Looking At Bank of America's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Bank of America. Our analysis of options history for Bank of America BAC revealed 37 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 25 were puts, with a value of $1,600,134, and 12 were calls, valued at $408,606.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $48.0 for Bank of America during the past quarter.

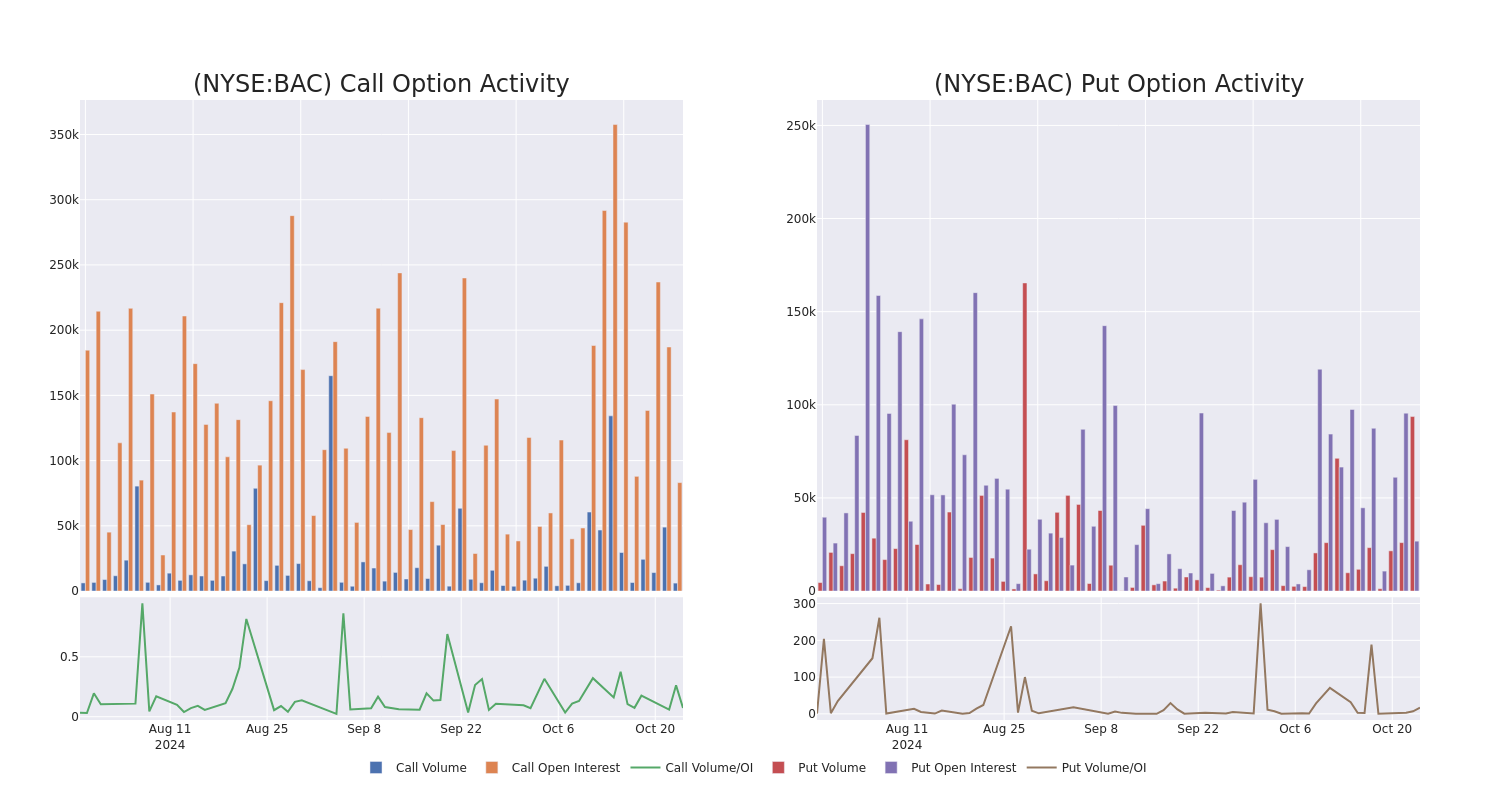

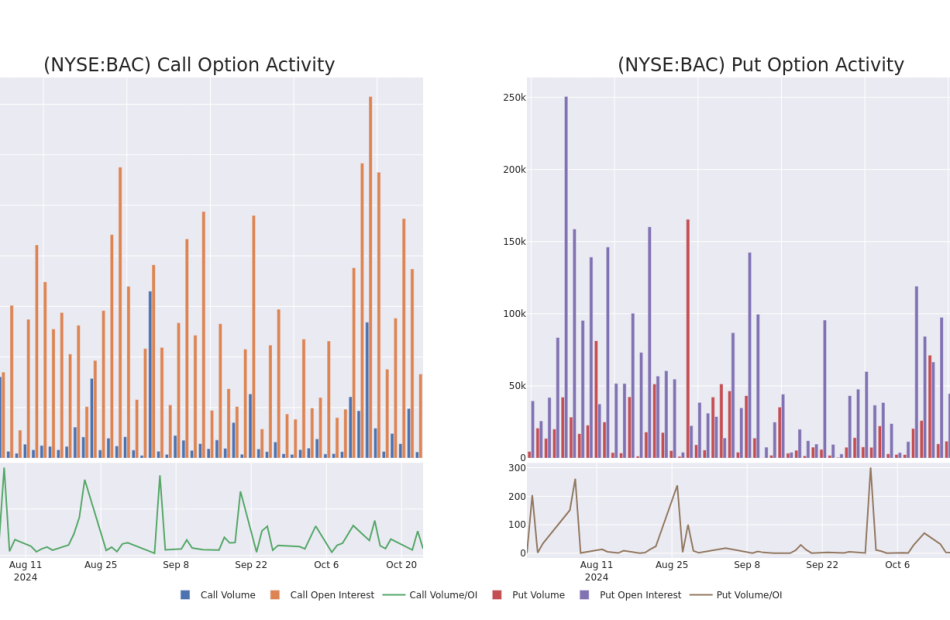

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Bank of America options trades today is 9159.25 with a total volume of 99,774.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Bank of America’s big money trades within a strike price range of $20.0 to $48.0 over the last 30 days.

Bank of America Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.42 | $2.4 | $2.4 | $43.00 | $79.9K | 5.4K | 4.0K |

| BAC | CALL | SWEEP | BEARISH | 12/20/24 | $22.5 | $22.4 | $22.43 | $20.00 | $76.2K | 15 | 0 |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.37 | $2.34 | $2.34 | $43.00 | $76.0K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.35 | $2.33 | $2.33 | $43.00 | $73.3K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.43 | $2.41 | $2.41 | $43.00 | $72.3K | 5.4K | 3.7K |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

In light of the recent options history for Bank of America, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Bank of America

- Trading volume stands at 15,957,725, with BAC’s price down by -0.09%, positioned at $42.3.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 84 days.

Expert Opinions on Bank of America

5 market experts have recently issued ratings for this stock, with a consensus target price of $48.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Bank of America, which currently sits at a price target of $48.

* An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $46.

* An analyst from Morgan Stanley persists with their Overweight rating on Bank of America, maintaining a target price of $47.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on Bank of America, maintaining a target price of $50.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Bank of America with a target price of $50.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of America options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply