These Analysts Revise Their Forecasts On Verizon After Q3 Results

Verizon Communications Inc VZ reported mixed fiscal third-quarter results on Tuesday.

Its sales growth was flat year over year, reaching $33.33 billion, marginally missing the analyst consensus estimate of $33.43 billion. Service and other revenue growth was offset by declines in wireless equipment revenue. Adjusted EPS of $1.19 beat the analyst consensus estimate of $1.18.

Postpaid phone net additions were 239,000. Verizon’s retail postpaid net additions were 349,000. The quarter saw 389,000 total broadband net additions. The company ended the quarter with 11.9 million broadband subscribers, up 16.0% year over year.

For FY24, Verizon reiterated a 2.0%–3.5% wireless service revenue growth. It maintained an adjusted EPS of $4.50 – $4.70 versus consensus of $4.57.

Verizon shares gained 1.9% to trade at $42.31 on Wednesday.

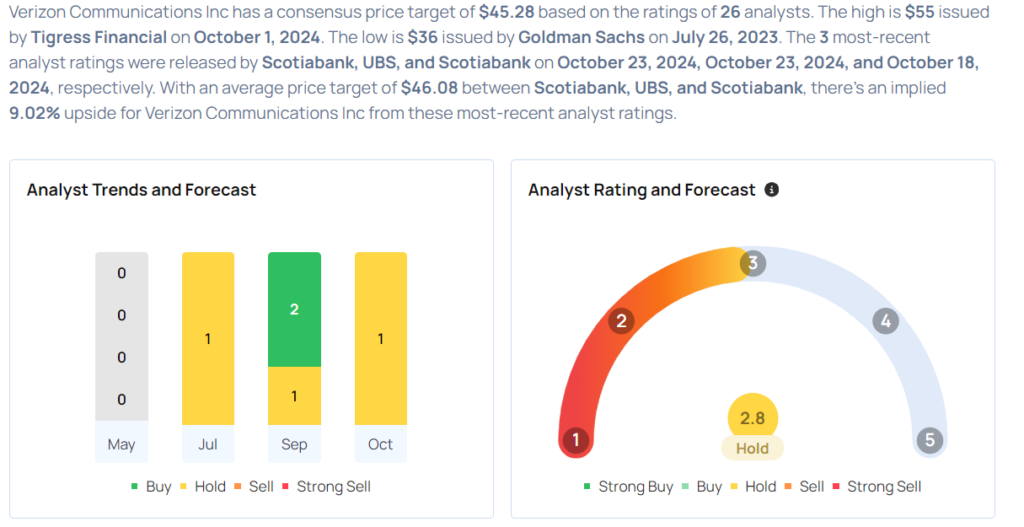

These analysts made changes to their price targets on Verizon following earnings announcement.

- UBS analyst John Hodulik maintained Verizon with a Neutral and raised the price target from $43 to $44.

- Scotiabank analyst Maher Yaghi maintained Verizon Communications with a Sector Perform and lowered the price target from $47.25 to $47.

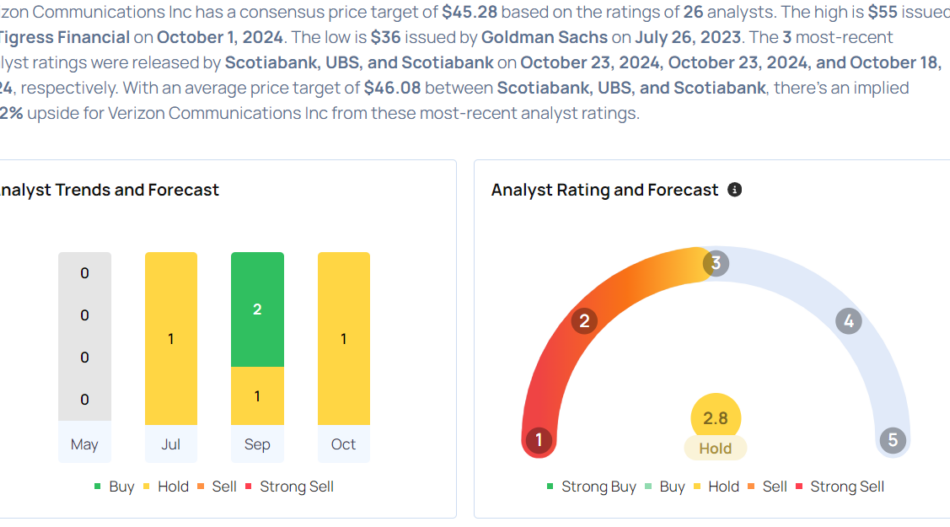

Considering buying VZ stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply