An Overview of World Acceptance's Earnings

World Acceptance WRLD is set to give its latest quarterly earnings report on Friday, 2024-10-25. Here’s what investors need to know before the announcement.

Analysts estimate that World Acceptance will report an earnings per share (EPS) of $1.99.

The market awaits World Acceptance’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

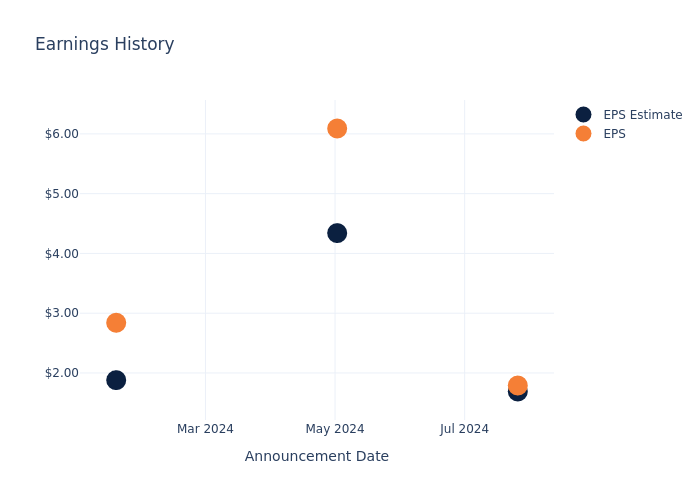

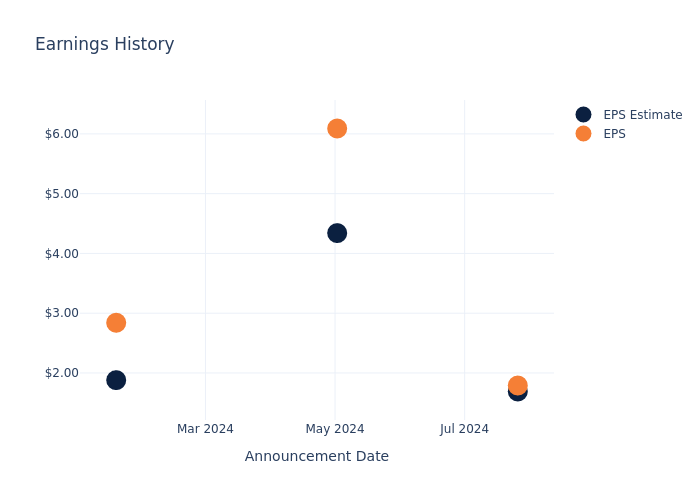

Earnings Track Record

The company’s EPS beat by $0.10 in the last quarter, leading to a 0.0% drop in the share price on the following day.

Here’s a look at World Acceptance’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.69 | 4.34 | 1.88 | 1.77 |

| EPS Actual | 1.79 | 6.09 | 2.84 | 2.71 |

| Price Change % | -18.0% | -1.0% | 17.0% | -5.0% |

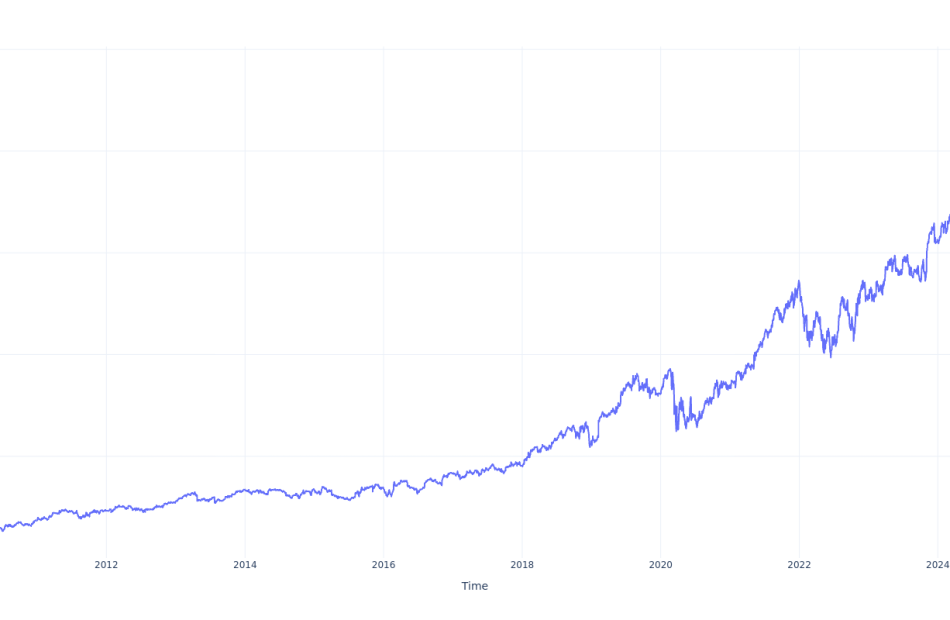

World Acceptance Share Price Analysis

Shares of World Acceptance were trading at $115.87 as of October 23. Over the last 52-week period, shares are up 19.22%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for World Acceptance visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

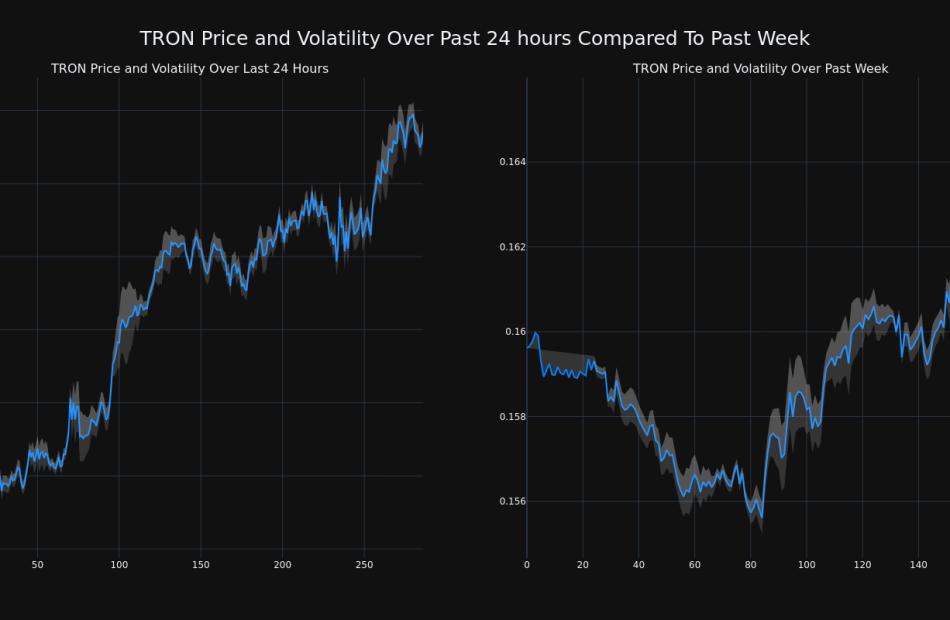

TRON's Price Increased More Than 3% Within 24 hours

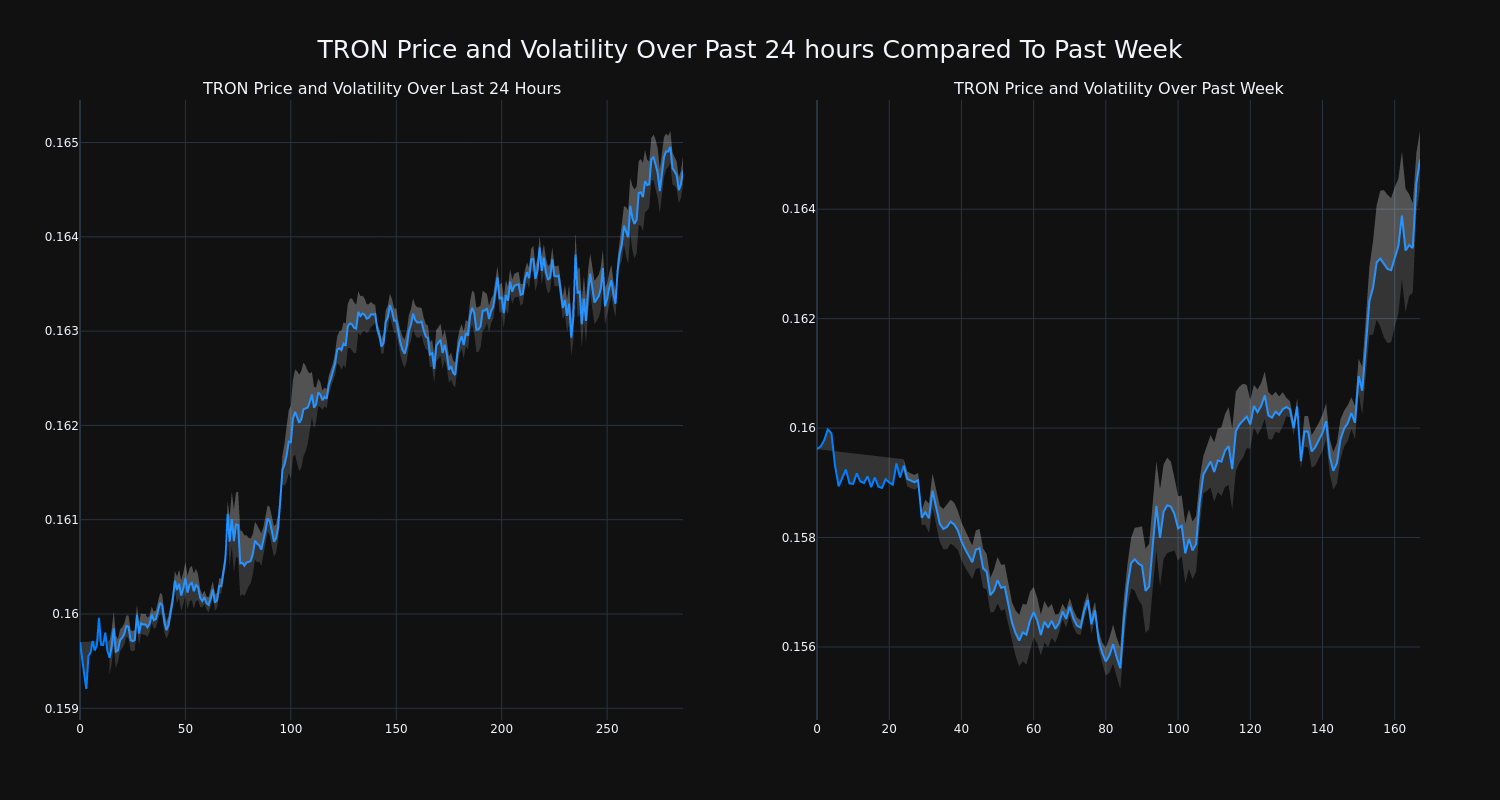

Over the past 24 hours, TRON’s TRX/USD price rose 3.01% to $0.16. This continues its positive trend over the past week where it has experienced a 3.0% gain, moving from $0.16 to its current price. As it stands right now, the coin’s all-time high is $0.23.

The chart below compares the price movement and volatility for TRON over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

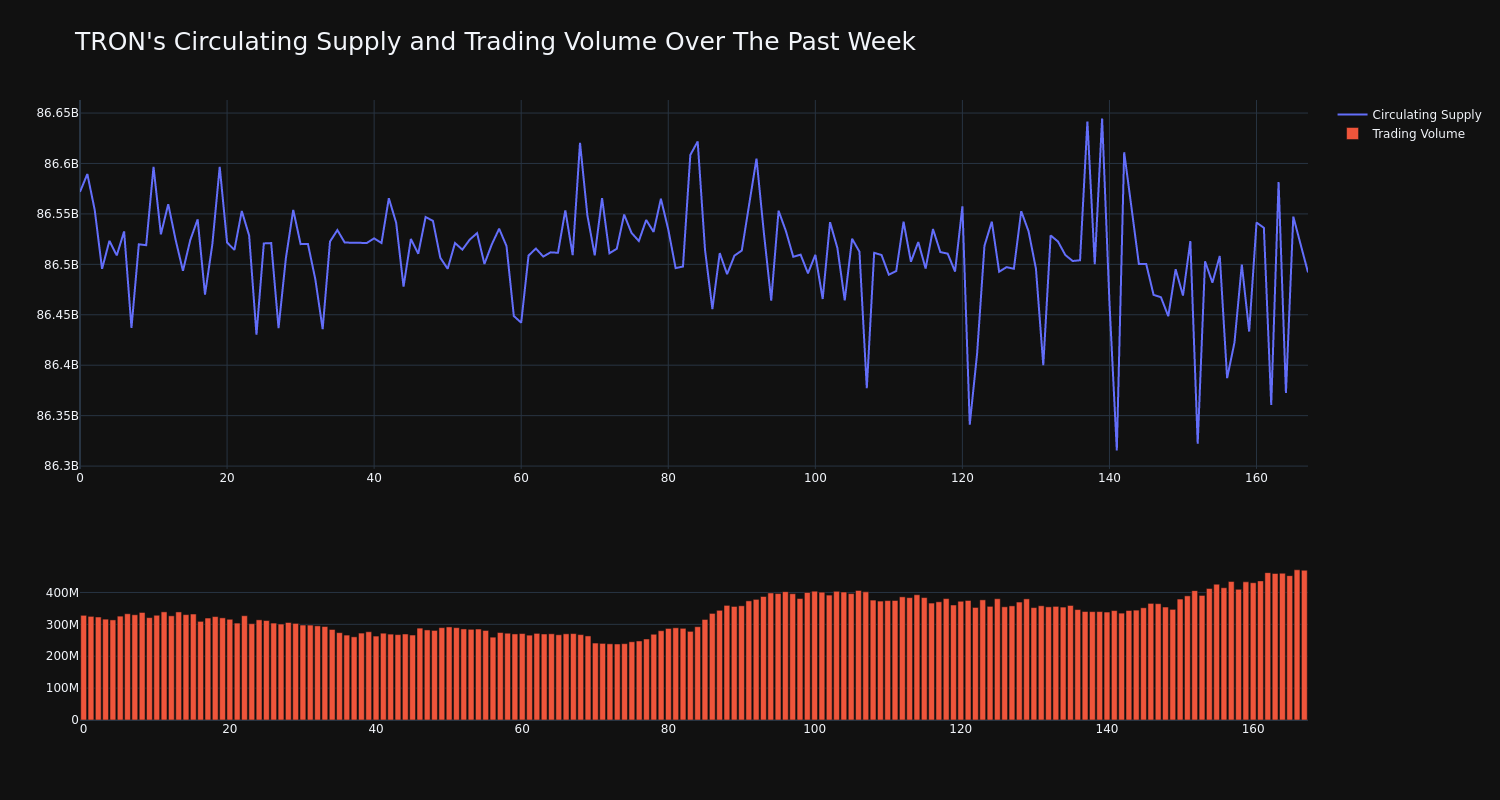

The trading volume for the coin has risen 43.0% over the past week diverging from the circulating supply of the coin, which has decreased 0.09%. This brings the circulating supply to 86.49 billion. According to our data, the current market cap ranking for TRX is #10 at $14.22 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Winpak Reports 2024 Third Quarter Results

WINNIPEG, MB, Oct. 24, 2024 /CNW/ – Winpak Ltd. (WPK) today reports consolidated results in US dollars for the third quarter of 2024, which ended on September 29, 2024.

|

Quarter Ended |

Year-To-Date Ended (1) |

||||||

|

September 29 |

October 1 |

September 29 |

October 1 |

||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

(thousands of US dollars, except per share amounts) |

|||||||

|

Revenue |

285,473 |

273,790 |

845,752 |

865,770 |

|||

|

Net income |

39,309 |

33,824 |

114,103 |

112,577 |

|||

|

Income tax expense |

14,659 |

11,970 |

43,287 |

38,956 |

|||

|

Net finance income |

(5,710) |

(5,033) |

(17,816) |

(12,551) |

|||

|

Depreciation and amortization |

13,338 |

11,866 |

39,038 |

35,912 |

|||

|

EBITDA (2) |

61,596 |

52,627 |

178,612 |

174,894 |

|||

|

Net income attributable to equity holders of the Company |

38,486 |

33,991 |

112,833 |

113,284 |

|||

|

Net income (loss) attributable to non-controlling interests |

823 |

(167) |

1,270 |

(707) |

|||

|

Net income |

39,309 |

33,824 |

114,103 |

112,577 |

|||

|

Basic and diluted earnings per share (cents) |

61 |

52 |

177 |

174 |

|||

|

Winpak Ltd. manufactures and distributes high-quality packaging materials and related packaging machines. The Company’s products are used primarily for the packaging of perishable foods, beverages and in healthcare applications. |

|

1 The 2024 fiscal year comprises 52 weeks and the 2023 fiscal year comprised 53 weeks. Each quarter of 2024 and 2023 comprises 13 weeks with the exception of the first quarter of 2023, which comprised 14 weeks. |

|

2 EBITDA is not a recognized measure under IFRS Accounting Standards (IFRS). Management believes that in addition to net income, this measure provides useful supplemental information to investors including an indication of cash available for distribution prior to debt service, capital expenditures, payment of lease liabilities and income taxes. Investors should be cautioned, however, that this measure should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s performance. The Company’s method of calculating this measure may differ from other companies and, accordingly, the results may not be comparable. |

(presented in US dollars)

Forward-looking statements: Certain statements made in the following report contain forward-looking statements including, but not limited to, statements concerning possible or assumed future results of operations of the Company. Forward-looking statements represent the Company’s intentions, plans, expectations and beliefs, and are not guarantees of future performance. Such forward-looking statements represent Winpak’s current views based on information as at the date of this report. They involve risks, uncertainties and assumptions and the Company’s actual results could differ, which in some cases may be material, from those anticipated in these forward-looking statements. Factors that could cause results to differ from those expected include, but are not limited to: the terms, availability and costs of acquiring raw materials and the ability to pass on price increases to customers; ability to negotiate contracts with new customers or renew existing customer contracts with less favorable terms; timely response to changes in customer product needs and market acceptance of our products; the potential loss of business or increased costs due to customer or vendor consolidation; competitive pressures, including new product development; industry capacity, and changes in competitors’ pricing; ability to maintain or increase productivity levels; ability to contain or reduce costs; foreign currency exchange rate fluctuations; changes in governmental regulations, including environmental, health and safety; changes in Canadian and foreign income tax rates, income tax laws and regulations. Unless otherwise required by applicable securities law, Winpak disclaims any intention or obligation to publicly update or revise this information, whether as a result of new information, future events or otherwise. The Company cautions investors not to place undue reliance upon forward-looking statements.

Financial Performance

Net income attributable to equity holders of the Company (Earnings) for the third quarter of 2024 of $38.5 million advanced by $4.5 million or 13.2 percent from the comparable 2023 quarter. The growth in sales volumes raised Earnings by $1.7 million. Gross profit was highly influential, elevating Earnings by $5.4 million. Operating expenses reduced Earnings by $1.8 million. In total, all remaining items lowered Earnings by $0.8 million.

For the nine months ended September 29, 2024, Earnings declined narrowly by 0.4 percent to $112.8 million from the corresponding 2023 result of $113.3 million. The improvement in gross profit was a key factor, augmenting Earnings by $11.7 million. Higher operating expenses led to a contraction in Earnings of $8.4 million. In combination, all other factors reduced Earnings by $3.8 million.

The fiscal year of the Company ends on the last Sunday of the calendar year and is usually 52 weeks in duration. However, the 2023 fiscal year consisted of 53 weeks, with the first quarter comprising 14 weeks, one more week than the current year. The additional week included in the 2023 first quarter was essentially the last week of the 2022 calendar year which contained several statutory holidays. Consequently, it is estimated that this additional week contributed 2 percent to 2023 year-to-date sales volumes and net income results.

Operating Segments and Product Groups

The Company provides three distinct types of packaging technologies: a) flexible packaging, b) rigid packaging and flexible lidding and c) packaging machinery. Each is deemed to be a separate operating segment.

The flexible packaging segment includes the modified atmosphere packaging, specialty films and biaxially oriented nylon product groups. Modified atmosphere packaging extends the shelf life of perishable foods, while at the same time maintains or improves the quality of the product. The packaging is used for a wide range of markets and applications, including fresh and processed meats, poultry, cheese, medical device packaging, high performance pouch applications and high-barrier films for converting applications. Specialty films include a full line of barrier and non-barrier films which are ideal for converting applications such as printing, laminating and bag making, including shrink bags. Biaxially oriented nylon film is stretched by length and width to add stability for further conversion using printing, metalizing or laminating processes and is ideal for food packaging applications such as cheese, fluid and viscous liquids, and industrial applications such as book covers and balloons.

The rigid packaging and flexible lidding segment includes the rigid containers, lidding and specialized printed packaging product groups. Rigid containers include portion control and single-serve containers, as well as plastic sheet, custom and retort trays, which are used for applications such as food, pet food, beverage, dairy, industrial and healthcare. Lidding products are available in die-cut, daisy chain and rollstock formats and are used for applications such as food, dairy, beverage, pet food, industrial and healthcare. Specialized printed packaging provides packaging solutions to the pharmaceutical, healthcare, nutraceutical, cosmetic and personal care markets.

Packaging machinery includes a full line of horizontal fill/seal machines for preformed containers and vertical form/fill/seal pouch machines for pumpable liquid and semi-liquid products and certain dry products.

Revenue

Revenue in the third quarter of 2024 was $285.5 million, exceeding the prior year comparable level of $273.8 million by 4.3 percent. Volumes expanded by 4.6 percent. Within the flexible packaging operating segment, volume gains amounted to 7 percent. For the modified atmosphere packaging product group, healthy volume growth was achieved at several meat accounts by onboarding much needed new converting capacity. Biaxially oriented nylon product group volumes advanced by 29 percent as the order level in the third quarter of 2023 was severely constrained while several key customers managed excessive inventory levels. The rigid packaging and flexible lidding operating segment posted volume gains of 1 percent. Rigid container volumes decreased by 4 percent due to a moderate drop in specialty beverage and applesauce container shipments. For the lidding product group, volumes surpassed the prior year by 5 percent predominantly because of specialty beverage lidding volumes. Building on the success achieved with pharmaceutical and nutraceutical accounts in 2023, the specialized printed packaging product group’s volumes surged by 16 percent. Fueled by much higher replacement parts sales, packaging machinery volumes vaulted by 34 percent. Selling price and mix changes lowered revenue by 0.3 percent.

For the first nine months of 2024, revenue decreased by $20.0 million from the $865.8 million recorded in the corresponding prior year period. Volumes receded by 0.4 percent. When normalizing for the additional week in the first quarter of 2023, volumes were 1.6 percent higher. The subsequent comments on operating segment and product group volumes are presented on an adjusted basis. The flexible packaging operating segment recorded an uptick in volumes of 4 percent. Modest volume growth for the modified atmosphere packaging product group reflected business gains pertaining to meat and cheese packaging, which was partially mitigated by the curtailment in demand for frozen food packaging. For the biaxially oriented nylon product group, volume growth of 26 percent was a reflection of the recovery from the sharp downturn in demand during the first three quarters of 2023. Specialty film volumes were virtually unchanged. Within the rigid packaging and flexible lidding operating segment, volumes dropped by 1 percent. The rigid container product group experienced a 3 percent decline in volumes stemming from lower specialty beverage and retort pet food container shipments. Lidding product group volumes were equal to the prior year. Packaging machinery volumes declined by 1 percent. Selling price and mix changes had a negative effect on revenue of $16.0 million.

Gross Profit Margins

Gross profit margins in the third quarter climbed by 2.8 percentage points to 32.0 percent of revenue from the 29.2 percent recorded in the same quarter of 2023. Despite the negative impact on selling prices of heightened competitive pressures and the pass-through of indexing adjustments, material costs declined to a greater extent, generating an increase in Earnings of $6.6 million. Other factors combined to reduce Earnings by $1.2 million. The most notable were greater personnel and depreciation expenses.

For the first nine months of 2024, gross profit margins were 31.9 percent of revenue, expanding by 2.5 percentage points from the 29.4 percent of revenue achieved during the 2023 year-to-date comparative period. Raw material cost reductions significantly outpaced the corresponding selling price decreases, which included the pass-through of indexing adjustments. This differential raised Earnings by $16.4 million. In total, all remaining items lowered Earnings by $4.7 million. The Company’s cost structure was adversely affected by higher personnel and depreciation expenses. Due to inflationary pressures, wages increased at a rate well above the historical norm. Conversely, enhanced output levels lowered the effective cost of production.

The raw material purchase price index increased by 1 percent compared to the second quarter of 2024. In relation to a year earlier, the index has advanced by 5 percent. During the third quarter, polyethylene resin realized modest appreciation of 5 percent while the prices for other key inputs were relatively unchanged.

Expenses and Other

Operating expenses in the third quarter of 2024, adjusted for foreign exchange, advanced at a rate of 11.0 percent in comparison to the 4.6 percent growth in sales volumes, thereby having an unfavorable impact on Earnings of $1.8 million. Expenses pertaining to the enterprise resource planning (ERP) project were the main driver. Furthermore, as a consequence of the inflationary environment, personnel and freight costs expanded markedly. The effective income tax rate edged higher because of permanent differences associated with foreign exchange, contracting Earnings by $0.5 million. Lastly, the level of net income attributable to non-controlling interests lessened Earnings by $1.0 million.

On a year-to-date basis, operating expenses, exclusive of foreign exchange, progressed at a rate of 9.4 percent whereas sales volumes fell by 0.4 percent, resulting in a reduction in Earnings of $8.4 million. The main contributing factors were personnel expenses and costs associated with implementing the upgraded ERP system. Foreign exchange had a negative effect on Earnings of $2.4 million due to the unfavorable translation differences recorded on the revaluation of monetary assets and liabilities in comparison to the favorable translation differences recorded in the first nine months of 2023. Net finance income added $3.4 million to Earnings as the magnitude of cash invested in short-term deposits and money market accounts, on average, was much higher than a year earlier. Permanent differences elevated the effective income tax rate by 1.8 percentage points, lowering Earnings by $2.3 million. The proportion of earnings attributable to non-controlling interests dampened Earnings by $2.0 million.

Capital Resources, Cash Flow and Liquidity

On February 29, 2024, the Toronto Stock Exchange (the “TSX”) accepted a notice filed by Winpak of its intention to make a normal course issuer bid (the “NCIB”) with respect to its outstanding common shares. The notice provided that Winpak may, during the 12-month period commencing March 4, 2024 and ending no later than March 3, 2025, purchase through the facilities of the TSX and other alternative Canadian trading systems up to a maximum of 1,950,000 common shares in total, being 3.0 percent of the issued and outstanding shares of Winpak as of February 21, 2024, which was fulfilled on May 13, 2024. On October 17, 2024, the TSX accepted a notice filed by Winpak to amend the NCIB to a maximum of 3,250,000 common shares. The price which Winpak will pay for any common shares will be the market price at the time of acquisition. Daily purchases under the NCIB will be generally limited to 11,644 common shares, other than block purchases. All shares purchased will be canceled. In connection with the NCIB, Winpak has entered into an automatic share purchase plan (“ASPP”) with CIBC World Markets Inc. to facilitate the purchase of common shares under the NCIB, including at times when Winpak would ordinarily not be permitted to purchase its common shares due to regulatory restrictions or self-imposed blackout periods.

During the third quarter of 2024, dividends in Canadian dollars of 5 cents per common share were declared, a significant increase from the 3 cents per common share that had been paid on a quarterly basis since 2007. The Board of Directors is committed to sustainable growth in the quarterly dividend, targeting the achievement of a payout ratio of approximately 10 percent of net earnings attributable to equity holders of the Company within the next five years.

The Company’s cash and cash equivalents balance ended the third quarter of 2024 at $516.0 million, an increase of $25.6 million from the end of the second quarter. Winpak continued to generate strong cash flows from operating activities before changes in working capital of $60.0 million. The net investment in working capital increased by $2.0 million. Trade and other receivables advanced by $6.9 million, reflecting the timing of customer payments and the higher revenue level relative to the preceding quarter. The $5.5 million growth in inventories was caused by the seasonal buildup of both raw materials and work-in-process inventories. Stemming from the timing of equipment and inventory purchases, trade payables and other liabilities expanded by $9.6 million. Cash was used for property, plant and equipment additions of $26.8 million, income tax payments of $9.5 million and other items totaling $1.9 million. Net finance income provided cash of $5.8 million.

For the first nine months of 2024, the cash and cash equivalents balance decreased by $25.9 million. Cash flows generated from operating activities before changes in working capital were solid at $177.4 million. Investments in working capital amounted to $5.8 million. Trade and other receivables grew by $14.0 million largely due to the higher level of revenue in the current quarter compared to the final quarter of 2023. In addition, inventories climbed by $12.8 million. The planned accumulation of manufactured inventories was partially offset by the continued reversal of aluminum foil inventories that had amassed during 2022. Influenced by the timing of supplier payments relating to inventory, equipment and building additions, trade payables and other liabilities increased by $20.6 million. Cash outflows included: property, plant and equipment expenditures of $101.2 million, common share repurchases of $62.9 million, income tax payments of $44.1 million and other items amounting to $6.8 million. Net finance income produced incremental cash of $17.5 million.

|

Summary of Quarterly Results |

|||||||||||||||

|

Thousands of US dollars, except per share amounts (US cents) |

|||||||||||||||

|

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

||||||||

|

2024 |

2024 |

2024 |

2023 |

2023 |

2023 |

2023 |

2022 |

||||||||

|

Revenue |

285,473 |

283,496 |

276,783 |

275,637 |

273,790 |

287,464 |

304,516 |

292,365 |

|||||||

|

Net income attributable to equity holders |

|||||||||||||||

|

of the Company |

38,486 |

38,825 |

35,522 |

34,846 |

33,991 |

40,006 |

39,287 |

31,235 |

|||||||

|

EPS |

61 |

61 |

55 |

54 |

52 |

62 |

60 |

48 |

|||||||

Looking Forward

Leveraging the business opportunity pipeline and building upon the solid volume growth achieved in the most recent quarter, Winpak is optimistic about the balance of 2024 as well as the upcoming year. In addition, central banks have initiated the cycle of significant projected interest rate cuts, which should have a positive impact on North American economic growth.

New pet food, healthcare and In-Mold-Label (IML) business will have a positive impact on sales volumes going forward. Furthermore, the strategic addition of new extrusion and converting capacity within the modified atmosphere packaging facility will provide the foundation for volume growth. Based on the preceding factors, the Company is projecting sales volume growth in the range of 5 to 7 percent for the final quarter of 2024 and 4 to 6 percent for 2025.

Over the next twelve months, market expectations are for overall resin prices to decline moderately. Effective October 15, 2024, the Canadian federal government implemented a 25 percent tariff on aluminum foil imported from China. As a result, the Company has expedited the realignment of its sourcing in order to minimize the financial impact. Two significant collective bargaining agreements will expire by mid-2025, adding some uncertainty to the Company’s future cost structure. Forecasted sales volume growth will positively influence equipment utilization rates, lowering the overall per unit cost of production. Overall, gross profit margins in the fourth quarter of 2024 should be comparable to the immediately preceding quarter and for 2025, should be within the range of 31 to 32 percent. Capital expenditures are forecast to be $130 million for 2024. During the third quarter of 2024, the Company continued to dedicate significant resources to the multi-year expansion project at the Winnipeg, Manitoba modified atmosphere packaging facility. It will establish a footprint for sizeable volume growth from 2026 onwards. A new cast co-extrusion line at the same facility was recently commercialized, targeting additional growth in the dairy market. Winpak will continue to assess prospective acquisition opportunities that align strategically with the Company’s core strengths. Based on the success of the current NCIB program, the Company is evaluating its renewal, effective March 2025.

Winpak Ltd.

Interim Condensed Consolidated Financial Statements

Third Quarter Ended: September 29, 2024

These interim condensed consolidated financial statements have not been audited or reviewed by the Company’s independent external auditors, KPMG LLP. For a complete set of notes to the condensed consolidated financial statements, refer to www.sedar.com or the Company’s website, www.winpak.com.

|

Winpak Ltd. |

|||||

|

Condensed Consolidated Balance Sheets |

|||||

|

(thousands of US dollars) (unaudited) |

|||||

|

September 29 |

December 31 |

||||

|

2024 |

2023 |

||||

|

Assets |

|||||

|

Current assets: |

|||||

|

Cash and cash equivalents |

515,959 |

541,870 |

|||

|

Trade and other receivables |

222,263 |

207,355 |

|||

|

Income taxes receivable |

6,352 |

4,565 |

|||

|

Inventories |

232,551 |

219,763 |

|||

|

Prepaid expenses |

8,144 |

8,942 |

|||

|

Derivative financial instruments |

268 |

1,542 |

|||

|

985,537 |

984,037 |

||||

|

Non-current assets: |

|||||

|

Property, plant and equipment |

606,562 |

543,387 |

|||

|

Intangible assets and goodwill |

30,635 |

31,833 |

|||

|

Employee benefit plan assets |

11,062 |

12,209 |

|||

|

648,259 |

587,429 |

||||

|

Total assets |

1,633,796 |

1,571,466 |

|||

|

Equity and Liabilities |

|||||

|

Current liabilities: |

|||||

|

Trade payables and other liabilities |

111,639 |

89,359 |

|||

|

Contract liabilities |

1,048 |

1,478 |

|||

|

Provisions |

600 |

– |

|||

|

Income taxes payable |

5,252 |

3,109 |

|||

|

118,539 |

93,946 |

||||

|

Non-current liabilities: |

|||||

|

Employee benefit plan liabilities |

6,243 |

6,362 |

|||

|

Deferred income |

17,818 |

18,062 |

|||

|

Provisions and other long-term liabilities |

11,162 |

12,685 |

|||

|

Deferred tax liabilities |

52,731 |

56,762 |

|||

|

87,954 |

93,871 |

||||

|

Total liabilities |

206,493 |

187,817 |

|||

|

Equity: |

|||||

|

Share capital |

28,319 |

29,195 |

|||

|

Reserves |

189 |

1,361 |

|||

|

Retained earnings |

1,363,923 |

1,319,491 |

|||

|

Total equity attributable to equity holders of the Company |

1,392,431 |

1,350,047 |

|||

|

Non-controlling interests |

34,872 |

33,602 |

|||

|

Total equity |

1,427,303 |

1,383,649 |

|||

|

Total equity and liabilities |

1,633,796 |

1,571,466 |

|||

|

Winpak Ltd. |

|||||||||

|

Condensed Consolidated Statements of Income |

|||||||||

|

(thousands of US dollars, except per share amounts) (unaudited) |

|||||||||

|

Quarter Ended |

Year-To-Date Ended |

||||||||

|

September 29 |

October 1 |

September 29 |

October 1 |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Revenue |

285,473 |

273,790 |

845,752 |

865,770 |

|||||

|

Cost of sales |

(194,121) |

(193,781) |

(576,143) |

(611,010) |

|||||

|

Gross profit |

91,352 |

80,009 |

269,609 |

254,760 |

|||||

|

Sales, marketing and distribution expenses |

(25,240) |

(22,564) |

(74,307) |

(70,517) |

|||||

|

General and administrative expenses |

(11,632) |

(10,647) |

(36,766) |

(30,758) |

|||||

|

Research and technical expenses |

(5,221) |

(4,980) |

(15,952) |

(14,738) |

|||||

|

Other (expenses) income |

(1,001) |

(1,057) |

(3,010) |

235 |

|||||

|

Income from operations |

48,258 |

40,761 |

139,574 |

138,982 |

|||||

|

Finance income |

6,833 |

6,697 |

21,461 |

17,150 |

|||||

|

Finance expense |

(1,123) |

(1,664) |

(3,645) |

(4,599) |

|||||

|

Income before income taxes |

53,968 |

45,794 |

157,390 |

151,533 |

|||||

|

Income tax expense |

(14,659) |

(11,970) |

(43,287) |

(38,956) |

|||||

|

Net income for the period |

39,309 |

33,824 |

114,103 |

112,577 |

|||||

|

Attributable to: |

|||||||||

|

Equity holders of the Company |

38,486 |

33,991 |

112,833 |

113,284 |

|||||

|

Non-controlling interests |

823 |

(167) |

1,270 |

(707) |

|||||

|

39,309 |

33,824 |

114,103 |

112,577 |

||||||

|

Basic and diluted earnings per share – cents |

61 |

52 |

177 |

174 |

|||||

|

Condensed Consolidated Statements of Comprehensive Income |

|||||||||

|

(thousands of US dollars) (unaudited) |

|||||||||

|

Quarter Ended |

Year-To-Date Ended |

||||||||

|

September 29 |

October 1 |

September 29 |

October 1 |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Net income for the period |

39,309 |

33,824 |

114,103 |

112,577 |

|||||

|

Items that will not be reclassified to the statements of income: |

|||||||||

|

Cash flow hedge gains (losses) recognized |

241 |

(633) |

(919) |

133 |

|||||

|

Cash flow hedge (gains) losses transferred to property, plant and equipment |

(35) |

(42) |

29 |

(59) |

|||||

|

206 |

(675) |

(890) |

74 |

||||||

|

Items that are or may be reclassified subsequently to the statements of income: |

|||||||||

|

Cash flow hedge gains (losses) recognized |

684 |

(863) |

(879) |

91 |

|||||

|

Cash flow hedge losses transferred to the statements of income |

142 |

37 |

494 |

955 |

|||||

|

Income tax effect |

(221) |

222 |

103 |

(280) |

|||||

|

605 |

(604) |

(282) |

766 |

||||||

|

Other comprehensive income (loss) for the period – net of income tax |

811 |

(1,279) |

(1,172) |

840 |

|||||

|

Comprehensive income for the period |

40,120 |

32,545 |

112,931 |

113,417 |

|||||

|

Attributable to: |

|||||||||

|

Equity holders of the Company |

39,297 |

32,712 |

111,661 |

114,124 |

|||||

|

Non-controlling interests |

823 |

(167) |

1,270 |

(707) |

|||||

|

40,120 |

32,545 |

112,931 |

113,417 |

||||||

|

Winpak Ltd. |

||||||||

|

Attributable to equity holders of the Company |

||||||||

|

Share |

Reserves |

Retained |

Total |

Non- |

Total equity |

|||

|

Balance at December 26, 2022 |

29,195 |

(972) |

1,174,551 |

1,202,774 |

36,001 |

1,238,775 |

||

|

Comprehensive income (loss) for the period |

||||||||

|

Cash flow hedge gains, net of tax |

– |

199 |

– |

199 |

– |

199 |

||

|

Cash flow hedge losses transferred to the statements |

||||||||

|

of income, net of tax |

– |

700 |

– |

700 |

– |

700 |

||

|

Cash flow hedge gains transferred to property, plant and |

||||||||

|

equipment |

– |

(59) |

– |

(59) |

– |

(59) |

||

|

Other comprehensive income |

– |

840 |

– |

840 |

– |

840 |

||

|

Net income (loss) for the period |

– |

– |

113,284 |

113,284 |

(707) |

112,577 |

||

|

Comprehensive income (loss) for the period |

– |

840 |

113,284 |

114,124 |

(707) |

113,417 |

||

|

Dividends |

– |

– |

(4,351) |

(4,351) |

– |

(4,351) |

||

|

Balance at October 1, 2023 |

29,195 |

(132) |

1,283,484 |

1,312,547 |

35,294 |

1,347,841 |

||

|

Balance at January 1, 2024 |

29,195 |

1,361 |

1,319,491 |

1,350,047 |

33,602 |

1,383,649 |

||

|

Comprehensive (loss) income for the period |

||||||||

|

Cash flow hedge losses, net of tax |

– |

(1,563) |

– |

(1,563) |

– |

(1,563) |

||

|

Cash flow hedge losses transferred to the statements |

||||||||

|

of income, net of tax |

– |

362 |

– |

362 |

– |

362 |

||

|

Cash flow hedge losses transferred to property, plant and |

||||||||

|

equipment |

– |

29 |

– |

29 |

– |

29 |

||

|

Other comprehensive loss |

– |

(1,172) |

– |

(1,172) |

– |

(1,172) |

||

|

Net income for the period |

– |

– |

112,833 |

112,833 |

1,270 |

114,103 |

||

|

Comprehensive (loss) income for the period |

– |

(1,172) |

112,833 |

111,661 |

1,270 |

112,931 |

||

|

Dividends |

– |

– |

(5,151) |

(5,151) |

– |

(5,151) |

||

|

Repurchase of common shares |

(876) |

– |

(63,250) |

(64,126) |

– |

(64,126) |

||

|

Balance at September 29, 2024 |

28,319 |

189 |

1,363,923 |

1,392,431 |

34,872 |

1,427,303 |

||

|

Winpak Ltd. |

|||||||

|

Quarter Ended |

Year-To-Date Ended |

||||||

|

September 29 |

October 1 |

September 29 |

October 1 |

||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Cash provided by (used in): |

|||||||

|

Operating activities: |

|||||||

|

Net income for the period |

39,309 |

33,824 |

114,103 |

112,577 |

|||

|

Items not involving cash: |

|||||||

|

Depreciation |

13,313 |

11,930 |

39,079 |

35,969 |

|||

|

Amortization – deferred income |

(432) |

(461) |

(1,276) |

(1,300) |

|||

|

Amortization – intangible assets |

457 |

397 |

1,235 |

1,243 |

|||

|

Employee defined benefit plan expenses |

756 |

623 |

2,112 |

2,446 |

|||

|

Net finance income |

(5,710) |

(5,033) |

(17,816) |

(12,551) |

|||

|

Income tax expense |

14,659 |

11,970 |

43,287 |

38,956 |

|||

|

Other |

(2,351) |

76 |

(3,368) |

(2,178) |

|||

|

Cash flow from operating activities before the following |

60,001 |

53,326 |

177,356 |

175,162 |

|||

|

Change in working capital: |

|||||||

|

Trade and other receivables |

(6,866) |

8,970 |

(13,997) |

14,664 |

|||

|

Inventories |

(5,468) |

26,003 |

(12,788) |

46,368 |

|||

|

Prepaid expenses |

639 |

(1,530) |

798 |

(5,273) |

|||

|

Trade payables and other liabilities |

9,618 |

3,009 |

20,613 |

(18,003) |

|||

|

Contract liabilities |

98 |

(29) |

(430) |

(1,864) |

|||

|

Employee defined benefit plan contributions |

(18) |

(1,523) |

(1,192) |

(2,308) |

|||

|

Income tax paid |

(9,546) |

(10,407) |

(44,144) |

(56,780) |

|||

|

Interest received |

6,787 |

6,700 |

20,865 |

16,782 |

|||

|

Interest paid |

(1,037) |

(1,547) |

(3,365) |

(4,509) |

|||

|

Net cash from operating activities |

54,208 |

82,972 |

143,716 |

164,239 |

|||

|

Investing activities: |

|||||||

|

Acquisition of property, plant and equipment – net |

(26,785) |

(22,921) |

(101,214) |

(44,506) |

|||

|

Acquisition of intangible assets |

(6) |

(70) |

(38) |

(356) |

|||

|

(26,791) |

(22,991) |

(101,252) |

(44,862) |

||||

|

Financing activities: |

|||||||

|

Payment of lease liabilities |

(409) |

(234) |

(1,208) |

(680) |

|||

|

Dividends paid |

(1,382) |

(1,472) |

(4,289) |

(4,349) |

|||

|

Repurchase of common shares |

– |

– |

(62,878) |

– |

|||

|

(1,791) |

(1,706) |

(68,375) |

(5,029) |

||||

|

Change in cash and cash equivalents |

25,626 |

58,275 |

(25,911) |

114,348 |

|||

|

Cash and cash equivalents, beginning of period |

490,333 |

454,746 |

541,870 |

398,673 |

|||

|

Cash and cash equivalents, end of period |

515,959 |

513,021 |

515,959 |

513,021 |

|||

SOURCE Winpak Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/24/c8447.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/24/c8447.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P Global Q3: Earnings Beat, Boosts 2024 Outlook, Commits To Capital Returns Amid Leadership Shift

S&P Global Inc SPGI reported quarterly adjusted EPS of $3.89, which beat the analyst consensus estimate of $3.64 and represented a 21% increase year over year.

Quarterly sales were $3.575 billion, beating the analyst consensus estimate of $3.431 billion and representing a 16% increase year over year, driven by growth in all divisions. The stock price tanked after the print.

Adjusted operating profit margin increased 180 basis points to 48.8%, primarily due to revenue growth in its Ratings and Indices divisions.

Also Read: IPO Rebound And FinTech Growth Potential Is Helping Nasdaq: Analyst Double Upgrades Stock

S&P Global generated $1.33 billion in free cash flow for the quarter.

Buyback and Dividend: For the full year 2024, the company expects to return approximately 85% of adjusted free cash flow to shareholders through dividends and share repurchases. The Board has authorized a quarterly cash dividend of $0.91. The company expects to execute additional accelerated share repurchases (ASR) totaling $1.3 billion in the coming weeks.

As announced earlier in June, S&P Global President of S&P Global Ratings Martina L. Cheung will become the company CEO effective November 1, 2024, taking over from Douglas Peterson. Eric Aboaf will join the company as CFO effective February 2025, taking over from interim finance chief Christopher Craig, as planned.

Outlook: S&P Global raised its full-year 2024 revenue outlook to 11.5% – 12.5% or $13.934 billion – $14.059 billion (prior 8.0% – 10.0% or $13.497 billion – $13.747 billion) versus the consensus of $13.79 billion. The company sees full-year adjusted EPS of $15.10 – $15.30 (prior $14.35 – $14.60), versus the $14.86 estimate.

Price Action: SPGI stock is down 2.509% at $498.16 at the last check Thursday.

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

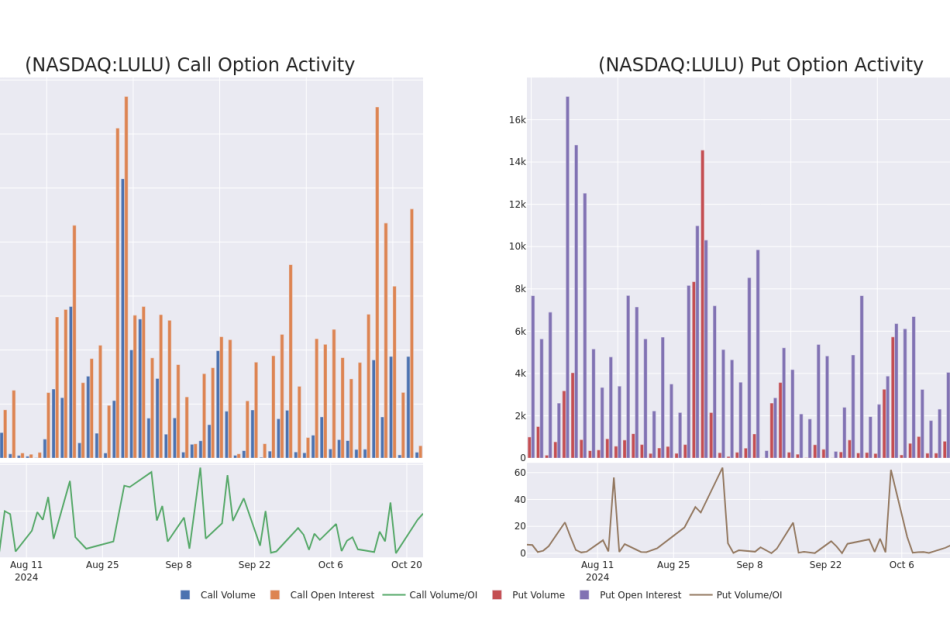

Decoding Lululemon Athletica's Options Activity: What's the Big Picture?

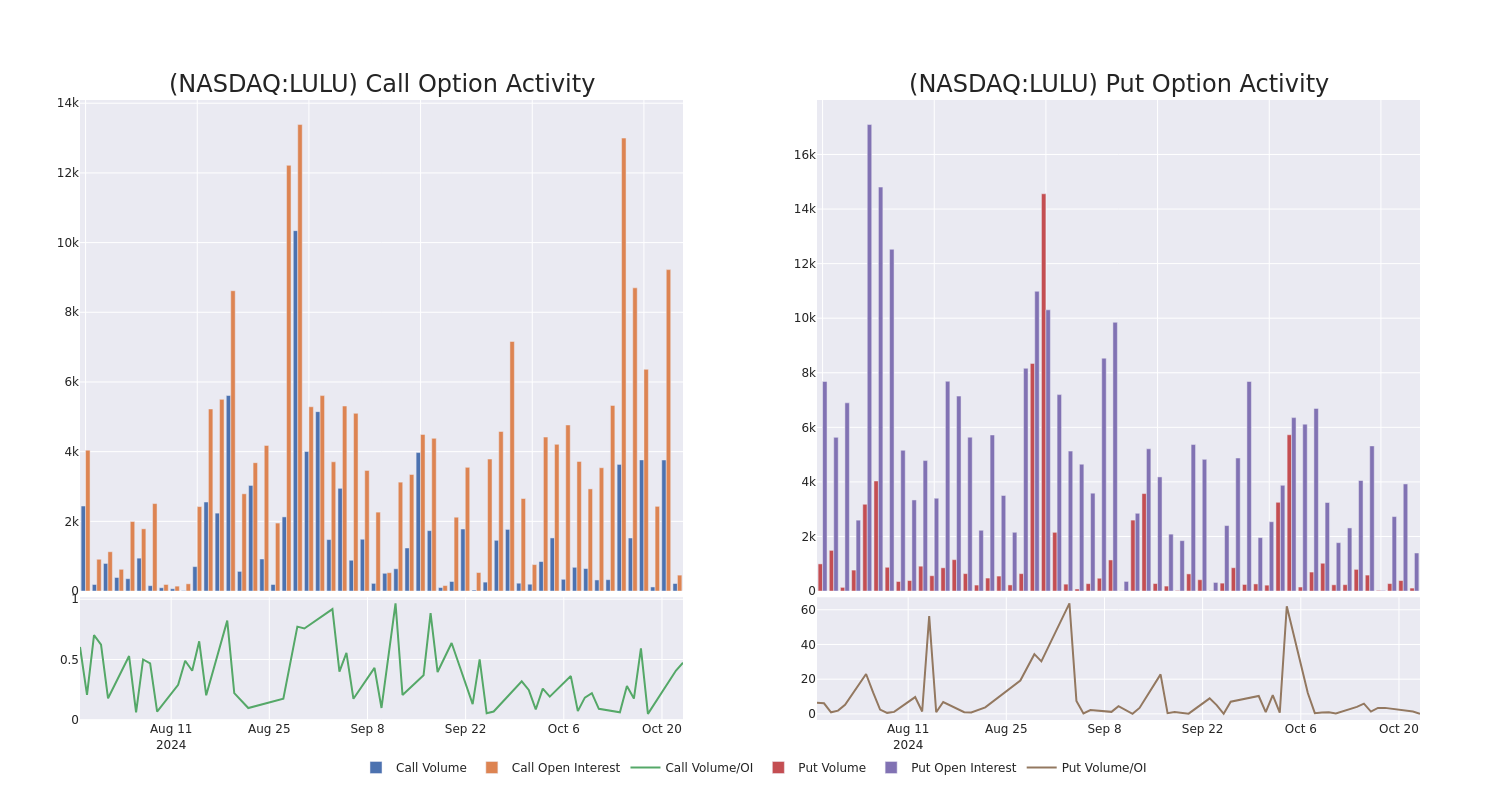

Whales with a lot of money to spend have taken a noticeably bearish stance on Lululemon Athletica.

Looking at options history for Lululemon Athletica LULU we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 48% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $932,722 and 16, calls, for a total amount of $822,020.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $320.0 for Lululemon Athletica during the past quarter.

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Lululemon Athletica stands at 433.8, with a total volume reaching 1,923.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lululemon Athletica, situated within the strike price corridor from $135.0 to $320.0, throughout the last 30 days.

Lululemon Athletica Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | PUT | SWEEP | BEARISH | 09/19/25 | $43.1 | $43.05 | $43.05 | $300.00 | $275.8K | 64 | 122 |

| LULU | PUT | SWEEP | BEARISH | 09/19/25 | $43.1 | $42.25 | $43.1 | $300.00 | $193.9K | 64 | 58 |

| LULU | PUT | TRADE | BULLISH | 11/29/24 | $21.6 | $20.75 | $20.8 | $310.00 | $135.2K | 0 | 130 |

| LULU | PUT | SWEEP | BULLISH | 11/29/24 | $20.8 | $19.95 | $20.8 | $310.00 | $135.2K | 0 | 65 |

| LULU | CALL | SWEEP | BEARISH | 08/15/25 | $172.65 | $169.1 | $169.15 | $135.00 | $101.5K | 6 | 6 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Where Is Lululemon Athletica Standing Right Now?

- Currently trading with a volume of 629,653, the LULU’s price is up by 0.77%, now at $295.4.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

What Analysts Are Saying About Lululemon Athletica

1 market experts have recently issued ratings for this stock, with a consensus target price of $314.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley persists with their Overweight rating on Lululemon Athletica, maintaining a target price of $314.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lululemon Athletica options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Federal Home Loan Bank of Atlanta Announces Third Quarter 2024 Operating Highlights and Declares Dividend

ATLANTA, Oct. 24, 2024 (GLOBE NEWSWIRE) — Federal Home Loan Bank of Atlanta (the Bank) today released preliminary unaudited financial highlights for the quarter ended September 30, 2024. All numbers reported below for the third quarter of 2024 are approximate until the Bank announces unaudited financial results in its Form 10-Q, which is expected to be filed with the Securities and Exchange Commission (SEC) on or about November 7, 2024.

Operating Results for the Third Quarter of 2024

- Net interest income for the third quarter of 2024 was $221 million, a decrease of $19 million, compared to net interest income of $240 million for the same period in 2023. Net income for the third quarter of 2024 was $150 million, a decrease of $28 million, compared to net income of $178 million for the same period in 2023. The decrease in net income was primarily due to a decrease in average advance balances. Net income for the current period was also impacted by $18 million in voluntary housing contributions during the third quarter of 2024.

- For the three months ended September 30, 2024, average advance balances were $89.8 billion, compared to average advance balances of $108.5 billion for the same period in 2023.

- The net yield on interest-earning assets for the third quarter of 2024 was 61 basis points, relatively stable, compared to 59 basis points for the same period in 2023. Many of the Bank’s assets and liabilities are indexed to the Secured Overnight Financing Rate (SOFR). Average daily SOFR during the third quarter of 2024 was 5.28 percent compared to 5.24 percent for the same period in 2023.

- The Bank’s third quarter 2024 performance resulted in an annualized return on average equity (ROE) of 7.50 percent as compared to 8.76 percent for the same period in 2023. The lower ROE was primarily driven by the decreased net income in 2024.

Financial Condition Highlights

- Total assets were $135.8 billion as of September 30, 2024, a decrease of $16.6 billion from December 31, 2023.

- Advances outstanding were $86.5 billion as of September 30, 2024, a decrease of $10.1 billion from December 31, 2023.

- Total capital was $7.9 billion as of September 30, 2024, a decrease of $256 million from December 31, 2023. Retained earnings was $2.7 billion as of September 30, 2024, an increase of $184 million from December 31, 2023.

- As of September 30, 2024, the Bank was in compliance with all applicable regulatory capital and liquidity requirements.

Reliable Source of Liquidity

- During the first nine months of 2024, the Bank originated a total of $233.4 billion of advances, thereby providing significant liquidity to its members to support lending and other activities in their communities. The Bank is proud to continue to execute on its mission to be a reliable source of liquidity and funding for its members, while remaining adequately capitalized.

Commitment to Affordable Housing and Community Development

- The Bank commits 10 percent of its income before assessments to support the affordable housing and community development needs of communities served by its members as required by law, which amounted to $72 million for the 2023 statutory Affordable Housing Program (AHP) assessment available for funding in 2024. As of September 30, 2024, the Bank has accrued $58 million to its AHP pool of funds that will be available to the Bank’s members and their communities in 2025 for funding of eligible projects.

- The Bank has committed to voluntarily contribute, at a minimum, an additional 50 percent of its prior year statutory AHP assessment to affordable housing. During 2024, the Bank authorized $49 million in voluntary housing contributions consisting of $23 million in voluntary AHP non-statutory contributions and $26 million in voluntary non-AHP contributions. These amounts are anticipated to be expensed during 2024. Together with the $72 million from the 2023 statutory AHP assessment, this will result in a total commitment by the Bank to support affordable housing and community development needs of over $120 million for 2024.

- Since the inception of its AHP in 1990, the Bank has awarded more than $1.2 billion in AHP funds, assisting more than 177,000 households.

Dividends

- The board of directors of the Bank approved a third quarter 2024 cash dividend at an annualized rate of 7.35 percent.

- “We are pleased to declare a strong third quarter dividend and return value to our members,” said FHLBank Atlanta Chair of the Board, Thornwell Dunlap. “This is a testament to FHLBank Atlanta’s commitment to serving as a reliable source of liquidity for our members to support their business objectives and communities.”

- The dividend payout will be calculated based on members’ capital stock held during the third quarter of 2024 and will be credited to members’ daily investment accounts at the close of business on November 6, 2024.

| Federal Home Loan Bank of Atlanta Financial Highlights (Preliminary and unaudited) (Dollars in millions) |

||||||||||

| Statements of Condition | As of September 30, 2024 | As of December 31, 2023 | ||||||||

| Advances | $ | 86,536 | $ | 96,608 | ||||||

| Investments | 47,882 | 54,207 | ||||||||

| Mortgage loans held for portfolio, net | 93 | 103 | ||||||||

| Total assets | 135,793 | 152,370 | ||||||||

| Total consolidated obligations, net | 124,414 | 141,572 | ||||||||

| Total capital stock | 5,159 | 5,597 | ||||||||

| Retained earnings | 2,708 | 2,524 | ||||||||

| Accumulated other comprehensive loss | (7 | ) | (5 | ) | ||||||

| Total capital | 7,860 | 8,116 | ||||||||

| Capital-to-assets ratio (GAAP) | 5.79 | % | 5.33 | % | ||||||

| Capital-to-assets ratio (Regulatory) | 5.79 | % | 5.33 | % | ||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||

| Operating Results and Performance Ratios | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||

| Net interest income | $ | 221 | $ | 240 | $ | 716 | $ | 648 | ||||||||||||

| Standby letters of credit fees | 5 | 2 | 13 | 6 | ||||||||||||||||

| Other income (loss) | 1 | (4 | ) | 4 | (4 | ) | ||||||||||||||

| Total noninterest expense (1) | 60 | 40 | 154 | 122 | ||||||||||||||||

| Affordable Housing Program assessment | 17 | 20 | 58 | 53 | ||||||||||||||||

| Net income | 150 | 178 | 521 | 475 | ||||||||||||||||

| Return on average assets | 0.41 | % | 0.43 | % | 0.45 | % | 0.34 | % | ||||||||||||

| Return on average equity | 7.50 | % | 8.76 | % | 8.29 | % | 7.29 | % | ||||||||||||

| ____________ | ||||||||||||||||||||

| (1) Total noninterest expense includes voluntary housing contributions of $18 million and $0 for the third quarter of 2024 and 2023, respectively, and $33 million and $7 million for the first nine months of 2024 and 2023, respectively. | ||||||||||||||||||||

The selected financial data above should be read in conjunction with the financial statements and notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Bank’s Third Quarter 2024 Form 10-Q expected to be filed with the SEC on or about November 7, 2024 which will be available at www.fhlbatl.com and on www.sec.gov.

About Federal Home Loan Bank of Atlanta

FHLBank Atlanta offers competitively-priced financing, community development grants, and other banking services to help member financial institutions make affordable home mortgages and provide economic development credit to neighborhoods and communities. The Bank is a cooperative whose members are commercial banks, credit unions, savings institutions, community development financial institutions, and insurance companies located in Alabama, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, and the District of Columbia. FHLBank Atlanta is one of 11 district banks in the Federal Home Loan Bank System (FHLBank System). Since 1990, the FHLBanks have awarded approximately $9.1 billion through the AHP’s competitive and homeownership set-aside programs, assisting more than 1.2 million households.

For more information, visit our website at www.fhlbatl.com.

To the extent that the statements made in this announcement may be deemed as “forward-looking statements”, they are made within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, which include statements with respect to the Bank’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, disbursements, expenses and program allocations for voluntary contributions to affordable housing and community development and future performance, and involve known and unknown risks, uncertainties, and other factors, many of which may be beyond the Bank’s control, and which may cause the Bank’s actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by such forward-looking statements, and the reader is cautioned not to place undue reliance on them, since those may not be realized due to a variety of factors, including, without limitation: legislative, regulatory and accounting actions, changes, approvals or requirements; completion of the Bank’s financial closing procedures and final accounting adjustments for the most recently completed quarter; SOFR variations; future economic, liquidity and market conditions (including in the housing market and banking industry); changes in demand for advances, advance levels, consolidated obligations of the Bank and/or the FHLBank System and their market; changes in interest rates; changes in prepayment speeds, default rates, delinquencies, and losses on mortgage-backed securities; volatility of market prices, rates and indices that could affect the value of financial instruments; changes in credit ratings and/or the terms of derivative transactions; changes in product offerings; political, national, and world events; disruptions in information systems; membership changes; mergers and acquisitions involving members; and other adverse developments or events, including extraordinary or disruptive events, affecting the market, involving other Federal Home Loan Banks, their members or the FHLBank System in general, including acts or war and terrorism. Additional factors that might cause the Bank’s results to differ from forward-looking statements are provided in detail in our filings with the Securities and Exchange Commission, which are available at www.sec.gov.

The forward-looking statements in this release speak only as of the date that they are made, and the Bank has no obligation and does not undertake to publicly update, revise, or correct any of these statements after the date of this announcement, or after the respective dates on which such statements otherwise are made, whether as a result of new information, future events, or otherwise, except as may be required by law. New factors may emerge, and it is not possible for us to predict the nature of each new factor, or assess its potential impact, on our business and financial condition. Given these uncertainties, we caution you not to place undue reliance on forward-looking statements.

CONTACT: Sheryl Touchton

Federal Home Loan Bank of Atlanta

stouchton@fhlbatl.com

404.716.4296

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

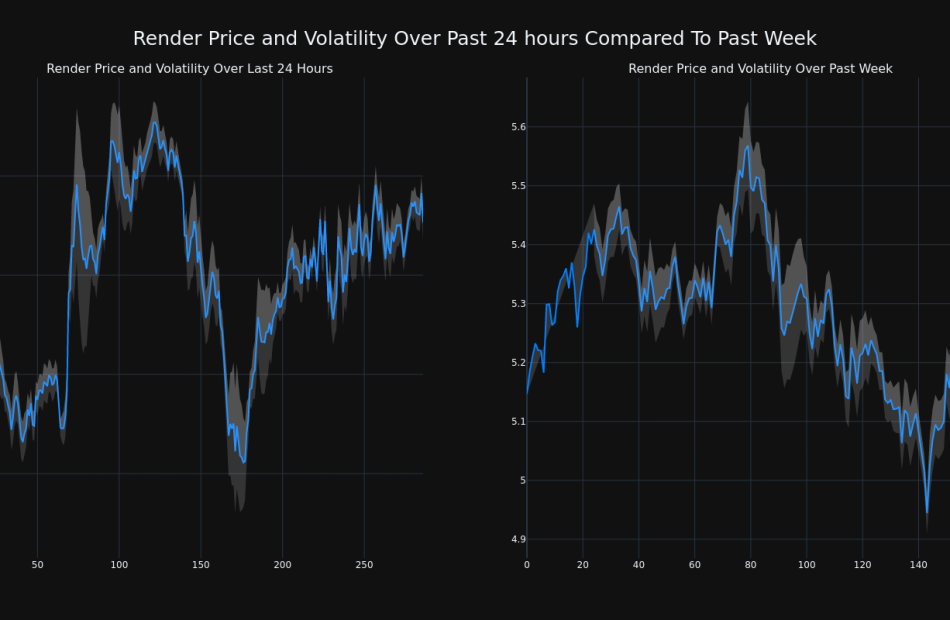

Cryptocurrency Render Rises More Than 3% In 24 hours

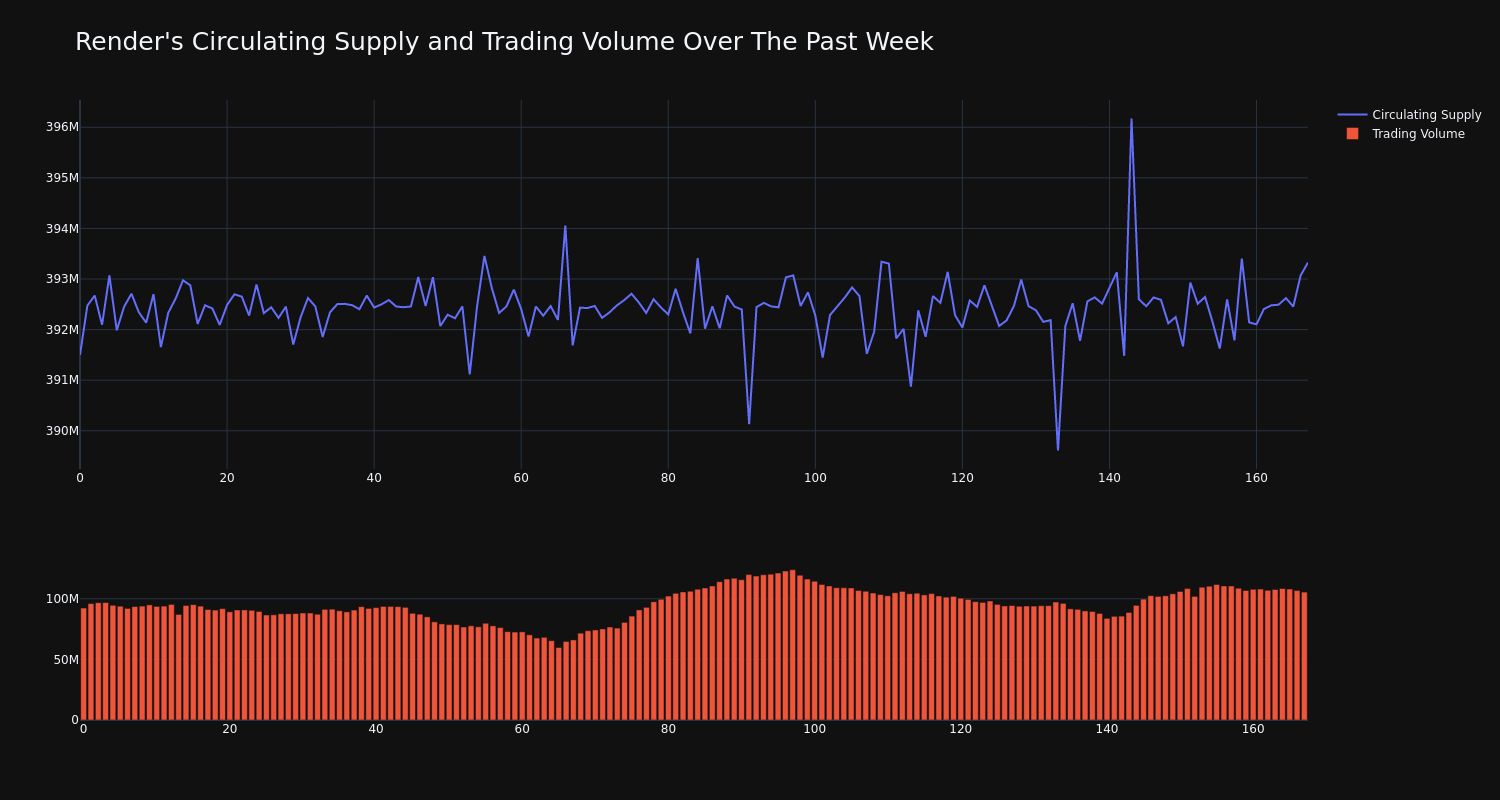

Over the past 24 hours, Render’s RENDER/USD price has risen 3.14% to $5.18. This is contrary to its negative trend over the past week where it has experienced a 0.0% loss, moving from $5.15 to its current price. As it stands right now, the coin’s all-time high is $13.53.

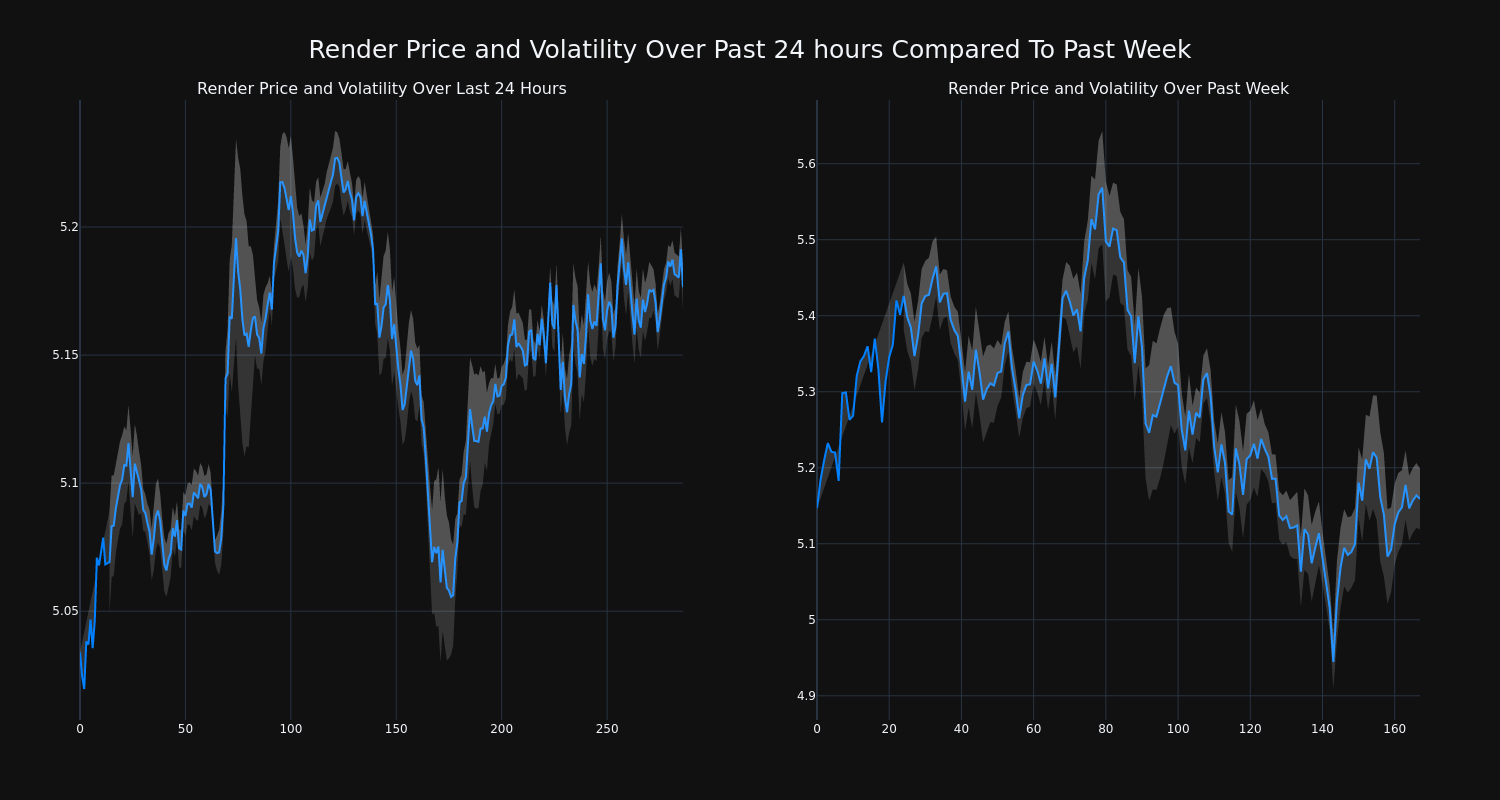

The chart below compares the price movement and volatility for Render over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

Render’s trading volume has climbed 14.0% over the past week along with the circulating supply of the coin, which has increased 0.47%. This brings the circulating supply to 392.46 million. According to our data, the current market cap ranking for RENDER is #50 at $2.04 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Reason I Haven't Bought Plug Power and Probably Never Will

I think hydrogen has the potential to be a game-changing fuel source. It could help supply the global economy with the emissions-free fuel it needs to help reach net-zero emissions by 2050. The fuel represents a massive opportunity that could be worth trillions of dollars in the coming years.

Given the immense potential of hydrogen, I’ve looked into various ways to invest in the emerging fuel source, including Plug Power (NASDAQ: PLUG). However, I haven’t invested in Plug Power and will probably never buy shares. Here’s the main reason why.

Plug Power has been around for a very long time. The company formed in 1997 and went public two years later. Despite being public for a quarter-century, Plug Power has never fully matured into a profitable and growing company.

Through the first six months of this year, Plug Power generated only $145 million in revenue. Instead of growing, its sales have fallen more than 50% over the past year, and its losses continue to pile up. Plug Power posted a net loss of $558 million during the first six months of 2024. That’s up from a nearly $443 million net loss across the same period of 2023.

That’s just the company’s operating losses. Plug Power is digging itself farther into a financial hole by investing heavily in building out its green hydrogen ecosystem. The purchase of property, plant, and equipment totaled another $194 million in the first half of the year. As a result, the company is burning through cash. Its cash balance was down to $1 billion at the end of June, falling from $1.5 billion in June of 2023.

The company has been covering its losses by issuing new shares. Those stock sales have massively increased its outstanding shares:

That has significantly diluted existing investors, which has weighed heavily on the stock price. Plug Power has lost an astounding 98.5% of its value since its IPO.

Plug Power is still several years away from turning the corner on profitability. While analysts expect Plug Power’s revenue to more than double by 2026 to over $2 billion, they still anticipate it will post a $250 million operating loss that year. That’s if everything goes according to plan, which hasn’t been the case for Plug Power in the past. It’s likely, then, that the company will need to continue issuing more stock to plug the gap between its revenue and losses. Future stock sales could continue to weigh on the share price.

Burnham Holdings, Inc. Announces Third Quarter 2024 Financial Results

LANCASTER, Pa., Oct. 24, 2024 /PRNewswire/ — Burnham Holdings, Inc. BURCA (“BHI”, the “Company”, “we” or “our”) today reported its consolidated financial results for the third quarter of 2024. Where noted, prior periods presented have been restated for a voluntary change in accounting principle related to our last-in, first-out (LIFO) inventory valuation as disclosed in our 2023 Annual Report.

- Net sales were $64.7 million for the third quarter of 2024, an increase of $5.0 million, or 8.3%, versus the third quarter of 2023. Year to date net sales were $176.1 million compared to $171.4 for the first nine months of 2023.

- Gross profit margin was 19.3% and 20.5% for the third quarters of 2024 and 2023, respectively. Year to date gross profit margins were 21.6% for 2024 versus 22.0% for 2023. Product mix and temporary inefficiencies from unplanned downtime adversely impacted third quarter 2024 gross profit margins.

- Selling, general, and administrative expenses (SG&A) were higher by $1.4 million and $2.0 million for the third quarter 2024 and the first nine months of 2024, respectively, versus the same periods last year. The primary driver in the increase in SG&A expenses was an adjustment to reserves related to uninsured litigation settlements and fees. Excluding these impacts, adjusted SG&A as a percentage of sales in the third quarter of 2024 was 15.6% compared to 17.1% for the third quarter of 2023.

- Adjusted EBITDA was $12.8 million, or 7.3%, for the nine months of 2024 versus $12.0 million, or 7.0%, for the first nine months of 2023. Adjusted EBITDA excludes the impact of the reserve adjustments noted above.

- Adjusted net income, excluding reserve adjustments, for the third quarter of 2024 was $1.7 million versus net income of $0.8 million for the third quarter of 2023.

- Adjusted diluted earnings per share were $0.37 and $0.17 for the third quarters of 2024 and 2023, respectively. For the first nine months of 2024 and 2023, adjusted diluted earnings per share were $1.18 and $1.03, respectively. Adjusted diluted earnings per share excludes $0.25 per share related to the reserve adjustments noted above for both the three months and nine months ended September 29, 2024.

For the third quarter of 2024, sales of residential products were higher by 2.2% versus the same period in 2023, while sales of commercial products were up 20.8% in 2024 versus 2023. For the nine months of 2024, residential sales were lower by 5.1% versus the prior year while commercial sales were higher by 13.0% versus the nine months of 2023. Thermal InMotion continues to expand BHI’s capabilities into previously unserved segments of the HVAC industry, and we are pleased with the results. The service and rentals businesses contributed $1.8 million of net sales in the third quarter of 2024 and $6.3 million for the nine months of 2024. Overall, we continue to believe order flow and our current backlogs are in line with seasonal operating patterns.

Average debt levels of the Company’s revolving credit facility for the third quarter of 2024 were approximately $10.6 million lower than the third quarter of 2023. On a year over year basis, the average debt levels on the revolving credit facility were approximately $9.6 million lower. We continue to evaluate our working capital needs, including inventory levels, to ensure we can appropriately meet production volumes and fund future growth initiatives.

About Burnham Holdings, Inc.: BHI is the parent company of multiple subsidiaries that are leading domestic manufacturers of boilers, furnaces and related HVAC products and accessories for residential, commercial, and industrial applications. BHI is listed on the OTC Exchange under the ticker symbol “BURCA”. For more information, please visit www.burnhamholdings.com.

Non-GAAP Financial Information: This press release contains certain non-GAAP financial measures, including adjusted SG&A, EBITDA, Adjusted EBITDA, Adjusted Net Income and adjusted diluted earnings per share. These non-GAAP financial measures do not provide investors with an accurate measure of, and should not be used as a substitute for, the comparable financial measures as determined in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company believes these non-GAAP financial measures, when read in conjunction with the comparable GAAP financial measures, give investors a useful tool to assess and understand the Company’s overall financial performance, because they exclude items of income or expense that the Company believes are not reflective of its ongoing operating performance, allowing for a better period-to-period comparison of operations of the Company. The Company acknowledges that there are many items that impact a company’s reported results, and the adjustments reflected in these non-GAAP measures are not intended to present all items that may have impacted these results. In addition, these non-GAAP measures are not necessarily comparable to similarly titled measures used by other companies.

|

Burnham Holdings, Inc. |

|||||||||

|

Consolidated Statements of Income |

|||||||||

|

(In thousands, except per share amounts) |

|||||||||

|

(Unaudited) |

|||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||

|

September 29, |

October 1, |

September 29, |

October 1, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Net sales |

$ 64,689 |

$ 59,705 |

$ 176,083 |

$ 171,406 |

|||||

|

Cost of goods sold |

52,217 |

47,489 |

138,035 |

133,613 |

|||||

|

Gross profit |

12,472 |

12,216 |

38,048 |

37,793 |

|||||

|

Selling, general and administrative expenses |

11,605 |

10,182 |

32,115 |

30,164 |

|||||

|

Operating income |

867 |

2,034 |

5,933 |

7,629 |

|||||

|

Other (expense) / income: |

|||||||||

|

Non-service related pension credit |

124 |

137 |

374 |

412 |

|||||

|

Interest and investment gain |

423 |

(222) |

912 |

267 |

|||||

|

Interest expense |

(697) |

(921) |

(1,526) |

(2,107) |

|||||

|

Other expense |

(150) |

(1,006) |

(240) |

(1,428) |

|||||

|

Income before income taxes |

717 |

1,028 |

5,693 |

6,201 |

|||||

|

Income tax expense |

165 |

236 |

1,309 |

1,426 |

|||||

|

Net income |

$ 552 |

$ 792 |

$ 4,384 |

$ 4,775 |

|||||

|

Earnings per share: |

|||||||||

|

Basic |

$ 0.12 |

$ 0.17 |

$ 0.94 |

$ 1.03 |

|||||

|

Diluted |

$ 0.12 |

$ 0.17 |

$ 0.93 |

$ 1.03 |

|||||

|

Cash dividends per share |

$ 0.23 |

$ 0.22 |

$ 0.69 |

$ 0.66 |

|||||

|

Burnham Holdings, Inc. |

||||||||

|

Consolidated Balance Sheets |

||||||||

|

(In thousands) |

||||||||

|

(Unaudited) |

(Unaudited) |

|||||||

|

September 29, |

December 31, |

October 1, |

||||||

|

ASSETS |

2024 |

2023 |

2023 |

|||||

|

Current Assets |

||||||||

|

Cash and cash equivalents |

$ 6,280 |

$ 5,880 |

$ 6,638 |

|||||

|

Trade accounts receivable, net |

29,573 |

31,023 |

27,704 |

|||||

|

Inventories, net |

70,158 |

58,017 |

72,043 |

|||||

|

Costs in Excess of Billings |

1,425 |

621 |

544 |

|||||

|

Prepaid expenses and other current assets |

3,038 |

1,954 |

3,130 |

|||||

|

Total Current Assets |

110,474 |

97,495 |

110,059 |

|||||

|

Property, plant and equipment, net |

70,040 |

64,437 |

63,728 |

|||||

|

Lease assets |

6,410 |

4,119 |

4,171 |

|||||

|

Other long-term assets |

18,592 |

18,620 |

17,831 |

|||||

|

Total Assets |

$ 205,516 |

$ 184,671 |

$ 195,789 |

|||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

|

Current Liabilities |

||||||||

|

Accounts payable & accrued expenses |

$ 29,663 |

$ 35,365 |

$ 26,620 |

|||||

|

Billings in excess of costs |

3,497 |

137 |

– |

|||||

|

Current portion of: |

||||||||

|

Long-term liabilities |

71 |

1,171 |

1,252 |

|||||

|

Lease liabilities |

1,175 |

1,051 |

1,036 |

|||||

|

Long-term debt |

184 |

184 |

– |

|||||

|

Total Current Liabilities |

34,590 |

37,908 |

28,908 |

|||||

|

Long-term debt |

48,390 |

27,232 |

53,713 |

|||||

|

Lease liabilities |

5,235 |

3,068 |

3,135 |

|||||

|

Other long-term liabilities |

5,847 |

5,933 |

6,726 |

|||||

|

Deferred income taxes |

9,039 |

9,095 |

8,423 |

|||||

|

Shareholders’ Equity |

||||||||

|

Preferred Stock |

530 |

530 |

530 |

|||||

|

Class A Common Stock |

3,633 |

3,633 |

3,630 |

|||||

|

Class B Convertible Common Stock |

1,311 |

1,311 |

1,314 |

|||||

|

Additional paid-in capital |

10,625 |

11,769 |

11,549 |

|||||

|

Retained earnings |

122,397 |

121,291 |

117,667 |

|||||

|

Accumulated other comprehensive loss |

(25,023) |

(24,668) |

(27,331) |

|||||

|

Treasury stock, at cost |

(11,058) |

(12,431) |

(12,475) |

|||||

|

Total Shareholders’ Equity |

102,415 |

101,435 |

94,884 |

|||||

|

Total Liabilities and Shareholders’ Equity |

$ 205,516 |

$ 184,671 |

$ 195,789 |

|||||

|

Burnham Holdings, Inc. |

||||

|

Consolidated Statements of Cash Flows |

||||

|

(In thousands) |

||||

|

(Unaudited) |

||||

|

Nine Months Ended |

||||

|

September 29, |

October 1, |

|||

|

2024 |

2023 |

|||

|

Cash flows from operating activities: |

||||

|

Net income |

$ 4,384 |

$ 4,775 |

||

|

Adjustments to reconcile net income to net cash related |

||||

|

to operating activities: |

||||

|

Depreciation and amortization |

4,031 |

3,730 |

||

|

Deferred income taxes |

50 |

162 |

||

|

Provision for long-term employee benefits |

(375) |

(375) |

||

|

Share-based compensation expense |

300 |

482 |

||

|

Other reserves and allowances |

(33) |

977 |

||

|

Changes in current assets and liabilities, net of acquisition: |

||||

|

Decrease in accounts receivable, net |

947 |

1,491 |

||

|

Increase in inventories, net |

(12,141) |

(10,495) |

||

|

Decrease / (increase) in other current assets |

1,954 |

(891) |

||

|

Decrease in accounts payable and accrued expenses |

(6,889) |

(7,681) |

||

|

Net cash used by operating activities |

(7,772) |

(7,825) |

||

|

Cash flows from investing activities: |

||||

|

Capital expenditures |

(9,638) |

(7,614) |

||

|

Purchase of CSI |

– |

(1,750) |

||

|

Other investing activities |

– |

(8) |

||

|

Net cash used by investing activities |

(9,638) |

(9,372) |

||

|

Cash flows from financing activities: |

||||

|

Net proceeds from revolver |

21,251 |

19,992 |

||

|

Repayment of term loan |

(92) |

– |

||

|

Share-based compensation activity |

(71) |

(44) |

||

|

Dividends paid |

(3,278) |

(3,107) |

||

|

Net cash provided by financing activities |

17,810 |

16,841 |

||

|

Net increase (decrease) in cash and cash equivalents |

$ 400 |

$ (356) |

||

|

Cash and cash equivalents, beginning of period |

$ 5,880 |

$ 6,994 |

||

|

Net increase (decrease) in cash and cash equivalents |

400 |

(356) |

||

|

Cash and cash equivalents, end of period |

$ 6,280 |

$ 6,638 |

||

|

Burnham Holdings, Inc. |

||||||||||||||||

|

Consolidated Statements of Shareholders’ Equity |

||||||||||||||||

|

(In thousands) |

||||||||||||||||

|

(Unaudited) |

||||||||||||||||

|

Class B |

Accumulated |

|||||||||||||||

|

Class A |

Convertible |

Additional |

Other |

Treasury |

||||||||||||

|

Preferred |

Common |

Common |

Paid-in |

Retained |

Comprehensive |

Stock, |

Shareholders’ |

|||||||||

|

Stock |

Stock |

Stock |

Capital |

Earnings |

Loss |

at Cost |

Equity |

|||||||||

|

Balance at December 31, 2023 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 11,769 |

$ 121,291 |

$ (24,668) |

$ (12,431) |

$ 101,435 |

||||||||

|

Net income |

– |

– |

– |

– |

2,991 |

– |

– |

2,991 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

253 |

– |

253 |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,065) |

– |

– |

(1,065) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

100 |

– |

– |

– |

100 |

||||||||

|

Balance at March 31, 2024 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 11,869 |

$ 123,217 |

$ (24,415) |

$ (12,431) |

$ 103,714 |

||||||||

|

Net income |

– |

– |

– |

– |

841 |

– |

– |

841 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

(27) |

– |

(27) |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Preferred stock – 6% |

– |

– |

– |

– |

(9) |

– |

– |

(9) |

||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,132) |

– |

– |

(1,132) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

100 |

– |

– |

– |

100 |

||||||||

|

Issuance of vested shares |

– |

– |

– |

(1,444) |

– |

– |

1,373 |

(71) |

||||||||

|

Balance at June 30, 2024 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 10,525 |

$ 122,917 |

$ (24,442) |

$ (11,058) |

$ 103,416 |

||||||||

|

Net income |

– |

– |

– |

– |

552 |

– |

– |

552 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

(581) |

– |

(581) |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,072) |

– |

– |

(1,072) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

100 |

– |

– |