A Closer Look at Intellia Therapeutics's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Intellia Therapeutics NTLA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with NTLA, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 19 options trades for Intellia Therapeutics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 0% bullish and 89%, bearish.

Out of all of the options we uncovered, 18 are puts, for a total amount of $944,718, and there was 1 call, for a total amount of $25,000.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.5 to $20.0 for Intellia Therapeutics over the recent three months.

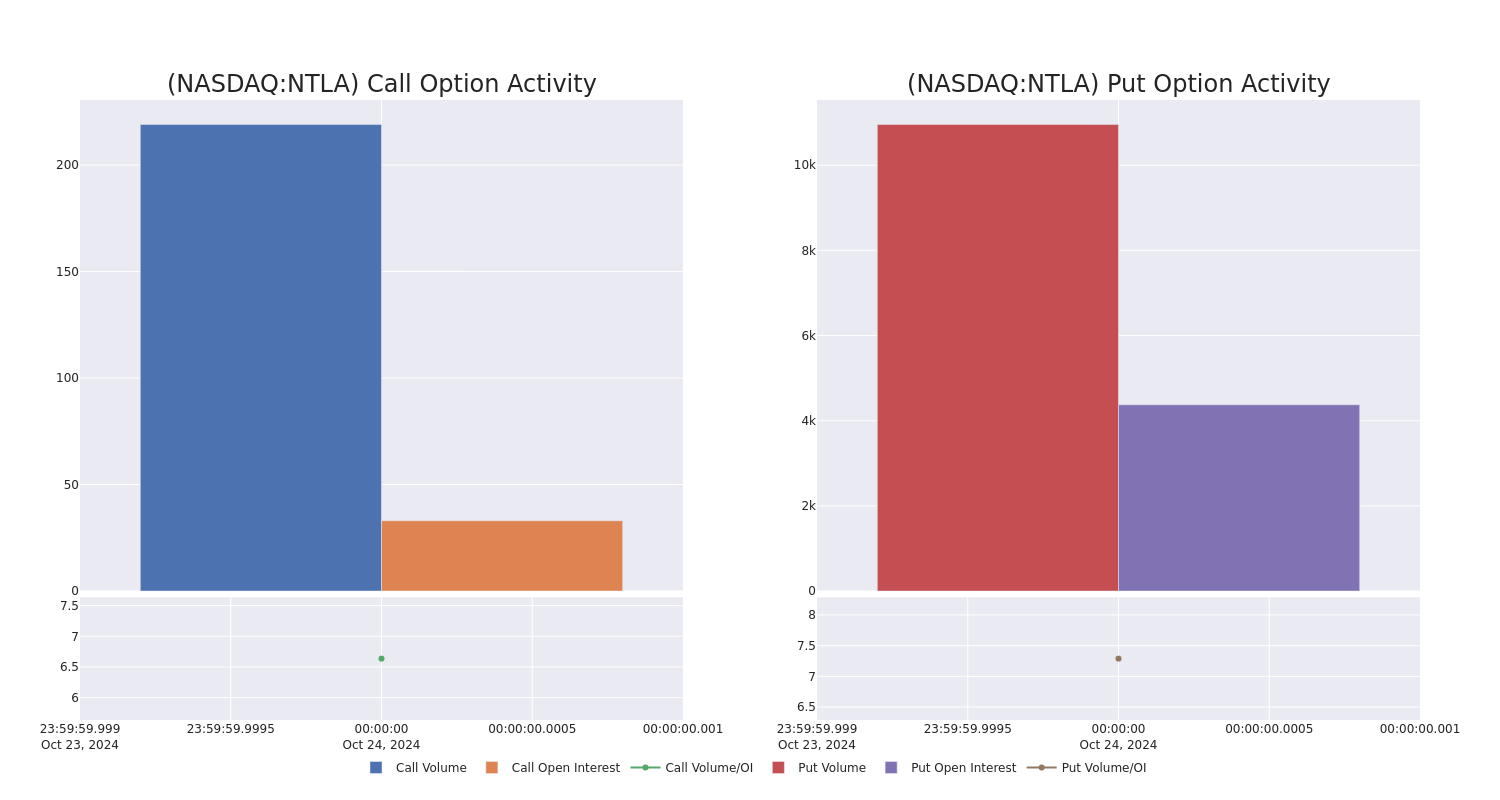

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Intellia Therapeutics’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intellia Therapeutics’s whale trades within a strike price range from $17.5 to $20.0 in the last 30 days.

Intellia Therapeutics Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NTLA | PUT | TRADE | BEARISH | 11/15/24 | $4.7 | $3.7 | $4.4 | $20.00 | $132.0K | 1.1K | 340 |

| NTLA | PUT | TRADE | BEARISH | 01/17/25 | $3.7 | $3.4 | $3.65 | $17.50 | $73.0K | 1.8K | 1.3K |

| NTLA | PUT | SWEEP | NEUTRAL | 01/17/25 | $3.7 | $3.6 | $3.65 | $17.50 | $73.0K | 1.8K | 805 |

| NTLA | PUT | SWEEP | BEARISH | 01/17/25 | $3.6 | $3.4 | $3.6 | $17.50 | $72.0K | 1.8K | 505 |

| NTLA | PUT | SWEEP | BEARISH | 01/17/25 | $5.3 | $5.0 | $5.3 | $20.00 | $53.0K | 1.3K | 753 |

About Intellia Therapeutics

Intellia Therapeutics is a gene editing company focused on the development of Crispr/Cas9-based therapeutics. Crispr/Cas9 stands for Clustered Regularly Interspaced Short Palindromic Repeats (Crispr)/Crispr-associated protein 9 (Cas9), which is a revolutionary technology for precisely altering specific sequences of genomic DNA. Intellia is focused on using this technology to treat genetically defined diseases. It’s evaluating multiple gene editing approaches using in vivo and ex vivo therapies to address diseases with high unmet medical needs, including ATTR amyloidosis, hereditary angioedema, sickle cell disease, and immuno-oncology. Intellia has formed collaborations with several companies to advance its pipeline, including narrow-moat Regeneron and wide-moat Novartis.

In light of the recent options history for Intellia Therapeutics, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Intellia Therapeutics

- With a trading volume of 7,786,070, the price of NTLA is down by -12.24%, reaching $17.5.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 14 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intellia Therapeutics, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply