Decoding Lululemon Athletica's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bearish stance on Lululemon Athletica.

Looking at options history for Lululemon Athletica LULU we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 48% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $932,722 and 16, calls, for a total amount of $822,020.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $320.0 for Lululemon Athletica during the past quarter.

Insights into Volume & Open Interest

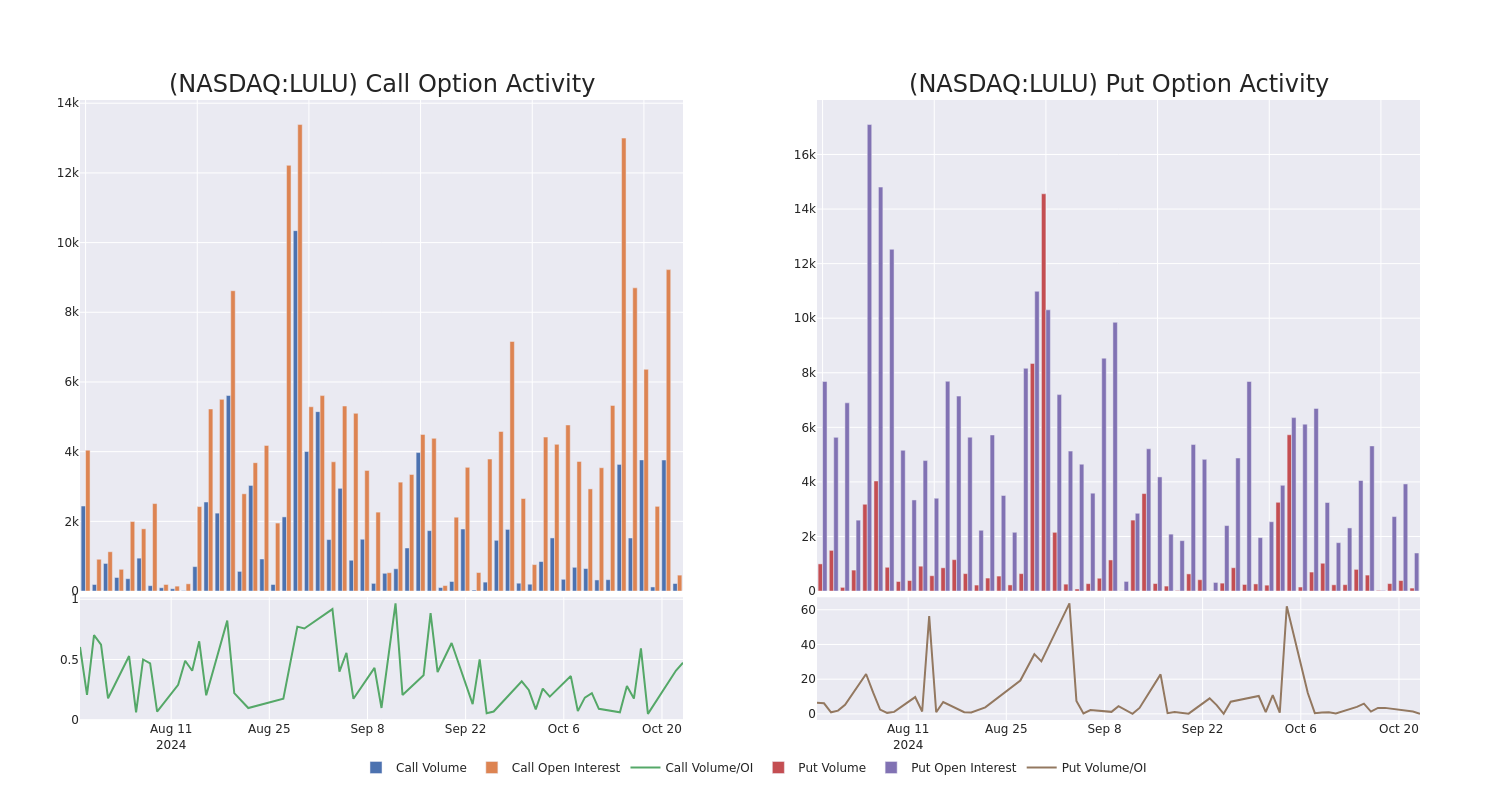

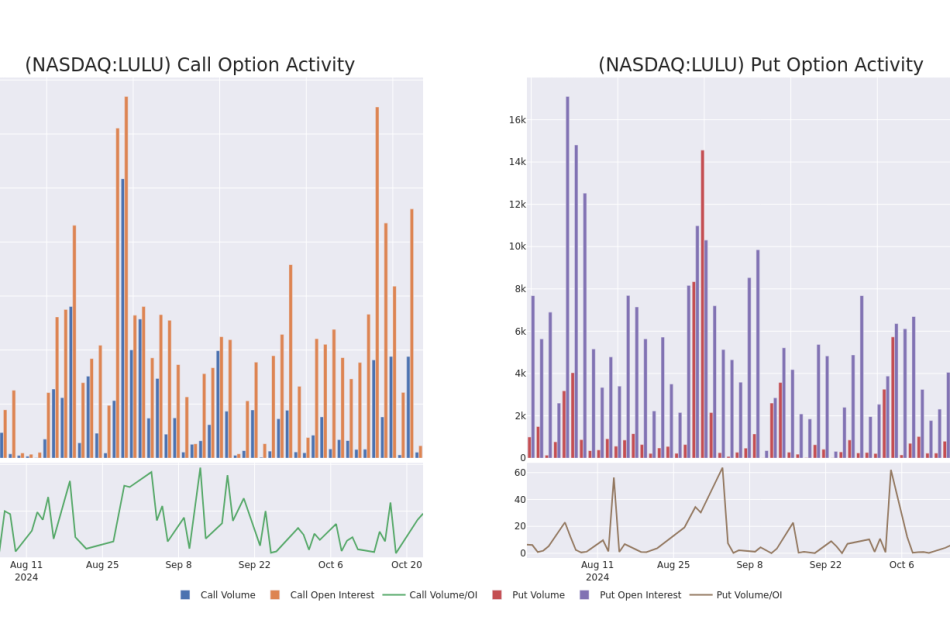

In today’s trading context, the average open interest for options of Lululemon Athletica stands at 433.8, with a total volume reaching 1,923.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lululemon Athletica, situated within the strike price corridor from $135.0 to $320.0, throughout the last 30 days.

Lululemon Athletica Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | PUT | SWEEP | BEARISH | 09/19/25 | $43.1 | $43.05 | $43.05 | $300.00 | $275.8K | 64 | 122 |

| LULU | PUT | SWEEP | BEARISH | 09/19/25 | $43.1 | $42.25 | $43.1 | $300.00 | $193.9K | 64 | 58 |

| LULU | PUT | TRADE | BULLISH | 11/29/24 | $21.6 | $20.75 | $20.8 | $310.00 | $135.2K | 0 | 130 |

| LULU | PUT | SWEEP | BULLISH | 11/29/24 | $20.8 | $19.95 | $20.8 | $310.00 | $135.2K | 0 | 65 |

| LULU | CALL | SWEEP | BEARISH | 08/15/25 | $172.65 | $169.1 | $169.15 | $135.00 | $101.5K | 6 | 6 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Where Is Lululemon Athletica Standing Right Now?

- Currently trading with a volume of 629,653, the LULU’s price is up by 0.77%, now at $295.4.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

What Analysts Are Saying About Lululemon Athletica

1 market experts have recently issued ratings for this stock, with a consensus target price of $314.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley persists with their Overweight rating on Lululemon Athletica, maintaining a target price of $314.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lululemon Athletica options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply