A Closer Look at DexCom's Options Market Dynamics

Financial giants have made a conspicuous bearish move on DexCom. Our analysis of options history for DexCom DXCM revealed 33 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $858,857, and 22 were calls, valued at $1,105,260.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $100.0 for DexCom during the past quarter.

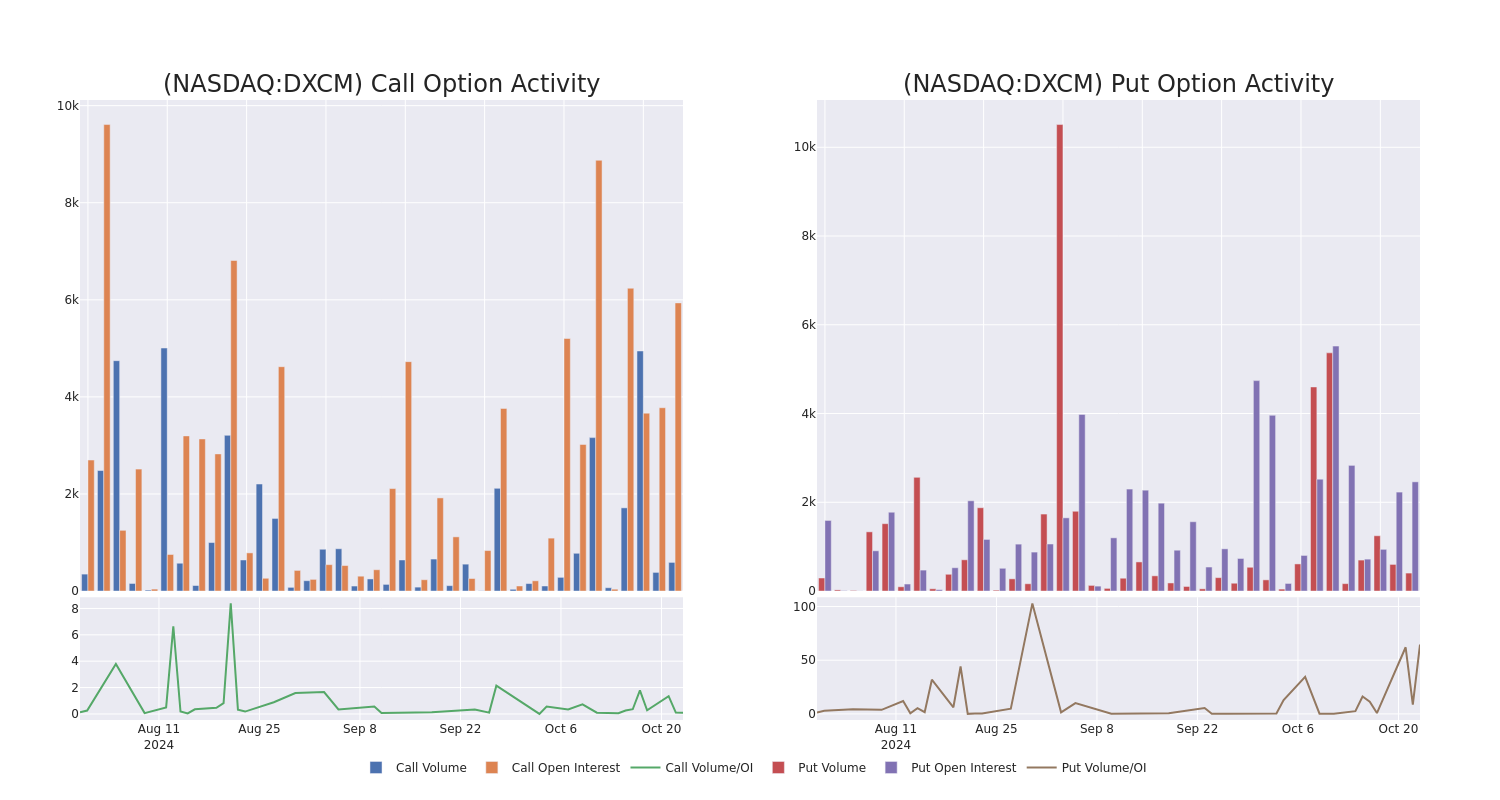

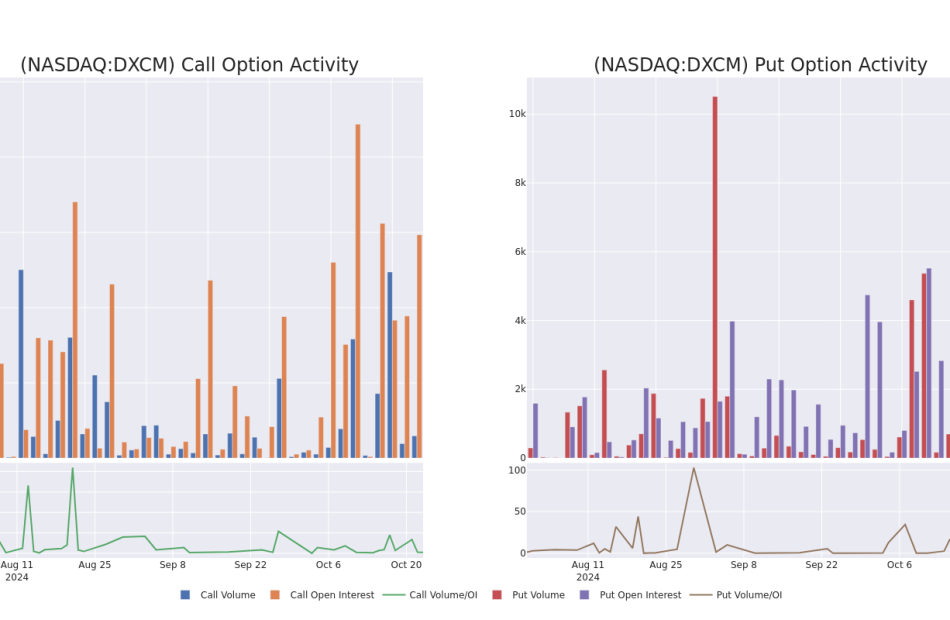

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for DexCom’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DexCom’s whale trades within a strike price range from $65.0 to $100.0 in the last 30 days.

DexCom Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | PUT | TRADE | NEUTRAL | 01/16/26 | $10.2 | $9.6 | $9.9 | $65.00 | $297.0K | 155 | 300 |

| DXCM | PUT | SWEEP | BEARISH | 06/20/25 | $28.0 | $27.8 | $28.0 | $100.00 | $162.4K | 1.0K | 58 |

| DXCM | CALL | SWEEP | BEARISH | 11/01/24 | $4.9 | $4.7 | $4.7 | $74.00 | $109.0K | 996 | 480 |

| DXCM | CALL | SWEEP | BEARISH | 01/16/26 | $14.0 | $13.5 | $13.5 | $85.00 | $108.0K | 53 | 80 |

| DXCM | PUT | SWEEP | BEARISH | 09/19/25 | $18.9 | $18.8 | $18.8 | $85.00 | $81.2K | 0 | 44 |

About DexCom

Dexcom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

After a thorough review of the options trading surrounding DexCom, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is DexCom Standing Right Now?

- Currently trading with a volume of 3,281,825, the DXCM’s price is up by 2.46%, now at $74.26.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

Professional Analyst Ratings for DexCom

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $120.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on DexCom with a target price of $120.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DexCom with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply