A Closer Look at Intellia Therapeutics's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Intellia Therapeutics NTLA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with NTLA, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 19 options trades for Intellia Therapeutics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 0% bullish and 89%, bearish.

Out of all of the options we uncovered, 18 are puts, for a total amount of $944,718, and there was 1 call, for a total amount of $25,000.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.5 to $20.0 for Intellia Therapeutics over the recent three months.

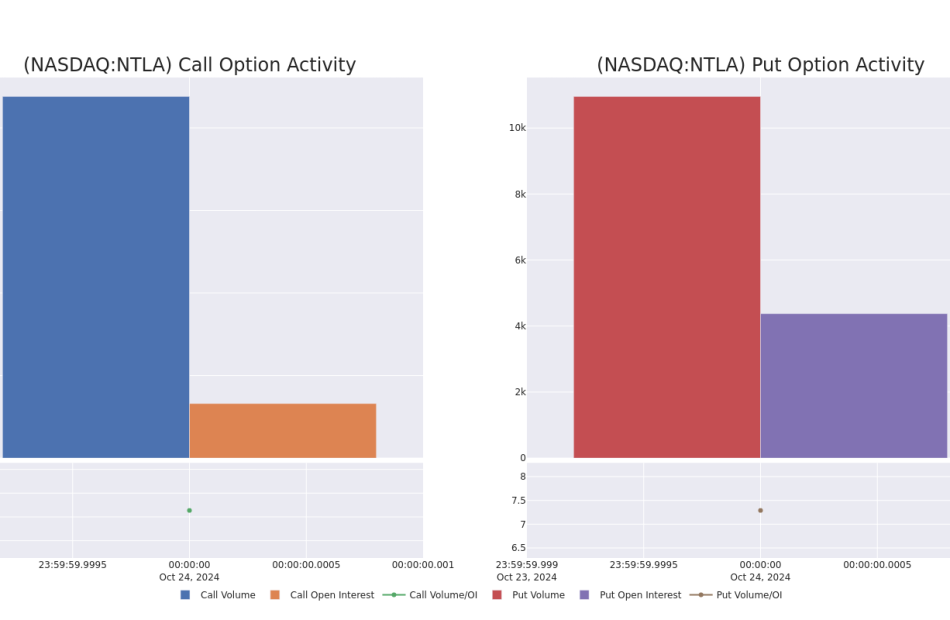

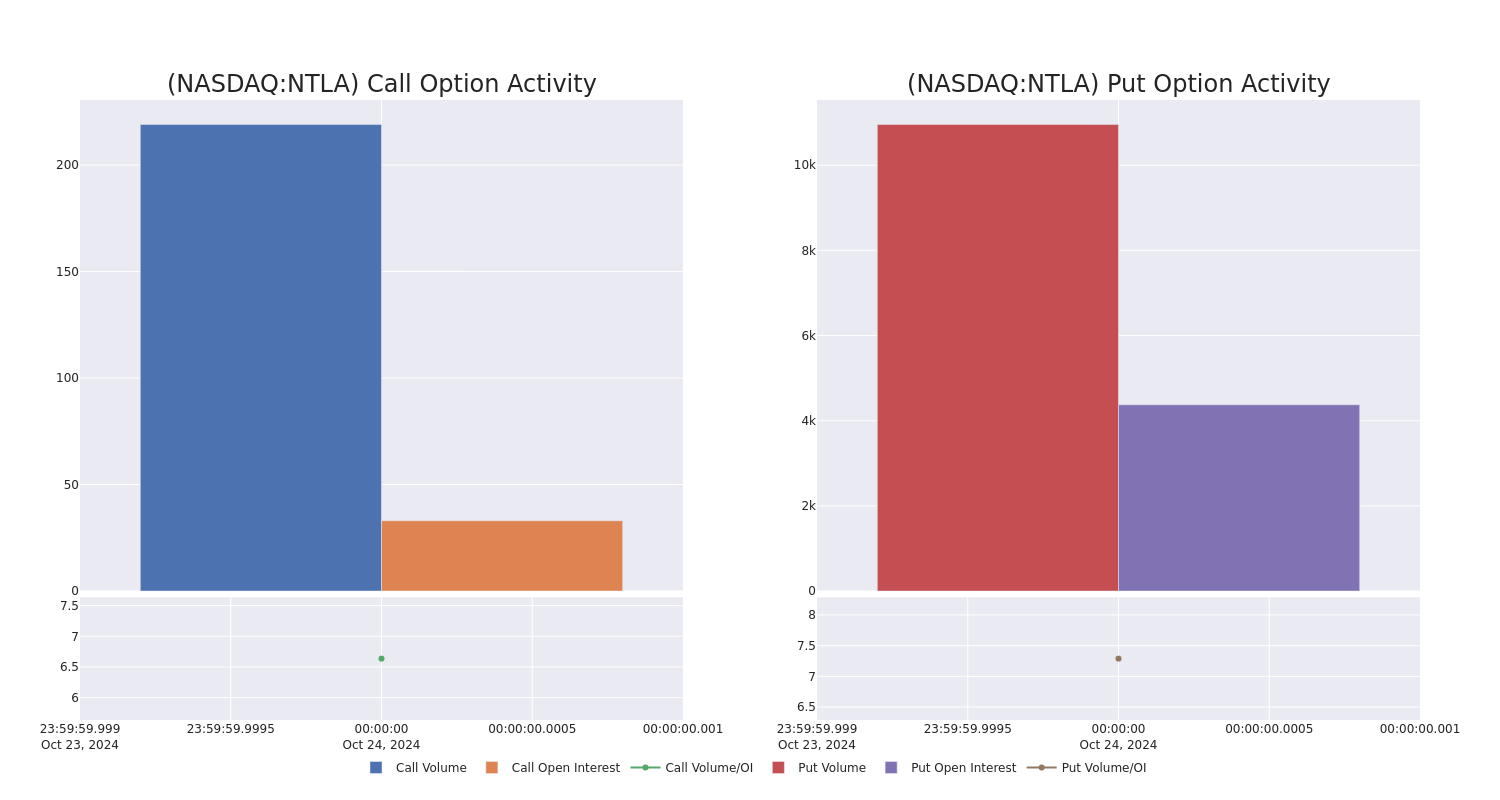

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Intellia Therapeutics’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intellia Therapeutics’s whale trades within a strike price range from $17.5 to $20.0 in the last 30 days.

Intellia Therapeutics Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NTLA | PUT | TRADE | BEARISH | 11/15/24 | $4.7 | $3.7 | $4.4 | $20.00 | $132.0K | 1.1K | 340 |

| NTLA | PUT | TRADE | BEARISH | 01/17/25 | $3.7 | $3.4 | $3.65 | $17.50 | $73.0K | 1.8K | 1.3K |

| NTLA | PUT | SWEEP | NEUTRAL | 01/17/25 | $3.7 | $3.6 | $3.65 | $17.50 | $73.0K | 1.8K | 805 |

| NTLA | PUT | SWEEP | BEARISH | 01/17/25 | $3.6 | $3.4 | $3.6 | $17.50 | $72.0K | 1.8K | 505 |

| NTLA | PUT | SWEEP | BEARISH | 01/17/25 | $5.3 | $5.0 | $5.3 | $20.00 | $53.0K | 1.3K | 753 |

About Intellia Therapeutics

Intellia Therapeutics is a gene editing company focused on the development of Crispr/Cas9-based therapeutics. Crispr/Cas9 stands for Clustered Regularly Interspaced Short Palindromic Repeats (Crispr)/Crispr-associated protein 9 (Cas9), which is a revolutionary technology for precisely altering specific sequences of genomic DNA. Intellia is focused on using this technology to treat genetically defined diseases. It’s evaluating multiple gene editing approaches using in vivo and ex vivo therapies to address diseases with high unmet medical needs, including ATTR amyloidosis, hereditary angioedema, sickle cell disease, and immuno-oncology. Intellia has formed collaborations with several companies to advance its pipeline, including narrow-moat Regeneron and wide-moat Novartis.

In light of the recent options history for Intellia Therapeutics, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Intellia Therapeutics

- With a trading volume of 7,786,070, the price of NTLA is down by -12.24%, reaching $17.5.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 14 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intellia Therapeutics, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: NextEra Energy Inc

Summary

Headquartered in Juno Beach, Florida, NextEra Energy provides generation, transmission, and distribution services. NEE has about 37,000 MW of total generating capacity, and about one-third of electricity is contributed by renewable wind and solar sources. The company also operates seven nuclear plants.

The company’s largest electric utility is FPL, one of the largest vertically integrated electric utilities in the U.S., with approximately 5.8 million customer accounts that generate about two-thirds of earnings. NEER, a nonregulated subsidiary, is the largest U.S. generator of wind and solar power and a leader in battery storage and renewable infrastructure. Its affiliated entities include NextEra Energy Partners LP, which trades as NEP. Argus Research does not cover NEP.

The company’s focus is on electricity and renewable generation. In 2023, it sold its Texas and Pennsylvania pipeline businesses and its gas utility, FCG. NextEra Energy has a generation presence in 38 states and four Canadian provinces, and is ahead of many peers in the use of renewable

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Pinnacle Bankshares Corporation Announces 3rd Quarter/Year to Date 2024 Earnings

ALTAVISTA, Va., Oct. 24, 2024 (GLOBE NEWSWIRE) — Net income for Pinnacle Bankshares Corporation PPBN, the one-bank holding company (the “Company” or “Pinnacle”) for First National Bank (the “Bank”), was $2,085,000, or $0.94 per basic and diluted share, for the third quarter of 2024, while net income for the nine months ended September 30, 2024 was $6,377,000, or $2.88 per basic and diluted share. In comparison, net income was $2,794,000, or $1.27 per basic and diluted share, and $7,483,000, or $3.41 per basic and diluted share, respectively, for the same periods of 2023. Consolidated results for the quarter and the nine-month periods are unaudited.

| Third Quarter & 2024 Year-to-Date Highlights |

| Income Statement comparisons are to the third quarter and first nine months of 2023 |

| Balance Sheet, Capital Ratios, and Stock Price comparisons are to December 31, 2023 |

Income Statement

- Third Quarter Net Income decreased 3% and Year-to-Date Net Income decreased 7%, excluding Bank Owned Life Insurance (BOLI) proceeds of $638,000 received in 2023.

Through nine months:

- Return on Assets was 0.86%.

- Net Interest Margin increased 15 basis points to 3.68%.

- Net Interest Income increased $1,368,000, or 5.5%.

- Provision for Credit Losses increased $330,000 due primarily to loan growth. Asset Quality remains strong with low Nonperforming Loans and no Other Real Estate Owned (OREO).

- Noninterest Income increased $229,000, or 4.6%, excluding BOLI proceeds, driven by higher fees from Merchant Card Processing and Sales of Mortgage Loans.

- Noninterest Expense increased $1,857,000, or 9%, due primarily to higher Core Operating System expenses and Salaries and Employee Benefits.

Balance Sheet

- Cash and Cash Equivalents increased $18.4 million, or 21%.

- Loans increased $37.5 million, or 6%.

- Securities decreased $51.6 million, or 22%, due to maturing U.S. Treasury Notes. The Securities Portfolio is relatively short term in nature with $61 million in U.S. Treasury Notes maturing during the next seven months providing liquidity, funding, and optionality.

- Total Assets decreased less than 1% due to a decline in Deposits.

- Deposits decreased 1%; however, Deposit Accounts have grown 3.5%.

- Liquidity is strong at 34% and 12% excluding Available for Sale Securities.

Capital Ratios & Stock Price

- The Bank’s Leverage Ratio increased to 9.21% due primarily to profitability.

- Total Risk Based Capital Ratio decreased slightly to 13.53% due to loan growth.

- Pinnacle’s Stock Price ended the quarter at $29.73 per share, based on the last trade, which is an increase of $5.72, or 24%. Total Return was 26.95% through nine months.

Net Income and Profitability

Net income generated during the third quarter of 2024 represents a $71,000, or 3%, decrease as compared to the same time period of 2023, net of $638,000 in BOLI proceeds, while net income generated for the nine months of 2024 represents a $468,000, or 7%, decrease as compared to the prior year, net of BOLI proceeds. The decrease in net income for the third quarter and year-to-date 2024 was driven by higher provision for loan losses and noninterest expense, partially offset by higher net interest income and noninterest income, net of BOLI proceeds.

