An Overview of Sensient Technologies's Earnings

Sensient Technologies SXT is gearing up to announce its quarterly earnings on Friday, 2024-10-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Sensient Technologies will report an earnings per share (EPS) of $0.80.

Sensient Technologies bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

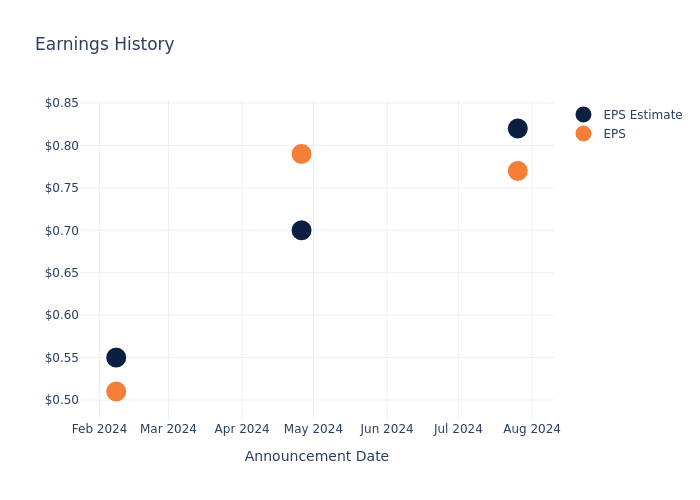

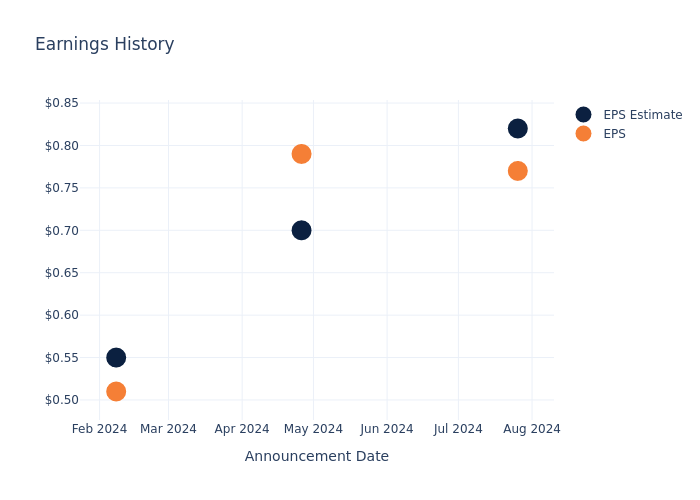

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.05, leading to a 0.0% drop in the share price the following trading session.

Here’s a look at Sensient Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.82 | 0.70 | 0.55 | 0.75 |

| EPS Actual | 0.77 | 0.79 | 0.51 | 0.75 |

| Price Change % | -5.0% | 1.0% | -4.0% | 2.0% |

Performance of Sensient Technologies Shares

Shares of Sensient Technologies were trading at $77.09 as of October 23. Over the last 52-week period, shares are up 37.79%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Sensient Technologies

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Sensient Technologies.

With 1 analyst ratings, Sensient Technologies has a consensus rating of Outperform. The average one-year price target is $85.0, indicating a potential 10.26% upside.

Analyzing Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Quaker Houghton, Ashland and Avient, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- For Quaker Houghton, analysts project an Buy trajectory, with an average 1-year price target of $192.5, indicating a potential 149.71% upside.

- Ashland is maintaining an Neutral status according to analysts, with an average 1-year price target of $97.0, indicating a potential 25.83% upside.

- Avient received a Outperform consensus from analysts, with an average 1-year price target of $55.0, implying a potential 28.65% downside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Quaker Houghton, Ashland and Avient are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Sensient Technologies | Outperform | 7.80% | $130.72M | 2.92% |

| Quaker Houghton | Buy | -6.43% | $175.72M | 2.50% |

| Ashland | Neutral | -0.37% | $186M | 0.20% |

| Avient | Outperform | 3.07% | $257.60M | 1.45% |

Key Takeaway:

Sensient Technologies ranks first in Revenue Growth among its peers. It also leads in Gross Profit margin. However, it ranks second in Consensus rating and third in Return on Equity.

Discovering Sensient Technologies: A Closer Look

Sensient Technologies Corp manufactures and markets natural and synthetic colors, flavors, and other specialty ingredients. The company has a widespread network of facilities around the globe, and its customers operate across a variety of end markets. Sensient’s offerings are predominantly applied to consumer-facing products, including food and beverage, cosmetics and pharmaceuticals, nutraceuticals, and personal care industries. The company’s principal products are flavors, flavor enhancers, ingredients, extracts, and bionutrients, essential oils, dehydrated vegetables and other food ingredients, natural and synthetic food and beverage colors, and others. The company’s three reportable segments were the Flavors & Extracts Group, the Color Group, and the Asia Pacific Group.

Sensient Technologies: A Financial Overview

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Sensient Technologies’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.8% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Sensient Technologies’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 7.67%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Sensient Technologies’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.92%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.55%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.63, Sensient Technologies adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Sensient Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply