Ribbon Cutting Opens Doors to 63-Unit Affordable Senior Housing Community in Denver

Cushing Terrell celebrates the ribbon cutting of Archdiocesan Housing, Inc. (AHI)/Catholic Charities-funded four-story, income-restricted housing complex for seniors in Denver, Colorado.

DENVER, Oct. 24, 2024 /PRNewswire/ — Multidisciplinary design firm Cushing Terrell, Palace Construction, IMEG Corp., and Terracon Consultants have cut the ribbon for the new Catholic Charities Housing-funded, four-story All Saints senior affordable housing development. Located at the corner of Federal and Vassar streets, the All Saints Apartments bring a much-needed income-restricted housing option for aging adults in Denver.

With developable land growing scarce in the Denver metro area, All Saints represents a growing trend of partnerships between public, private, and nonprofits/faith-based groups, offering a replicable model for future affordable housing developments. All Saints will exclusively serve residents earning below 60% of Area Median Income (AMI), directly addressing growing demand among some of the city’s most vulnerable residents.

“Working toward a Denver where everyone can afford to live means not leaving anyone behind, least of all those who have long called our city home,” said Denver Mayor Mike Johnston. “We’re proud to support projects like All Saints, which ensures seniors have a space that is not only affordable but beautiful and environmentally efficient.”

“This is important work we’re all doing for the people of the city of Denver, and Cushing Terrell is honored to be part of the team making it possible,” said Laura Dougherty, Cushing Terrell Denver Office Director. “It’s exciting to see the ribbon cut on the finished All Saints project, which has been a rewarding five-year partnership, helping to realize Monsignor Peter Quang Nguyen’s vision and meet a big community need.”

Designed for efficiency, affordability, and well-being, the new community maximizes unit count while ensuring individual living spaces retain views and ample daylight. Holistic resident health is further supported through common gathering spaces, counseling rooms, bike storage, and access to public transportation.

Learn more about the site selection and design solutions.

“The industry has been working to partner with local churches, turning unused land into community projects like affordable housing,” said Justin Raddatz, Vice President of Development for Catholic Charities Housing. ”The need for senior housing in Denver is critical, and the Archdiocese, Church of All Saints, and the City of Denver came together to make this a reality. With the help of Cushing Terrell and Palace Construction, this project shows what can be accomplished when public, private, and faith-based groups collaborate, and we hope it’s the first of many.”

“We’re delighted to be a part of another successful endeavor with Archdiocese Housing,” said Garth Geer, President of Palace Construction. ”The project is a great success, and I could not ask for a better team dynamic. The opportunities and services facilitated by All Saints are so important, and Palace is honored to do our part to provide safe and comfortable homes for residents.”

The project team is pursuing sustainable certification through the National Green Building Standard at the bronze level, which addresses energy, water, and resource efficiency as well as operations and quality of indoor environmental factors such as access to views and daylight, operable windows, and healthy materials.

The development includes 63 studio and one-bedroom, age- and income-restricted affordable apartments and dedicated spaces for supportive and community programming.

About Cushing Terrell

Cushing Terrell was founded in 1938 on the belief that integrating architecture, engineering, and design opens the doors for deepened relationships and enhanced creativity. This foundation continues to define the firm and its multidisciplinary team today. With 17 offices across the United States and services spanning 30 disciplines, the team works collaboratively to design systems and spaces that help people live their best lives and enjoy healthy, sustainable built environments. Learn more at cushingterrell.com.

About Catholic Charities of the Archdiocese of Denver

Catholic Charities of Denver shelters, feeds, houses, educates, counsels, and provides emergency assistance and critical services to tens of thousands of neighbors across Northern Colorado each year. As the charitable arm of the Archdiocese of Denver, Catholic Charities — in partnership with volunteers, churches, nonprofit organizations, government agencies, medical facilities, and educational institutions — provides life-changing support to Coloradans. The list of what Catholic Charities does is remarkably diverse: Samaritan House, Marisol Services, Catholic Charities Housing, Early Childhood Education, Immigration, St. Raphael Counseling, Emergency, Victim’s and Food Assistance, Kinship and Senior Services and regional work in Northern Colorado and on the Western Slope. For more than 95 years, Catholic Charities has supported neighbors and transformed lives, and we look forward to serving our community into our second century and beyond.

About Palace Construction

Palace Construction Co, Inc. strives to be the most valued construction and restoration services partner by approaching each task with the mission of exceeding expectations and providing exceptional services to our clients, coworkers, and community. Since 1963 — and following in the footsteps of our founder’s motto to always “Do the Right Thing” — we carry on our sustaining mission and live by our tagline “Building Better Lives.” We honor our values of being professional, accountable, loyal, adaptable, consistent, and exceptional and understand that these values apply to how we interact with ourselves, our staff, our clients, our trade partners, and our community.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ribbon-cutting-opens-doors-to-63-unit-affordable-senior-housing-community-in-denver-302286624.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ribbon-cutting-opens-doors-to-63-unit-affordable-senior-housing-community-in-denver-302286624.html

SOURCE Cushing Terrell

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brian C Judkins At Chemed Exercises Options

Brian C Judkins, VP and Chief Legal Officer at Chemed CHE, reported a large exercise of company stock options on October 23, according to a new SEC filing.

What Happened: Judkins, VP and Chief Legal Officer at Chemed, made a strategic move by exercising stock options for 0 shares of CHE as detailed in a Form 4 filing on Wednesday with the U.S. Securities and Exchange Commission. The transaction value amounted to $0.

The latest update on Thursday morning shows Chemed shares down by 0.0%, trading at $593.15. At this price, Judkins’s 0 shares are worth $0.

All You Need to Know About Chemed

Chemed Corp operates subsidiaries in two main segments: VITAS and Roto-Rooter. The VITAS segment generates the majority of the firm’s revenue. It provides hospice and palliative care services to patients with terminal illnesses through a network of physicians, registered nurses, home health aides, social workers, and volunteers. The vast majority of the segment’s revenue is received from the Medicare and Medicaid reimbursement programs. The Roto-Rooter segment provides plumbing, drain cleaning, water restoration, and related services to residential and commercial customers. Chemed generates the majority of its revenue from business in the United States.

Chemed: Financial Performance Dissected

Revenue Growth: Chemed displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 7.6%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 34.59%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Chemed’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 4.7.

Debt Management: Chemed’s debt-to-equity ratio is below the industry average at 0.12, reflecting a lower dependency on debt financing and a more conservative financial approach.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 30.06 is lower than the industry average, implying a discounted valuation for Chemed’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 3.88 is above industry norms, reflecting an elevated valuation for Chemed’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 19.54, Chemed could be considered undervalued.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Chemed’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Forget Nvidia and Buy These 2 Millionaire-Maker Stocks Instead?

Some stocks can give you life-changing returns in the long run.

If you had invested $3,500 in Apple (NASDAQ: AAPL) 20 years ago, you’d have a total return of $1.1 million by now. The rise of smartphones worked wonders for the empire Steve Jobs created.

The same $3,500 investment in October 2004 would be worth $1.9 million today if you had picked up some Netflix (NASDAQ: NFLX) stock instead. The serial innovator dominated video stores like Blockbuster into bankruptcy, then switched gears to deliver even richer gains with video-streaming services.

And a $3,500 investment in Nvidia (NASDAQ: NVDA) would work out to a $4.7 million return in 20 years. The designer of graphics processing units (GPUs) and other number-crunching microchips caught fire in November 2022, earnings a 1,050% return in the last two years alone. Wall Street absolutely loves Nvidia’s leading role in the market for artificial intelligence (AI) processing hardware.

Those big gains already happened, though. I can’t go back in time and catch them again. This trio of proven millionaire-makers is still rising to new highs, but they probably won’t multiply many times over from this lofty plateau. It gets harder and harder to unleash big percentage gains from a massive market cap.

So Netflix, Apple, and Nvidia may be solid stocks if you’re looking for stable and robust long-term returns, and I own two of them with that mentality. However, they don’t seem likely to deliver game-changing growth again.

Tomorrow’s potential millionaire-makers may be small today, but they’re staring down a long runway of future growth and innovation. Many of today’s top growth stocks will fizzle and fail, but getting in on just one of these early stage opportunities can make you forget about the misses.

On that note, I can’t stop buying stock in Roku (NASDAQ: ROKU) and Duolingo (NASDAQ: DUOL). These modest mid-cap stocks have truly wealth-building growth potential. I can’t promise millionaire-making returns, but Roku and Duolingo are two of my best bets in this category.

Duolingo is already on a roll. The language-learning expert has posted a 242% stock return in the last two years. Trailing twelve-month sales rose 87% over the same period while free cash flows (FCF) soared 553% higher. In other words, this little company is experiencing high-octane growth today and market makers are paying attention.

So Duolingo’s stock isn’t cheap. These shares are valued at 55 times FCF and 203 times earnings — lofty multiples even for a terrific growth stock.

Analyst Report: Las Vegas Sands Corp

Analyst Profile

John D. Staszak, CFA

Securities Analyst: Consumer Discretionary & Consumer Staples

John’s specialty at Argus includes the gaming, lodging and restaurant groups within the Consumer Discretionary sector. John earned an MBA from the University of Texas and a BA in Economics from the University of Pennsylvania. In the financial services industry, he has worked as an analyst and consultant for firms including Standard & Poor’s, the Bank of New York, Harris Nesbitt Gerard and Merrill Lynch. John is a CFA charterholder. Forbes magazine named John as the second-best stock picker among restaurant analysts in 2006. He was also ranked the second-best analyst covering the restaurant sector by the Wall Street Journal in 2007, a year in which a Financial Times/StarMine survey also ranked John that same way. In 2008, the Journal again listed John as an award winner, with a third-best designation among hotel industry analysts and a fifth-best designation among restaurant analysts.

PVpallet Launches Crowdfunding Campaign on StartEngine to Drive Sustainable Innovation

Montrose, IA October 24, 2024 –(PR.com)– Supporting Sustainable Packaging in Solar

With a mission to replace traditional single-use packaging with reusable alternatives, PVpallet invites individuals to join its efforts in promoting a circular economy in the solar industry.

“We are committed to addressing the critical issue of packaging waste in the solar industry,” said Philip Schwarz, CEO and Co-founder of PVpallet. “Our crowdfunding campaign is an opportunity for supporters of sustainability to learn more about our mission and contribute to a greener future.”

Transitioning from Education to Action

Since its last crowdfunding campaign, PVpallet has educated the industry on the impact of packaging waste and introduced a range of products, including its flagship PVpallet Series X. Now, the company is entering a new phase of growth, focused on expanding its product line and enhancing the circularity of solar supply chains.

“Our journey from raising awareness to actively reducing waste has been incredibly rewarding, and this equity crowdfunding campaign represents the next step in our growth,” added Schwarz. “We’re excited to focus on scaling our solutions to better serve the solar industry’s evolving needs.”

About PVpallet

PVpallet is dedicated to reducing waste in the solar industry by providing innovative and sustainable packaging solutions. The company is committed to supporting the responsible growth of the solar sector while promoting a greener future.

For more information, please visit our StartEngine campaign page: https://www.startengine.com/offering/pvpallet

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

Contact Information:

PVpallet.com

Vanessa Benkert

877-787-2553

Contact via Email

pvpallet.com

Read the full story here: https://www.pr.com/press-release/923832

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stoic Equity Partners Announces Latest Acquisition in Arkansas

Daphne, Ala.-based commercial real estate investment group announces the acquisition of a flex industrial complex on Old Wire Road in Springdale, AR.

DAPHNE, Ala., Oct. 24, 2024 /PRNewswire/ — Stoic Equity Partners announced its most recent acquisition of a flex industrial property in Springdale, AR. This is the firm’s fourth asset in the state of Arkansas and first in the NW Arkansas market. The industrial complex, located at 444 Old Wire Rd., is a 94,589-square-foot multi-tenant facility that includes nine buildings comprised of 20 suites.

“We began targeting the NW Arkansas market earlier this year, so we are excited to get this property closed,” said Grant Reaves, Co-Founder and Managing Director of Stoic Equity Partners. “The Old Wire property has a great layout and has been very well maintained, making it a great location for its tenants. The NW Arkansas market is currently expanding at a pace I have not witnessed in some time. The growth around not just Walmart but other large companies headquartered in the area, coupled with the great lifestyle of its residents shall continue to push the market higher in the coming years.”

With this latest acquisition, Stoic Equity Partners continues to broaden its footprint in the Southeast, now owning over 1.1MM SF of commercial space across six states in the Southeast. The firm remains focused on identifying and capitalizing on high-potential investment opportunities within the flex industrial sector.

About Stoic Equity Partners

Stoic Equity Partners is a Daphne, Ala.-based commercial real estate investment firm dedicated to value-added and opportunistic commercial real estate acquisitions and developments throughout the Southeast. Co-founders Jeremy Friedman and Grant Reaves leverage their extensive experience as commercial real estate brokers to manage and sponsor strategic investments.

For more information about Stoic Equity Partners and its approach to real estate investment, please visit stoicEP.com.

Media Contact

Jeremy Friedman

Co-founder and CEO, Stoic Equity Partners

Phone: 251-747-9111

Email: 385348@email4pr.com

Address

2210 Main Street, Ste H

Daphne, AL 36526

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/stoic-equity-partners-announces-latest-acquisition-in-arkansas-302285372.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/stoic-equity-partners-announces-latest-acquisition-in-arkansas-302285372.html

SOURCE Stoic Equity Partners

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cancer Awareness: Why Putting Yourself First Isn't Selfish – It's Life-Saving And How This Weed Brand Is Supporting Survivors

Have you ever skipped an appointment because you were too busy? Because you felt guilty about taking time for yourself? Breast Cancer Awareness Month (BCAM) is a global campaign supported by numerous organizations, including the United Nations, observed annually in October that aims to increase awareness about the disease and promote early detection through screenings.

Breast cancer remains the most common cancer in women worldwide, with millions of new cases every year, it’s the leading cause of cancer deaths among women globally.

However, many of these deaths could be prevented through early detection and treatment. Early-stage breast cancer has a 5-year survival rate of 99%, while this number drops significantly for later-stage diagnoses, underscoring the life-saving power of regular check-ups.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Preventable Deaths

The World Health Organization (WHO) states that early detection and timely treatment are crucial in reducing breast cancer mortality, with survival rates significantly improving in early-stage diagnoses. Access to mammograms and appropriate treatment can increase survival rates by up to 90%. However, socioeconomic barriers often lead women to delay or avoid check-ups.

The Taboo Of Check-Ups

Despite the importance of regular check-ups, many people avoid them due to societal pressures and taboos. In some cultures, discussing health concerns like breast exams can be uncomfortable, and individuals often deprioritize their health in favor of responsibilities like family care or work-life balance.

Why This Is A Gender Issue

Gender inequality plays a role in healthcare costs, as women often face financial barriers due to lower incomes and caregiving responsibilities. In 2020, cancer care in the U.S. cost $183 billion, with breast cancer being a major contributor. These financial challenges disproportionately impact women, making timely access to care more difficult.

Read Also: As Cannabis Use Grows Among Cancer Patients, Federal Agency Highlights Need For Rescheduling

Why Check-Ups Matter

Early detection through routine check-ups can save lives, yet the fear of receiving bad news, time constraints and societal expectations can delay those vital screenings. Health often takes a backseat due to the pressures of daily life—whether it’s balancing work, caregiving, or other responsibilities. It’s essential to recognize that prioritizing one’s health is not selfish – it’s necessary.

To ensure early detection of breast cancer, it’s important to consult your healthcare provider for personalized advice and follow general guidelines from trusted organizations such as the American Cancer Society and WHO. Regular clinical breast exams are essential and monthly self-exams can help detect lumps, skin changes, or other unusual symptoms.

Her Highness’ BOOBYLICIOUS

Her Highness, a women’s cannabis lifestyle brand, is donating 20% of proceeds from its limited-edition BOOBYLICIOUS cannabis-infused pre-rolls to support post-mastectomy reconstruction through My Hope Chest, an organization that provides reconstructive surgery for breast cancer survivors without financial means.