Profitability as measured by the Company’s return on average assets (“ROA”) decreased to 0.86% for the nine months ended September 30, 2024, as compared to 1.02% for the same time period of 2023. Correspondingly, return on average equity (“ROE”) decreased to 11.76% for the nine months ended September 30, 2024, as compared to 16.44% for the same time period of 2023.

“We are pleased that Pinnacle’s performance through nine months of 2024 is tracking closely to 2023,” stated Aubrey H. Hall, III, President and Chief Executive Officer for both the Company and the Bank. He further commented, “Our Company is in a solid position with ample funding, an expanding net interest margin, and strong asset quality.”

Net Interest Income and Margin

The Company generated $8,941,000 in net interest income for the third quarter of 2024, which represents a $707,000, or 8.5%, increase as compared to $8,234,000 for the third quarter of 2023. Interest income increased $1,615,000, or 15%, due to higher yields on earning assets and increased loan volume, while interest expense increased $908,000, or 38%, due to higher interest rates paid on deposits and increased certificates of deposit volume.

The Company generated $26,169,000 in net interest income through nine months of 2024, which represents a $1,368,000, or 5.5%, increase as compared to $24,801,000 for the same time period of 2023. Interest income increased $4,341,000, or 14%, as yield on earning assets increased 55 basis points to 4.94%. Interest expense increased $2,973,000, or 49%, due to higher interest rates paid on deposits as cost to fund earning assets increased 40 basis points to 1.26%. Net interest margin increased to 3.68% for the nine months of 2024 from 3.53% for the same time period of 2023.

Reserves for Credit Losses and Asset Quality

The provision for credit losses was $136,000 in the third quarter of 2024 as compared to $4,000 in the third quarter of 2023. Through nine months of 2024, the provision for credit losses was $396,000 as compared to $66,000 for the same time period of 2023. Provision expense has increased as a result of higher loan volume and recent trends in economic indicators.

The allowance for credit losses (ACL) was $4,795,000 as of September 30, 2024, which represented 0.71% of total loans outstanding. In comparison, the ACL was $4,511,000 or 0.70% of total loans outstanding as of December 31, 2023. Non-performing loans to total loans decreased to 0.14% as of September 30, 2024, compared to 0.24% as of year-end 2023. ACL coverage of non-performing loans was 502% as of September 30, 2024, compared to 290% as of year-end 2023. Management views the allowance balance as being sufficient to offset potential future losses in the loan portfolio.

Noninterest Income and Expense

Noninterest income for the third quarter of 2024 increased $94,000, or 5.6%, to $1,763,000 as compared to $1,669,000, net of BOLI proceeds, for the third quarter of 2023. The increase was primarily due to a $76,000 increase in fees generated from sales of mortgage loans, a $30,000 increase in merchant card fees, and a $16,000 increase in service charges on loan accounts.

Noninterest income through nine months of 2024 increased $229,000, or 4.6%, to $5,198,000 as compared to $4,969,000 for the same time period in 2023, net of BOLI proceeds. The increase was mainly due to a $103,000 increase in merchant card processing fees, a $53,000 increase in fees generated from sales of mortgage loans, a $41,000 increase in service charges on loan accounts, and a $33,000 increase in in commissions and fees from sales of investment and insurance products.

Noninterest expense for the third quarter of 2024 increased $753,000, or 10%, to $7,961,000 as compared to $7,208,000 for the third quarter of 2023. The increase was primarily due to a $332,000 increase in salary and benefits, a $179,000 increase in core operating system expenses, and an $81,000 increase in occupancy expense.

Noninterest expense through nine months of 2024 increased $1,857,000, or 9%, to $23,044,000 as compared to $21,187,000 for the same time period of 2023. The increase was mainly due to a $694,000 increase in core operating system expenses, a $448,000 increase in salary and benefits, a $138,000 increase in occupancy expense, and a $109,000 increase dealer loan expenses.

The Balance Sheet and Liquidity

Total assets as of September 30, 2024, were $1,015,994,000, down less than 1% from $1,016,528,000 as of December 31, 2023. The principal components of the Company’s assets as of September 30, 2024, were $678,893,000 in total loans, $182,010,000 in securities, and $106,009,000 in cash and cash equivalents. Through nine months of 2024, total loans have increased $37,456,000, or 6%, from $641,437,000, securities have decreased $51,569,000, or 22%, from $233,579,000, and cash and cash equivalents have increased $18,420,000, or 21%, from $87,589,000.00.

The majority of the Company’s securities portfolio is relatively short-term in nature. Forty-eight percent (48%) of the Company’s securities portfolio is invested in U.S. Treasury Notes having an average maturity of 1.22 years with $61,000,000 maturing during the next seven months. The Company’s entire securities portfolio was classified as available for sale on September 30, 2024, which provides transparency regarding unrealized losses. Unrealized losses associated within the available for sale securities portfolio were $9,915,000 as of September 30, 2024, or five percent (5%) of book value, an improvement from $14,943,000 as of December 31, 2023.

The Company had a strong liquidity ratio of 34% as of September 30, 2024. The liquidity ratio excluding the available for sale securities portfolio was 12% providing the opportunity to sell excess funds at an attractive federal funds rate. The Company has access to multiple liquidity lines of credit through its correspondent banking relationships and the Federal Home Loan Bank. None of these contingency funding sources have been utilized.

Total liabilities as of September 30, 2024, were $938,622,000, down $9,501,000, or 1%, from $948,123,000 as of December 31, 2023, as deposits have decreased $11,081,000, or 1%, through nine months of 2024 to $921,363,000 from $932,444,000. First National Bank’s number of deposit accounts increased 3.5% during the same time period as the Bank has benefited from the closures of large national bank branches and bank mergers within markets served along with its reputation for providing extraordinary customer service.

Total stockholders’ equity as of September 30, 2024, was $77,372,000 and consisted primarily of $66,787,000 in retained earnings. In comparison, as of December 31, 2023 total stockholders’ equity was $68,405,000. The increase in stockholders’ equity is due primarily to 2024 profitability and an increase in the market value of the securities portfolio and pension assets. Both the Company and Bank remain “well capitalized” per all regulatory definitions.

Loan Production Office and New Branch in South Boston

On July 15, 2024, First National Bank announced plans to open a Loan Production Office (LPO) and a Full-Service Branch in Halifax County, Virginia. Since this announcement, an experienced team of bankers has been hired and the LPO has opened at 97A Main Street, South Boston, Virginia. Additionally, regulatory approval has been received for the branch, which has temporarily opened at the same location. The permanent branch will open at 4027 Halifax Road, South Boston, Virginia later this year.

Company Information

Pinnacle Bankshares Corporation is a locally managed community banking organization serving Central and Southern Virginia. The one-bank holding company of First National Bank serves market areas consisting primarily of all or portions of the Counties of Amherst, Bedford, Campbell, Halifax, and Pittsylvania, and the Cities of Charlottesville, Danville and Lynchburg. The Company has a total of eighteen branches with one branch in Amherst County within the Town of Amherst, two branches in Bedford County; five branches in Campbell County, including two within the Town of Altavista, where the Bank was founded; one branch in the City of Charlottesville, three branches in the City of Danville; three branches in the City of Lynchburg; and three branches in Pittsylvania County, including one within the Town of Chatham. A Loan Production Office and a temporary full-service branch have been opened in South Boston, with the Bank having plans to open a permanent full-service branch location in the near future to serve South Boston and the greater Halifax County market. First National Bank is in its 116th year of operation.

Cautionary Statement Regarding Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of federal securities laws that involve significant risks and uncertainties. Any statements contained herein that are not historical facts are forward-looking and are based on current assumptions and analysis by the Company. These forward-looking statements, including statements made in Mr. Hall’s quotes may include, but are not limited to, statements regarding the credit quality of our asset portfolio in future periods, the expected losses of nonperforming loans in future periods, returns and capital accretion during future periods, our cost of funds, the maintenance of our net interest margin, future operating results and business performance and our growth initiatives. Although we believe our plans and expectations reflected in these forward-looking statements are reasonable, our ability to predict results or the actual effect of future plans or strategies is inherently uncertain, and we can give no assurance that these plans or expectations will be achieved. Factors that could cause actual results to differ materially from management’s expectations include, but are not limited to: changes in consumer spending and saving habits that may occur, including increased inflation; changes in general business, economic and market conditions; attracting, hiring, training, motivating and retaining qualified employees; changes in fiscal and monetary policies, and laws and regulations; changes in interest rates, inflation rates, deposit flows, loan demand and real estate values; changes in the quality or composition of the Company’s loan portfolio and the value of the collateral securing loans; changes in macroeconomic trends and uncertainty, including liquidity concerns at other financial institutions, and the potential for local and/or global economic recession; changes in demand for financial services in Pinnacle’s market areas; increased competition from both banks and non-banks in Pinnacle’s market areas; a deterioration in credit quality and/or a reduced demand for, or supply of, credit; increased information security risk, including cyber security risk, which may lead to potential business disruptions or financial losses; volatility in the securities markets generally, including in the value of securities in the Company’s securities portfolio or in the market price of Pinnacle common stock specifically; and other factors, which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These risks and uncertainties should be considered in evaluating the forward-looking statements contained herein, and you should not place undue reliance on such statements, which reflect our views as of the date of this release.

| Pinnacle Bankshares Corporation Selected Financial Highlights (9/30/24, 6/30/24, and 9/30/23 results unaudited) (In thousands, except rations, share, and per share data) |

||||||||||

| 3 Months Ended | 3 Months Ended | 3 Months Ended | ||||||||

| Income Statement Highlights | 9/30/2024 | 6/30/2024 | 9/30/2023 | |||||||

| Interest Income | $ | 12,262 | $ | 11,754 | $ | 10,647 | ||||

| Interest Expense | 3,321 | 2,936 | 2,413 | |||||||

| Net Interest Income | 8,941 | 8,818 | 8,234 | |||||||

| Provision for Credit Losses | 136 | 242 | 4 | |||||||

| Noninterest Income | 1,763 | 1,812 | 2,307 | |||||||

| Noninterest Expense | 7,961 | 7,681 | 7,208 | |||||||

| Net Income | 2,085 | 2,208 | 2,794 | |||||||

| Earnings Per Share (Basic) | 0.94 | 1.00 | 1.27 | |||||||

| Earnings Per Share (Diluted) | 0.94 | 1.00 | 1.27 | |||||||

| 9 Months Ended | Year Ended | 9 Months Ended | ||||||||

| Income Statement Highlights | 9/30/2024 | 12/31/2023 | 9/30/2023 | |||||||

| Interest Income | $ | 35,200 | $ | 41,888 | $ | 30,859 | ||||

| Interest Expense | 9,031 | 8,716 | 6,058 | |||||||

| Net Interest Income | 26,169 | 33,172 | 24,801 | |||||||

| Provision for Credit Losses | 396 | 70 | 66 | |||||||

| Noninterest Income | 5,198 | 7,964 | 5,607 | |||||||

| Noninterest Expense | 23,044 | 29,280 | 21,187 | |||||||

| Net Income | 6,377 | 9,762 | 7,483 | |||||||

| Earnings Per Share (Basic) | 2.88 | 4.45 | 3.41 | |||||||

| Earnings Per Share (Diluted) | 2.88 | 4.45 | 3.41 | |||||||

| Balance Sheet Highlights | 9/30/2024 | 12/31/2023 | 9/30/2023 | |||||||

| Cash and Cash Equivalents | $ | 106,009 | $ | 87,589 | $ | 87,373 | ||||

| Total Loans | 678,893 | 641,437 | 624,203 | |||||||

| Total Securities | 182,010 | 233,579 | 235,431 | |||||||

| Total Assets | 1,015,994 | 1,016,528 | 996,567 | |||||||

| Total Deposits | 921,363 | 932,444 | 918,269 | |||||||

| Total Liabilities | 938,622 | 948,123 | 933,674 | |||||||

| Stockholders’ Equity | 77,372 | 68,405 | 62,893 | |||||||

| Shares Outstanding | 2,215,020 | 2,198,158 | 2,196,543 | |||||||

| Ratios and Stock Price | 9/30/2024 | 12/31/2023 | 9/30/2023 | |||||||

| Gross Loan-to-Deposit Ratio | 73.68 | % | 68.79 | % | 67.98 | % | ||||

| Net Interest Margin (Year-to-date) | 3.68 | % | 3.52 | % | 3.53 | % | ||||

| Liquidity | 33.61 | % | 37.27 | % | 38.24 | % | ||||

| Efficiency Ratio | 73.47 | % | 71.20 | % | 69.67 | % | ||||

| Return on Average Assets (ROA) | 0.86 | % | 1.00 | % | 1.02 | % | ||||

| Return on Average Equity (ROE) | 11.76 | % | 15.69 | % | 16.44 | % | ||||

| Leverage Ratio (Bank) | 9.21 | % | 8.82 | % | 8.64 | % | ||||

| Tier 1 Capital Ratio (Bank) | 12.84 | % | 12.98 | % | 13.08 | % | ||||

| Total Capital Ratio (Bank) | 13.53 | % | 13.67 | % | 13.79 | % | ||||

| Stock Price | $ | 29.73 | $ | 24.01 | $ | 19.25 | ||||

| Book Value | $ | 34.93 | $ | 31.12 | $ | 28.63 | ||||

| Asset Quality Highlights | 9/30/2024 | 12/31/2023 | 9/30/2023 | |||||||

| Nonaccruing Loans | $ | 956 | $ | 1,557 | $ | 1,859 | ||||

| Loans 90 Days or More Past Due and Accruing | 0 | 0 | 0 | |||||||

| Total Nonperforming Loans | 956 | 1,557 | 1,859 | |||||||

| Loan Modifications | 340 | 357 | 1,025 | |||||||

| Loans Individually Evaluated | 1,296 | 2,287 | 2,884 | |||||||

| Other Real Estate Owned (OREO) (Foreclosed Assets) | 0 | 0 | 0 | |||||||

| Total Nonperforming Assets | 956 | 1,557 | 1,859 | |||||||

| Nonperforming Loans to Total Loans | 0.14 | % | 0.24 | % | 0.30 | % | ||||

| Nonperforming Assets to Total Assets | 0.09 | % | 0.15 | % | 0.19 | % | ||||

| Allowance for Credit Losses | $ | 4,795 | $ | 4,511 | $ | 4,474 | ||||

| Allowance for Credit Losses to Total Loans | 0.71 | % | 0.70 | % | 0.72 | % | ||||

| Allowance for Credit Losses to Nonperforming Loans | 502 | % | 290 | % | 241 | % | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On PureCycle Technologies

Deep-pocketed investors have adopted a bullish approach towards PureCycle Technologies PCT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PCT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 26 extraordinary options activities for PureCycle Technologies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 38% bearish. Among these notable options, 2 are puts, totaling $80,209, and 24 are calls, amounting to $1,274,958.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $20.0 for PureCycle Technologies over the recent three months.

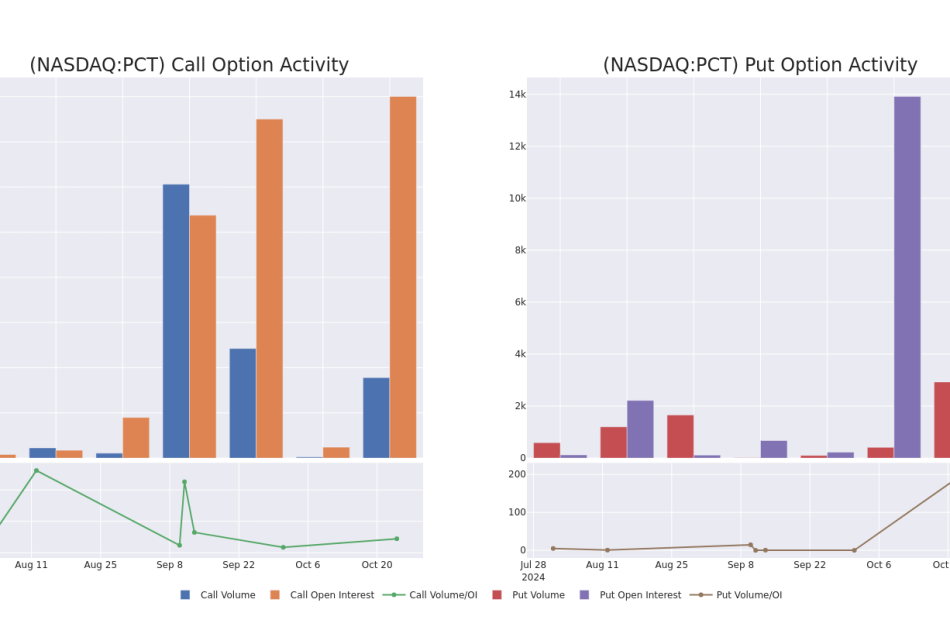

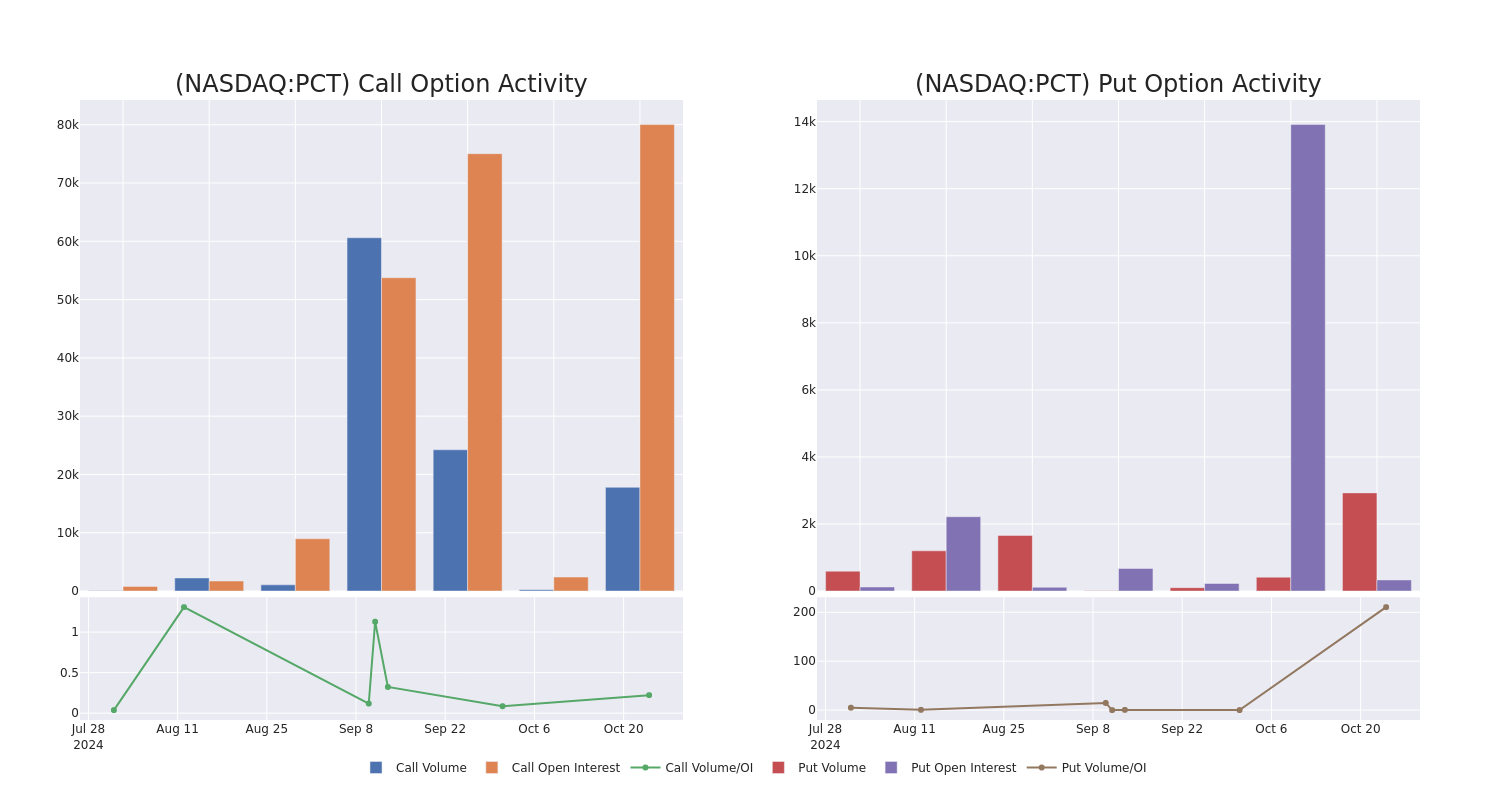

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PureCycle Technologies’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PureCycle Technologies’s significant trades, within a strike price range of $2.5 to $20.0, over the past month.

PureCycle Technologies Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $1.5 | $1.35 | $1.35 | $15.00 | $146.0K | 5.0K | 1.5K |

| PCT | CALL | SWEEP | BULLISH | 12/20/24 | $1.3 | $1.15 | $1.3 | $14.00 | $136.3K | 7 | 1.0K |

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $2.5 | $2.3 | $2.3 | $12.00 | $115.0K | 8.5K | 528 |

| PCT | CALL | SWEEP | BULLISH | 11/15/24 | $2.1 | $2.1 | $2.1 | $11.00 | $84.0K | 4.3K | 477 |

| PCT | CALL | TRADE | BULLISH | 07/18/25 | $3.1 | $2.7 | $3.1 | $15.00 | $77.5K | 66 | 500 |

About PureCycle Technologies

PureCycle Technologies Inc holds a license to commercialize the only patented solvent-based purification recycling technology, developed by The Procter & Gamble Company (P&G), for restoring waste polypropylene (PP) into a virgin-like resin. The proprietary process removes color, odor, and other contaminants from recycled feedstock resulting in virgin-like polypropylene suitable for any PP market.

Following our analysis of the options activities associated with PureCycle Technologies, we pivot to a closer look at the company’s own performance.

PureCycle Technologies’s Current Market Status

- With a trading volume of 11,445,452, the price of PCT is up by 28.08%, reaching $14.14.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 14 days from now.

Professional Analyst Ratings for PureCycle Technologies

In the last month, 1 experts released ratings on this stock with an average target price of $14.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $14.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PureCycle Technologies options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meow! Dogecoin, Shiba Inu Leapfrogged By Cat Coins Gaining: It's 'Cat Season Once Again,' Says Trader

Cat-themed cryptocurrencies Popcat POPCAT/USD and cat in a dogs world MEW/USD have emerged as top gainers in the overall crypto market.

What Happened: According to Coingecko, cat coins are nearing a $5 billion market cap, with a 7.7% gain in the last 24 hours. Popcat flipped Bonk BONK/USD to become the second-largest meme coin on the Solana SOL/USD network, trailing only Dogwifhat WIF/USD.

Mew reached a significant milestone, crossing the $1 billion valuation—an impressive feat for a Solana-based meme coin.

Meme coin favorites like Dogecoin DOGE/USD and Shiba Inu SHIB/USD have lagged, unable to match the recent gains of these cat coins.

| Cryptocurrency | Price | Market cap | 24-hour trend | 7-day trend |

| Dogecoin DOGE/USD | $0.1399 | $20.5B | +2.9% | +15.2% |

| Shiba Inu SHIB/USD | $0.00001781 | $10.5B | +2.7% | +0.7% |

| Popcat POPCAT/USD | $1.59 | $1.56B | +12.2% | +22% |

| cat in a dogs world MEW/USD | $0.1116 | $992M | +23.4% | +35.7% |

Also Read: Trader Shares 3-Point Strategy To Win With Meme Coins—Here’s Where Dogecoin, Shiba Inu Come In

Trader Notes: Popular trader Altcoin Sherpa highlighted on X (formerly Twitter) that “cat season” is back, with Popcat leading the charge and Mew showing strong potential. He emphasized that outside of AI-related memes, the most promising sector right now is cat-themed tokens.

Another trader, Bluntz, predicts a major breakout for Popcat, pointing to its resilience during market pullbacks and a bullish 1-2 setup pattern. He suggests that assets demonstrating strength during market declines tend to outperform in bullish markets

Meanwhile, Crypto General noted that MEW has been on a steady uptrend since its launch, recently breaking its all-time high. He expects a parabolic move in the coming days, potentially driving the price to $0.045.

Crypto trader Curbo even compared MEW to Shiba Inu, hinting that it could be the next big meme coin of this cycle.

Read Next:

Image: Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

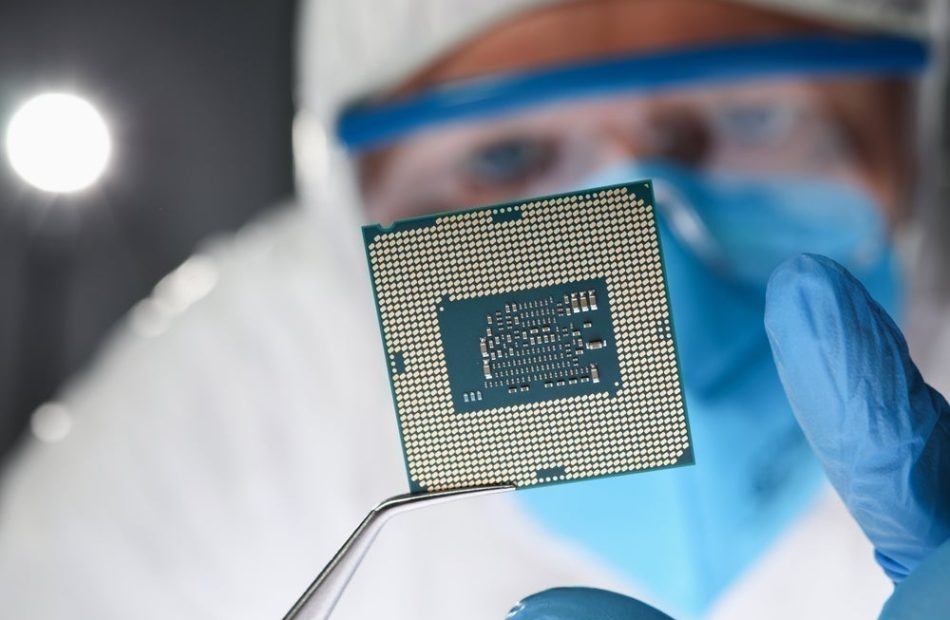

Lam Research Positioned For Growth Amid NAND Recovery And Advanced Packaging Strength, Analysts Highlight China Risks

BofA Securities analyst Vivek Arya reiterated the Buy rating on Lam Research LRCX, raising the price forecast to $92 from $88.

Arya expresses confidence in Lam Research’s leverage to key tech trends, its strong exposure to a NAND recovery, and solid free cash flow generation.

However, the analyst notes that while China is expected to normalize to 30% of the mix in December, ongoing risks from export controls remain, and gains in gross and operating margins appear limited.

The analyst raises the earnings estimates for 2025 and 2026 by 4% and 7%, respectively.

The analyst writes that the company’s unique portfolio will help it outperform its competitors in 2025, despite concerns about ASML Holding N.V outlook.

Also Read: ASML Stock Plunges Further On Lower 2025 Sales Outlook: Analysts Break Down Semiconductor Challenges

Arya notes that recent high shipments of lithography tools to China might lead to a bigger correction there, but Lam Research is less affected by this due to its strengths in advanced technologies like NAND and packaging.

Overall, Lam Research has several growth opportunities in 2025, even with potential challenges in China and delays from Intel and Samsung.

Meanwhile, Goldman Sachs analyst Toshiya Hari reiterated the Buy rating on Lam Research, lowering the price forecast to $96 from $102.50).

The analyst highlights that advancements in NAND, leading-edge foundry/logic, and DRAM will increase demand for etching and deposition, helping Lam gain market share in wafer fabrication equipment (WFE) in 2025 and beyond.

The analyst notes that while ASML lowered its 2025 revenue guidance due to weak demand in leading-edge foundry and potential declines in Chinese spending, Lam Research maintained its forecast of a mid-$90 billion WFE market for 2024.

In fact, Lam Research expects WFE spending to grow in 2025, driven by changes in NAND technology and ongoing strength in DRAM, HBM, and leading-edge foundry sectors, the analyst adds.

Hari notes, Advanced Packaging, essential for AI technology, will boost Lam Research’s performance.

Additionally, in the Systems business, China’s share of total revenue decreased to 37% in the September quarter from 42% in the March quarter and 39% in the June quarter.

Per Hari, the market will perceive the guided decline in China contribution positively, given the tendency for the market to pay a below-average multiple for revenue streams generated in China.

According to Hari, the market is likely to view the expected decline in China’s contribution positively, as it typically assigns a “below-average” multiple to revenue generated in China.

Price Action: LRCX shares are trading higher by 4.87% to $76.41 at last check Thursday.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq Edges Higher; Honeywell Shares Fall After Q3 Results

U.S. stocks traded mixed midway through trading, with the Nasdaq Composite gaining around 0.3% on Thursday.

The Dow traded down 0.72% to 42,206.88 while the NASDAQ rose 0.26% to 18,323.75. The S&P 500 also fell, dropping, 0.16% to 5,788.23.

Check This Out: Top 3 Tech Stocks You’ll Regret Missing In Q4

Leading and Lagging Sectors

Consumer discretionary shares rose by 2.6% on Thursday.

In trading on Thursday, materials shares fell by 1.1%.

Top Headline

Shares of Honeywell International Inc. HON fell around 4% on Thursday after the company reported third-quarter results and updated FY24 guidance.

Revenue grew 6% year-over-year (organic: +3%) to $9.728 billion, missing the consensus of $9.901 billion. Adjusted EPS was $2.58 (+8% Y/Y), beating the consensus of $2.50.

For FY24, the company lowered sales guidance to $38.6 billion – $38.8 billion (from $39.1 billion – $39.7 billion prior) versus the consensus of $39.20 billion. Honeywell tightened adjusted EPS guidance to $10.15 – $10.25 (from $10.05 – $10.25) versus the estimate of $10.13.

Equities Trading UP

- Nxu, Inc. NXU shares shot up 216% to $0.7930. Nxu and Verde Bioresins reported a proposed merger.

- Shares of QuantumScape Corporation QS got a boost, surging 25% to $6.49 after the company said it has begun producing low volumes of its first B-sample cells and has begun shipping cells for automotive customer testing.

- Molina Healthcare, Inc. MOH shares were also up, gaining 22% to $336.39 after the company reported better-than-expected third-quarter financial results.

Equities Trading DOWN

- Beyond, Inc. BYON shares dropped 26% to $7.03 after the company reported worse-than-expected third-quarter adjusted EPS and sales.

- Shares of Marinus Pharmaceuticals, Inc. MRNS were down 80% to $0.3413 after the company announced its Phase 3 TrustTSC trial of Oral Ganaxolone did not meet its primary endpoint.

- Community Health Systems, Inc. CYH was down, falling 23% to $4.2550 following third-quarter earnings.

Commodities

In commodity news, oil traded down 0.7% to $70.29 while gold traded up 0.4% at $2,741.10.

Silver traded down 0.1% to $33.790 on Thursday, while copper fell 0.1% to $4.3350.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 0.25%, Germany’s DAX gained 0.54% and France’s CAC 40 rose 0.27%. Spain’s IBEX 35 Index rose 0.12%, while London’s FTSE 100 rose 0.28%.

The S&P Global UK composite PMI declined to 51.7 in October from 52.6 in September, while Eurozone composite edged higher rose to 49.7 in October versus 49.6 in the previous month.

The HCOB Germany composite PMI increased to 48.4 in October versus 47.5 in September, while French composite PMI slipped to 47.3 in October from 48.6 in September.

Asia Pacific Markets

Asian markets closed mostly lower on Thursday, with Japan’s Nikkei 225 gaining 0.10%, Hong Kong’s Hang Seng Index falling 1.30%, China’s Shanghai Composite Index falling 0.68% and India’s BSE Sensex falling 0.02%.

The HSBC India composite PMI rose to 58.6 in October from 58.3 in the prior month. The au Jibun Bank Flash Japan composite PMI declined to 49.4 in October compared to a final reading of 52.0 in September.

Economics

- The Chicago Fed National Activity Index fell to a reading of -0.28 in September compared to a revised level of -0.01 in August.

- U.S. initial jobless claims declined by 15,000 from the prior week to 227,000 during the period ending Oct. 19, compared to market estimates of 242,000.

- U.S. building permits declined by 3.1% to an annual rate of 1.425 million in September.

- The S&P Global flash manufacturing PMI rose to 47.8 in October versus a 15-month low level of 47.3 in September.

- The S&P Global services PMI increased to 55.3 in October from 55.2 in the prior month.

- Sales of new single-family homes in the U.S. surged 4.1% to an annual rate of 738,000 in September.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cryptocurrency Pepe Up More Than 3% In 24 hours

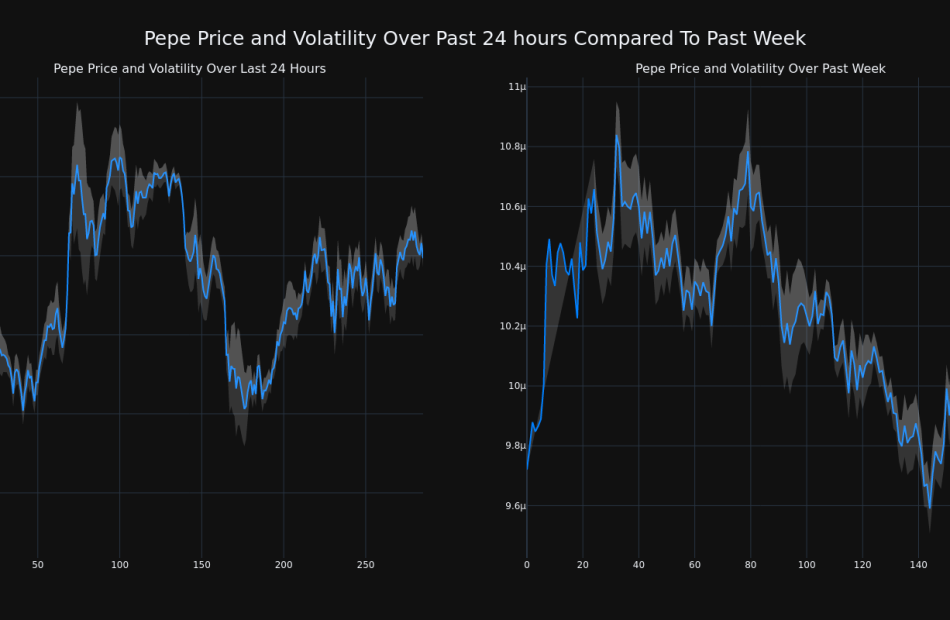

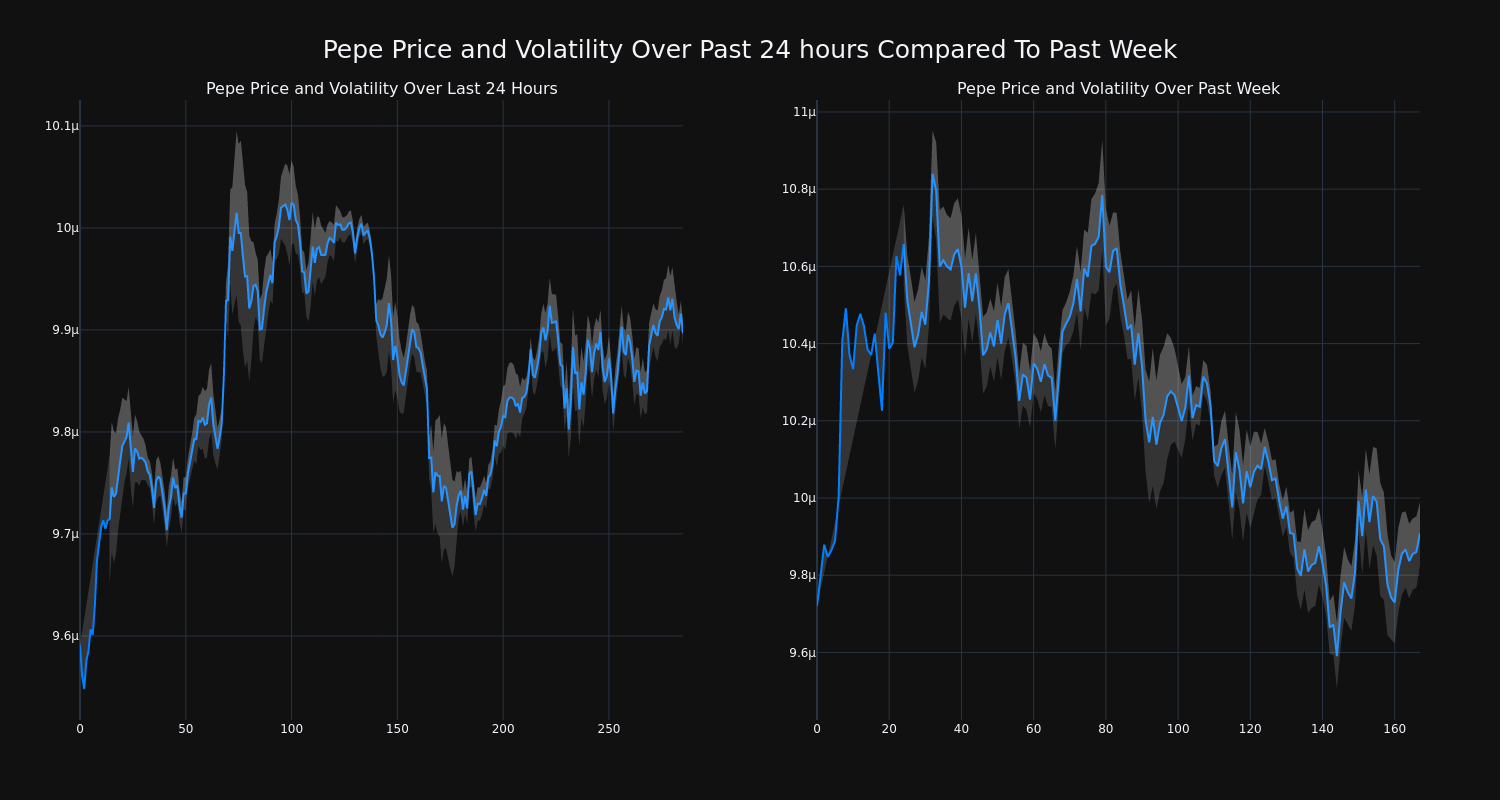

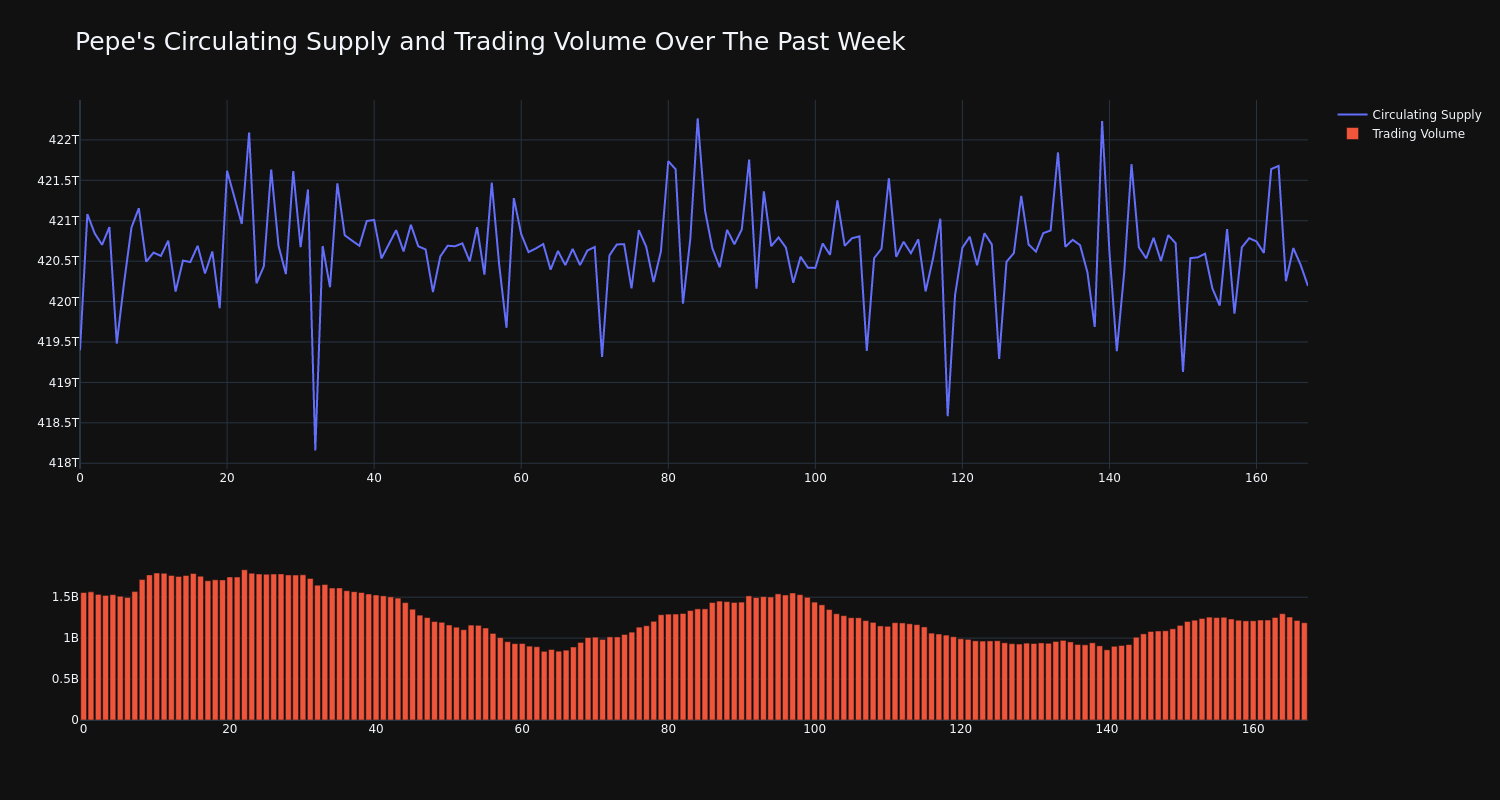

Over the past 24 hours, Pepe’s PEPE/USD price has risen 3.31% to $0.000010. This continues its positive trend over the past week where it has experienced a 2.0% gain, moving from $0.000010 to its current price.

The chart below compares the price movement and volatility for Pepe over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has decreased 24.0% over the past week, while the overall circulating supply of the coin has increased 0.19% to over 420.69 trillion. This puts its current circulating supply at an estimated 100.0% of its max supply, which is 420.69 trillion. The current market cap ranking for PEPE is #29 at $4.16 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

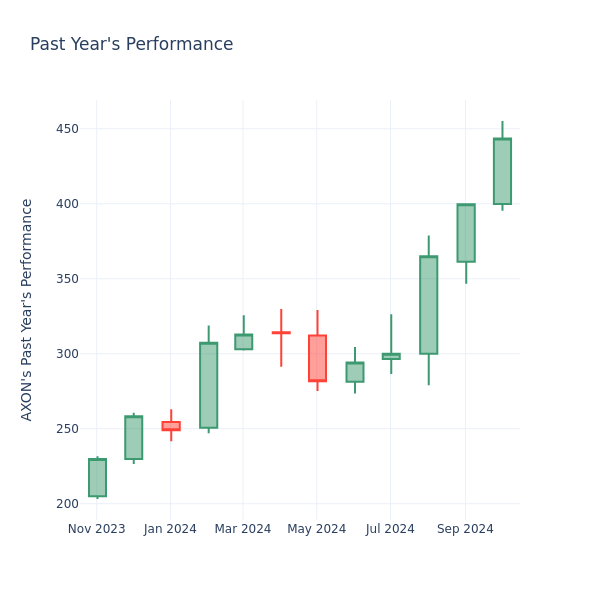

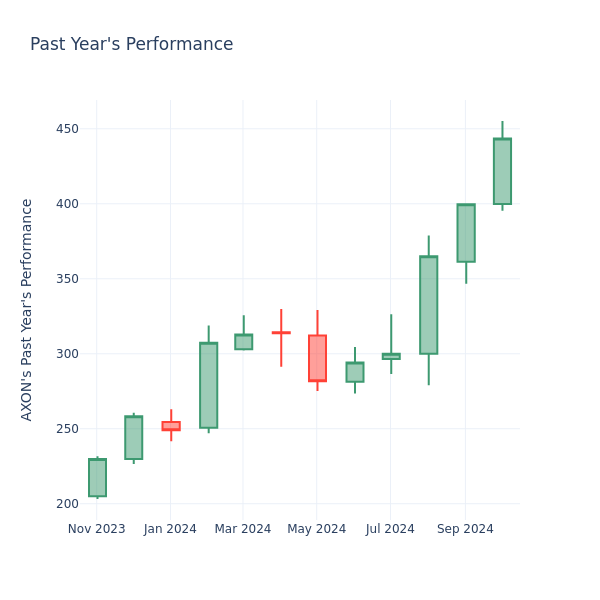

Price Over Earnings Overview: Axon Enterprise

In the current session, the stock is trading at $443.51, after a 0.19% increase. Over the past month, Axon Enterprise Inc. AXON stock increased by 12.78%, and in the past year, by 120.92%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Axon Enterprise P/E Ratio Analysis in Relation to Industry Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of 81.81 in the Aerospace & Defense industry, Axon Enterprise Inc. has a higher P/E ratio of 116.8. Shareholders might be inclined to think that Axon Enterprise Inc. might perform better than its industry group. It’s also possible that the stock is overvalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Penns Woods Bancorp, Inc. Reports Third Quarter 2024 Earnings

WILLIAMSPORT, Pa., Oct. 24, 2024 (GLOBE NEWSWIRE) — Penns Woods Bancorp, Inc. PWOD

Penns Woods Bancorp, Inc. achieved net income of $14.0 million for the nine months ended September 30, 2024, resulting in basic and diluted earnings per share of $1.86.

Highlights

- Net income, as reported under generally accepted accounting principles (GAAP), for the three and nine months ended September 30, 2024 was $4.8 million and $14.0 million, respectively, compared to $2.2 million and $11.1 million for the same periods of 2023. Results for the three and nine months ended September 30, 2024 compared to 2023 were impacted by an increase in net interest income of $1.7 million and $2.3 million, respectively, as the cost of funds has stabilized. The disposal of assets related to two former branch properties resulted in a one time after-tax loss of $261,000 for the nine month period ended September 30, 2024.

- The allowance for credit losses was impacted for the three and nine months ended September 30, 2024 by a provision for credit losses of $740,000 and a negative provision of $299,000, respectively, compared to provisions for credit losses of $1.4 million and $263,000 for the 2023 periods. The recognition of a negative provision for credit losses for the nine months ended September 30, 2024 is due primarily to recoveries during the second quarter of 2024 on a commercial loan. In addition, a minimal level of loan charge-offs of $312,000 contributed to the recognition of the negative provision for credit losses for the nine months ended September 30, 2024.

- Basic and diluted earnings per share for the three and nine months ended September 30, 2024 were $0.64 and $1.86, respectively, compared to basic and diluted earnings per share of $0.31 and $1.56 basic and $1.53 diluted for the three and nine month periods ended September 30, 2023.

- Annualized return on average assets was 0.86% for the three months ended September 30, 2024, compared to 0.41% for the corresponding period of 2023. Annualized return on average assets was 0.84% for the nine months ended September 30, 2024, compared to 0.70% for the corresponding period of 2023.

- Annualized return on average equity was 9.60% for the three months ended September 30, 2024, compared to 5.06% for the corresponding period of 2023. Annualized return on average equity was 9.74% for the nine months ended September 30, 2024, compared to 8.58% for the corresponding period of 2023.

Net Income

Net income from core operations (“core earnings”), which is a non-GAAP measure of net income excluding net securities gains or losses, was $4.8 million and $14.0 million, respectively, for the three and nine months ended September 30, 2024 compared to $2.3 million and $11.2 million for the same periods of 2023. Basic and diluted core earnings per share (non-GAAP) for the three and nine months ended September 30, 2024 were $0.63 and $1.86, respectively, while basic and diluted core earnings per share for the three month period of 2023 were $0.32 and for the nine month period of 2023 were $1.58 basic and $1.55 diluted. Annualized core return on average assets and core return on average equity (non-GAAP) were 0.85% and 9.54%, respectively, for the three months ended September 30, 2024, compared to 0.42% and 5.20% for the corresponding period of 2023. Annualized core return on average assets and core return on average equity (non-GAAP) were 0.84% and 9.75%, respectively, for the nine months ended September 30, 2024, compared to 0.71% and 8.67% for the corresponding period of 2023. A reconciliation of the non-GAAP financial measures of core earnings, core return on assets, core return on equity, core earnings per share and tangible book value per share to the comparable GAAP financial measures is included at the end of this press release.

Net Interest Margin

The net interest margin for the three and nine months ended September 30, 2024 was 2.88% and 2.79% respectively, compared to 2.65% and 2.82% for the corresponding periods of 2023. The increase in the net interest margin for the three month period was driven by an increase in the rate paid on interest-earning assets of 64 basis points (“bps”), while the decrease in the net interest margin for the nine month period was driven by a 96 bps increase in the rate paid on interest-bearing liabilities. The overall increase in interest rates over the periods resulted in increases to both the yield on the earnings asset portfolio and the rate paid on interest bearing liabilities. Driving the increase in the yield and interest income on the earning assets portfolio was the repricing of legacy assets coupled with portfolio growth. The average loan portfolio balance increased $76.0 million and $127.0 million, respectively, for the three and nine month periods ended September 30, 2024 compared to the same periods of 2023 as the average yield on the portfolio increased 65 bps and 72 bps, resulting in an increase in taxable equivalent interest income of $3.9 million and $14.5 million, for the periods. The three and nine month periods ended September 30, 2024 were impacted by an increase of 55 bps and 70 bps in the yield earned on the securities portfolio as legacy securities matured with the funds reinvested at higher rates, which resulted in an increase in taxable equivalent interest income of $343,000 and $1.2 million, respectively. Short-term borrowings decreased in volume, which offset the impact of an increase in rate paid, resulting in a decrease of $1.5 million and $2.1 million in expense for the three and nine month periods ended September 30, 2024 compared to the same periods of 2023. The rate paid on interest-bearing deposits increased 76 bps and 116 bps, respectively, or $3.1 million and $11.8 million in expense, for the three and nine month periods ended September 30, 2024 compared to the corresponding periods of 2023 due to the rate environment, an increase in competition for deposits, and a migration of deposit balances from core deposits to higher rate time deposits. The rates paid on time deposits significantly contributed to the increase in funding costs as rates paid for the three and nine month periods ended September 30, 2024 compared to the same periods of 2023 increased 70 bps and 114 bps, respectively, or $2.2 million and $8.2 million in expense, as deposit gathering campaigns continued to focus on time deposits with a maturity of five months. In addition, brokered deposits have been utilized to assist with funding the loan portfolio growth and contributed to the increase in time deposit funding costs, while lowering the reliance on higher cost short-term borrowings.

Assets

Total assets increased to $2.3 billion at September 30, 2024, an increase of $82.8 million compared to September 30, 2023. Net loans increased $58.0 million to $1.9 billion at September 30, 2024 compared to September 30, 2023, as continued emphasis was placed on commercial loan growth and indirect auto lending. The investment portfolio increased $8.8 million from September 30, 2023 to September 30, 2024. Investment debt securities increased $12.8 million from September 30, 2023 to September 30, 2024 as fixed rate instruments with maturities of approximately ten years were added to the portfolio to lock in yields.

Non-performing Loans

The ratio of non-performing loans to total loans ratio increased to 0.42% at September 30, 2024 from 0.20% at September 30, 2023, as non-performing loans increased to $7.9 million at September 30, 2024 from $3.7 million at September 30, 2023. The majority of non-performing loans involve loans that are either in a secured position and have sureties with a strong underlying financial position or have been classified as individually evaluated loans that have a specific allocation recorded within the allowance for credit losses. Net loan charge offs of $328,000 and $312,000 for the three and nine months ended September 30, 2024, respectively, impacted the allowance for credit losses, which was 0.62% of total loans at September 30, 2024 compared to 0.71% at September 30, 2023. Exposure to non-owner occupied office space is minimal at $13.9 million at September 30, 2024 with none of these loans being delinquent.

Deposits

Deposits increased $133.1 million to $1.7 billion at September 30, 2024 compared to September 30, 2023. Noninterest-bearing deposits decreased $18.6 million to $452.9 million at September 30, 2024 compared to September 30, 2023. Core deposits declined $6.6 million as deposits migrated from core deposit accounts into time deposits as market rates and competition for deposits increased. Core deposit gathering efforts remained focused on increasing the utilization of electronic (internet and mobile) deposit banking by our customers. Core deposits have remained stable at $1.2 billion over the past five quarters. Interest-bearing deposits increased $151.6 million from September 30, 2023 to September 30, 2024 due to growth in the time deposit portfolio of $78.7 million as customers sought a higher rate of interest. Brokered deposit balances increased $61.0 million to $167.7 million at September 30, 2024 as this funding source was utilized to supplement funding loan portfolio growth, while reducing the need to draw upon available borrowing lines. A campaign to attract time deposits with a maturity of five to twenty-four months commenced during the latter part of 2022 and has continued throughout 2023 and 2024 with current efforts centered on five months.

Shareholders’ Equity

Shareholders’ equity increased $29.2 million to $203.7 million at September 30, 2024 compared to September 30, 2023 due in part to a registered at-the-market offering that generated $7.5 million in capital during the fourth quarter of 2023. During the three and nine months ended September 30, 2024 there were no shares issued as part of the registered at-the-market offering. A total of 9,074 and 31,050 shares for net proceeds of $205,000 and $632,000 were issued as part of the Dividend Reinvestment Plan during the three and nine months ended September 30 2024. Accumulated other comprehensive loss of $5.3 million at September 30, 2024 decreased from a loss of $14.9 million at September 30, 2023 as a result of a decrease in net unrealized loss on available for sale securities to $2.6 million at September 30, 2024 from a net unrealized loss of $10.9 million at September 30, 2023, coupled with a decrease in loss of $1.3 million in the defined benefit plan obligation. The current level of shareholders’ equity equates to a book value per share of $26.96 at September 30, 2024 compared to $24.55 at September 30, 2023, and an equity to asset ratio of 9.02% at September 30, 2024 and 8.02% at September 30, 2023. Tangible book value per share (a non-GAAP measure) increased to $24.77 at September 30, 2024 compared to $22.20 at September 30, 2023. Dividends declared for the three and nine months ended September 30, 2024 and 2023 were $0.32 and $0.96 per share.

Penns Woods Bancorp, Inc. is the parent company of Jersey Shore State Bank, which operates sixteen branch offices providing financial services in Lycoming, Clinton, Centre, Montour, Union, and Blair Counties, and Luzerne Bank, which operates eight branch offices providing financial services in Luzerne County, and United Insurance Solutions, LLC, which offers insurance products. Investment and insurance products are offered through Jersey Shore State Bank’s subsidiary, The M Group, Inc. D/B/A The Comprehensive Financial Group.

NOTE: This press release contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Management uses the non-GAAP measure of net income from core operations in its analysis of the company’s performance. This measure, as used by the Company, adjusts net income determined in accordance with GAAP to exclude the effects of special items, including significant gains or losses that are unusual in nature such as net securities gains and losses. Because these certain items and their impact on the Company’s performance are difficult to predict, management believes presentation of financial measures excluding the impact of such items provides useful supplemental information in evaluating the operating results of the Company’s core businesses. These disclosures should not be viewed as a substitute for net income determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

This press release may contain certain “forward-looking statements” including statements concerning plans, objectives, future events or performance and assumptions and other statements, which are statements other than statements of historical fact. The Company cautions readers that the following important factors, among others, may have affected and could in the future affect actual results and could cause actual results for subsequent periods to differ materially from those expressed in any forward-looking statement made by or on behalf of the Company herein: (i) the effect of changes in laws and regulations, including federal and state banking laws and regulations, and the associated costs of compliance with such laws and regulations either currently or in the future as applicable; (ii) the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as by the Financial Accounting Standards Board, or of changes in the Company’s organization, compensation and benefit plans; (iii) the effect on the Company’s competitive position within its market area of the increasing consolidation within the banking and financial services industries, including the increased competition from larger regional and out-of-state banking organizations as well as non-bank providers of various financial services; (iv) the effect of changes in interest rates; (v) the effects of health emergencies, including the spread of infectious diseases or pandemics; or (vi) the effect of changes in the business cycle and downturns in the local, regional or national economies. For a list of other factors which could affect the Company’s results, see the Company’s filings with the Securities and Exchange Commission, including “Item 1A. Risk Factors,” set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

You should not place undue reliance on any forward-looking statements. These statements speak only as of the date of this press release, even if subsequently made available by the Company on its website or otherwise. The Company undertakes no obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Previous press releases and additional information can be obtained from the Company’s website at www.pwod.com.

| Contact: | Richard A. Grafmyre, Chief Executive Officer | |

| 110 Reynolds Street | ||

| Williamsport, PA 17702 | ||

| 570-322-1111 | e-mail: pwod@pwod.com | |

| PENNS WOODS BANCORP, INC. CONSOLIDATED BALANCE SHEET (UNAUDITED) |

|||||||||||

| (In Thousands, Except Share and Per Share Data) | September 30, | ||||||||||

| 2024 | 2023 | % Change | |||||||||

| ASSETS: | |||||||||||

| Noninterest-bearing balances | $ | 28,805 | $ | 26,651 | 8.08 | % | |||||

| Interest-bearing balances in other financial institutions | 10,889 | 8,939 | 21.81 | % | |||||||

| Total cash and cash equivalents | 39,694 | 35,590 | 11.53 | % | |||||||

| Investment debt securities, available for sale, at fair value | 197,466 | 184,667 | 6.93 | % | |||||||

| Investment equity securities, at fair value | 1,145 | 1,072 | 6.81 | % | |||||||

| Restricted investment in bank stock | 21,227 | 25,289 | (16.06)% | ||||||||

| Loans held for sale | 8,967 | 4,083 | 119.62 | % | |||||||

| Loans | 1,875,174 | 1,818,461 | 3.12 | % | |||||||

| Allowance for credit losses | (11,588 | ) | (12,890 | ) | (10.10)% | ||||||

| Loans, net | 1,863,586 | 1,805,571 | 3.21 | % | |||||||

| Premises and equipment, net | 27,975 | 30,746 | (9.01)% | ||||||||

| Accrued interest receivable | 11,433 | 10,500 | 8.89 | % | |||||||

| Bank-owned life insurance | 45,378 | 33,695 | 34.67 | % | |||||||

| Investment in limited partnerships | 6,966 | 8,275 | (15.82)% | ||||||||

| Goodwill | 16,450 | 16,450 | — | % | |||||||

| Intangibles | 133 | 235 | (43.40)% | ||||||||

| Operating lease right of use asset | 2,861 | 2,562 | 11.67 | % | |||||||

| Deferred tax asset | 3,034 | 6,961 | (56.41)% | ||||||||

| Other assets | 12,935 | 10,772 | 20.08 | % | |||||||

| TOTAL ASSETS | $ | 2,259,250 | $ | 2,176,468 | 3.80 | % | |||||

| LIABILITIES: | |||||||||||

| Interest-bearing deposits | $ | 1,247,399 | $ | 1,095,760 | 13.84 | % | |||||

| Noninterest-bearing deposits | 452,922 | 471,507 | (3.94)% | ||||||||

| Total deposits | 1,700,321 | 1,567,267 | 8.49 | % | |||||||

| Short-term borrowings | 78,305 | 193,746 | (59.58)% | ||||||||

| Long-term borrowings | 252,508 | 217,645 | 16.02 | % | |||||||

| Accrued interest payable | 5,509 | 2,716 | 102.84 | % | |||||||

| Operating lease liability | 2,936 | 2,619 | 12.10 | % | |||||||

| Other liabilities | 15,977 | 17,935 | (10.92)% | ||||||||

| TOTAL LIABILITIES | 2,055,556 | 2,001,928 | 2.68 | % | |||||||

| SHAREHOLDERS’ EQUITY: | |||||||||||

| Preferred stock, no par value, 3,000,000 shares authorized; no shares issued | — | — | n/a | ||||||||

| Common stock, par value $5.55, 22,500,000 shares authorized; 8,064,713 and 7,620,250 shares issued; 7,554,488 and 7,110,025 shares outstanding | 44,802 | 42,335 | 5.83 | % | |||||||

| Additional paid-in capital | 62,989 | 55,890 | 12.70 | % | |||||||

| Retained earnings | 114,008 | 104,067 | 9.55 | % | |||||||

| Accumulated other comprehensive loss: | |||||||||||

| Net unrealized loss on available for sale securities | (2,571 | ) | (10,886 | ) | 76.38 | % | |||||

| Defined benefit plan | (2,719 | ) | (4,051 | ) | 32.88 | % | |||||

| Treasury stock at cost, 510,225 shares | (12,815 | ) | (12,815 | ) | — | % | |||||

| TOTAL SHAREHOLDERS’ EQUITY | 203,694 | 174,540 | 16.70 | % | |||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 2,259,250 | $ | 2,176,468 | 3.80 | % | |||||

| PENNS WOODS BANCORP, INC. CONSOLIDATED STATEMENT OF INCOME (UNAUDITED) |

||||||||||||||||||||||

| (In Thousands, Except Share and Per Share Data) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||

| INTEREST AND DIVIDEND INCOME: | ||||||||||||||||||||||

| Loans including fees | $ | 25,632 | $ | 21,720 | 18.01 | % | $ | 74,021 | $ | 59,571 | 24.26 | % | ||||||||||

| Investment securities: | ||||||||||||||||||||||

| Taxable | 1,874 | 1,365 | 37.29 | % | 5,213 | 3,870 | 34.70 | % | ||||||||||||||

| Tax-exempt | 61 | 114 | (46.49)% | 233 | 410 | (43.17)% | ||||||||||||||||

| Dividend and other interest income | 621 | 722 | (13.99)% | 1,980 | 1,827 | 8.37 | % | |||||||||||||||

| TOTAL INTEREST AND DIVIDEND INCOME | 28,188 | 23,921 | 17.84 | % | 81,447 | 65,678 | 24.01 | % | ||||||||||||||

| INTEREST EXPENSE: | ||||||||||||||||||||||

| Deposits | 9,599 | 6,463 | 48.52 | % | 26,439 | 14,686 | 80.03 | % | ||||||||||||||

| Short-term borrowings | 932 | 2,412 | (61.36)% | 4,024 | 6,084 | (33.86)% | ||||||||||||||||

| Long-term borrowings | 2,601 | 1,714 | 51.75 | % | 7,667 | 3,892 | 96.99 | % | ||||||||||||||

| TOTAL INTEREST EXPENSE | 13,132 | 10,589 | 24.02 | % | 38,130 | 24,662 | 54.61 | % | ||||||||||||||

| NET INTEREST INCOME | 15,056 | 13,332 | 12.93 | % | 43,317 | 41,016 | 5.61 | % | ||||||||||||||

| PROVISION (RECOVERY) FOR CREDIT LOSSES | 740 | 1,372 | (46.06)% | (299 | ) | 263 | (213.69)% | |||||||||||||||

| NET INTEREST INCOME AFTER PROVISION (RECOVERY) OF CREDIT LOSSES | 14,316 | 11,960 | 19.70 | % | 43,616 | 40,753 | 7.03 | % | ||||||||||||||

| NON-INTEREST INCOME: | ||||||||||||||||||||||

| Service charges | 537 | 545 | (1.47)% | 1,551 | 1,557 | (0.39)% | ||||||||||||||||

| Net debt securities losses, available for sale | (5 | ) | (45 | ) | 88.89 | % | (40 | ) | (125 | ) | 68.00 | % | ||||||||||

| Net equity securities gains (losses) | 41 | (36 | ) | 213.89 | % | 24 | (35 | ) | 168.57 | % | ||||||||||||

| Bank-owned life insurance | 206 | 170 | 21.18 | % | 856 | 892 | (4.04)% | |||||||||||||||

| Gain on sale of loans | 416 | 257 | 61.87 | % | . | 1,021 | 732 | 39.48 | % | |||||||||||||

| Insurance commissions | 145 | 136 | 6.62 | % | 425 | 416 | 2.16 | % | ||||||||||||||

| Brokerage commissions | 164 | 142 | 15.49 | % | 521 | 448 | 16.29 | % | ||||||||||||||

| Loan broker income | 351 | 241 | 45.64 | % | 841 | 728 | 15.52 | % | ||||||||||||||

| Debit card income | 355 | 320 | 10.94 | % | 1,052 | 995 | 5.73 | % | ||||||||||||||

| Other | 211 | 145 | 45.52 | % | 657 | 546 | 20.33 | % | ||||||||||||||

| TOTAL NON-INTEREST INCOME | 2,421 | 1,875 | 29.12 | % | 6,908 | 6,154 | 12.25 | % | ||||||||||||||

| NON-INTEREST EXPENSE: | ||||||||||||||||||||||

| Salaries and employee benefits | 6,402 | 6,290 | 1.78 | % | 19,224 | 18,778 | 2.38 | % | ||||||||||||||

| Occupancy | 731 | 784 | (6.76)% | 2,394 | 2,422 | (1.16)% | ||||||||||||||||

| Furniture and equipment | 731 | 867 | (15.69)% | 2,436 | 2,503 | (2.68)% | ||||||||||||||||

| Software amortization | 245 | 237 | 3.38 | % | 657 | 593 | 10.79 | % | ||||||||||||||

| Pennsylvania shares tax | 351 | 280 | 25.36 | % | 1,022 | 807 | 26.64 | % | ||||||||||||||

| Professional fees | 530 | 719 | (26.29)% | 1,654 | 2,313 | (28.49)% | ||||||||||||||||

| Federal Deposit Insurance Corporation deposit insurance | 399 | 425 | (6.12)% | 1,179 | 1,122 | 5.08 | % | |||||||||||||||

| Marketing | 60 | 167 | (64.07)% | 209 | 594 | (64.81)% | ||||||||||||||||

| Intangible amortization | 26 | 25 | 4.00 | % | 77 | 92 | (16.30)% | |||||||||||||||

| Other | 1,409 | 1,378 | 2.25 | % | 4,652 | 4,275 | 8.82 | % | ||||||||||||||

| TOTAL NON-INTEREST EXPENSE | 10,884 | 11,172 | (2.58)% | 33,504 | 33,499 | 0.01 | % | |||||||||||||||

| INCOME BEFORE INCOME TAX PROVISION | 5,853 | 2,663 | 119.79 | % | 17,020 | 13,408 | 26.94 | % | ||||||||||||||

| INCOME TAX PROVISION | 1,052 | 439 | 139.64 | % | 3,022 | 2,355 | 28.32 | % | ||||||||||||||

| NET INCOME AVAILABLE TO COMMON SHAREHOLDERS’ | $ | 4,801 | $ | 2,224 | 115.87 | % | $ | 13,998 | $ | 11,053 | 26.64 | % | ||||||||||

| EARNINGS PER SHARE – BASIC | $ | 0.64 | $ | 0.31 | 106.45 | % | $ | 1.86 | $ | 1.56 | 19.23 | % | ||||||||||

| EARNINGS PER SHARE – DILUTED | $ | 0.64 | $ | 0.31 | 106.45 | % | $ | 1.86 | $ | 1.53 | 21.57 | % | ||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING – BASIC | 7,544,344 | 7,072,440 | 6.67 | % | 7,528,758 | 7,064,336 | 6.57 | % | ||||||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING – DILUTED | 7,544,344 | 7,228,940 | 4.36 | % | 7,528,758 | 7,220,836 | 4.26 | % | ||||||||||||||

| PENNS WOODS BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES (UNAUDITED) |

||||||||||||||||||

| Three Months Ended | ||||||||||||||||||

| (Dollars in Thousands) | September 30, 2024 | September 30, 2023 | ||||||||||||||||

| Average Balance (1) |

Interest | Average Rate |

Average Balance (1) |

Interest | Average Rate |

|||||||||||||

| ASSETS: | ||||||||||||||||||

| Tax-exempt loans (3) | $ | 69,831 | $ | 534 | 3.04 | % | $ | 68,243 | $ | 462 | 2.69 | % | ||||||

| All other loans | 1,805,097 | 25,210 | 5.56 | % | 1,730,669 | 21,355 | 4.90 | % | ||||||||||

| Total loans (2) | 1,874,928 | 25,744 | 5.46 | % | 1,798,912 | 21,817 | 4.81 | % | ||||||||||

| Taxable securities | 207,888 | 2,355 | 4.61 | % | 193,019 | 1,945 | 4.09 | % | ||||||||||

| Tax-exempt securities (3) | 11,475 | 77 | 2.73 | % | 20,777 | 144 | 2.81 | % | ||||||||||

| Total securities | 219,363 | 2,432 | 4.51 | % | 213,796 | 2,089 | 3.96 | % | ||||||||||

| Interest-bearing balances in other financial institutions | 10,167 | 140 | 5.48 | % | 11,868 | 142 | 4.75 | % | ||||||||||

| Total interest-earning assets | 2,104,458 | 28,316 | 5.36 | % | 2,024,576 | 24,048 | 4.72 | % | ||||||||||

| Other assets | 132,244 | 131,451 | ||||||||||||||||

| TOTAL ASSETS | $ | 2,236,702 | $ | 2,156,027 | ||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY: | ||||||||||||||||||

| Savings | $ | 214,050 | 282 | 0.52 | % | $ | 225,357 | 181 | 0.32 | % | ||||||||

| Super Now deposits | 220,825 | 1,133 | 2.04 | % | 244,387 | 1,174 | 1.91 | % | ||||||||||

| Money market deposits | 320,908 | 2,781 | 3.45 | % | 294,006 | 1,862 | 2.51 | % | ||||||||||

| Time deposits | 482,335 | 5,403 | 4.46 | % | 342,450 | 3,246 | 3.76 | % | ||||||||||

| Total interest-bearing deposits | 1,238,118 | 9,599 | 3.08 | % | 1,106,200 | 6,463 | 2.32 | % | ||||||||||

| Short-term borrowings | 66,795 | 932 | 5.54 | % | 173,364 | 2,412 | 5.52 | % | ||||||||||

| Long-term borrowings | 250,938 | 2,601 | 4.12 | % | 204,901 | 1,714 | 3.32 | % | ||||||||||

| Total borrowings | 317,733 | 3,533 | 4.42 | % | 378,265 | 4,126 | 4.33 | % | ||||||||||

| Total interest-bearing liabilities | 1,555,851 | 13,132 | 3.35 | % | 1,484,465 | 10,589 | 2.83 | % | ||||||||||

| Demand deposits | 453,169 | 471,494 | ||||||||||||||||

| Other liabilities | 27,558 | 24,193 | ||||||||||||||||

| Shareholders’ equity | 200,124 | 175,875 | ||||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 2,236,702 | $ | 2,156,027 | ||||||||||||||

| Interest rate spread (3) | 2.01 | % | 1.89 | % | ||||||||||||||

| Net interest income/margin (3) | $ | 15,184 | 2.88 | % | $ | 13,459 | 2.65 | % | ||||||||||

1. Information on this table has been calculated using average daily balance sheets to obtain average balances.

2. Non-accrual loans have been included with loans for the purpose of analyzing net interest earnings.

3. Income and rates on fully taxable equivalent basis include an adjustment for the difference between annual income

from tax-exempt obligations and the taxable equivalent of such income at the standard tax rate of 21%

| Three Months Ended September 30, | ||||||

| 2024 | 2023 | |||||

| Total interest income | $ | 28,188 | $ | 23,921 | ||

| Total interest expense | 13,132 | 10,589 | ||||

| Net interest income (GAAP) | 15,056 | 13,332 | ||||

| Tax equivalent adjustment | 128 | 127 | ||||

| Net interest income (fully taxable equivalent) (non-GAAP) | $ | 15,184 | $ | 13,459 | ||

| PENNS WOODS BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES (UNAUDITED) |

||||||||||||||||||

| Nine Months Ended | ||||||||||||||||||

| September 30, 2024 | September 30, 2023 | |||||||||||||||||

| (Dollars in Thousands) | Average Balance (1) |

Interest | Average Rate |

Average Balance (1) |

Interest | Average Rate |

||||||||||||

| ASSETS: | ||||||||||||||||||

| Tax-exempt loans (3) | $ | 69,455 | $ | 1,490 | 2.87 | % | $ | 66,372 | $ | 1,371 | 2.76 | % | ||||||

| All other loans | 1,792,518 | 72,844 | 5.43 | % | 1,668,596 | 58,488 | 4.69 | % | ||||||||||

| Total loans (2) | 1,861,973 | 74,334 | 5.33 | % | 1,734,968 | 59,859 | 4.61 | % | ||||||||||

| Taxable securities | 203,964 | 6,795 | 4.45 | % | 188,477 | 5,331 | 3.78 | % | ||||||||||

| Tax-exempt securities (3) | 13,625 | 295 | 2.89 | % | 25,837 | 519 | 2.69 | % | ||||||||||

| Total securities | 217,589 | 7,090 | 4.35 | % | 214,314 | 5,850 | 3.65 | % | ||||||||||

| Interest-bearing balances in other financial institutions | 10,382 | 398 | 5.12 | % | 10,619 | 366 | 4.61 | % | ||||||||||

| Total interest-earning assets | 2,089,944 | 81,822 | 5.24 | % | 1,959,901 | 66,075 | 4.41 | % | ||||||||||

| Other assets | 131,000 | 132,133 | ||||||||||||||||

| TOTAL ASSETS | $ | 2,220,944 | $ | 2,092,034 | ||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY: | ||||||||||||||||||

| Savings | $ | 217,056 | 811 | 0.50 | % | $ | 233,784 | 456 | 0.26 | % | ||||||||

| Super Now deposits | 218,307 | 3,303 | 2.02 | % | 293,636 | 3,026 | 1.38 | % | ||||||||||

| Money market deposits | 308,027 | 7,734 | 3.35 | % | 292,490 | 4,807 | 2.20 | % | ||||||||||

| Time deposits | 446,158 | 14,591 | 4.37 | % | 264,855 | 6,397 | 3.23 | % | ||||||||||

| Total interest-bearing deposits | 1,189,548 | 26,439 | 2.97 | % | 1,084,765 | 14,686 | 1.81 | % | ||||||||||

| Short-term borrowings | 96,669 | 4,024 | 5.60 | % | 155,136 | 6,084 | 5.26 | % | ||||||||||

| Long-term borrowings | 256,960 | 7,667 | 3.99 | % | 169,276 | 3,892 | 3.07 | % | ||||||||||

| Total borrowings | 353,629 | 11,691 | 4.43 | % | 324,412 | 9,976 | 4.12 | % | ||||||||||

| Total interest-bearing liabilities | 1,543,177 | 38,130 | 3.30 | % | 1,409,177 | 24,662 | 2.34 | % | ||||||||||

| Demand deposits | 454,967 | 484,662 | ||||||||||||||||

| Other liabilities | 31,133 | 26,334 | ||||||||||||||||

| Shareholders’ equity | 191,667 | 171,861 | ||||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 2,220,944 | $ | 2,092,034 | ||||||||||||||

| Interest rate spread (3) | 1.94 | % | 2.07 | % | ||||||||||||||

| Net interest income/margin (3) | $ | 43,692 | 2.79 | % | $ | 41,413 | 2.82 | % | ||||||||||

1. Information on this table has been calculated using average daily balance sheets to obtain average balances.

2. Non-accrual loans have been included with loans for the purpose of analyzing net interest earnings.

3. Income and rates on fully taxable equivalent basis include an adjustment for the difference between annual income

from tax-exempt obligations and the taxable equivalent of such income at the standard tax rate of 21%

| Nine months ended September 30, | ||||||

| 2024 | 2023 | |||||

| Total interest income | $ | 81,447 | $ | 65,678 | ||

| Total interest expense | 38,130 | 24,662 | ||||

| Net interest income (GAAP) | 43,317 | 41,016 | ||||

| Tax equivalent adjustment | 375 | 397 | ||||

| Net interest income (fully taxable equivalent) (non-GAAP) | $ | 43,692 | $ | 41,413 | ||

| (Dollars in Thousands, Except Per Share Data, Unaudited) | Quarter Ended | |||||||||||||||||||

| 9/30/2024 | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | ||||||||||||||||

| Operating Data | ||||||||||||||||||||

| Net income | $ | 4,801 | $ | 5,390 | $ | 3,808 | $ | 5,555 | $ | 2,224 | ||||||||||

| Net interest income | 15,056 | 14,515 | 13,746 | 13,948 | 13,332 | |||||||||||||||

| Provision (recovery) for credit losses | 740 | (1,177 | ) | 138 | (1,742 | ) | 1,372 | |||||||||||||

| Net security gains (losses) | 36 | (19 | ) | (33 | ) | (18 | ) | (81 | ) | |||||||||||

| Non-interest income, excluding net security gains (losses) | 2,385 | 2,044 | 2,495 | 2,239 | 1,956 | |||||||||||||||

| Non-interest expense | 10,884 | 10,996 | 11,623 | 10,997 | 11,172 | |||||||||||||||

| Performance Statistics | ||||||||||||||||||||

| Net interest margin | 2.88 | % | 2.83 | % | 2.69 | % | 2.73 | % | 2.65 | % | ||||||||||

| Annualized cost of total deposits | 2.27 | % | 2.14 | % | 2.01 | % | 1.89 | % | 1.64 | % | ||||||||||

| Annualized non-interest income to average assets | 0.43 | % | 0.37 | % | 0.45 | % | 0.41 | % | 0.35 | % | ||||||||||

| Annualized non-interest expense to average assets | 1.95 | % | 1.98 | % | 2.10 | % | 2.02 | % | 2.07 | % | ||||||||||

| Annualized return on average assets | 0.86 | % | 0.97 | % | 0.69 | % | 1.02 | % | 0.41 | % | ||||||||||

| Annualized return on average equity | 9.60 | % | 11.12 | % | 8.03 | % | 12.60 | % | 5.06 | % | ||||||||||

| Annualized net loan charge-offs (recoveries) to average loans | 0.07 | % | (0.09)% | 0.08 | % | (0.05)% | 0.01 | % | ||||||||||||

| Net charge-offs (recoveries) | 328 | (396 | ) | 380 | (209 | ) | 33 | |||||||||||||

| Efficiency ratio | 62.26 | % | 66.25 | % | 71.41 | % | 67.78 | % | 72.76 | % | ||||||||||

| Per Share Data | ||||||||||||||||||||

| Basic earnings per share | $ | 0.64 | $ | 0.72 | $ | 0.51 | $ | 0.77 | $ | 0.31 | ||||||||||

| Diluted earnings per share | 0.64 | 0.72 | 0.51 | 0.77 | 0.31 | |||||||||||||||

| Dividend declared per share | 0.32 | 0.32 | 0.32 | 0.32 | 0.32 | |||||||||||||||

| Book value | 26.96 | 26.13 | 25.72 | 25.51 | 24.55 | |||||||||||||||

| Tangible book value (Non-GAAP) | 24.77 | 23.93 | 23.50 | 23.29 | 22.20 | |||||||||||||||

| Common stock price: | ||||||||||||||||||||

| High | 23.98 | 21.08 | 22.64 | 23.64 | 27.17 | |||||||||||||||

| Low | 19.29 | 17.17 | 18.44 | 20.05 | 20.70 | |||||||||||||||

| Close | 23.79 | 20.55 | 19.41 | 22.51 | 21.08 | |||||||||||||||

| Weighted average common shares: | ||||||||||||||||||||

| Basic | 7,544 | 7,529 | 7,513 | 7,255 | 7,072 | |||||||||||||||

| Fully Diluted | 7,544 | 7,529 | 7,513 | 7,255 | 7,229 | |||||||||||||||

| End-of-period common shares: | ||||||||||||||||||||

| Issued | 8,065 | 8,052 | 8,036 | 8,019 | 7,620 | |||||||||||||||

| Treasury | (510 | ) | (510 | ) | (510 | ) | (510 | ) | (510 | ) | ||||||||||

| (Dollars in Thousands, Unaudited) | Quarter Ended | |||||||||||||||||||

| 9/30/2024 | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | ||||||||||||||||

| Financial Condition Data: | ||||||||||||||||||||

| General | ||||||||||||||||||||

| Total assets | $ | 2,259,250 | $ | 2,234,617 | $ | 2,210,116 | $ | 2,204,809 | $ | 2,176,468 | ||||||||||

| Loans, net | 1,863,586 | 1,855,054 | 1,843,805 | 1,828,318 | 1,805,571 | |||||||||||||||

| Goodwill | 16,450 | 16,450 | 16,450 | 16,450 | 16,450 | |||||||||||||||

| Intangibles | 133 | 158 | 184 | 210 | 235 | |||||||||||||||

| Total deposits | 1,700,321 | 1,648,093 | 1,618,562 | 1,589,493 | 1,567,267 | |||||||||||||||

| Noninterest-bearing | 452,922 | 461,092 | 471,451 | 471,173 | 471,507 | |||||||||||||||

| Savings | 211,560 | 218,354 | 220,932 | 219,287 | 226,897 | |||||||||||||||

| NOW | 218,279 | 209,906 | 208,073 | 214,888 | 220,730 | |||||||||||||||

| Money Market | 321,614 | 320,101 | 299,916 | 299,353 | 291,889 | |||||||||||||||

| Time Deposits | 328,294 | 310,187 | 292,372 | 260,067 | 249,550 | |||||||||||||||

| Brokered Deposits | 167,652 | 128,453 | 125,818 | 124,725 | 106,694 | |||||||||||||||

| Total interest-bearing deposits | 1,247,399 | 1,187,001 | 1,147,111 | 1,118,320 | 1,095,760 | |||||||||||||||

| Core deposits* | 1,204,375 | 1,209,453 | 1,200,372 | 1,204,701 | 1,211,023 | |||||||||||||||

| Shareholders’ equity | 203,694 | 197,087 | 193,517 | 191,556 | 174,540 | |||||||||||||||

| Asset Quality | ||||||||||||||||||||

| Non-performing loans | $ | 7,940 | $ | 6,784 | $ | 7,958 | $ | 3,148 | $ | 3,683 | ||||||||||

| Non-performing loans to total assets | 0.35 | % | 0.30 | % | 0.36 | % | 0.14 | % | 0.17 | % | ||||||||||

| Allowance for credit losses on loans | 11,588 | 11,234 | 11,542 | 11,446 | 12,890 | |||||||||||||||

| Allowance for credit losses on loans to total loans | 0.62 | % | 0.60 | % | 0.62 | % | 0.62 | % | 0.71 | % | ||||||||||

| Allowance for credit losses on loans to non-performing loans | 145.94 | % | 165.60 | % | 145.04 | % | 363.60 | % | 349.99 | % | ||||||||||

| Non-performing loans to total loans | 0.42 | % | 0.36 | % | 0.43 | % | 0.17 | % | 0.20 | % | ||||||||||

| Capitalization | ||||||||||||||||||||

| Shareholders’ equity to total assets | 9.02 | % | 8.82 | % | 8.76 | % | 8.69 | % | 8.02 | % | ||||||||||

* Core deposits are defined as total deposits less time deposits and brokered deposits.

| Reconciliation of GAAP and Non-GAAP Financial Measures (UNAUDITED) |

||||||||||||||||

| (Dollars in Thousands, Except Per Share Data, Unaudited) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||