Kindred's Journey Towards Zero: An increase in Q3 revenue from high-risk players

SLIEMA, Malta, Oct. 23, 2024 /PRNewswire/ — For the third quarter of 2024, Kindred’s Gross winnings revenue from high-risk players reached 3.2 per cent, an increase from the previous quarter. While it is an increase, Kindred remains fully dedicated to lowering this share of revenue and continues to see a sustainable behaviour change from players after interventions.

Kindred Group plc (Kindred) reports a slight increase in its share of revenue from high-risk players for the third quarter 2024 at 3.2 per cent (Q2 2024 3.0 per cent). The percentage of detected customers who exhibited improved behaviour after interventions showed an improvement at 87.3 per cent (compared to 86.8 per cent in Q2 2024 and 87.1 per cent in Q1 2024). The improvement underscores Kindred’s ongoing commitment to not only identifying risk behaviour but also continuously refining the interventions applied to foster safer gambling habits.

|

Global statistics from Kindred Group |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024* |

|

Share of gross winnings revenue from high-risk players |

3.3 % |

3.1 % |

3.2 % |

3.0 % |

3.2 % |

|

Improvement effect after interventions |

86.7 % |

87.4 % |

87.1 % |

86.8 % |

87.3 % |

*90 day rolling period between 19 June 2024 and 18 September 2024

“The rise in high-risk revenue presents a challenge in the third quarter, which reinforces the need for further advancements in our behavioral harm detection and automated intervention systems. Looking ahead, we recognise this need as well as to broaden our focus to ensure comprehensive coverage across more areas related to safer gambling. A key aspect of this future strategy is to build on the strengths, insights and knowledge gained from our proprietary detection system over the years,” says Esther Scheepers, Head of Responsible Gambling at Kindred Group.

“The general awareness and knowledge around gambling disorder is increasing rapidly, as is the sophistication of technological support tools. By combining our own knowledge with new and improved technology, we can enhance detection capabilities further. We are currently upgrading our detection system with a new improved system, which will enable us to integrate more robust compliance features and optimise our overall approach to safer gambling. Additionally, we are exploring opportunities to expand and refine our research initiatives, particularly in areas shaped by current trends and emerging issues in consumer protection,” ends Esther Scheepers.

In February 2021, Kindred started to communicate about its share of revenue of harmful gambling and reports this data and the improvement effect after interventions each quarter. This is a key part of Kindred’s work with fostering a factual and transparent dialogue, paving the way for a more sustainable industry.

About Kindred’s Journey towards Zero

Kindred Group is committed to transform gambling by being a trusted source of entertainment that contributes positively to society. Therefore, Kindred has set an ambition to reach zero per cent revenue from harmful gambling and to report this metric on a quarterly basis. This is done to increase transparency, to support a fact-based dialogue about harmful gambling, and to raise awareness of the Group’s sustainability work. To read more, visit: www.kindredgroup.com/zero

For more information:

Alexander Westrell, Director of Communications

press@kindredgroup.com

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/kindreds-journey-towards-zero-an-increase-in-q3-revenue-from-high-risk-players-302284177.html

View original content:https://www.prnewswire.com/news-releases/kindreds-journey-towards-zero-an-increase-in-q3-revenue-from-high-risk-players-302284177.html

SOURCE Kindred Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Alcoa Corp

Summary

Alcoa Corp. is a global provider of bauxite, alumina, and aluminum products. The company is based in Pittsburgh and has approximately 13,600 employees in 17 countries.

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

These 2 Artificial Intelligence (AI) Giants Are Trading at Record Highs. Wall Street Says Only 1 Is a Buy.

This year has been a big one for artificial intelligence (AI) stocks, with these players leading gains in the S&P 500. Investors have piled into the stocks to get in early on a big market opportunity — analysts forecast today’s $200 billion AI market will reach beyond $1 trillion later this decade. That could equal significant revenue for companies using AI as well as those that develop AI products and services.

And today, some of these AI players already are scoring big wins in terms of earnings and stock performance. In fact, two top AI companies are trading at record highs right now after climbing in the triple digits since the start of the year. These players both have reported fantastic earnings and offer solid long-term outlooks — but Wall Street says only one of them is a buy today. Let’s zoom in on each of these AI leaders.

Nvidia (NASDAQ: NVDA) has become an AI empire over the past few years, selling not only its top graphics processing units (GPUs) but also a full range of products and services to support any AI project. This has resulted in triple-digit earnings growth quarter after quarter, and growth may be far from over. For three reasons.

First, as mentioned, the AI market is soaring and should continue to grow throughout the decade, offering ongoing revenue growth opportunities to companies in the space. Second, Nvidia already is a leader with the best-performing GPUs around, and that’s led to demand for its products outpacing supply. Finally, Nvidia has pledged to update these GPUs annually, a key move that should keep it in the lead.

Nvidia shares may not be dirt cheap at 50 times forward earnings estimates, but considering the company’s growth, gross margin of more than 70%, and long-term prospects, valuation looks reasonable. Though Wall Street’s average price forecast calls for less than a 4% gain over the coming 12 months, analysts’ average recommendation is a “buy.” So, the general feeling is Nvidia is a stock to pick up today — though it may not soar tremendously in the year to come, the stock still has what it takes to roar higher over the long term.

Palantir Technologies (NYSE: PLTR) has been around for about 20 years and through most of its history, it’s been associated with government contracts. But thanks to its leap into AI, Palantir’s overall growth as well as its commercial business have taken off. For example, in the most recent quarter, Palantir reported its highest level of quarterly profit ever.

So, why are companies and governments flocking to this software company? Palantir, using AI, helps customers aggregate their data and make the best possible use of it. And this often produces game-changing results — from increased efficiency to entirely new ways of getting business or projects done.

IMF Brightens US Economic Growth Projections, Warns National Debt 'Not Stabilized' (CORRECTED)

Editor’s note: This story has been updated to remove draft notes that were erroneously included.

The International Monetary Fund (IMF) delivered a mixed message on the U.S. economy in its latest World Economic Outlook report.

While the Washington-based institution raised its forecast for U.S. growth in 2024, citing strong consumer spending and robust business investment, it also issued a stark warning about the country’s fiscal trajectory.

According to the IMF, the U.S. public debt will continue to surge, with significant long-term risks posed by persistent deficits and rising debt-servicing costs.

The IMF revised its 2024 growth outlook for the U.S. upward to 2.8%, a 0.2 percentage point increase from its July estimate.

The report credits resilient consumer spending, buoyed by real wage gains, particularly for lower-income households and solid nonresidential investment for the stronger forecast.

The Federal Reserve’s monetary policy, which pivoted towards easing in September 2024 with a 50 basis point cut, was another crucial factor in the updated U.S. economic outlook.

The IMF also revised its 2025 forecast slightly upward, projecting 2.2% growth, a 0.3 percentage point increase from previous estimates.

Despite these upward revisions, the pace of economic expansion is anticipated to slow due to less government spending and a softening job market, which could curb consumer demand.

Read Now: US Economy Eyes 3.4% Growth In Q3: Is Soft Landing Turning Into Reacceleration?

On the inflation front, the IMF projects U.S. inflation to average 3% in 2024, with a year-end target of 2.3%. By 2025, inflation is expected to decline further, averaging 1.9%.

The report highlights that inflationary pressures are easing, but there are still significant downside risks to the global economy. “The global economy is at the last mile of disinflation,” the IMF highlights, while warning that disinflation efforts could be more costly than anticipated if inflation persists longer than expected.

The Fed’s rate-cutting cycle is expected to continue, with the federal funds rate projected to return to its long-term equilibrium of 2.9% by the third quarter of 2026 — nearly a year earlier than previously expected.

While the growth story for the U.S. economy is largely positive, the IMF’s warnings on fiscal policy are harder to ignore.

The U.S. fiscal deficit remains a significant concern, projected at 7.6% of GDP in 2024 and 7.3% in 2025. By 2029, the deficit is expected to narrow slightly to 6%, but much of this will be driven by rising interest rate expenses, which now constitute a significant portion of government outlays.

Government debt is set to climb further, with the IMF forecasting gross government debt to reach 121% of GDP in 2024, 124% in 2025, and a staggering 131.7% by 2029.

These projections have led the IMF to issue a stark warning: “Under current policies, the U.S. public debt is not stabilized.”

Furthermore, the IMF added, “Delaying is costly: in countries where debt is projected to increase further — such as Brazil, France, Italy, South Africa, the U.K. and the U.S. — delaying action will make the required adjustment even larger.”

| Key Economic Indicators | 2024 | 2025 | 2029 |

|---|---|---|---|

| GDP Growth | 2.8% | 2.2% | 2.1% |

| Inflation (Average) | 3.0% | 1.9% | 2.1% |

| Fiscal Deficit (% of GDP) | 7.6% | 7.3% | 6.0% |

| Gross Debt (% of GDP) | 121% | 124% | 131.7% |

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent Stock-Split Stock That's a No-Brainer Buy Right Now and 1 to Avoid at All Costs

In case you haven’t noticed, the bull market is in full swing on Wall Street. The ageless Dow Jones Industrial Average, broad-based S&P 500, and growth-fueled Nasdaq Composite, have all soared to multiple record highs in 2024.

While much of this optimism has been attributed to the hype surrounding artificial intelligence (AI), it would be a mistake to overlook the role investor euphoria has played in lifting the tide for market-leading businesses enacting stock splits.

A stock split is a tool publicly traded companies can lean on to superficially adjust the share price and outstanding share count of their stock. This adjustment is cosmetic in the sense that it doesn’t alter a company’s market cap or in any way affect its operating performance.

Since the start of 2024, more than a dozen prominent businesses have completed a stock split, and all but one has been of the forward variety. A forward split makes shares nominally cheaper for retail investors who lack access to fractional-share purchases through their broker.

At the moment, one of these high-profile stock-split stocks makes for a no-brainer buy, while another is rife with red flags.

The magnificent stock-split stock that’s sending out all the right signals for investors is Japan-based consumer electronics colossus Sony Group (NYSE: SONY). Sony’s American depositary receipts (ADRs) completed a 5-for-1 forward split on Oct. 8, which reduced Sony’s share price from the mid-$90s to around $19.

Some investors might be skittish about putting their money to work in Sony given that it’s in the middle of a console development cycle. The PlayStation 5 (PS5) was released roughly four years ago, and it’ll probably be another two years, at minimum, before the company’s next-gen console is on retail shelves. It’s not uncommon for console sales to lag this late in the cycle.

However, Sony Group has a number of levers it’s been able to pull to bolster its important gaming segment.

In August, the company announced it would raise the price of its PS5 console by 19% in its home market of Japan. Additionally, PlayStation Plus revenue has been increasing. This is a subscription service that allows people to game with their friends, access exclusive titles, and save their data to the cloud. It’s a relatively high-margin way to build on this nicely profitable operating segment.

Something else to consider is that Sony Group’s stock often rallies well in advance of the release of its next-generation gaming console. Game and Network Services accounted for 28% of Sony’s consolidated sales in the latest quarter, and the figure could meaningfully expand when the next-gen console hits retail shelves in two or three years.

TD Synnex Chief Legal Officer Trades $2.46M In Company Stock

DAVID VETTER, Chief Legal Officer at TD Synnex SNX, executed a substantial insider sell on October 21, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that VETTER sold 20,000 shares of TD Synnex. The total transaction amounted to $2,462,800.

At Tuesday morning, TD Synnex shares are down by 0.0%, trading at $120.75.

Delving into TD Synnex’s Background

TD Synnex Corp is a distributor and solutions aggregator for the IT ecosystem. The company aggregates and distributes IT hardware, software, and systems including personal computing devices and peripherals, mobile phones and accessories, printers, server and datacenter infrastructure, hybrid cloud, security, networking, communications and storage solutions, and system components. Its geographical segments include, the Americas, Europe, and APJ.

Breaking Down TD Synnex’s Financial Performance

Positive Revenue Trend: Examining TD Synnex’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.19% as of 31 August, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Insights into Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 6.54%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): TD Synnex’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.09.

Debt Management: With a below-average debt-to-equity ratio of 0.5, TD Synnex adopts a prudent financial strategy, indicating a balanced approach to debt management.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 15.66 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.18, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 8.62, TD Synnex presents an attractive value opportunity.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Navigating the World of Insider Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of TD Synnex’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Active Optical Cable Market Size/Share Worth USD 27,383.2 Million by 2033 at a 14.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

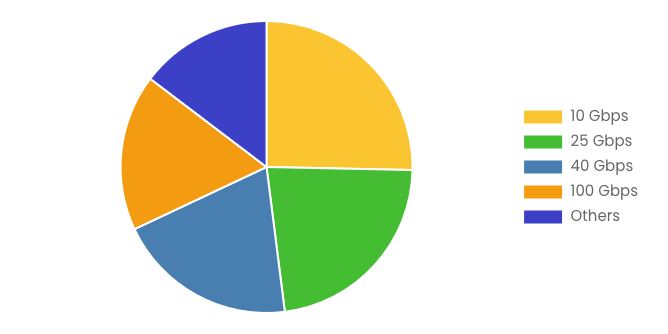

Austin, TX, USA, Oct. 23, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Active Optical Cable Market Size, Trends and Insights By Data Rate (10 Gbps, 25 Gbps, 40 Gbps, 100 Gbps, Others), By Application (Data Centers, Consumer Electronics, High-Performance Computing (HPC), Telecommunications, Automotive, Others), By Protocol (Ethernet, InfiniBand, Fiber Channel, HDMI/DisplayPort, USB, Others), By Length (Short Range (up to 100 meters), Medium Range (100 meters to 300 meters), Long Range (above 300 meters)), By Connector Type (SFP (Small Form-factor Pluggable), QSFP (Quad Small Form-factor Pluggable), CXP (InfiniBand CXP), CFP (C Form-factor Pluggable), Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

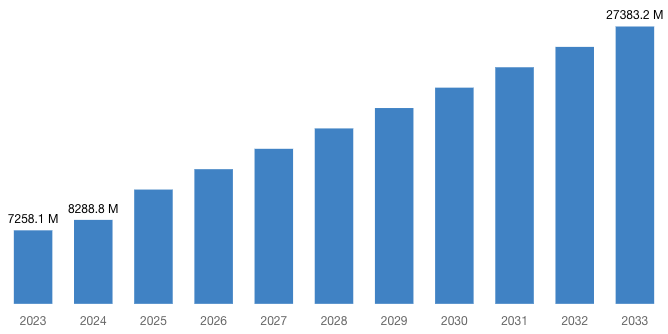

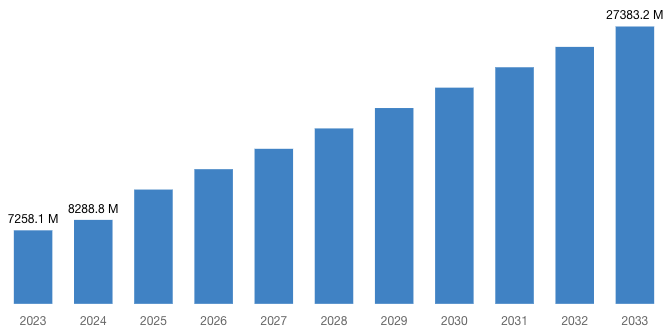

“According to the latest research study, the demand of global Active Optical Cable Market size & share was valued at approximately USD 7,258.1 Million in 2023 and is expected to reach USD 8,288.8 Million in 2024 and is expected to reach a value of around USD 27,383.2 Million by 2033, at a compound annual growth rate (CAGR) of about 14.2% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Active Optical Cable Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53152

Active Optical Cables (AOCs) Market: Growth Factors and Dynamics

- Rising Demand for High-speed Data Transmission: The increasing need for high-speed data transmission in data centers, telecommunications, and cloud computing environments is a significant driver for the AOCs market. AOCs offer faster data transfer rates compared to traditional copper cables, meeting the growing bandwidth requirements of modern applications and driving market growth.

- Advancements in Networking Technologies: Continuous advancements in networking technologies, such as Ethernet, InfiniBand, and Fiber Channel, are fueling the demand for AOCs. These cables support higher data rates, lower latency, and longer reach compared to copper cables, enabling the deployment of high-performance networking solutions in various industries.

- Data Center Expansion and Cloud Computing Adoption: The expansion of data centers and the widespread adoption of cloud computing services drive the demand for AOCs. As data centers scale to accommodate increasing volumes of data and workloads, AOCs provide scalable and flexible connectivity solutions, facilitating high-speed data transfer between servers, switches, and storage devices.

- Demand for High-performance Computing (HPC) Systems: The growth of HPC systems in research, scientific simulations, and artificial intelligence (AI) applications drives the adoption of AOCs. AOCs enable fast and reliable data transmission between compute nodes, accelerators, and storage systems in HPC clusters, supporting the high-bandwidth and low-latency requirements of compute-intensive workloads.

- Advantages over Copper Cables: AOCs offer several advantages over traditional copper cables, including higher data transfer rates, lower power consumption, reduced electromagnetic interference (EMI), and lighter weight. These advantages make AOCs ideal for applications requiring long-distance, high-speed data transmission in data centers, telecommunications, and consumer electronics.

- Growing Adoption in Consumer Electronics: The increasing adoption of high-definition video streaming, virtual reality (VR), and gaming applications in consumer electronics drives the demand for AOCs. AOCs based on HDMI and DisplayPort protocols enable high-speed, high-resolution video and audio transmission over longer distances, enhancing the user experience in home entertainment systems and digital signage applications.

Request a Customized Copy of the Active Optical Cable Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=53152

Active Optical Cables (AOCs) Market: Partnership and Acquisitions

- In 2022, II-VI Incorporated introduced the Pluggable Optical Line Subsystem (POLS) in QSFP form factor, tailored for 400ZR/ZR+ transport in data center interconnects. This compact system supports full-duplex multichannel transmission, reducing power consumption and space usage, while ensuring compatibility with widely available sockets.

