Satoshi Nakamoto Identity Prediction Market Appears More Volatile Than Bitcoin: Sassaman Dethrones Peter Todd

Bettors on the social prediction market Manifold believed late technologist Len Sassaman to be Bitcoin’s BTC/USD mysterious creator Satoshi Nakamoto, as estimates on the play money-powered platform fluctuate wildly.

What happened: At the time of writing, Sassaman’s odds were 26%, as the cryptographer and privacy champion emerged as the platform’s new favorite.

However, only a few hours ago, the odds were in favor of Peter Todd, the Bitcoin Core engineer identified as Satoshi in the recent HBO documentary “Money Electric: The Bitcoin Mystery.” Todd has categorically denied these claims.

Sassasman’s odds reached an all-time high of 46% when the trailer of the documentary was released in the first week of October. This was also the time when punters on cryptocurrency-based Polymarket bet heavily in favor of him.

Todd’s odds reached 71% on Oct. 14, before nearly halving five days later, and 11% as of this writing.

Why It Matters: Manifold is a social prediction market where users can bet on events and compete with friends for free.

Users can either place bets through “Mana”, a play-money currency, or “Sweepcash,” which can be redeemed for real money.

A user, John Vandivier, while replying to an X post by economist Robin Hanson, said that estimates on the platform aren’t stable, noting how odds shifted in favor of Sassasman from Todd in no time.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NICHI announces Nunavut recipients of funding to advance critical Indigenous housing projects in urban, rural and northern areas and address urgent and unmet needs

IQALUIT, NU, Oct. 23, 2024 /CNW/ – Today, National Indigenous Collaborative Housing Incorporated (NICHI) Chief Executive Officer John Gordon and Minister of Indigenous Services and Minister responsible for FedNor, Patty Hajdu, announced the recipients of NICHI’s expression of need process to address the critical need for safe and affordable urban, rural and northern Indigenous housing projects in Nunavut.

Today’s announcement includes nearly $13 million in funding for 3 projects in Nunavut led by:

- YWCA Agvik Nunavut

- Uquutaq Society – Butler Affordable Housing

- Pairijiit Tigummiaqtikkut Society – Elder Housing Capacity building

Through the national process, $277.8 million out of a total funding amount of $281.5 million is being distributed to 75 projects across the country aimed at building more than 3800 units. This funding was provided to Indigenous Services Canada through Budget 2022 and was distributed by NICHI, applying its “For Indigenous, By Indigenous” approach. NICHI brings together Indigenous-led housing, homelessness, and housing-related service delivery organizations to provide lasting solutions that address diverse housing inadequacies including homelessness for Indigenous Peoples living in urban, rural and northern areas.

Over 171,000 Indigenous Peoples in urban, rural and northern areas off reserve are in core housing need according to the 2021 Census. Indigenous Peoples continue to experience core housing needs at a significantly higher rate than non-Indigenous people – with the gap between them being exacerbated by the housing and homelessness crisis and by inadequacies in distinctions-based funding.

Through a For Indigenous, By Indigenous approach to Indigenous housing that recognizes Indigenous organizations are best placed to understand the needs of their communities, Indigenous Services Canada is striving to close this gap by 2030.

Access to safe and affordable housing is critical to improving health and social outcomes, and to ensure a better future for Indigenous communities. This funding initiative is part of the Government of Canada’s commitment to address the social determinants of health and advance self-determination in alignment with the United Nations Declaration on the Rights of Indigenous Peoples Articles 21 and 23.

Quotes

“Indigenous housing providers deserve Indigenous advocacy at the national level. By securing this investment and developing a For Indigenous, By Indigenous funding process, NICHI is putting Indigenous people back in charge of housing policy for our people and communities. The overwhelming expression of need we received in our application process – totalling $2 billion across 447 applications – demonstrates that the work is far from over – but today, we’re excited to announce funding that will make a positive impact in the lives of Indigenous peoples in Nunavut.”

John Gordon

Chief Executive Officer, National Indigenous Collaborative Housing Incorporated

“In true partnership with Indigenous Peoples, we are getting more homes built, faster. Communities know best what they need, which is why these projects follow a By Indigenous, For Indigenous approach. We will always be there for communities as they take the lead to build homes; it’s a matter of fairness.”

The Honourable Patty Hajdu

Minister of Indigenous Services

“NICHI’s remarkable achievement in swiftly delivering $277.8 million underscores its unwavering commitment to advancing Indigenous housing nationwide. As a new organization, NICHI’s expedient action demonstrates unparalleled dedication and catalytic impact in transforming community housing landscapes. We commend NICHI for its pivotal role in driving forward this transformative initiative.”

Lisa Ker

Acting Executive Director for the Community Housing Transformation Centre

“With thousands of years of collective experience, urban, rural, and northern Indigenous housing providers have the capacity, know-how, and shovel-ready projects to address the challenge. NICHI has shown that it can deliver funding programs swiftly, fairly, and responsibly.”

Margaret Pfoh

President, Canadian Housing and Renewal Association

Quick facts

- On June 8, 2023, the Government of Canada announced that the National Indigenous Collaborative Housing Inc. (NICHI) would deliver $281.5 million in immediate funding over two years to address the urgent, unmet needs of Indigenous Peoples living in urban, rural and northern areas.

- NICHI held its expression of need process from late November 2023 to January 12, 2024, and funding was allocated to 75 non-profit, Indigenous-led housing organizations by an objective, unbiased Project Selection Advisory Council who prioritized urgent and unmet housing need in Indigenous communities across the country. Currently, $3.7 million of the total funding amount remains to be allocated.

- The National Indigenous Collaborative Housing Inc. (NICHI) is an Indigenous-led national housing organization working to ensure that all Indigenous people across Canada have access to supports and services that provide safe, affordable, secure and dignified housing.

- Support for projects will include funding for acquisitions of new properties and buildings, construction of new facilities, repairs and renovations, housing-related training, growing organizational capacity and administration costs.

Associated links

Stay connected

Join the conversation about Indigenous Peoples in Canada:

X: @GCIndigenous

Facebook: @GCIndigenous

Instagram: @gcindigenous

Facebook: @GCIndigenousHealth

You can subscribe to receive our news releases and speeches via RSS feeds. For more information or to subscribe, visit www.isc.gc.ca/RSS.

SOURCE Indigenous Services Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/23/c8537.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/23/c8537.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Equinor third quarter 2024 results

Equinor (EQNREQNR delivered adjusted operating income* of USD 6.89 billion and USD 2.04 billion after tax in the third quarter of 2024. Equinor reported net operating income of USD 6.91 billion and net income at USD 2.29 billion. Adjusted net income* was USD 2.19 billion, leading to adjusted earnings per share* of USD 0.79.

Financial and operational performance

- Solid financial results

- Effective execution of extensive turnaround programme

- Strong cash flow from operations

Strategic progress

- All-time high production from the Troll field in the gas year

- Northern Lights facility completed and ready to receive CO2

- Acquired a 9.8 percent stake in Ørsted in October

Capital distribution

- Third quarter ordinary cash dividend of USD 0.35 per share, extraordinary cash dividend of USD 0.35 per share and fourth tranche of share buy-back of up to USD 1.6 billion

- Total capital distribution for 2024 in line with announced level of around USD 14 billion

Anders Opedal, President and CEO of Equinor ASA:

“With solid operational performance and results, we are well on track to deliver strong cashflow from operations in line with what we said at the capital markets update in February.”

“Over time, we have upgraded the capacity in the gas value chain. This has contributed to an all-time high production from the Troll field in the gas year. In the quarter, the Johan Sverdrup field delivered a production record of more than 756 000 barrels of oil in one day and reached the milestone of one billion barrels produced since the start-up five years ago. This strengthens our position to deliver safe and reliable energy to Europe.”

“We continue to invest in renewables and develop low carbon value chains. In the quarter, the world’s first commercial storage facility, Northern Lights, was completed and is now ready to receive CO2 from customers.”

Operational performance

Equinor delivered a total equity production of 1,984 mboe per day in the third quarter, down from 2,007 mboe in the same quarter last year.

On the Norwegian continental shelf (NCS), production increased by 2 percent compared to the third quarter 2023. This was due to high gas production from the Troll field and positive contributions from Aasta Hansteen and Oseberg. The increase was partially offset by extensive turnarounds, natural decline and reduced ownership in the Statfjord area.

Internationally, new wells contributed positively to the production. However, the international production was negatively impacted by offshore turnarounds and hurricanes in the United States.

In the quarter, Equinor completed nine offshore exploration wells with one commercial discovery. Four wells were ongoing at the quarter end. Two wells were expensed.

Equinor produced 677 GWh from renewable assets in the third quarter, up 82 percent from the same quarter last year. The increase was driven by the addition of onshore power plants in 2024. The offshore wind parks Dudgeon, Sheringham Shoal and Arkona also contributed positively to the production.

The progress at Dogger Bank A is slower than expected. Based on this, the expected growth in power production from renewable assets in 2024 is adjusted to around 50 percent.

Strategic progress

Equinor continued to optimise the portfolio through projects and strategic business development in the quarter.

On the NCS, the Johan Castberg production vessel was securely anchored at the field in the Barents Sea and hook-up is on track for production start before year-end. In the quarter, Troll B and C became partly powered from shore, contributing to the company’s efforts to strengthen competitiveness and halve operated emissions by 2030.

The recent acquisition of a 9.8 percent stake in Ørsted, gives Equinor exposure to premium offshore wind assets in operation and a solid project pipeline. In the quarter, Equinor also won an offshore wind lease in the U.S. Atlantic Ocean at an attractive price, adding optionality of around 2 gigawatt capacity to its existing portfolio. Furthermore, the company started recalibrating its portfolio of early phase renewable projects to reduce cost and focus business development toward core markets.

Equinor continues to progress its low carbon solutions portfolio. The Northern Lights facility was completed on estimated time and budget. In the UK, two key partner-operated low-carbon solution projects secured funding from the government.

Solid financial results

Equinor delivered adjusted operating income* of USD 6.89 billion. USD 5.88 billion come from Exploration and Production Norway, USD 407 million from E&P International and USD 207 million from E&P USA. Marketing, Midstream & Processing delivered adjusted operating income* of USD 545 million, driven by LNG, power trading and geographical arbitrage for LPG. Adjusted operating income* from Renewables was negative USD 115 million, as the costs of project development exceeded the earnings from assets in operation.

Cash flow from operating activities before taxes paid and working capital items amounted to USD 9.23 billion for the third quarter. Cash flow from operations after taxes paid* was USD 6.25 billion for the quarter, and USD 14.0 billion year to date.

Equinor paid one NCS tax instalment of USD 2.87 billion in the quarter and total capital expenditures were USD 3.14 billion. Organic capital expenditure* was USD 3.08 billion for the quarter and USD 8.73 billion year to date. The organic capital expenditure* guiding for the year is adjusted to USD 12-13 billion. After taxes, capital distribution to shareholders and investments, net cash flow* ended at negative USD 3.42 billion in the third quarter. The Norwegian state’s share of the share buy-back programme of USD 4.02 billion in July impacted the net cash flow*.

Adjusted net debt to capital employed ratio* was negative 2.0 percent at the end of the third quarter, compared to negative 3.4 percent at the end of the second quarter of 2024.

Capital distribution

The board of directors has decided an ordinary cash dividend of USD 0.35 per share and an extraordinary cash dividend of USD 0.35 per share for the third quarter of 2024. This is in line with communication at the capital markets update in February.

The board has decided to initiate a fourth and final tranche of share buy-back for 2024 of up to USD 1.6 billion. The fourth tranche will commence on 25 October and end no later than 31 January 2025. This fourth tranche will complete the announced share buy-back programme of up to USD 6 billion for 2024. It will also conclude total capital distribution for 2024 of around USD 14 billion.

The third tranche of the share buy-back programme was completed on 16 October 2024 with a total value of USD 1.6 billion.

All share buy-back amounts include shares to be redeemed by the Norwegian state.

—

* For items marked with an asterisk throughout this report, see Use and reconciliation of non-GAAP financial measures in the Supplementary disclosures.

—

Further information from:

Investor relations

Bård Glad Pedersen, senior vice president Investor relations,

+47 918 01 791 (mobile)

Press

Sissel Rinde, vice president Media relations,

+47 412 60 584 (mobile)

This information is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act

- Equinor Third quarter 2024 Financial statements and review

- CFO presentation – 3rd quarter 2024 results

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Viridien and SLB complete the data acquisition for a multi-client survey in Bonaparte Basin, offshore Australia

Paris, France – October 24, 2024

Viridien and SLB have recently completed the acquisition of a new multi-client survey in the Bonaparte Basin, off the NW coast of Australia, that has received industry support and prefunding. The resulting ~6,760 sq km ultramodern PSDM seismic data set will provide a thorough evaluation of this highly prospective and underexplored area to improve industry understanding. The data is currently being processed and the final data will be available in Q2 2025.

The complex geological area has been historically challenging to image due to the presence of carbonates and the shallow water. The new survey will provide modern, high-quality data over an area lacking recent, or any 3D data. The data also partially covers a carbon storage block, recently awarded as permit G-13-AP. The survey deployed Sercel Sentinel MS multi-component streamers and the Sercel QuietSea marine mammal monitoring system.

Dechun Lin, EVP, Earth Data, Viridien, said: “We are delighted to have partnered with SLB for the first time in Australia to successfully complete this large data acquisition project. The new high-quality data set will give interested players greater insight into the exploration and carbon storage potential of this promising area. We will continue to look for opportunities to invest in the country.”

About Viridien:

Viridien (www.viridiengroup.com) is an advanced technology, digital and Earth data company that pushes the boundaries of science for a more prosperous and sustainable future. With our ingenuity, drive and deep curiosity we discover new insights, innovations, and solutions that efficiently and responsibly resolve complex natural resource, digital, energy transition and infrastructure challenges. Viridien employs around 3,500 people worldwide and is listed as VIRI on the Euronext Paris SA FR.

Contacts

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I caught my employee secretly working a second remote job. Here's why I decided to fire them — and why I think overemployment is sometimes unethical.

-

Patrick Synge fired one of his employees for secretly working a second remote job while on the clock.

-

He shared how he caught the employee and why he decided to fire them.

-

He says overemployment is sometimes “unethical” and can hurt worker productivity.

This as-told-to essay is based on an email conversation with Patrick Synge, the cofounder and chief commercial officer of the business-process-outsourcing and remote-recruitment company Metrickal. The business is headquartered in Barcelona and has 10 full time, fully remote employees, in addition to more than 200 contractors worldwide. The following has been edited for length and clarity.

I’m the cofounder and CCO of a business where every employee works fully remotely. In January, I caught one of them secretly working a second full-time remote job.

Here’s how it all played out — and why I decided to fire them.

My business is headquartered in Barcelona, but one of my employees was based in Peru. He was hired in 2022, and in the beginning, he did his job very well. But then, I started to receive complaints from clients about missed assignments and deadlines. He had also become quite unresponsive. These complaints from clients started to become somewhat regular.

When this employee started refusing certain shifts he usually worked, I became suspicious. I had a feeling that he was doing something on the side, but because there was no proof, I didn’t want to jump to any conclusions.

So instead, I had one-on-one meetings with him to discuss his job performance. When the same issues continued, I told him that if things didn’t change, I’d have to let him go.

While he showed some signs of improvement, his overall performance didn’t change much. This put a significant burden on the rest of the team, who had to cover his shifts and deal with missed deadlines.

In December, unrelated to this particular employee, my company rolled out the time-tracking software called DeskTime.

My long-term goal is to introduce a four-day workweek at my company, and I decided the first step in this process would be understanding how my employees spend their time and what could be optimized to boost productivity.

So our entire team of full-time employees and freelance contractors started using DeskTime. They each had to install the app on their computers, so everyone was well aware that this was being implemented.

After a few weeks, I looked through the tracking data of the struggling employee and noticed there was another company’s name — a US business — that regularly appeared in the data. It became clear to me that this employee had worked on some other company’s tasks.