Co-founder Allison Krongard, a breast cancer survivor, says she hopes the initiative will offer healing and support to women on their journey.

This initiative serves as a reminder that taking care of health should be a priority, and supporting causes like BOOBYLICIOUS highlights the importance of healthcare equity and early detection. BOOBYLICIOUS is available at select NY dispensaries.

Read Also: Cannabinoids Show Promising Anti-Cancer Potential Yet Mechanisms Remain Unclear, New Study

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alphabet Q3 Earnings Won't Be Catalyst Google Investors Are Hoping For, But Stock Still An 'Attractive' Buy, Analyst Says

Wedbush analyst Scott Devitt has reiterated an Outperform rating and $205 price target on Alphabet Inc. GOOG ahead of earnings on Oct. 29. Here’s what you need to know.

What To Know: The Wedbush analyst released a new note on Wednesday calling Alphabet an “above average company” with a “below average multiple.”

While Alphabet’s advertising growth estimates for the quarter should be achievable, the potential for significant upside is limited, Devitt said. He pointed to mixed feedback from Wedbush’s third-quarter Digital Advertising Survey and recent data from Skai that showed a slowdown in Google Search growth.

Additionally, competitive pressure from Amazon.com Inc’s AMZN Prime Video ads and increased digital video ad inventory could weigh on YouTube’s performance, the analyst said. Devitt expects both Google Search and YouTube Ads to grow by 11.5% year-over-year, though YouTube’s growth may slightly miss consensus estimates, he said.

“Sentiment is mixed for Alphabet relative to mega cap internet peers as investors continue to weigh potential regulatory headwinds and the risk of generative AI to the search business,” the analyst said.

See Also: Hong Kong Bans WhatsApp And Google Drive On Civil Servants’ Work Computers Citing Security Concerns

Devitt also highlighted regulatory risks surrounding Alphabet, particularly the ongoing Justice Department case related to search. He said any major business model impact from these cases is likely years away, but noted that key dates are approaching.

While these challenges create headline risk, the components of Google’s adtech business under scrutiny represent less than 8% of gross revenue and just 2% of operating profit, Devitt said.

Despite these risks, Devitt remains optimistic about Alphabet’s transition to generative AI in search, which has shown promising user engagement. He believes this shift will create new monetization opportunities over time. With Alphabet trading at a valuation below the S&P 500 and its mega-cap peers, Devitt reiterated an Outperform rating heading into earnings next week.

“While we don’t view the upcoming quarterly report as a likely catalyst for Alphabet, we do think shares are attractive at current levels with shares trading below the market multiple,” the Wedbush analyst said.

GOOG Price Action: Alphabet shares were up 0.12% at $164.66 at the time of writing Thursday, according to Benzinga Pro.

Read Next

Photo: Pixie Me via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of Sensient Technologies's Earnings

Sensient Technologies SXT is gearing up to announce its quarterly earnings on Friday, 2024-10-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Sensient Technologies will report an earnings per share (EPS) of $0.80.

Sensient Technologies bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

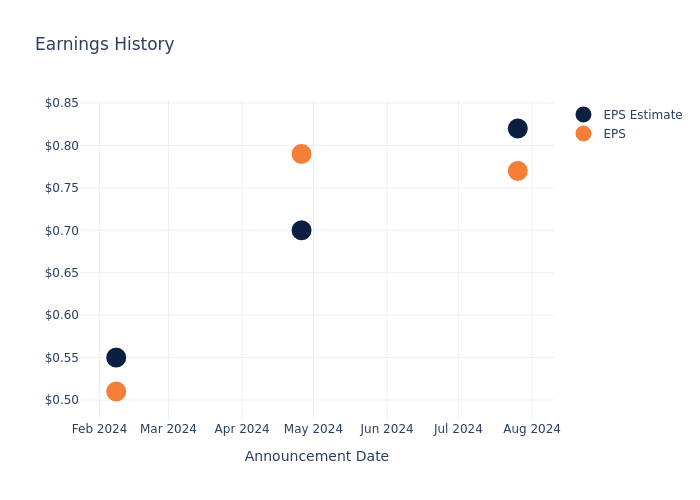

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.05, leading to a 0.0% drop in the share price the following trading session.

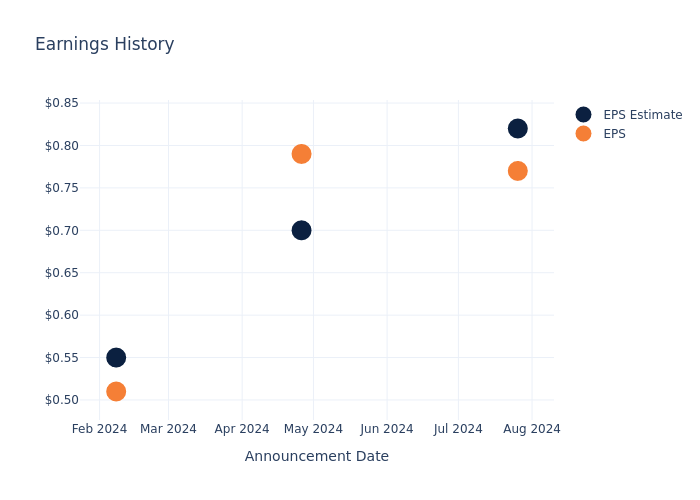

Here’s a look at Sensient Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.82 | 0.70 | 0.55 | 0.75 |

| EPS Actual | 0.77 | 0.79 | 0.51 | 0.75 |

| Price Change % | -5.0% | 1.0% | -4.0% | 2.0% |

Performance of Sensient Technologies Shares

Shares of Sensient Technologies were trading at $77.09 as of October 23. Over the last 52-week period, shares are up 37.79%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Sensient Technologies

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Sensient Technologies.

With 1 analyst ratings, Sensient Technologies has a consensus rating of Outperform. The average one-year price target is $85.0, indicating a potential 10.26% upside.

Analyzing Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Quaker Houghton, Ashland and Avient, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- For Quaker Houghton, analysts project an Buy trajectory, with an average 1-year price target of $192.5, indicating a potential 149.71% upside.

- Ashland is maintaining an Neutral status according to analysts, with an average 1-year price target of $97.0, indicating a potential 25.83% upside.

- Avient received a Outperform consensus from analysts, with an average 1-year price target of $55.0, implying a potential 28.65% downside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Quaker Houghton, Ashland and Avient are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Sensient Technologies | Outperform | 7.80% | $130.72M | 2.92% |

| Quaker Houghton | Buy | -6.43% | $175.72M | 2.50% |

| Ashland | Neutral | -0.37% | $186M | 0.20% |

| Avient | Outperform | 3.07% | $257.60M | 1.45% |

Key Takeaway:

Sensient Technologies ranks first in Revenue Growth among its peers. It also leads in Gross Profit margin. However, it ranks second in Consensus rating and third in Return on Equity.

Discovering Sensient Technologies: A Closer Look

Sensient Technologies Corp manufactures and markets natural and synthetic colors, flavors, and other specialty ingredients. The company has a widespread network of facilities around the globe, and its customers operate across a variety of end markets. Sensient’s offerings are predominantly applied to consumer-facing products, including food and beverage, cosmetics and pharmaceuticals, nutraceuticals, and personal care industries. The company’s principal products are flavors, flavor enhancers, ingredients, extracts, and bionutrients, essential oils, dehydrated vegetables and other food ingredients, natural and synthetic food and beverage colors, and others. The company’s three reportable segments were the Flavors & Extracts Group, the Color Group, and the Asia Pacific Group.

Sensient Technologies: A Financial Overview

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Sensient Technologies’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.8% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Sensient Technologies’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 7.67%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Sensient Technologies’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.92%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.55%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.63, Sensient Technologies adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Sensient Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Intellia Therapeutics's Options Market Dynamics

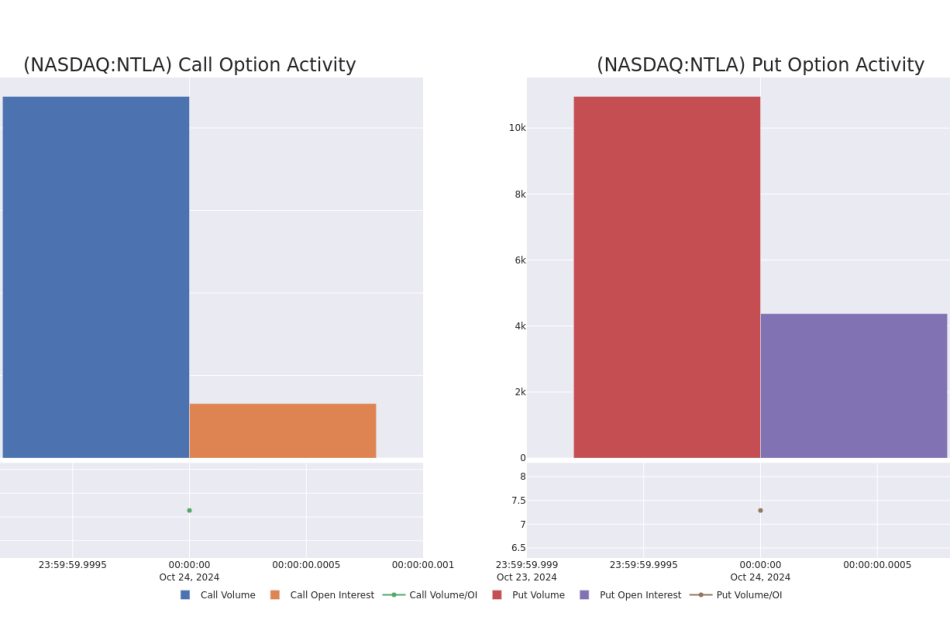

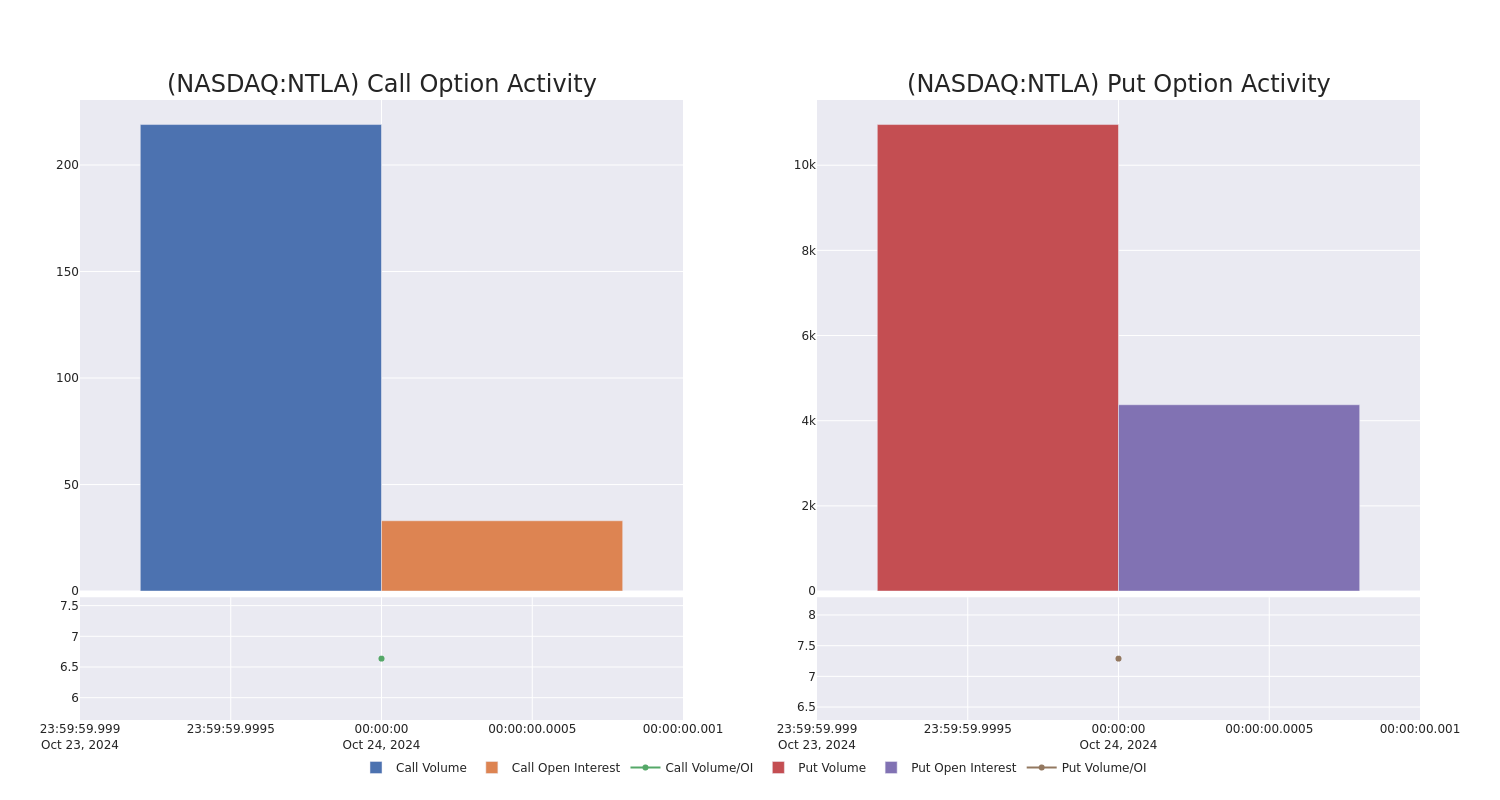

Investors with a lot of money to spend have taken a bearish stance on Intellia Therapeutics NTLA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with NTLA, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 19 options trades for Intellia Therapeutics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 0% bullish and 89%, bearish.

Out of all of the options we uncovered, 18 are puts, for a total amount of $944,718, and there was 1 call, for a total amount of $25,000.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.5 to $20.0 for Intellia Therapeutics over the recent three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Intellia Therapeutics’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intellia Therapeutics’s whale trades within a strike price range from $17.5 to $20.0 in the last 30 days.

Intellia Therapeutics Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NTLA | PUT | TRADE | BEARISH | 11/15/24 | $4.7 | $3.7 | $4.4 | $20.00 | $132.0K | 1.1K | 340 |

| NTLA | PUT | TRADE | BEARISH | 01/17/25 | $3.7 | $3.4 | $3.65 | $17.50 | $73.0K | 1.8K | 1.3K |

| NTLA | PUT | SWEEP | NEUTRAL | 01/17/25 | $3.7 | $3.6 | $3.65 | $17.50 | $73.0K | 1.8K | 805 |

| NTLA | PUT | SWEEP | BEARISH | 01/17/25 | $3.6 | $3.4 | $3.6 | $17.50 | $72.0K | 1.8K | 505 |

| NTLA | PUT | SWEEP | BEARISH | 01/17/25 | $5.3 | $5.0 | $5.3 | $20.00 | $53.0K | 1.3K | 753 |

About Intellia Therapeutics

Intellia Therapeutics is a gene editing company focused on the development of Crispr/Cas9-based therapeutics. Crispr/Cas9 stands for Clustered Regularly Interspaced Short Palindromic Repeats (Crispr)/Crispr-associated protein 9 (Cas9), which is a revolutionary technology for precisely altering specific sequences of genomic DNA. Intellia is focused on using this technology to treat genetically defined diseases. It’s evaluating multiple gene editing approaches using in vivo and ex vivo therapies to address diseases with high unmet medical needs, including ATTR amyloidosis, hereditary angioedema, sickle cell disease, and immuno-oncology. Intellia has formed collaborations with several companies to advance its pipeline, including narrow-moat Regeneron and wide-moat Novartis.

In light of the recent options history for Intellia Therapeutics, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Intellia Therapeutics

- With a trading volume of 7,786,070, the price of NTLA is down by -12.24%, reaching $17.5.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 14 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intellia Therapeutics, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.