- In 2021, Broadcom unveiled 100Gbps Multimode AOCs and pluggable optical transceivers enabling high-speed connectivity for modern servers, supporting link speeds up to 100-Gb/s per lane. These innovations address the growing demand for fast and efficient data transmission in server environments.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 8,288.8 Million |

| Projected Market Size in 2033 | USD 27,383.2 Million |

| Market Size in 2023 | USD 7,258.1 Million |

| CAGR Growth Rate | 14.2% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Data Rate, Application, Protocol, Length, Connector Type and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Active Optical Cable report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Active Optical Cable report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Active Optical Cable Market Report @ https://www.custommarketinsights.com/report/active-optical-cable-market/

Active Optical Cables (AOCs) Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Active Optical Cables (AOCs) Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Supply Chain Disruptions: The COVID-19 pandemic disrupted global supply chains, leading to shortages of critical components and materials required for AOC manufacturing. Delays in production and logistics hindered the availability of AOCs, impacting the market’s growth.

- Reduced IT Spending: Economic uncertainties caused by the pandemic led to reduced IT spending by businesses and enterprises, affecting investments in data center infrastructure and network upgrades. This resulted in a slowdown in AOC procurement and deployment, particularly in industries heavily impacted by the pandemic.

- Resilience in Data Center Expansion: As businesses adapt to remote work and digital transformation initiatives, the demand for data center infrastructure rebounds. Increased investments in cloud computing, online services, and remote collaboration tools drive the deployment of AOCs for high-speed data transmission within data centers.

- Acceleration of 5G Rollout: The rollout of 5G networks accelerates post-pandemic, driving demand for AOCs in telecommunications infrastructure. AOCs support high-speed data transmission between 5G base stations, routers, and core networks, enabling the delivery of low-latency, high-bandwidth services to consumers and businesses.

- Recovery in High-performance Computing (HPC): Recovery in HPC applications, such as scientific research, AI, and simulations, drives demand for AOCs in data-intensive computing environments. AOCs facilitate fast and reliable data transmission between compute nodes, accelerators, and storage systems, supporting the performance requirements of HPC workloads.

- Return of Consumer Electronics Demand: The recovery of consumer electronics demand post-pandemic boosts the adoption of AOCs in applications like high-definition video streaming, gaming, and virtual reality. AOCs based on HDMI and DisplayPort protocols enable high-speed, high-resolution video and audio transmission, enhancing the user experience in home entertainment systems and digital displays.

- Investments in Semiconductor Manufacturing: Investments in semiconductor manufacturing capacity and technology advancements support the production of AOC components, reducing supply chain constraints. Enhanced manufacturing capabilities improve the availability and affordability of AOCs, enabling market recovery and meeting the growing demand for high-speed connectivity solutions.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Active Optical Cables (AOCs) Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Active Optical Cable Market Report @ https://www.custommarketinsights.com/report/active-optical-cable-market/

Key questions answered in this report:

- What is the size of the Active Optical Cable market and what is its expected growth rate?

- What are the primary driving factors that push the Active Optical Cable market forward?

- What are the Active Optical Cable Industry’s top companies?

- What are the different categories that the Active Optical Cable Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Active Optical Cable market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Active Optical Cable Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/active-optical-cable-market/

Active Optical Cable Market – Regional Analysis

The Active Optical Cables (AOCs) Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, the Active Optical Cable market is characterized by a strong focus on technological innovation and the adoption of high-speed networking solutions. Trends include increased investments in data center infrastructure, cloud computing services, and emerging technologies such as 5G networks and artificial intelligence (AI). Additionally, partnerships between technology companies and government initiatives drive advancements in networking technologies and propel market growth.

- Europe: Europe’s AOCs market sees trends driven by the region’s emphasis on sustainable development and digital transformation. Key trends include the deployment of AOCs in renewable energy projects, smart city initiatives, and high-speed broadband networks. Additionally, collaborations between industry stakeholders and research institutions drive advancements in photonics, optoelectronics, and fiber optic communication technologies, positioning Europe as a leader in the global AOCs market.

- Asia-Pacific: The Asia-Pacific region dominates the global AOCs market, driven by rapid industrialization, urbanization, and technological advancements. Trends include the proliferation of 5G networks, expansion of data center infrastructure, and adoption of fiber optic connectivity solutions in emerging economies such as China, India, and Southeast Asia. Additionally, government initiatives to promote digital connectivity, smart manufacturing, and smart city development fuel market growth and drive demand for AOCs.

