Analyst Report: Comerica, Inc.

Summary

Based in Dallas, Comerica has 430 bank locations in Texas, California, Michigan, Arizona, and Florida, with some select business lines in several other states, as well as in Canada and Mexico. The company organizes its business int

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Chitosan Market to Surpass Value of $62.76 Billion by 2031: SkyQuest Technology

Westford, US, Oct. 24, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the global chitosan market size will reach a value of USD 62.76 Billion by 2031, with a CAGR of 21.3% during the forecast period (2024-2031). Global market is predicted to witness explosive growth due to the ever-growing demand among consumers for organic and natural products. Chitosan fits the green and eco-friendly choices that consumers are increasingly opting for The demand for chitosan is also being driven by the growing pharmaceutical sector and growing health consciousness attributed to its excellent properties in tissue engineering, drug delivery systems, and wound healing.

Request Sample of the Report- https://www.skyquestt.com/sample-request/chitosan-market

Asia-Pacific Dominance Due to Its Large Customer Base

The global chitosan market share was dominated by Asia-Pacific. The success of the region is owed to a number of factors. Among such factors are the strong presence of significant manufacturers, easy access to raw materials, and the strong food and pharmaceutical industries, which use significant quantities of chitosan in various applications. With more than 4.5 billion people living in its territory and growing sectors of industry fast, Asia-Pacific is one significant source of a considerable customer base and a lucrative market for chitosan products.

On the contrary, the North America chitosan market is anticipated to grow at the fastest rate. This growth is driven by growing awareness of the diverse benefits Chitosan could offer in most medical, cosmetic, and agricultural applications. In addition, robust legislation on green innovation combined with overwhelming demand for green and organic products has also contributed to better observance of chitosan application in North America.

Chitosan Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 13.39 Billion |

| Estimated Value by 2031 | USD 62.76 Billion |

| Growth Rate | Poised to grow at a CAGR of 21.3 % |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Source, Application, Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Chitosan and its Rising Demand |

| Key Market Opportunities | Emerging Applications of Chitosan |

| Key Market Drivers | Advancements in Extraction and Processing Technologies |

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/chitosan-market

Shrimp-Based Chitosan and its Prevalence Due to the Seafood Industry’s Waste

The shrimp-based chitosan segment held the largest market share and also the biggest category in terms of source. The wide prevalence of chitosan derived from shrimp can be traced to the sheer amount of waste from shrimp produced by the seafood processing industry. Increased demand for shrimp, which is increasingly becoming a popular seafood product, has increased the market for shrimp-based chitosan. Shrimp shells are full of chitin. Moreover, high-quality and pure chitosan produced from shrimp is highly in demand by different end-use industries such as cosmetics, agriculture, and pharmaceuticals.

Rapid Growth of Chitosan in Biomedical & Pharmaceuticals Industry Due to Its Antibacterial Properties

The biomedical & pharmaceuticals segment is the fastest-growing category in the Chitosan market. Due to its outstanding antibacterial, biodegradable, and biocompatibility properties, chitosan is a great material for various medicinal applications. It is now gaining high application in tissue engineering, drug delivery systems, wound healing, and other fields of medicinal practice. The biomedical & pharmaceuticals industry is increasingly growing due to factors such as the increasing frequency of chronic illnesses, advanced drug delivery technologies, and demand for regenerative medicine.

Is this report aligned with your requirements? Purchase Inquiry- https://www.skyquestt.com/buy-now/chitosan-market

Chitosan Market Drivers

- Advancements in Extraction and Processing Technologies

- Agricultural Applications

- Growing Demand for Biodegradable Products

Chitosan Market Restraints

- High Production Costs

- Variability in Quality

- Regulatory Challenges

Chitosan Market Key Players

- Koyo World

- Primex Iceland

- Primex EHF

- KitoZyme SA

- CarboMer Inc.

- United Chitotechnologies Inc.

- Biophrame Technologies

- Primex

- G.T.C. Bio Corporation

- Golden-Shell Pharmaceutical Co., Ltd.

Key Questions Covered in the Chitosan Market Report

- What are the factors driving the growth of the global chitosan market?

- Which is the dominant region within the market?

- What are the major players operating within the market?

This report provides the following insights:

Analysis of key drivers (advancements in extraction & processing technologies, growing demand for biodegradable products), restraints (high production costs, regulatory challenges), opportunities (emerging applications, R&D), and challenges (sustainability of raw materials, competition from synthetic alternatives) influencing the growth of the chitosan market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Report:

Biochar Market: Global Opportunity Analysis and Forecast, 2024-2031

Green Ammonia Market: Global Opportunity Analysis and Forecast, 2024-2031

Activated Carbon Market: Global Opportunity Analysis and Forecast, 2024-2031

Specialty Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Lubricants Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

West Pharmaceutical's Q3 Performance Shows Rising Demand For Syringes, Company Boosts Annual Forecast And Dividend

On Thursday, West Pharmaceutical Services, Inc. WST reported adjusted EPS of $1.85, down from $2.16 a year ago, beating the consensus of $1.50.

The designer and manufacturer of injectable pharmaceutical packaging and delivery systems reported sales of $746.9 million, beating the consensus of $709.62 million.

The Proprietary Products Segment’s sales declined by 0.2% to $601.4 million, and the organic net sales decline was 0.5%.

High-value products (components and devices) represented over 75% of segment net sales in the period, led by customer demand for self-injection device platforms.

Sales in the Contract-Manufactured Products Segment grew marginally by 0.4% to $145.5 million. Organic net sales were consistent with the third quarter of last year.

Segment performance was driven by growth in self-injection devices for obesity and diabetes, offset by a decrease in sales of healthcare diagnostic devices.

Eric M. Green, President, CEO, and Chair of the Board, commented, “We are pleased to report solid third-quarter results…This reinforces my confidence in West’s execution capabilities as we continue to deliver our proven market-led strategy and attractive long-term potential.”

Dividend: West Pharmaceutical approved the fourth quarter 2024 dividend of $0.21/share, up 5% from the $0.20/share paid in the four preceding quarters. The dividend will be paid on November 20 to shareholders of record as of November 13.

Guidance: West Pharmaceutical Services raised its fiscal year 2024 guidance on favorable currency movements.

The company expects 2024 adjusted EPS guidance of $6.55-$6.75 compared to prior guidance of $6.35-$6.65 and consensus of $6.51.

West Pharmaceutical Services forecasts 2024 sales of $2.875 billion-$2.905 billion compared to prior guidance of $2.87 billion-$2.9 billion and a consensus of $2.874 billion.

Price Action: At the last check on Thursday, WST stock was up 17.60% at $337.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

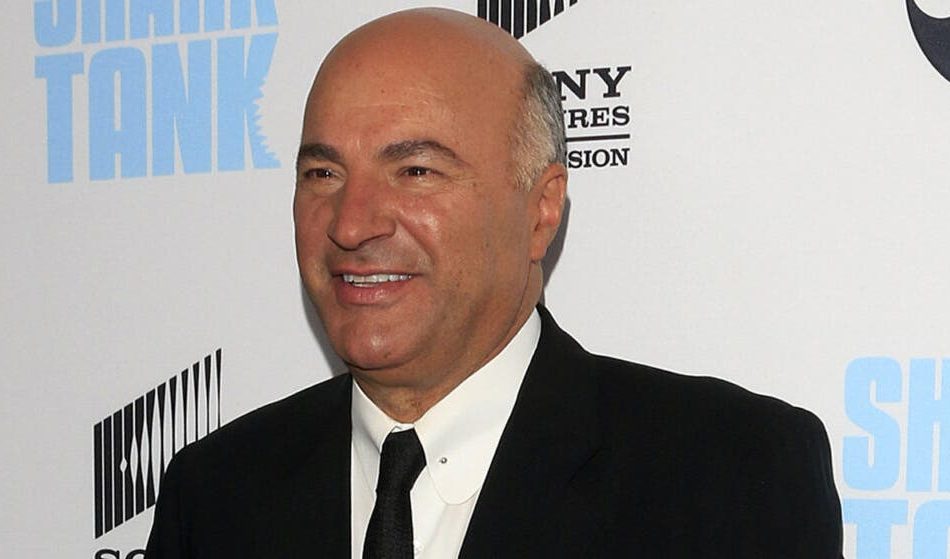

Kevin O'Leary Warns, 'Never Let A Man Control Your Financial Destiny.' He Says, Divorce Your Husband And 'You're A Nobody In The System'

Kevin O’Leary, often called Mr. Wonderful by many, is well-known for giving honest and frank advice, particularly regarding relationships and money.

During a recent appearance on The View with his Shark Tank colleagues Mark Cuban and Daniel Lubetzky, O’Leary made it clear that women must aggressively take charge of their financial independence. In other words, they should never give up control of their financial future to a man.

Don’t Miss:

He pointed out that 50% of marriages fail – often due to financial issues – and emphasized that losing control of your finances risks losing your independence.

“If you get divorced from your husband, you’re a nobody in the system,” O’Leary said. He stressed that women need to maintain their credit scores and financial identities. Women can end up financially vulnerable without a credit card or a solid credit score.

His solution? Each partner should have their credit cards plus a shared card for communal expenses. He also underlined the importance of having an individual investing account to ensure that every woman has her own financial safety net.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

According to O’Leary, the right partner supports your financial independence, not one who takes it away. He advises women to limit how much control anyone, including their spouse, has over their money. He wants women to prioritize their financial identity and ensure their assets are in their name.

“Never let a man control your financial destiny,” O’Leary urged. His advice may sound harsh to some, but it’s rooted in a pragmatic view of what happens when financial independence is compromised. O’Leary believes that maintaining your own financial identity is key to personal freedom.

170 Banks Now Armed With Data Insights: Green Check Rolls Out Cannabis Banking Solutions

Green Check, a leader in compliant cannabis banking solutions, has introduced a new portfolio management capability for its network of over 170 financial institutions (FIs).

This new module provides FIs with a portfolio-wide dashboard that enhances data analysis and offers custom product creation and detailed reporting features.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Advanced Tools For Data-Driven Decisions

The dashboard allows financial institutions to build, explore and export customized services, improving account management by monitoring key growth indicators and potential churn risks.

With proactive account management tools, FIs can track portfolio and account-level valuations, sales trends and industry-wide comparisons.

Other features include task overviews, market landscape insights, and state-by-state forecasts based on growth models.

“Financial institutions need integrated data sources that reflect program and industry trends to make goal-oriented business decisions,” Kevin Hart, founder and CEO of Green Check, told Benzinga Cannabis.

He emphasized that FIs now have access to a comprehensive framework for setting goals and measuring progress, including forward-looking variables from a report commissioned with Whitney Economics and CTrust.

Read Next: Cannabis Rescheduling And Credit Risk: What Industry Insiders Are Saying

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Here's How Much $100 Invested In Taiwan Semiconductor 10 Years Ago Would Be Worth Today

Taiwan Semiconductor TSM has outperformed the market over the past 10 years by 13.5% on an annualized basis producing an average annual return of 24.81%. Currently, Taiwan Semiconductor has a market capitalization of $1.03 trillion.

Buying $100 In TSM: If an investor had bought $100 of TSM stock 10 years ago, it would be worth $917.42 today based on a price of $198.09 for TSM at the time of writing.

Taiwan Semiconductor’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

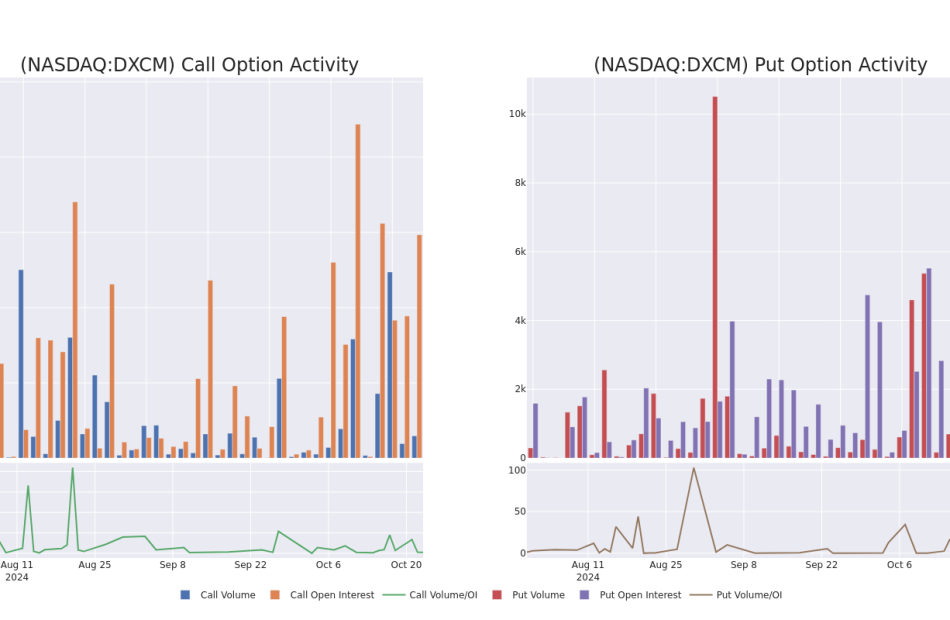

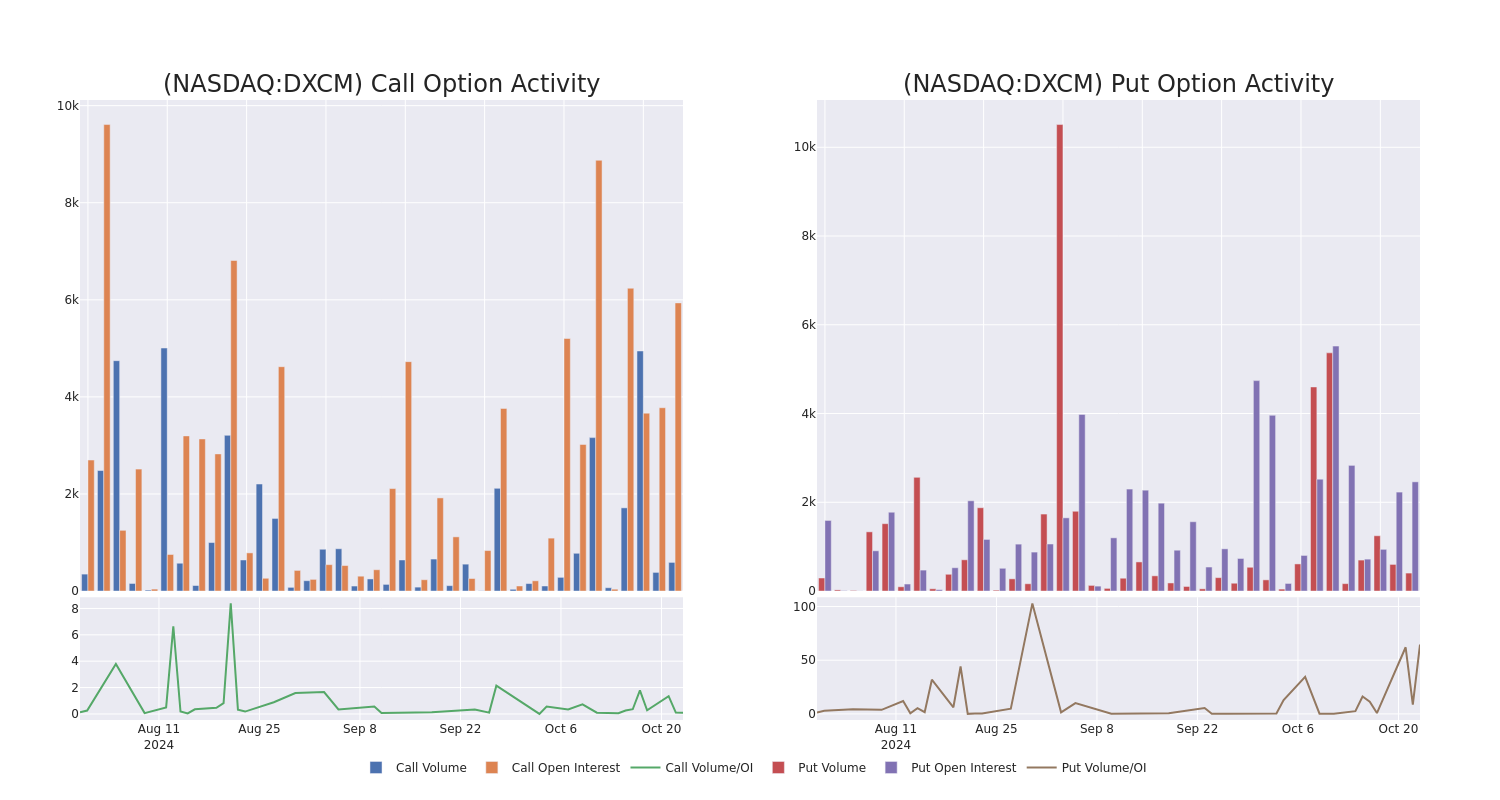

A Closer Look at DexCom's Options Market Dynamics

Financial giants have made a conspicuous bearish move on DexCom. Our analysis of options history for DexCom DXCM revealed 33 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $858,857, and 22 were calls, valued at $1,105,260.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $100.0 for DexCom during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for DexCom’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DexCom’s whale trades within a strike price range from $65.0 to $100.0 in the last 30 days.

DexCom Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | PUT | TRADE | NEUTRAL | 01/16/26 | $10.2 | $9.6 | $9.9 | $65.00 | $297.0K | 155 | 300 |

| DXCM | PUT | SWEEP | BEARISH | 06/20/25 | $28.0 | $27.8 | $28.0 | $100.00 | $162.4K | 1.0K | 58 |

| DXCM | CALL | SWEEP | BEARISH | 11/01/24 | $4.9 | $4.7 | $4.7 | $74.00 | $109.0K | 996 | 480 |

| DXCM | CALL | SWEEP | BEARISH | 01/16/26 | $14.0 | $13.5 | $13.5 | $85.00 | $108.0K | 53 | 80 |

| DXCM | PUT | SWEEP | BEARISH | 09/19/25 | $18.9 | $18.8 | $18.8 | $85.00 | $81.2K | 0 | 44 |

About DexCom

Dexcom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

After a thorough review of the options trading surrounding DexCom, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is DexCom Standing Right Now?

- Currently trading with a volume of 3,281,825, the DXCM’s price is up by 2.46%, now at $74.26.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

Professional Analyst Ratings for DexCom

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $120.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on DexCom with a target price of $120.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DexCom with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Protein Hydrolysates Market Size on Track for USD 6.6 Billion by 2031, Expanding at 6.1% CAGR as Demand for High-Purity Proteins for Muscle Recovery Soars| Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 24, 2024 (GLOBE NEWSWIRE) — The global protein hydrolysates industry was worth US$ 3.8 billion in 2022. Between 2023 and 2031, it is expected to increase at a CAGR of 6.1% and reach US$ 6.6 billion by the end of the forecast period. The hypoallergenic properties of protein hydrolysates make them popular in infant formulas. As disposable incomes rise and awareness of infant health and nutrition grows, specialized infant formulas are in high demand, leading to higher sales of protein hydrolysates.

Food and beverage industries use protein hydrolysates for various reasons, such as fortified products, nutritional supplements, and functional beverages. Protein hydrolysates are incorporated into products as consumers seek convenience and nutritional benefits.

In the future, protein hydrolysate products may be customized to meet individual nutritional needs and health goals based on advances in technology, including genetic testing. Developing specialized protein formulations for specific groups of consumers could be a driving force behind the demand for protein formulations.

Click to Request PDF Sample Report and Drive Impactful Decisions: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54057

In the protein hydrolysate market, digital technologies such as block chains could enhance trust and transparency by enhancing supply chain transparency and consumer engagement. Direct marketing, which targets consumers directly, can also be developed through platforms, and individualized nutrition advice can also be provided based on a consumer’s biometrics and preferences.

Global Protein Hydrolysates Market: Competitive Landscape

Manufacturers are developing sports drinks, bars, and powders incorporating protein hydrolysate.

Key Market Players

- BRF Global

- Novozymes

- Crescent Biotech

- AMCO Proteins

- Scanbio Marine Group AS

- Bioiberica S.A.U.

- Kemin Industries Inc.

- Chaitanya Agro Biotech Pvt. Ltd.

- Copalis

- Bio-marine Ingredients Ireland

- Titan Biotech

- ZXCHEM USA INC.

- SUBONEYO Chemicals Pharmaceuticals P Limited

- NAN Group

- SAMPI

Key Findings of the Market Report

- A significant share of the market for protein hydrolysates will be occupied by plant protein.

- Powdered protein hydrolysates are popularly used in sports nutrition and during exercise recovery because of their high quality and availability

- Post-exercise recovery products containing protein hydrolysate have become increasingly popular with sports enthusiasts and athletes

- In 2022, the protein hydrolysates market was dominated by Europe.

Global Protein Hydrolysates Market: Growth Drivers

- Sports nutrition products are in high demand as health and fitness become more important. The rapid growth in the global protein hydrolysates market is due to the rapid absorption of protein hydrolysates and their muscle recovery properties, which makes them a popular choice among sportsmen and fitness enthusiasts.

- The demand for nutritionally beneficial products is growing as consumers become more health-conscious. The easy digestibility and high bioavailability of protein hydrolysates make them more appealing to health-conscious consumers than traditional protein sources.

- Due to advancements in processing technologies, manufacturers have produced more functional and sensory protein hydrolysates. Protein hydrolysates can easily be customized to meet nutritional and application requirements through innovative techniques like enzyme hydrolysis and membrane filtration.

- A growing number of people are adopting plant-based and vegan diets, which increases the demand for alternative protein sources. Consumers seeking cruelty-free and sustainable protein options increasingly turn to plant-derived protein hydrolysates.

- Ongoing research is driving innovation in the market to improve protein hydrolysates’ nutritional profile and functionality. Collaboration between academia, research institutions, and industry players has contributed to developing protein hydrolysate products with improved health benefits.

Download Sample PDF Brochure Here: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54057

Global Protein Hydrolysates Market: Regional Landscape

- Regulations regarding food safety, labeling, and health claims are strict throughout Europe. Regulation regarding protein hydrolysates, such as approvals of new ingredients or health claims, can significantly impact market dynamics. In response to the trend towards improved health, Europeans are increasingly interested in functional foods and beverages. With a growing health-conscious market, proteins hydrolysate will continue to gain popularity.

- Sustainable environmental practices and ethically sourced products are top priorities in Europe. For manufacturers to meet the demands of European consumers, they need to adhere to sustainable sourcing practices, environmentally friendly production methods, and transparent supply chain practices.

- Plant-based and vegan movements are becoming popular in Europe as health concerns, environmental sustainability, and animal welfare grow. Plant-derived protein hydrolysates may experience an increase in demand as consumer preferences align with plant-derived protein sources.

- The European food industry is home to many research institutes and companies that perform cutting-edge research in the science and technology of food. As a result of ongoing research and innovation efforts, new protein hydrolysate formulations will likely be developed with improved nutritional and functional benefits, driving growth in the market.

- Direct-to-consumer channels and e-commerce platforms are increasing in popularity and offer manufacturers greater opportunities to reach consumers directly in Europe. Digital marketing, e-commerce, and nutrition-specific platforms could facilitate consumer engagement and market access.

Key Developments

- In August 2023, Kemin Industries, a global manufacturer of ingredients, aims to better the lives of 80 percent of the world’s population through its products.

- A new manufacturing facility has opened in Verona, Missouri, to produce Proteus® functional proteins for the food industry that will enhance meat and poultry products and increase yield.

Global Protein Hydrolysates Market: Segmentation

By Product Type

- Milk Protein Hydrolysates

- Marine Protein Hydrolysates

- Meat Protein Hydrolysates

- Plant Protein Hydrolysates

- Silk Protein Hydrolysates

- Egg Protein Hydrolysates

- Yeast Protein Hydrolysates

By Source

By Form

By End Use

- Infant Formula

- Clinical Nutrition

- Sports Nutrition & Dietary Supplements

- Food & Beverages

- Animal Feed

- Cosmetics & Personal Care

- Others

By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- South Asia & Pacific

- East Asia

- Oceania

- Middle East & Africa

Drive Your Growth Strategy: Purchase the Report for Key Insights! https://www.transparencymarketresearch.com/checkout.php?rep_id=54057<ype=S

Explore Trending Reports of Food and Beverages:

- Probiotics Market – The global probiotics market is estimated to flourish at a CAGR of 8.0% from 2023 to 2031. According to Transparency Market Research, sales of probiotics are slated to total US$ 18.4 billion by the end of the aforementioned period of assessment.

- Apple Sauce Market – The global apple sauce market is estimated to flourish at a CAGR of 3.4% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for apple sauce is estimated to reach US$ 2.6 billion by the end of the aforementioned period of assessment.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rogers Communications Q3 Earnings Beat Expectations Amid Ongoing Network Investment Plans

Rogers Communication, Inc. RCI shares are trading lower after the company reported third-quarter results.

In U.S. dollars, adjusted earnings per share of $1.04 beat the analyst consensus estimate of 98 cents.

In Canadian dollars, the earnings per share were C$1.42, up 12% year over year. Quarterly sales totaled C$5.129 billion, up 1% year over year.

Wireless service revenue grew by 2% this quarter, mainly due to an increase in mobile phone subscribers over the past year.

Cable revenue fell by 1% this quarter but showed improvement from previous quarters, impacted by competitive promotions and a drop in Home Phone and Satellite subscribers.

Media revenue rose by 11% this quarter, driven mainly by higher sports-related revenue.

Also Read: Delivery Giant UPS Breaks Revenue-Miss Streak After 10 Quarters, Stock Soars

Consolidated adjusted EBITDA increased 6% this quarter, and the adjusted EBITDA margin increased by 230 basis points due to the full realization of the synergy program associated with the Shaw Transaction and ongoing cost efficiencies.

As of September 30, the firm had C$4.8 billion of available liquidity, consisting of C$0.8 billion in cash and equivalents and C$4 billion available under bank and other credit facilities.

The company declared a C$0.50 per share dividend on October 23.

Outlook Reiterated: Total service revenue is expected to grow by 8% to 10%, while adjusted EBITDA is projected to increase by 12% to 15%.

After the quarter ended, Rogers signed a non-binding term sheet with a prominent global financial investor for a structured equity investment of C$7 billion to finance part of its network. The completion of this agreement depends on finalizing definitive contracts and is anticipated to close in the fourth quarter.

Price Action: RCI shares are trading lower by 3.59% to $37.82 at last check Thursday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.