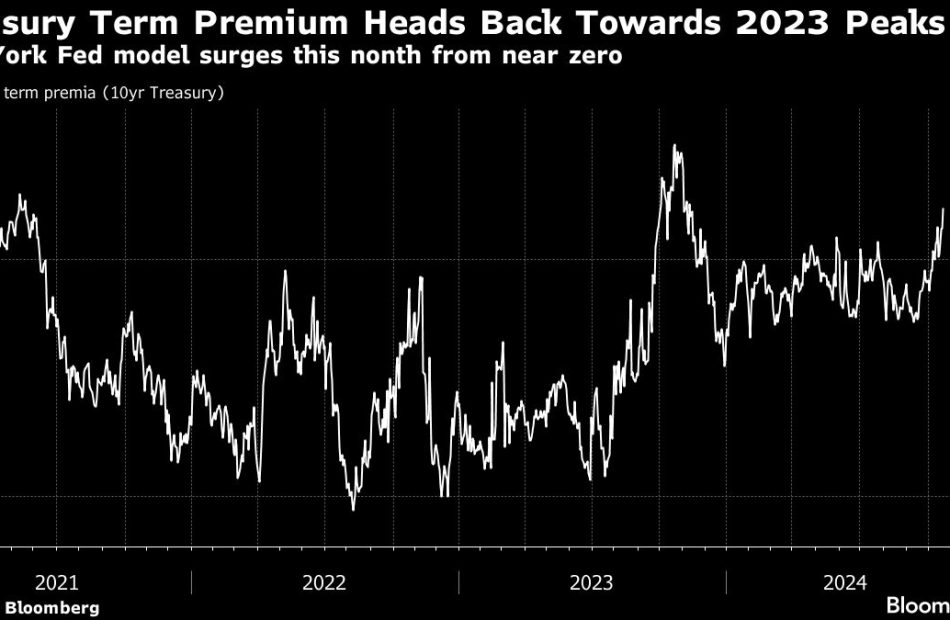

Surge in Treasury ‘Term Premium’ Warns of Rising Bond Risks

(Bloomberg) — The US Treasury market, already mired in one of its worst losing stretches of the year, is flashing a fresh warning sign of mounting risks as yields surge.

Most Read from Bloomberg

The so-called term premium on 10-year Treasury notes — an expression of the extra yield investors demand for owning the debt rather than rolling over shorter-term securities — has risen from near zero to just under a quarter point so far this month to the highest since last November, a Federal Reserve gauge shows.

As academic as the indicator may sound, the measure is closely monitored by market watchers. It offers important information about investors’ perception of future risk — whether it be inflation, supply or anything else that extends beyond the expected path of short-term rates.

In the latest instance, the jump in term premium comes amid a deepening bond market selloff as traders price in a shallower path of Fed interest-rate cuts in the face of resilient economic data.

Also playing an important role in the past week is a very tight presidential race and a growing feeling among some investors that the Republican party has the chance of gaining Congress and the White House. That outcome is seen as increasing the prospect of more spending and tax cuts — on top of the inflationary pressures of Donald Trump’s proposed tariff regime — at a time when US borrowing is highly elevated.

“It’s a combination of things right now, with the election, fiscal and tariff risks, so term premium is higher,” said George Catrambone, head of fixed income, DWS Americas. “Labor and consumer resiliency keeps inflation and growth higher than the Fed’s long-term targets.”

According to the Fed’s measure, the term premium on the US 10-year note turned positive last October for the first time since June 2021, and peaked at just under half a point as deficit spending concerns flared. The measure plumbed a generational low of -1.67% in 2020 — driven in part by declining inflation and in the years before that was largely contained by Fed purchases of government bonds as a component of its monetary policy.

Now, the measure is rising as selling pressure across the bond market pushes the Bloomberg Treasury index to a 2.1% loss for October. Treasuries are on course for their first monthly decline since April, with the 10-year yield headed toward 4.25%.

Dow Records Worst Session In Over A Month, Apple, Nvidia Drag Nasdaq Down: Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed a decline in the overall market sentiment, while the index remained in the “Greed” zone on Wednesday.

U.S. stocks settled lower on Wednesday, with the Dow Jones index recording its worst session in over a month. Both the Dow and S&P 500 logged losses for the third straight session.

Megacap stocks moved lower on Wednesday, with Apple Inc. AAPL and NVIDIA Corp. NVDA losing more than 2% during the session.

McDonald’s Corporation MCD shares fell more than 5% on Wednesday following CDC reports of an E. coli outbreak linked to quarter pounders. AT&T Inc T reported better-than-expected earnings for the third quarter. Boeing Co BA reported a loss for the third quarter on Wednesday.

On the economic data front, U.S. existing home sales declined 1% from the previous month to an annualized rate of 3.84 million in September.

Most sectors on the S&P 500 closed on a negative note, with consumer discretionary, information technology, and communication services stocks recording the biggest losses on Wednesday. However, real estate and utilities stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 410 points to 42,514.95 on Wednesday. The S&P 500 fell 0.92% to 5,797.42, while the Nasdaq Composite dipped 1.60% to close at 18,276.65 during Wednesday’s session.

Investors are awaiting earnings results from Dow Inc. DOW, Honeywell International Inc. HON, and American Airlines Group Inc. AAL today.

What is CNN Business Fear & Greed Index?

At a current reading of 63.1, the index remained in the “Greed” zone on Wednesday, versus a prior reading of 67.9.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla, Dow And 3 Stocks To Watch Heading Into Thursday

With U.S. stock futures trading mixed this morning on Thursday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Dow Inc. DOW to report quarterly earnings at 57 cents per share on revenue of $30.44 billion before the opening bell, according to data from Benzinga Pro. Dow shares gained 0.5% to $51.72 in after-hours trading.

- Lam Research Corporation LRCX reported better-than-expected earnings for its first quarter. The company said it sees second-quarter adjusted earnings of 87 cents per share, plus or minus 10 cents, and quarterly revenue of $4.3 billion, plus or minus $300 million. Lam Research shares gained 5.6% to $76.91 in the after-hours trading session.

- Analysts expect Honeywell International Inc. HON to post quarterly earnings at $2.50 per share on revenue of $9.90 billion. The company will release earnings before the markets open. Honeywell shares fell 0.6% to $219.00 in after-hours trading.

Check out our premarket coverage here

- Tesla Inc. TSLA reported stronger-than-expected earnings for its third quarter, while sales missed estimates. The automaker reported third-quarter earnings per share of 72 cents, beating a Street consensus estimate of 58 cents per share. Tesla shares jumped 12.1% to $239.50 in the after-hours trading session.

- Analysts expect American Airlines Group Inc. AAL to report quarterly earnings at 15 cents per share on revenue of $13.47 billion before the opening bell. American Airlines shares gained 1% to $12.96 in after-hours trading.

Check This Out:

Photo courtesy: Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hex Bolts Market Size Forecasted to Hit USD 2.0 Billion by 2031 at 3.0% CAGR Growth: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 23, 2024 (GLOBE NEWSWIRE) — The global hex bolts market is estimated to surge at a CAGR of 3.0% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for hex bolts is estimated to reach US$ 2.0 billion by the end of 2031.

A significant trend is the rise of modular construction techniques. As demand for rapid and cost-effective building solutions grows, modular construction offers an efficient alternative. Hex bolts play a crucial role in assembling prefabricated modules, driving demand for specialized fasteners designed for modular construction applications.

The emergence of advanced material sciences introduces new possibilities for hex bolt design and performance. Lightweight yet durable materials, such as titanium alloys and composite materials, offer superior strength-to-weight ratios and corrosion resistance, addressing specific application requirements across industries.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=71196

The trend towards miniaturization in electronics and consumer appliances drives demand for miniature hex bolts. As devices become smaller and more compact, the need for precise and reliable fastening solutions grows, fueling demand for miniature hex bolts in manufacturing processes.

Key Players –

Some prominent players are as follows:

- Oglaend System Group

- Trifast plc

- Vikrant Fasteners

- Ningbo XinXing Fasteners Manufacture Co. Ltd.

- Dokka Fasteners

- Canco Fasteners

- IGC Fastners

- Alloy Fasteners

- OneMonroe

- RS Components Pte. Ltd.

- United Fasteners

Key Findings of the Market Report

- Fully threaded segment leads the hex bolts market, offering versatility and uniform fastening across applications, ensuring secure connections in various industries.

- Stainless steel material segment leads the hex bolts market due to its corrosion resistance, durability, and wide application across various industries.

- The construction application segment leads the hex bolts market due to demand for fasteners in building infrastructure and commercial projects.

Hex Bolts Market Growth Drivers & Trends

- Increasing investments in construction and infrastructure projects worldwide drive demand for hex bolts, essential for structural stability and assembly.

- Expanding automotive production fuels demand for hex bolts used in vehicle assembly, supported by rising consumer demand.

- Growing manufacturing activities across various sectors spur demand for hex bolts, essential components in machinery, equipment, and industrial applications.

- Continuous innovations in materials, coatings, and manufacturing processes enhance hex bolt performance, durability, and corrosion resistance, driving market growth.

- Increasing emphasis on sustainability prompts the adoption of eco-friendly and recyclable materials in hex bolt production, aligning with environmental regulations and corporate responsibility initiatives.

Global Hex Bolts Market: Regional Profile

- In North America, particularly in the United States and Canada, the hex bolts market thrives due to robust construction and automotive sectors. Demand is driven by infrastructure development projects and the flourishing manufacturing industry.

- Key players like Fastenal Company and Portland Bolt & Manufacturing Company dominate the market, offering a wide range of hex bolts tailored to diverse industrial applications.

- In Europe, countries like Germany and France lead the hex bolts market, buoyed by stringent quality standards and advanced manufacturing capabilities.

- The region’s robust automotive and aerospace industries fuel demand for high-performance fastening solutions. Established players such as Stanley Black & Decker and Hilti Corporation maintain market dominance through innovative product offerings and strategic partnerships.

- In the Asia Pacific region, rapid industrialization and infrastructure investments drive market growth. Countries like China, Japan, and India witness significant demand for hex bolts, fueled by construction activities and the burgeoning manufacturing sector.

- Local players alongside global giants like Würth Group and ITW Construction Asia Pacific compete by offering cost-effective solutions and expanding their distribution networks across the region.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=71196

Hex Bolts Market: Competitive Landscape

The hex bolts market boasts a competitive landscape characterized by the presence of key players like Fastenal Company, Stanley Black & Decker, and Hilti Corporation.

These companies dominate with extensive product portfolios, global distribution networks, and robust R&D capabilities. Regional players such as Portland Bolt & Manufacturing Company cater to niche markets with specialized offerings.

Market competition is fueled by factors like product quality, pricing strategies, and customer service. Mergers, acquisitions, and partnerships are common strategies employed by companies to strengthen their market position and expand their geographical presence in the hex bolts market. Product Portfolio

- Oglaend System Group offers a comprehensive range of multidiscipline support systems for the offshore, marine, and industrial sectors, including cable management solutions, support systems, and fire protection products.

- Trifast plc specializes in the design, manufacturing, and distribution of industrial fasteners and components, serving diverse sectors including automotive, electronics, and construction.

- Vikrant Fasteners provides high-quality fastening solutions for industrial applications, offering a wide range of bolts, nuts, screws, and washers catering to diverse industries worldwide.

Hex Bolts Market: Key Segments

By Threaded Type

- Fully Threaded

- Partially Threaded

By Material

- Stainless Steel

- Carbon Steel

- Alloy

- Others

By Application

- Automotive

- Construction

- Aerospace

- Others (Industrial Machinery, Home Appliances, etc.)

By Price

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=71196<ype=S

More Trending Reports by Transparency Market Research –

- Water Softening Systems Market – The global water softening systems market is projected to flourish at a CAGR of 6.2% from 2023 to 2031. As per the report published by TMR, a valuation of US$ 10.9 Bn is anticipated for the market in 2031.

- Vertical Lift Module Market – The global vertical lift module market is projected to grow at a CAGR of 9.1% from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Expected To Open In Red As Investors Eye Tesla Earnings: Gold Surges, Crude Slips As Analysts Predict A Stall In Risk Rally

A risk-off mood persists on Wall Street as the index futures point to a marginally lower start on Wednesday after the tech-led rebound witnessed in the previous session. Nvidia Corp. NVDA fell in premarket, followed by Apple Inc. AAPL and Tesla Inc. TSLA.

Chipmakers and chip designers will also be in focus today. While Taiwan Semiconductor Manufacturing Co. Ltd. TSM alerted the U.S. about a potential violation of expert rules, Qualcomm Inc. QCOM faces the threat of its chip designing license being canceled by Arm Holdings Plc. ARM.

On Wednesday, investors will have Tesla, Boeing Co. BA, AT&T Inc. T, Starbucks Corp. SBUX, Spirit Airlines Inc. SAVE, and McDonald’s Corp. MCD on their radar.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.30% |

| S&P 500 | -0.18% |

| Dow Jones | -0.40% |

| R2K | -0.30% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY fell 0.21% to $582.10 and the Invesco QQQ ETF QQQ declined 0.22% to $494.34, according to Benzinga Pro data.

Cues From Last Session:

Investors remained cautious, with most sectors on the S&P 500 index closing the day in the red. However, consumer staples and communication services stocks beat the overall trend to rise.

Tech stocks helped the Nasdaq Composite index close the day in the green, bucking a wider decline in the markets.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.18% | 18,573.13 |

| S&P 500 | -0.05% | 5,851.20 |

| Dow Jones | -0.02% | 42,924.89 |

| Russell 2000 | -0.37% | 2,231.53 |

Insights From Analysts:

Following six consecutive weeks of gains, the markets have remained gloomy this week, with tech stocks offering some respite amid sideways movements in most other sectors.

One of the factors playing on investors’ minds is the rise in benchmark US 10-year treasury yields, which rose to their highest mark since July.

On the economic data front, the composite manufacturing index in the US Fifth District came in at -14 for October compared to a reading of -21 in the prior month.

“We now recommend moving to the sidelines. We think investors are likely to as well; the risk rally should stall for the next few weeks,” said analysts at Barclays in a note according to CNBC, commenting on the gloomy performance in equity markets this week.

The International Monetary Fund, though, expects U.S. growth to remain strong. According to its latest World Economic Outlook report, the IMF revised its projected U.S. GDP growth rate to 2.8%, up from its previous projection of 2.6%.

For 2025, IMF revised U.S. GDP growth projections upwards from 1.9% to 2.2%.

Charlie Bilello, Chief Market Strategist at Creative Planning, highlighted a continued surge in gold prices, which rose to a new all-time high of $2,772.55 an ounce.

See Also: Best Futures Trading Software

Upcoming Economic Data:

- Fed Governor Michelle Bowman is scheduled to deliver a speech at 9 a.m. ET.

- Existing home sales data is scheduled to be released at 10 a.m. ET.

- Federal Reserve Bank of Richmond President Thomas Barkin will speak at noon ET.

- The Federal Reserve will also publish its latest ‘Beige Book’ at 2 p.m. ET.

Stocks In Focus:

- Tesla will release its third-quarter earnings after market hours. Analysts expect EPS to fall below estimates.

- McDonald’s hamburgers have been linked to an E-coli outbreak.

- Frontier Airlines ULCC is reportedly considering renewing its bid for Spirit Airlines.

- Starbucks reported weak preliminary results and suspended guidance for the full fiscal year 2025.

- Telecom major AT&T is scheduled to report its earnings before markets open.

Commodities, Bonds And Global Equity Markets:

Crude oil futures fell in the early New York session, falling nearly 1.8% as data showed a rise in U.S. inventory, exceeding expectations.

The 10-year Treasury note yield rose marginally to 4.222%.

Asian markets were mixed on Wednesday, with Chinese markets edging up while Japan’s Nikkei 225 declined.

European stocks continued to remain tentative and were mostly lower in early trading.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.