- LAMEA (Latin America, Middle East, and Africa): In the LAMEA region, trends in the AOCs market are influenced by factors such as infrastructure development, economic diversification, and geopolitical dynamics. Key trends include the deployment of AOCs in oil and gas exploration, telecommunication networks, and smart grid projects. Additionally, partnerships between regional and international companies drive technology transfer and knowledge exchange, fostering market growth and innovation in the AOCs sector.

Request a Customized Copy of the Active Optical Cable Market Report @ https://www.custommarketinsights.com/report/active-optical-cable-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Active Optical Cable Market Size, Trends and Insights By Data Rate (10 Gbps, 25 Gbps, 40 Gbps, 100 Gbps, Others), By Application (Data Centers, Consumer Electronics, High-Performance Computing (HPC), Telecommunications, Automotive, Others), By Protocol (Ethernet, InfiniBand, Fiber Channel, HDMI/DisplayPort, USB, Others), By Length (Short Range (up to 100 meters), Medium Range (100 meters to 300 meters), Long Range (above 300 meters)), By Connector Type (SFP (Small Form-factor Pluggable), QSFP (Quad Small Form-factor Pluggable), CXP (InfiniBand CXP), CFP (C Form-factor Pluggable), Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/active-optical-cable-market/

List of the prominent players in the Active Optical Cables (AOCs) Market:

- Finisar Corporation

- Molex LLC

- TE Connectivity Ltd.

- Broadcom Inc.

- Mellanox Technologies (now part of NVIDIA Corporation)

- Sumitomo Electric Industries Ltd.

- Siemon Company

- 3M Company

- Amphenol Corporation

- EMCORE Corporation

- FCI USA LLC (a subsidiary of Amphenol Corporation)

- HUBER+SUHNER AG

- Accelink Technologies Co. Ltd.

- Reflex Photonics Inc.

- Timbercon Inc.

- Others

Click Here to Access a Free Sample Report of the Global Active Optical Cable Market @ https://www.custommarketinsights.com/report/active-optical-cable-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Artificial Intelligence in Banking Market: Artificial Intelligence in Banking Market Size, Trends and Insights By Component (Service, Solution), By Application (Fraud Detection and Prevention, Transaction Monitoring, Identity Verification, Customer Service, Virtual Assistants, Automated Customer Support, Risk Management, Credit Scoring, Market Risk Analysis, Personalized Banking, Customer Recommendations, Targeted Marketing, Compliance and Regulatory Reporting, Anti-Money Laundering (AML), Know Your Customer (KYC), Others), By Technology (Machine Learning, Supervised Learning, Unsupervised Learning, Reinforcement Learning, Natural Language Processing (NLP), Text Analysis, Speech Recognition, Chatbots and Virtual Assistants, Robotic Process Automation (RPA), Process Automation, Workflow Automation, Predictive Analytics, Risk Management, Customer Insights), By Enterprise Size (Large Enterprise, SMEs), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Custom Software Development Services Market: Custom Software Development Services Market Size, Trends and Insights By Deployment Mode (Cloud-based, On-Premises), By Solution Type (Web/desktop-based solutions, Mobile–Based Solutions, SME’s, Large Enterprises), By End User (SME’s, Large Enterprises), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Intelligent Building Management Systems Market: Intelligent Building Management Systems Market Size, Trends and Insights By Type (Building Energy Management Systems (BEMS), Security Management Systems, Life Safety Systems, Facility Management Systems, Smart HVAC Control Systems, Others), By Service (Professional Services, Managed Services), By Application (Residential, Commercial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Custom Software Development Market: US Custom Software Development Market Size, Trends and Insights By Type (Web-based Solutions, Mobile App, Enterprise Software, Others), By Deployment Model (On-premises, Cloud-based), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-User Industry (Healthcare, BFSI (Banking, Financial Services, and Insurance), Retail, Manufacturing, Government, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Data Center Precision Air Conditioning Market: Data Center Precision Air Conditioning Market Size, Trends and Insights By Type (Computer Room Air Conditioners (CRACs), Close Coupled Computer Room Air Handlers (CCRAHs)), By Capacity (Below 100 kW, 100-200 kW, 200-300 kW, Above 300 kW), By Free Cooling Technology (Direct Free Cooling, Indirect Free Cooling), By Deployment (New Installations, Retrofits, Upgrades), By Application (Data Centers, Server Rooms, Telecommunication Facilities), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

B2B Cross-border Payments Market: B2B Cross-border Payments Market Size, Trends and Insights By Activity (Large Enterprise Size, Small and Medium-sized Enterprises), By End-user (Individuals, Businesses), By Channel (Bank Transfer, Money Transfer Operator, Card Payment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

5G Femtocell Market: 5G Femtocell Market Size, Trends and Insights By Type (IU-H, IMS/SIP), By Application (Indoor, Outdoor), By End User (Residential, Commercial, Public Places), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Asia Pacific Social Robots Market: Asia Pacific Social Robots Market Size, Trends and Insights By Component (Hardware, Software, Services), By Technology (Machine Learning, Computer Vision, Context Awareness, Natural Language Processing), By End Use Industry (Healthcare & Pharmaceutical, Education, Media and Entertainment, Consumer Goods & Retail, Electrical and Electronics, Automotive, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Active Optical Cables (AOCs) Market is segmented as follows:

By Data Rate

- 10 Gbps

- 25 Gbps

- 40 Gbps

- 100 Gbps

- Others

By Application

- Data Centers

- Consumer Electronics

- High-Performance Computing (HPC)

- Telecommunications

- Automotive

- Others

By Protocol

- Ethernet

- InfiniBand

- Fiber Channel

- HDMI/DisplayPort

- USB

- Others

By Length

- Short Range (up to 100 meters)

- Medium Range (100 meters to 300 meters)

- Long Range (above 300 meters)

By Connector Type

- SFP (Small Form-factor Pluggable)

- QSFP (Quad Small Form-factor Pluggable)

- CXP (InfiniBand CXP)

- CFP (C Form-factor Pluggable)

- Others

Click Here to Get a Free Sample Report of the Global Active Optical Cable Market @ https://www.custommarketinsights.com/report/active-optical-cable-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Active Optical Cable Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Active Optical Cable Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Active Optical Cable Market? What Was the Capacity, Production Value, Cost and PROFIT of the Active Optical Cable Market?

- What Is the Current Market Status of the Active Optical Cable Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Active Optical Cable Market by Considering Applications and Types?

- What Are Projections of the Global Active Optical Cable Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Active Optical Cable Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Active Optical Cable Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Active Optical Cable Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Active Optical Cable Industry?

Click Here to Access a Free Sample Report of the Global Active Optical Cable Market @ https://www.custommarketinsights.com/report/active-optical-cable-market/

Reasons to Purchase Active Optical Cable Market Report

- Active Optical Cable Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Active Optical Cable Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Active Optical Cable Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Active Optical Cable Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Active Optical Cable market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Active Optical Cable Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/active-optical-cable-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Active Optical Cable market analysis.

- The competitive environment of current and potential participants in the Active Optical Cable market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Active Optical Cable market should find this report useful. The research will be useful to all market participants in the Active Optical Cable industry.

- Managers in the Active Optical Cable sector are interested in publishing up-to-date and projected data about the worldwide Active Optical Cable market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Active Optical Cable products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Active Optical Cable Market Report @ https://www.custommarketinsights.com/report/active-optical-cable-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Active Optical Cable Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/active-optical-cable-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Warren Buffett Sold 56% of Berkshire's Stake in Apple and Is Piling Into Wall Street's Most Prominent Reverse Stock Split of 2024

There’s arguably not a billionaire money manager that garners more attention on Wall Street than Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) chief, Warren Buffett. The accurately dubbed “Oracle of Omaha” has led his company’s Class A shares (BRK.A) to a mouthwatering aggregate return of more than 5,600,000% since he became CEO almost six decades ago.

Riding Buffett’s coattails has been a surefire long-term investment strategy. Mirroring his trades is made simple thanks to required Form 13F filings with the Securities and Exchange Commission (SEC).

No later than 45 calendar days following the end to a quarter, institutional investors with at least $100 million in assets under management are required to file Form 13F with the SEC. This filing provides a concise snapshot of which stocks Wall Street’s best money managers are buying and selling — and there’s no 13F more anticipated each quarter than Berkshire Hathaway.

Over the last two years, Buffett and his team have been decisive net sellers of stocks. Based on the seven quarters of cash flow statements from Berkshire Hathaway (from Oct. 1, 2022 through June 30, 2024), Buffett and his top investing aides, Todd Combs and Ted Weschler, have sold close to $132 billion more in stocks than they’ve purchased.

While no Warren Buffett stock has been given the heave-ho quite like Berkshire’s No. 1 holding, Apple (NASDAQ: AAPL), the Oracle of Omaha is finding value in Wall Street’s most prominent reverse stock split stock of 2024.

Amid Warren Buffett’s selling spree, top holding Apple has been meaningfully reduced. In a three-quarter period from Oct. 1, 2023 through June 30, 2024, Berkshire’s stake in Apple declined by more than 515 million shares, or 56%, to precisely 400 million shares.

Benign profit-taking may very well be the catalyst that enticed Buffett to ring the register. During Berkshire Hathaway’s annual shareholder meeting in early May, he opined that the corporate tax rate would likely climb in the future. With his company sitting on a mammoth unrealized gain in Apple, he suggested that locking in some gains now at a lower tax rate would, eventually, be viewed favorably by Berkshire Hathaway’s shareholders.

To add to this point, Berkshire’s chief has continued to praise Apple’s business, even as he sizably pared down his company’s No. 1 position. He appreciates Apple’s strong branding and the loyalty of its customer base.

Coalesce Recognized as Leader in Snowflake's Modern Marketing Data Stack Report

SAN FRANCISCO, Oct. 22, 2024 (GLOBE NEWSWIRE) — Coalesce, the data transformation company, today announced that it has been recognized as an Integration and Modeling leader in the Modern Marketing Data Stack 2025: How Leading Marketers Are Thriving In a World Redefined By AI, Privacy and Data Gravity executed and launched by Snowflake, the AI Data Cloud company.

The third annual edition of Snowflake’s Modern Marketing Data Stack report identifies the technologies, tools, and platforms used by Snowflake customers to show how marketers and advertisers can leverage the Snowflake AI Data Cloud with accompanying partner solutions to serve existing customers and convert valuable prospects.

Snowflake analyzed usage patterns from a pool of approximately 9,800 customers as of April 2024, and identified 10 technology categories that organizations consider when building their marketing data stacks to capitalize on AI.

The extensive report highlights three core factors throughout the industry that mark a significant departure from the martech ecosystem highlighted in the inaugural report in 2022, creating a new normal where AI, data gravity, and privacy are intertwined.

The report offers details on how this paradigm shift is giving rise to new trends in the marketing landscape, from truly data-empowered marketers to innovative measurement techniques for marketing effectiveness. The categories include:

Marketing and Advertising Tools & Platforms

- Analytics & Data Capture

- Enrichment & Hygiene

- Identity & Onboarding

- Customer Data Platforms

- Marketing & Customer Engagement

- Programmatic Solutions

- Measurement & Optimization

Data Tools & Platforms

- Integration & Modeling

- Consent Management

- Business Intelligence

The report explores each of these categories that comprise the Modern Marketing Data Stack, highlighting AI Data Cloud Product Partners and their solutions as “leaders” or “ones to watch” within each category. The report also details how current Snowflake customers leverage a number of these partner technologies to enable data-driven marketing strategies and informed business decisions. Snowflake’s report provides a concrete overview of the partner technology providers and data providers marketers choose to create their data stacks.

“We’re witnessing a changing of the guard around AI and how marketers capitalize on this massive opportunity as the very shape of the marketing stack evolves, leveraging the Snowflake AI Data Cloud to access and act on data directly where it resides,” said Denise Persson, Chief Marketing Officer at Snowflake. “Coalesce emerged as a leader in the Integration and Modeling Category with joint customers leveraging their platform to build high-quality data products that are accessible for marketing teams, and easily collaborated on with their data experts.”

Coalesce was identified in Snowflake’s report as a leader in the Integration and Modeling Category for enabling joint customers to build data pipelines on Snowflake’s AI Data Cloud that are accessible and scalable for their marketing teams.

“We’re proud that Snowflake has identified Coalesce as a leader in Snowflake’s 2025 Modern Marketing Data Stack report,” said Wade Tibke, CMO at Coalesce. “Instant access to trusted and governed data is critical to the success of marketing teams today. Too often, marketing teams feel slowed down or even bottlenecked by centralized data teams that are busy maintaining data infrastructure and pipelines, and overwhelmed with business requests. Our mission is to empower marketing data practitioners of every ability to build data projects at scale, whether that’s updating existing data pipelines feeding critical marketing dashboards, or building entirely new data projects that drive marketing insights and innovation.”

Click here to read The Modern Marketing Data Stack 2025: How Leading Marketers Are Thriving In a World Redefined By AI, Privacy and Data Gravity.

About Coalesce

Coalesce revolutionizes data transformations to accelerate the delivery of data projects. Recognizing data transformation’s critical role in the analytics lifecycle, we’ve created an inclusive developer platform that automates most SQL coding without sacrificing flexibility. Our platform boosts data team efficiency tenfold, allowing faster data pipeline development while empowering organizations to concentrate on extracting maximum value from their data. Discover more at Coalesce.io.

Media Contact Aleks Todorova Sr. Director, Corp Communications pr@coalesce.io

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.