | 03/21/25 | $16.3 | $16.15 | $16.3 | $72.50 | $125.5K | 698 | 93 |

| MRVL | PUT | TRADE | BEARISH | 02/21/25 | $9.75 | $9.7 | $9.75 | $85.00 | $96.5K | 256 | 0 |

| MRVL | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.7 | $6.7 | $85.00 | $93.8K | 4.1K | 233 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Following our analysis of the options activities associated with Marvell Tech, we pivot to a closer look at the company’s own performance.

Present Market Standing of Marvell Tech

- Trading volume stands at 4,689,325, with MRVL’s price down by -4.12%, positioned at $79.92.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 37 days.

What Analysts Are Saying About Marvell Tech

1 market experts have recently issued ratings for this stock, with a consensus target price of $91.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup persists with their Buy rating on Marvell Tech, maintaining a target price of $91.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Marvell Tech options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

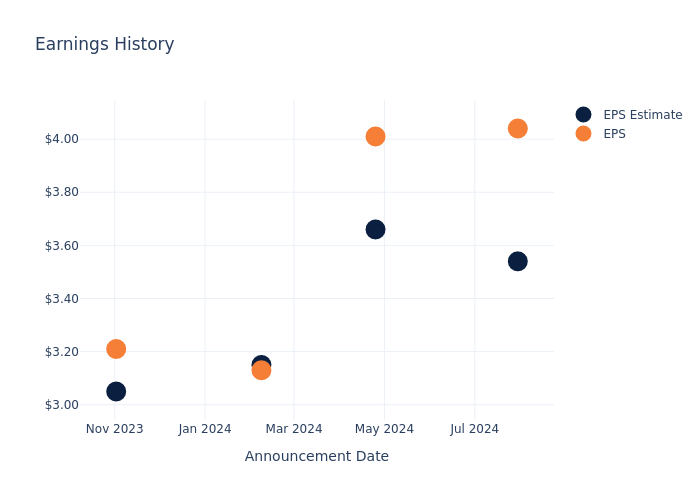

Earnings Preview: S&P Global

S&P Global SPGI is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect S&P Global to report an earnings per share (EPS) of $3.64.

The announcement from S&P Global is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

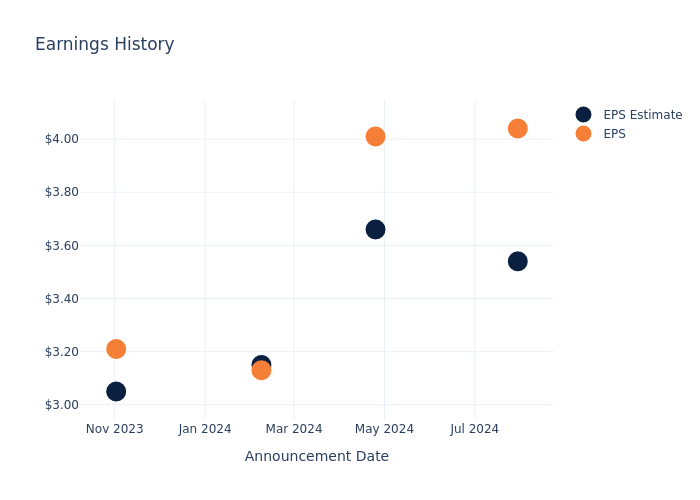

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.50, leading to a 0.77% drop in the share price the following trading session.

Here’s a look at S&P Global’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 3.54 | 3.66 | 3.15 | 3.05 |

| EPS Actual | 4.04 | 4.01 | 3.13 | 3.21 |

| Price Change % | -1.0% | 0.0% | 0.0% | 2.0% |

Market Performance of S&P Global’s Stock

Shares of S&P Global were trading at $513.52 as of October 22. Over the last 52-week period, shares are up 46.84%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for S&P Global visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's the Only Stock Billionaires Warren Buffett and David Tepper Both Own

Do billionaires of a feather flock together? Not necessarily. Warren Buffett and David Tepper serve as good examples.

Both men rank among the wealthiest people in the world, with Buffett’s net worth around $146 billion and Tepper’s net worth topping $21 billion. Both are long-term investors who sometimes take contrarian positions.

But these two billionaires aren’t attracted to the same stocks very often. Buffett’s Berkshire Hathaway portfolio includes 41 holdings. Tepper’s Appaloosa Management hedge fund has 37 holdings. However, Buffett and Tepper own only one stock in common.

Before I reveal which lone stock is in both Berkshire Hathaway’s and Appaloosa Management’s portfolios, I must acknowledge something that isn’t readily apparent. Technically, Buffett and Tepper own three of the same stocks. However, two of those stocks come with an asterisk beside their names.

To explain the situation, let’s review some corporate history. In 1995, General Re acquired New England Asset Management (NEAM). Around three years later, Berkshire Hathaway acquired General Re. Why is this important? Because NEAM still has its own investment portfolio that’s separate from Berkshire’s.

NEAM’s holdings include Microsoft and Qualcomm. Both tech stocks are also in Tepper’s Appaloosa portfolio. Buffett doesn’t manage NEAM’s investments but indirectly owns shares of Microsoft and Qualcomm.

While these two stocks warrant an asterisk beside their names, another stock deserves two asterisks. NEAM owns Google parent Alphabet‘s Class A shares. Tepper doesn’t own the Class A shares but does own Alphabet‘s Class C shares, which trade under a different ticker. In this case, Buffett, indirectly, and Tepper, directly, are invested in the same company, although not the same stock.

What’s the one stock that’s a common denominator in Buffett’s and Tepper’s holdings that doesn’t require a special explanation? Amazon (NASDAQ: AMZN).

Berkshire Hathaway first bought Amazon stock in the first quarter of 2019. Buffett subsequently revealed that the decision to buy Amazon was made by one of his two investment managers. However, Buffett has liked Amazon and its founder Jeff Bezos for years.

He no doubt approved of the purchase. The legendary investor has even expressed regret in the past for not buying Amazon stock sooner.

Interestingly, Tepper also initiated a new position in Amazon in the first quarter of 2019. Unlike Buffett, he has never been hesitant about buying high-flying growth stocks.

2024 Fisher Service Award for Military Community Service Recipients Announced

Washington, D.C., Oct. 23, 2024 (GLOBE NEWSWIRE) — Fisher House Foundation and Military Times Foundation have awarded grants to five non-profit organizations supporting military service members and their families. The Fisher Service Award for Military Community Service provides funding toward innovative programs created to improve the quality of life of veterans.

The Fisher Service Award began in 1999 as the Newman’s Own Awards and have now awarded more than $3.4 million across 210 non-profit programs.

“Congratulations to the 2024 Fisher Service Award recipients,” said Chairman and CEO of Fisher House Foundation Ken Fisher. “These exceptional programs are making a meaningful difference for the military and veteran community we hold close. We deeply appreciate our partners at Military Times and our esteemed judges for their unwavering support and commitment.”

“Military Times is proud to support military-connected families and organizations that strive to improve the lives of those in this community. Our support of the Fisher Service Award is just one of the many ways we underscore the Military Times mission of service to the community we serve” said Kelly Facer, SVP Sightline Media Group / Military Times. ”As is the case every year, our honorees exemplify the power of community, cooperation, and innovation in tackling the most important issues for our nation’s heroes and their families.”

After receiving over 515 entries for the 2024 program, 11 judges evaluated each entry based on the organization’s creativity, innovation, and impact on the respective communities. Fisher House Foundation and Military Times Foundation are proud to announce that the five winning organizations are:

Children’s Museum at Joint Base Lewis-McChord, Greentrike; HillVets Fellowship Program, HillVets Foundation; Musicians on Call Veteran’s Bedside Program, Musicians on Call; Mobile Service Units (MSU) Serving Isolated Veterans in Mendocino and Lake Counties CA, Nation’s Finest; and Stronghold Ambassador Program, Stronghold Food Pantry (Organization information below.)

The leading 2024 Fisher Service Award-winning organization received a $100,000 grant, with the remaining top organizations receiving $75,000. All recipients will also receive an advertising package from Military Times valued at $50,000. The 2024 recipients were honored in a ceremony hosted by Fisher House Foundation and Military Times in Washington, D.C., on October 23, 2024. Photos from the ceremony can be viewed at https://www.flickr.com/photos/fisherhousefoundation/sets.

Founded in service of military families in 2021, Greentrike’s Children’s Museum at Joint Base Lewis-McChord is the only children’s museum on a US military base in the world. The Children’s Museum at JBLM provides an array of innovative playscapes that invite self-directed play to empower children’s imaginations. The Children’s Museum at JBLM is the home for Play to Learn, a weekly play-based learning program for children six and under and their caregivers. Admission to the Museum is always Pay As You Will, a donation-only admission model designed to eliminate financial barriers and provide access for all.

“We are deeply honored to have the Children’s Museum at Joint Base Lewis-McChord selected as a Fisher Service Award recipient,” said Greentrike CEO Tanya Durand. “Fisher House Foundation’s support of the Museum will help ensure all military families connected to JBLM have an opportunity to experience the power of play together. We share this honor with all who have been instrumental in securing our vision to establish the first and only children’s museum on a U.S. military installation so that families navigating the challenges of military life have their own indoor play and gathering space, rich learning environment, art studio, and a place to make friends, build community, and experience joy. We are truly grateful to Fisher House Foundation and the Military Times Foundation for recognizing that our work can help ensure optimal childhood development and support the families who are serving our country.”

Applications for the 2025 Fisher Service Awards are currently open. Learn more at https://fisherhouse.org/programs/fisher-service-award/.

###

About Military Times

The Military Times digital platforms and print products are the trusted source for independent news and information for service members and their families. The military community relies on the Army Times, Marine Corps Times, Navy Times, and Air Force Times for reporting on everything important to their lives, including: pay, benefits, finance, education, health care, recreational resources, retirement, promotions, product reviews, and entertainment. Military Times is published by Sightline Media Group. To learn more, visit www.militarytimes.com.

About Fisher House Foundation

Fisher House Foundation is best known for its network of 98 comfort homes where military and veteran families can stay at no cost while a loved one is receiving treatment. These homes are located at major military and VA medical centers nationwide and in Europe, close to the medical center or hospital they serve. Fisher Houses have up to 21 suites with private bedrooms and baths. Families share a common kitchen, laundry facilities, a warm dining room, and an inviting living room. Fisher House Foundation ensures that there is never a lodging fee. Since inception, the program has saved military and veteran families an estimated $610 million in out-of-pocket costs for lodging and transportation. www.fisherhouse.org.

Winning Entries

Children’s Museum at Joint Base Lewis-McChord

Greentrike – Tacoma, Washington

Greentrike’s Children’s Museum at Joint Base Lewis-McChord (the Museum) is a robust, relevant, and pioneering resource for military families. Like the Children’s Museum of Tacoma, the idea for a children’s museum at JBLM was inspired to fill a gap in meaningful activities for military children that could also involve the adults who care for them. In 2021, Greentrike combined over 30 years of museum program management, with several years of research and discussions, to design and open the first and only children’s museum on a US military base in the world. greentrike.org

HillVets Fellowship Program

HillVets Foundation – Washington D.C

HillVets is a nonprofit organization dedicated to empowering veterans, service members, and military families through leadership development, mentorship, and policy advocacy. HillVets connects veterans with leaders, enhancing their advocacy on key issues. Programs include fellowships on Capitol Hill, networking opportunities, and educational initiatives that help veterans transition into influential roles in government, policy, and beyond. hillvets.org

Musicians on Call Veteran’s Bedside Program

Musicians on Call – Nashville, Tennessee

Hospitalized veterans face particular challenges, which is why Musicians On Call prioritizes delivering music to the VA community. MOC Bedside brings live music directly to veterans, their families and caregivers so they can access the healing power of music when they need it most. MOC volunteers have proudly performed for over 100,000 veterans, in person and virtually, in VA hospitals nationwide. musiciansoncall.org

Mobile Service Units (MSU) Serving Isolated Veterans in Mendocino and Lake Counties, CA

Nation‘s Finest – Santa Rosa, California

Nation’s Finest Mobile Service Unit (MSU) delivers essential services like case management and telehealth to veterans in rural and underserved areas, bridging gaps in access to VA resources. By bringing care directly to them, the MSU ensures veterans receive timely medical, mental health, and support services, fostering stability, community, and access to benefits and employment programs. nationsfinest.org

Stronghold Ambassador Program

Stronghold Food Pantry – Leavenworth, Kansas

Stronghold’s Ambassador Program leverages technology and innovation to deliver fresh and nonperishable groceries to military and veteran families worldwide. By activating Ambassadors globally, the traditional food pantry model is transformed into a movement for new service delivery. The program bridges cutting-edge solutions with genuine human connection, prioritizing compassion and integrity while fostering empowerment and a cycle of positivity for all. strongholdfoodpantry.org

Judges for the 2024 competition were:

Ms. Gina Allvin, Spouse of General David W. Allvin, Vice Chief of Staff of the United States Air Force

Ms. Kelly Facer, Sr. Vice President, Military Times, a Sightline Media Group Company

Mrs. Tammy Fisher, Trustee, Fisher House Foundation

Ms. Patty George, Spouse of General Randy A. George, Chief of Staff of the Army

Ms. Christine Grady, Spouse of Admiral Christopher W. Grady, Vice Chairman of the Joint Chiefs of Staff

Mrs. Kelly Hokanson, Spouse of General Daniel Hokanson, Chief of the National Guard Bureau

Ms. LyndaLee Lunday, Spouse of Admiral Kevin E. Lunday, Vice Commandant of the Coast Guard Ms. Ann Morrison, Spouse of LTG John B. Morrison, United States Army Chief of Staff G-6

Mrs. Lynne Pace, Trustee, Fisher House Foundation

Ms. Jennifer Saltzman, Spouse of General B. Chance Saltzman, Chief of Space Operations, United States Space Force

Mrs. Suzie Schwartz, Trustee, Fisher House Foundation

Michelle Horn Fisher House Foundation 2405992478 mhorn@fisherhouse.org

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

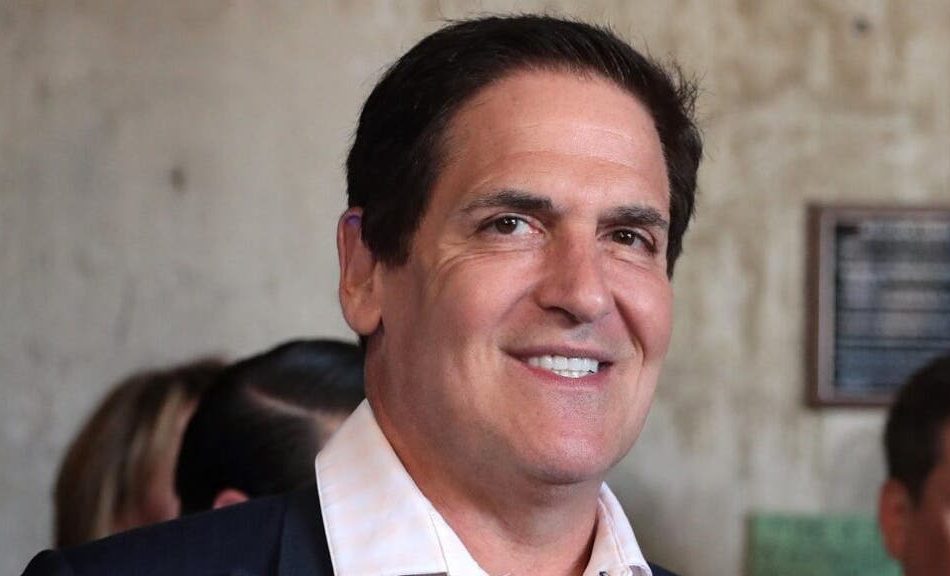

At An Arizona Town Hall, Mark Cuban Assures That Harris Won't Tax Unrealized Gains. If He's Wrong, He'll Work Against Her In The Future

Billionaire entrepreneur Mark Cuban made it clear at a town hall in Arizona that he doesn’t believe Vice President Kamala Harris would ever support a tax on unrealized gains. Speaking to a room full of local entrepreneurs while campaigning for Harris, Cuban boldly stated that if Harris ever backed such a tax, he would actively campaign against her.

“I’m glad you asked that,” Cuban said in response to an audience member’s question about unrealized gains. “Some people think that there’s going to be an unrealized gains tax on capital gains. There is not, there is not.” He reassured everyone that they shouldn’t worry about this kind of tax, which would require people to pay taxes on investments that haven’t yet been sold.

Don’t Miss:

The audience’s concern is somewhat understandable. In August, Vice President Harris endorsed President Joe Biden’s fiscal year 2025 budget, which includes a proposal to tax unrealized gains for individuals with more than $100 million in total income. This proposal aims to create a 25% minimum tax on those gains, which has made some people, especially in the tech and finance sectors, anxious. However, Cuban insisted that Harris wouldn’t follow through on this plan.

Cuban was straightforward when sharing his personal views. He even went so far as to promise that if he turned out to be wrong about Harris’s intentions, he would work to make sure she wouldn’t get reelected. “If I’m wrong, she’s going to hate to hear that, I’ll work so she doesn’t get elected again. Because that’s how wrong I think that is, but I already know it’s not going to happen,” he said, prompting laughter from the audience.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for just $1,000

It’s worth noting that while Harris supported Biden’s budget, which contains the unrealized gains tax idea, she hasn’t specifically talked about it herself. Cuban emphasized that Harris hasn’t directly addressed the unrealized gains tax and that’s a significant point. “You haven’t heard her talk about it,” he added.

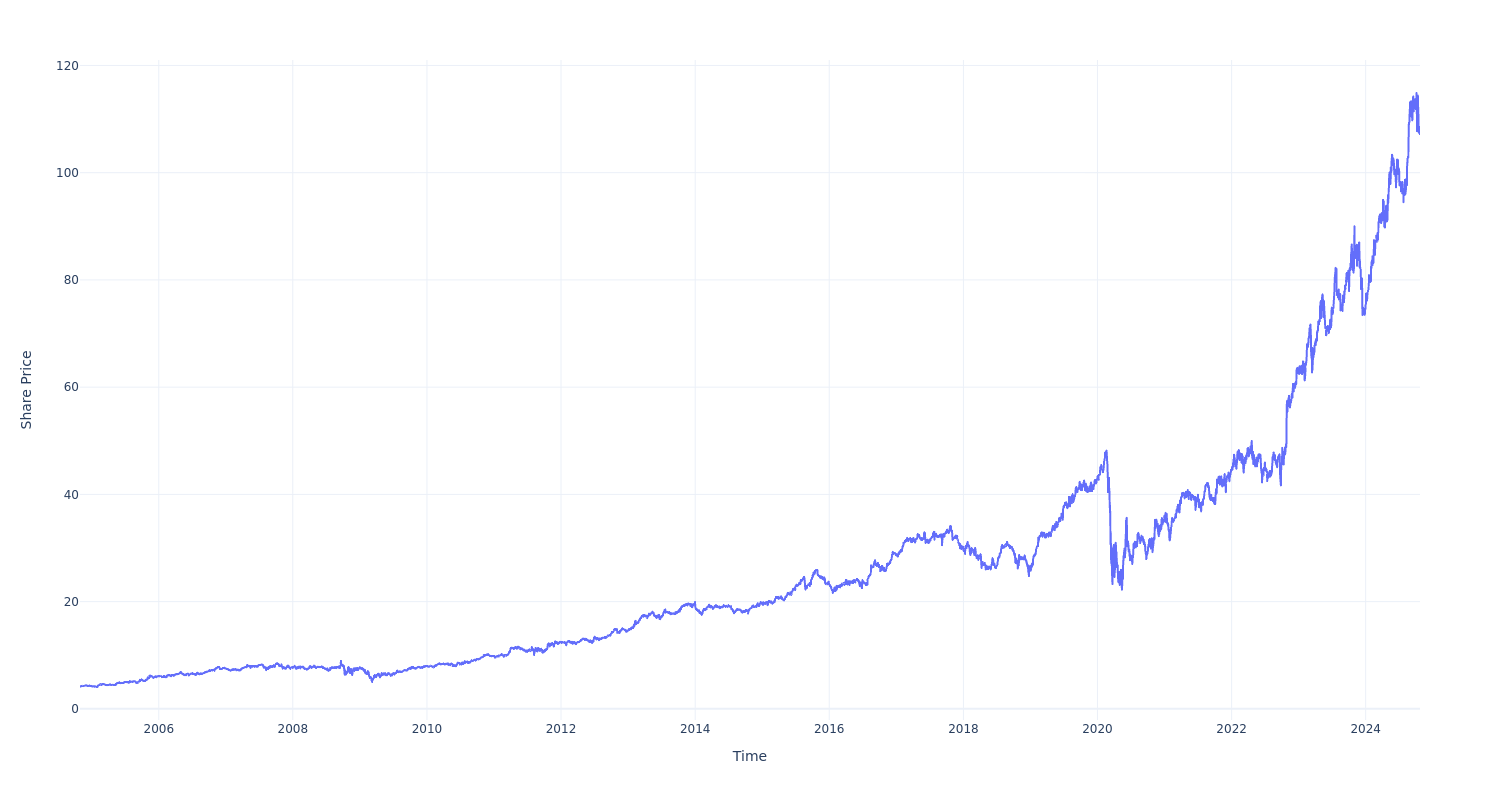

$1000 Invested In Arch Capital Group 20 Years Ago Would Be Worth This Much Today

Arch Capital Group ACGL has outperformed the market over the past 20 years by 9.18% on an annualized basis producing an average annual return of 17.64%. Currently, Arch Capital Group has a market capitalization of $40.54 billion.

Buying $1000 In ACGL: If an investor had bought $1000 of ACGL stock 20 years ago, it would be worth $25,672.88 today based on a price of $107.80 for ACGL at the time of writing.

Arch Capital Group’s Performance Over Last 20 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mill Creek Announces Start of Preleasing at Modera Academical Village

First Phase of Mixed-Use Community Adds 397 Homes to Western Broward County

DAVIE, Fla., Oct. 23, 2024 /PRNewswire/ — Mill Creek Residential, a leading developer, owner-operator and investment manager specializing in premier rental housing across the U.S., today announced the start of preleasing at Modera Academical Village, a mixed-use apartment community in Western Broward County.

The contemporary community, situated just east of S. University Drive and moments west of Nova Southeastern University, is the first of two phases and features 397 homes along with 9,500 square feet of ground-floor retail space. When complete, the Academical Village Master Plan will include a tree-lined central boulevard that provides direct access to the NSU campus, and a pedestrian bridge connecting to the campus and outdoor seating areas. First move-ins are anticipated for late December.

“We’re excited to officially open our doors and welcome our first residents to this truly unique community,” said Andrea Rowe, senior managing director of development in South Florida for Mill Creek Residential. “The master-planned village is rapidly becoming one of the most appealing attractions in the surrounding area, and we’re delighted to be a part of it. Residents will have immediate access to a variety of employment opportunities because the NSU campus and HCA Florida University Hospital are within walking distance. They’ll also enjoy prime connectivity to the greater South Florida area.”

Positioned at 3440 SW 76 Terrace, the community offers commuter-friendly access to many of South Florida’s primary expressways, including Interstates 595, 75 and 95, along with the Florida Turnpike. The immediate Western Broward County area includes a variety of prominent retailers, dining options and grocers.

Modera Academical Village will be built to, and is pursuing, an NGBS Silver® Certification and offers one-, two- and three-bedroom homes with den layouts available. Community amenities include a resort-style swimming pool with a grilling area, sky lounge with expansive views, outdoor dining, therapeutic salt room, spacious clubroom with gathering space and catering kitchen, hotel-inspired lobby, coffee bar, onsite dog park and pet spa, landscaped courtyards and a club-quality fitness center with cardio equipment, private fitness studio and TRX system. Residents will also have access to coworking spaces, private workstations, conference room, digital package lockers, community-wide WiFi, controlled-access guest technology, garage parking, EV-charging stations, bike-repair station, dedicated bike storage and additional storage space.

Apartment interiors include nine-foot ceilings, wood plank-style flooring, stainless steel appliances, quartz countertops, tile backsplashes, soft-close cabinets, in-home washers and dryers, large closets, USB ports, keyless entry system and smart thermostats. Bathrooms include double vanities, linen closets, soaking tubs and additional high-end features. Select homes include private balconies and patios, separate dining areas, double basin sinks, large chef’s islands, built-in desks and shelving, wine coolers and frameless glass showers.

About Mill Creek Residential

Mill Creek Residential Trust LLC is a national rental housing company focused on developing, acquiring, and operating rental communities in targeted markets nationwide. The national company, headquartered in Boca Raton, Florida, proactively develops, acquires, constructs, and operates communities through its seasoned team of real estate professionals in offices across the United States. Mill Creek is building its portfolio in many of the nation’s most desirable markets in Seattle, Portland, the San Francisco Bay area, Sacramento, Southern California, Phoenix, Denver, Dallas, Austin, Houston, South Florida, Tampa, Orlando, Atlanta, Nashville, Charlotte, Raleigh, Washington, D.C., New Jersey, New York, and Boston. As of June 30, 2024, the company’s portfolio comprises 145 communities representing over 41,350 rental homes operating and/or under construction. For more information, please visit www.MillCreekPlaces.com.

Media Contact

Stephen Ursery

LinnellTaylor Marketing

stephen@linnelltaylor.com

303.682.3945

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mill-creek-announces-start-of-preleasing-at-modera-academical-village-302283878.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mill-creek-announces-start-of-preleasing-at-modera-academical-village-302283878.html

SOURCE Mill Creek Residential

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uncovering Potential: Simply Good Foods's Earnings Preview

Simply Good Foods SMPL is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Simply Good Foods to report an earnings per share (EPS) of $0.50.

Simply Good Foods bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

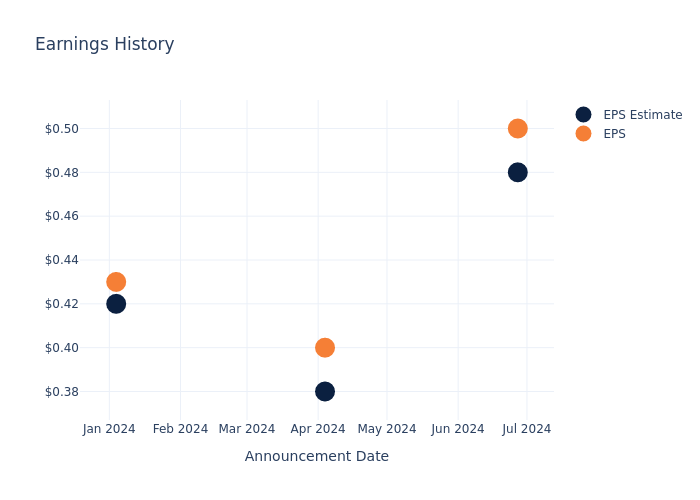

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.02, leading to a 1.23% increase in the share price the following trading session.

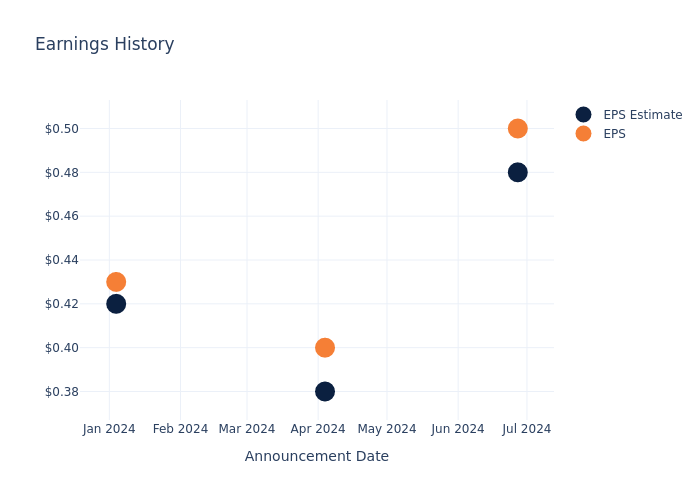

Here’s a look at Simply Good Foods’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.48 | 0.38 | 0.42 | 0.45 |

| EPS Actual | 0.50 | 0.40 | 0.43 | 0.45 |

| Price Change % | 1.0% | -2.0% | -4.0% | 4.0% |

Tracking Simply Good Foods’s Stock Performance

Shares of Simply Good Foods were trading at $32.51 as of October 22. Over the last 52-week period, shares are down 11.46%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Insights on Simply Good Foods

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Simply Good Foods.

The consensus rating for Simply Good Foods is Outperform, based on 1 analyst ratings. With an average one-year price target of $42.0, there’s a potential 29.19% upside.

Analyzing Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of J&J Snack Foods, Nomad Foods and Cal-Maine Foods, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Buy trajectory for J&J Snack Foods, with an average 1-year price target of $200.0, indicating a potential 515.2% upside.

- As per analysts’ assessments, Nomad Foods is favoring an Buy trajectory, with an average 1-year price target of $24.0, suggesting a potential 26.18% downside.

- Cal-Maine Foods received a Neutral consensus from analysts, with an average 1-year price target of $82.0, implying a potential 152.23% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for J&J Snack Foods, Nomad Foods and Cal-Maine Foods, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Simply Good Foods | Outperform | 3.07% | $133.63M | 2.47% |

| J&J Snack Foods | Buy | 3.33% | $147.77M | 3.92% |

| Nomad Foods | Buy | 1.07% | $232.80M | 2.68% |

| Cal-Maine Foods | Neutral | 71.09% | $247.22M | 8.10% |

Key Takeaway:

Simply Good Foods is positioned in the middle among its peers for Consensus rating. It ranks at the bottom for Revenue Growth and Gross Profit, while it is at the top for Return on Equity.

All You Need to Know About Simply Good Foods

The Simply Good Foods Co is a consumer packaged food and beverage company. It provides low-carbohydrate, high protein bars, shakes, and other products such as confections, chips, and cookies under the Atkins and Quest brands. The company distributes its products in retail channels, predominantly in North America, including grocery, club, and mass merchandise, as well as through e-commerce, convenience, and other channels.

Simply Good Foods: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Simply Good Foods’s remarkable performance in 3 months is evident. As of 31 May, 2024, the company achieved an impressive revenue growth rate of 3.07%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Staples sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 12.35%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Simply Good Foods’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.47%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Simply Good Foods’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 1.91% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Simply Good Foods’s debt-to-equity ratio is below the industry average at 0.14, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Simply Good Foods visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

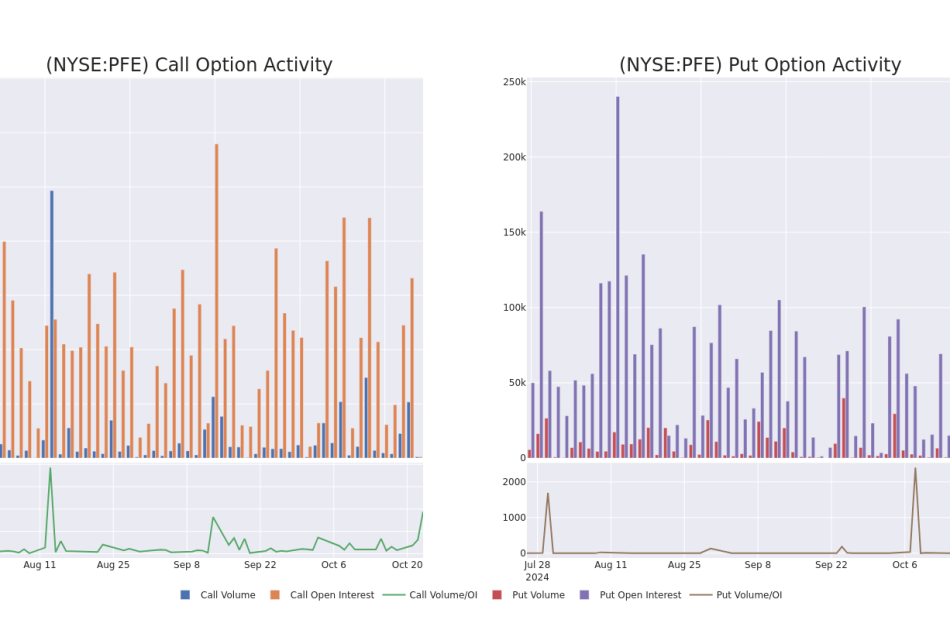

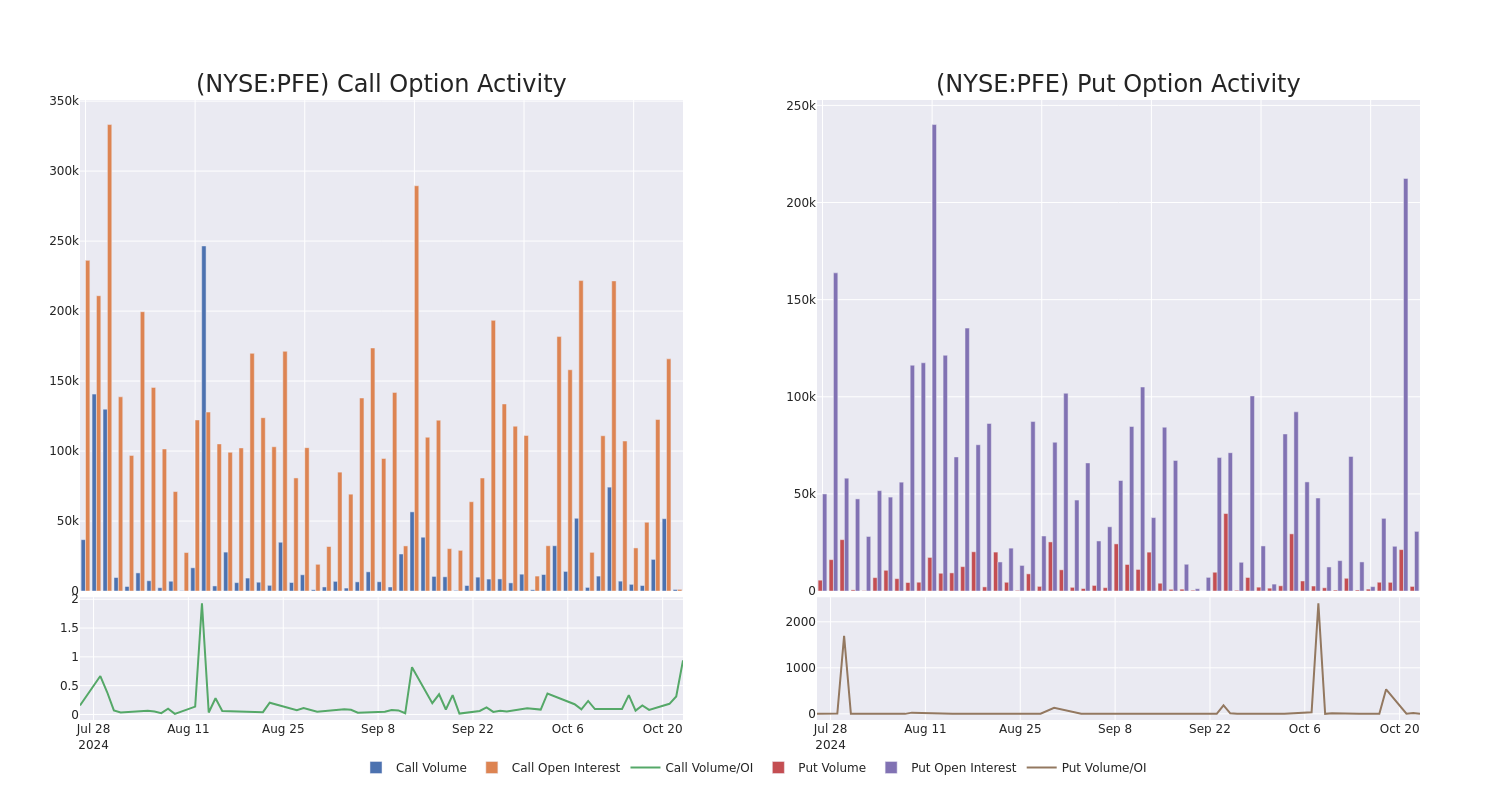

A Closer Look at Pfizer's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Pfizer.

Looking at options history for Pfizer PFE we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $215,253 and 4, calls, for a total amount of $110,938.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $23.0 to $32.0 for Pfizer over the last 3 months.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Pfizer’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Pfizer’s whale activity within a strike price range from $23.0 to $32.0 in the last 30 days.

Pfizer Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PFE | PUT | TRADE | BULLISH | 12/20/24 | $0.85 | $0.83 | $0.83 | $28.00 | $76.2K | 23.4K | 1.1K |

| PFE | PUT | SWEEP | BEARISH | 10/25/24 | $0.35 | $0.28 | $0.28 | $29.00 | $35.4K | 6.8K | 550 |

| PFE | PUT | TRADE | NEUTRAL | 11/08/24 | $3.5 | $3.4 | $3.45 | $32.00 | $34.5K | 339 | 320 |

| PFE | PUT | TRADE | BULLISH | 11/08/24 | $3.5 | $3.45 | $3.45 | $32.00 | $34.5K | 339 | 220 |

| PFE | PUT | TRADE | BULLISH | 11/08/24 | $3.5 | $3.45 | $3.45 | $32.00 | $34.5K | 339 | 120 |

About Pfizer

Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding covid-19-related product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Having examined the options trading patterns of Pfizer, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Pfizer Standing Right Now?

- Trading volume stands at 13,273,870, with PFE’s price down by -0.12%, positioned at $28.8.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 6 days.

Professional Analyst Ratings for Pfizer

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $40.666666666666664.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Bernstein downgraded its action to Market Perform with a price target of $32.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Pfizer, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.